Академический Документы

Профессиональный Документы

Культура Документы

Sponge Iron Industry B K Oct 06

Загружено:

sdОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Sponge Iron Industry B K Oct 06

Загружено:

sdАвторское право:

Доступные форматы

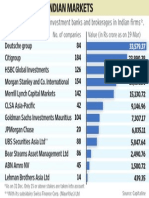

Batlivala & Karani

B&K Securities

SECTOR U P D A T E

4th October 2006

Sponge Iron Industry Growing with Steel

Indian economy is one of the fastest growing economies of the world

with 7.5-8% expected Real GDP growth. Steel demand is expected to

double by 2012 on rising demand from infrastructure and construction

sector. About 48% of steel is made through secondary route (Electric

route) which uses mix of sponge iron and scrap in steel making.

We see the demand of sponge iron to remain buoyant driven by growth

in steel production.

Production of steel scrap in India is low at 15-20% of its consumption

due to longer product life cycle, as the country is in developing phase and

the consumption pattern is tilted in favour of infrastructure and

construction rather than consumer durables. Therefore, secondary steel

makers have to depend on imported steel scrap. Coal based sponge iron

is fast replacing imported steel scrap due to low cost of production as

non-coking coal and iron ore (two critical raw materials) are domestically

available and its production is rising.

The growth of gas based sponge iron has been limited due to poor

availability and higher cost of gas. Essar Steel, Ispat Industries and Vikram

Ispat are the only producers in India who came up in 1990s on western

coast of India.

The future of sponge iron will belong to the players who have their

captive sources of raw materials which will insulate them from market

fluctuations. Presently, only Jindal Steel & Power and Monnet Ispat have

captive resources of both iron ore and coal. Tata Sponge has recently

acquired 115 mn tonnes mineable coal deposit in Orissa which will get

functional by FY09.

Key industry data (Sponge Iron production)

(Mn tonnes)

Sanjay Jain

sanjay.jain@bksec.com

Tel.: 91-22-4007 6217

FY06

FY12E

CAGR (%)

Gas based

4.5

7.1

Coal based

7.3

16.3

14

Total

11.8

23.4

12

% of Coal based

61.6

69.6

Ashish Kejriwal

ashish.kejriwal@bksec.com

Tel.: 91-22-4007 6216

B&K RESEARCH

OCTOBER 2006

Investment arguments

The production of sponge iron (Direct Reduced Iron/Hot Briquetted Iron) started in late

1970s with one small sponge iron plant in the public sector in Andhra Pradesh viz. Sponge

Iron India Limited. During last decade, due to growth in domestic steel demand, a vigorous

growth in domestic steel production led by the secondary steel making sector, relatively low

cost of investment and ease of setting up of a sponge iron plant, availability of mineral

resources, frequent problems of scrap (affordability and availability), the sponge iron industry

has grown manifold and India became the world leader in sponge iron production in 2003.

Growth in steel production

The demand for steel continues to rise due to boom in infrastructure and construction

industry. The production of crude steel has grown at a CAGR of 9% during FY01-06 and

reached at 41.3 MT in FY06.

Increasing crude steel production

45

40

Crude steel production

(mn tons)

35

30

25

20

15

10

5

FY06

FY05

FY04

FY03

FY02

FY01

Source: SAIL

The production of steel through the secondary route (EAF, IF), using hot metal (pig iron),

Domestically available raw

materials would continue to

drive growth

sponge iron/scrap as their basic raw materials, accounts for approx. 48% of the total steel

output and has grown at a CAGR of 18% during FY01-05. The trend is expected to continue

due to rising availability of coal based sponge iron produced from domestically available raw

material. The flue gases generated in sponge iron making are utilised for production of power

for captive consumption.

Increasing production through the secondary route

(Mn tonnes)

FY01

FY02

FY03

FY04

FY05

CAGR (%)

Crude steel production

26.9

28

30.4

34.2

38.5

Main producers

17.3

17.8

19.0

20

20.0

Secondary producers

9.6

10.2

11.5

14.2

18.5

18

EAF

5.3

5.9

6.7

8.2

10.2

IF units

4.3

4.3

4.8

8.2

% share of secondary producers

36

36

38

42

48

Source: JPC

SPONGE IRON INDUSTRY

B&K RESEARCH

OCTOBER 2006

Continued substitution demand for scrap

Proportion of sponge iron in secondary production is expected to go up. Production of steel

scrap in India is low at 15-20% of its consumption due to longer product life cycle, as the

Sponge iron replacing

imported steel scrap due to

low cost of production

country is in developing phase and the consumption pattern is tilted in favour of infrastructure

and construction. Domestic availability of scrap is low, as the ship-breaking industry (main

source of indigenous scrap generation) isnt getting enough ships for breaking. Therefore,

secondary steel makers have to depend on imported steel scrap. Coal based sponge iron is

fast replacing imported steel scrap due to low cost of production, as non-coking coal and iron

ore (two critical raw materials) are domestically available and its production is rising.

Increasing share of sponge iron by secondary producers

(%)

00-01

01-02

02-03

03-04

04-05

05-06

Sponge iron

30

30

38

43

50

60

Scrap/Pig iron

70

70

62

57

50

40

Source: AML Steel

As Indian steel producers have to depend on import of scrap, the domestic prices of sponge

iron align with the landed price of scrap.

Scrap vs. DRI prices

Sponge iron price move in line

with landed cost of steel

scrap

300

16,000

250

14,000

12,000

200

10,000

150

8,000

100

6,000

Scrap Shredded fob Rotterdam $/ton (LHS)

DRI prices , Kolkata (Rs /ton incl. excis e & taxes , RHS)

50

2,000

-

1996

1998

2000

2002

Feb-03

Apr-03

Jun-03

Aug-03

Oct-03

Dec-03

Feb-04

Apr-04

Jun-04

Aug-04

Oct-04

Dec-04

Feb-05

Apr-05

Jun-05

Aug-05

Oct-05

Dec-05

Feb-06

Apr-06

Jun-06

4,000

Source: Metal Bulletin, JPC

SPONGE IRON INDUSTRY

B&K RESEARCH

OCTOBER 2006

Overview

The Indian sponge iron industry has seen a rapid and powerful growth in the coal based

sponge iron segment in the country, while the gas based segment is restricted mainly to 3

producers namely Essar Steel, Vikram Ispat and Ispat Industries due to expensive and limited

supply of natural gas. Moreover, the cost of setting a gas based sponge iron unit is very high

which is not feasible for small players. The demand of sponge iron in India has grown at a

CAGR of 10% over the last 10 years.

Production Processes & Technologies

In India, mainly coal based rotary kilns and gas based shaft furnace reactors are used for

producing sponge iron.

Coal based process

Sponge iron produced by

reducing iron ore using

non-coking coal

Coal based plants are of smaller size, requires low capital investment. Sponge iron is produced

by reducing iron ore using non-coking coal. Iron ore lumps and non-coking coal are charged

into a rotary kiln in requisite proportion along with fluxes. Coal plays a dual role in the process

by acting as a redundant as well as fuel for providing heat to maintain the requisite temperature

inside the kiln at 950-1050C. The reduction process occurs in solid state. Waste heat from

spent gases is utilised to produce power.

Gas based process

Requires high capital

investment, sponge iron

produced by reducing iron ore

pellets using natural gas

Gas based plants are of relatively larger sizes, require higher capital investment and uses

Midrex and HYL-III technologies for reducing iron ore pellets with natural gas as the redundant

in the reactor. The difference between the two technologies is the process of reforming and

use of the spent gas. The Midrex uses CO2 (+ steam) based reforming of the natural gas while

HYL-lll uses mainly the H2O reforming process. The specific consumption of various raw

materials for production of 1 tonne sponge iron (by Midrex process) include iron oxide 1.49

tonnes, natural gas of 2.5 GCal and 100 KWh of electricity. The hematite ore pellets/lumps

should possess 67% Fe minimum.

