Академический Документы

Профессиональный Документы

Культура Документы

Generate Monthly Cash Flow With Selling Stock Options

Загружено:

Alan EllmanОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Generate Monthly Cash Flow With Selling Stock Options

Загружено:

Alan EllmanАвторское право:

Доступные форматы

strategies

www.tradersonline-mag.com 03.2015

Generate Monthly Cash Flow

with Selling Stock Options

Part I: Covered Call Writing

Retail investors are always seeking ways to generate higher-than-risk-free-returns and still maintain

capital preservation as a key component to the strategy. For most of us, the thought of combining the

stock market with stock options is far too speculative and not for the average blue collar investor. In

this series of three articles, this myth will be debunked and you will be presented with a set of specific

rules and guidelines geared towards enhancing your annualized returns. In this first article, covered call

writing will be highlighted.

What is Covered Call Writing?

person the right but not the obligation to buy our shares

Covered call writing is a strategy that combines two

from us at a price that we determine (= the strike price)

other strategies: buying stock (long the stock) and

and by a date that we determine (= the expiration date). In

selling stock options (short the option). We first buy an

return for undertaking this obligation we are paid a cash

appropriate stock screening process will be discussed

premium (= the option premium) which is determined by

and sell the option or sell via online trading an unknown

the market.

58

strategies

We will be looking at strike prices near

the current market value of the stock.

Preview Example

profit on the stock side of this trade (buy at $48, sell

Since option contracts almost always consist of 100 shares

at $50 x 100). Our total 1-month profit is $350 (= $150 +

of underlying stock per contract, we will purchase 100

$200) less small commissions or a 7.3 per cent 1-month

shares of a company at $48 per share for an investment

return.

or cost basis of $4,800. Once we own these shares and

are therefore in a covered or protected position, we are

Three Skills Essential to Master this Strategy

now free to sell the option. Lets assume we select the

Before risking even one penny of our hard-earned

$50 strike price and agreed upon sales prices. In other

money, we must master all three aspects of this strategy:

words, the option buyer now controls our shares and has

1. stock selection (you can also use Exchange-Traded

the right to exercise that option and buy our shares from

Funds or ETFs for short), 2. option selection (strike

us at $50.

price and expiration date) and 3. position management

Every contract eventually terminates and ceases to

(exit strategies).

exist. Most option contracts expire on the third Friday of

the month at 4 pm ET (= Eastern Time) and we will be

1. Stock Selection

dealing predominantly with 1-month options. Therefore,

Since we first purchase shares before selling the

the option buyer can buy our shares from us at $50 at

corresponding options, we should only use securities

any time from the sale of the option through 4 pm (ET) on

that we would otherwise want to own. In other words, in

expiration Friday.

our 30-day obligation period we want to own shares least

A typical option premium for this hypothetical

likely to go down in value. This means that our screening

example would be $1.50 or $150 for the contract (100

process must be rigorous and not based on option returns

shares). A $150 initial profit on a cost basis of $4,800

but rather on the quality of the underlying security. As

represents a 3.1 per cent initial return which annualizes

a result, we demand stocks that are fundamentally and

to 37.5 per cent. After the position is entered, it must also

technically (price chart) sound as well as meeting certain

be managed.

common sense requirements like minimum trading

Position management or exit strategies will be

volume.

addressed later in this article. For now, lets look at the

two major outcomes that are possible by expiration (4 pm

a. Fundamental Analysis

ET, the third Friday of the month).

In this first screen, we demand stocks with strong

sales and earnings growth. There are some excellent

(1) The price of the stock remains under $50

proprietary screens like Investors Business Dailys IBD 50

In this scenario, the option will expire worthless because

and SmartSelect screens as well as some free screening

the option buyer will not choose to exercise the option

sites like finviz.com.

and buy our shares for $50 when they can be purchased

at market for a lower price. We keep the $150 premium

and still own our shares and are now free to sell another

option the following month.

(2) The price of the stock moves above $50

In this situation our shares will be sold at the strike

price of $50, unless we execute an exit strategy to avoid

our shares being sold. If our shares are, in fact, sold

Dr. alan ellman

Alan Ellman is president of the Blue Collar Investor

Corp. He holds a Series 65 and is a national speaker

for The Stock Traders Expo, The Money Show and

the American Association of Individual Investors.

