Академический Документы

Профессиональный Документы

Культура Документы

Forms of Ownership

Загружено:

Kumar AnuragАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Forms of Ownership

Загружено:

Kumar AnuragАвторское право:

Доступные форматы

MBA 4011 Entrepreneurship and Small Business Mgt

Module 5: Form of Business Ownership.

Forms of Business Ownership: Business ownership means having the control over a business

enterprise and being able to dictate its functioning and operations.

" Individual or entity who owns a business entity in an attempt to profit from the successful operations

of the company. Generally has decision making abilities and first right to profit "

There are three ways in which business ownership may be acquired- initiating a business, purchasing a

company that is already existing and franchising.

Types of ownerships are:

Sole Proprietorships

Partnerships

Corporation

Other Types

1. Sole Proprietorships: A sole proprietorship is a business that is owned (and usually operated) by

one person. That person controls and manages the business.A sole proprietorship, also known as the

sole trader or simply a proprietorship, is a type of business entity that is owned and run by one

individual or one legal person and in which there is no legal distinction between the owner and the

business. The owner is in direct control of all elements and is legally accountable for the finances of

such business and this may include debts, loans, loss etc. It is the simplest form of business ownership

and the easiest to start. There are more than 22 million sole proprietorships in the United States. Its

main features are : Ease of formation is its most important feature because it is not required to go through elaborate

legal formalities. No agreement is to be made and registration of the firm is also not essential.

However, the owner may be required to obtain a license specific to the line of business from the

local administration.

The capital required by the organisation is supplied wholly by the owner himself and he

depends largely on his own savings and profits of his business.

Owner has a complete control over all the aspects of his business and it is he who takes all the

decisions though he may engage the services of a few others to carry out the day-to-day

activities.

Owner alone enjoys the benefits or profits of the business and he alone bears the losses.

The firm has no legal existence separate from its owner.

The liability of the proprietor is unlimited i.e. it extends beyond the capital invested in the firm.

Lack of continuity i.e. the existence of a sole proprietorship business is dependent on the life of

the proprietor and illness, death etc. of the owner brings an end to the business. The continuity

of business operation is therefore uncertain.

Advantages of Sole Proprietorships

Ease of Start-Up and Closure. No contracts, agreements, or other legal documents are

required to start or end a sole proprietorship, and there are no minimum capital

requirements.

Department Of Management Studies

BIT Mesra, Jaipur Campus

By: Santosh kumar , santk@live.com

MBA 4011 Entrepreneurship and Small Business Mgt

Module 5: Form of Business Ownership.

Pride of Ownership. The amount of time and hard work that the owner invests in a sole

proprietorship is substantial, and the owner deserves a great deal of credit for assuming the

risks and solving the problems associated with operating sole proprietorships.

Retention of All Profits. All profits earned by a sole proprietorship become the personal

earnings of its owner. Thus, the owner has a strong incentive to succeed.

Flexibility of Being Your Own Boss. The sole owner of a business is completely free to

make decisions about the firms operations. A sole proprietor can switch from retailing to

wholesaling, move a shops location, open a new store, or close an old one.

Less accounting hassle :

No Special Taxes. The sole proprietorships profits are taxed as personal income of the

owner. Thus, a sole proprietorship does not pay the special state and federal income taxes

that corporations pay.

Better transparency: As all bank accounts has been handled by propriter only.

Privacy Information about sole traders is kept private, unlike that of limited companies

which is necessarily made public after registration with Companies House.

Specialist Often a small business, sole traders can offer a more personal service with local

roots and ties. This can be more appealing to potential customers in the local community.

Disadvantages of Sole Proprietorships

Unlimited Liability. Unlimited liability is a legal concept that holds a business owner

personally liable for all the debts of the business. If the business fails, the sole proprietors

personal property including savings and other assets can be seized to pay creditors.

Lack of Continuity. Legally, the sole proprietor is the business. If the owner retires, dies, or is

declared legally incompetent, the business essentially ceases to exist.

Lack of Money. Banks, suppliers, and other lenders are usually unwilling to lend large sums

to sole proprietorships. The limited ability to borrow can prevent a sole proprietorship from

growing.

Limited Management Skills. The sole proprietor often is the sole managerin addition to

being the sole salesperson, buyer, accountant, and, on occasion, janitor. The business can

suffer in the areas in which the owner is less knowledgeable.

Difficulty in Hiring Employees. The sole proprietor may find it hard to attract and keep

competent help. Potential employees may feel that there is no room for advancement in a firm

whose owner assumes all managerial responsibilities.

Beyond the Sole Proprietorship. The major disadvantage of a sole proprietorship is the

limited amount that one person can do in a workday.

Reverse economies of scale sole traders will be unable to take advantage of economies of

scale in the same way as limited companies and larger corporations, who can afford to buy in

bulk. This might mean that they have to charge higher prices for their products or services in

order to cover the costs.

