Академический Документы

Профессиональный Документы

Культура Документы

Dry Cleaning - Minieh

Загружено:

alassadi09Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Dry Cleaning - Minieh

Загружено:

alassadi09Авторское право:

Доступные форматы

AFC Consultants International

DRY CLEANING PROJECT

TABLE OF CONTENTS

EXECUTIVE SUMMARY............................................................................ 2

PROJECT DESCRIPTION ......................................................................... 2

2.1

2.2

DRY CLEANING PROCESS ....................................................................................... 3

DRY-CLEANING WASTES ........................................................................................ 4

MARKET ANALYSIS ................................................................................ 4

3.1

3.2

TARGET MARKET ................................................................................................ 4

SWOT ANALYSIS .............................................................................................. 5

MARKETING PLAN.................................................................................. 5

FINANCIAL PLAN ................................................................................... 6

5.1

5.2

5.3

5.4

5.5

5.6

5.7

5.8

INITIAL INVESTMENT ........................................................................................... 6

MAJOR ASSUMPTIONS .......................................................................................... 6

PROJECTED INCOME S TATEMENT .............................................................................. 8

PROJECTED B ALANCE S HEET ................................................................................... 9

PROJECTED C ASH FLOWS ...................................................................................... 9

RATIO ANALYSIS ...............................................................................................10

BREAK-EVEN ANALYSIS ........................................................................................10

SENSITIVITY ANALYSIS ........................................................................................11

RECOMMENDATIONS AND KEY SUCCESS FACTORS ................................ 11

ECONOMIC IMPACT EVALUATION......................................................... 11

LBN/B7-4100/IB/99/0225/JC20/0105

AFC Consultants International

Executive Summary

The project consists in establishing a dry cleaning outlet in the Minieh-Donnieh Caza region in

North of Lebanon. This outlet will cater to the Minieh-Donnieh Caza and North of Lebanon

region and will reach its peak during the summer season where all the Lebanese expatriates

come back for the summer to visit their families and a large number of vacationing residents

from Tripoli and other areas come to spend the summer season.

The initial investment for the project is estimated at $49,500 which includes $35,500 in dry

cleaning equipment, $5,000 in generator, $2,000 in furniture, $2,000 in office equipment, and

$5,000 in working capital.

The main assumptions consider average daily cleaning of 25 pieces over an average period of

6 months. This is a conservative figure due to the high demand during the summer season

and limited competition in the region. The success of the business will rely on a convenient

and accessible location.

The projections are taken over a period of 7 years. The dry cleaning outlet is expected to

provide an average annual net profit of $8,086. It will be able to distribute dividends starting

year 1.

The dry cleaning outlet provides an internal rate of return (IRR) of 30% and a payback period

of 4 years and 2 months. These results show that the project is feasible if it is well managed.

A worst-case scenario was developed with the assumption of lower number of units from 25

pcs/day to 20 pcs/day for the dry cleaning outlet, gave an IRR of 22% and a payback period

of 5 years and 6 months. A best-case scenario based on higher number of units per day from

25 pcs/day to 30 pcs/day provides the dry cleaning outlet an IRR of 37% and a payback

period of 3 years and 5 months.

The project will offer 2 full time job opportunities (including the project owner) and will

provide a convenient dry cleaning facility in the Donnieh area.

Project description

The project consists in establishing a dry cleaning outlet in Donnieh area in North of Lebanon.

Currently, there is only one dry cleaning facility in the whole Donnieh area, which is also

located at the borders of Minieh and is not convenient for the Donnieh residents. In fact, this

facility could not be sufficient, especially during the summer season when all the vacationing

people come to spend the summer season, running away from the heat on the coast.

Dry cleaning is any cleaning process for clothing and textiles using an organic solvent rather

than water. The solvent used is typically tetrachloroethylene (perchloroethylene), abbreviated

"perc" in the industry and "dry-cleaning fluid" by the public. Dry cleaning is necessary for

cleaning items which would otherwise be damaged by water and soap or detergent. It may be

used if hand washing needed for some delicate fabrics is excessively laborious.

The dry cleaner places cleaned clothes on metallic hangers, inside thin clear plastic garment

bags before delivering to the clients.

