Академический Документы

Профессиональный Документы

Культура Документы

Crossing The Line

Загружено:

alfred83070 оценок0% нашли этот документ полезным (0 голосов)

17 просмотров2 страницыinfo on photoshop

Оригинальное название

Crossing the Line

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документinfo on photoshop

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

17 просмотров2 страницыCrossing The Line

Загружено:

alfred8307info on photoshop

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 2

technical

advantage

by Jennifer

Pellet

Crossing the Line

he MACD may sound like a new

offering from a particular fast-food

chain, but its really a technical tool

that serves as an investment barometer

for traders. MACD, or moving average

convergence/divergence, is a momentum

indicator that signals when a trader might

want to buy or sell a stock.

The MACD is computed using exponential

moving averages (EMAs) of stocks. Unlike a

simple moving average, which is calculated

by adding up a stocks closing price each

day during a specified period, then dividing

by the number of days, an EMA employs a

formula that gives greater weight to more

w w w. t d a m e r i t r a d e . c o m

recent closing prices because they provide

additional information about the stocks

current situation. In a MACD analysis, the

difference between two moving averages

(typically, the 26-day EMA is subtracted

from the 12-day EMA) is plotted as a line on

a graph referred to as the MACD, or fast,

line. A second line known as the signal,

or slow, line and usually representing a

nine-day EMA calculated for the MACD

itself is plotted alongside the first.

For investors using the MACD, whats

important is how the fast and slow lines

interact particularly when they cross

over each other, explains Derek Moore,

Director of National Education for

TD AMERITRADE. Traders generally view

a MACD line above the signal line as more

bullish than bearish, he says. But when the

MACD line has been below the signal line

and then crosses above it, that indicates the

price may be turning more positive on a nearterm basis. Traders see that as a trigger as a

potential time to buy or at least to watch the

stock more closely. Conversely, a dip below

the signal line by a MACD is viewed as a

negative crossover, suggesting the beginning

of a possible price drop.

The difference between the MACD and

the signal line is often plotted as a histogram,

Chris Noble/Getty Images

The MACD tries to pinpoint the moment when a stocks momentum shifts

solid bars that extend above zero when the

buying certain stocks or the entire S&P

With technical

MACD line is above the signal line, and

500 for a specified period every time theres a

analysis, you

below it when the MACD line is under the

MACD crossover, for example and it will

position yourself

signal line. The length of the bars represents

show you all the trades you would have made

for success by

the distance between the MACD and signal

and what the hypothetical results might have

lines. Another area of interest is the center

been, Moore says. Its a great way to test

taking emotion

line, Moore says. Traders look for the

and tweak strategies youre considering.

out of the game

MACD to cross above or below the center

Backtesting can provide some indication of

and instilling

line as a second signal to confirm a potential

a strategys potential, but no technical tool is

discipline.

entry or exit point.

foolproof, Moore cautions. Seasoned traders

Crossovers alone, however, can be

know you cant expect to buy at the bottom

Derek Moore,

Director of National Education,

misleading, and its crucial for investors to

and sell at the top 100% of the time, he

TD AMERITRADE

employ the MACD as just one of several

says. With technical analysis, you position

analytical tools. For example, because it relies

yourself for success by taking emotion out of

on historical prices, the MACD is a lagging

the game and instilling discipline. n

indicator and functions best when a market or

security is trending upward or downward. In

Backtesting is the evaluation of a particular trading strategy using historical data. Results presented

a sideways market, a crossover can whipsaw,

are hypothetical; they did not actually occur. Past performance of a security or strategy does not

or reverse quickly, burning an investor who

guarantee the security or strategy will be successful in the future. Results could vary significantly

acts precipitously or without an exit strategy.

and losses could result. In order for a programmed trade to be automatically entered when the

Moreover, the MACD is unique in

conditions you set are met, your computer must be on and StrategyDesk must be running. You are

that it combines a moving averagebased

responsible for all orders entered in your account when a program trade you set is activated. Please

indicator and an oscillator, an indicator that

make sure you keep sufficient funds or positions in your account to support program trades.

fluctuates above and below a center line as

StrategyDesk is a trademark of TD AMERITRADE IP Company, Inc. Used with permission.

its value changes. While there

are no upper or lower limits

to a MACDs values, traders

using oscillating indicators tend

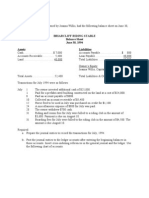

When the MACD line crosses above the signal line after remaining below it,

to perceive the stock as being

traders often expect a positive price jump. But beware when a MACD crosses

overbought or oversold when

below the signal line, which might suggest the beginning of a price drop.

prices hit the upper or lower end of

16.8

the period being studied, Moore

15.5

explains. So when the MACD

14.3

13.0

rises into the higher ranges of

13.0

the study, a trader might want to

11.7

consider a defensive action. With

11.7

10.5

any technical indicator, you

always look at price first.