2. Partnerships

_The Partnership Act defines a partnership as a voluntary association of two or more persons to act as

co-owners of a business for profit.

"Partnership" is the relation between persons who have agreed to share the profits of a business carried

on by all or any of them acting for all.

Persons who have entered into partnership with one another are called individually, "partners" and

collectively "a firm", and the name under which their business is carried on is called the "firm-name".

There are approximately 3 million partnerships in the United States. The main features are.

Department Of Management Studies

BIT Mesra, Jaipur Campus

By: Santosh kumar , santk@live.com

MBA 4011 Entrepreneurship and Small Business Mgt

Module 5: Form of Business Ownership.

liability is joint and unlimited.

Registration not compulsory.

Active partners take part in day-to-day operations of the business, in addition to investing in it.

Active partners are entitled to a share of the enterprise's profits.

Sleeping partners invest in the business and are entitled to a share of its profits, but do not

participate in day-to-day operations.

Types of Partners

General Partners. A general partner is a person who assumes full or shared responsibility for

operating a business.

General partners are active in day-to-day business operations, and each partner can enter into

contracts on behalf of all the others. He or she assumes unlimited liability for all debts,

including debts incurred by any other general partner without his or her knowledge or

consent.

A general partnership is a business co-owned by two or more general partners who are liable

for everything the business does.

To avoid future liability, a general partner who withdraws from the partnership must give

notice to creditors, customers, and suppliers.

Limited Partners . A limited partner is a person who contributes capital to a business but who

has no management responsibility or liability for losses beyond his or her investment in the

partnership.

A limited partnership is a business co-owned by one or more general partners who manage

the business and limited partners who invest money in it. Special rules apply to limited

partnerships intended to protect customers and creditors who deal with them.

A master limited partnership (MLP) is a business partnership that is owned and managed

like a corporation but taxed like a partnership. Units of ownership in MLPs can be sold to

investors to raise capital and are often traded on organized security exchanges.(doesnt

exist in India)

What is the difference between a general partnership and a limited partnership?

Usually, when you hear the term "partnership," it refers to a general partnership -- that is, one where all

partners participate to some extent in the day-to-day management of the business. Limited partnerships

are very different from general partnerships, and are usually set up by companies that invest money in

other businesses or real estate.

While limited partnerships have at least one general partner who controls the company's day-to-day

operations and is personally liable for business debts, they also have passive partners called limited

partners. Limited partners contribute capital to the business (investment money) but have minimal

control over daily business decisions or operations.

In return for giving up management power, a limited partner's personal liability is capped at the amount

of his or her investment. In other words, the limited partner's investment can go toward paying off any

partnership debts, but the investor's personal assets cannot be touched -- this is called "limited liability."

However, a limited partner who starts tinkering with the management of the business can quickly lose

limited liability status.

Doing business as a limited partnership can be at least as costly and complicated as doing business as a

corporation. For instance, complex securities laws often apply to the sale of limited partnership

interests. Consult a lawyer with experience in setting up limited partnerships if you're interested in

creating this type of business.

Department Of Management Studies

BIT Mesra, Jaipur Campus

By: Santosh kumar , santk@live.com

MBA 4011 Entrepreneurship and Small Business Mgt

Module 5: Form of Business Ownership.

The Partnership Agreement. Articles of partnership are an agreement listing and explaining the

terms of the partnership. When entering into a partnership agreement, partners would be wise to let a

neutral third party assist.

Before starting a partnership business, all the partners have to draw up a legal document called a

Partnership Deed of Agreement. It usually contains the following information:

There are many parts that should be included in any articles of partnership. These are:

Names of included parties - includes all names of people participating in this contract

Commencement of partnership- includes when the partnership should begin. The date of the

contract is assumed as this date, if none is given.

Duration of partnership - includes how long the partnership should last. It is automatically

assumed that the death of one of the contracting parties breaks the contract, unless otherwise

stated.

Business to be done - includes exactly what will be done in this partnership. This section should

be very particular to avoid confusion and loopholes.

Name of firm - includes the name of the business entity.

Initial investments - includes how much each partner will invest immediately or by installments.

Division of profits and losses - includes what percentages of profits and losses each partner will

receive. If it is not a limited partnership, then there is unlimited liability (each partner is

responsible for all partners' debts, including their own).

Ending of the business - includes what happens when the business winds down. Usually this

includes three parts:

1) All assets are turned into cash and divided among the members in a certain proportion;

2) one partner may purchase the others' shares at their value;

3) all property is divided among the members in their proper proportions.

Date of writing - includes simply the date that the contract was written.

Advantages of Partnerships

Ease of Start-Up. Partnerships are relatively easy to form. As with sole proprietorships, legal

requirements are often limited to registering the name of the business and purchasing licenses

or permits.

