Академический Документы

Профессиональный Документы

Культура Документы

1737

Загружено:

ZaHirEypOhАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

1737

Загружено:

ZaHirEypOhАвторское право:

Доступные форматы

International Journal of Academic Research in Accounting, Finance and Management Sciences

Volume 2, Issue 4 (2012)

ISSN: 2225-8329

Usage of Credit Cards Beyond Limit : A Case Study of Younger

Generations in Malaysia

Kaviyarasu ELANGKOVAN

ABSTRACT

Undergraduate Student

University Putra Malaysia

E-mail: kavi.economicsupm@gmail.com

Young generations around 30s who hold numbers of credit card and personal loans are

an example of todays Malaysia. Many people claims that the socio economy status of

someone is reflected by the number of credit cards they own. Without realizing the

consequences of the usage of credit card beyond their limit, more and more young

peoples aged around 30s were declared bankrupt due to credit card debts. This research

intended to explore the factors that contributed to the bankruptcy of younger generation

due to credit card debts. The findings of the research provide useful outcomes to younger

generation as well as public in order to increase their awareness regarding the

bankruptcy issue that could be seen as a new disease. An update on the insolvency

trends, performance and recent initiatives undertaken by Malaysia Department of

Insolvency (MdI) were also reviewed in this study. Insolvency Trends and the

administrations consisting of individual bankruptcies and bankrupts cooperation were

also studied thoroughly.

KEY WORDS Bankruptcy, credit cards, young peoples

JEL CODES

F65

1. Introduction

Credit cards were first issued in the USA in the early twentieth century. In Malaysia, the

first card was introduced in the mid-1970s (Zafar U. Ahmed & et al., 2010) [1]. At the early on

period, credit cards were only issued to professionals or successful business persons by card

issuing companies. However, with the passage of time, eligibility criteria for obtaining credit cards

have been changed because credit cards are now easily obtained by individuals regardless of their

income or other measures of financial wellbeing. As a result, the number of cardholders reached

to about three million by the turn of the last century (Zafar U.Ahmed & et al., 2010)[1].The

increase of credit card has brought many side effects to the users especially for the people aged

below 30. This is because credit card influence them in making the excessive spending because it

easier and convenient for user to pay with credit card rather than bring cash with them. As a result,

in March 2009, outstanding debts from credit card holders amounted to RM15.719 billion were

reported. Then, by the year2009 outstanding credit card debts accounted for 1.35 percent of the

total loans outstanding or 11.41 percent of the total consumer credit (Bank Negara Malaysia, 2009;

as cited in Zafar U. Ahmed & et al., 2010)[1].Thus, its shows that increase in the number of credit

www.hrmars.com/journals 330

International Journal of Academic Research in Accounting, Finance and Management Sciences

Volume 2, Issue 4 (2012)

ISSN: 2225-8329

card holders seeking bankruptcy records over the years were also reported. The people below 30

are the leading aged group that has been declared bankrupt because of credit card debts (Credit

Card Debt and You: Under-30s under Siege, Malay Mail Insight, 2009) [2].

In the bankruptcy survey of the Panel Study of Income Dynamics, the most common reason

that households gave for filing for bankruptcy was high debt/misuse of credit cards33 percent

gave this as their primary reason for filing. A 2006 survey of debtors who sought credit counseling

prior to filing for bankruptcy found that debt was even more important: two-thirds were in

financial difficulty because of poor money management/excessive spending (National

Foundation for Credit Counseling, 2006). In addition, all of the empirical models of the bankruptcy

filing decision have found that consumers are more likely to file if they have higher debt.

Domowitz and Sartain (1999) found that households are more likely to file as their credit card and

medical debt levels increase. Gross and Souleles (2002a) similarly found that credit card holders

are more likely to file as their credit card debt increases. In Fay, Hurst, and White (2002) found

that households are more likely to file as their financial gain from filing increaseswhere the

financial gain from filing mainly depends on how much debt would be discharged in bankruptcy.

International comparisons also suggest a connection between credit card debt and

bankruptcy filings. Ellis (1998) uses the comparison between the United States and Canada to

argue for the importance of credit card debt in explaining the increase in bankruptcy filings.

