Академический Документы

Профессиональный Документы

Культура Документы

Marketing Plan Townhouse FIX PDF

Загружено:

Dea BonitaИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Marketing Plan Townhouse FIX PDF

Загружено:

Dea BonitaАвторское право:

Доступные форматы

JATINANGOR MAYFAIR TOWNHOUSE

MARKETING PLAN

Marketing Management

MM 5003

Final Exam

Andi Dea Kamala Bonita

29113066 / YP49A

Nebrian Hardika

29113122 / YP49A

MASTER OF BUSINESS ADMINISTRATION

SCHOOL OF BUSINESS AND MANAGEMENT

INSTITUT TEKNOLOGI BANDUNG

2015

Jatinangor Mayfair Townhouse

1. Executive Summary

PT Pakuwon Jati Tbk. is a diversified real estate developer focused in Jakarta and Surabaya. The

Company's portfolio of prime properties includes retail, residential, commercial and hospitality

developments Established in 1982 and listed on both the Jakarta and Surabaya Stock exchanges

since 1989, Pakuwon Jati is an established brand name with over 25 years of experience

successfully developing, marketing and operating properties. The Company is vertically

integrated across the full real estate value chain from land acquisition, property development,

marketing and operational management.

Based on Companys Article of Associations, the Company is engaged in business:

Shopping center named as Tunjungan Plaza

Business center named as Menara Mandiri

FiveStar Hotels named as Sheraton Surabaya Hotel and Towers, also

Real estate business Pakuwon City (formerly Laguna Indah Housing) and industrial

estate (which has not operated and will change to residential estate), all located in

Surabaya.

PT Pakuwon Jati Tbk. have experience and capacity to capture market share of property in

Indonesia. However, PT Pakuwon Jati Tbk. are not able to utilize the potential of property

market in Bandung. So the Mayfair Townhouse project is a stepping stone for company to begin

capturing market in Bandung, especially Jatinangor.

Thus, the project comes to answer the potential growing population in Jatinangor, the

educational massive project, and welcoming the increase of Bandung economic power.

2. Situational Analysis

2.1. Market Summary

Market Demographics

BANDUNG

Bandung is city located in the West Java. Strategically linked west java and middle

java, Bandung often times used as transit area for logistic coming from west to

middle java. With the size of 8.098 Ha, Bandung can be considered as middle sized

city, if compared with Jakarta. Population reach up to 2.5 million with steady

increase about 1.2% each year since 2010. Based from population pyramid, it can

be seen that Bandung had a very good age distribution.

1|Page

Jatinangor Mayfair Townhouse

Productive ratio shows 70% out of total, with realization that 90% out of total

population are still working. It shows how Bandung have a good population an

economic balance. Unemployment level also decreasing year by year since 2010,

with rate around 8-12%. Bandung economic income reach up to 4.33 Trillion

rupiah, which a 30% increase over year 2013. Thus, economic in a whole is

increasing around 8.87% in 2013. The increase of Bandung economic power is not

solely due to the locals, data shows that the rate of air traffic is increasing

incrementally.

2|Page

Jatinangor Mayfair Townhouse

Business sector in Bandung growth massively due to foreigner from other cities or

country. A ratio of 42% business sector in Bandung were in property, restaurant,

and trade . People come to Bandung rated up to 50.000 person each year, which

divided equally from low to high class level. Bandung well managed city, and great

atmosphere create a target location for many. This create an increase in property

sector around 15-30% since 2010. Tribune news stated in 2010 that Bandung is one

of the best city to invest in property business.

From townhouse, to apartment, they shows a promising future. The growing

business, economic power, rate of population are the major determinant for investor

to invest in Bandung. Indo news also stated that the price of property in Bandung

shows a positive number with a steady increase around 7.5% - 11.5% each year

since 2010. However, 71% out of total property searches are still looking for

housing, not apartment. Moreover, this is an opportunity for investor to invest in

housing.

JATINANGOR

As the rate of people invest in property keep rising in Bandung, Jatinangor hold its

own advantages. Located in east of Bandung, Jatinangor were once a left behind

area, which only several considered to invest. This is due to its location that far from

central city of Bandung. Connected via toll road, and public road, Jatinangor is easy

to reach. Right now Jatinangor is one of the most considered area to invest.