Minieh-Donnieh Caza - Feasibility Study Dry cleaning project

LBN/B7-4100/IB/99/0225/JC20/0105

AFC Consultants International

2.1 Dry cleaning process

A dry cleaning machine is similar to a combination of a domestic washing machine, and

clothes dryer. Garments are placed into a washing/extraction chamber (referred to as the

basket, or drum), which is the core of the machine. The washing chamber contains a

horizontal, perforated drum that rotates within an outer shell. The shell holds the solvent

while the rotating drum holds the garment load. The basket capacity is between 9 and 36 kg

of garments.

During the wash cycle the chamber is filled approximately 1/3 full of solvent and begins to

rotate, agitating the clothing. The solvent temperature is maintained at 29.4C, as a higher

temperature may extract dye from garments, causing color loss. During the wash cycle, the

chamber is constantly fed a supply of fresh solvent from the working solvent tank while spent

solvent is removed and sent to a filter unit comprising a distillation boiler and condenser. The

ideal flow rate is roughly 8 liters of solvent per kilogram of garments per minute, depending

on the size of the machine.

Before being placed in the machine, garments are inspected for stains and soils by the

operator. Depending on the nature of the soil, a catalyst may be applied to it. This depends on

the operator's judgment of the makeup of the textile and the soil itself. Oil-based soils (such

as grease, oil, or lipstick) typically are removed well by perchloroethylene, while water-based

soils (such as coffee, wine, perspiration, blood, and semen) will need a catalyst to allow the

dry cleaning solvent to emulsify and lift them. Food-based grease soils fall in between the two,

and a milder catalyst may be applied.

Garments are also checked for foreign objects. Items such as plastic pens will dissolve in the

solvent bath and may damage textiles beyond recovery. Some textile dyes are "loose" (red

being the main culprit), and will shed dye during solvent immersion. These will not be included

in a load along with lighter colored textiles to avoid color transfer. The solvent used must be

distilled to remove impurities that may transfer to clothing.

Garments are checked for dry-cleaning compatibility, including fasteners. Many decorative

fasteners either are not dry cleaning solvent proof or will not withstand the mechanical action

of cleaning. These will be removed and re-stitched after the cleaning, or protected with a

small padded protector. Fragile items, such as feather bedspreads or tasseled rugs or

hangings may be enclosed in a loose mesh bag. The density of perchloroethylene is around

1.7 g/cm at room temperature (70% heavier than water), and the sheer weight of absorbed

solvent may cause the textile to fail under normal force during the extraction cycle unless the

mesh bag provides mechanical support.

A typical wash cycle lasts for 8-15 minutes depending on the type of garments and amount of

soiling. During the first three minutes, solvent-soluble soils dissolve into the perchloroethylene

and loose, insoluble soil comes off. It takes approximately ten to twelve minutes after the

loose soil has come off to remove the ground-in insoluble soil from garments. Machines using

hydrocarbon solvents require a wash cycle of at least 25 minutes because of the much slower

rate of solvation of solvent-soluble soils. A dry-cleaning surfactant "soap" may also be added.

At the end of the wash cycle, the machine starts a rinse cycle, and the garment load is rinsed

with fresh distilled solvent from the pure solvent tank. This pure solvent rinse prevents

discoloration caused by soil particles being absorbed back onto the garment surface from the

"dirty" working solvent.

After the rinse cycle the machine begins the extraction process, which recovers dry-cleaning

solvent for reuse. Modern machines recover approximately 99.99% of the solvent employed.

The extraction cycle begins by draining the solvent from the washing chamber and

accelerating the basket to 350 to 450 rpm, causing much of the solvent to spin free of the

fabric. When no more solvent can be spun out, the machine starts the drying cycle.

During the drying cycle, the garments are tumbled in a stream of warm air (145F/63C) that

Minieh-Donnieh Caza - Feasibility Study Dry cleaning project

LBN/B7-4100/IB/99/0225/JC20/0105

AFC Consultants International

circulates through the basket, evaporating any traces of solvent left after the spin cycle. The

air temperature is controlled to prevent heat damage to the garments. The exhausted warm

air from the machine then passes through a chiller unit, where solvent vapors are condensed

and returned to the distilled solvent tank. Modern dry cleaning machines use a closed-loop

system where the chilled air is reheated and re-circulated. This results in high solvent

recovery rates and reduced air pollution. In the early days of dry cleaning, large amounts of

perchlorethylene were vented to the atmosphere, because it was regarded as cheap and

believed to be harmless.

After the drying cycle is complete, a deodorizing (aeration) cycle cools the garments and

removes the last traces of solvent, by circulating cool outside air over the garments and then

through a vapor recovery filter made from activated carbon and polymer resins. After the

aeration cycle, the garments are clean and ready for pressing/finishing.