Composition of Coal and Gas based Sponge Iron

(%)

Fe (Metallic) Metallisation Carbon

Coal based

81-84

90 (+/-2)

Gas based

86.5

93+

Sulphur

Phosphorus

Size

0.2-0.3 .025-.03 max

.05-.06 max

3-30 mm

1.5-3

.015 max

.04 max 6-200 mm

India has been the worlds largest producer of sponge iron since 2003 producing 11.8 mn

tonnes in FY06, registering a growth of 15% over the last year. This has been due to rapid and

powerful growth in the coal based sponge iron segment in the country.

SPONGE IRON INDUSTRY

B&K RESEARCH

OCTOBER 2006

Sponge iron (DRI/HBI) production

(Mn tonnes)

FY04

FY05

FY06 FY07E FY08E FY09E FY10E

FY11E FY12E

Gas based

Coal based

10

12

13

15

16

16

Total

10

12

16

19

20

22

23

23

Growth (%)

17

27

15

32

20

% of Coal based

51

55

62

62

63

65

67

69

70

Source: B&K Estimates

FY12E

FY11E

FY10E

FY09E

FY08E

Coal Based

FY06

FY05

Gas Based

FY07E

18

16

14

12

10

8

6

4

2

0

FY04

Gap expected to widen further

in coming years

production (mtpa)

Sponge Iron production

Source: JPC & B&K Estimates

The share of coal based DRI production has increased from about 37% in FY01 to about

62% in FY06 and the gap is expected to widen further in the coming years.

SPONGE IRON INDUSTRY

B&K RESEARCH

OCTOBER 2006

Raw materials scenario

Non-coking coal

Non-coking coal is the basic raw material for coal based sponge iron plant. Although, India

has a vast reserves of non-coking coal (about 221 bn tonnes out of which proven reserves

Vast reserves of non-coking

coal but of inferior quality

with higher percentage of ash

content

are about 79 bn tonnes) but of inferior quality with higher percentage of ash content. The

high ash content is a major problem for sponge iron producers, as higher coal consumption is

needed in order to affect the same degree of reduction. Over 75% of non-coking coal

production is the lower D, E, and F grade. Generally, with 1% increase in the ash content,

production capacity decreases by about 2.5%. According to industry estimates, calibrated

non-coking coal (grade B/C) requirement is about 1-1.2 tonnes per tonne of sponge iron

produced but if low grade (grade D/E/F) coal is being used, then the coal required will go up

to as much as 2.5 tonnes or more.

The non-coking coal with a higher % of ash content needs to be washed and should be

Players located near coal

mines

brought it to a level of 25% or less for use in sponge iron kilns which adds to the cost. Freight

charges by railways constitutes about 30-40% of the total cost of non-coking coal. So, its

beneficial for the DRI (Direct Reduced Iron)/sponge iron producers to set up plants near

coal mines so as to save on transportation costs. Therefore, most of the players are located in

Chhattisgarh, Orissa and West Bengal region.

Many big players have already acquired captive coal blocks or are in the process of acquiring

it. But small players which are numerous in India have to depend on the market. Coal India

Limited has introduced the system of E-auction and supply of coal through Multi Commodity

Increasing coal prices put

pressure on the margins of

the players

exchange for the core sector other than the power utilities. So, now the prices are market

driven which will inevitably interrupt consistent supplies for producers who depend on market.

Higher ash content and increasing coal prices due to demand-supply mismatch put pressure

on the margins of the players. Some players like Tata Sponge Iron Limited started importing

low ash content non-coking coal and blend it with high ash content domestic non-coking coal.

Although, imported non-coking coal is very expensive vis--vis domestic one but in order to

improve the efficiency of the kilns, large players have started doing so.

Iron ore

Coal based sponge iron plants normally use 100% lump ores with Fe content greater than

62% while the gas based plants normally use a feed mix of iron ore pellets and lumps of

around 67% Fe content. According to industry norm, about 1.6 tonnes of calibrated lump

iron ore (5-18mm, Fe: Minimum 62%) is required to produce 1 tonne of sponge iron.

India has vast reserves of medium grade iron ore (hematite ores, Fe: 62-65%) which are

mainly located in the states of Orissa, Jharkhand, Chhattisgarh, Karnataka and Goa region.

SPONGE IRON INDUSTRY

B&K RESEARCH

OCTOBER 2006

Recoverable reserves of hematite as on 1.4.2000

(Mn tonnes)

Vast reserves of medium

grade iron ore available in

India

High Grade

Medium Grade

Low Grade

(Fe+65%)

(Fe 62-65%)

(Fe<62%)

Chhattisgarh

461

562

Orissa

548

Jharkhand

Karnataka

Goa Region

Others

Total

% share in total

Others

Total

463

417

1,903

1,857

508

291

3,204

44

1,754

873

188

2,859

215

583

79

90

966

133

392

56

581

30

134

146

104

406

1,298

5,023

2,461

1,146

9,919

13

51

25

12

100

Source: IBM, Nagpur

Increasing prices

About 54% of the total domestic production is exported in FY05 due to better realisation at

the global level owing to the higher demand of steel worldwide, in particular China. The price

at the domestic level is also moving northward.

Iron Ore

(MT)

FY03

FY04

FY05

Production

99

121

145

Export

48

63

78

% of production exported

48

52

54

Source: IBM & MMTC

Dolomite

Dolomite acts in the coal based process as a desulphuriser, removing sulphur from the feed

mix during the reduction process. It constitutes a very small proportion of total raw materials

required in the process and doesnt have much impact on the cost.

Natural gas

Availability of natural gas

restricted to western part of

country

Natural gas is used in gas based sponge iron units mainly through two processes in India

namely Midrex and HYL-III. Availability of natural gas is restricted to the western part of the

country which has favoured the growth of the gas based units there. High price of natural gas

in India is increasing the cost of production of the gas based producers.

Power generation

Power generation through waste heat from spent gases at very low cost is one of the biggest

advantages the coal based sponge iron unit is enjoying with. This would help the companies

in reducing the cost of production and earn additional income by selling the surplus power.

SPONGE IRON INDUSTRY

B&K RESEARCH

OCTOBER 2006

Captive power position

(Unit: KWh)

Module (TPA)

Additional income to Coal

based sponge iron plant

Module-wise power position

Power generation

Own consumption

Surplus power

150,000

10-12

3.5

6.5

100,000

7-8

2-2.5

1.5

30,000

Source: JPC

Raw material facility

More than 80% of the sponge iron producers are small producers (installed capacity of less

than 60,000 TPA) and have to depend on the market for basic raw materials. Producers are

unable to utilise their capacity to the fullest and are on the verge of closure amidst fluctuating

and increasing prices of raw materials, shortage of power facilities and lack of infrastructure.

Integrated players having captive raw materials are at advantageous position.

Regional overview

State/Region

Total No.

Captive power

Coal

Iron ore

of units

generation

linkage

source

Chhattisgarh

38

24

Orissa

33

24

West Bengal

30

23

Jharkhand

11

Karnataka

13

Andhra Pradesh

12

Tamil Nadu

Goa

Maharashtra

56

203

16

88

20

Others

Total

Source: JPC

Raw material availability and regional production

Chhattisgarh alone accounts for about 38% of total coal based sponge iron production.