Alan has published five books on stock and option

investing as well as over 300 journal articles and

has produced more than 200 educational videos.

alan@thebluecollarinvestor.com

for $50, we have now generated an additional $200

59

strategies

www.tradersonline-mag.com 03.2015

is an earnings report due out prior

F1) Technical Chart for Centene Corp

to expiration of the contract. This

means that we will only hold a stock

for a maximum of two consecutive

months in our covered call writing

portfolio,

since

most

companies

report on a quarterly basis. Other

common

sense

screens

include

minimum trading volume (250,000

shares per day), proper stock and

industry diversification (no one stock

or industry should represent more

than 20 per cent of our portfolio) and

cash allocation (allocate a similar

amount of cash to each position).

Table

demonstrates

the

screening process (first row on

Figure 1 demonstrates the use of four technical indicators used to identify trend and momentum in order to

select the best underlying securities for option-selling. This chart shows a mixed technical picture which will

assist in determining strike price and exit strategy choices.

Source: www.stockcharts.com

top) we provide for our premium

members on a weekly basis.

Option Selection

There are three aspects of an option

we must evaluate before deciding

b. Technical Analysis

on which will be most beneficial to achieving the highest

Since we are undertaking a 1-month obligation, it is

returns while still factoring in capital preservation: a.

important to identify trend and Momentum and to have

strike price (the price we agree to sell our shares for), b.

volume confirmation of these indicators. There are a

expiration date of the contract and c. the cash premium

myriad of useful technical indicators such as the ones

we will receive.

presented in the chart for Centene Corp (CNC) in Figure 1.

For trend identification, we can use the 20-day and

a. Strike Price Selection

100-day Exponential Moving Averages (EMAs).

Generally, we will be looking at strike prices near the current

For trend and Momentum identification, we can use

market value of the stock. These strike prices are the ones

the MACD histogram.

that will generate the highest returns. The relationship

For Momentum identification, we can use the

between the strike price and the current market value of

Stochastic Oscillator.

the underlying security is known as the moneyness of

Volume is used to confirm changes in the other

the option. For call options, if the strike is higher than the

indicators as well as detect divergences.

current market value (as it was in the preview example), it

is known as an out-of-the-money strike. If the call strike is

It is important that we all become proficient at reading

lower than the stock price, it is called in-the-money. If the

price charts to have the ability to maximize returns when

two prices are the same, we have the at-the-money strike.

selling stock options. Although it may be intimidating

In a bull market environment with strong chart

initially (it was for me), reading a price chart becomes

technicals, we are more likely to choose an out-of-the-

quite easy and time efficient as we become familiar with

money strike where we have an opportunity to generate

the parameters we choose.

two income streams: one from the sale of the call option

and the other from the share appreciation.

c. Common Sense Principles

In a bearish or volatile market environment, we are

The final set of screens we use in selecting the best

more likely to select an in-the-money strike which gives

candidates for option-selling fall into the category of

us protection of the option profit. Lets examine this last

common sense screens. The most important of these

sentence: An option premium can have two components

screens is the rule that we never sell an option, when there

to it: time value (actual profit) and intrinsic value, if the

60

strategies

strike is in-the-money and not profit. For example, if a

navigate through earnings reports which become

stock is trading at $32 and we sell an in-the-money $30

public quarterly so we can move in and out of securities

strike for $3, the premium is broken down as follows:

rather easily compared to a longer-term commitment.

Some covered call writers prefer weeklys which may

$2 = Intrinsic value: amount strike is in-the-money

return higher annualized results.

There are pros and cons to weeklys. For example, we

and not profit because we will lose $2 on the sale of

the stock.

can use them right up earnings reports and therefore,

$1 = Time value: actual initial profit.

hypothetically, 48 weeks of the year. On the other side of

the fence, we have quadruple the commissions and less

By using the intrinsic value to buy down our cost

time for position management techniques. We must know

basis from $32 to $30, our initial profit now calculates to

all the advantages and disadvantages to each approach

$1/$30 = 3.3 per cent. This profit is protected as long as

before deciding on which is best for our specific trading

share value does not decline below $30, so our downside

style.

protection is $2/$32 = 6.25 per cent. This means that we

are guaranteed a 1-month return of 3.3 per cent as long

c. Cash Premium Goals

as share value does not decline by more than 6.25 per

The higher our goal, the greater the risk. This is because

cent by expiration Friday. Therein lies the value of an in-

higher premiums mean more volatile stocks and therefore

the-money strike. The disadvantage is that we will not

a greater chance of share depreciation. There is no one

participate in additional profits, if share value appreciates

range that is right for every investor.

However, covered call writing is a conservative

by expiration.

option strategy, so a reasonable goal for initial 1-month

b. Expiration Date Selection

returns would fall into the two to four per cent range.