Information taken from lecturer in ITB, UNPAR, and IPDN shows that they are

planning to reside its university in Jatinangor .

UNPAD already station in Jatinangor, and keep planning to increase its capacity.

Central Bandung is not suitable anymore for studying. Thus, Jatinangor as

undeveloped area considered as the future of Bandung academic area. ITB and

UNPAD, already had their master plan to construct massive and multiple building

for its university. Even ITB School of business and management (SBM) already

migrate their student to Jatinangor.

3|Page

Jatinangor Mayfair Townhouse

Market Needs

Today, Jatinangor is still minim of housing and apartment supply. With the

upcoming prediction that all of those university will reside in Jatinangor, it can be

forecast that the rate of population rate will increase exponentially up to 500% in

the next decade. Therefore, the demand will began increasing, and the supply will

be filled. Investor should get an early ticket to participate in this investment, before

the land price, and opportunity missed. Below are Jatinangor forecasted map, with

some are still under development, and some already established. UNPAR in the

other hand have not yet determined where to reside.

4|Page

Jatinangor Mayfair Townhouse

Most of the student, or citizen in Jatinangor will be varied, from low to high class.

This can be seen from the capacity of student and lecturer class level. Most ITB

SBM considered as middle to high, and UNPAR already well known for its middle

to high class private university. Not to mention, the proportion of Jakarta citizen

that be part of the university. Their buying power will together increase the area

economic condition. Jatinangor not only has a promising future for property, but

also resemble a market for middle to high class housing.

The rate of economic growth in Bandung, major plan, population growth, easy

access, and combined with great atmosphere in Jatinangor, created the best

condition to invest especially in housing.

Market Trend

Market trend in business property in Bandung is significantly increasing. This trend

has shown itself in recent years this. Many housing also apartment who stands

growing rapidly at some points in the past may not inconceivable. Suppose, the area

of bandung bandung east and south used to just considered regions pasisian alias

the edges were not is in the category of the construction of new occupancy rapidly.

But in reality, it is now many housing that stand in the area of east bandung for

example, we can see new perumahan-perumahan in the regions ujungberung, cibiru,

cinunuk, cileunyi, until the area of university campus in jatinangor. Not to mention

if we talk to him about the development of its gedebage very promising with due to

the construction of bandung gelora the lake of fire. This is the prospect of defining

feature of the property of being promising.

Since 2011 ,the construction of housing in Bandung is also not only in the form of

residences in new land . Now, trend in bandung was also the construction of housing

in housing complexes that have been constructed long (known also with housings

clusters). The phenomenon of an increase in the sale of property in bandung and the

surrounding areas it is aftermath of population density of being within the city of

Bandung. The land price that increasingly narrow make the price of housing in the

city of Bandung rival sharp .The alternative, the area of a suburb of Bandung now

be the solution for those who want to build or buy a house. Because the fact in the

field indicates that property prices in Bandung every year an uphill sharply

compared to other cities in West Java.

5|Page

Jatinangor Mayfair Townhouse

Market Growth

In 2013 one of the sectors that showed exceptional growth is Indonesias property

market. On average, net profit of companies engaged in Indonesia's property sector

grew 68 percent during the full year. Of the 45 property companies that are listed

on the Indonesia Stock Exchange (IDX), 26 posted net profit growth that exceeded

60 percent. In the first quarter of 2014, the property sector index of the IDX

continued its fast pace by rising over 45 percent.

Prices of Indonesian residential property also have risen significantly since 2011 at

around 30 percent per year. Although having risen sharply, there are no signs of a

bubble yet as Indonesian property prices come from a low base, while the

affordability ratio of Jakarta is still moderate compared to capital cities in other

Asian countries. What makes Indonesia property grow smoothly was due to its

Four years of strong economic growth. Indonesias economy grew by 6.2% in 2012,

after real GDP growth of 6.5% in 2011, 6.2% in 2010 and 4.6% in 2009. And

Indonesias strong economic growth is expected to continue - real GDP growth of

about 6.2% to 6.6% is in 2013.

6|Page

Jatinangor Mayfair Townhouse

Public capacity to spend increase as GDP rise. The capacity of public spend work

in the same as the Property price and its economic cycle. Property prices will be

moderate in 2014 although housing demand in the Greater Jakarta area remains

robust amid a growing population, the continued process of urbanization and a

growing per capita GDP. It also stresses that Indonesia has a young population over 50 percent of the total population is below the age of 30 years - and thus many

Indonesians are expected to buy their first house in the near future. We can see that

the opportunity to invest and develop property business in Indonesia is open wide.