2.2 Dry-cleaning wastes

Cooked muck - Cooked Powder Residue the waste material generated by cooking

down or distilling muck. Cooked powder residue is a hazardous waste and contains

solvent, powdered filter material (diatomite), carbon, non-volatile residues, lint, dyes,

grease, soils and water. This material should then be disposed of in accordance with

the municipality.

Sludge - The waste sludge or solid residue contains solvent, water, soils, carbon and

other non-volatile residues. Still bottoms from chlorinated solvent dry cleaning

operations are hazardous wastes.

Environment - Perc is classified as a hazardous air contaminant by the EPA and must

be handled as a hazardous waste. To prevent it from getting into drinking water, dry

cleaners that use perc must take special precautions against site contamination.

Market Analysis

Minieh-Donnieh Caza region is a perfect location for the establishment of a Dry cleaning outlet

as this part of the country has only two similar projects in Meriata which is located on the

coastal part of the caza on the border between Minieh and Donnieh. For that matter it is

advisable to locate this project towards the upper part of Donnieh, which does not have any

dry cleaning facility.

3.1 Target market

It is expected to have seasonal effects on the productivity of the dry-cleaning facility: During

the summer season, some expatriates and locals that reside in the capital and other main

cities come to spend the vacations in their native villages. Moreover, the region of Donnieh

consists in a vacationing area for residents from the coast extending from Tripoli to Minieh and

part of Akkar. These visitors flow will create increased demand for the dry-cleaning facility as

they will need services for items such as:

Suits

Shirts

Wedding events

Curtain cleaning

Dresses etc...

Minieh-Donnieh Caza - Feasibility Study Dry cleaning project

LBN/B7-4100/IB/99/0225/JC20/0105

AFC Consultants International

3.2 SWOT Analysis

STRENGTHS

WEAKNESSES

The dry cleaning facility will offer

convenient, competitively priced, quality

service to a number of villages in the area

of Donnieh and part of Minieh.

Since this business is repetitive, it is more

likely to have repeat customers from

season to season.

Pressure on cash flows of the project as

the revenues are not evenly spread

throughout the year. It is expected to

have most of the business from

vacationers and expatriates coming to

their villages on holidays and in the

summer.

OPPORTUNITIES

THREATS

The Donnieh area needs a dry cleaning

facility as there is a large resident

population from vacationers to visiting

expatriates during the spring and summer

months that require dry cleaning services.

2 similar projects on the coastal part of

the caza in Meriata could add some

pressure on the sales if the prices are not

competitive or the quality of the service is

not at least comparable.

Joint ventures are possible to increase the

business volume to serve nearby villages.

Hence, small satellite shops could

quickly mushroom to share the existing

facility.

The use of easier to wash fabrics might

limit the use of the dry cleaning facility.

The difficult economic and political

situation in the country constitutes

constant threat for Lebanese enterprises.

Marketing Plan

The main marketing objectives include:

Direct contacts with local customers in order to quickly boost sales.

Providing an excellent service to ensure customer satisfaction for repetitive business.

It is very common to see a production facility share its resources (such as machinery,

know-how, soap and chemicals etc) with other dry clean outlets. These outlets would

not have to heavily invest in machinery and would be able to quickly launch their

business. In this case, the dry clean project owner would be able to significantly boost

his turnover.

Need to differentiate the service from the existing two dry cleaning outlets that

already exist in Meriata. That could be achieved by client awareness and excellent

prices and quality of service.

Minieh-Donnieh Caza - Feasibility Study Dry cleaning project

LBN/B7-4100/IB/99/0225/JC20/0105

AFC Consultants International

Financial Plan

This section details the calculations, assumptions and methodology used as a basis for the

projections of the expected financial performance of the dry cleaner outlet.

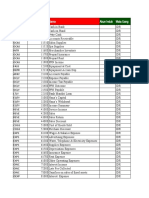

5.1 Initial Investment

Investment Requirements

Description

Quantity

Industrial washing machine 20kg (used)

Table for ironing (used)

Drying press machine - 20kg (used)

Professional dry/clean machine - 20kg

Dryer machine - 20kg (used)

Generator (used)

Boiler sytem and exaust

Installations of boiler system

Spotting table

Ventillation + ducting

Computer and office equipment

Furniture

1

1

1

1

1

1

1

1

1

1

Total costs of equipments

Working capital needs

Unit price Amount in $

5,500

5,500

2,000

2,000

3,000

3,000

12,000

12,000

3,000

3,000

5,000

5,000

5,000

5,000

2,000

2,000

2,000

2,000

1,000

1,000

2,000

2,000

44,500

5,000

Total investment cost

49,500

The above table shows the various equipments needed for the establishment of the Dry

cleaning shop facility.

