Академический Документы

Профессиональный Документы

Культура Документы

ADB Outlook 2015 Myanmar

Загружено:

AUNG M.RyomaАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

ADB Outlook 2015 Myanmar

Загружено:

AUNG M.RyomaАвторское право:

Доступные форматы

Myanmar

Policy reform allowed rapid economic growth in the closing fiscal year and is expected to drive

stronger expansion through the forecast period. Inflation will likely accelerate as well, and stresses

are seen building in fiscal and external accounts. A key challenge is to develop the countrys human

resources, in particular by better equipping its young people for roles in a modern economy.

Economic performance

GDP growth is estimated at 7.7% in FY2014 (ending 31 March 2015),

reecting strong expansion in construction, manufacturing, and

services. The governments ambitious structural reform program has

underpinned the strong growth performance in recent years.

Construction was driven by government investment in infrastructure,

and property development in Yangon and Mandalay. Manufacturing

benetted from increasing ows of foreign direct investment, with more

than one new garment factory opening per week on average in 2014.

Growth in services was bolstered by a surge in tourist arrivals from

2.0million in 2013 to an estimated 3.1 million in 2014 (Figure 3.27.1).

The natural gas industry continued to expand, as reected in a $400

million increase in gas exports to $2.1 billion in the rst half of FY2014.

However, growth in agriculture slowed. Agriculture provides just over

30% of GDP and more than 60% of employment.

A 10% increase in business registrations in the rst 9 months of

FY2014 indicated that business condence remains robust (Figure 3.27.2).

The Directorate of Investment and Company Administration streamlined

procedures to slash from 72 days to 3 days the time it takes to register a

company. Growth in credit to the private sector continued to grow rapidly

at 36% year on year in November 2014.

Approvals of foreign direct investment totaled $6.6 billion between

April and December 2014, up from $4.0 billion for all of FY2013.

Telecommunications attracted almost a third, followed by oil and gas

at 24%, real estate at 18%, hotels at 13%, and manufacturing (primarily

garments) at 8%. Less than 1% was for agriculture.

Ination picked up toward the end of FY2014, partly because of

rising food prices and higher prices for imports owing to depreciation

of the Myanmar kyat. The kyat weakened from MK965 to the US dollar

at the start of FY2014 to MK1,042 toward the end, largely the result of

a widening current account decit and a stronger US dollar. Ination

averaged an estimated 5.9%.

Strong demand for capital equipment and liberalized import and

foreign exchange restrictions drove a surge in merchandise imports

that outpaced exports, widening the current account decit to an

estimated 7.1% of GDP in FY2014. Gross official reserves look set to total

This chapter was written by Peter Brimble and Yan P. Oo of the Myanmar Resident

Mission, ADB, Yangon.

3.27.1Tourism

Tourist arrivals

Revenue from tourism

Million arrivals

4

$ billion

2.0

1.5

1.0

0.5

2010

2011

2012

2013

2014

0.0

Note: Years are scal years ending 31 March of the

following calendar year. Tourist arrivals include border

tourism.

Source: Ministry of Hotels and Tourism.

3.27.2Domestic business registrations

Number of businesses

8,000

6,000

4,000

2,000

0

2002 2004 2006 2008 2010 2012 2014

(AprDec)

Note: Years are scal years ending 31 March of the

following calendar year. Data in FY 2014 covers the rst 9

months from April-December 2014.

Source: Directorate of Investment and Company

Administration.

228Asian Development Outlook 2015

$4.8billion at the end of the scal year, which is cover for 2.7 months of

imports, down from 3.0 months in FY2013.

The government increased spending in FY2014, while revenue from

sales of telecommunications licenses declined from FY2013, widening

the scal decit to an estimated 4.3% of GDP. Treasury bill auctions

introduced in January 2015 broadened options for funding the decit

and strengthened the capacity of the Central Bank of Myanmar to follow

an independent monetary policy.

