Академический Документы

Профессиональный Документы

Культура Документы

ACTL1122 Week 4 Issues in Financial Reporting

Загружено:

leolau2015Исходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

ACTL1122 Week 4 Issues in Financial Reporting

Загружено:

leolau2015Авторское право:

Доступные форматы

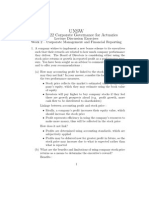

Week 4

ACTL1122 Week 4

Issues in Financial Reporting

Week 4 Outline:

1. Accounting for Non-Cash Adjustments

2. Gearing

3. Case Study Application

1 / 16

Week 4

Topic Objectives and Learning Approach

I

Recognise key accounting adjustments such as

depreciation/amortisation and impairment of assets and their

purpose in reporting more relevant asset values

Understand the basics of asset valuation using discounted cash

flow models

Recognise the impact of asset impairment and company gearing

Understand the importance of gearing in context of the current

economic situation

See how the accounting concepts learnt may be integrated into a

company case study

2 / 16

Week 4

This Weeks Readings

I

I

I

2010 Transfield Services Infrastructure Fund Full-Year Financial

Results Presentation

Transfield Services Infrastructure Fund Rights Issue Booklet

Transfield Services Infrastructure Fund Case Study Reading

The material provided in these readings provide you with a more

big picture view of how companies manage their risks and

capital. Do not try to read the Rights Issue Booklet in its entirety,

but rather focus on the Chairmans Address and the Company

Presentation. The Case Study Reading provides a helicopter

view of the Capital Structure Review and company background

3 / 16

Accounting for Non-Cash Adjustments

Overview

I

Fair valuation accounting means financial statements should

ideally report values in such a way it is relevant to the current

market

Historical cost accounting and the modified version of it states

values are recorded as at transaction, with adjustments

Adjustments may be made to assets or liabilities over time to

reflect market movements, even if transactions do not occur

I

Such adjustments have no cash consequences (value change, but

no cash inflow/outflow)

Profits and losses are booked, but they are not realised until a

transaction occurs

Such adjustments ideally improve relevance, usefulness and

aims to give a true and fair view

Compromises on reliability and conservatism, however

4 / 16

Accounting for Non-Cash Adjustments

Examples of Accounting Adjustments

I

Depreciation of non-current assets :

I

Revaluation of non-current assets :

I

Appreciation of land or other assets due to economic changes

Amortisation of intangible assets :

I

Reflect estimated market value due to wear and tear or technical

obsolescence

Reflect reduced ability for such assets to provide economic benefits

(brand name, mines with depleted resources)

Impairment of non-current assets :

I

Reflect the current value of assets which can no longer be

expected to deliver future revenue at the level implied by the book

value (previous over-valuation)

5 / 16

Accounting for Non-Cash Adjustments

Depreciation and Amortisation

I

I

I

Non-current assets are recorded at transaction value, under

historical cost accounting

Ideally financial statements should reflect fair value

Non-current assets may have limited useful life, after which it is

either replaced or disposed of

Earnings will be volatile if these asset values are updated at the

end of useful life

To reconcile, periodic adjustments may be made to perishable

non-current assets :

I

I

Wear and tear through continual use

Technical obsolescence or the assets capability being surpassed

by new innovations

Recognised as an expense

6 / 16

Accounting for Non-Cash Adjustments

Discussion Question 1

Explain how the following non-current assets with limited useful lives

may decline in value gradually, thus justifying the need to recognise

their depreciation on a periodic basis :

(a) A supercomputer holding vast volumes of data for a bank, kept

inside an air-conditioned warehouse

(b) An investment property in the form of a 10 storey apartment block

(c) A coal mine with an estimated reserve of 60 million tonnes which

is under operation

7 / 16

Accounting for Non-Cash Adjustments

Re-valuation of Assets

Assets with unlimited useful life may be subject to appreciation

due to increase demand, especially land

Re-valuation of assets may be arguably recognised as a profit

under fair-valuation accounting :

I

Increase in fair value reflects recognition of increase in future

economic benefit

However, some argue this is not appropriate because this is not

realised in a transaction

Left to subjective interpretation in practice conservatism vs

following the revenue recognition principle

8 / 16

Accounting for Non-Cash Adjustments

Impairment of Assets

I

Assets may be recorded in the books at a higher value than their

current market value

When periodic review is conducted, assets may be found to be

worth substantially less :

I

Business operations have proven to consistently be below target as

implied in book value

Economic outlook becoming negative, thus affecting assets ability

to generate future economic benefits as it had in the past

The asset value has dropped because it is no longer as well

regarded by investors (especially with property, development

projects, etc.)

