Академический Документы

Профессиональный Документы

Культура Документы

Pyq Acc 116

Загружено:

HaniraMhmdОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Pyq Acc 116

Загружено:

HaniraMhmdАвторское право:

Доступные форматы

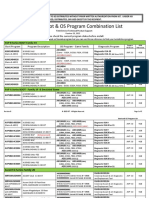

AC/SEP 20141ACC11611651211

CONF1DENTIAL

UNIVERSITI TEKNOLOGI MARA

FINAL EXAMINATION

COURSE

COURSE CODE

EXAMINATION

TIME

: INTRODUCTION TO COST ACCOUNTING l COST

ACCOUNTING

: ACCII61165/211

: SEPTEMBER 2014

: 3HOURS

INSTRUCTIONS TO CANDIDATES

1.

This question paper consists of five (5) questions.

2.

Answer ALL questions in the Answer Bookiet. Start each answer on a new page.

3.

Do not bring any material into the examination room unless permission is given by the

invig ilator.

4.

Please check to make sure that this examination pack consists of:

i)

ii)

the Question Paper

an Answer Booklet - provided by the Faculty

DO NOT TURN THIS PAGE UNTIL YOU ARE TOLD TO DO 50

This examThation paper consists of 7 printed pages

Hak Cipta Universiti Teknologi MARA

CONFIDENTIAL

CONFIDENTIAL

AC/SEP 20141ACCII6/165/211

QUESTION 1

a.

State any three (3) roles and responsibilities of a cost accountant or a management

accountant towards the company.

(3 marks)

b.

ldentify the following costs based on their functions

Administration cost

Production cost

Marketing, Selling and Distribution cost

Finance cost

Research and Development cost

i.

ii.

iii.

iv.

V.

Advertising costs to promote a new product

Depreciation of machines in Assembly Centre

Consultancy costs paid to a company conducting a survey on a new product

Muna Boutique purchased 3,000 meters of fabric for new clothing line

lnterest on loan borrowed by Sani for setting up his business

(5 marks)

(Total: 8 marks)

QUESTION 2

a.

i.

State the differences between direct material and indirect material.

(2 marks)

ii.

Provide an example of a direct material and indirect material.

(1 mark)

iii.

List the functions and essential information contained in the following documents

1.

2.

Store requisition notes

Goods received notes

(4 marks)

Hak Cipta Universiti Teknologi MARA

CONFIDENTIAL

CONFIDENTIAL

AC/SEP 2014/ACCI 16/165/21 1

b. Fkri Enterprise purchases and sells a single product caiied Kristy. The company

maintains a perpetual inventory system. The company values its stock based on the

Last-in-First-out (LIFO) method.

Opening stock for January 2014 of Kristy was 800 units at a total cost of RM2,000.

The transactions during the month are as follows:

Date

3January

6 January

9 January

12January

15 January*

20 January

28January

Purchases

Units

Total Value

(RM)

11500

47500

27000

67400

-

-

3,000

107500

-

-

-

-

lssues

Units

27800

27500

11200

Additional information:

a.

Fikri Enterprise returned 300 units of Kristy to the store due to excess taken.

These units were purchased on 6 January.

b.

During a physical stock count at the end of January, there were 1,000 units of

Kristy in store.

Required:

i.

Prepare a Store Ledger Card for January 2014 using the Last-in-First-out (LIFO)

method of pricing issues of raw material and show the value of closing stock.

(14 marks)

ii.

State two (2) advantages and two (2) disadvantages of LIFO method in valuing

the stocks.

(4 marks)

iii.

State three (3) possible reasons for any discrepancy to occur between the

balance as per store ledger card and the physical stock count.

(3 marks)

(Total: 28 marks)

Hak Cipta Universiti Teknologi MARA

CONFIDENTIAL

CONFIDENTIAL

AC/SEP 2014/ACCII6/165/211

QUESTION 3

a.