Total external debt as a ratio to GDP fell slightly to 17.6%. Debt

sustainability analysis by the International Monetary Fund in October

2014 found Myanmar at low risk of external debt distress after clearing

arrears with Paris Club creditors in 2013.

3.27.1Selected economic indicators (%)

2015

2016

GDP growth

8.3

8.2

Ination

8.4

6.6

Current account balance

(share of GDP)

-6.8

-5.0

Source: ADB estimates.

Economic prospects

After moderating in FY2014, growth is forecast to accelerate to 8.3%

in FY2015 and remain close to this pace in FY2016 as it is propelled

by investment stimulated by structural reform, an improved business

environment, and Myanmars gradual integration into the subregion

(Figure 3.27.3).

Better prospects in neighboring India and Thailandand further aeld

in the major industrial economiessupport the outlook for Myanmar but

are partly offset by a slowdown in the Peoples Republic of China.

Fiscal policy is expected to provide additional stimulus in FY2015.

Increases in government spending and higher civil service salaries

could sharply widen the scal decit to 6.3% of GDP. This raises

concern because prudent scal policy is particularly important to

macroeconomic stability when monetary policy tools are limited. It

could be a challenge to maintain scal discipline ahead of national

elections in the fourth quarter of 2015.

Higher scal spending and expected higher wages will add to

domestic demand such that ination is projected to accelerate to 8.4% in

FY2015 before easing in FY2016 (Figure 3.27.4).

Strong economic growth will drive up imports, though lower global

oil prices will counteract some of the impact on the trade balance. The

current account decit is seen narrowing slightly to 6.8% of GDP in

FY2015 (Figure 3.27.5). Eventually, though, low oil prices could drag

down natural gas prices, dampening export earnings and government

revenue. This vulnerability in scal and external accounts intensies the

need to build gross official reserves to more comfortable levels.

External debt is projected to rise to $12.5 billion in FY2015, or 18%

of GDP. Myanmars risk of debt distress is expected to remain low

as signicant concessional funding becomes available. In addition, a

new public debt law and debt management office will strengthen the

management of debt, both external and domestic.

After 4 years of signicant economic reform, many development

challenges remain: improving infrastructure, strengthening governance

and public sector capacity, developing human capital, building a

dynamic private sector, and revitalizing agriculture. Poverty reduction

is imperative. The United Nations Development Programme last year

3.27.3GDP growth

%

10

8

5year moving average

6

4

2

0

2010 2011 2012 2013 2014 2015 2016

Forecast

Note: Years are scal years ending 31 March of the

following calendar year.

Sources: International Monetary Fund; ADB estimates.

3.27.4Inflation

%

10

8

6

4

2

0

2010 2011 2012 2013 2014 2015 2016

Forecast

Note: Years are scal years ending 31 March of the

following calendar year.

Sources: International Monetary Fund; ADB estimates.

Economic trends and prospects in developing Asia: Southeast Asia

ranked Myanmar 150 among 187 countries included in its human

development index, with 26% of the population below the poverty line.

Risks to the economic outlook come from thin external and scal

buffers, ethnic and sectarian tensions, vulnerability to bad weather, and

possible slowing of reform momentum ahead of the elections. Progress

was achieved in 2014 toward improving economic data, which is badly

needed to support policy formulation and planning.

Myanmar229

3.27.5Current account balance

% of GDP

0

Policy challengeequipping young people for a

modern economy

Many young people entering Myanmars workforce are poorly educated

and skilled. This undercuts efforts to achieve inclusive economic growth

and threatens to trap the economy in a model that adds little value and

depends heavily on exploiting natural resources.

Employers cite inadequate human resources as a serious barrier

to doing business. They complain that the low quality and relevance

of education, compounded by low average attainment, leaves young

workers ill-equipped for either work or further training because they

lack basic knowledge and skills for problem-solving or teamwork.