The initial investment for the project is estimated at $49,500 which include $35,500 in

industrial equipment, $5,000 in generator, $2,000 in furniture, $2,000 in office equipment,

and $5,000 in working capital.

5.2 Major assumptions

The assumptions are conservative and are based on market achievable levels.

They consider an average daily cleaning of 25 pieces over an average operating period of 6

months per year, which is a conservative figure due to the high demand and limited

competition in the region.

GENERAL ASSUMPTIONS

Revenues assumptions

price / item

Shirts

Pants

Suits

Dresses

Coats

Curtains

Leather coats / shirts

Blazers

$1.3

$2.7

$8.0

$6.6

$6.6

$6.6

$16.6

$5

Totals

Minieh-Donnieh Caza - Feasibility Study Dry cleaning project

Percentage of

sales

Units per day

25

Total revenue / week

20%

30%

23%

10%

4%

2%

1%

10%

100%

$39.8

$119.4

$274.6

$99.5

$39.8

$19.9

$24.9

$79.6

$697.5

6

LBN/B7-4100/IB/99/0225/JC20/0105

AFC Consultants International

The project assumes an average of 25 pieces of clothing per day for a 6 day/week schedule.

The breakdown percentages of the items to be washed are also stated in the above mentioned

table. From the 25 pcs per day we assumed that 30% of them were pants, 20% shirts, 23%

suits etc. The total sales revenue per week has been calculated to be approximately

$697.5/week.

The following revenue growth assumptions are taken for the subsequent years.

Revenue growth assumptions

Sales growth

Total units per year

Total units per day

Year 1

3,900

25

Year 2

20%

4,680

30

Year 3

15%

5,382

35

Year 4

10%

5,920

38

Year 5

Year 6

5%

6,216

40

5%

6,527

42

Year 7

5%

6,853

44

The following table shows the main assumptions for the income statement:

Income Statement Assumptions

Working days

Working weeks per year

Working months per year

Nylon garment bags (price/kg)

Nylon bags weight per garment

Hangers (box of 450 units)

Soap price per kg

Soap usage per garment

Perclore (for dry clean) / 1 barrel

Maintenance on equipment

Fuel cost

Electricity

Annual rent-100 m2 premises

Increase in rent every 3 years

Annual increase in general expenses

Annual increase in salaries

Income Tax Rate

6

26

6

$3.1

40

$29

$1.7

20

$540

$100

15%

6%

$2,000

10%

3%

2%

2%

per week

per year

per year

gr.

1 kg/day

gr.

/year

/month

of sales

of sales

/year

As stated earlier, conservatively, the income statement is based on an average of 6 months of

operations. Hence, it will be mainly operated during part of spring, summer and part of the fall

season to accommodate the local and expatriates clients during the summer.

An annual increase in general expenses of 3% is taken into account for inflation factors. The

electricity expenses are estimated to represent 6% of sales. The fuel cost is assumed at an

average of 15% of sales.

Staff structure

The dry cleaning facility will have two full-time jobs: one manager (the owner) and one full

time skilled worker. We have to note that the shop will be operational only 6 months of the

year, hence, the project incurs wages during 6 months only, although the owner would

continue the operations alone during the low season.

The manager/owner will be responsible for running the daily operations, developing new

marketing strategies, as well as dealing with the clients while ensuring quality servicing.

Moreover, the manager will be in charge of the accounting operations of the outlet. The

manager/owner will not have a monthly salary but will be able to have dividends starting in

year 1.

Minieh-Donnieh Caza - Feasibility Study Dry cleaning project

LBN/B7-4100/IB/99/0225/JC20/0105

AFC Consultants International

Furthermore, 1 skilled worker will be hired with a monthly salary of $300.

