Академический Документы

Профессиональный Документы

Культура Документы

Pension - Public Servants' Pension Scheme - Since 1 May 2015

Загружено:

Candice HurstАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Pension - Public Servants' Pension Scheme - Since 1 May 2015

Загружено:

Candice HurstАвторское право:

Доступные форматы

PUBLIC SECTOR PENSION SCHEME

Introduction

The States of Guernsey provides a defined benefit pension scheme on a Career Average Revalued

Earnings (CARE) basis, which provides a benefit based on your average earnings over the whole

period of your career.

Main benefits

The Scheme provides:

a pension linked to your pensionable earnings (up to 85,552*) over your whole career, increased

each year in line with inflation (up to 6%) together with a lump sum at retirement equal to 3 times

your pension

an option to take additional tax free cash in exchange for part of your pension (subject to Income

Tax limits)

special early retirement terms (subject to certain conditions) if you have to retire early because of

ill health

a death benefit of 3 times your final pay if you die in service

a pension for your spouse or qualifying dependant after your death

How is my pension calculated?

Your pension builds up at 1/80th of your pensionable earnings (up to 85,552*) each year. When you

retire, these yearly amounts (revalued to retirement in line with RPIX price inflation capped at 6% pa)

are added together to calculate your retirement pension.

Consider the following example:

Year 2016

pensionable pay = 25,000

pension accrued in 2016 = 25,000 x 1/80 = 312.50 pa

Year 2017

pensionable pay = 25,750

pension accrued in 2017 = 25,750 x 1/80 = 321.88 pa

inflation for 2017 = 3%

pension accrued at the end of 2017 =

(312.50 x 1.03) + 321.88 = 643.76 pa

Year 2018

pensionable pay = 26,523

pension accrued in 2018 = 26,523 x 1/80 = 331.54 pa

inflation for 2018 = 3%

pension accrued at the end of 2018 =

(643.76 x 1.03) + 331.54 = 994.61 pa

The pension will continue to accrue in the same way for each year of employment.

In addition to the pension, a lump sum of 3 times the pension would be payable at retirement. You

also have the option to swap part of your pension for additional tax free cash at retirement.

Contributions on pensionable earnings above 85,552* are paid into a defined contribution section of

the Scheme.

CL1821447.1

When can I retire?

Your Normal Pension Date (NPD) is the State Pension Age (SPA). This is the age at which you can

draw your benefits in full.

The SPA is currently age 65. However it will increase to age 67 by 2031. It will start to increase in

2020 and will increase by 2 months each year until it reaches age 67. The SPA may increase further

in the future as the States have announced that the intention is to raise it to age 70 by 2049. If the

SPA changes, your NPD will change also.

You do not have to work until your NPD. You can choose to retire earlier but your pension will be

reduced because it would be paid for longer than anticipated, unless you have to retire on health

grounds.

How much do I pay?

You pay contributions of 7.5% of your pensionable earnings. You will receive tax relief on your

contributions.

The contribution from your employer is higher than this. The employers contribution for future service

benefits can reach 14% of pensionable earnings. If it reaches this ceiling, members future benefits

and/or contributions have to be adjusted.

What benefits would be payable when I die?

If you die in service, a lump sum would be payable equal to 3 times your pensionable earnings.

In addition a spouse/qualifying dependants pension would be payable equal to half your accrued

pension, plus one quarter of the pension you would have accrued had you remained in service until

Normal Pension Date, based upon your salary at death.

If you die after retirement, a spouse/qualifying dependants pension would be payable equal to half

your own pension.

In addition, if you die within 5 years of retirement, a lump sum would be payable equal to the unpaid

balance of 5 years pension payments.

What benefits do I get if I leave the Scheme?

If you leave the Scheme having completed 2 years service, your accrued benefits can remain in the

Scheme and be paid to you at retirement. Alternatively you can transfer your accrued benefits to a

new employers scheme or a personal pension arrangement or receive a refund of your own

contributions (less tax). If you have less than 2 years service when you leave you are entitled to a

transfer value or a refund only.

Can I increase my pension?

You will be able to pay additional voluntary contributions to a defined contribution section in the

Scheme, once this has been established, to make additional savings for your retirement. Further

details will be provided once this facility is available.

Further details

Further details will be set out in the Rules of the CARE section and in an Explanatory Booklet. This

will be available online once it has been produced.