Broadening the ranks of secondary school graduates is a prerequisite

to expanding and modernizing industry and services. Enhanced

technical and vocational education and training (TVET) needs to play

a complementary role by providing specic technical skills. However,

in FY2009, 57% of males and 39% of females who were aged 1827 and

held formal jobs had left school during or immediately after secondary

school, and fewer than 2% had completed post-secondary TVET.

Analysis of enrollment data suggests that secondary education is

the bottleneck: of the estimated 1.1 million new enrollees in rst grade

in 2002, four-fths successfully completed primary schooling 5 years

later, but only one-tenth completed secondary education by passing

the matriculation exam at the end of grade 11 in 2013 (Figure 3.27.6).

Low pass-through from secondary school is a principal factor limiting

entry into higher education and TVET. Moreover, half of all youths, and

two-thirds of the poor, are unable to complete even lower-secondary

education, which leaves them with virtually no access to TVET and

facing bleak prospects for decent employment.

To address these challenges, the government is preparing its National

Education Sector Plan, 20162020. The plan is expected to improve the

secondary school curriculum and align it with workforce needs, boost

secondary education completion rates, establish pathways linking secondary

education with TVET, and expand access to new forms of demand-responsive

TVET, particularly for disadvantaged youths and unskilled workers.

More broadly, the government is starting to address chronic

underinvestment in education. Public investment in education was 0.8%

of GDP in 2011, far below the Asian norm. From FY2011 to FY2013, the

government more than tripled spending on education in nominal terms,

but this brought spending to only an estimated 2.0% of GDP. Critically,

the education plan will provide an evidence-based roadmap for further

increases in nancing.

8

2010 2011 2012 2013 2014 2015 2016

Forecast

Note: Years are scal years ending 31 March of the

following calendar year.

Sources: International Monetary Fund; ADB estimates.

3.27.6Grade progression and exit from

schooling

Thousand students

1,200

Primary

1,000

Upper

Lower

secondary secondary

800

600

400

200

0

1

2 3 4 5 6 7 8 9 10 11 Pass

Grade

Note: Pass refers to grade 11 students who successfully

pass the matriculation exam.

Source: ADB staff estimates using Myanmar Education

Management Information System data for school years

2002/03 2012/13, and adjusting grade 1 enrollment for

underreported repetition.

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Bid Evaluation Report Sample TemplateДокумент2 страницыBid Evaluation Report Sample Templatemarie100% (8)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Final Answers Chap 002Документ174 страницыFinal Answers Chap 002valderramadavid67% (6)

- Study For 33KV Sub-Marine Cable Crossings PDFДокумент80 страницStudy For 33KV Sub-Marine Cable Crossings PDFOGBONNAYA MARTINSОценок пока нет

- Myanmar Government Ministries 2015Документ17 страницMyanmar Government Ministries 2015AUNG M.RyomaОценок пока нет

- Chinese Military Bases in Burma - Griffith Asia InstituteДокумент32 страницыChinese Military Bases in Burma - Griffith Asia InstitutelearningboxОценок пока нет

- Kokang Conflict - Chinese Beef Up Vigilance at BorderДокумент4 страницыKokang Conflict - Chinese Beef Up Vigilance at BorderAUNG M.RyomaОценок пока нет

- Kanbawza Burmese Army Is Anathema To DemocracyДокумент5 страницKanbawza Burmese Army Is Anathema To DemocracyAUNG M.RyomaОценок пока нет

- Political Parties - Parliament ALTSEAN BurmaДокумент2 страницыPolitical Parties - Parliament ALTSEAN BurmaAUNG M.RyomaОценок пока нет

- Myanmar President Vows Fresh Reform - FTДокумент2 страницыMyanmar President Vows Fresh Reform - FTAUNG M.RyomaОценок пока нет

- Ipad General InfoДокумент154 страницыIpad General Infobusbd2Оценок пока нет

- Guglielmo 2000 DiapirosДокумент14 страницGuglielmo 2000 DiapirosJuan Carlos Caicedo AndradeОценок пока нет