Impairment is recognised as a expense, similar to depreciation

and amortisation :

I

Future economic benefits are no longer recognised at the same

level as what was paid

9 / 16

Accounting for Non-Cash Adjustments

Asset Valuation Discounted Cash Flow Method

I

Assets may be viewed as Cash Generating Units (CGU)

Current value is the present value of expected future cash flow

generated :

I

Distinct from profits, since profits contain accounting adjustments

such as depreciation, amortisation etc.

Future economic benefits is in terms of cash

DCF method is like valuing net present value of annuities :

I

I

Review of ACTL1101 and FINS1613 concepts

Keep it simple for this course, but note in practice you need to

remove accounting adjustments from the NPV calculation

10 / 16

Gearing

What is Gearing?

I

Gearing can be measured as the how much of the companys

equity is supporting its borrowings and loans

Good measure of solvency position for the company :

I

Find an optimal gearing range to balance stability and capitalising

on risk

Gearing ratio is popularly used :

Net debt

Net debt + Shareholders equity

11 / 16

Gearing

Company Gearing and Decision-Making

I

Company operational and strategic decisions :

I

I

I

Expand or contract operations to ensure suitable capital structure

Repay borrowings to improve company stability

Raise further equity or debt capital for expansion or to manage

capital

Lending banks and decision to seek company actions to

reassure them of their solvency :

I

I

Loans may have clauses on maximum level of gearing

Where company is getting close to breaching the gearing

covenant, the banks may request company act urgently (sell off

assets or raise equity capital)

Banks may recall the loan where there is significant risks of

financial distress (do not want to be the last in case the cupboard is

bare)

12 / 16

Gearing

Asset Values, Impairments and Gearing

I

Asset values as recorded in the company financial statements

affect gearing levels :

I

Borrowings do not reduce when assets are written off as they are

contractual obligations

When assets are written down in value, the shareholders take the

full amount of the writedown (maybe net of taxes depending on

what type of assets being written off)

Gearing levels can increase dramatically in a significant asset

writedown :

I

Previously purchased investments have been reviewed to reflect a

lower market value

Previously acquired businesses had been overpaid so the goodwill

is written off

Research or development projects have delivered negative or less

positive results, resulting in lower market value due to delay in

realising benefits

13 / 16

Case Study Application

Transfield Services Infrastructure Fund Capital

Structure Review

I

I

Commenced in June 2009, completed in May 2010

Rationale was to ensure the fund had the right capital structure

to conduct business going forward :

I

I

A sustainable gearing level to ensure company financial stability

Review its portfolio of assets to determine their suitability to the

companys strategy

Propose possible actions such as managing debt levels, asset

trades and equity issue

On completion of the Capital Structure Review, the Board

recommended :

I

I

I

Sale of Mount Millar Wind Farm for $191 million

Fully underwritten equity issue of $110 million

Refinancing of existing bank loans with $263 million repayment

($728 million to $465 million)

14 / 16

Case Study Application

Discussion Questions

Refer to the presentation of the Transfield Services Infrastructure

Fund Equity Issue Booklet to answer the following questions :

(a) What types of information have been presented in the

presentation? What are the purposes of that information?

(b) What decisions have been made in relation to the companys

strategy?

(c) How do the decisions impact on the companys financial position,

in particular on their solvency position?

(d) If you were an existing shareholder faced with the decision of

whether to participate in this equity issue, what types of factors

would you consider and what would you do?

(e) With the benefit of hindsight, how effective was the Capital

Structure Review? What information would you use to evaluate

that?

15 / 16

Summary

Summary

I

Take time to reflect on the following :

I

What tension exists in the application of accounting theory and

relevant reporting for non-current assets?

How does depreciation, amortisation and impairment of assets

help companies report more relevant information? To what extent

is it of limited use?

What are the advantages and disadvantages of a business

borrowing money to operate?