Besides, production is largely concentrated in Eastern region (Orissa, West Bengal and

Jharkhand) contributing about 39% in total coal based production in FY05 due to their

proximity to basic raw materials iron ore and non-coking coal. The industry is virtually nonexistent in North India due to scarcity of raw materials. Gas based producers are located in

Western India only due to their proximity to natural gas. The whole production is consumed

domestically. This scenario is unlikely to change in the coming years due to increasing domestic

demand by the secondary producers.

SPONGE IRON INDUSTRY

B&K RESEARCH

OCTOBER 2006

Sponge iron production Geographical distribution

Chhattisgarh, Orissa, West

Bengal and Jharkhand

contributing approx. 77% of

total Coal based DRI

production in FY05

SPONGE IRON INDUSTRY

B&K RESEARCH

OCTOBER 2006

The Gas based Sponge Iron producers

Gas-based sponge iron is produced by Midrex process and HYL-III process using naphtha

or natural gas. This process is employed by Essar Steel, Ispat Industries and Vikram Ispat

(only Vikram Ispat uses HYL-III process). The entire sponge iron production of Vikram

Ispat is sold in the open market. Other gas based producers mainly consume it internally for

the production of steel.

Essar Steel

Worlds largest gas based DRI

plant having production

capacity of 3.4 MTPA

Essar Steel operates the worlds largest gas based Direct Reduced Iron (DRI) plant with a

production capacity of 3.4 million tonnes per annum (MTPA) at Hazira, Gujarat (5 gas based

modules with Midrex technology). The plant uses state-of-the-art technology, which ensures

high quality raw material for the steel plant. DRI is produced in two forms, namely, Hot

Briquetted Iron (HBI) and Hot Direct Reduced Iron (HDRI).The HDRI system is an Essar

innovation that saves approx. 100 KWh/tonne of HDRI consumed by Electric Arc Furnace,

thus, utilising the 650 Celsius heat contained in the HDRI. The plant is supported by a

captive power plant of 32 MW, which operates at 100% capacity.

Raw materials linkages

Long-term linkages for iron

ore and natural gas

Iron ore The company has a long-term contract with National Mineral Development

Corporation for calibrated lump iron ore and fines. The company has 8 MTPA capacity

pelletisation plant at Visakhapatnam and 8 MTPA iron ore beneficiation plant at Bailadila.

Natural gas The company also has long-term contracts for the supply of gas with GAIL,

IOCL, BPCL, GSPC etc. But, the supply of gas is erratic. Normally, 125 KWh of electricity

is consumed and on an average 325 SM3 of natural gas is used for producing a unit of

HBI.

HBI produced for captive consumption

Essar uses the HBI-Electric Arc Furnace-Continuous caster-Hot strip mill route to strip

making. The company consumes almost entire HBI produced for making steel.

Capacity

Production

Sales

FY06

FY05

FY04

FY03

FY02

4

3.5

3

2.5

2

1.5

1

0.5

0

FY01

Production mainly for captive

consumption

mtpa

Sponge iron

Captive cons.

Source: Essar Steel, annual reports

SPONGE IRON INDUSTRY

10

B&K RESEARCH

OCTOBER 2006

Ispat Industries Ltd.

Ispat Industries Limited (IIL) (formerly known as Nippon Denro Ispat), promoted by the

Mittals of Ispat group, is one of the leading integrated steel makers in India. The company

commissioned its gas based single mega-module plant for making sponge iron in Dolvi, Raigarh

(Maharashtra) in 1994 using direct-reduction technology Megamond series 1000 module

from Midrex Corporation, US, the world leader in this field. The current installed capacity of

the plant is 1.6 MTPA.

Raw materials dependence

Less availability of natural

gas restricts plant to operate

at its enhanced capacity

Iron ore The company sources its iron ore pellets requirements from National Mineral

Development Corporation, as IIL has no captive iron ore mines.

Natural gas Natural gas is sourced from GAIL, India but IIL is getting less gas due to

overall shortage of gas supply in India. Therefore, the company is not able to operate the

plant at its enhanced capacity.

Captive consumption

Ispat Industries, being the producer of hot rolled coils in India, currently consumes almost

entire sponge iron produced internally. In FY06, the production of HBI got affected due to

lower availability of natural gas as well as due to shutdown of plant for 35 days during MayJune for capital repairs.

Capacity

Production

Sales

FY06

FY05

FY04

FY03

FY02

1.8

1.6

1.4

1.2

1

0.8

0.6

0.4

0.2

0

FY01

Production mainly for captive

consumption

mtpa

Sponge iron

Captive cons .

Source: Ispat Industries, annual reports

SPONGE IRON INDUSTRY

11

B&K RESEARCH

OCTOBER 2006

Vikram Ispat (Unit of Grasim Ind.)

Plant having capacity of 0.9

MTPA can produce both HBI

and DRI from the same

reactor

Vikram Ispat, a unit of Grasim Industries Ltd. is located at Salav village in Raigad, Maharashtra.

The plant was set up in 1989 with a capacity of 0.75 MTPA of sponge iron in the form of

HBI, based on HYL-III technology from HYLSA, Mexico. In 1998, Oxygen Injection System

and DRI Cooling system was commissioned and the plant capacity was increased to 0.9

MTPA. The plant can produce both HBI and DRI from the same reactor.

Raw materials

Iron ore in the form of pellets is sourced from Gujarat Industrial Investment Corporation

and lump ore from Bailadila .The company doesnt have captive mines.

Natural gas consisting of 90-95% methane is sourced from the piping network of GAIL,

India. The plant has been integrated with total energy concept (due to HYL III process)

with 8.7 MW power capacity.

Sponge iron

1

Entire production is sold in

the open market

mtpa

0.8

0.6

0.4

0.2

Capacity

Production

FY06

FY05

FY04

FY03

FY02

FY01

Sales

Source: Grasim Industries, annual reports

Less availability of natural gas rising input cost

In FY06, due to an acute shortage of natural gas (continuous reduction in the generation of

gas from ONGC wells over the last five years), the plant couldnt be utilised properly and

hence production fell. In order to cater to the market demand, the plant has been using

supplementary energy sources like naphtha and propane which are 5-6 times costlier than

natural gas. The input cost has increased in multiples leaving the business margins bare

minimum.

No captive consumption

Vikram Ispat is the only gas based sponge iron player selling its entire production in the

market, as the company has no steel making facility. In FY06, sponge iron constitutes approx.

9% to the total turnover of the company.

SPONGE IRON INDUSTRY

12

B&K RESEARCH

OCTOBER 2006

Coal based sponge iron producers

Jindal Steel & Power Ltd.

Worlds largest coal based

sponge iron plant having

capacity of 1.37 MTPA

Jindal Steel & Power Limited (JSPL) with an installed capacity of 1.37 MTPA (10 kilns) in

Raigarh, Chhattisgarh is the worlds largest coal based sponge iron plant today. JSPL, being

integrated backwardly has its own captive raw material resources (iron ore & coal) and power

generation, which in turn has enabled the company to insulate itself from the market fluctuations

of raw material prices and to control quality and enhance production. Presently, JSPL is using

in-house Jindal technology for producing sponge iron.

Captive raw materials insulating JSPL from market fluctuations

Iron ore: JSPL is operating a captive iron ore mine at Tensa in Orissa. The requirement of

iron ore is met from companys Tensa mines.

Non-coking coal: The total requirement of non-coking coal of +6-20 mm size is met from

the captive colliery (equipped with coal washery with the capacity of 6 MTPA) developed

by JSPL at Tamnar in Chhattisgarh. JSPL saves on transportation owing to having its

plant near captive coal mines.

Dolomite: Dolomite is sourced from Baradwar in Chhattisgarh (about 70 km from Raigarh).