5.3 Projected Income Statement

Dry Cleaning project

Projected Income Statement

Total revenues

Sales revenues

Total revenues

Cost of materials-soap

Cost of materials-packaging

Electricity

Fuel

Maintenance of machines

Total cost of sales

Gross margin

Gross profit margin %

General & administrative expenses

Salaries

Rental charges

Telephone expenses

Other administrative costs

Total General & Administrative Exp

EBITDA

Depreciation expenses

Tax expenses

Net Income

Net profit Margin

Year 1

Year 2

Year 3

Year 4

Year 5

Year 6

Year 7

18,135

18,135

673

735

1,088

2,720

600

5,816

12,319

68%

21,762

21,762

699

882

1,306

3,264

618

6,769

14,993

69%

25,027

25,027

723

1,014

1,502

3,754

637

7,629

17,397

70%

27,529

27,529

741

1,116

1,652

4,129

656

8,294

19,236

70%

28,906

28,906

751

1,171

1,734

4,336

675

8,668

20,238

70%

30,351

30,351

762

1,230

1,821

4,553

696

9,061

21,290

70%

31,869

31,869

773

1,291

1,912

4,780

716

9,473

22,395

70%

1,800

2,000

300

1,000

5,100

7,219

4,650

51

2,518

14%

1,836

2,000

309

1,030

5,175

9,818

4,650

103

5,065

23%

1,873

2,000

318

1,061

5,252

12,146

4,650

150

7,346

29%

1,910

2,200

328

1,093

5,531

13,705

4,650

181

8,874

32%

1,948

2,200

338

1,126

5,612

14,626

4,650

200

9,777

34%

1,987

2,200

348

1,159

5,694

15,596

4,250

227

11,119

37%

2,027

2,420

358

1,194

5,999

16,396

4,250

243

11,903

37%

The income statement shows satisfactory income levels with an average net profit margin of

30% starting from year 1. Of course, these results will depend on the projected sales. In

subsequent years, the dry cleaning outlet will benefit from increased marketing efforts by the

manager, and repeat business. The company reaches a net profit that exceeds $7,000 in year

3.

With constant marketing and networking efforts from the site manager, the project is

expected to reach a sales volume of $28,906 by year 5, which would provide net profits

exceeding $9,000 for that year.

The projections are taken over a period of 7 years. The dry cleaning outlet is expected to

provide an average annual net profit of $8,086. It will be able to distribute dividends starting

in year 1.

Minieh-Donnieh Caza - Feasibility Study Dry cleaning project

LBN/B7-4100/IB/99/0225/JC20/0105

AFC Consultants International

5.4 Projected Balance Sheet

The balance sheet shows the projected assets and liabilities of the company.

Dry Cleaning project

Projected Balance Sheet

Cash & Equivalents

Accounts Receivable

Current Assets

Equipment

Furniture

Computer & office equipment

Accumulated Depreciation

Net Fixed Assets

Total Assets

Expenses payable

Total Liabilities

Invested Capital

Retained Earnings

Shareholders Equity

Total Liab. & Shrholders Equity

Stat. Of Retained Earnings

Begin. Retained Earnings

Net income

Dividends Paid

Ending Retained Earnings

Year 1

Year 2

9,656

756

10,412

40,500

2,000

2,000

4,650

39,850

50,262

510

510

49,500

252

49,752

50,262

Year 1

2,518

2,266

252

Year 3

Year 4

Year 5

Year 6

Year 7

14,669

907

15,576

40,500

2,000

2,000

9,300

35,200

50,776

518

518

49,500

758

50,258

50,776

19,925

1,043

20,968

40,500

2,000

2,000

13,950

30,550

51,518

525

525

49,500

1,493

50,993

51,518

25,386

1,147

26,533

40,500

2,000

2,000

18,600

25,900

52,433

553

553

49,500

2,380

51,880

52,433

30,965

1,204

32,169

40,500

2,000

2,000

23,250

21,250

53,419

561

561

49,500

3,358

52,858

53,419

36,275

1,265

37,539

40,500

2,000

2,000

27,500

17,000

54,539

569

569

49,500

4,470

53,970

54,539

41,682

1,328

43,010

40,500

2,000

2,000

31,750

12,750

55,760

600

600

49,500

5,660

55,160

55,760

Year 2

252

5,065

4,558

758

Year 3

758

7,346

6,611

1,493

Year 4

1,493

8,874

7,986

2,380

Year 5

2,380

9,777

8,799

3,358

Year 6

3,358

11,119

10,007

4,470

Year 7

4,470

11,903

10,713

5,660

The company is expected to start distributing dividends starting in year 1 at 90% of net

profits.

5.5 Projected Cash Flows

The following table shows the projected cash flows of the project.