What are the reasons for a company needing to monitor its gearing

ratio?

How do the aspects of financial reporting this week all link up

together?

16 / 16

Вам также может понравиться

- ACTL1122 Week 1 Actuaries and CorporationsДокумент19 страницACTL1122 Week 1 Actuaries and CorporationsJohnОценок пока нет

- Introduction To Accounting & Finance FinalДокумент25 страницIntroduction To Accounting & Finance FinalManeesh Chitturu100% (1)

- Financial Statement Analysis of Mother DairyДокумент75 страницFinancial Statement Analysis of Mother DairySagar Paul'gОценок пока нет

- Introduction To Finance 1Документ11 страницIntroduction To Finance 1skrzakОценок пока нет

- Project On Sun PharmaДокумент77 страницProject On Sun PharmaNivedha MОценок пока нет

- Understand Financial Reports in 40 CharactersДокумент26 страницUnderstand Financial Reports in 40 CharactersmhikeedelantarОценок пока нет

- f1.3 Financial Acoounting CpaДокумент173 страницыf1.3 Financial Acoounting CpaCyiza Ben RubenОценок пока нет

- Current Assets Current LiabilitiesДокумент7 страницCurrent Assets Current LiabilitiesShubham GuptaОценок пока нет

- Module Fs AnalysisДокумент12 страницModule Fs AnalysisCeejay RoblesОценок пока нет

- Ratio Analysis (1) .Doc 1Документ24 страницыRatio Analysis (1) .Doc 1Priya SinghОценок пока нет

- Accounting For ManagersДокумент10 страницAccounting For ManagersThandapani PalaniОценок пока нет

- IAS 40 Investment Property GuideДокумент29 страницIAS 40 Investment Property GuideNollecy Takudzwa BereОценок пока нет

- Pamantasan NG Lungsod NG Maynila PLM Business School A.Y. 2020-2021 First SemesterДокумент39 страницPamantasan NG Lungsod NG Maynila PLM Business School A.Y. 2020-2021 First SemesterHarlene BulaongОценок пока нет

- Jawaban Assigment CH 1Документ5 страницJawaban Assigment CH 1AjiwОценок пока нет

- Fin StatementДокумент18 страницFin StatementDRISYAОценок пока нет

- Financial Statements AwnsersДокумент11 страницFinancial Statements Awnserskhalida khanОценок пока нет

- PRACTICE Quiz 1 - CFASДокумент8 страницPRACTICE Quiz 1 - CFASLing lingОценок пока нет

- Balance Sheet CFS Condesed SuymmaryДокумент8 страницBalance Sheet CFS Condesed SuymmaryOmar HosnyОценок пока нет

- Confidential NotesДокумент35 страницConfidential Noteskamaljit kaushikОценок пока нет

- Financial Reporting & Ratio Analysis GuideДокумент36 страницFinancial Reporting & Ratio Analysis GuideHARVENDRA9022 SINGHОценок пока нет

- Financial Reporting GuideДокумент32 страницыFinancial Reporting GuideAbdulmajed Unda MimbantasОценок пока нет

- HW#1 Answer KeyДокумент9 страницHW#1 Answer KeyRamin MelikovОценок пока нет

- Template 3: Module Template Module No. & Title Module 6: Financial Reporting and AnalysisДокумент17 страницTemplate 3: Module Template Module No. & Title Module 6: Financial Reporting and AnalysisTrisha Monique VillaОценок пока нет

- Corporate FinanceДокумент51 страницаCorporate FinanceAnna FossiОценок пока нет

- GeloДокумент4 страницыGeloJhay Thompson BernabeОценок пока нет

- Introduction to Financial Accounting and Ratio AnalysisДокумент95 страницIntroduction to Financial Accounting and Ratio AnalysisPomri EllisОценок пока нет

- Assignment On: Financial Statement Analysis and Valuation Course Code: (F-401)Документ7 страницAssignment On: Financial Statement Analysis and Valuation Course Code: (F-401)Md Ohidur RahmanОценок пока нет

- Assessing Future and Current Performance of Organisations Using Ratio AnalysisДокумент11 страницAssessing Future and Current Performance of Organisations Using Ratio AnalysisGeorge Rabar100% (1)