Muhammad commenced his business, Mafh Bakery in January 2014. Muhammad

empIoys Pn. Anis, a very experienced baker and Cik Izzah, who was a cupcake seller

for the last 3 years. Both of them are responsible to produce cakes and cupcakes

which are ordered by Mafh Bakerys customers.

Since the demand has increased, Muhammad hires Encik Amzar Jalil as a driver for

his bakery. At the same time, Cik Athirah has been appointed as an accountant in

Mafh Bakery. The business operates daily from 8.00 am to 7.00 pm, and is being

monitored consistently by his son, Farid who works as a cashier. The company also

hires Hafie as a security guard.

Required:

ldentify direct Iabours and indirect labours amongst the workers mentioned above.

Give reasons for each of your answer.

(6 marks)

b.

Due to financial insolvency Muhammad has sold his business to Mohd Rafiq. Rafiq,

then restructured the business and hire another four workers, Amin, Hana, Ashikin and

Shatirah. Amin and Hana are paid on hourly worked, while Ashikin and Shatirah are

paid on the number of units produced.

Payment to Ashikin and Shatirah are based on straight piecework and differential

piecework respectively. They will be paid on good units only and are promised a

monthly guaranteed minimum wages of RMI ,200.

The workers normally work seven (7) hours a day, Monday to Friday a week. Overtime

rate will be at 150% of the rate. The following information relates to the four workers

for the month of January 2014.

Amin

Hana

Ashikin

Shatirah

Unit

Hours

produced Worked

-

50

-

40

50

44

60

45

Rate per

Hour(RM)

20

30

20

30

Rate per

Unit(RM)

-

-

30

20

Defected

units

2

O

The differential piecework wages will be as follows:

Up to 20 units

21 - 40 units

41 - 50 units

51 units and above

Hak Cipta Universiti Teknologi MARA

RM1O per unit

RMI2 per unit

RM15 per unit

RM20 per unit

CONFIDENTIAL

CONFIDENTIAL

AC/SEP 2014/ACCII6/1651211

Required:

i.

Calculate the gross wages for the four workers of Mafh Bakery.

(13 marks)

11.

State one (1) advantage and tWo (2) disadvantages of differential piecework

scheme of remuneration.

(3 marks)

(Total: 22 marks)

QUESTION 4

Namia Manufacturing Sdn Bhd is preparing its budgeted production overhead and managed

to determine the apportionment cost of those overhead to products. There are five centres

consists of 3 production centres and 2 service centres.

For the year 2013, cost centre expenses and related information have been budgeted as

follows:

Cost centre

Canteen

Maintenance

Basis of Apportionment

Number of empioyees

Maintenance hours

Total Machine Machine Assembly Canteen Maintenance

Centre

Centre

Centre

Centre

Centre

1

2

RM

RM

RM

RM

RM

RM

?

lndirect labour 78,560

97980

131684

223638

181400

167300

81480

?

lndirect

21300

0

0

materials

121600

lndirect

87420

?

0

0

27101

Expenses

Apportionment 81 1 571

32 7 410

221220

141850

87841

3,250

Cost

Additional information:

Total Machine Machine Assembly Canteen Maintenance

Centre

Centre

Centre

Centre

Centre

1

2

100

40

30

20

10

0

Maintenance

hours

Direct labour 35 7 000

hours

25,700

Machine

usage hours

17630

Numberof

employees

8 7 000

67200

207800

7 7 200

18,000

21400

500

450

400

380

400

Hak cipta Universiti Teknologi MARA

CONFIDENTIAL

CONFIDENTIAL

AC/SEP 2014/ACCI 1 6/165/21 1

Required:

a.

Calculate the missing value for the indirect labour, indirect materials and indirect

expenses.

(3 marks)

b.

ldentify a suitable basis of apportionment for the overhead costs listed below:

i.

ii.

iii.

iv.

V.

vi.

lnsurance on building

Depreciation on machinery

Electricity expenses

lnspection expenses

Rent and rates of building

Utilities expenses

(3 marks)

C.