The Indonesia property market will remain in a good shape with marginal

fluctuations expected to occur during 2014 owing to economic and political

fluctuations lying ahead. The prices for every segment have nearly doubled since

the past three years in majority of the regions and will continue to augment in the

short term future. Despite these the market in the future was likely to reach USD ~

million in 2018 and is projecting to grow at a CAGR of 9.6% during the period

2014-2018.

We believe that the property market in some larger cities of Java has started to

become saturated. Jakarta, Bandung and Surabaya are mentioned has cities that

have seen such an increase in property development in recent years that their future

perspectives are revised down. Other islands, such as Sumatra and Kalimantan, are

said to be potentially large markets that are currently still underdeveloped.

2.2. SWOT

Strength

Pakuwon reside as one of the expert for property development in Indonesia with

experience over 25 years. Its IPO, act as approval for company transparency.

Experience handling multiple property plan, made Pakuwon diversify its source of

income, from hotels, to shopping center. Its net revenue growth that exceed 50%,

from the past 5 years, proof how effective and efficient the company operate.

Weakness

In terms of property, up until now Pakuwon focusing mainly in Jakarta and

Surabaya. Pakowon has not yet come as contender in many other area such as

Sumatra, Kalimantan, and Nor Sulawesi. Which actually consist an opportunity.

7|Page

Jatinangor Mayfair Townhouse

Therefore, Pakuwon is not very expert in analyzing or creating projection in the

cities other than its home base.

Opportunity

Property is considered as growing opportunity in Indonesia, as population keep

increase exponentially. This also followed by the GDP growth rate of Indonesia that

reach almost 6%. Mc Kinsey also stated that Indonesia as one of the top 17th for

GDP volume, and will increase up to next decade. Opportunity reside in the national

capacity to spend, and especially in Property, where population growth rate as its

determinant factor

Threat

Pakuwon does not strife alone in competing the market share of property. There are

many competitor in the market such as Bumi Serpong Damai, Lippo Group, Agung

Podomoro Group, etc. all of them also embed the experience, and capital power that

compete with Pakuwon. The rapid increase of land price also considered as a threat

in property developer, if does not handled faster. Other things is that several factor

would affecting the property industry, such as; Mortage Interest, cost of building

material, and tax rates. This factor should be monitored by the player in the market.

2.3. Competition

We divided the competition into 2 categories, Direct Competition and Indirect Competition.

Direct competition are an apple to apple competition. Competitors who have or potentially

will have the same project or product as PWON in this project, which are Townhouses. And

indirect competition are competitors who have or potentially will have products or projects

that could be a substitute for this product or project for PWON such as apartments.

Direct Competition:

Competitors

Istana Group

Overview and Positioning

Providing as many services as possible to the community

through providing accommodation, facilities and other

social responsibilities. The first property developer in west

java and already have a strong recognition in Bandung city.

8|Page

Jatinangor Mayfair Townhouse

Indirect Competition:

Competitors

Bandung

Inti

Overview and Positioning

Graha A strong player in property business in Bandung. Bandung

Group

Inti Graha Group have an advantage because of their

experience since 1986 and focusing in Bandung City and

Regency. Owned many apartments, hotels and shopping

malls across Bandung such as Galery Ciumbuleuit, BTC

Hotel, Grand Setiabudi Hotel, etc. In Jatinangor, Bandung

Inti Graha already developed a very first apartment in

Jatinangor, Pinewood Apartment, and a shopping malls,

Jatinangor Town Square.

Agung Podomoro Group

The pioneer of real estate concept in Indonesia. A strong

player in Jakarta. Since 1995 they focusing on the projects

with utilizing the limited land in the city concept. They

are famous with developing an apartment with fancy

shopping malls and play a strong role in the increasing

number of shopping malls in Jakarta. But yet so far they just

did 2 land projects in Bandung.

Lippo Group

The pioneer of well-planned and cohesively designed

independent townships which instigated in anticipation of

todays rapid urban population sprawl. The developer of 2

famous shopping malls in Bandung (Bandung Indah Plaza

and Istana Plaza) and Siloam hospital, but yet they havent

run any residence projects in Bandung city.