- Qualifying Reviewer Questions CFASДокумент9 страницQualifying Reviewer Questions CFASReinalyn Larisma MendozaОценок пока нет

- Practice Set Chapter 1 - Acc 111Документ4 страницыPractice Set Chapter 1 - Acc 111Eshe Rae Arquion IIОценок пока нет

- The Conceptual Framework For Financial ReportingДокумент32 страницыThe Conceptual Framework For Financial ReportingDINIE RUZAINI BINTI MOH ZAINUDINОценок пока нет

- Assignment: On Financial Statement Analysis and ValuationДокумент4 страницыAssignment: On Financial Statement Analysis and ValuationMd Ohidur RahmanОценок пока нет

- Financial Analysis: Unit 9Документ20 страницFinancial Analysis: Unit 9Đinh AnhОценок пока нет

- Chapter 3 Managerial-Finance Solutions PDFДокумент24 страницыChapter 3 Managerial-Finance Solutions PDFMohammad Mamun UddinОценок пока нет

- Financial Statements and Analysis: ̈ Instructor's ResourcesДокумент24 страницыFinancial Statements and Analysis: ̈ Instructor's ResourcesMohammad Mamun UddinОценок пока нет

- Conceptual Framework - Chapter 2Документ42 страницыConceptual Framework - Chapter 2Wijdan Saleem EdwanОценок пока нет

- Ch.2 Techniques of Financial AnalysisДокумент74 страницыCh.2 Techniques of Financial Analysisj787100% (1)

- FINANCIAL ANALYSIS COURSE OUTLINE TOPICSДокумент5 страницFINANCIAL ANALYSIS COURSE OUTLINE TOPICSjamalzareenОценок пока нет

- Business Finance Lesson 3Документ34 страницыBusiness Finance Lesson 3Iekzkad RealvillaОценок пока нет

- ACCA F7 SummaryДокумент10 страницACCA F7 SummaryLai AndrewОценок пока нет

- Module 4 Preparing The Financial Statements: Statement of Financial PositionДокумент20 страницModule 4 Preparing The Financial Statements: Statement of Financial PositionErine Contrano100% (2)

- Group 4 Summary AgribusinessДокумент4 страницыGroup 4 Summary AgribusinessJoyce DuranaОценок пока нет

- Financial StatementДокумент17 страницFinancial StatementNaveen AggarwalОценок пока нет

- Self Study - Financial Accounting Chapter 1 To Chapter 4Документ23 страницыSelf Study - Financial Accounting Chapter 1 To Chapter 4Ana Saggio0% (1)

- Financial Management (Preliminary Term)Документ78 страницFinancial Management (Preliminary Term)Zie TanОценок пока нет

- The Statement of Financial PositionДокумент24 страницыThe Statement of Financial Positionelle rotairoОценок пока нет

- Accounting For Financial Services: Questions Selected byДокумент25 страницAccounting For Financial Services: Questions Selected byGhulam MurtazaОценок пока нет

- Kieso Chapter 1 SlideДокумент61 страницаKieso Chapter 1 SlideErni RohmawatiОценок пока нет

- Financial Accounting Course OutlineДокумент4 страницыFinancial Accounting Course OutlineASMARA HABIBОценок пока нет

- 1 - Intro To Financial AccountingДокумент20 страниц1 - Intro To Financial AccountingChaarLeene SusanöОценок пока нет

- Answers To Review QuestionsДокумент3 страницыAnswers To Review QuestionsRose Ann Moraga FrancoОценок пока нет

- Readings - Introduction To Financial ManagementДокумент35 страницReadings - Introduction To Financial ManagementAnish AdhikariОценок пока нет

- Balance SheetДокумент22 страницыBalance Sheetujjwal100% (1)

- DIA 06 Block 01Документ30 страницDIA 06 Block 01Navneet Singh BhakuniОценок пока нет

- Social AccountingДокумент28 страницSocial Accountingfeiyuqing_276100% (1)

- Leac 203Документ27 страницLeac 203Ias Aspirant AbhiОценок пока нет

- Orca Share Media1668925931673 6999982710921667804Документ26 страницOrca Share Media1668925931673 6999982710921667804Chekani Kristine MamhotОценок пока нет

- Financial ManagementДокумент16 страницFinancial Managementcoolleen101318Оценок пока нет