Prepare an overhead analysis sheet for Namia Manufacturing Sdn Bhd using the

repeated distribution method (your answer to the nearest Ringgit). Based on your final

amount of the total overhead after re-apportionment, calculate the overhead

absorption rate (OAR) for each of the three productions centre below using the

following basis:

i.

ii.

iii.

Machine Centre 1 - Machine Usage Hours

Machine Centre 2 - Machine Usage Hours

Assembly Centre - Direct Labour Hours

(14 marks)

d.

Calculate any under or over absorption of overheads if the actual activity for the year

2013 are as follows:

Actual overhead

Direct labour hours

Machine usage hour

Machine Centre

1

RM607304

77400

57400

Machine Centre Assembly Centre

2

RM467983

RM671608

77210

267340

161880

37100

(5 marks)

e.

State three (3) problems that might arise when apportioning service department costs

to production departments.

(3 marks)

(Total: 28 marks)

Hak Cipta Universiti Teknoiogi MARA

CONFIDENTIAL

CONFIDENTIAL

AC/SEP 201 4/ACCI 1 6/1 65/21 1

QUESTION 5

MZ Sdn Bhd is a wooden chair producer. During the month of May 2014, a special order

(Batch No. 50888) of 10 wooden chairs were received from Pahang. The material such as

woods, nails and varnish are required in making these chairs. The following information is

avaiiable for Batch No. SC888:

Woods

Nails

Wages/Salaries:

Chair maker (Completed job within 10 days)

Supervisor

Designer fees

Salesman commission

Driver for delivery

Varnish

RM

RM11500

RM300

RM50 per day

RM800

RM1 ,000

RM200

RM50

RM250

Required:

i.

Prepare a job cost sheet for Batch No. SC888. Show clearly:

a.

prime cost

b.

total production cost

C.

total cost and

d.

selling price

(4 marks)

(3 marks)

(2 marks)

(3 marks)

The management target profit margin is 30% on sales.

ii.

Describe two (2) characteristics ofjob costing.

(2 marks)

(Total: 14 marks)

END OF QUESTION PAPER

Hak Cipta Univers;ti Teknologi MARA

CONFIDENTIAL

Вам также может понравиться

- Working Capital Management, EleconДокумент56 страницWorking Capital Management, Eleconrrpatel_idol100% (1)

- Armed Struggle in Africa (1969)Документ167 страницArmed Struggle in Africa (1969)Dr.VolandОценок пока нет

- Acc106 Feb2021 Question Set 1Документ15 страницAcc106 Feb2021 Question Set 1Fara husna0% (1)

- Igt - Boot Os List Rev B 10-28-2015Документ5 страницIgt - Boot Os List Rev B 10-28-2015Hector VillarrealОценок пока нет

- Introduction to Soil Investigation ReportДокумент76 страницIntroduction to Soil Investigation ReportRuzengulalebih ZEta's-Listik50% (2)

- Private Security Industry ReportДокумент40 страницPrivate Security Industry ReportkarndeОценок пока нет

- Electrical Power System Design For Industrial FacilitiesДокумент29 страницElectrical Power System Design For Industrial Facilitiesgusgon521292100% (1)

- MS For The Access Control System Installation and TerminationДокумент21 страницаMS For The Access Control System Installation and Terminationwaaji snapОценок пока нет

- OilField Review 2016 Cement EvaluationДокумент10 страницOilField Review 2016 Cement EvaluationLuisОценок пока нет

- Assignment - OHD ACC116Документ3 страницыAssignment - OHD ACC116Nurul NajihaОценок пока нет

- Eco 415 Assignment 1Документ3 страницыEco 415 Assignment 1capeto01100% (3)

- Bbaw2103 Financial AccountingДокумент15 страницBbaw2103 Financial AccountingSimon RajОценок пока нет

- ENT300 - Final Project - Hair SalonДокумент93 страницыENT300 - Final Project - Hair SalonAfiq Iqmal56% (16)