Wijaya Karya

Have a strong name as a contractor and developer and have

an advantage as a state-owned company. With Wika Reality

as their subsidiaries in Lands project, Wijaya Karya already

have experiences and projects especially in High Race

Building. In Bandung, Wika Reality owned and developed

a High Rise building including apartment, Tamansari La

Grande Bandung.

Pembangunan Perumahan Another strong player and a state-owned company in

(PP)

property business. PP have a business entity focusing in

9|Page

Jatinangor Mayfair Townhouse

property business which is PP Properti. In Bandung PP

Properti owned a hotel, Park Hotel Bandung, and

developing another one, Pullman Hotel.

Adhi Karya

Adhi Persada Properti is one of business entity from Adhi

Karya in property line business. Another strong player and

a state-owned company in this business. Taman Melati

Jatinangor is the only property project that Adhi Persada

Property developed in Bandung City and Bandung Regency

area.

2.4. Product Offering

The Project, Mayfair townhouse will construct a townhouse with moderate size land of 200

m2, over massive land of 14.000 m2. Totaling a number of 56 luxurious house unit, this

will create a self-sustaining cluster of houses. Each house will contribute 50 m2 for green

area, pedestrian, and road. The cluster will have its own self-sustaining security, garden,

and jogging track.

The townhouse would represent a luxurious housing that deliver a modern, environment

friendly, and comfortable experience. A townhouse that suitable to the newly wed, high

pace and modern university student, or veteran who desire a comfortable resting place.

3. Marketing Strategy

3.1. Mission

One of the mission of PT Pakuwon Jati Tbk is developing premier superblocks and

townships which enhance quality of life. PT Pakuwon Jati Tbk have experience and

10 | P a g e

Jatinangor Mayfair Townhouse

capacity to capture market share of property in Indonesia. However, PT Pakuwon Jati Tbk

are not able to utilize the potential of property market in Bandung. So this project could be

as a stepping stone for company to begin capturing market in Bandung, especially

Jatinangor.

By provides high quality and comfortable units house also supported with clean

environment in which our resident can enjoy all of the benefits of safe, attractive and

inviting houses. Resident safety, happiness and comfort are our main goals.

PT Pakuwon Jati Tbk maintain competitive market price while working toward expanding

the number of units owned, and increasing total profits earned.

3.2. Marketing Objective

The project comes to answer the potential growing population in Jatinangor, the educational

massive project, and welcoming the increase of Bandung economic power. Thus the

objectives of this project:

Encouragingly substantial sales in year one and growing steadily through year three.

Gross margin moderate and improving over the span of the plan.

Net profit/sales to be positive by the second year.

Have a crime rate of 0.

3.3. Financial Objective

This project require funds Rp 44,544,800,000 and expected to gain profit less than 3 years.

With NPV more than Rp.10.000.000.000 and the IRR is above 20%. The funding of this

project will be come from companys funding and bank loans. Financing decisions plays a

foremost role in the real estate market, as real estate transactions involve a large amount of

cash flows, which is usually funded by external sources such as bank.

Ratio

PWON

Industry

1,4

1

2,82

1,41

55% 127%

82%

Liquidity

Current Ratio

Quick Ratio

Debt

Debt Ratio

Debt to Equity

Profitability

Gross Profit Margin

33%

47%

11 | P a g e

Jatinangor Mayfair Townhouse

Operating Profit

Margin

Net Profit Margin

Return on total Asset

Return on Equity

33%

37%

12,22

27,70

30%

38%

8,1

16,23

Price/Earnings

12,39

18,96

Market

Firm Condition

Liabilities (Rp'000)

Equity (Rp'000)

Debt to Equity

Total Asset (Rp'000)

Solvency over total liabilities

Retained Earnings (Rp'000)

Remarks

5,195,736,526 Company debt to equity ratio, and

liabilities solvency shows that the

4,102,508,882 company is at moderate level.

1.27 Both equity and asset able to cover

its liabilities. Retained earnings

shows a steady increase each year,

9,298,245,408 totaling this year with 2 trillion

rupiah.

0.56

Which made the best funding

scheme to use half retained

earnings and half taken from banks.