Dry Cleaning project

STATEMENT OF CASH FLOWS

Net income

Adjustments to reconcile net income

to cash provided by operating activities

Depreciation

Change in receivables

Change in payables

Total Adjustments

Cash provided by operating activities

Cash Flow from Investing Activities

Capital expenditures

Investment in fixed assets

Net cash used in investing activities

Cash flow from financing activities

Net Investment by owners

Net borrowings & repayments of loans

Dividends distributed

Cash provided by financing activities

Cash at beginning of year

Changes in cash

Cash at end of year

Year 1

Year 2

Year 3

Year 4

Year 5

Year 6

Year 7

2,518

5,065

7,346

8,874

9,777

11,119

11,903

4,650

(756)

510

4,404

6,922

4,650

(151)

8

4,506

9,571

4,650

(136)

8

4,522

11,867

4,650

(104)

28

4,574

13,447

4,650

(57)

8

4,601

14,377

4,250

(60)

8

4,198

15,317

4,250

(63)

30

4,217

16,120

(44,500)

(44,500)

49,500

(2,266)

47,234

(4,558)

(4,558)

(6,611)

(6,611)

(7,986)

(7,986)

(8,799)

(8,799)

9,656

9,656

9,656

5,013

14,669

14,669

5,256

19,925

19,925

5,461

25,386

25,386

5,578

30,965

(10,007)

(10,007)

(10,713)

(10,713)

30,965

5,310

36,275

36,275

5,408

41,682

The projected cash flows show the initial net investment in the equipment in year 1. This

investment is financed by capital injection of $49,500. In the same year, the dry cleaning

outlet starts operations and is able to start distributing dividends.

Minieh-Donnieh Caza - Feasibility Study Dry cleaning project

LBN/B7-4100/IB/99/0225/JC20/0105

AFC Consultants International

5.6 Ratio analysis

The following table shows the main financial ratios for the cold storage facility.

Ratio Analysis

Year 1

Current Ratio

Working capital

Profitability Ratios

Gross Profit Margin

Operating Profit Margin

Net Profit Margin

Financial Strength

Total Debt to Owners' Equity

Management Effectiveness

Return on Average Assets

Return On Average Equity=ROE

Return on Investment = ROI

Asset Management (Efficiency)

Total Assets Turnover: Sales / total

assets

Total Debt to Total Assets

Year 2

Year 3

Year 4

Year 5

Year 6

Year 7

20.42

9,902

30.10

15,058

39.92

20,443

47.97

25,980

57.33

31,608

65.92

36,970

71.69

42,410

68%

40%

14%

69%

45%

23%

70%

49%

29%

70%

50%

32%

70%

51%

34%

70%

51%

37%

70%

51%

37%

1.0%

1.0%

1.0%

1.1%

1.1%

1.1%

1.1%

5%

5%

6%

10%

10%

14%

14%

14%

24%

17%

17%

34%

18%

18%

46%

20%

21%

65%

21%

22%

93%

36%

1.0%

43%

1.0%

49%

1.0%

53%

1.1%

54%

1.1%

56%

1.0%

57%

1.1%

The current ratio, which is computed by dividing current assets by current liabilities, shows

increasing and high levels throughout the years. The working capital is positive in all the

years, confirming the ability of the company to meet its short term liabilities.

The net profit margin increases gradually with the increased profitability. Starting year 2, this

margin increases from 23% up to 37% in year 7.

The return on average assets, which is computed by dividing net profits by total assets, shows

how much profit the company is able to achieve from the use of its assets. This ratio reaches

18.3% by year 5 as the Dry cleaning shop achieves higher sales volume.

The return on average investment shows healthy levels fueled by the growth in profitability.

The average return on investment is around 15%.

The total assets turnover shows how well the management is making use of its assets. The

assets turnover is computed by dividing sales over total assets. This ratio shows satisfactory

levels starting in year 2.

The internal rate of return (IRR) is 30% and the payback period, which is the period

necessary to pay back the investment, is 4 years and 2 months. These results show that the

project is feasible.

5.7 Break-even analysis

The following table shows the annual revenue levels needed for the Dry cleaning shop project

to break even. Thus, an average of $14,529 in year 1 is a minimum level for the outlet to

break even.