- Tutorial 6 QДокумент5 страницTutorial 6 Qmei tanОценок пока нет

- The Recording ProcessДокумент30 страницThe Recording ProcesssyuhadaОценок пока нет

- Week 1.basis Period Change in Accounting Dates - With Q AДокумент39 страницWeek 1.basis Period Change in Accounting Dates - With Q Asahrasaqsd0% (1)

- MALAYSIA TOURISM PROMOTION STRATEGIESДокумент7 страницMALAYSIA TOURISM PROMOTION STRATEGIESmeeyaОценок пока нет

- Assigment Account FullДокумент16 страницAssigment Account FullFaid AmmarОценок пока нет

- Toro divisions performance measurementДокумент7 страницToro divisions performance measurementjr ylvsОценок пока нет

- Table of Content: Num. PagesДокумент14 страницTable of Content: Num. Pagescrossbonez9350% (2)

- QUIZ 1 Agr 113 Chapter 1Документ1 страницаQUIZ 1 Agr 113 Chapter 1Emellda MAОценок пока нет

- Lecture Tutorial - P, CL and CA (A)Документ3 страницыLecture Tutorial - P, CL and CA (A)yym cindyy100% (1)

- Skop Kerja Latihan Industri (Diploma Pengurusan Teknologi (Perakaunan) )Документ6 страницSkop Kerja Latihan Industri (Diploma Pengurusan Teknologi (Perakaunan) )jeme2ndОценок пока нет

- Elc231 Mid Sem Test June2020 Set1 PDFДокумент6 страницElc231 Mid Sem Test June2020 Set1 PDFNURUL AIN IZZATI BINTI MUHAMAD ZAILAN SOVILINUSОценок пока нет

- Walkthrough ExampleДокумент2 страницыWalkthrough ExampleXaralisa Jazz50% (2)

- Internship Log Book Template LATESTДокумент29 страницInternship Log Book Template LATESTNabila HusnaОценок пока нет

- Eco120 108 113 107Документ11 страницEco120 108 113 107Amiruddin Zubir100% (1)

- Fin420 540Документ11 страницFin420 540Zam Zul0% (1)

- Infographic FIN346 Chapter 2Документ2 страницыInfographic FIN346 Chapter 2AmaninaYusriОценок пока нет

- Ab5.49 - Report Group A - HLB2013Документ12 страницAb5.49 - Report Group A - HLB2013alya farhana100% (1)

- Far160 (CT XXX 2022) QuestionДокумент4 страницыFar160 (CT XXX 2022) QuestionFarah HusnaОценок пока нет

- Tutorial Pengekosan KeluaranДокумент13 страницTutorial Pengekosan KeluaranatehanaОценок пока нет

- Controlling Material Structure for Desired PropertiesДокумент3 страницыControlling Material Structure for Desired PropertiesNorazilah YunusОценок пока нет

- Group Assignment 1Документ3 страницыGroup Assignment 1syarifahsuraya02Оценок пока нет

- Chapter 1 211Документ13 страницChapter 1 211Nazirul SafwatОценок пока нет

- TAX Treatment For TAX267 and TAX317 Budget 2019Документ5 страницTAX Treatment For TAX267 and TAX317 Budget 2019nonameОценок пока нет

- Acc116 165 211Документ6 страницAcc116 165 211Mustaqim MustaphaОценок пока нет

- Usage of Smartphones Among UiTM StudentsДокумент2 страницыUsage of Smartphones Among UiTM StudentsAzyan Farhana Adham100% (1)

- Understanding Statistics with Real-World ExamplesДокумент9 страницUnderstanding Statistics with Real-World ExamplesNurul Farhan IbrahimОценок пока нет

- Question 4 JULY2020 MAF251Документ5 страницQuestion 4 JULY2020 MAF251Tengku Ed Tengku AОценок пока нет