2,133,582,174

Funding Scheme

Banks (50%)

22,272,400,000

Retained Earnings (50%)

22,272,400,000

Retained Earnings used

1.04%

Firm Fundamental and Funding Scheme

Cost of Equity

AAR (Aritmetric Average)

Compunding Annualized Return (AAR)

GAR (Geomertic Average)

Compounding GAR

Beta

Variance.P Month

Var.P.year

Std.Dev

Risk Free

COE AAR

COE GAR

2,16%

26,0%

1,48%

19,28%

1,21

1,39%

16,74%

40,91%

7,5%

15,475

14,64%

12 | P a g e

Jatinangor Mayfair Townhouse

Cost of Debt

CIMB

Mandiri

BCA

ICBC

Total

Loan

Interest Paid Annually

Weight

835.522.839 11,25%

93.996.319

49%

360.000.000

10%

36.000.000

19%

325.543.313 10,75%

34.995.906

18%

243.323.190 10,75%

26.157.243

14%

191.149.468 10,85% before tax

Weighted Average Cost of Capital (WACC)

Cost of Equity

15.5%

Cost of Debt

10.9%

COE weighted

Long term Liabilities

Total Equity

2,345,869,289

3,876,350,621

COD Weighted

Weight

Weight

4.09%

37.70%

62.30%

10%

W.A.C.C

12.7%

3.4. Target Market

The target market of this Townhouse are people who have an interest to invest their money

to buy a house just for an investment or for living in the developing area of Jatinangor.

13 | P a g e

Jatinangor Mayfair Townhouse

3.5. STP

Segmenting

First we divided the segment of the market based on the demographic (profession)

Family of students or future students of the university which the campuses

are located in Jatinangor area.

Landlords who buys house as an investment or to rent it as a boarding house

for the students of the universities.

Workers who work in Bandung and want to buy a house for living.

Entrepreneurs who want to seek place for their businesses.

Second we divided based on the geographic area:

People including students who live or stay in Bandung City.

People including students who stay in Jatinangor area.

People from outside Bandung City and Bandung Regency.

Targeting

Our most suitable target are families of students or future students that the campuses

are around Jatinangor area. And landlord who wants to buy houses to rent it as a

boarding house to students because of the opportunities in the upcoming future for

Jatinagor as an academics area.

Positioning

The luxury green townhouse with its self-sustaining facilities, free garden services,

easy access (near toll road) and located in developing area which have a bright

future especially for academic purpose.

3.6. Strategy

The strategy of the new projects from PWON is differentiation focus because of the Narrow

Target in their competitive scope and differentiation in their competitive advantage.

Competitive Advantage

Competitive

Scope

Broad

Target

Narrow

Target

Lower Cost

Differentiation

Cost Leadership

Differentiation

Cost Focus

Differentiation Focus

14 | P a g e

Jatinangor Mayfair Townhouse

Broad Target: Because Bandung as one of the main destination for academic purpose

especially in university level with many competitive university such as ITB and UNPAD.

The competitive scope will eventually just within Bandung City and Regency, especially in

Jatinangor area.

Differentiation: Due to current condition which is there still limited Townhouse or Real

Estate in Jatinangor area. PWON will have a differentiation competitive advantage in the

market at Jatinangor area by developing Townhouses with luxury and modern design and

free gardens services.

3.7. Marketing Mix

Product

The Townhouse: A luxurious moderate size house with modern exterior design, and

minimalist interior design. The design will represent shape and layout that

appropriate with todays trend and consist of two floor and one semi basement. In

the backyard there is open space with small garden and swimming pool. Designed

by architect expert, Dea Bonita.S.T.

3D View

Floor Plan View

15 | P a g e

Jatinangor Mayfair Townhouse

Front View

Backyard 3D View

Features:

Housing Feature

Bedroom

Bathroom

Kitchen

Carport

Land

200m2

House

175m2

The house is not furnished, but we will be able to give a reference for the furniture

design/buy if needed. There will be one main bed room, two regular bed room, and

one small room, that can be used as storage, or another bedroom. Carport will be

in small size, but able to withstand medium SUV. Kitchen is stationed together

with living room. Active land used will be 175 m2, while the other 25 m2 for green

area around the house.

16 | P a g e

Jatinangor Mayfair Townhouse

House Blueprint

Place

Below are the location of the selected area in Jatinangor that would be process.