- Chapter 3 SummaryДокумент3 страницыChapter 3 SummaryDarlianne Klyne BayerОценок пока нет

- 2013 ACTL1101 Week 5 Lecture Discussion SolutionsДокумент4 страницы2013 ACTL1101 Week 5 Lecture Discussion Solutionsleolau2015Оценок пока нет

- 2013 ACTL1101Week 2 Lecture Discussion SolutionsДокумент7 страниц2013 ACTL1101Week 2 Lecture Discussion Solutionsleolau2015Оценок пока нет

- Measure and Evaluate Portfolio PerformanceДокумент28 страницMeasure and Evaluate Portfolio Performanceleolau2015Оценок пока нет

- FINS3616 2015 EquationДокумент1 страницаFINS3616 2015 Equationleolau2015Оценок пока нет

- Week 13 Portfolio PerformanceДокумент1 страницаWeek 13 Portfolio Performanceleolau2015Оценок пока нет

- Week 12 Tutorial QuestionsДокумент1 страницаWeek 12 Tutorial Questionsleolau2015Оценок пока нет

- Optimal PortfoliosДокумент32 страницыOptimal Portfoliosleolau2015Оценок пока нет

- Sims - Seeing The Big Picture in Claims Reserving PaperДокумент42 страницыSims - Seeing The Big Picture in Claims Reserving Paperleolau2015Оценок пока нет

- Measure and Evaluate Portfolio PerformanceДокумент28 страницMeasure and Evaluate Portfolio Performanceleolau2015Оценок пока нет

- FINS3616 2015 EquationДокумент1 страницаFINS3616 2015 Equationleolau2015Оценок пока нет

- 2011 End of Session ExaminationДокумент7 страниц2011 End of Session Examinationleolau2015Оценок пока нет

- 2012 ACTL5108 Mid Year ExaminationДокумент7 страниц2012 ACTL5108 Mid Year Examinationleolau2015Оценок пока нет

- 2012 ACTL5108 Mid Year ExaminationДокумент7 страниц2012 ACTL5108 Mid Year Examinationleolau2015Оценок пока нет

- 2011 End of Session ExaminationДокумент7 страниц2011 End of Session Examinationleolau2015Оценок пока нет

- Transforming The Duration Equation Into An EXCEL Spreadsheet - Bonds With Integer Periods To MaturityДокумент4 страницыTransforming The Duration Equation Into An EXCEL Spreadsheet - Bonds With Integer Periods To Maturityleolau2015Оценок пока нет

- Burn RecoveryДокумент906 страницBurn Recoveryazazel82482Оценок пока нет

- (2015-S1) - FINS3616 - Tutorial Slides - Week 02 - Introduction + Global Financial System + FX SystemsДокумент40 страниц(2015-S1) - FINS3616 - Tutorial Slides - Week 02 - Introduction + Global Financial System + FX Systemsleolau2015Оценок пока нет

- Transactions - Week 4 SolnДокумент13 страницTransactions - Week 4 Solnleolau201533% (3)

- CAPMДокумент30 страницCAPMleolau2015Оценок пока нет

- MGMT 1002 Topic 1 Introduction s1 2014 (3 Slides Per Page)Документ15 страницMGMT 1002 Topic 1 Introduction s1 2014 (3 Slides Per Page)leolau2015Оценок пока нет

- Econ1102 Week 1Документ56 страницEcon1102 Week 1leolau2015Оценок пока нет

- Interpersonal Deception III. Effects of Deceit On Perceived Communication and Nonverbal Behavior DynamicsДокумент31 страницаInterpersonal Deception III. Effects of Deceit On Perceived Communication and Nonverbal Behavior Dynamicsleolau2015Оценок пока нет

- CAPMДокумент30 страницCAPMleolau2015Оценок пока нет

- Mortgage Securitization in Litigation SeminarДокумент7 страницMortgage Securitization in Litigation Seminarjoelrguez1Оценок пока нет

- How To Survive The Job Automation ApocalypseДокумент47 страницHow To Survive The Job Automation Apocalypsefabrignani@yahoo.comОценок пока нет

- Wellex Group vs. SandiganbayanДокумент3 страницыWellex Group vs. SandiganbayanKling KingОценок пока нет

