Академический Документы

Профессиональный Документы

Культура Документы

Bio Watch: Boston - Spring 2015

Загружено:

Anonymous Feglbx5Исходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Bio Watch: Boston - Spring 2015

Загружено:

Anonymous Feglbx5Авторское право:

Доступные форматы

BIO WATCH

BOSTON | SPRING 2015

entry: purchasing research materials, renting lab

space and hiring a talented, highly educated labor

pool are only a few of the high-ticket items needed

to get in the proverbial door not to mention the

groundbreaking idea, drug or device under development. With drugs taking as long as 10 to 15 years to

grow from concept to Food and Drug Administration

(FDA) approval, companies need significant funding

in order to survive. Even if the product is approved,

the firm generally survives for a time on limited

earnings never mind a profit. Fortunately, the life

science sector has found success in securing public

funding in the shape of National Institutes of Health

(NIH) grants. It is also the beneficiary private venture

capital (VC) funding. In fact, despite its small size,

Massachusetts received the largest amount of biotech venture capital over the last two quarters - more

than the entire state of California - by $200,000,000.

MASSACHUSETTS

BIOTECH BEGINNINGS

In 1977, Cambridge, Massachusetts became the

worlds first city to govern the handling of genetic

material through the Cambridge Recombinant DNA

Technology Ordinance.1 At the time, DNA intelligence

was in its infancy it was only 25 years earlier that

Watson and Crick discovered the double helix. However, it was well known that the discovery would be

critically important to understanding diseases and to

the future development of pharmaceuticals. Massachusetts and Cambridge in particular has been

at the forefront of biotechnology since the fields

inception. While Cambridge benefits from proximity

to academic prowess, it was the communitys early

acceptance of biotechnology that enabled the industry to flourish.

From big pharma to seed stage start-ups, establishing a life sciences company has steep barriers to

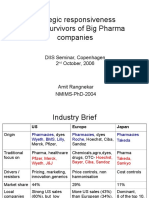

1.55 B

VENTURE CAPITAL FUNDING

Q4 2014-Q1 2015

1.15 B

189 M

127 M

Massachusetts

Bay Area

San Diego

Philadelphia

Metro

62 M

DC/Metroplex

53 M

NY Metro

Massachusetts received 41.5% of the total US Biotech VC

funding over the last two quarters.

Source: DTZ Boston Research and PwC Moneytree

According to a November 2014 study released by

the Tufts Center for the Study of Drug Development,

it takes more than $2.5 billion over the course of a

decade to bring a novel medicine to market.2 While

the study was criticized for discounting early-stage

NIH investments and orphan drug tax credits, $2.5B

is still a long way from the $802 million estimate the

center released in its last study in 2003. The rise in

development costs is due in large part to the focus

on complicated diseases that are difficult to treat

such as Alzheimers. And research on these types of

diseases is risky the study estimated that just 12%

of compounds undergoing clinical testing make it to

approval.

What does this have to do with real estate?

As a result of skyrocketing R&D costs, larger companies are opting to acquire or partner, rather than generate in-house a development pipeline.3 Most recently, Roche successfully completed a tender offer for a

57% majority stake in Cambridge-based Foundation

Medicine. The companies are expected to collaborate in four areas of R&D: integrating Foundations

tumor profiling platform into Roches clinical development, developing new diagnostics in the areas of

cancer immunotherapy and circulating tumor DNA

analysis, co-developing companion diagnostics, and

developing in vitro diagnostic kits for Foundations

tests.4 Foundation Medicine signed an expansion for

38,000 SF at 10 Canal Park in January (just 2 years

into an 8-year lease) the firm also occupies 61,000

SF at 150 Second Street.

SUBMARKET COMPARISON

SEAPORT (BOSTON)

The Seaport may have started as Bostons Innovation

District, but in recent years, 50 Northern Avenue has

become one of its more prominent buildings - home to

Vertex Pharmaceuticals. Vertex has made strides in the

improvement of cystic fibrosis therapeutics and looks to

further benefit their patients with their New Drug Application for combination therapy for CF - sent to the FDA in

November of 2014.

Next door, at 155 Seaport Boulevard, is the 21,000

square-foot headquarters of Intarcia Therapeutics. Intarcia

has recently had positive results testing its subcutaneous

drug delivery system for daily management of chronic

diseases. As a result of its early success, it secured an

impressive $200M in venture capital funding in 2014.