Captive power generation: JSPL also saves on power front due to captive power generation

based on flue gases generated in sponge iron making.

Sponge iron

1.6

1.4

Increased production of DRI

will be used internally for

ramping up of production of

steel

(mtpa)

1.2

Capacity

Sales

Production

Captive cons .

1

0.8

0.6

0.4

0.2

FY06

FY05

FY04

FY03

FY02

FY01

*Increased capacity in FY05 to 1.37mtpa from 0.65mtpa

Source: JSPL, annual reports

Four new kilns for making sponge iron have been added in 2005 which has raised the

capacity from 0.65 MTPA to 1.37 MTPA. The increased production of sponge iron will be

consumed internally for ramping up production of steel.

SPONGE IRON INDUSTRY

13

B&K RESEARCH

OCTOBER 2006

Monnet Ispat

Monnet Ispat Limited (MIL), promoted jointly by Sandeep Jajodia and Jindal Strips in 1990

manufactures sponge iron, steel billets and various finished steel products near Raipur in

Chhattisgarh. MIL is one of the largest coal-based sponge iron producer in India (installed

capacity: 0.3 MTPA) backed by captive resources of raw material viz. coal, iron ore and

captive power.

Production capacity expected

to increase to 0.8 MTPA by

3QFY07

Over the years, MIL has steadily ramped up capacities from 0.1 MTPA of sponge iron in

FY00 to 0.3 MTPA in FY04. MIL is setting up six sponge iron kilns (4 kilns of 350 TPD and

2 kilns of 100 TPD each) with total capacity of 0.5 MTPA which is expected to commence

production in the beginning of 3QFY07.

The company also has captive power plant at Raipur (60 MW) operating on flue gases from

sponge iron kilns which reduces companys dependence on state electricity boards. MIL is

also in the process of installing 90 MW captive power plant at Raigarh operating on char and

coal fines from sponge iron plant and captive coal mine.

Backward integration gives competitive advantage

Captive coal mines insulate

MIL from market fluctuations

of coal prices

Coal Mine Raigarh: This underground mine has extractable reserves of 86 mn tonnes

(estimated reserves are 126 mn tonnes). The quality of coal is better than open-cast mine.

MIL started the production of coal in April 2005 and is currently mining at the rate of 0.6

MTPA and plans to ramp it up to 1.2 MTPA in order to meet the increased demand of coal

from Raigarh project. Most of the companys in-house requirements for coal would be met

from the captive sources.

Iron Ore Mine Orissa: The mine has estimated 30 mn tonnes of extractable iron ore

reserves which will be entirely for captive use.

Sponge iron

0.4

0.3

Capacity

Sales

Production

Captive cons.

mtpa

0.3

0.2

0.2

0.1

0.1

FY06

FY05

FY04

FY03

FY02

FY01

0.0

Source: Monnet Ispat, annual reports

Over the years, MIL has started increasing the usage of sponge iron for captive consumption.

Sponge iron contributes approx. 25% to the total turnover of the company.

SPONGE IRON INDUSTRY

14

B&K RESEARCH

OCTOBER 2006

Coal based sponge iron producers

Company

Present capacity

Production

Coal cost/

Iron ore cost/

(tonnes)

(FY05)

tonne DRI

tonne DRI

1,370,000

692,682

1,050

1,575

Captive raw materials, produces steel.

Tata Sponge Iron Ltd.

390,000

223,686

3,750

2,880

Acquired coal mines, get operational by FY09.

Monnet Ispat Ltd.*

300,000

240,133

1,375

2,400

Captive raw materials, iron ore mines get

Jindal Steel & Power

Remarks

operational soon. produces steel.

GSAL (India) Ltd.

220,000

68,967

3,479

5,526

No captive resources.

Raipur Alloy & Steel

210,000

91,767

2,800

6,400

Acquired iron ore & coal mines, will get

operational in future, produces steel.

Singhal Enterprises (P)

198,000

134,537

3,450

5,280

No captive resources.

Bihar sponge Iron Ltd.

180,000

140,998

3,250

4,370

No captive resources.

Sunflag Iron & Steel Co.

150,000

134,192

3,103

6,720

No captive resources, produces steel.

HEG Ltd.

120,000

87,141

3,019

5,965

No captive resources, produces steel.

Orissa Sponge Iron Ltd.

100,000

108,116

2,750

4,740

No captive resources, produces steel.

*Increasing its capacity to 800,000 tonnes in FY07.

Source: Industry sources.

Cost structure (Coal based sponge Iron producers)

d iron

Acquire e s

o r e m in

Others

Power

Fuel oil

Dolomite

Acquired coal

mines

Plants with

No

Linkages(4th)

Linkage-Iron

ore(3rd)

Non-CokingCoal

Iron Ore

Captive coal

mines(2nd)

9000

8000

7000

6000

5000

4000

3000

2000

1000

0

Captive Raw

Materials(1st)

(Rs)

Secured Future

Struggling to

Survive

Source: B&K Research

Note: Jindal Steel & Power falls in 1st, Monnet Ispat in 2nd and Tata Sponge in 3rd category.

Players like JSPL having

captive raw materials

produce at a very low cost and

have a secured future

The players like Jindal Steel & Power who has captive raw materials incurred approx. Rs.

2,900/tonne variable cost in making sponge iron against approx. Rs. 8,800/tonne for players

having no captive raw material sources. Monnet Ispat has acquired iron ore mines to reduce

its variable cost/tonne of sponge iron further. Tata Sponge is moving towards second level,

as the company has recently acquired coal mines which will insulate the company from the

market fluctuations and helps in reducing coal cost. Increasing prices of raw materials make

small players vulnerable and many players have shutdown temporarily.

Future prospects

The sponge iron industry has been posting strong growth over the last five-six years. The

growth of Indian sponge iron industry will be propelled mainly by coal based sponge iron

producers. This is due to availability of abundant raw material domestically and low capital

required in installing sponge iron plant. There is limited scope for new gas based sponge iron

SPONGE IRON INDUSTRY

15

B&K RESEARCH

OCTOBER 2006

unit coming in near future. The existing 3 players may plan for further expansion but it

depends on the future availability of natural gas which is in short supply currently. The

availability of natural gas is expected to improve for Ispat Industries and Vikram Ispat by end

2007, as the Dahej-Uran gas pipeline is slated to be commissioned by then.

On the raw material front, the supply of basic inputs for coal based sponge iron, iron ore and non-

Demand for sponge iron

expected to grow due to

availability of abundant raw

material domestically,

growth being propelled by

Coal based DRI producers and

the future will belong to the

players who have captive

sources of raw materials

coking coal are abundant. But increasing iron ore prices and inferior quality of non-coking coal

poses a problem for DRI producers. Increasing freight and power cost also poses problem for

small producers. Therefore, the future of sponge iron will belong to the players who have captive

sources of raw materials which will insulate them from market fluctuations. Presently, only Jindal

Steel & Power and Monnet Ispat have captive resources of both iron ore and coal (production

from iron ore mines of Monnet Ispat will commence soon). Tata Sponge has recently acquired

115 mn tonnes mineable coal deposit in Orissa which will be functional by FY09.

The demand for sponge iron is expected to remain firm, as it directly depends on the demand

of steel which is expected to reach more than 110 mn tonnes by 2020. With increasing share

of secondary producers which uses mix of sponge iron and scrap in making steel and reduced

domestic availability of high quality scrap and its increasing cost, the future demand for

sponge iron looks promising.