General credit cards were first issued in 1966 in the United States and in 1968 in Canada. In

Canada, both credit card debt and bankruptcy filings increased rapidly starting in 1969. But in the

United States, usury laws in a number of states limited the maximum interest rates that lenders

could charge on loans, which held down their willingness to issue credit cards. U.S. bankruptcy

filings remained constant throughout the 1970s. In 1978, however, the U.S. Supreme Court

effectively abolished state usury laws in the Marquette decision, and after that, both credit card

debt and bankruptcy filings increased rapidly in the United States.3 Mann (2006) documents a

similarly close relationship between credit card debt and bankruptcy filings in Australia, Japan, and

the United Kingdom.

Livshits, MacGee, and Tertilt (2006) use calibration techniques to examine various

explanations for the increase in bankruptcy filings since the early 1980s.They find that only the

large increase in credit card debt combined with a reduction in the punishment for bankruptcy can

explain the increase in bankruptcy filings since the early 1980s.Finally, mortgage debt has also

grown rapidly since 1980, although the growth rate of mortgage debt is well below the growth

rate of revolving debt; that is, real mortgage debt per household tripled between 1980 and 2006,

while real revolving debt per household grew by a factor of 4.6 over the same period. The increase

in mortgage debt and the increase in bankruptcy filings are related in several ways: First,

homeowners often file for bankruptcy to delay mortgage lenders from foreclosing on their homes.

Second, although mortgage debt is not discharged in bankruptcy, homeowners may want to file

because having their consumer debt discharged makes it easier for them to meet their mortgage

obligations.

Finally, debtors may file for bankruptcy if their mortgage lender has already foreclosed and

the house has been sold for less than the amount owed. In this situation, debtors in some states

are liable for the difference, but the debt can be discharged in bankruptcy. For more discussion of

these interactions between mortgage debt and consumer debt, see Berkowitz and Hynes (1999)

and Lin and White (2001).

331

www.hrmars.com/journals

International Journal of Academic Research in Accounting, Finance and Management Sciences

Volume 2, Issue 4 (2012)

ISSN: 2225-8329

Overall, the increase in credit card and possibly mortgage debt levels since1980 provides

the most convincing explanation for the increase in bankruptcy filings in the United States. But

adverse events and debt levels interact with each other in explaining the increase in bankruptcy

filings because, as debt level increase, any particular adverse event is more likely to trigger

financial distress and bankruptcy.

2. Findings of Study

Given the apparent connection between the expansion in credit card debt and the rise in

bankruptcy filings, its useful to review how markets for credit cards have evolved in recent

decades. My discussion here draws on Ausubel (1997), Evans and Schmalensee (1999), Moss and

Johnson (1999), Peterson (2004), and Mann (2006). Until the 1960s, consumer credit generally

took the form of mortgages or installment loans from banks or credit unions. Obtaining a loan

required going through a face-to-face application procedure with a bank or credit union employee,

explaining the purpose of the loan, and demonstrating ability to repay.

Because of the costly application procedure and the potential embarrassment of being

turned down, these loans were generally small and went only to the most creditworthy customers.

This pattern began to change with the introduction of credit cards in1966, since credit cards

provided unsecured lines of credit that consumers could use at any time for any purpose. The

earliest credit cards were issued by banks where consumers had their checking or savings accounts.

Because most states had usury laws that limited maximum interest rates, banks offered credit

cards only to the most creditworthy consumers and card use therefore grew only slowly. But after

the Marquette decision in 1978, credit card issuers could charge higher interstates, and they

expanded in states where low interest rate limits had previously made lending unprofitable.

Over time, the development of credit bureaus and computerized credit scoring models

changed credit card markets, because lenders could obtain information from credit bureaus about

individual consumers credit records and could therefore offer credit cards to consumers who had

no prior relationship with the lender. Lenders first offered credit cards to consumers who applied

by mail, and then began sending out pre-approved card offers to lists of consumers whose credit

records were screened in advance. These innovations reduced the cost of credit both by

eliminating the face-to-face application process and by allowing lenders to expand nationally,

which increased competition in local credit card markets. From1977 to 2001, the proportion of U.S.

households having at least one credit card rose from 38 to 76 percent (Durkin, 2000).