Availability of Capital and Credit. Because partners can pool their funds, a partnership

usually has more capital available than does a sole proprietorship. This, coupled with the

general partners unlimited liability, can form the basis for a better credit rating.

Personal Interest. General partners are very concerned with the operation of the firm, perhaps

even more so than sole proprietors; they are responsible for the actions of all other general

partners, as well as for their own.

Combined Business Skills and Knowledge. Partners often have complementary skills. The

weakness of one partner in a certain area may be offset by another partners strength in that

area.

Retention of Profits. As in a sole proprietorship, all profits belong to the owners of the

partnership.

No Special Taxes. Like a sole proprietor, each partner is taxed only on his or her share of the

profits.

Disadvantages of Partnerships

_Unlimited Liability. Each general partner is legally and personally responsible for the debts and

actions of any other partner, even if that partner did not incur those debts or do anything

wrong. Limited partners, however, risk only their original investment.

_Management Disagreements. Most of the problems that develop in a partnership involve one

partner doing something that disturbs the other partner(s). When partners disagree about

Department Of Management Studies

BIT Mesra, Jaipur Campus

By: Santosh kumar , santk@live.com

MBA 4011 Entrepreneurship and Small Business Mgt

Module 5: Form of Business Ownership.

decisions, policies, or ethics, distrust may build to the point where it is impossible to operate

the business successfully.

_Lack of Continuity. A partnership is terminated if any one of the general partners dies,

withdraws, or is declared legally incompetent.

_Frozen Investment. It is easy to invest money in a partnership, but it is sometimes quite difficult

to get it out.

_ Tax Liability . whole tax liability will be bear by Partners only.

Procedure for Registration of a Partnership Firm

The law relating to a partnership firm is contained in the Indian Partnership Act, 1932. Under

Section 58 of the Act, a firm may be registered at any time by filing an application with the

Registrar of Firms of the area in which any place of business of the firm is situated or proposed to

be situated.

Application shall contain:* name of the firm ( unique)

* place or principal place of business

* names of any other places where the firm carries on business.

* date on which each partner joined the firm

* name in full and permanent address of partners.

* duration of the firm

Application shall be signed and verified by all the partners or their duly authorized agents.

Application shall be accompanied by prescribed fee as well as the following documents:

* certified true copy of the Partnership deed entered into.

* ownership proof of the principal place of business

*Under Section 59 of the Act, when the Registrar of Firms is satisfied that the provisions of

section 58 have been duly complied with, he shall record an entry of the statement in

the Register of Firms and issue a Certificate of Registration.

Penalty for furnishing false particulars (Section 70): Any person who signs any statement,

amending statement, notice or intimation under this Chapter containing any particular which he knows

to be false or does not believe to be true or containing particulars which he knows to be incomplete or

does not believe to be complete, shall be punishable with imprisonment which may extend to three

months, or with a fine or with both.

Any alterations, subsequent to Registration shall be notified to the registrar:Change in firm name and principal place of business (Section 60) shall require sending of a new

application form along with the prescribed fee, duly signed and verified by all the partners.

* Change relating to opening and closing of branches. (Section 61)

* Change in the name and permanent address of any partner (Section 62)

Accordingly, the various forms prescribed under the Indian Partnership Act, 1932, for the alterations in

the registered partnership firm are:a. Form No. II :- For change of principle place of business & change in the name of the firm.

b. Form No. III :- For change of the other then principle place of business.

c. Form No. IV :- For change of name of the partners & permanent address of the partners.

d. Form No. V :- For change of constitution of forms & addition or retirement of partner.

e. Form No.VI :- For dissolution of the firm

Department Of Management Studies

BIT Mesra, Jaipur Campus

By: Santosh kumar , santk@live.com

MBA 4011 Entrepreneurship and Small Business Mgt

Module 5: Form of Business Ownership.

f. Form No. VII :- For minor partner attains the age of majority.

Note: A partner of an unregistered firm cannot file a suit in any court against the firm or other

partners for the enforcement of any right arising from a contract or right conferred by the Partnership

Act unless the firm is registered and the person suing is or has been shown in the Register of Firms as

a partner in the firm.

An unregistered firm or any of its partners cannot claim a set off (i.e. mutual adjustment of debts

owned by the disputant parties to one another) or other proceedings in a dispute with a third party.

Hence, every firm finds it advisable to get itself registered sooner or later.

3. Corporation

A corporation is an artificial being, invisible, intangible, and existing only in contemplation of the

law. Hence, a corporation is an artificial person created by law, with most of the legal rights of a

real person. There are 6 million corporations in the United States. Corporations comprise only about

19 percent of all businesses, but they account for 83 percent of all sales revenues.

Corporate Ownership. The shares of ownership of a corporation are called stock, and those who

own the shares are called stockholders, or sometimes shareholders.

A closed corporation is a corporation whose stock is owned by relatively few people and is not

bought and sold on security exchanges.