But not all of the Seaports life science firms need expansive footprints - at the other end of the neighborhood is 27

Drydock Avenue. Home to a handful of smaller biotech

companies - such as Immunetics, AbVitro Inc. and Ad

Biotech - the facility has historically provided economically

priced office and lab options.

360,000 SF project could provide a relief valve for companies seeking centrally located lab space.

LONGWOOD MEDICAL AREA (LMA-BOSTON)

While the majority of the space in Longwood is owner

occupied, DTZ tracks five buildings totaling just over 1.5

MSF that are leased commercially. However, due to its

proximity to world class hospitals (Brigham and Womens,

Boston Childrens Hospital, Beth-Israel, Dana Farber) and

medical education facilities (Boston University, Harvard,

Massachusetts College of Pharmacy and Health Sciences), its rare for space to become available for lease. As a

result, vacancy has been below 15% since the mid-1990s

and below 1.0% for the past three years.

SUBMARKET MAP

*Most active submarkets for Life Science real estate

Methuen

deals.

Lawrence

N. Andover

495 North

Andover

Tewksbury

Chelmsford

Westford

And the Seaport offers new construction opportunities.

One of the largest building opportunities still available in

this neighborhood is the proposed Innovation Square at

Northern Avenue project. Located at the corner of Northern Avenue and Tide Street, the site is no longer restricted

to water-dependent use and is zoned for laboratory use

and biopharmaceutical manufacturing - a prime option for

large companies. With only a few blocks over 50,000 SF

available in Kendall Square (and 7 companies looking for

at least that much lab space in Cambridge), this proposed

Lowell

Lynnfield

Boxborough

Concord

Marlborough

Wakefield

Burlington 128

Acton

495 WEST

Stoneham

Bedford

Woburn

Maynard

Lexington

Lincoln

Medford

128 Central

METROWEST

Weston

Southborough

Natick

Wellesley

Revere

CAMBRIDGE

Somerville

Allston

Brookline BOSTON

Newton

128

Needham

Quincy

Hingham

128 South

Hopkinton

Westwood

495 South

Weymouth

Dedham

Norwood

Braintree

Canton

Randolph

Franklin

Seaport At A Glance

NIH Funding

Rockland

Milford

$1,713,737,264

Venture Capital (2014)

$208,500,203

Vacancy Rate

0.0%

Largest Tenant

Vertex

Source: DTZ Boston Research, NIH.gov, and PwC Moneytree

Norwell

3/24 South

Foxborough

24

Pembroke

Brockton

Mansfield

Taunton

Most of us already know that Cambridge is the life science

epicenter of New England - and arguably the country.

Approximately 20% of all biotechnology firms registered

in Massachusetts are located within a mile radius of East

Cambridges Kendall Square neighborhood - 50% are

within 5 miles.

At just over 6.0 MSF, the East Cambridge lab market is

the largest in greater Boston and obviously the most

popular. Prime spaces are leasing at over $70 PSF NNN

a 7.5% increase over the past year. And vacancy stood

at a minuscule 3.3% at the end of the first quarter. Despite

these tight conditions, well-established tenants are doing

whatever it takes to maintain or establish a presence in

East Cambridge. Large companies such as Amgen, Genzyme, Pfizer and Novartis have all decided that location

trumps price when it comes to the importance of proximity

to great minds and innovative culture.

What is a scientist after all? It is a

curious man looking through a keyhole, the keyhole of nature, trying to

know whats going on.

-Jacques Yves Cousteau (1910-1997)

MAJOR CAMBRIDGE DEALS 2014-2015

With only a few blocks of space available over 50,000 SF

and, at last count, 7 tenants touring the market for at least

that much space, we expect rents to climb considerably in

the next 12 to 18 months. Recent deliveries and projects

under construction include: Pfizers facility at 610 Main

Street, and Novartiss Campus at 181 Massachusetts

Avenue.

TENANT

SF

ADDRESS

Baxter International

200,000

650 East Kendall St

Alnylam Pharmaceuticals

295,000

675 West Kendall St

Agios

113,000

88 Sidney St

However, the latest development news is Genzymes

headquarters relocation it will move from 340,000 SF

at 500 Kendall Street into 251,000 SF build-to-suit at 50

Binney Street in August of 2018. Despite the decrease in

square footage, the new building will not contain an atrium and will therefore be able to house the 950 current

employees as well as accommodate anticipated growth of

350 new employees.