Over the same period, revolving credit increased from 16 to 37 percent of no mortgage

consumer credit, which means that credit card loans gradually replaced other forms of consumer

credit. This shift from installment to revolving loans meant dramatic changes in the terms of

consumer debt. Secured and installment loans typically carried fixed interest rates and fixed

repayment schedules. Credit card loans, in contrast, allow lenders to change the interest rate at

any time and allow debtors to choose how much they repay each month, subject to a low

minimum repayment requirement. Consumers who repay in full each month use credit cards only

for transacting; they receive an interest-free loan from the date of the purchase to the due date of

the bill. In contrast, consumers who repay less than the full amount due each month use credit

cards for both transacting and borrowing; they pay interest from the date of purchase. If

borrowers pay late or exceed their credit limits, then lenders raise the interest rate to a penalty

range and impose additional fees.

www.hrmars.com/journals 332

International Journal of Academic Research in Accounting, Finance and Management Sciences

Volume 2, Issue 4 (2012)

ISSN: 2225-8329

Credit card issuers compete heavily for new customers by mailing out unsolicited, preapproved credit card offers: in 2001, the average U.S. household received45 of these offers (BarGill, 2004). Over time, competition among issuers has led them to offer increasingly favorable

introductory terms and increasingly onerous post-introductory terms. The favorable introductory

terms include zero annual fees, low or zero introductory interest rates on purchases and balance

transfers, and rewards such as cash back or frequent flier miles for each dollar spent. The

favorable introductory terms encourage consumers to accept new cards, while the rewards

programs encourage them to charge more on the cards and the low minimum repayment

requirements encourage them to borrow. The format of the monthly bills also encourages

borrowing, since minimum payments are often shown in large type while the full amount due is

shown in small type.

Minimum monthly payments are lowtypically the previous months interest and fees

plus1 percent of the principlewhich means that debtors who pay only the minimum each month

still owe nearly half of any amount borrowed after five years. After the introductory period, terms

become much more onerous: the average credit card interest rate is 16 percent, interest rates rise

to 24 to 30 percent if debtors pay late, and penalty fees for paying late or exceeding the credit

limit are around $35. This pattern of credit card pricing implies that issuers make losses on new

accounts and offset their losses with profits on older accounts (Ausubel, 1991, 1997; Bar-Gill,

2004).

Credit card issuers have also expanded their high-risk operations by lending to consumers

who have lower incomes, lower credit scores, and past bankruptcy filings. The percentage of

households in the lowest quintile of the income distribution who have credit cards rose from 11

percent in 1977 to 43 percent in 2001(Durkin, 2000; Johnson, 2005). Three-quarters of bankrupts

also had at least one credit card within a year after filing (Staten, 1993).The shift of consumer debt

from installment debt to credit card debt, combined with the pattern of credit card pricing, has

made consumers debt burdens much more sensitive to changes in income. When consumers

incomes are high, they are likely to pay their credit card bills in full, and therefore their debt

burden is low and they pay little or no interest. But when incomes decline, consumers are likely to

pay late or to pay the minimum on their credit cards, so that their debt burdens increase and they

pay much more in interest and fees. Although credit cards allow consumers to smooth

consumption when their incomes fall, the cost of doing so is extremely high and may cause some

debtors to enter a state of ongoing financial distress.

3. Insolvency Trends and the Administration (Report by Department of Insolvency

Malaysia)

As reflected in the Figure 1, the total number of individual bankruptcies registered from

2005 to March 2011 is 90,898. 3. In the first quarter of 2011, 20,555 creditors petitions were filed

in court to initiate bankruptcy proceedings and this marks an increase of 0.78% from the first

quarter in the previous year where 20,395 creditors petitions were filed in court.

333

www.hrmars.com/journals

International Journal of Academic Research in Accounting, Finance and Management Sciences

Volume 2, Issue 4 (2012)

ISSN: 2225-8329

Figure 1. Yearly Petitions and Orders made from 2005 to 2011

Generally, Figure 1 further indicates a sharp increase of 40.11% in the number of creditors

petitions filed in 2010 in contrast to the number of creditors petitions filed in 2009. 17,490

petitions were filed by creditors in 2009 whereas as many as 87, 645 petitions were filed by

creditors in 2010. In consequence to the increased number of creditors petitions filed in 2010, the

ending of 2010 shows an increase of 11.65% in respect of individual bankruptcies registered as

compared to the number of individual bankruptcies registered in 2009.