SPONGE IRON INDUSTRY

16

B&K RESEARCH

OCTOBER 2006

Global scenario

Global production of sponge iron (DRI/HBI) has been strong over the last decade. The steel

industry globally is using about 25% of the alternative iron sources like DRI/HBI to produce high

quality steels in the EAFs. DRI is now recognised as a high purity, top quality charge material

throughout the world which has been reflected by the strong growth of sponge iron (DRI/HBI)

production which has risen to 56 MTPA in 2005 as against about 40 MTPA in 2001.

World DRI production

70

60

( Mt)

50

40

30

20

10

2006E

2005

2004

2003

2002

2001

2000

1999

1998

1997

1996

Source: Midrex Technologies, Inc & B&K estimates

EAF production Increasing share in steel making

Increasing steel production

through EAF route and low

availability of scrap boost

demand for sponge iron

The production through the EAF route has gone up from about 26.6% in 1988 of the global

production to about 31.7% in 2005. Outside China, very few new blast furnaces have been

built in recent years. EAF steelmaking continues to grow because of its capital and operating

cost advantages vis--vis the integrated route. This growth results in increased demand for

EAF charge materials which includes scrap, DRI/HBI and pig iron. Since world steel production

was essentially flat from 1980-95, the growth rate of the obsolete scrap supply leveled off

which led to increase in their prices. Amidst these limitations, demand for DRI increased and

its use in EAFs increased by almost 12 MT in 2000-05. We expect this trend to continue in

future.

Geographical distribution

Sponge iron producers are mainly concentrated in Latin America (including Mexico), Middle

East and Asian region. Latin America is still the largest producers of DRI in the world but over

the last three years, their share has declined from 36% of total world DRI production to 34%

in 2005. This is due to increasing prices of natural gas and larger growth in the coal based DRI

production by Indian producers which led to overall increase in Indias share to 20%.

SPONGE IRON INDUSTRY

17

B&K RESEARCH

OCTOBER 2006

Production Geographical distribution

(Mn tonnes)

2000

2001

2002

2003

2004

2005

Latin America

16.0

14.1

16.0

17.0

19.0

19.3

Argentina

1.4

1.3

1.5

1.7

1.7

1.8

Brazil

0.4

0.4

0.4

0.4

0.4

0.4

Mexico

5.8

3.7

4.9

5.6

6.5

6.0

Peru

0.1

0.1

0.0

0.1

0.1

0.1

Trinidad & Tobago

1.5

2.3

2.3

2.3

2.4

2.1

Venezuela

6.7

6.4

6.9

6.9

7.8

9.0

12.1

12.1

13.0

13.9

15.3

15.9

Egypt

2.1

2.4

2.5

2.9

3.0

2.9

Iran

4.7

5.0

5.3

5.6

6.4

6.9

Libya

1.5

1.1

1.2

1.3

1.6

1.7

Qatar

0.6

0.7

0.8

0.8

0.8

0.8

Saudi Arabia

3.1

2.9

3.3

3.3

3.4

3.6

10.1

10.6

11.3

13.8

14.7

15.3

Australia

0.6

1.4

1.0

2.0

0.7

Myanmar

0.0

0.0

0.0

0.0

0.0

China

0.1

0.1

0.2

0.3

0.4

0.4

India

5.4

5.6

6.6

7.7

9.4

11.1

Indonesia

1.8

1.5

1.5

1.2

1.5

1.4

Malaysia

1.3

1.1

1.1

1.6

1.7

1.4

New Zealand

0.9

0.9

0.9

1.0

1.0

1.0

North America

2.7

0.1

0.7

0.7

1.3

0.8

Canada

1.1

0.2

0.5

1.1

0.6

US

1.6

0.1

0.5

0.2

0.2

0.2

1.9

2.5

2.9

2.9

3.1

3.3

1.9

2.5

2.9

2.9

3.1

3.3

1.5

1.6

1.6

1.5

1.6

1.8

1.5

1.6

1.6

1.5

1.6

1.8

0.5

0.2

0.5

0.6

0.6

0.4

0.5

0.2

0.5

0.6

0.6

0.4

44.7

41.3

46.0

50.5

55.6

56.8

Middle East/N. Africa

Asia/Oceania

Former USSR/Eastern Europe

Russia

Sub-Saharan Africa

South Africa

Western Europe

Germany

World Total

Source: Midrex Technologies, Inc.

SPONGE IRON INDUSTRY

18

B&K RESEARCH

OCTOBER 2006

Major DRI Producing Blocs (2002)

Major DRI Producing Blocs (2005)

6% 3% 1% 1%

6% 3%1% 1%

36%

14%

34%

20%

10%

7%

29%

28%

Latin America( including Mexico)

As ia/ Oceania(excluding India)

Former USSR/Eas tern Europe

North America(US & Canada)

Middle Eas t/ North Africa

India

Sub-Saharan Africa

Wes tern Europe

Source: Midrex Technologies, Inc

Production processes

85% of sponge iron produced

through gas based process in

gas rich areas like Middle

East, Latin America and

Russia

Globally, about 85% of the sponge iron is produced through gas based process mainly in large

gas rich areas like Middle East, Latin America and Russia. Coal based process has increased

from less than 10% in the 1990s to about 15% in 2005 due to the proliferation of small rotary

kiln plants in India. Among different production processes, Midrex Technology continues to

dominate the world scenario with more than 60% market share since 1987.

40

140

35

30

120

100

25

20

80

60

15

10

40

Utilisation(%)

Capacity & production

World DRI capacity utilisation by process (2005)

20

5

0

0

Midrex

Capacity(Mt)

HYL

Finmet

Production(Mt)

Coal-bas ed

Utilis ation (%)

Source: Midrex Technologies, Inc

India leads the way

Growth in Indian sponge iron

industry due to setting up

large number of small

capacity rotary kilns

SPONGE IRON INDUSTRY

Sponge iron growth in 2005 was entirely due to a number of small capacity rotary kilns

started in India. India led the world in sponge iron production with 11.1 million tonnes

followed by Venezuela with 8.9 million tonnes, Iran with 6.9 million tonnes and Mexico with

6.0 million tonnes in CY05.

19

B&K RESEARCH

OCTOBER 2006

India

Vanezuela

Iran

Mexico

2006E

2005

2004

2003

2002

2001

16

14

12

10

8

6

4

2

0

2000

Production (Mt)

Top 5 Global DRI producers

Saudi Arabia

Source: Midrex technologies, Inc & B&K estimates

New capacity on the way

Even though very little sponge iron capacity has been added over the past few years outside of

India, the strong surge in its price has encouraged investment in new capacity. As at the end of first

quarter 2006, over 15 million tonnes of new gas based DRI capacity has been contracted (Midrex

process), the first of these plants will begin operation by late 2006. The newly contracted capacity

has been focused in areas where inexpensive natural gas is abundant, including the Middle East

and South America, as well as projects in Malaysia and Russia. This new investment was driven by

sustained high prices of alternate iron and of low residual, high quality scrap steel.

SPONGE IRON INDUSTRY

20

B&K RESEARCH

OCTOBER 2006

Tata Sponge Iron (Rs. 113)

Share Data

Reuters code

Not Rated

TTSP.BO

Tata Sponge Iron (TSIL) is the largest coal based sponge iron producer in Eastern India with

IPIT IN

total installed capacity of 390,000 TPA. The company is ideally located in close proximity of

Market cap. (US$ mn)

36

iron ore mines in Keonjhar, Orissa. Recently, the company has acquired a coal block on a 30-

6m avg. daily turnover (US$ mn)

0.3

year lease basis in Orissa along with two more associates and is expected to become operational

Bloomberg code

Issued Shares (mn)

Performance (%)

15.4

by FY09 which will help reducing the companys coal cost significantly. The company has also

increased its power generation facility from 7.5 MW to 26 MW which insulates its dependence

1m

3m

12m

Absolute

(4)

(1)

(36)

management recently. Following are the key highlights:

Relative

(10)

(19)

(56)

on state electricity boards and increase earnings by selling surplus power. We spoke to the

Major shareholders (%)

Increasing production through the secondary route

Increase in steel production through the secondary route (EAF, IF), which uses hot metal

Promoters

41

(pig iron), sponge iron/scrap as their basic raw materials, accounts for 48% of the total

Institutions

steel output. It has grown at a CAGR of 18% during FY01-05. The trend is expected to

Public & Others

continue due to rising availability of coal based sponge iron produced from domestically

56

Relative performance

available raw material.