Amgen

79,000

200 Cambridgepark Dr

Dicerna

40,000

87 Cambridgepark Dr

Biogen

152,664

renewal

10 Cambridge Center

Momenta

78,454

sublease renewal from

Vertex Pharmaceuticals

675 West Kendall St

Genzyme

251,000

50 Binney St

Biogen

93,000

sublease from Ironwood

Pharmaceuticals

301 Binney St

Biogen

79,683

301 Binney St

Saugus

Malden

Waltham

Framingham

Westborough

Beverly

Peabody

Wilmington

Littleton

Hudson

Danvers

128 North

Billerica

CAMBRIDGE

Cambridge At A Glance

NIH Funding

$331,458,725

Venture Capital (2014)

$1,211,232,900

Vacancy Rate

10.0%

Largest Tenant

Novartis, Pfizer, Biogen

Source: DTZ Boston Research, NIH.gov, and PwC Moneytree

Source: DTZ Boston Research

128 CENTRAL

Major tenants clearly see a value in this - Shire has

recently committed to 202,000 SF at 95 Hayden Avenue

in Lexington and 104,000 SF at 235 Wyman Street in

Waltham. The company will shift its U.S. operational headquarters from Chesterbrook, PA to Lexington, MA where

its rare disease business unit is based. The announcement came shortly after Chicago-based AbbVie called off

its proposed $55 billion acquisition of Shire.

AVERAGE

LIFE SCIENCE

DEAL

Venture Capital (2014)

$235,104,201

Vacancy Rate

17.1%

Largest Tenant

Shire

NIH Funding

$3,079,266

Venture Capital (2014)

32,500,101

Vacancy Rate

39.1%

Largest Tenant

Sanofi/Genzyme

CAMBRIDGE

128 CENTRAL

$41.50 GROSS

$61.25 NNN

$35.00 NNN

BASE RENT

$39.50 PSF

$57.00 PSF

$30.00 PSF

$50.00 PSF

$37.00 PSF

$10.00 PSF

While most pharmaceutical companies tend to congregate

in Cambridge, medical device and diagnostic companies

have taken a liking to the 495/Metrowest Corridor. Genzyme is one of the more visible tenants in the submarket,

but others include Boston Scientific (300 Boston Scientific

Way, Marlborough), Quest Diagnostics (200 Forest Street,

Marlborough), Berg Pharma, AB Sciex and Heartware

(all at 500 Old Connecticut Path, Framingham) as well

as Boston Heart Diagnostics and rEVO Biologics (both at

175 Crossing Boulevard in Framingham). 495/Metrowest

continues to be the most economical option for tenants

seeking research and development space. At $19.00 PSF

NNN, asking rents have remained stable for the past three

years and are more than 70% lower than those in Cambridge.

495 WEST

6,750 SF

21,820 SF

47,650 SF

EFFECTIVE RENT

TI PACKAGE

**Average deal over the last 12

months within each submarket.

$49,457,893

Source: DTZ Boston Research, NIH.gov, and PwC Moneytree

4,460 SF

SIZE

NIH Funding

495 / MetroWest At A Glance

Cubist Pharmaceuticals (a recent acquisition of Merck)

also resides on Hayden Avenue. Additionally, Winter

Street in Waltham is another hot spot for life science firms

- GlaxoSmithKline, AstraZeneca, Histogenics, Alkermes,

Immunogen and Fresenius all make it their regional

homes.

SEAPORT

495/METROWEST

128 Central At A Glance

While 128 Central does not generally receive as much

attention as Kendall Square, its tenant composition is

comparable. However, 128 Central offers lab space at half

the price of Kendall Square. It also offers free parking.

$19.15 NNN

$18.00 PSF

$20.00 PSF

FREE RENT

0 MONTHS

0 MONTHS

0 MONTHS

4 MONTHS

TERM

5 YEARS

4 YEARS

5.6 YEARS

3 YEARS

BUILDING CLASS

A-

Source: DTZ Boston Research

SOURCES

PUBLIC LIFE SCIENCE COMPANIES WITH MA PRESENCE

Cambridge, Massachusetts, Municipal Code 8.20.

Tufts Center for the Study of Drug

Development. Cost to Develop and

Win Marketing Approval for a New

Drug is $2.6 Billion. N.p., 18 Nov.