Located in the west of university, and city center. South, and southeast area are still

green. It will be our source of fresh air.

Price

Rp 1,500,000,000 per unit for first year selling period. Sfter one year the price will

increase 20%.

17 | P a g e

Jatinangor Mayfair Townhouse

Promotion

Brochure / mass media marketing and the property website. In Indonesia, online

property portals are increasingly becoming a tool for research on buying, selling or

leasing residential, commercial, retail and other kind of properties. Online property

websites are used to take the relevant steps to buying or renting a property. This

starts with searching for relevant properties within our consumers price bracket.

Once a property has been found, these platforms can be used to contact property

agents, request call backs for further information on specific houses, and finally

purchase the perfect property.

3.8. Marketing Research

Whether looking in residential or investment property, buyers are concerned with the many

elements surrounding the property itself, including the lifestyle, location and culture of the

area. Then theres access to health services, transport, education, entertainment, day-to-day

living conveniences all of these things influence the choice of a buyer.

Competitor is already offered varieties products and much more complex so we need to

know the needs and consumer advocacy in order to give a products in accordance with the

wishes, necessity, perception and lifestyle of the consumer in order to attract consumer.

Several factors that affect buying intention to invest property:

Physical Evidence

Exterior design

Showed the style of the house from the outside. So buyer can see the colors

and texture that provide in the house.

18 | P a g e

Jatinangor Mayfair Townhouse

Interior design

The layout design should make the residence feel comfort. Good air and

lighting system.

Atmosphere

No air and sound pollution, easy to get clean water, good accessibility, etc.

Furniture

Should design to answer the needs of each room in the house.

Facility

Easy to get good facility around the residential.

Price

Reasonable price and the opportunity to have loan to pay.

Service

Get a good quality before and after services.

Location

The location was easy to reach by public transportation, not frequent traffic

congestion.

Sales Person

The salesperson should have knowledge about the product that offered, give a good

presentation about every detail of the house and have a good relationship with the

buyer

Buying Intention

The buyer always want to get the detail information of what they will going to pay

and they always have preference to the product.

19 | P a g e

Jatinangor Mayfair Townhouse

4. Financial

4.1. Sales Projection

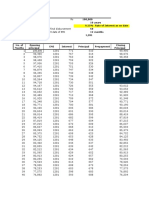

PROJECTED CASHFLOW AND FINANCIAL FEASIBILITY

DESCRIPTION

Condition

INITIAL INVESTMENT

Year.1

Year.2

Year.3

Year.4

Year.5

15

10

1,500,000,000

1,725,000,000

1,983,750,000

2,281,312,500

2,623,509,375

30,000,000,000

25,875,000,000

19,837,500,000

15,969,187,500

10,494,037,500

795,442,857

982,942,857

982,942,857

982,942,857

982,942,857

2,000,000,000

2,200,000,000

2,420,000,000

2,662,000,000

2,928,200,000

1,000,000,000

1,100,000,000

1,210,000,000

1,331,000,000

1,464,100,000

44,544,800,000

SALES

PRICE

Growth 15%

(annually)

TOTAL SALES

REVENUE

Year.0

Rp.

20

EXPENDITURE

HOUSING

MARKETING

Growth 10%

Advertising and Media

20 | P a g e

Jatinangor Mayfair Townhouse

Roadshow

1,000,000,000

1,100,000,000

1,210,000,000

1,331,000,000

1,464,100,000

990,000,000

1,089,000,000

1,197,900,000

1,317,690,000

1,449,459,000

Salary

900,000,000

990,000,000

1,089,000,000

1,197,900,000

1,317,690,000

Bonus

90,000,000

99,000,000

108,900,000

119,790,000

131,769,000

3,785,442,857

4,271,942,857

4,600,842,857

4,962,632,857

5,360,601,857

26,214,557,143

21,603,057,143

15,236,657,143

11,006,554,643

5,133,435,643

(18,330,242,857)

3,272,814,286

18,509,471,429

29,516,026,071

34,649,461,714

GENERAL EXPENSE

Employee

TOTAL

EXPENDITURE

Growth 10%

15 Person

Rp.

Profit / Cash Flow

Discount rate

Commulative Cash flow

(44,544,800,000)

12.70%

Rp.