9.2

1.0

Investors new to using the

0.8

MACD line

MACD or interested in trying

0.6

crosses

centerline

0.4

out a combination of technical

0.2

analysis tools can gauge the

0.01

0.0

potential effectiveness of their

-0.2

0.5

MACD line

strategies with the backtesting

0.6 -0.4

crosses

Histogram

signal line

-0.6

feature on TD AMERITRADEs

506

606

706

806

906

1006

1106

12 06

0107

02 07 0307

new StrategyDesk tool. You can

enter your trading methodology

Michael Moran

Analyzing a MACD Chart

800-669-3900

Вам также может понравиться

- Technical Analysis MasterClass CheatSheet PDFДокумент14 страницTechnical Analysis MasterClass CheatSheet PDFAman KumarОценок пока нет

- Brain Dump For PMP Preparation Ver 1.1Документ8 страницBrain Dump For PMP Preparation Ver 1.1Muhammad JamalОценок пока нет

- Solution To Case 32 by Jim DemelloДокумент7 страницSolution To Case 32 by Jim DemelloRefi Reyhandi Mahardhika100% (2)

- Bachelor in Business Administrator (Hons) Future: Individual Assignment 1 - Future Trading Plan (FTP)Документ26 страницBachelor in Business Administrator (Hons) Future: Individual Assignment 1 - Future Trading Plan (FTP)Muhammad Faiz100% (2)

- Shrewsbury Herbal Products, LTDДокумент1 страницаShrewsbury Herbal Products, LTDWulandari Pramithasari0% (1)

- Ilango Tech Analysis ExplainedДокумент58 страницIlango Tech Analysis ExplainedmrvinodkОценок пока нет

- MACD Ebook PDFДокумент20 страницMACD Ebook PDFegdejuana67% (3)

- Momentum Trading Strategies: Day Trading Made Easy, #4От EverandMomentum Trading Strategies: Day Trading Made Easy, #4Рейтинг: 4 из 5 звезд4/5 (2)

- Fixed Asset Accounting Project ReportДокумент80 страницFixed Asset Accounting Project ReportRobinn Tigga0% (1)

- GE McKinsey Matrix PowerPointДокумент9 страницGE McKinsey Matrix PowerPointOseas GomezОценок пока нет

- Certificate of Employers ' Liability Insurance (A)Документ1 страницаCertificate of Employers ' Liability Insurance (A)Vincent JohnОценок пока нет

- THE 12 Rs of OPPORTUNITY SCREENINGДокумент1 страницаTHE 12 Rs of OPPORTUNITY SCREENINGMaria AngelaОценок пока нет

- PudiledowekizolefumДокумент2 страницыPudiledowekizolefumkakaaОценок пока нет

- Moving Average Convergence DivergenceДокумент8 страницMoving Average Convergence DivergenceshivasharesОценок пока нет

- A Primer On The MACDДокумент5 страницA Primer On The MACDTecwyn LimОценок пока нет

- Macd PDFДокумент5 страницMacd PDFSandeep MishraОценок пока нет

- Moving Average Convergence DivergenceДокумент3 страницыMoving Average Convergence DivergenceNikita DubeyОценок пока нет

- Macd 11 29 11Документ4 страницыMacd 11 29 11TraderLibraryОценок пока нет

- MACD Indicator Explained, With Formula, Examples, and LimitationsДокумент8 страницMACD Indicator Explained, With Formula, Examples, and Limitationsbedul68Оценок пока нет

- Indicator Soup: Enhance Your Technical Trading - September 2007 - by Darrell JobmanДокумент5 страницIndicator Soup: Enhance Your Technical Trading - September 2007 - by Darrell JobmanLuisa HynesОценок пока нет

- The MACD Indicator: 122 Martin Pring On Market MomentumДокумент1 страницаThe MACD Indicator: 122 Martin Pring On Market MomentumTUAN NGUYỄNОценок пока нет

- Keep An Eye On MomentumДокумент5 страницKeep An Eye On MomentumLe BinhОценок пока нет

- Combine MACD and Relative Strength To Time TradesДокумент3 страницыCombine MACD and Relative Strength To Time Tradesemirav2Оценок пока нет

- Technical Indicators (Sharemarket)Документ34 страницыTechnical Indicators (Sharemarket)rcora69Оценок пока нет

- MACDДокумент28 страницMACDTami ColeОценок пока нет

- Trading 101Документ27 страницTrading 101Rica NavarroОценок пока нет

- Trade Plan Group e 540Документ11 страницTrade Plan Group e 540Jesiah PascualОценок пока нет