A slight increase is shown in the number of Receiving Orders (RO) and Adjudication Orders

(AO) made in the beginning of 2011. The first quarter of 2011 denotes an increase of 7.27%

number of registered bankruptcy cases as 4,841 RO and AO were made in comparison to 4,513 RO

and AO made in the first 3 months of 2010.

Figure 2. Cases Resolved Based on Categories from 2005 to March 2010

www.hrmars.com/journals 334

International Journal of Academic Research in Accounting, Finance and Management Sciences

Volume 2, Issue 4 (2012)

ISSN: 2225-8329

Parallel with the Tenth Malaysia Plan and the New Economic Policy introduced by the

government, Malaysian Department of Insolvency (MdI) strives to provide an effective

administration of bankruptcy cases in ensuring the enhancement of public service delivery system

and efficiency. Out of the total number of bankruptcy cases administered, a total of 23,147 cases

had been resolved via 3 modes that is, discharge by way of court order, discharge via certificate of

Director General of Insolvency and annulment of the Adjudication Orders, in the period between

2005 to March 2011.

As indicated in Figure 2, majority of cases had been resolved by way of discharge via

certificate of Director General of Insolvency made in pursuant to section 33A, Bankruptcy Act 1967

in which 11, 342 (49%) bankruptcy cases were resolved. 8, 101 (35%) bankruptcy cases were

resolved by way of annulment of adjudication orders and 16% of cases were resolved when 3,704

bankrupts had obtained their discharge by way of court order.

4. Bankrupts Applications in pursuance to Section 38 of Malaysian Bankruptcy Act 1967

To recap, Section 38 of the Malaysian Bankruptcy Act 1967 restricts undischarged

bankrupts from inter alia, leaving Malaysia, carrying on any business and maintaining any action in

court, without the previous permission of the DGI. Bankrupts can obtain the permission of the DGI

against any of those abovementioned restrictions by submitting their applications to the

administering branch and it will be processed within 7 days from the date of application, as

promised in MdIs client charter.

Figure 3. Number and types of application made by bankrupts from 2010 to 2011

335

www.hrmars.com/journals

International Journal of Academic Research in Accounting, Finance and Management Sciences

Volume 2, Issue 4 (2012)

ISSN: 2225-8329

Figure 3 depicts the number and most common types of applications made by bankrupts.

In the first 3 months of 2011, 1,735 applications to obtain the permission of DGI for various

reasons were made and 100% of it was approved. Applications made to leave Malaysia in the first

quarter of 2011 shows a slight decrease of 3.7% when only 1,585 applications were made, as

compared to the 1,644 applications made in the first quarter of 2010. 102 applications made by

bankrupts to obtain the permission of DGI to carry on any business were approved in the first

quarter of 2010 in contrast to 153 similar applications made in the first quarter of 2010, which

marks a decrease of 33.33%. Nevertheless, applications made by bankrupts to obtain the

permission of DGI to maintain court action indicates an increase of 30.6% whereby 48 bankrupts

made the application within the first 3 months of 2011 in comparison to only 37 applications made

in the first 3 months of 2010.

Figure 4. Statement of Affairs filed by bankrupts from 2009 to 2011

The level of bankrupts cooperation can mainly be indicated in the number of Statement of

Affairs filed, as against the number of individual bankruptcies registered in a year. A bankrupts

cooperation in filing the Statement of Affairs is imperative in ensuring an efficient administration

of each bankruptcy case. It is also essential in considering any of the applications made by the

bankrupt during his/her period in bankruptcy.

As shown in Figure 4, between first quarters of 2009, 2010 and 2011, a noticeable steady

increase in filing of Statement of Affairs by bankrupts is recorded in each quarter. 48.8% increase

in filing of Statement of Affairs is shown from the first quarter of 2010 in which 2, 615 bankrupts

had filed their Statement of Affairs in the first as compared to only 1,757 who did so in the same

period of 2009. The cooperation given by bankrupts continues to increase by 6.3% when 2, 780

bankrupts had filed their Statement of Affairs in the first quarter of 2011.