An open corporation is a corporation whose stock is sold to the general public and can be

purchased by any individual.

Forming a Corporation. The process of forming a corporation is called incorporation.

Where to Incorporate. A business is allowed to incorporate in any country it chooses. Some

country are more hospitable than others and offer fewer restrictions and other benefits to attract new

firms.

An incorporated business is called a domestic corporation in the country in which it is

incorporated.

In all other country where it does business, it is called a foreign corporation.

A corporation chartered by another government and conducting business in the India is an MNC.

(Incorporation process in shown as flow chart in Fig below):

Corporate Structure

_Board of Directors. The board of directors is the top governing body of a corporation, and directors

are elected by the stockholders and can be chosen from within the corporation or from outside of it. The

major responsibilities of the board of directors are to set company goals and to develop general plans

for meeting those goals.

_Corporate Officers. Corporate officers (the chairman of the board, president, executive vice

presidents, corporate secretary, treasurer, any other top executives) are appointed by the board of

directors. These officers help the board make plans, carry out strategies established by the board, hire

employees, and manage day-to-day business activities.

Department Of Management Studies

BIT Mesra, Jaipur Campus

By: Santosh kumar , santk@live.com

MBA 4011 Entrepreneurship and Small Business Mgt

Module 5: Form of Business Ownership.

Advantages of Corporations

Limited Liability. One of the most attractive features of corporate ownership is limited liability. If a

corporation fails, creditors have a claim only on the assets of the corporation, not on the owners

personal assets.

Ease of Raising Capital. The corporation is by far the most effective form of business ownership for

raising capital.

Ease of Transfer of Ownership. Ownership is transferred when shares of stock are sold, and

practically no restrictions apply to the sale and purchase of stock issued by an open corporation.

Perpetual Life. Because a corporation is essentially a legal person, it exists independently of its

owners and survives them.

Specialized Management. Typically, corporations are able to recruit more skilled, knowledgeable, and

talented managers than proprietorships and partnerships.

Disadvantages of Corporations.

Difficulty and Expense of Formation. Forming a corporation can be a relatively complex and costly

process.

Government Regulation and Increased Paperwork. Most government regulation of business is

directed at corporations, which must file many reports on their business operations and finances with

Department Of Management Studies

BIT Mesra, Jaipur Campus

By: Santosh kumar , santk@live.com

MBA 4011 Entrepreneurship and Small Business Mgt

Module 5: Form of Business Ownership.

local, state, and federal governments and make periodic reports to their stockholders.

Conflict Within the Corporation. The pressure to increase sales revenue, reduce expenses, and

increase profits often leads to stress and tension for both managers and employees.

Double Taxation. Unlike sole proprietorships and partnerships, corporations must pay a tax on their

profits. Then stockholders must pay a personal income tax on profits received as dividends.

Profit Sharing : profit will share among all stock holders.

Lack of Secrecy - Because open corporations are required to submit detailed reports to government

agencies and to stockholders, they cannot keep their operations confidential.

4. Other Types of Business Ownership

Some entrepreneurs choose other forms of organization to meet their special needs. Among these are

S-corporations, limited-liability companies, Cooperatives , Joint venture , PPP, Syndication,

not-for-profit corporations , Franchise Ownership , Licensing etc

S-Corporations. (doesnt allow in India)If a corporation meets certain requirements, its directors may

apply to the Internal Revenue Service for status as an S-corporation. An S-corporation is a corporation

that is taxed as corporation though it were a partnership. To qualify for this special status, the firm must

meet the following criteria:

_ No more than 100 stockholders are allowed.

_ Stockholders must be individuals, estates, or exempt organizations.

_ There can only be one class of outstanding stock.

_ The firm must be a domestic corporation eligible to file for S-corporation status.

_ There can be no non resident stockholders.

_ All stockholders must agree to the decision to form an S-corporation.

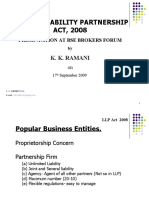

Limited-Liability Partnership. A limited-liability Partnership (LLP) is a form of business

ownership that combines the benefits of a corporation and a partnership while avoiding some of the

restrictions and disadvantages of those forms of ownership. Chief advantages of an LLP include the

following under The Limited Liability Partnership Act 2008 (was published in the official Gazette of

India on January 9, 2009 and has been notified with effect from 31 March 2009):

_ LLP members are taxed like a partnership and thus avoid the double taxation imposed

on most corporations.

_ Like a corporation, an LLP provides limited-liability protection for acts and debts of the

LLP.

_The LLP provides more management flexibility when compared with corporations. An

LLP is generally run by the owners or managers who make all the management

decisions.