350

300

250

200

150

100

50

0

Sponge iron is fast replacing imported steel scrap in secondary steel making

Production of steel scrap in India is low at 15-20% of its consumption due to longer

product life cycle, as the country is in developing phase and the consumption pattern is

tilted in favour of infrastructure and construction rather than consumer durables.

Jun-06

Tata Sponge Iron

(Actual)

Sens ex

sponge iron is fast replacing imported steel scrap due to low cost of production, as non-

Oct-06

Mar-06

Nov-05

Aug-05

Apr-05

Dec-04

Therefore, secondary steel makers have to depend on imported steel scrap. Coal based

coking coal and iron ore (two critical raw materials) are domestically available and its

production is rising.

Own power generation

By realising the importance of captive power plant for having an edge in the cost competitive

markets, recently TSIL has expanded its power generation facilities by installing two more

power plants (18.5 MW) in Kiln 1 and Kiln 3 increasing total capacity from 7.5 MW to 26

MW. The new 18.5 MW power plant is expected to get operational by October 2006.

TSILs total power requirement is about 10 MW for the current capacity. Sale of surplus

power (made an arrangement to sell 10-12 MW of power @ Rs. 3.15/unit) will contribute

additional revenue (approx. 160 mn per year) from FY07 itself.

Captive coal block: A reality

Recently, TSIL has acquired a coal block on a 30-year lease basis in Orissa along with two

more associates. The estimated mineable coal deposit is about 115 mn tonnes. TSILs

share is 51%. The coal block is expected to become operational by the end of FY09. This

will insulate the company from volatility in non-coking coal prices and reduce its coal cost

significantly which presently constitutes about 44% of total expenses.

Strategic location

TSIL is located at Bilaipada near Joda, in the Keonjhar District of Orissa. The plant is

ideally located in the close proximity of iron ore mines (25 kms away from plants) and

sponge iron consumers of Eastern region which saves on transportation cost.

SPONGE IRON INDUSTRY

21

B&K RESEARCH

OCTOBER 2006

Over capacity due to smaller players

The situation of over capacity exists due to emergence of many small coal based players

which keep a cap on the prices of sponge iron.

Increasing prices of iron ore and non-coking coal

Though, the company has leased out some mining assets to Tata Steel Ltd. for operation

of its Khondbond iron ore mine for its captive use and are better placed than the players

having no captive sources but then also the prices are expected to increase further due to

high demand both at domestic as well as global level, particularly from China which

squeezes the margin of the company. Non-coking coal prices are also increasing and we

expect the prices to be firm in near future.

Raw material cost

2,800

2,600

2,400

2,200

2,000

1,800

1,600

1,400

1,200

1,000

800

600

400

200

0

FY08E

FY07E

FY06

FY05

FY04

FY03

FY02

FY01

FY00

Coal (Rs /ton)

Iron Ore (Rs /ton)

Source: Company & B&K research

SPONGE IRON INDUSTRY

22

B&K RESEARCH

OCTOBER 2006

Business background

Tata Sponge Iron (TSIL) was incorporated in 1982 as a Joint Venture of Tata Steel and

Industrial Promotion & Investment Corporation of Orissa Ltd. (IPCOL) for the production

of sponge iron, based on TISCO-Direct Reduction (TDR) Technology. The plant is located

at Bilaipada near Joda, in the Keonjhar district of Orissa. In 1991, Tata Steel acquired

IPICOLs stake and TSIL became its subsidiary.

Growth path

450

(000 tons)

400

350

Production Capacity

300

250

200

150

100

50

FY 06

FY 98

FY 91

FY 86

Source: Company

The plant was initially designed for a production capacity of 90,000 TPA and subsequently

the capacity was enhanced to 120,000 TPA in 1990-91 by entering into foreign collaboration

with Lurgi, Germany in 1987-89. The company later to meet the growing demand of sponge

iron doubled its capacity by adding another Kiln of equivalent capacity in 1998-99, bringing

the capacity to 240,000 TPA.

In December 2001, TSIL commissioned a 7.5 MW captive power plant to produce electricity

from the waste heat of exit gases of its Kiln No.2.

Capacity expansion

Increased installed capacity

of sponge iron to 390,000 TPA

and captive co-power

generation facilities to 26 MW

Recently, TSIL expanded its capacity by installing 3rd Kiln having a capacity of 150,000

TPA. As a result, the companys sponge iron making facility has increased from 240,000

TPA to 390,000 TPA. The facility commenced production from March 2006. Also, TSIL

has set up power generation facilities of 18 MW by recovering the waste heat of the kilns

which is expected to be operational from October 2006. The total cost incurred was

approx. Rs. 1.9 bn.

Acquired a coal block on 30

year lease basis in Orissa

Recently, TSIL has acquired a coal block on a 30 year lease basis in Orissa along with two

more associates (SPS Sponge Iron Ltd. and Messrs Scaw Industries Ltd.). The estimated

mineable coal deposit is about 115 mn tonnes. TSILs share is 51%. The coal block is

expected to become operational by the end of FY09. The total expected cost incurred on

coal mines is approx. Rs. 3 bn.

In-house TDR Technology

Tata Steel developed in-house technology based on Coal to produce sponge iron. It was the

first sponge iron plant in India to receive the ISO-9002 and the ISO-14000 certifications.

SPONGE IRON INDUSTRY

23

B&K RESEARCH

OCTOBER 2006

Process

Rotary kiln cross-section

Source: Company

Iron ore (hematite) and non-coking coal are charged into a rotary kiln in requisite proportion

with dolomite to produce sponge iron. Coal plays a dual role in the process by acting as a

redundant as well as fuel for providing heat to maintain the requisite temperature inside the

kiln at 950-1050C. The reduction process occurs in solid state. In this reduction process,

coal is combusted in a controlled manner and it converts to carbon monoxide to remove

oxygen from the iron ore. At the end of the process, iron ore is optimally reduced and

discharged to a rotary cooler for cooling below 120C and finally sponge iron comes out of

the kiln. Power is generated by using the waste heat of the hot spent gases of the kiln.

Source: Company

Valuations

Full ramp-up of 3rd kiln by October 2006 would provide volume CAGR of 38% during

Potential to grow earnings in

long-term

FY06-08E. 26 MW of captive power and sale of approx. 10-12 MW surplus power would

add to earnings. Coal mines (expected to start by FY09) would reduce coal cost (currently

form 44% of total cost). At the current price of Rs. 113, the stock is trading at 6.2x FY07E

and 4.1x FY08E earnings. We feel that the company has potential to grow earnings in longterm. We dont have rating on the stock.

SPONGE IRON INDUSTRY

24

B&K RESEARCH

OCTOBER 2006

Financials

Production

The company is poised for major growth in the production of sponge iron in the coming two

years post increasing its installed capacity to 390,000 TPA.

Production

Source: Tata Sponge, Annual Reports, B&K estimates

Revenues

Revenues of TSIL are expected to increase at 40% CAGR over the next two years due to

recent capacity expansion from 240,000 TPA to 390,000 TPA. The company has shown a

decline of 20% in its revenue in FY06 due to lesser production (due to higher ash content in

non-coking coal received by Coal India Limited which reduces productivity and increasing

prices of both iron ore and non-coking coal) as well as due to pressure on realisation front.