- The Basis of Technical AnalysisДокумент7 страницThe Basis of Technical AnalysisFranklin Aleyamma JoseОценок пока нет

- 7 Technical Indicators To Build A Trading ToolkitДокумент26 страниц7 Technical Indicators To Build A Trading ToolkitsunilvermabitspilaniОценок пока нет

- The Ultimate Indicators For Crypto TradingДокумент8 страницThe Ultimate Indicators For Crypto TradingUgo BenОценок пока нет

- What Is Moving Average Convergence Divergence - Macd?Документ7 страницWhat Is Moving Average Convergence Divergence - Macd?Ali Abdelfatah MahmoudОценок пока нет

- Wayne A. Thorp - The MACD A Combo of Indicators For The Best of Both WorldsДокумент5 страницWayne A. Thorp - The MACD A Combo of Indicators For The Best of Both WorldsShavya SharmaОценок пока нет

- MACD - Trading The MACD DivergenceДокумент7 страницMACD - Trading The MACD DivergenceAaron DrakeОценок пока нет

- 3 Best Technical Indicators On EarthДокумент11 страниц3 Best Technical Indicators On Earth009xx81% (26)

- MACD HistogramДокумент66 страницMACD Histogrammkd36cal100% (4)

- DailyFX Guide The Fundamentals of Range TradingДокумент10 страницDailyFX Guide The Fundamentals of Range TradingAugustoОценок пока нет

- Principles of Trading Based On Moving AveragesДокумент2 страницыPrinciples of Trading Based On Moving AveragesJack XuanОценок пока нет

- What Is The MACD Indicator?Документ14 страницWhat Is The MACD Indicator?JuniorОценок пока нет

- TradingДокумент3 страницыTradingDerek Dixman ChakowelaОценок пока нет

- Spotting Trend Reversals MACDДокумент7 страницSpotting Trend Reversals MACDOtmane Senhadji El Rhazi100% (1)

- MACD Technical IndicatorДокумент6 страницMACD Technical Indicatorarveti bhuvaneshОценок пока нет

- 8 Day Course - Lesson 4 - Oscillators (RSI & MACD) (FXCM) (11 P.)Документ11 страниц8 Day Course - Lesson 4 - Oscillators (RSI & MACD) (FXCM) (11 P.)Edson Lopes50% (2)

- Professional Day Trading & Technical Analysis Strategic System For Intraday Trading Stocks, Forex & Financial Trading.От EverandProfessional Day Trading & Technical Analysis Strategic System For Intraday Trading Stocks, Forex & Financial Trading.Оценок пока нет

- Elder System - Three ScreensДокумент4 страницыElder System - Three ScreensAnonymous Mp5LmNTkLu100% (1)

- Types of Trading Indicators - Wealth SecretДокумент4 страницыTypes of Trading Indicators - Wealth Secretqgy7nyvv62Оценок пока нет

- MACD Trading StretegyДокумент8 страницMACD Trading StretegyegdejuanaОценок пока нет

- Moving Average Convergence Divergence (MACD)Документ2 страницыMoving Average Convergence Divergence (MACD)vinaОценок пока нет

- Day Trading and Trading IndicatorsДокумент10 страницDay Trading and Trading IndicatorsFrancisco ClementeОценок пока нет

- Spotting Trend Reversals With MACDДокумент3 страницыSpotting Trend Reversals With MACDnypb2000100% (3)

- The 4macd SystemДокумент5 страницThe 4macd Systemfrog manОценок пока нет

- Bachelor in Business Administrator (Hons) Future: Individual Assignment 1 Future Trading Plan (FTP)Документ18 страницBachelor in Business Administrator (Hons) Future: Individual Assignment 1 Future Trading Plan (FTP)Muhammad FaizОценок пока нет

- Technical Study Alerts Guide: Summary of FeaturesДокумент5 страницTechnical Study Alerts Guide: Summary of FeaturesHomero García AlonsoОценок пока нет

- The Jeff Clark Trader Guide To Technical Analysis Mvo759Документ19 страницThe Jeff Clark Trader Guide To Technical Analysis Mvo759Ethan Dukes100% (1)

- MACD Part 3: Chart SchoolДокумент3 страницыMACD Part 3: Chart SchoolSonu KumarОценок пока нет

- Indicaters of StocksДокумент5 страницIndicaters of StocksarshadalicaОценок пока нет

- Bachelor in Business Administration (Hons) FINANCE (BA242) : Future Trading Plan (FTP)Документ26 страницBachelor in Business Administration (Hons) FINANCE (BA242) : Future Trading Plan (FTP)Muhammad FaizОценок пока нет