- Based on the information provided, prepare the Statement of Cash Flows for SintokTech Bhd for the year ended 31 December 2021 using the indirect methodДокумент6 страницBased on the information provided, prepare the Statement of Cash Flows for SintokTech Bhd for the year ended 31 December 2021 using the indirect methodNajihah RazakОценок пока нет

- Tutorial 6 Non Current Assets (Q)Документ3 страницыTutorial 6 Non Current Assets (Q)lious liiОценок пока нет

- Eiwu / Sharp Picket, Press Statement 28 Feb 2013Документ2 страницыEiwu / Sharp Picket, Press Statement 28 Feb 2013Salam Salam Solidarity (fauzi ibrahim)100% (1)

- Past Years TPT250Документ12 страницPast Years TPT250Ain hsyx100% (1)

- Assignment 1 FinalДокумент17 страницAssignment 1 FinalGary AngОценок пока нет

- Ais205 June 23Документ7 страницAis205 June 23ediza adha0% (1)

- TAX 467 Topic 4 Capital Allowance - AgricultureДокумент11 страницTAX 467 Topic 4 Capital Allowance - AgricultureAnis RoslanОценок пока нет

- PBL Tax - Final-EditДокумент23 страницыPBL Tax - Final-EditRE100% (1)

- Journals Question 2 ProblemsДокумент22 страницыJournals Question 2 ProblemsAzam YahyaОценок пока нет

- Law Report Ques 41Документ15 страницLaw Report Ques 41Syahirah AliОценок пока нет

- Law of Contract Analysis of Pot SaleДокумент3 страницыLaw of Contract Analysis of Pot Salefardeen khanОценок пока нет

- Eco 415 Apr07Документ5 страницEco 415 Apr07myraОценок пока нет

- ECO415Документ6 страницECO415Khuzairi NakhoudaОценок пока нет

- FAR 110 UitmДокумент2 страницыFAR 110 UitmIs Farez75% (4)

- ECO211Документ11 страницECO211Mia KulalОценок пока нет

- Jawabab MK WayanДокумент1 страницаJawabab MK WayanErica LesmanaОценок пока нет

- L1 - ABFA1013 IA (Student)Документ9 страницL1 - ABFA1013 IA (Student)toushiga0% (1)

- Group Project Far670 7e VS MynewsДокумент33 страницыGroup Project Far670 7e VS MynewsNurul Nadia MuhamadОценок пока нет

- Sta104 Tutorial 1Документ3 страницыSta104 Tutorial 1Ahmad Aiman Hakimi bin Mohd Saifoul ZamzuriОценок пока нет

- Assignment RES452Документ2 страницыAssignment RES452halili rozaniОценок пока нет

- MKT243 Mind MapДокумент1 страницаMKT243 Mind MapNurul IzzahОценок пока нет

- Ais160 GProject Mac-Aug 2020Документ3 страницыAis160 GProject Mac-Aug 2020Ahmad Arief0% (1)

- CH3 LabourДокумент9 страницCH3 Labourzuereyda100% (4)

- Sample 4 Soalan Test PDFДокумент5 страницSample 4 Soalan Test PDFEmmy LizaОценок пока нет

- D FAR110 Test Jun 2022 QuestionДокумент6 страницD FAR110 Test Jun 2022 QuestionNADIYATUL AMIRAH AHMAD NAZMIОценок пока нет

- NO. Name Matric No.: Department of Building Universiti Teknologi Mara (Perak)Документ5 страницNO. Name Matric No.: Department of Building Universiti Teknologi Mara (Perak)Che Wan Nur SyazlyanaОценок пока нет

- mkt243 2011 S1Документ6 страницmkt243 2011 S1rxzlajuОценок пока нет

- This Examination Paper Consists of 7 Printed Pages: © Hak Cipta Universiti Teknologi MARAДокумент7 страницThis Examination Paper Consists of 7 Printed Pages: © Hak Cipta Universiti Teknologi MARAFaiz Mohamad0% (1)