2014. Web. 30 Apr. 2015.

495 NORTH

495 WEST

Waltham

Somerville

495 SOUTH

WORCESTER

BIOTECH SECTOR BREAKDOWN WITHIN MA

128 NORTH

Bioinformatics 3%

Boston

Marlborough

128 CENTRAL

128 SOUTH

28

Agricultural Industrial 4%

METROWEST

Carroll, John D. GSKs New Boston

Collaboration Chief Goes anti-pharma as He Prowls for Partners. FierceBiotech. N.p., 2 Sept. 2014. Web. 19

Mar. 2015.

Karow, Julia. Roche to Use Foundation Medicines Test in Phase III

Anti-PD-L1 Drug Trials. GenomeWeb.

N.p., 22 Apr. 2015. Web. 30 Apr. 2015.

4

Medical Device 5%

BOSTON

Human Diagnostic

Development 6%

5

CAMBRIDGE

INNER SUBURBS

33

Research Product

& Instruments 11%

Source: DTZ Boston Research

LARGEST RECENT DEALS

Contract Research

& Manufacturing 16%

675 W Kendall Street

Cambridge

251,000 SF

50 Binney St

Cambridge

650 E Kendall

Cambridge

I-495

11%

88 Sidney Street

Cambridge

79,000 SF

78,454 SF

MOMENTA

Route 128

31%

PHARMACEUTICALS

AGIOS

10 Cambridge Center 1 Research Drive

Cambridge

Westborough

93,000 SF

AMGEN

113,000 SF

BIOGEN

114,000 SF

GENZYME

152,664 SF

BIOGEN

GE HEALTHCARE

200 Forest Street

Marlborough

200,000 SF

BAXTER INTERNATIONAL

209,855 SF

GENZYME

ALNYLAM

295,000 SF

301 Binney Street 200 Cambridgepark 675 W Kendall Street

Cambridge

Cambridge

Cambridge

Drug Development 55%

Boston

Inner

Suburbs

11%

LARGEST TENANTS IN MA BY SQUARE FEET

Cambridge

47%

Sanofi / Genzyme 2,260,000 SF

Biogen 1,190,000 SF

Novartis 1,440,000 SF

Pfizer 1,120,000 SF

Vertex 1,180,000 SF

Source: DTZ Boston Research

Source: DTZ Boston Research

For More Information, Contact:

Ashley E. Lane

Vice President, Research

DTZ

One International Place

Boston, Massachusetts 02110

Direct Tel: +1 (617) 279 4570

Ashley.Lane@dtz.com

Matthew B. Smith

Research Analyst

DTZ

One International Place

Boston, Massachusetts 02110

Direct Tel: +1 (617) 279 4589

Matthew.Smith@dtz.com

One International Place

10th Floor

Boston, MA 02110

Вам также может понравиться

- Biology Is Technology: The Promise, Peril, and New Business of Engineering LifeОт EverandBiology Is Technology: The Promise, Peril, and New Business of Engineering LifeРейтинг: 4 из 5 звезд4/5 (3)

- Preserving the Promise: Improving the Culture of Biotech InvestmentОт EverandPreserving the Promise: Improving the Culture of Biotech InvestmentОценок пока нет

- Greater Boston Life Sciences ReportДокумент8 страницGreater Boston Life Sciences ReportAnonymous Feglbx5Оценок пока нет

- NKF Research Life Sciences June 2020Документ28 страницNKF Research Life Sciences June 2020citybizlist11Оценок пока нет

- 5 Predictions of Life ScienceДокумент32 страницы5 Predictions of Life ScienceJuan Carlos Antonio TéllezОценок пока нет

- Signs of Life:: The Growth of Biotechnology Centers in The U.SДокумент40 страницSigns of Life:: The Growth of Biotechnology Centers in The U.SIvor RoystonОценок пока нет

- PulseДокумент2 страницыPulseAnonymous Feglbx5Оценок пока нет

- The Role of Small Firms in U.S BioTДокумент13 страницThe Role of Small Firms in U.S BioTNguyen VyОценок пока нет

- BioDistrict Business PlanДокумент34 страницыBioDistrict Business PlanBioDistrict New OrleansОценок пока нет

- Illinois Innovation Ecosystem - OLDДокумент40 страницIllinois Innovation Ecosystem - OLDISTCoalitionОценок пока нет

- MedTechWatchCanada-vol3 Iss2Документ12 страницMedTechWatchCanada-vol3 Iss2Test PersonОценок пока нет

- 4 Eva Cramer Biotech Suny DownstateДокумент3 страницы4 Eva Cramer Biotech Suny DownstateNYC Council Tech in Govn't CommitteeОценок пока нет