_one partner is not responsible or liable for another partner's misconduct or negligence

_Provisions have been made for corporate actions like mergers, amalgamations etc

Not-for-Profit Corporations- A not-for-profit corporation is a corporation organized to provide a

social, educational, religious, or other service rather than to earn a profit. Various charities, museums,

private schools, and colleges are organized in this way, primarily to ensure limited liability. Once

approved by state authorities, not-for-profit corporations must meet specific Internal Revenue Service

guidelines in order to obtain tax-exempt status.

Cooperatives, Joint Ventures, and Syndicates

_ Cooperatives. A cooperative is an association of individuals or firms whose purpose is to

perform some business function for its members. Cooperatives are found in all segments of

our economy, but they are most prevalent in agriculture.

Department Of Management Studies

BIT Mesra, Jaipur Campus

By: Santosh kumar , santk@live.com

MBA 4011 Entrepreneurship and Small Business Mgt

Module 5: Form of Business Ownership.

_ Joint Ventures. A joint venture is an agreement between two or more groups to form a

business entity to achieve a specific goal or to operate for a specific period of time. Once the

goal is reached or the period of time has elapsed, the joint venture is dissolved.

_ Public Private Partnership (PPP). A joint venture between Private and Government body to

achieve a specific goal or to operate for a specific period of time. Once the goal is reached

or the period of time has elapsed, the joint venture is dissolved

_Syndicates. A syndicate is a temporary association of individuals or firms organized to

perform a specific task that requires a large amount of capital and is dissolved as soon as its

purpose has been accomplished. Syndicates are most commonly used to underwrite large

insurance policies, loans, and investments.

Franchise Ownership: A franchise is a business system in which private entrepreneurs purchase the

rights to open , Use and run a a firm's successful business model and brand for a prescribed period of

time at a location. The franchising company, or franchisor, signs a contractual agreement with the

franchisee, explaining in detail the companys rules for operating the franchise.

Franchises developed in the mid-nineteenth century. Isaac Singer, the inventor of the sewing

machine, created franchises to distribute his machines more effectively to larger areas. The idea of

franchises spread to the restaurant industry in the 1950s when Ray Kroc, founder of McDonalds, began

selling franchises to spread the fast food chain throughout the U.S. and the world.

Disadvantages and Advantages of franchisor :

Advantage:

Easy to enter new Market:

Access to better talent. Franchising is a great way to find talented people to manage your locations

and give them an incentive to work hard.

Easy expansion capital. Franchising is a good way to obtain expansion capital. Because your

franchisees pay to buy outlets in your chain, you can grow the number of locations without tapping

much of your own capital or needing to request financing from banks or investors.

Minimized growth risk. Franchising can generate high financial returns for relatively little risk. In

franchise, you put relatively little money into adding each location.

Responsibility Sharing:

Disadvantages

Less control over Business. You can't tell franchisees what to do the way you can with employees.

Franchisees are independent businesses. Moreover, they have different goals from yours, which can

easily conflict and even lead to legal trouble.

Innovation challenges. It's a lot harder to innovate with franchising than if you own your own outlets.

With franchising, if you come up with a new idea, you have to negotiate with your franchisees to get

them to accept the new product or whatever innovation you want to introduce, instead of just putting

the new idea in place on your own.

Conflict of interest: Franchisor and Franchisee are two different companies, may have different

goal and ideology create conflict between them.

***********************************************************************************

Department Of Management Studies

BIT Mesra, Jaipur Campus

By: Santosh kumar , santk@live.com

Вам также может понравиться

- Types of Business Ownership in MalaysiaДокумент3 страницыTypes of Business Ownership in MalaysiaMardhiah Ramlan0% (1)

- Legal Requirments of Business ManagementДокумент42 страницыLegal Requirments of Business ManagementAasi RaoОценок пока нет

- Forms of Business OwnershipДокумент2 страницыForms of Business OwnershipBek AhОценок пока нет

- Partnership BusinessДокумент14 страницPartnership Businessabdullah akhtar100% (1)

- ICP 813-Report StructureДокумент19 страницICP 813-Report StructureArsyad ArsyadiОценок пока нет

- Singapore Legal SystemДокумент17 страницSingapore Legal SystemDormKangОценок пока нет

- Sample Lease ContractДокумент5 страницSample Lease ContractTon BetitoОценок пока нет

- Forms of OwnershipДокумент16 страницForms of OwnershipshrutiОценок пока нет

- Business Plan Sample (Presentation)Документ60 страницBusiness Plan Sample (Presentation)Athirah Noor100% (2)

- Forms of Business OrganizationsДокумент21 страницаForms of Business OrganizationsRosel SariegoОценок пока нет

- Sample Business ProposalДокумент8 страницSample Business ProposalKathleen DamianОценок пока нет

- Forms of Business OwnershipДокумент9 страницForms of Business OwnershipNazifa AfrozeОценок пока нет

- Asphalt Mixture Volumetric PropertiesДокумент11 страницAsphalt Mixture Volumetric PropertiesHuda MahdiОценок пока нет