- What Is SMA - Simple Moving Average - FidelityДокумент3 страницыWhat Is SMA - Simple Moving Average - FidelityArundhathi MОценок пока нет

- Trading Strategies Explained: A selection of strategies traders could use on the LMAX platformОт EverandTrading Strategies Explained: A selection of strategies traders could use on the LMAX platformОценок пока нет

- Stock Market Strategies EBookДокумент10 страницStock Market Strategies EBookRahul IngleОценок пока нет

- Accuracy of MACD Divergence For TradingДокумент4 страницыAccuracy of MACD Divergence For Tradingpeeyush24Оценок пока нет

- Mean Reversion Day Trading Strategies: Profitable Trading StrategiesОт EverandMean Reversion Day Trading Strategies: Profitable Trading StrategiesРейтинг: 5 из 5 звезд5/5 (1)

- Day Trading Strategies: Momentum Indicators: Day Trading Made Easy, #5От EverandDay Trading Strategies: Momentum Indicators: Day Trading Made Easy, #5Оценок пока нет

- Crypto and Forex Trading - Algorithm Trading StrategiesОт EverandCrypto and Forex Trading - Algorithm Trading StrategiesРейтинг: 4 из 5 звезд4/5 (1)

- Day Trading Strategies For Beginners: Day Trading Strategies, #2От EverandDay Trading Strategies For Beginners: Day Trading Strategies, #2Оценок пока нет

- Naspers Investments and Divestment ActivitiesДокумент11 страницNaspers Investments and Divestment ActivitiesManideep NuluОценок пока нет

- Chapter1-Taxes and DefinitionsДокумент37 страницChapter1-Taxes and DefinitionsSohael Adel AliОценок пока нет

- Assignment 1Документ6 страницAssignment 1Haider Chelsea KhanОценок пока нет

- A New Vision For Human ResourcesДокумент16 страницA New Vision For Human ResourcesAlejandra GarciaОценок пока нет

- Shell Dividend PolicyДокумент4 страницыShell Dividend PolicyAdrian SaputraОценок пока нет

- Sweet Poison DayamaniДокумент20 страницSweet Poison DayamaniwillyindiaОценок пока нет

- G12 Business Finance: Module 2 (Week 3-4)Документ18 страницG12 Business Finance: Module 2 (Week 3-4)Jessa GallardoОценок пока нет

- Evaluation and Prediction of Common Stock Prices - A StatisticalДокумент66 страницEvaluation and Prediction of Common Stock Prices - A StatisticalJay PadamaОценок пока нет

- BBA (MOM) - 109 Financial AccountingДокумент2 страницыBBA (MOM) - 109 Financial AccountingGaurav JainОценок пока нет

- Sbi Mutual Fund: SBI Magnum Children's Benefit Fund - Savings PlanДокумент9 страницSbi Mutual Fund: SBI Magnum Children's Benefit Fund - Savings PlanvvpvarunОценок пока нет

- Ratio AnalysisДокумент47 страницRatio AnalysisyasarОценок пока нет

- Accounting Textbook Solutions - 62Документ18 страницAccounting Textbook Solutions - 62acc-expertОценок пока нет

- Financial ManagementДокумент8 страницFinancial Managementmandeep_kaur20Оценок пока нет

- Airthread Acquisition: Income StatementДокумент31 страницаAirthread Acquisition: Income StatementnidhidОценок пока нет

- Accounting Concepts and ConventionsДокумент22 страницыAccounting Concepts and ConventionsMishal SiddiqueОценок пока нет

- Demand, Supply,-WPS OfficeДокумент15 страницDemand, Supply,-WPS OfficeRobelyn Gabion AbayonОценок пока нет

- Indian Technology Startup Funding Report 2017Документ141 страницаIndian Technology Startup Funding Report 2017Dhir100% (1)

- Purchase Method ConsolidationДокумент3 страницыPurchase Method Consolidationsalehin1969Оценок пока нет

- Ratio Analysis of IJMДокумент26 страницRatio Analysis of IJMawaismaqbool83% (6)

- Willoughby Square EB-5 PromotionДокумент7 страницWilloughby Square EB-5 PromotionNorman OderОценок пока нет

- Enterprise Asset Management: Product Management, SAP AGДокумент71 страницаEnterprise Asset Management: Product Management, SAP AGDave LlewellynОценок пока нет

- Fair and Equitable Treatment Under Int. LawДокумент41 страницаFair and Equitable Treatment Under Int. LawAnkit Anand100% (1)

- 1 - Project Management FrameworkДокумент60 страниц1 - Project Management Frameworklaxave8817Оценок пока нет