* this amount is linked to civil service pay grade SO6

CL1821447.1

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- G. L. Bajaj Institute of Technology & Management: Fee ReceiptДокумент1 страницаG. L. Bajaj Institute of Technology & Management: Fee ReceiptmaniastuntОценок пока нет

- Ofsted Feeback Day 1Документ11 страницOfsted Feeback Day 1Candice HurstОценок пока нет

- Schedule For 3rd January 2016Документ2 страницыSchedule For 3rd January 2016Candice HurstОценок пока нет

- EFC Achievement Rates V National Rate 16-17Документ3 страницыEFC Achievement Rates V National Rate 16-17Candice HurstОценок пока нет

- Ofsted Final Day ASB 230218Документ50 страницOfsted Final Day ASB 230218Candice HurstОценок пока нет

- EFC - I Am Proud Post It NotesДокумент3 страницыEFC - I Am Proud Post It NotesCandice HurstОценок пока нет

- FEC Second Visit LetterДокумент2 страницыFEC Second Visit LetterCandice HurstОценок пока нет

- EFC Press Release Formal Collaboration With BSC 2017.07.03Документ2 страницыEFC Press Release Formal Collaboration With BSC 2017.07.03Candice HurstОценок пока нет

- Ofsted Feeback Day 1Документ11 страницOfsted Feeback Day 1Candice HurstОценок пока нет

- Questions Raised at ASB and Responses - 30th JuneДокумент3 страницыQuestions Raised at ASB and Responses - 30th JuneCandice HurstОценок пока нет

- DRAFT FEC Visit ScheduleДокумент2 страницыDRAFT FEC Visit ScheduleCandice Hurst100% (1)

- A New Dawn Gagan Mohindra Letter To EFC StaffДокумент1 страницаA New Dawn Gagan Mohindra Letter To EFC StaffCandice HurstОценок пока нет

- EFC Learning Area RestructureДокумент9 страницEFC Learning Area RestructureCandice HurstОценок пока нет

- SPA Feeling Music Tracks.Документ2 страницыSPA Feeling Music Tracks.Candice HurstОценок пока нет

- Verbal Feedback From RMV First Meeting 25 April 2017Документ4 страницыVerbal Feedback From RMV First Meeting 25 April 2017Candice HurstОценок пока нет

- Verbal Feedback From RMV First Meeting 25 April 2017Документ4 страницыVerbal Feedback From RMV First Meeting 25 April 2017Candice HurstОценок пока нет

- How Do You Feel About Next WeekДокумент2 страницыHow Do You Feel About Next WeekCandice HurstОценок пока нет

- Vision 2020Документ4 страницыVision 2020Candice HurstОценок пока нет

- Mock RMV ScheduleДокумент8 страницMock RMV ScheduleCandice HurstОценок пока нет

- Modern Manager's ToolkitДокумент194 страницыModern Manager's ToolkitCandice Hurst100% (2)

- Building Student Involvement, Attention & RecallДокумент97 страницBuilding Student Involvement, Attention & RecallCandice HurstОценок пока нет

- Our Ofsted InspectorsДокумент6 страницOur Ofsted InspectorsCandice HurstОценок пока нет

- 3 Day Inspection Plan UPDATEДокумент7 страниц3 Day Inspection Plan UPDATECandice HurstОценок пока нет

- Our Ofsted InspectorsДокумент6 страницOur Ofsted InspectorsCandice HurstОценок пока нет

- College ResultsДокумент2 страницыCollege ResultsCandice HurstОценок пока нет

- Accommodation Changes Sept 2016Документ2 страницыAccommodation Changes Sept 2016Candice HurstОценок пока нет

- Info From HRДокумент1 страницаInfo From HRCandice HurstОценок пока нет

- DRAFT Mental Wellbeing Policy 2016Документ3 страницыDRAFT Mental Wellbeing Policy 2016Candice HurstОценок пока нет

- Shortlisting For Digital Creative Post 12 July 2016Документ4 страницыShortlisting For Digital Creative Post 12 July 2016Candice HurstОценок пока нет

- Email To PRCPA TeamДокумент3 страницыEmail To PRCPA TeamCandice HurstОценок пока нет

- Acca F6 Taxation Vietnam 2012 Jun QuestionДокумент12 страницAcca F6 Taxation Vietnam 2012 Jun QuestionNguyễn GiangОценок пока нет