- The Social Enterprise Business ModelДокумент3 страницыThe Social Enterprise Business ModelDENNROSE DECLAROОценок пока нет

- Business Proposal (Lakhri Foods)Документ9 страницBusiness Proposal (Lakhri Foods)Md TowkikОценок пока нет

- Business Plan Template For A Startup BusinessДокумент38 страницBusiness Plan Template For A Startup BusinessJosh Emman Flores Lara100% (1)

- Event ManagementДокумент24 страницыEvent Managementharshita100% (1)

- Sample Membership Recruitment-Retention PlansДокумент19 страницSample Membership Recruitment-Retention Planswelhabashy30100% (1)

- Sources of Funds: Presented by Yogeesh L N Lecturer in Commerce and Management BangaloreДокумент14 страницSources of Funds: Presented by Yogeesh L N Lecturer in Commerce and Management BangaloreYogeesh LNОценок пока нет

- Mission and VissionДокумент11 страницMission and VissionPradeep Kumar V PradiОценок пока нет

- Research QuestionnaireДокумент5 страницResearch QuestionnaireMarilyn E. VillarinoОценок пока нет

- TEMPLATE Concept-Paper AbmДокумент13 страницTEMPLATE Concept-Paper AbmNavinohj Lopez DaroОценок пока нет

- Argumentative EssayДокумент2 страницыArgumentative EssayLenielynBisoОценок пока нет

- Examples of Well-Written Essay PDFДокумент2 страницыExamples of Well-Written Essay PDFMd Delowar Hossain MithuОценок пока нет

- Mini Marketing Plan OutlineДокумент8 страницMini Marketing Plan Outlineapi-323496212Оценок пока нет

- Sole Proprietorship 4Документ8 страницSole Proprietorship 4Mikhaela Divine GarciaОценок пока нет

- 1Homeroom-WPS OfficeДокумент5 страниц1Homeroom-WPS Officexayezi ablenОценок пока нет

- Financial AnalysisДокумент69 страницFinancial AnalysisOlawale Oluwatoyin Bolaji100% (2)

- Nature and Characteristics of The Business MarketДокумент4 страницыNature and Characteristics of The Business MarketEdgar Junior PahonangОценок пока нет

- IT Module 4Документ2 страницыIT Module 4Crizele Joy LagudaОценок пока нет

- Operational Plan TemplateДокумент1 страницаOperational Plan TemplateFahad Abdillahi FaaraxОценок пока нет

- Individual Employment AgreementДокумент7 страницIndividual Employment AgreementBon Bon BonОценок пока нет

- Importance of Banks in An EconomyДокумент3 страницыImportance of Banks in An EconomyfinkeeffacolegeОценок пока нет

- What Are The Types of Business Organization? Differentiate EachДокумент3 страницыWhat Are The Types of Business Organization? Differentiate EachCarmelle BahadeОценок пока нет

- Bake N Flake Company Final 4Документ31 страницаBake N Flake Company Final 4sarojОценок пока нет

- Proper and Responsible Use of Social MediaДокумент2 страницыProper and Responsible Use of Social MediaAnisah MamoribidОценок пока нет

- Environmental ScanningДокумент14 страницEnvironmental ScanningJewel M. BabadillaОценок пока нет

- DLSU FDNMark Principles of Marketing Midterm 1st Term AY 20-21Документ2 страницыDLSU FDNMark Principles of Marketing Midterm 1st Term AY 20-21Andrew ContapayОценок пока нет

- Sole ProprietorshipsДокумент15 страницSole ProprietorshipsPARTH Saxena0% (1)

- Business Legal Forms of OwnershipДокумент44 страницыBusiness Legal Forms of OwnershipNecie Nilugao Rodriguez100% (1)

- Social ResponsibilityДокумент11 страницSocial ResponsibilityAbdul Mujeeb Khan50% (2)

- Alternative InvestmentДокумент3 страницыAlternative InvestmentdhwaniОценок пока нет

- Sample Business PlanДокумент25 страницSample Business PlanpavankoppadОценок пока нет

- Business Plan Group 8 3b NSДокумент20 страницBusiness Plan Group 8 3b NSElexis RaymundoОценок пока нет

- Accounting Finals Exam Reviewer Adjusting EntriesДокумент4 страницыAccounting Finals Exam Reviewer Adjusting EntriesElleana DОценок пока нет

- Airbnb Reflection PaperДокумент3 страницыAirbnb Reflection PaperSab Bueno100% (1)

- The Big Deal 2008 Social Enterprise Business PlanДокумент5 страницThe Big Deal 2008 Social Enterprise Business PlanduttonjОценок пока нет

- Business Idea GenerationДокумент25 страницBusiness Idea GenerationVictor BarnabasОценок пока нет