FINANCIAL

FEASIBILITY

NPV

Rp.

14,204,689,061

IRR

Rp.

20.55%

Payback Period

Year

(18,330,242,857)

2 Years and 5

Months

After calculate the sales projection, this projects result is good for the company because all of the financial objective are full field.

21 | P a g e

Jatinangor Mayfair Townhouse

4.2. Expenses

Project General Expense

Employee

15

Salary

5,000,000

Bonus

500,000

Total cost (1st Year)

990,000,000

Increase

10%

Marketing Expense

Advertising and Media

2,500,000,000

Roadshow

Jakarta

1,500,000,000

Bandung

1,000,000,000

Total cost (1st Year)

5,000,000,000

Increase

10%

4.3. Break-even Analysis

Project Overview

Land Area:

Housing:

Details

14 m2

m2 (include

250 50m2, for Road

and pedestrian)

Total House:

56 Unit

Total Design Fee: 2,500,000,000 Project

Total Land Price: 14,000,000,000 Project

Initial Investment 44,544,800,000

Breakdown

House Construction Fee(Rp.):

Land (ask):

Land(bid):

Design Fee:

2,000,000

500,000,000

1,250,000

1,000,000

250,000,000

Details

m2

Unit

m2

m2

Unit

44,642,857 Unit

22 | P a g e

Jatinangor Mayfair Townhouse

m2 (calculated

4 200m2, house

effective)

IMB

COGS house - Total

Selling price (1st Year)

Profit

Fixed Cost

Variable Cost

Breakeven Volume

800

795,442,857

1,500,000,000

704,557,143

16,500,000,000

795,442,857

23

unit

Unit

Unit

Unit

Project

Project

Unit

Break-even Chart

Units Required for Break-Even:

Dollar Sales Required for Break-Even:

Variable Costs Per Unit:

Total Variable Costs:

Total Fixed Costs:

Months to Break-Even:

23

Rp35.128.449.474,82

$795.442.857,00

Rp18.295.185.711,00

Rp16.500.000.000,00

0,0

23 | P a g e

Jatinangor Mayfair Townhouse

5. Implementation

5.1. Control

In controlling the implementation of the project, we should make a mitigation strategy of

the risks so if the risks is do happen in the future, we could make a strategy to overcome

that risk in the most effective and efficient way.

Risk Identification

Mitigation Strategy

Low unit sales

Make

new

Responsibility

marketing Marketing Manager

strategy or improvise the

current strategy to increase

the sales

Late finish of the project

Make a new target with Project Leader

bonuses as a stimulus and

fine as a punishment for the

late

New

development

of Create a new values and POD Project Leader

similar project from the to

be

more

competitive

competitors

against the others

Cost over budget

Make a new fund request Finance Manager

from the company or loan the

money from the Bank

5.2. Marketing Organization

Berau Marketing

Marketing

Division

Mass Media

Marketing

Specialist

Sales

Division

Digital

Marketing

Specialist

Salesperson

24 | P a g e

Jatinangor Mayfair Townhouse

Marketing Manager

Manager is the one who lead the marketing and sales division. Control the staff to

do marketing for the advertising of the project and also control the sales staff to

achieve goal on sale.

Digital Marketing Specialist

Nowaday, every property has a personality that a property site can spotlight. With

all of the search sites available, homes and properties get grouped with other listings

enabling them to get lost in the mix. In today's media rich world every property for

sale deserves its very own website. The specialist make sure that the website

provides all of the detail about the information of the Jatinangor Mayfair

Townhouse. Todays buyers looking to purchase a property overseas, expect to find

what they are looking for quickly and easily on-line. The buyers want to see; a

Google Map location of the property, quality details and a quick response to their

enquiry 7 days per week. This and more comes as standard.

Mass Media Marketing Specialist

Brochure design is all about up excitement,

anticipation, and interest. The perfect shop window

to advertise all available properties, or to promote

a service, or to advertise a single prestigious home

that the agent feels buyers need to know about.

Salesperson

Salesperson make list details of land or buildings

for sale and arrange the advertising of properties

also assess buyers' needs and locate properties for

their consideration.