- No-Hands Navigation: Isis InsightsДокумент28 страницNo-Hands Navigation: Isis InsightsIsis Innovation Ltd.Оценок пока нет

- Research Innovation CampusesДокумент16 страницResearch Innovation CampusesJames LeeОценок пока нет

- 10 Stocks For The Next 10 Years - April 13, 2007Документ5 страниц10 Stocks For The Next 10 Years - April 13, 2007rotterdam010Оценок пока нет

- Bio WorldДокумент198 страницBio Worldmc_goaОценок пока нет

- Historia de La BiotecnologíaДокумент5 страницHistoria de La BiotecnologíaAlma MezaОценок пока нет

- Microsoft Word Forging 1000 Venture S... Ion Economy - Campbell Falcão 004Документ17 страницMicrosoft Word Forging 1000 Venture S... Ion Economy - Campbell Falcão 004Aaron AppletonОценок пока нет

- BioView3 PDFДокумент1 страницаBioView3 PDFAnonymous Feglbx5Оценок пока нет

- The Spatial Clustering of Science and CapitalДокумент42 страницыThe Spatial Clustering of Science and CapitalAnaMariaОценок пока нет

- Spectre CaseДокумент9 страницSpectre CaseAhmad ZaryabОценок пока нет

- 01-02-2014 Term Sheet - Thursday, January 2894Документ6 страниц01-02-2014 Term Sheet - Thursday, January 2894Sri ReddyОценок пока нет

- Forbes PatentsДокумент2 страницыForbes PatentsbperilloОценок пока нет

- Blog Post - Take Aways From IIC KeynotesДокумент5 страницBlog Post - Take Aways From IIC Keynotesdch204Оценок пока нет

- ISOM1380 2020W Pt1 StudentsДокумент55 страницISOM1380 2020W Pt1 StudentsYuen Hei Max LeeОценок пока нет

- Microline - Riding The Wave of Technological InnovationДокумент16 страницMicroline - Riding The Wave of Technological InnovationJimmyОценок пока нет

- 181175Документ24 страницы181175micael O'coileanОценок пока нет

- BIG SCIENCE: What's It Worth?Документ48 страницBIG SCIENCE: What's It Worth?pirotteОценок пока нет

- Accelerating Commercialization Cost Saving Health Technologies ReportДокумент25 страницAccelerating Commercialization Cost Saving Health Technologies ReportBrazil offshore jobsОценок пока нет

- Division of Medicinal Chemistry and Chemical BiologyДокумент3 страницыDivision of Medicinal Chemistry and Chemical BiologygiaovukhoayduocОценок пока нет

- ECSC Commercial Market ECSC Commercial Market AnalysisДокумент26 страницECSC Commercial Market ECSC Commercial Market AnalysisM-NCPPCОценок пока нет

- Chapter 15 - Licensing The Technology Biotechnology Com - 2020 - BiotechnologyДокумент24 страницыChapter 15 - Licensing The Technology Biotechnology Com - 2020 - BiotechnologyazizaОценок пока нет

- Eli Lilly Biotech Pilot Plant, Indianapolis, United States of AmericaДокумент5 страницEli Lilly Biotech Pilot Plant, Indianapolis, United States of AmericaShyam Sunder BudhwarОценок пока нет

- Where Innovation Creates ValueДокумент7 страницWhere Innovation Creates Valuepatriot133Оценок пока нет

- GE Heathcare BOP ArticleДокумент7 страницGE Heathcare BOP ArticleMustafa HussainОценок пока нет

- Life+Sciences RE EbookДокумент8 страницLife+Sciences RE EbookSОценок пока нет

- Economic Roadmap Nov21 2013Документ31 страницаEconomic Roadmap Nov21 2013Departamento de Desarrollo Económico y ComercioОценок пока нет

- Auerswald Et Al 2003 Private Sector Decision Making Early Tech DevelopmentДокумент34 страницыAuerswald Et Al 2003 Private Sector Decision Making Early Tech DevelopmentABLloydОценок пока нет

- Visu SonДокумент14 страницVisu SonHHHHHHEAMAYОценок пока нет

- Subcommittee Hearing On Sbir: Advancing Medical BreakthroughsДокумент75 страницSubcommittee Hearing On Sbir: Advancing Medical BreakthroughsScribd Government DocsОценок пока нет

- A Mini Case Study of Product Strategy - The Cyphe Stent From Cordis (A Johnson & Johnson Company) RДокумент15 страницA Mini Case Study of Product Strategy - The Cyphe Stent From Cordis (A Johnson & Johnson Company) RneerajonwayОценок пока нет