- Feasib Survey QuestionnaireДокумент1 страницаFeasib Survey Questionnaireyel5buscato100% (1)

- Pros and Cons of Sole Proprietorship and PartnershipДокумент3 страницыPros and Cons of Sole Proprietorship and PartnershipElly MwangiОценок пока нет

- Forms of Business OrganizationДокумент1 страницаForms of Business OrganizationElla Simone100% (3)

- Lesson 9.09.20 Financial System in The PhilippinesДокумент5 страницLesson 9.09.20 Financial System in The PhilippinesVatchdemonОценок пока нет

- Respecting Our FlagДокумент37 страницRespecting Our FlagRyan BandejasОценок пока нет

- Tem1002020 Business PlanДокумент7 страницTem1002020 Business PlanCLARISSA VICTORIA LUMAINОценок пока нет

- Amendment 2 To Employment ContractДокумент2 страницыAmendment 2 To Employment ContractRob PortОценок пока нет

- Differences Between Common Stock and Preferred StockДокумент2 страницыDifferences Between Common Stock and Preferred Stocksai krishnaОценок пока нет

- Cooperative Governance - Dr.M.KarthikeyanДокумент26 страницCooperative Governance - Dr.M.Karthikeyankarthianjale100% (4)

- Balance Sheet AccountsДокумент7 страницBalance Sheet AccountsroldanОценок пока нет

- Business Plan Final Report - SS Sprts ClubДокумент16 страницBusiness Plan Final Report - SS Sprts ClubShweta SaxenaОценок пока нет

- Industrial OwnershipДокумент64 страницыIndustrial OwnershipJennifer Padilla JuanezaОценок пока нет

- Receipt 888919078594Документ1 страницаReceipt 888919078594Kumar AnuragОценок пока нет

- Illustrator For Beginners Tastytuts PDFДокумент25 страницIllustrator For Beginners Tastytuts PDFBejenaru GeorgeОценок пока нет

- New Microsoft Office Word DocumentДокумент1 страницаNew Microsoft Office Word DocumentKumar AnuragОценок пока нет

- <html><!-- InstanceBegin template="/Templates/vorlage.dwt" codeOutsideHTMLIsLocked="false" --> <head> <meta http-equiv="Content-Type" content="text/html; charset=iso-8859-1" /> <title>ERROR: Invalid Request</title> <style type="text/css"> <!-- td { font-size: 12px; font-family: Verdana, Arial, Helvetica, sans-serif; } a { color: #CC0000; text-decoration: none; } a:hover { text-decoration: underline; } a:visited { color: #CC0000; text-decoration: none; } a:active { color: #FF0000; } --> </style> <script language="JavaScript" type="text/JavaScript"> <!-- function MM_reloadPage(init) { //reloads the window if Nav4 resized if (init==true) with (navigator) {if ((appName=="Netscape")&&(parseInt(appVersion)==4)) { document.MM_pgW=innerWidth; document.MM_pgH=innerHeight; onresize=MM_reloadPage; }} else if (innerWidth!=document.MM_pgW || innerHeight!=document.MM_pgH) location.reload(); } MM_reloadPage(true); //--> </script> </head> <body>Документ54 страницы<html><!-- InstanceBegin template="/Templates/vorlage.dwt" codeOutsideHTMLIsLocked="false" --> <head> <meta http-equiv="Content-Type" content="text/html; charset=iso-8859-1" /> <title>ERROR: Invalid Request</title> <style type="text/css"> <!-- td { font-size: 12px; font-family: Verdana, Arial, Helvetica, sans-serif; } a { color: #CC0000; text-decoration: none; } a:hover { text-decoration: underline; } a:visited { color: #CC0000; text-decoration: none; } a:active { color: #FF0000; } --> </style> <script language="JavaScript" type="text/JavaScript"> <!-- function MM_reloadPage(init) { //reloads the window if Nav4 resized if (init==true) with (navigator) {if ((appName=="Netscape")&&(parseInt(appVersion)==4)) { document.MM_pgW=innerWidth; document.MM_pgH=innerHeight; onresize=MM_reloadPage; }} else if (innerWidth!=document.MM_pgW || innerHeight!=document.MM_pgH) location.reload(); } MM_reloadPage(true); //--> </script> </head> <body>Shekhar ShrivastavaОценок пока нет

- Dividendpolicy 120920003757 Phpapp02Документ5 страницDividendpolicy 120920003757 Phpapp02Shivarajkumar JayaprakashОценок пока нет

- Chapter 7 Fund Flow StatementДокумент37 страницChapter 7 Fund Flow StatementMukesh Agarwal86% (7)

- RDM 04 Managing - Channel.conflictДокумент15 страницRDM 04 Managing - Channel.conflictKumar AnuragОценок пока нет

- Kimball Office - Fundamentals of Workplace Strategy - 2010Документ10 страницKimball Office - Fundamentals of Workplace Strategy - 2010heroinc1Оценок пока нет