- DBP V MIRANGДокумент1 страницаDBP V MIRANGTricia100% (1)

- Nool Vs Ca Case DigestДокумент2 страницыNool Vs Ca Case DigestJesser Caparas0% (2)

- Detailed Assets & Debts in The Bankruptcy Filing of "Sister Wives" Star Christine Allred Brown 3/2010Документ34 страницыDetailed Assets & Debts in The Bankruptcy Filing of "Sister Wives" Star Christine Allred Brown 3/2010borninbrooklyn0% (1)

- Department of Labor: CarriercontactДокумент15 страницDepartment of Labor: CarriercontactUSA_DepartmentOfLaborОценок пока нет

- South Africa Bank Loans InformationДокумент3 страницыSouth Africa Bank Loans InformationFrancois Vd MerweОценок пока нет

- Special Power of AttorneyДокумент1 страницаSpecial Power of AttorneyGenesis MaggayОценок пока нет

- The Law of Mortgages: Tenga, R.W. & Sist Joseph A MANUAL OF LAND LAW IN TANZANIA (Draft, Tumaini University, 2009)Документ39 страницThe Law of Mortgages: Tenga, R.W. & Sist Joseph A MANUAL OF LAND LAW IN TANZANIA (Draft, Tumaini University, 2009)RANDAN SADIQ67% (6)

- Debt Recovery and Collection Procedure With Reference To PNBДокумент66 страницDebt Recovery and Collection Procedure With Reference To PNBshreya27_desh100% (9)

- NESARA Law Signed Into Law by President Bill Clinton October 10, 2000Документ5 страницNESARA Law Signed Into Law by President Bill Clinton October 10, 2000in1or86% (21)

- Finals Notes For Land TitlesДокумент10 страницFinals Notes For Land TitlesJoy Navaja DominguezОценок пока нет

- Bank of Uganda Commercial Bank Interest Rates Charges February 2017Документ2 страницыBank of Uganda Commercial Bank Interest Rates Charges February 2017Uganda Business NewsОценок пока нет

- Agreement SaleДокумент4 страницыAgreement Saleshruti gupta100% (1)

- CBS Product Codes For Daily Use PDFДокумент2 страницыCBS Product Codes For Daily Use PDFArijit DebОценок пока нет

- Mat112 Sept - 2014Документ7 страницMat112 Sept - 2014Nara SakuraОценок пока нет

- PGAI vs Anscor Land - CIAC jurisdiction over surety disputesДокумент172 страницыPGAI vs Anscor Land - CIAC jurisdiction over surety disputesNis SaОценок пока нет

- Homework Stata Exercises Due FridayДокумент6 страницHomework Stata Exercises Due FridaySophia GoldsonОценок пока нет

- RTB Taxation II Course Outline 2016-2017Документ21 страницаRTB Taxation II Course Outline 2016-2017Victor LimОценок пока нет

- Collapse of The Thai BahtДокумент5 страницCollapse of The Thai BahtShakil AlamОценок пока нет

- Ust Civil Q and A 2013 To 2015Документ55 страницUst Civil Q and A 2013 To 2015twenty19 lawОценок пока нет

- Peasant Movement in MaharashtraДокумент2 страницыPeasant Movement in MaharashtraNaufil Siddiqui100% (1)

- Banking Terminology Dutch EnglishДокумент5 страницBanking Terminology Dutch EnglishDavid KimОценок пока нет

- Conflicts Rules On Personal PropertyДокумент28 страницConflicts Rules On Personal PropertyMarian SantosОценок пока нет

- Dodge Construction Outlook 2014Документ5 страницDodge Construction Outlook 2014Erik HooverОценок пока нет

- Pub - Project Financing 7th Edition PDFДокумент256 страницPub - Project Financing 7th Edition PDFAlberto Baron Sanchez100% (1)

- Banking products and services overviewДокумент21 страницаBanking products and services overviewtanyaОценок пока нет

- Oblicon Reviewer 2010Документ159 страницOblicon Reviewer 2010Nath AntonioОценок пока нет

- Civil Court Jurisdiction Over Fraud ClaimsДокумент2 страницыCivil Court Jurisdiction Over Fraud ClaimsKHUSHBOO SHARMAОценок пока нет