- Resume (Suyash Garg)Документ1 страницаResume (Suyash Garg)Suyash GargОценок пока нет

- Hilti AnchorДокумент5 страницHilti AnchorGopi KrishnanОценок пока нет

- Br2e Int Readingfile10 PDFДокумент2 страницыBr2e Int Readingfile10 PDFSanti RodriguezОценок пока нет

- Exercise Guide - Broad Crested WeirДокумент18 страницExercise Guide - Broad Crested Weirvipul anandОценок пока нет

- BBI2002 SCL 7 WEEK 8 AdamДокумент3 страницыBBI2002 SCL 7 WEEK 8 AdamAMIRUL RIDZLAN BIN RUSIHAN / UPMОценок пока нет

- Tankguard AR: Technical Data SheetДокумент5 страницTankguard AR: Technical Data SheetAzar SKОценок пока нет

- 13 - Conclusion and SuggestionsДокумент4 страницы13 - Conclusion and SuggestionsjothiОценок пока нет

- Instructions For The Safe Use Of: Web LashingsДокумент2 страницыInstructions For The Safe Use Of: Web LashingsVij Vaibhav VermaОценок пока нет

- Wheel CylindersДокумент2 страницыWheel Cylindersparahu ariefОценок пока нет

- On The Backward Problem For Parabolic Equations With MemoryДокумент19 страницOn The Backward Problem For Parabolic Equations With MemorykamranОценок пока нет

- Panch ShilДокумент118 страницPanch ShilSohel BangiОценок пока нет

- MC 33199Документ12 страницMC 33199Abbode HoraniОценок пока нет

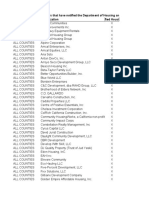

- Ab 1486 Developer Interest ListДокумент84 страницыAb 1486 Developer Interest ListPrajwal DSОценок пока нет

- Top Ten Helicopter Checkride TipsДокумент35 страницTop Ten Helicopter Checkride TipsAbhiraj Singh SandhuОценок пока нет

- About UPSC Civil Service Examination Schedule and Subject ListДокумент4 страницыAbout UPSC Civil Service Examination Schedule and Subject Listjaythakar8887Оценок пока нет

- CS506 Mid SubjectiveДокумент2 страницыCS506 Mid SubjectiveElma AlamОценок пока нет

- UK LL M Thesis - Builders' Liability in UK Law Under TortДокумент16 страницUK LL M Thesis - Builders' Liability in UK Law Under TortRajan UppiliОценок пока нет

- Che 342 Practice Set I IДокумент4 страницыChe 342 Practice Set I IDan McОценок пока нет

- Asme Pvho-2-2019Документ61 страницаAsme Pvho-2-2019Vijay KumarОценок пока нет

- Pfmar SampleДокумент15 страницPfmar SampleJustin Briggs86% (7)

- Advanced Excel Training ManualДокумент6 страницAdvanced Excel Training ManualAnkush RedhuОценок пока нет

- Hood Design Using NX Cad: HOOD: The Hood Is The Cover of The Engine in The Vehicles With An Engine at Its FrontДокумент3 страницыHood Design Using NX Cad: HOOD: The Hood Is The Cover of The Engine in The Vehicles With An Engine at Its FrontHari TejОценок пока нет

- Pavement Design - (Rigid Flexible) DPWHДокумент25 страницPavement Design - (Rigid Flexible) DPWHrekcah ehtОценок пока нет

- Shear Wall Design PDFДокумент9 страницShear Wall Design PDFjk.dasgupta100% (2)

- Corporate Restructuring Companies Amendment Act 2021Документ9 страницCorporate Restructuring Companies Amendment Act 2021Najeebullah KardaarОценок пока нет

- Adding Print PDF To Custom ModuleДокумент3 страницыAdding Print PDF To Custom ModuleNguyễn Vương AnhОценок пока нет