- Legal and Ethical IisuesДокумент3 страницыLegal and Ethical IisuesKumar AnuragОценок пока нет

- Intellectual Property ManagementДокумент13 страницIntellectual Property ManagementKumar AnuragОценок пока нет

- UntitledДокумент41 страницаUntitledkarlsОценок пока нет

- Chapter 5 QuestionsДокумент2 страницыChapter 5 QuestionsWilfred McClain JrОценок пока нет

- Limited Liability Partnership ACT, 2008: K. K. RamaniДокумент34 страницыLimited Liability Partnership ACT, 2008: K. K. Ramaniarmk_0073141Оценок пока нет

- Corporation ReviewerДокумент13 страницCorporation ReviewerMyka Ann GarciaОценок пока нет

- Characteristics of Capital MarketДокумент12 страницCharacteristics of Capital MarketUTKARSH ZAMBAREОценок пока нет

- Major Pipelines in IndiaДокумент2 страницыMajor Pipelines in IndiaAnil Kumar SinghОценок пока нет

- Texas LLC Update 0509141033Документ43 страницыTexas LLC Update 0509141033tortdogОценок пока нет

- 110.stockholders Equity ExercisesДокумент4 страницы110.stockholders Equity ExercisesRosalinda DacayoОценок пока нет

- Reviewer Corp Project (If Needed)Документ5 страницReviewer Corp Project (If Needed)A cОценок пока нет

- LLP Consent Form 9 and Subscribers SheetДокумент3 страницыLLP Consent Form 9 and Subscribers Sheetnitish100% (1)

- Permanent IPs-1-92Документ146 страницPermanent IPs-1-92Kumar AnkitОценок пока нет

- Dda 2 12Документ7 страницDda 2 12genius_blueОценок пока нет

- Bam 241: Business Laws and Regulations Second Periodical ExaminationДокумент19 страницBam 241: Business Laws and Regulations Second Periodical ExaminationGiner Mabale StevenОценок пока нет

- A Company Is A Natural Legal Entity Formed by The Association and Group of People To Work Together Towards Achieving A Common ObjectiveДокумент3 страницыA Company Is A Natural Legal Entity Formed by The Association and Group of People To Work Together Towards Achieving A Common ObjectiveLokesh KadyanОценок пока нет

- Commercial Law - Business OrganizationsДокумент21 страницаCommercial Law - Business OrganizationsRoji Belizar HernandezОценок пока нет

- Law On PartnershipДокумент8 страницLaw On Partnershiparianna jungОценок пока нет

- By I/, /uДокумент21 страницаBy I/, /uContra Value BetsОценок пока нет

- Joint Stock Company Gp1 by Professor & Lawyer Puttu Guru PrasadДокумент32 страницыJoint Stock Company Gp1 by Professor & Lawyer Puttu Guru PrasadPUTTU GURU PRASAD SENGUNTHA MUDALIARОценок пока нет

- NIR AP NetworkДокумент711 страницNIR AP NetworkmalumaatОценок пока нет

- Business Incorporation UsДокумент21 страницаBusiness Incorporation UsMARIANA CRISTINA ANAYA QUINTEROОценок пока нет

- Customer StatementДокумент18 страницCustomer Statementmuhyideen6abdulganiyОценок пока нет

- Research Proposal For Law in ClassroomДокумент13 страницResearch Proposal For Law in ClassroomRome VonhartОценок пока нет

- pcl0012 Company & LLP (Students)Документ39 страницpcl0012 Company & LLP (Students)VishithiraОценок пока нет

- Fed Reserve Member Banks 6-20-09Документ229 страницFed Reserve Member Banks 6-20-09Ragnar DanneskjoldОценок пока нет

- Quiz 3Документ3 страницыQuiz 3wivadaОценок пока нет

- Everything About - Significant Beneficial Ownership - Presentation - 08.02Документ23 страницыEverything About - Significant Beneficial Ownership - Presentation - 08.02Farha RahmanОценок пока нет

- Print - Nrs - Chapter 78 - Private CorporationsДокумент96 страницPrint - Nrs - Chapter 78 - Private Corporationscah2009aОценок пока нет

- THE Business Organization: BERNARDO, Eleina Bea L. 11 Grade - Plato (ABM)Документ14 страницTHE Business Organization: BERNARDO, Eleina Bea L. 11 Grade - Plato (ABM)Eleina Bea BernardoОценок пока нет

- Bosal Holding - Analysis and CritiqueДокумент11 страницBosal Holding - Analysis and CritiqueArdi BaharudinОценок пока нет

- Corporations: Organization and Capital Stock Transactions: Accounting Principles, Ninth EditionДокумент33 страницыCorporations: Organization and Capital Stock Transactions: Accounting Principles, Ninth EditionAhmed El KhateebОценок пока нет