- Boston Highlights Q1 2013Документ2 страницыBoston Highlights Q1 2013Anonymous Feglbx5Оценок пока нет

- Health Facilities Management-February 2015Документ48 страницHealth Facilities Management-February 2015MichaelОценок пока нет

- Phosphonics Investment Releaseapril2010Документ4 страницыPhosphonics Investment Releaseapril2010api-94537271Оценок пока нет

- ThermoFisher Company AnalysisДокумент14 страницThermoFisher Company AnalysisGijoОценок пока нет

- Bad Science - and Bad Business - at The NRCДокумент2 страницыBad Science - and Bad Business - at The NRCEvidenceNetwork.caОценок пока нет

- The 3 Annual Life Science Conference: Biotechnology Strategy Project Realizing Israel PotentialДокумент20 страницThe 3 Annual Life Science Conference: Biotechnology Strategy Project Realizing Israel Potentialalex.nogueira396Оценок пока нет

- Early-Stage Valuation in The Biotechnology IndustryДокумент54 страницыEarly-Stage Valuation in The Biotechnology Industrytransbunko100% (1)

- Adiseshu-WCM - VarianДокумент81 страницаAdiseshu-WCM - VarianPrathapReddyОценок пока нет

- Internationalization of R&D (IRD)Документ35 страницInternationalization of R&D (IRD)Sreejit NairОценок пока нет

- Investing in BiotechДокумент3 страницыInvesting in BiotechFrankValkenburgОценок пока нет

- Bay Area Houston Business Development UpdateДокумент11 страницBay Area Houston Business Development UpdateCoy DavidsonОценок пока нет

- Big Pharma Pricing and InnovationДокумент20 страницBig Pharma Pricing and Innovationnelly1Оценок пока нет

- Hemel (2017) .Bayh-Dole Beyond BordersДокумент29 страницHemel (2017) .Bayh-Dole Beyond Borderse.mariogd99Оценок пока нет

- ¡PartnershipsforValue AddedThroughBioprospectingДокумент19 страниц¡PartnershipsforValue AddedThroughBioprospectingmberensteinОценок пока нет

- University Technology Transfer Benefits The Economy and People EverywhereДокумент1 страницаUniversity Technology Transfer Benefits The Economy and People EverywherenessleeОценок пока нет

- Characteristics of Competitive Intelligence PractiДокумент17 страницCharacteristics of Competitive Intelligence PractiGiacomo FaisОценок пока нет

- South Korea and BiotechnologyДокумент7 страницSouth Korea and BiotechnologyArturo Parra SОценок пока нет

- Medical Science PlanДокумент22 страницыMedical Science PlanAdeline OngОценок пока нет

- Individual Assignment Example - Mindray Medical PDFДокумент10 страницIndividual Assignment Example - Mindray Medical PDFCheryl ShongОценок пока нет

- The Woodlands Office Submarket SnapshotДокумент4 страницыThe Woodlands Office Submarket SnapshotAnonymous Feglbx5Оценок пока нет

- CIO Bulletin - DiliVer LLC (Final)Документ2 страницыCIO Bulletin - DiliVer LLC (Final)Anonymous Feglbx5Оценок пока нет

- Houston's Office Market Is Finally On The MendДокумент9 страницHouston's Office Market Is Finally On The MendAnonymous Feglbx5Оценок пока нет

- ValeportДокумент3 страницыValeportAnonymous Feglbx5Оценок пока нет

- Houston's Industrial Market Continues To Expand, Adding 4.4M SF of Inventory in The Third QuarterДокумент6 страницHouston's Industrial Market Continues To Expand, Adding 4.4M SF of Inventory in The Third QuarterAnonymous Feglbx5Оценок пока нет

- Progress Ventures Newsletter 3Q2018Документ18 страницProgress Ventures Newsletter 3Q2018Anonymous Feglbx5Оценок пока нет

- 4Q18 Atlanta Local Apartment ReportДокумент4 страницы4Q18 Atlanta Local Apartment ReportAnonymous Feglbx5Оценок пока нет

- THRealEstate THINK-US Multifamily ResearchДокумент10 страницTHRealEstate THINK-US Multifamily ResearchAnonymous Feglbx5Оценок пока нет

- 4Q18 Washington, D.C. Local Apartment ReportДокумент4 страницы4Q18 Washington, D.C. Local Apartment ReportAnonymous Feglbx5Оценок пока нет