- MD Wasim Ansari, Paytm, PPTДокумент20 страницMD Wasim Ansari, Paytm, PPTMd WasimОценок пока нет

- 50% Discount for Women Candidates at Fosma Maritime InstituteДокумент2 страницы50% Discount for Women Candidates at Fosma Maritime InstituteAshis SarkarОценок пока нет

- Ju 1Документ1 страницаJu 1lesly malebrancheОценок пока нет

- EBTax UAT Test Script ARДокумент2 страницыEBTax UAT Test Script ARchirag0% (1)

- M/Chip Functional Architecture For Debit and Credit: Applies To: SummaryДокумент12 страницM/Chip Functional Architecture For Debit and Credit: Applies To: SummaryAbiy MulugetaОценок пока нет

- The Cash Transactions and Cash Balances of Banner Inc ForДокумент1 страницаThe Cash Transactions and Cash Balances of Banner Inc Foramit raajОценок пока нет

- Philippine VAT and Percentage Tax RatesДокумент41 страницаPhilippine VAT and Percentage Tax RatesKim AranasОценок пока нет

- R12-Tables and ViewsДокумент29 страницR12-Tables and ViewsshikhaОценок пока нет

- State Bank of IndiaДокумент2 страницыState Bank of Indiakiran gemsОценок пока нет

- KCT Online Fees Payment ReceiptДокумент1 страницаKCT Online Fees Payment Receiptvidhyapathy0% (1)

- Income Tax 214C 2017Документ52 страницыIncome Tax 214C 2017A JOKHIOОценок пока нет

- Disbursement Vouchers Version 2Документ13 страницDisbursement Vouchers Version 2Ryan Jay CagumbayОценок пока нет

- CRN6945022112Документ5 страницCRN6945022112SOWJANYAОценок пока нет

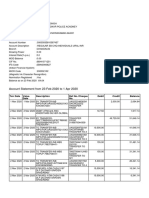

- Mr. Shyam Singh's bank account statement and detailsДокумент3 страницыMr. Shyam Singh's bank account statement and detailsShyamОценок пока нет

- 64309445932019499Документ76 страниц64309445932019499Prabhat SharmaОценок пока нет

- (Resolved) HSBC Credit Card - Recovery After 1 Year of Settlement of Credit CardДокумент6 страниц(Resolved) HSBC Credit Card - Recovery After 1 Year of Settlement of Credit CardDaniel Smart OdogwuОценок пока нет

- PDF 2007 2013 Taxation Law Philippine Bar Examination Questions and Suggested Answers JayarhsalsampladotДокумент125 страницPDF 2007 2013 Taxation Law Philippine Bar Examination Questions and Suggested Answers JayarhsalsampladotIrin200Оценок пока нет

- In 031588Документ1 страницаIn 031588daltonico111Оценок пока нет

- L63 MobДокумент35 страницL63 MobLove AmbienceОценок пока нет

- PaypalДокумент2 страницыPaypala.shyamОценок пока нет

- Official Receipt: Global Indian International SchoolДокумент1 страницаOfficial Receipt: Global Indian International SchoolBadal BhattacharyaОценок пока нет

- New Income Tax Rates for Corporations Under CREATEДокумент22 страницыNew Income Tax Rates for Corporations Under CREATEJeanette LampitocОценок пока нет

- Your Payment History: Hai ! Ini Adalah Bil Anda Untuk Bulan NovemberДокумент3 страницыYour Payment History: Hai ! Ini Adalah Bil Anda Untuk Bulan Novemberkhair kamilОценок пока нет

- Merged DocumentДокумент93 страницыMerged DocumentsurekhaОценок пока нет

- Philamlife vs. SOFДокумент1 страницаPhilamlife vs. SOFMichelleОценок пока нет

- SAMDS012136Документ1 страницаSAMDS012136amitОценок пока нет

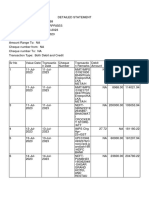

- Detailstatement - 19 7 2023@15 21 27Документ2 страницыDetailstatement - 19 7 2023@15 21 27aarti RwtОценок пока нет

- What is Letter of Credit? Bank Payment Tool for ExportersДокумент2 страницыWhat is Letter of Credit? Bank Payment Tool for ExportersCarlos KarmunОценок пока нет