The shorter the time frame, the greater the annualized

After setting your goal, make sure a trade will meet

returns. This is why 1-month options have been

this objective before entering the position. Goals can

highlighted in this article. Monthlys also allow us to

also be adjusted up or down depending on overall

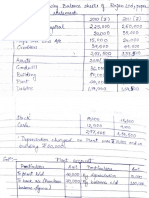

T1) Screening Process for Selecting the Best Option-Selling Candidates

Symbol

Company Name

Weekly

Rank or

Other

Source

Price

Opts

Avail

(Y/N)

Report

Same Store

Sales (Y/N)

Pass Fundl

And Techl

Screens

(Y/N)

Avg. Vol.:

>250K

Sh/Day

(Y/N)

Pass Risk

vs. Reward

(Rank 5 or

Higher)

Chart: PRICE

BAR above 20

EMA above 100

EMA (Y/N/@)

Tech Ind.

OK: MACD

& Stoch.

(Y/N/?)

Earn.

Report In

This Option

Month (Y/N)

Passed All Screens - ELIGIBLE CANDIDATES

AAP

Advance Auto Parts

26

154.18

AMAT

Applied Materials Inc

Other

25.04

AMBA

Ambrella Inc

49

54.69

ARMK

Aramark

Other

30.13

AVGO

Avago Technologies

Other

103.99

BIIB

Biogen Idec Inc

46

340.87

CAVM

Cavium Inc

16

58.77

DLTR

Dollar Tree Inc

Other

68.41

EA

Electronic Arts Inc

Other

46.66

EXR

Extra Space Storage

Other

59.44

FFIV

F5 Networks Inc

24

133.26

FL

Foot Locker Inc

Other

56.70

10

IDTI

Integrated Device Tech

Other

19.90

The screening process for selecting the most elite option-selling underlying securities should include fundamental, technical and common sense screens as demonstrated

in the BCI Weekly Stock Screen of December, 14th 2014.

Source: Blue Collar Investor

61

strategies

www.tradersonline-mag.com 03.2015

F2) Options Chain for Facebook from December, 17th Dec. 2014

this critical subject appropriate justice within the context

of this one article. However, there are several key points

that must be discussed.

Events that May Create an Exit Opportunity

Stock price declines precipitously.

Stock price gaps down.

Stock price accelerates exponentially.

An ex-dividend date is scheduled prior to contract

expiration.

The price of the stock is above the strike at expiration

with no earnings due out the next contract.

The price of the stock is above the strike with an

earnings report due out the following month.

This options chain for the one-month $77.50 strike price shows a bid-ask spread

of $1.94 to $1.97. Since we sell at the bid, our initial return that should be used

when calculating initial profit is $1.94.

Source: Blue Collar Investor

All exit strategies begin with buying back the option.

This will relieve us of our option obligation, and still

leave us long the stock. Now we are in a position to

sell another option, sell the stock or take no immediate

action. An excellent guideline to use, when a stock price

is declining, is to buy back the option when its value

market environment, personal risk tolerance and chart

declines to 20 per cent or less of the original sale value

technicals.

in the first half of a contract or ten per cent or less in the

second half of a contract.

3. Position Management (Exit Strategies)

Lets look at a real-life example for Facebook (FB) (see

Once we have entered our covered call trade, we now

Figure 2). On 17th of Dec 2014, Facebook was trading at

move into management mode. There is no way to give

$75.73. The 1-month January out-of-the-money $77.50

strike generated $194 per contract which represented

a 2.6 per ent 1-month return or 31 per cent annualised.

Strategy Snapshot

If the stock price should decline, so will the value of

the corresponding call option. Should the option value

Strategy Name:

Covered Call Writing

Strategy Type:

Cash Flow Trading

Time Horizon:

Usually longer-term position in a stock plus max.

30-day holding period of short option

second half of the contract, we also buy back the option

Setup:

Technical and fundamentally sound stock, choose

short option strike price depending on market

state (general hint: at the money, bull market:

out of the money, bear market: in the money)

Entry:

When holding the stocks, sell 1 options contract

of the new series for each 100 shares

risk tolerance and chart technicals will influence our

Stop-Loss:

Optional; put stop loss for stock in case it should

massively decline

Take Profit:

Buy back option once it falls to 20% (10%) of

price shorted in first (second) 15 days of ist 30day max holding period

Trailing-Stop:

Risk and Money

Management:

Keep positions small as downside protection is

limited; diversify positions across sectors

Strategy Profile:

Less risky than outright stock position as short

option delivers premium in case of declining or

constant stock price; higher hit rate and smoother

profits over time; max. profit is capped at strike

price of short option

decline below $0.40 in the first half of the contract, the

20 per cent guideline tells us to immediately buy back

that option. If option value declines below $0.20 in the

and evaluate what our next step will be. Factors such as

time to expiration, overall market assessment, personal

position management decisions.