Dry Cleaning project

BREAK-EVEN ANALYSIS

Year 1

Year 2

Year 3

Year 4

Year 5

Year 6

Year 7

Total Revenues

Total Variable Costs

Total Fixed Costs

18,135

5,216

10,350

21,762

6,151

10,443

25,027

6,993

10,538

27,529

7,638

10,836

28,906

7,993

10,937

30,351

8,366

10,640

31,869

8,757

10,966

Break-even revenues

14,529

14,558

14,625

14,997

15,117

14,689

15,121

Minieh-Donnieh Caza - Feasibility Study Dry cleaning project

10

LBN/B7-4100/IB/99/0225/JC20/0105

AFC Consultants International

5.8 Sensitivity analysis

A worst-case scenario was developed with the assumption of lower turnover from 25

pcs/day to 20 pcs/day for the dry cleaning outlet, gave an IRR of 22% and a payback period

of 5 years and 6 months.

In this case, the business will have an average profitability of $4,271 annually.

A best-case scenario was based on higher turnover up from 25 pcs/day to 30 pcs/day. This

scenario provided the dry cleaning project an IRR of 37%, an average profitability and a

payback period of 3 years and 5 months.

Sensitivity Analysis

Worst-case

20 pcs/day

Most likely

25 pcs/day

Best-case

30 pcs/day

Average net income

Average net profit margin

19%

30%

37%

Internal rate of return

Payback period in years

22%

5 years and 6 months

30%

4 years and 2 months

37%

3 years and 5 months

4,271

11,901

8,086

These results show that the project is feasible, especially if it is well-managed providing

quality services and if the manager is able to market well the dry cleaning outlet to optimize

the sales and leverage the projects capacity.

Recommendations and key success factors

In order to achieve satisfactory results, there are some key success factors that should be

highlighted:

The management needs to invest in direct contacts and public relations efforts to

attract the largest number of clients from neighboring villages to utilize the facility.

The business should try to build a loyal clientele, which will come back every year.

The manager needs to be able to operate on his own with the help of an additional

skilled labor during high seasons in order for him to optimize his profit margins.

The plant manager should ensure proper maintenance and regular daily cleaning

services to keep the facility as clean and as efficient as possible.

Economic Impact Evaluation

The dry cleaning outlet will create 2 new jobs: one full time manager/owner and 1 skilled

worker, thereby contributing positively to the socio-economic environment by offering new

opportunities to Minieh-Donnieh caza citizens.

Minieh-Donnieh Caza - Feasibility Study Dry cleaning project

11

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- 162 005Документ1 страница162 005Angelli LamiqueОценок пока нет

- Problem SolvingДокумент10 страницProblem SolvingRegina De LunaОценок пока нет

- 104 2022 218 BdoДокумент29 страниц104 2022 218 BdoJason BramwellОценок пока нет

- Performa InvoiceДокумент260 страницPerforma Invoicesartlab accountsОценок пока нет

- Dimensional Fund Advisors 2002 Case SoluДокумент3 страницыDimensional Fund Advisors 2002 Case SoluPawan PoollaОценок пока нет

- Solution Manual For Multinational Business Finance 15th by EitemanДокумент36 страницSolution Manual For Multinational Business Finance 15th by Eitemanpicheywitlingaip34100% (47)

- Govacctg New PDFДокумент190 страницGovacctg New PDFJasmine Lim100% (1)

- January Batch MasterclassДокумент16 страницJanuary Batch MasterclassSaransh GuptaОценок пока нет

- Laundries Dry-Cleaning OperationsДокумент8 страницLaundries Dry-Cleaning Operationsalassadi09Оценок пока нет

- Mmi 07 Bma 14 Corporate FinancingДокумент20 страницMmi 07 Bma 14 Corporate FinancingchooisinОценок пока нет

- Wind Turbine Feasibility StudyДокумент157 страницWind Turbine Feasibility Studyalassadi09Оценок пока нет

- Advanced Camarilla Pivot Based TradingДокумент1 страницаAdvanced Camarilla Pivot Based TradingrajaОценок пока нет

- Astana Wind FarmДокумент18 страницAstana Wind Farmalassadi09Оценок пока нет

- Tolbert Medical Clinic Anniston, Alabama: Planning Assessment, Space Program & Site Test Fit AnalysisДокумент15 страницTolbert Medical Clinic Anniston, Alabama: Planning Assessment, Space Program & Site Test Fit Analysisalassadi09Оценок пока нет

- Kansas Drug CourtДокумент55 страницKansas Drug Courtalassadi09Оценок пока нет

- Bank Loan Management SystemДокумент2 страницыBank Loan Management Systemalassadi0933% (3)