- Institute of Cost and Management Accountants of Pakistan Summer (May) 2011 ExaminationsДокумент4 страницыInstitute of Cost and Management Accountants of Pakistan Summer (May) 2011 ExaminationsNaveed Mughal AcmaОценок пока нет

- Sales Forecast AnalysisДокумент2 страницыSales Forecast AnalysisHaniraMhmdОценок пока нет

- Questionnaire Survey - Service QualityДокумент4 страницыQuestionnaire Survey - Service QualityHaniraMhmdОценок пока нет

- ELC270Документ11 страницELC270HaniraMhmdОценок пока нет

- Administrative Functions Classification GuideДокумент2 страницыAdministrative Functions Classification GuideHaniraMhmdОценок пока нет

- PAD Quiz N AnswerДокумент4 страницыPAD Quiz N AnswerZack ZainalОценок пока нет

- MU0017 Talent ManagementДокумент12 страницMU0017 Talent ManagementDr. Smita ChoudharyОценок пока нет

- Project CST 383Документ1 083 страницыProject CST 383api-668525404Оценок пока нет

- About Kia Motors Corporation: All-NewДокумент19 страницAbout Kia Motors Corporation: All-NewWessam FathiОценок пока нет

- March 2017Документ11 страницMarch 2017Anonymous NolO9drW7MОценок пока нет

- 1 s2.0 S0313592622001369 MainДокумент14 страниц1 s2.0 S0313592622001369 MainNGOC VO LE THANHОценок пока нет

- Human Computer InteractionДокумент12 страницHuman Computer Interactionabhi37Оценок пока нет

- Tutorial: Energy Profiles ManagerДокумент6 страницTutorial: Energy Profiles ManagerDavid Yungan GonzalezОценок пока нет

- Education, A Vital Principle For Digital Library Development in IranДокумент23 страницыEducation, A Vital Principle For Digital Library Development in Iranrasuli9Оценок пока нет

- SUTI Report - Metro ManilaДокумент87 страницSUTI Report - Metro ManilaIvan Harris TanyagОценок пока нет

- Group 2 - Assignment 2 - A Case Study of Telecom SectorДокумент13 страницGroup 2 - Assignment 2 - A Case Study of Telecom Sectorfajarina ambarasariОценок пока нет

- EasementДокумент10 страницEasementEik Ren OngОценок пока нет

- Apple Led Cinema Display 24inchДокумент84 страницыApple Led Cinema Display 24inchSantos MichelОценок пока нет

- TurboVap LV Users ManualДокумент48 страницTurboVap LV Users ManualAhmad HamdounОценок пока нет

- Lifetime Physical Fitness and Wellness A Personalized Program 14th Edition Hoeger Test BankДокумент34 страницыLifetime Physical Fitness and Wellness A Personalized Program 14th Edition Hoeger Test Bankbefoolabraida9d6xm100% (27)

- Basic Accounting Principles and Budgeting FundamentalsДокумент24 страницыBasic Accounting Principles and Budgeting Fundamentalskebaman1986Оценок пока нет

- Lecture 2 Leader-Centred PerspectivesДокумент24 страницыLecture 2 Leader-Centred PerspectivesLIVINGSTONE CAESARОценок пока нет

- ReportДокумент4 страницыReportapi-463513182Оценок пока нет

- Framing Business EthicsДокумент18 страницFraming Business EthicsJabirОценок пока нет

- Office of The Controller of Examinations Anna University:: Chennai - 600 025Документ4 страницыOffice of The Controller of Examinations Anna University:: Chennai - 600 025M.KARTHIKEYANОценок пока нет

- Norlys 2016Документ124 страницыNorlys 2016elektrospecОценок пока нет

- Patient Safety IngДокумент6 страницPatient Safety IngUlfani DewiОценок пока нет

- Brochures Volvo Engines d11 CanadaДокумент4 страницыBrochures Volvo Engines d11 CanadaDIONYBLINK100% (2)