Conclusion

Covered call writing is a low-risk strategy geared to

retail investors. The trades are constructed to generate

monthly cash flow keeping capital preservation as a

high priority. The three skills that must be mastered to

justify risking our hard-earned money, when using this

trading approach, are stock selection, option selection

and position management.

In Part 2 of this three-part series we will discuss

put-selling.

62

Вам также может понравиться

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- To Take Into Account 2Документ8 страницTo Take Into Account 2Omaira DiazОценок пока нет

- Chapter 3 Quiz KeyДокумент2 страницыChapter 3 Quiz KeyAmna MalikОценок пока нет

- Assignment Article 2Документ14 страницAssignment Article 2Trend on Time0% (1)

- Name of AssociationДокумент2 страницыName of AssociationTony Peterz KurewaОценок пока нет

- Uniform CostingДокумент2 страницыUniform CostingSyed Mujtaba HassanОценок пока нет

- Discovery JT FoxxДокумент10 страницDiscovery JT Foxxrifishman1Оценок пока нет

- Psa 710Документ19 страницPsa 710JecОценок пока нет

- Incorporation of Section 8 CompanyДокумент10 страницIncorporation of Section 8 CompanyThakreОценок пока нет

- Sebi (Prohibition of Insider Trading) Regulations, 1992Документ22 страницыSebi (Prohibition of Insider Trading) Regulations, 1992Latest Laws TeamОценок пока нет

- Watch Tower Charter Corporate Entities and AmendmentsДокумент116 страницWatch Tower Charter Corporate Entities and AmendmentsSo AZ Cop Watch100% (1)

- I Once Scoffed at The Notion ofДокумент5 страницI Once Scoffed at The Notion ofYaniHeryaniОценок пока нет

- TestBank IBДокумент29 страницTestBank IBJoey Zahary GintingОценок пока нет

- E-Commerce in The Czech RepublicДокумент19 страницE-Commerce in The Czech RepublicAccaceОценок пока нет

- Chapter V - Promoter's ContractsДокумент6 страницChapter V - Promoter's ContractsSui100% (4)

- Recourse Loan Agreement SampleДокумент15 страницRecourse Loan Agreement Samplehimadri.banerji60Оценок пока нет

- Dumaguete Construction FirmsДокумент2 страницыDumaguete Construction FirmsHannah JovannОценок пока нет

- Apollo: Retreading Material and Retreaded TyresДокумент5 страницApollo: Retreading Material and Retreaded TyresghdbakjdОценок пока нет

- Demystifying Venture Capital Economics Part 1Документ6 страницDemystifying Venture Capital Economics Part 1Tarek FahimОценок пока нет

- First 10 Cases - CommrevДокумент179 страницFirst 10 Cases - CommrevStephen JacoboОценок пока нет

- Strategy - Motilal Oswal PDFДокумент292 страницыStrategy - Motilal Oswal PDFpradip1729Оценок пока нет

- Globe-BlackBerry Partner RetailersДокумент4 страницыGlobe-BlackBerry Partner RetailersAlora Uy GuerreroОценок пока нет

- Exposure Draft PSAK 55 (REVISI 2006)Документ49 страницExposure Draft PSAK 55 (REVISI 2006)Chang Mei LiОценок пока нет

- Vending Zone ProposedДокумент30 страницVending Zone ProposedRishabh PrajapatiОценок пока нет

- Solutions of Cash Flow Statement QuestionsДокумент7 страницSolutions of Cash Flow Statement QuestionsSuvana YasminОценок пока нет

- Cultural Challenges of Integration-Daiichi Sankyo and Ranbaxy - ModATeam5Документ11 страницCultural Challenges of Integration-Daiichi Sankyo and Ranbaxy - ModATeam5Mahda Sumayyah100% (1)

- YamahaДокумент13 страницYamahaAyush GuptaОценок пока нет

- Coca ColaДокумент18 страницCoca ColajigneshvamjaОценок пока нет

- 1 SGD To Idr - Google SearchДокумент2 страницы1 SGD To Idr - Google SearchBachtiar M TaUfikОценок пока нет

- Return To The Energy and Resources InstituteДокумент5 страницReturn To The Energy and Resources InstitutevijisignhОценок пока нет

- List of Power PlantДокумент39 страницList of Power PlantShambhu MehtaОценок пока нет