- Jeans Bakery OutlineДокумент2 страницыJeans Bakery Outlinealassadi09Оценок пока нет

- Business Plan of RestaurantДокумент64 страницыBusiness Plan of RestaurantRohit JainОценок пока нет

- Div Div Div Div h2 h2 Article Section h3 Span Span h3 Img Figcaption Figcaption AДокумент3 страницыDiv Div Div Div h2 h2 Article Section h3 Span Span h3 Img Figcaption Figcaption Aalassadi09Оценок пока нет

- Branded Jeans ResearchДокумент57 страницBranded Jeans Researchalassadi09Оценок пока нет

- Olive OilДокумент28 страницOlive Oilalassadi09Оценок пока нет

- T Shirt Printing BakeryДокумент39 страницT Shirt Printing Bakeryalassadi09100% (1)

- What Is Behavioral Finance?: Meir StatmanДокумент12 страницWhat Is Behavioral Finance?: Meir Statmanalassadi09Оценок пока нет

- Public Library in Saida Done By:ragheid Saaeid & Mohamad MaaroufДокумент26 страницPublic Library in Saida Done By:ragheid Saaeid & Mohamad Maaroufalassadi09Оценок пока нет

- سلطات الضبط في مجال النشاطات المالية والطاقوية والشبكاتية ودورها في الترخيـص بالاستـثمارДокумент30 страницسلطات الضبط في مجال النشاطات المالية والطاقوية والشبكاتية ودورها في الترخيـص بالاستـثمارIlhem BelabbesОценок пока нет

- I M B M +® Æ I " T ( "' : H V™ T JДокумент26 страницI M B M +® Æ I " T ( "' : H V™ T JPratik GazalwarОценок пока нет

- Engineering Management Case StudiesДокумент20 страницEngineering Management Case StudiesJohn Ryan Toledo67% (3)

- Daftar Akun Rumah Cantik HanaДокумент4 страницыDaftar Akun Rumah Cantik HanaLSP SMKN 1 BanjarmasinОценок пока нет

- Seminar - PPT - FinalДокумент26 страницSeminar - PPT - FinalMythili MuthappaОценок пока нет

- Jose Maria College College of Business Education: Audit TheoryДокумент10 страницJose Maria College College of Business Education: Audit TheoryMendoza Ron NixonОценок пока нет

- Free Online Calculators - Math, Fitness, Finance, ScienceДокумент3 страницыFree Online Calculators - Math, Fitness, Finance, SciencejОценок пока нет

- System of Financial Control & Budgeting 2006 (Updated October 2018)Документ51 страницаSystem of Financial Control & Budgeting 2006 (Updated October 2018)usman ziaОценок пока нет

- SAP Cash Bank AccountingДокумент5 страницSAP Cash Bank AccountingHenrique BergerОценок пока нет

- Concepts and Process of Book BuildingДокумент4 страницыConcepts and Process of Book BuildingGopalsamy SelvaduraiОценок пока нет

- Accounting For InventoriesДокумент32 страницыAccounting For InventoriesShery HashmiОценок пока нет

- Issues That Affect The Global Banking IndustryДокумент3 страницыIssues That Affect The Global Banking Industryem-tech100% (1)

- Consumer Education SyllabusДокумент4 страницыConsumer Education SyllabusEm Jay0% (2)

- Sukanya Samriddhi Account Excel Calculator DownloadДокумент3 страницыSukanya Samriddhi Account Excel Calculator DownloadanuragpugaliaОценок пока нет

- Fundamental AnalysisДокумент26 страницFundamental Analysisaruncbe07Оценок пока нет

- st2112040843 deДокумент31 страницаst2112040843 desujaydas00123Оценок пока нет

- Chapter 21 (Saunders)Документ21 страницаChapter 21 (Saunders)sdgdfs sdfsf100% (1)

- AT.2900b - Auditing (AUD) SyllabusДокумент2 страницыAT.2900b - Auditing (AUD) SyllabusBryan Christian MaragragОценок пока нет

- Pakistan Synthetics Limited: Condensed Interim Balance Sheet (Unaudited)Документ8 страницPakistan Synthetics Limited: Condensed Interim Balance Sheet (Unaudited)mohammadtalhaОценок пока нет

- Laundry QuestionnaireДокумент3 страницыLaundry QuestionnaireRIGENE MAGNAYEОценок пока нет