4. Conclusions

As the bankruptcy due to credit card debts has increase especially among people aged below

30, serious effort should be taken to curb this issue. Thus, researcher has come out with several

recommendation or suggestion regarding this issue. Firstly, it is recommended to encourage

www.hrmars.com/journals 336

International Journal of Academic Research in Accounting, Finance and Management Sciences

Volume 2, Issue 4 (2012)

ISSN: 2225-8329

people aged below 30s to use the debit card rather than credit card in order to reduce the debt

and bankruptcy among them. Debit card will debit money directly from the owner account which

prevents ones to spend more than his or her ability. Whereas, credit card allow the card holder to

borrow money from the issuing bank and there will be interest charges from the credit card

company on the purchases that had been made. Thus, the higher debts can increase the chances

to be declared as bankruptcy among credit card holder. Therefore, using debit card is the wise

action when making the purchases since it will only allow the card holder to spend within their

limit. Other steps that can be considered is to increase the knowledge about credit card and

bankruptcy among people aged below 30s. Providing the credit education to the people aged

below 30 as well as public can help them in managing their money wisely and use the credit

correctly to avoid debts. It can be done through financial seminar, talk from professional person or

forum. The credit education can help ones to manage their financial, debt and set up a better

planning for the future and it should begin as early as possible. Then, it is recommended for the

government or any non government organization (NGO) to aggressively come out and implements

the campaign in order to create the awareness regarding the credit card debts. For example, in the

campaign should encourage public as well as people below 30s to bring their cash or use debit

card rather than use the credit cards when buying things. By doing so, the public and people aged

below 30s can think twice before purchase any product or service. Through this kind of campaign,

it can increase the awareness regarding the credit card debts implication and the advantages and

disadvantages of having the credit card.

References

1. Ausubel, Lawrence M. (1997). Credit Card Defaults,Credit Card Profits, and Bankruptcy.

American Bankruptcy Law Journal, 71(spring): 249270.

2. Bar-Gill, Oren (2004). Seduction by Plastic.Northwestern Law Review, 98 (summer): 1373.

3. Barron, John M., Michael E. Staten, andStephanie M. Wilshusen (2002). The Impact of

Casino Gambling on Personal Bankruptcy FilingRates. Contemporary Economic Policy, 20(4): 440

45.

4. Domowitz, Ian, and Robert L. Sartain (1999). Determinants of the Consumer Bankruptcy

Decision. Journal of Finance, 54(1): 40320.

5. Efrat, Rafael (2002). Global Trends in Personal Bankruptcy. American Bankruptcy Law

Journal, 76 (winter): 81110.

6. Gropp, Reint, J. Karl Scholz, and Michelle J.White (1997). Personal Bankruptcy and

CreditSupply and Demand, Quarterly Journal of Economics, 112(1): 21751.

7. Lin, Emily Y., and Michelle J. White (2001).Bankruptcy and the Market for Mortgage and

Home Improvement Loans. Journal of Urban Economics, 50(1): 13862.

8. Livshits, Igor, James MacGee, and Michele Tertilt (2006). Accounting for the Rise in

Consumer Bankruptcies. http://economics.uwo.ca/faculty/livshits/BankruptcyRise.pdf.

9. Moss, David A., and Gibbs A. Johnson (1999). The Rise of Consumer Bankruptcy:

Evolution, Revolution, or Both? American Bankruptcy Law Journal, 73 (spring): 311.

10. Shuzen, Ng. (2009). Credit Card Debt and You: Under-30s Under Siege, available at:

http://www.mmail.com.my/content/credit-card-debt-and-you-under30s-under-siege

11. Wang, Hung-Jen, and Michelle J. White (2000). An Optimal Personal Bankruptcy System

and Proposed Reforms. Journal of Legal Studies, 29(1): 25586.