Net sales and growth

Source: Tata Sponge, Annual Reports, B&K estimates

Cost

The average cost of iron ore is expected to remain firm in the next two years. More of noncoking coal is required due to higher % of ash content in it which needs to be washed to

reduce the ash content to an acceptable level which will increase its prices.

SPONGE IRON INDUSTRY

25

B&K RESEARCH

OCTOBER 2006

Raw Material Cost

Source: Tata Sponge, Annual Reports, B&K estimates

Margins

Margins of the company have declined in FY06 due to lower realisation coupled with the

higher input prices. The company is targeting high growth in revenues to improve margins.

We expect realisation to be comparatively better in the next two years. Margins will be under

pressure due to higher iron ore and coal prices. The company has been allotted a coal mine in

Orissa but will be able to get advantage only from FY09.

EBITDA and Margins

EBITDA/ton, Cost/ton, Price/ton

Source: Tata Sponge, Annual Reports, B&K estimates

Capex

Recently, TSIL added a 150,000 TPA sponge iron unit and 18.5 MW waste gas recovery

based captive power plant with an investment of approx. Rs. 1.9 bn (expected to be fully

ramped up by October 2006). TSIL has also acquired a coal block on a 30 year lease basis in

Orissa along with two more associates. The company will use its reserves as well as take debt

to finance projects. The total expected cost incurred on coal mines is approx. Rs. 3 bn. The

company plans to spend approx. Rs. 400 mn for development of colliery in FY07.

SPONGE IRON INDUSTRY

26

B&K RESEARCH

OCTOBER 2006

PAT and Margin

We expect PAT to increase by 38% CAGR in the next two years driven by higher volume

growth (due to capacity expansion) and sustainability on realisation front.

PAT and margin

Source: Tata Sponge, Annual Reports, B&K estimates

Improving quarterly results

Net sales

Source: Tata Sponge, Annual Reports

First quarter of FY07 shows some sign of improvement. Net sales starts increasing due to

installation of 3rd kiln of 150,000 tonnes capacity in the last two quarters. EBITDA and PAT

margin also improved on q-o-q basis. With improvement in prices, we expect the trend to

continue.

SPONGE IRON INDUSTRY

27

B&K RESEARCH

OCTOBER 2006

EBITDA and margin

PAT and margin

Source: Tata Sponge, Annual Reports

Raw material cost

Source: Tata Sponge, Annual Reports, B&K Estimates

SPONGE IRON INDUSTRY

28

B&K RESEARCH

OCTOBER 2006

Income Statement

Cash Flow Statement

Yr. ended 31 Mar. (Rs. m) FY05

Net sales

Growth (%)

Operating expenses

Operating profit

FY06 FY07E

FY08E

Yr. ended 31 Mar. (Rs. m) FY05

FY06 FY07E

FY08E

2,304

1,852

2,720

3,618

Pre-tax profit

951

343

429

650

36.2

(19.6)

46.9

33.0

Depreciation

71

75

93

105

(1,375)

(1,546)

(2,380)

(3,127)

358

(54)

44

(16)

929

306

340

491

Total tax paid

(552)

(88)

(171)

(230)

80

160

Cash flow from oper. (a)

828

276

396

509

Capital expenditure

(300)

(1,294)

(639)

(700)

(300)

(1,294)

(639)

(700)

528

(1,018)

(243)

(191)

Debt raised/(repaid)

(1)

700

825

825

(92)

(116)

(132)

(70)

Other operating income

Chg in working capital

EBITDA

929

306

420

651

Growth (%)

75.1

(67.1)

37.4

54.9

Depreciation

(72)

(76)

(95)

(106)

Other income

94

113

120

125

952

344

445

670

Interest paid

(1)

(1)

(16)

(20)

Dividend (incl. tax)

Pre-tax profit

951

343

429

650

Cash flow from fin. (c)

(93)

583

693

755

Net chg in cash (a+b+c)

434

(434)

450

563

FY06 FY07E

FY08E

EBIT

(before non-recurring items)

Pre-tax profit

Cash flow from inv. (b)

Free cash flow (a+b)

951

343

429

650

Tax (current + deferred)

(342)

(121)

(152)

(230)

Net profit

609

221

278

420

EPS (Rs)

39.5

14.4

18.0

27.3

Adjusted net profit

609

221

278

420

EPS growth

77.2

(63.6)

25.3

51.3

Growth (%)

77.2

(63.6)

25.3

51.3

EBITDA margin

40.3

16.5

15.0

17.2

Net income

609

221

278

420

EBIT margin

41.3

18.5

15.9

17.7

ROCE

73.2

17.4

15.2

16.6

(34.4)

46.3

62.9

65.0

FY06 FY07E

FY08E

(after non-recurring items)

Balance Sheet

Yr. ended 31 Mar. (Rs. m) FY05

Current assets

Investments

Net fixed assets

Total assets

Current liabilities

FY06 FY07E

FY08E

Key Ratios

Yr. ended 31 Mar. (%) FY05

Net debt/Equity

Valuations

799

498

1,017

1,758

1,165

2,384

2,930

3,525

PER

2.8

7.8

6.2

4.1

1,972

2,890

3,955

5,292

PCE

2.5

5.8

4.7

3.3

Price/Book

1.3

1.2

1.0

0.9

Yield (%)

6.2

3.6

3.6

3.6

Yr. ended 31 Mar. (x)

FY05

440

477

510

672

707

1,532

2,357

EV/Net sales

0.6

1.3

1.0

0.8

Other non-current liabilities

205

235

235

235

EV/EBITDA

1.4

7.9

6.6

4.7

Total liabilities

652

1,419

2,277

3,264

FY06 FY07E

FY08E

Share capital

154

154

154

154

1,166

1,317

1,524

1,874

1,320

1,471

1,678

2,028

Total equity & liabilities 1,972

2,890

3,955

5,292

Return on equity (%)

Total Debt

Du Pont Analysis ROE

Yr. ended 31 Mar. (x)

Reserves & surplus

Shareholders funds

SPONGE IRON INDUSTRY

FY05

Net margin (%)

26.4

12.0

10.2

11.6

Asset turnover

1.3

0.8

0.8

0.8

Leverage factor

1.6

1.7

2.2

2.5

56.6

15.9

17.6

22.7

29

B&K RESEARCH

OCTOBER 2006

B&K Securities is the trading name of Batlivala & Karani Securities India Pvt. Ltd.

The information contained herein is confidential and is intended solely for the addressee(s). Any unauthorized access, use, reproduction, disclosure or

dissemination is prohibited. This information does not constitute or form part of and should not be construed as, any offer for sale or subscription of or any

invitation to offer to buy or subscribe for any securities. The information and opinions on which this communication is based have been complied or arrived

at from sources believed to be reliable and in good faith, but no representation or warranty, express or implied, is made as to their accuracy, correctness and

are subject to change without notice. Batlivala & Karani Securities India P Ltd and/ or its clients may have positions in or options on the securities mentioned

in this report or any related investments, may effect transactions or may buy, sell or offer to buy or sell such securities or any related investments. Recipient/

s should consider this report only for secondary market investments and as only a single factor in making their investment decision. The information enclosed

in the report has not been whetted by the compliance department due to the time sensitivity of the information/document. Some investments discussed in this

report have a high level of volatility. High volatility investments may experience sudden and large falls in their value causing losses when the investment is

realized. Those losses may equal your original investment. Some investments may not be readily realizable and it may be difficult to sell or realize those

investments, similarly it may prove difficult for you to obtain reliable information about the value, risks to which such an investment is exposed. Neither B&K

Securities nor any of its affiliates shall assume any legal liability or responsibility for any incorrect, misleading or altered information contained herein.