- 4Q18 North Carolina Local Apartment ReportДокумент8 страниц4Q18 North Carolina Local Apartment ReportAnonymous Feglbx5Оценок пока нет

- 4Q18 Philadelphia Local Apartment ReportДокумент4 страницы4Q18 Philadelphia Local Apartment ReportAnonymous Feglbx5Оценок пока нет

- Fredericksburg Americas Alliance MarketBeat Retail Q32018Документ1 страницаFredericksburg Americas Alliance MarketBeat Retail Q32018Anonymous Feglbx5Оценок пока нет

- 4Q18 South Florida Local Apartment ReportДокумент8 страниц4Q18 South Florida Local Apartment ReportAnonymous Feglbx5Оценок пока нет

- 4Q18 New York City Local Apartment ReportДокумент8 страниц4Q18 New York City Local Apartment ReportAnonymous Feglbx5Оценок пока нет

- Mack-Cali Realty Corporation Reports Third Quarter 2018 ResultsДокумент9 страницMack-Cali Realty Corporation Reports Third Quarter 2018 ResultsAnonymous Feglbx5Оценок пока нет

- 4Q18 Boston Local Apartment ReportДокумент4 страницы4Q18 Boston Local Apartment ReportAnonymous Feglbx5Оценок пока нет

- 4Q18 Houston Local Apartment ReportДокумент4 страницы4Q18 Houston Local Apartment ReportAnonymous Feglbx5Оценок пока нет

- 3Q18 Philadelphia Office MarketДокумент7 страниц3Q18 Philadelphia Office MarketAnonymous Feglbx5Оценок пока нет

- Wilmington Office MarketДокумент5 страницWilmington Office MarketWilliam HarrisОценок пока нет

- 4Q18 Dallas Fort Worth Local Apartment ReportДокумент4 страницы4Q18 Dallas Fort Worth Local Apartment ReportAnonymous Feglbx5Оценок пока нет

- Under Armour: Q3 Gains Come at Q4 Expense: Maintain SELLДокумент7 страницUnder Armour: Q3 Gains Come at Q4 Expense: Maintain SELLAnonymous Feglbx5Оценок пока нет

- Fredericksburg Americas Alliance MarketBeat Industrial Q32018Документ1 страницаFredericksburg Americas Alliance MarketBeat Industrial Q32018Anonymous Feglbx5Оценок пока нет

- Fredericksburg Americas Alliance MarketBeat Office Q32018Документ1 страницаFredericksburg Americas Alliance MarketBeat Office Q32018Anonymous Feglbx5Оценок пока нет

- Asl Marine Holdings LTDДокумент28 страницAsl Marine Holdings LTDAnonymous Feglbx5Оценок пока нет

- 2018 U.S. Retail Holiday Trends Guide - Final PDFДокумент9 страниц2018 U.S. Retail Holiday Trends Guide - Final PDFAnonymous Feglbx5Оценок пока нет

- Roanoke Americas Alliance MarketBeat Retail Q32018 FINALДокумент1 страницаRoanoke Americas Alliance MarketBeat Retail Q32018 FINALAnonymous Feglbx5Оценок пока нет

- Roanoke Americas Alliance MarketBeat Office Q32018 FINALДокумент1 страницаRoanoke Americas Alliance MarketBeat Office Q32018 FINALAnonymous Feglbx5Оценок пока нет

- Hampton Roads Americas Alliance MarketBeat Retail Q32018Документ2 страницыHampton Roads Americas Alliance MarketBeat Retail Q32018Anonymous Feglbx5Оценок пока нет

- Roanoke Americas Alliance MarketBeat Office Q32018 FINALДокумент1 страницаRoanoke Americas Alliance MarketBeat Office Q32018 FINALAnonymous Feglbx5Оценок пока нет

- Hampton Roads Americas Alliance MarketBeat Office Q32018Документ2 страницыHampton Roads Americas Alliance MarketBeat Office Q32018Anonymous Feglbx5Оценок пока нет

- 9 Pharmacokinetics WorkbookДокумент16 страниц9 Pharmacokinetics WorkbookClayson BuftonОценок пока нет

- Global Pharma StrategyДокумент15 страницGlobal Pharma StrategyDr Amit RangnekarОценок пока нет

- Introduction To Clinical ResearchДокумент19 страницIntroduction To Clinical ResearchVignesh GaneshОценок пока нет