25 | P a g e

Вам также может понравиться

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Adirondack Trust and Dfs Consent OrderДокумент13 страницAdirondack Trust and Dfs Consent OrderrkarlinОценок пока нет

- Comparision Between Pre GST and Post Gst....Документ26 страницComparision Between Pre GST and Post Gst....Yash MalhotraОценок пока нет

- Reporte Dibella Group Alineada A #Iso26000Документ32 страницыReporte Dibella Group Alineada A #Iso26000ALBERTO GUAJARDO MENESESОценок пока нет

- CLQ Macquarie Valuation 020518 PDFДокумент8 страницCLQ Macquarie Valuation 020518 PDFscandiumloverОценок пока нет

- The Wall Street Journal 21 - 06 - 23Документ32 страницыThe Wall Street Journal 21 - 06 - 23Juan Francisco Pagés NavarreteОценок пока нет

- Customer LoyaltyДокумент16 страницCustomer LoyaltySiddharth TrivediОценок пока нет

- Icici DmartДокумент6 страницIcici DmartGOUTAMОценок пока нет

- Cyber Receipt PDFДокумент1 страницаCyber Receipt PDFprince_rahul_159Оценок пока нет

- Practice Questions - 1-2 PDFДокумент29 страницPractice Questions - 1-2 PDFHarish C NairОценок пока нет

- Loan CalculatorДокумент5 страницLoan CalculatorHema Kumar Hema KumarОценок пока нет

- Press Release Q1 2019Документ3 страницыPress Release Q1 2019knighthood4allОценок пока нет

- ST MARY LAND & EXPLORATION CO 10-K (Annual Reports) 2009-02-24Документ145 страницST MARY LAND & EXPLORATION CO 10-K (Annual Reports) 2009-02-24http://secwatch.comОценок пока нет

- 407 - 1e LTN20170420808 PDFДокумент196 страниц407 - 1e LTN20170420808 PDFTony ZhangОценок пока нет

- Questions and AnswersДокумент12 страницQuestions and Answersaparajita rai100% (3)

- PWC: A Calculated Breach of TrustДокумент33 страницыPWC: A Calculated Breach of TrustAFRОценок пока нет

- Becamex Presentation - Full Version 4Документ34 страницыBecamex Presentation - Full Version 4Trường Hoàng XuânОценок пока нет

- Nepal Chartered Accountants Act, 1997 and Regulation, 2061, NepaliДокумент164 страницыNepal Chartered Accountants Act, 1997 and Regulation, 2061, NepaliSujan PahariОценок пока нет

- Alternative Risk Premia October 2019 1575682443 PDFДокумент12 страницAlternative Risk Premia October 2019 1575682443 PDFCaden LeeОценок пока нет

- Nature and Form of The Contract: Atty. DujuncoДокумент9 страницNature and Form of The Contract: Atty. DujuncoShaiОценок пока нет

- Sworn Statement of Assets, Liabilities and NetworthДокумент2 страницыSworn Statement of Assets, Liabilities and Networthmarianne pendonОценок пока нет

- Starbucks Analylsis 2Документ26 страницStarbucks Analylsis 2api-321188189Оценок пока нет

- Kieso IFRS4 TB ch03Документ93 страницыKieso IFRS4 TB ch03John Vincent CruzОценок пока нет

- Richest Man in Babylon AnnotationДокумент10 страницRichest Man in Babylon Annotationmark jukicОценок пока нет

- Yohanes TampubolonДокумент8 страницYohanes TampubolonTOT BandungОценок пока нет

- Fundamentals of ABM Week1-4 LessonsДокумент9 страницFundamentals of ABM Week1-4 LessonsYatogamiОценок пока нет

- Fiinancial Analysis of Reckitt BenckiserДокумент10 страницFiinancial Analysis of Reckitt BenckiserKhaled Mahmud ArifОценок пока нет

- Behavioural IssuesДокумент64 страницыBehavioural IssuesEvan JordanОценок пока нет

- 12 Accounts CBSE Sample Papers 2019Документ10 страниц12 Accounts CBSE Sample Papers 2019Salokya KhandelwalОценок пока нет

- #Financial Management and Debt Control in Public EnterprisesДокумент54 страницы#Financial Management and Debt Control in Public EnterprisesD J Ben Uzee100% (2)

- Acc162 Final Exam Write The Letter Pertaining To Best AnswerДокумент3 страницыAcc162 Final Exam Write The Letter Pertaining To Best AnswerWilliam DC RiveraОценок пока нет