337

www.hrmars.com/journals

International Journal of Academic Research in Accounting, Finance and Management Sciences

Volume 2, Issue 4 (2012)

ISSN: 2225-8329

12. Zafar U. Ahmed, Ishak Ismail, M. Sadiq Sohail, Ibrahim Tabsh, Hasbalaila Alias (2010).

Malaysian consumers credit card usage behavior, Asia Pacific Journal of Marketing and Logistics,

Vol. 22 No. 4, pp. 528 - 544.

www.hrmars.com/journals 338

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- IfsДокумент23 страницыIfsRahul Kumar JainОценок пока нет

- Aud 2Документ7 страницAud 2Raymundo EirahОценок пока нет

- Đề thi thử Deloitte-ACE Intern 2021Документ60 страницĐề thi thử Deloitte-ACE Intern 2021Đặng Trần Huyền TrâmОценок пока нет

- Case Study On Equity ValuationДокумент3 страницыCase Study On Equity ValuationUbaid DarОценок пока нет

- Amplify University TrainingДокумент11 страницAmplify University Trainingshariz500100% (1)

- The Role of Investment Banking in IndiaДокумент13 страницThe Role of Investment Banking in IndiaGuneet SaurabhОценок пока нет

- Revised Corporation Code MnemonicsДокумент3 страницыRevised Corporation Code MnemonicsZicoОценок пока нет

- RWJ Chapter 1 - EUДокумент17 страницRWJ Chapter 1 - EULokkhi BowОценок пока нет

- DRAFT 1. Executive Summary and IntroductionДокумент12 страницDRAFT 1. Executive Summary and IntroductionAllana NacinoОценок пока нет

- Senior High School Department: Quarter 3 - Module 4: Debit and Credit-The Double - Entry SystemДокумент13 страницSenior High School Department: Quarter 3 - Module 4: Debit and Credit-The Double - Entry SystemJaye Ruanto100% (1)

- Characteristics of The RestaurantДокумент2 страницыCharacteristics of The RestaurantSudhansuSekharОценок пока нет

- Chapter 6 Sample ProblemsДокумент3 страницыChapter 6 Sample ProblemsShaiTengcoОценок пока нет

- Barings Bank CaseДокумент15 страницBarings Bank CaseRamya MattaОценок пока нет

- Spectrans M1 M2Документ7 страницSpectrans M1 M2Patricia CruzОценок пока нет

- Billing Address: Tax InvoiceДокумент1 страницаBilling Address: Tax InvoiceManojkumar DОценок пока нет

- Tax Invoice: Akbar & CompanyДокумент1 страницаTax Invoice: Akbar & CompanyTTIPLОценок пока нет

- Unit-1Financial Credit Risk AnalyticsДокумент40 страницUnit-1Financial Credit Risk AnalyticsAkshitОценок пока нет

- 3rd GovAcc 1SAY2324Документ9 страниц3rd GovAcc 1SAY2324Grand DuelistОценок пока нет

- ToolKit Roads&Highways Low-ResДокумент896 страницToolKit Roads&Highways Low-ResAbd Aziz MohamedОценок пока нет

- MBIДокумент16 страницMBIPankaj SharmaОценок пока нет

- Week 6 Case AnalysisДокумент2 страницыWeek 6 Case AnalysisVarun Abbineni0% (1)

- TT10 QuestionДокумент1 страницаTT10 QuestionUyển Nhi TrầnОценок пока нет

- Risk ManagementДокумент1 страницаRisk ManagementThảo NguyễnОценок пока нет

- LNT Grasim CaseДокумент9 страницLNT Grasim CaseRickMartinОценок пока нет

- CHAPTER 1 (STRUCTuRE OF MALAYSIAN FINANCIAL SYSTEM)Документ13 страницCHAPTER 1 (STRUCTuRE OF MALAYSIAN FINANCIAL SYSTEM)han guzelОценок пока нет

- Payment PDFДокумент1 страницаPayment PDFAMAN SAURAVОценок пока нет

- Ch.18 Revenue Recognition: Chapter Learning ObjectiveДокумент5 страницCh.18 Revenue Recognition: Chapter Learning ObjectiveFaishal Alghi FariОценок пока нет

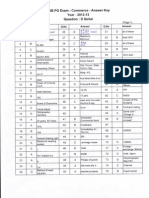

- TRB Commerce - PG - Answer Key 2012Документ2 страницыTRB Commerce - PG - Answer Key 2012babu4in1Оценок пока нет

- The Foreign Exchange Market NoteДокумент12 страницThe Foreign Exchange Market Noteరఘువీర్ సూర్యనారాయణОценок пока нет

- Internship Report On Deposit and Investment Management of Al Arafah Islami Bank LimitedДокумент211 страницInternship Report On Deposit and Investment Management of Al Arafah Islami Bank LimitedWahidHossainОценок пока нет