- PharmacoparametersДокумент48 страницPharmacoparameterskatrina_cruz_3Оценок пока нет

- Pharma Company ProfileДокумент548 страницPharma Company Profilelavate amol bhimraoОценок пока нет

- HES 005 Session 1 SASДокумент8 страницHES 005 Session 1 SASG I100% (1)

- Research & Development (R&D) - FormulationДокумент2 страницыResearch & Development (R&D) - FormulationAliah ZuhairahОценок пока нет

- Jubilant Life Sciences Receives ANDA Approval For Rosuvastatin Calcium Tablets (Company Update)Документ3 страницыJubilant Life Sciences Receives ANDA Approval For Rosuvastatin Calcium Tablets (Company Update)Shyam SunderОценок пока нет

- CiplaДокумент16 страницCiplaRoshan SharmaОценок пока нет

- Current Student Master s2Документ5 страницCurrent Student Master s2Mad MadОценок пока нет

- List of Medicine Manufacturing Companies in Baddi With AddressДокумент10 страницList of Medicine Manufacturing Companies in Baddi With AddressKPM PHARMA MACHINERIES KPM Pharma Machineries100% (9)

- M PharmaI-II2011Документ3 страницыM PharmaI-II2011irc_avtarОценок пока нет

- Process Validation of Oral Solid Dosage Form. Tablet-An OverviewДокумент16 страницProcess Validation of Oral Solid Dosage Form. Tablet-An OverviewAndy Rojas100% (1)

- Bioavailability & Bioequivalence Pharmacokinetic PrinciplesДокумент24 страницыBioavailability & Bioequivalence Pharmacokinetic PrinciplesKoya AnushareddyОценок пока нет

- Generic DrugsДокумент9 страницGeneric DrugsZanila YoshiokaОценок пока нет

- E5 Ethnic Factors in The Acceptability of Foreign Clinical DataДокумент7 страницE5 Ethnic Factors in The Acceptability of Foreign Clinical Data涂皇堯Оценок пока нет

- Achieving Market Dominance Through ReformulationДокумент223 страницыAchieving Market Dominance Through ReformulationHerry HendrayadiОценок пока нет

- Pharmaceutical Industry in IndiaДокумент11 страницPharmaceutical Industry in IndiaSudarshan MahajanОценок пока нет

- Introduction Letter: We Are Proud To Be Associated With Some of The Reputed Brands As Mentioned BelowДокумент3 страницыIntroduction Letter: We Are Proud To Be Associated With Some of The Reputed Brands As Mentioned BelowNikesh DoshiОценок пока нет

- Guidance For Industry Botanical Drug ProductsДокумент52 страницыGuidance For Industry Botanical Drug ProductsJY MarОценок пока нет

- Biopharmaceutics IntroductionДокумент46 страницBiopharmaceutics IntroductionMinal NadeemОценок пока нет

- Regulatory AffairsДокумент8 страницRegulatory Affairsnsk79in@gmail.com100% (1)

- وزارة الصحة - قائمة الألف وأربعمائة دواء التي تم تخفيض أسعارهاДокумент128 страницوزارة الصحة - قائمة الألف وأربعمائة دواء التي تم تخفيض أسعارهاالشبيبةОценок пока нет

- Sažetak Karakteristika Leka: Film Tableta, 200 MG Pakovanje: Blister, 1x12 Film TabletaДокумент10 страницSažetak Karakteristika Leka: Film Tableta, 200 MG Pakovanje: Blister, 1x12 Film TabletaFantasmaGoriaОценок пока нет

- Top Pharma Company PhilippinesДокумент4 страницыTop Pharma Company Philippinesspace1234100% (1)

- List of Pharma Companies With WebsitesДокумент50 страницList of Pharma Companies With WebsitesBusani brahma RajuОценок пока нет

- Sept. 2014. 1. Pendahuluan AccДокумент39 страницSept. 2014. 1. Pendahuluan AccMuhammad FalcaoОценок пока нет

- Prescription: Sudha Assistant Professor Gnit College of Pharmacy Greater NoidaДокумент28 страницPrescription: Sudha Assistant Professor Gnit College of Pharmacy Greater NoidaNilanjan MukherjeeОценок пока нет

- Non Compartmental AnalysisДокумент13 страницNon Compartmental AnalysisMuhammad FaheemОценок пока нет

- Pharmaceutical in India: IndustryДокумент25 страницPharmaceutical in India: IndustryHari NaghuОценок пока нет