Analysts Declaration:

We, Sanjay Jain & Ashish Kejriwal, hereby certify that the views expressed in this report accurately reflect our personal views about the subject securities and issuers.

We also certify that no part of our compensation was, is, or will be, directly or indirectly, related to the specific recommendation or view expressed in this report.

B & K SECURITIES INDIA PRIVATE LTD.

Equity Market Division: 12/14, Brady House, 2nd Floor, Veer Nariman Road, Fort, Mumbai-400 001, India. Tel.: 91-22-2289 4000, Fax: 91-22-2287 2767.

Registered Office: Room No. 3/4, 7 Lyons Range, Kolkata-700 001. Tel.: 91-033-2243 7902.

B&K Research is also available on Bloomberg <BNKI>, Thomson First Call & Investext.

Вам также может понравиться

- 3month Mibor From NseДокумент1 страница3month Mibor From NsesdОценок пока нет

- Month-Wise Position of Trades Received by Ccil For Settlement For The Financial Year: 2007-2008Документ1 страницаMonth-Wise Position of Trades Received by Ccil For Settlement For The Financial Year: 2007-2008sdОценок пока нет

- Budget at A Glance (In Crore of Rupees)Документ5 страницBudget at A Glance (In Crore of Rupees)sdОценок пока нет

- Eco 20092301Документ62 страницыEco 20092301sdОценок пока нет

- BHEL One PagerДокумент1 страницаBHEL One PagersdОценок пока нет

- Simple Returns WorkingДокумент6 страницSimple Returns WorkingsdОценок пока нет

- Roto Pump - FinancialsДокумент8 страницRoto Pump - FinancialssdОценок пока нет

- Kaashyap Technology 1407Документ32 страницыKaashyap Technology 1407sdОценок пока нет

- Bongaigaon Ref - FinanДокумент10 страницBongaigaon Ref - FinansdОценок пока нет

- No. of Companies Value (In Rs Crore As On 19 Mar)Документ1 страницаNo. of Companies Value (In Rs Crore As On 19 Mar)sdОценок пока нет

- Simple Returns Returns Over Sensex Co - Name M.Cap 1 WK 1 Mon 3 Mon 6 Mon 1 Yr 1 WK 1 Mon 3 Mon MKT Cap Over 5000 CRДокумент4 страницыSimple Returns Returns Over Sensex Co - Name M.Cap 1 WK 1 Mon 3 Mon 6 Mon 1 Yr 1 WK 1 Mon 3 Mon MKT Cap Over 5000 CRsdОценок пока нет

- Understanding Economic Systems and Business: The Future of BusinessДокумент65 страницUnderstanding Economic Systems and Business: The Future of BusinesssdОценок пока нет

- Annual Report 2005-06 Vindhya TeleДокумент64 страницыAnnual Report 2005-06 Vindhya TelesdОценок пока нет

- Quarterly - Zee Telefilms LTDДокумент3 страницыQuarterly - Zee Telefilms LTDsdОценок пока нет

- PresentationДокумент36 страницPresentationsdОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Itmk3 RДокумент4 страницыItmk3 RVc ShekharОценок пока нет

- BUKU Kinetika Reduksi OreДокумент213 страницBUKU Kinetika Reduksi OreGalih SenopatiОценок пока нет

- BCISM - Market Review On Steel Trend 2021Документ11 страницBCISM - Market Review On Steel Trend 2021Karen LimОценок пока нет

- ITmk3 TechnologyДокумент8 страницITmk3 Technologyferozcan100% (1)

- AmldraftДокумент249 страницAmldraftadhavvikasОценок пока нет

- Direct From MidrexДокумент10 страницDirect From MidrexLekhamani YadavОценок пока нет

- Assignment 3 PMTДокумент2 страницыAssignment 3 PMTDewi Lestari Natalia MarpaungОценок пока нет

- Reduction Kinetics of Iron Ore PelletsДокумент43 страницыReduction Kinetics of Iron Ore PelletsDivyesh Parmar100% (1)

- Pre Feasibility Report: Iron Ore Pelletization PlantДокумент34 страницыPre Feasibility Report: Iron Ore Pelletization PlantChetan M BaligarОценок пока нет

- Summary of Findings From HYBRIT Pre-Feasibility Study 2016-2017Документ11 страницSummary of Findings From HYBRIT Pre-Feasibility Study 2016-2017Okko NОценок пока нет

- Steel MakingДокумент38 страницSteel Makings.samОценок пока нет

- Pre-Feasibility Report: Ankur Udyog Limited (Steel Division)Документ38 страницPre-Feasibility Report: Ankur Udyog Limited (Steel Division)فردوس سليمان100% (1)

- JSPL Annual Report 16 17 PDFДокумент264 страницыJSPL Annual Report 16 17 PDFSant DayalОценок пока нет

- A Presentation On Dri-Ii in JSPL, Raigarh: By:-Harish Patel (Meta-5 Sem)Документ14 страницA Presentation On Dri-Ii in JSPL, Raigarh: By:-Harish Patel (Meta-5 Sem)Rahul PandeyОценок пока нет

- A Study On Performance of Indian Steel IndustryДокумент53 страницыA Study On Performance of Indian Steel IndustryHarshal MevadaОценок пока нет

- Ironmaking - Part 1Документ37 страницIronmaking - Part 1Aryan MishraОценок пока нет

- Direct From: 4Th Quarter 2019Документ14 страницDirect From: 4Th Quarter 2019JeanОценок пока нет

- Vale Pellets - Reliable Supply To The DR Market: Head Technical MarketingДокумент26 страницVale Pellets - Reliable Supply To The DR Market: Head Technical MarketingJose Hurtado Ojeda100% (1)

- Jeevaka Industries LTD (Sponge Iron Division), Nasthipur (V), Hatnoora (M), Sangareddy Dist - EXE SUM ENGДокумент17 страницJeevaka Industries LTD (Sponge Iron Division), Nasthipur (V), Hatnoora (M), Sangareddy Dist - EXE SUM ENGKolipaka KarunakarОценок пока нет

- TEC ALT Process Descriptions and Flow DiagramsДокумент45 страницTEC ALT Process Descriptions and Flow DiagramsUli ArthaОценок пока нет

- Cluster IronДокумент31 страницаCluster IronPraneeth Kumar V RОценок пока нет

- Dri InternshipДокумент38 страницDri InternshipGuruprasad Sanga100% (3)

- State of The Art and Future of The Blast FurnaceДокумент16 страницState of The Art and Future of The Blast Furnacesaibal_silОценок пока нет

- Optimized Sponge Iron Making ProcessДокумент10 страницOptimized Sponge Iron Making Processawneet_semc100% (1)

- Metals and Mining January 2021Документ44 страницыMetals and Mining January 2021ankit100% (1)

- PSA 50 Paper PDFДокумент5 страницPSA 50 Paper PDFshashi kant kumarОценок пока нет

- Environmental Issues Management: C P C BДокумент79 страницEnvironmental Issues Management: C P C BGanesh N KОценок пока нет

- MM1202Документ1 страницаMM120222- Debaduti RoutОценок пока нет

- Breakthrough Pathways To Decarbonize The Steel Sector 1676093321Документ7 страницBreakthrough Pathways To Decarbonize The Steel Sector 1676093321keshoooОценок пока нет

- Mini Blast FurnaceДокумент8 страницMini Blast FurnaceSantosh UpadhyayОценок пока нет