Академический Документы

Профессиональный Документы

Культура Документы

Gurgaon Residential Property Market Overview - May 2015

Загружено:

Colliers International0 оценок0% нашли этот документ полезным (0 голосов)

28 просмотров2 страницыGurgaon Residential Q1 2015:

Prime residential loses it's sheen and market remained sluggish in 1Q 2015.

Оригинальное название

Gurgaon Residential Property Market Overview -May 2015

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документGurgaon Residential Q1 2015:

Prime residential loses it's sheen and market remained sluggish in 1Q 2015.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

28 просмотров2 страницыGurgaon Residential Property Market Overview - May 2015

Загружено:

Colliers InternationalGurgaon Residential Q1 2015:

Prime residential loses it's sheen and market remained sluggish in 1Q 2015.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 2

Gurgaon | RESIDENTIAL

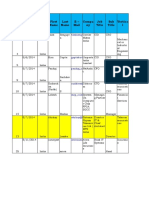

Market Indicators

Relative to prior period

Market Q3

2014

Market Q4

2014

Market Q1 Market Q2

2015

2015F

CAPITAL RATE

RENTAL RATE

NEW PROJECTS

CONSTRUCTION

During 1Q 2015 primary sales continue to remain

sluggish in premium segment however, some traction

was witnessed in secondary market for ready to move in

projects. Projects launched under affordable housing

scheme of HUDA witnessed good response due to their

lower price and good locations.

In premium segment a few new projects were launched

primarily in newly developing sector in Sohna region.

These projects includes; Ashiana Anmol by Ashiana

Housing at Sector 33, Hill Town by Supertech Ltd. at

Sector 2 and M3M Marina by M3M India at Sector 68.

All these projects were launched in the price range of INR

4,400 6,600 per sq ft. In affordable segment projects

like Andour Heights' by Signature Global located in

Sector 71, NH-8 was launched. All of these projects are

expected to be complete in the span of 2 to 3 years.

Developers have already over stretched themselves by

launching huge townships and large sized projects, which

were difficult to execute and required significant funding.

With paucity on bank lending on these projects, the

construction pace slowed down to alarming levels and

not many projects / parts of the projects saw

Market Trends

MICRO MARKETS

CAPITAL VALUES

(INR PSF)

% CHANGE

QoQ

YoY

completion during the quarter. Major projects

completed were Lifestyle Homes and Gurgaon 21

both by Vatika Group located in Sector 83. These

projects were priced in the range of INR 5,200 5,400

per sq ft in secondary market.

Average Capital Value Trends

In 1Q 2015, capital values remained stable across all

the micro markets, however capital values decline by

3% QoQ in Golf Course Road. Rents across all the

micro markets were remained stable.

In a major court decision this quarter the Punjab and

Haryana High Court freed a stay on issuing change of

land use (CLU) licenses to builders and on acquiring

land to develop residential and commercial properties.

This will help to unlock the valuable residential

investment in the market and will pave the way for new

licensed colonies and remove the hurdle for developers.

Source: Colliers International India Research

Average Rental Values

Colliers View

There have been significant delays in completion of

most of the infrastructure projects in Gurgaon, but the

real estate market is expected to reap significant

benefits post completion of these projects, thus we

expect that the mid range and affordable schemes

projects will continue to see traction in near term,

however capital values will remain stable in both

primary and secondary market.

Source: Colliers International India Research

National Director

Residential Services

sumit.jain@colliers.com

Senior Manager

Residential Services| Gurgaon

nitish.rajvanshi@colliers.com

Director

Residential Services| India

arvind.kapoor@colliers.com

Associate Director

Research Services

surabhi.arora@colliers.com

Manager

Research Services

sachin.sharma@colliers.com

Colliers International (India)

Property Services Pvt. Ltd.

Copyright 2015 Colliers International.

The information contained herein has been obtained from sources deemed

reliable. While every reasonable effort has been made to ensure its accuracy, we

cannot guarantee it. No responsibility is assumed for any inaccuracies. Readers are

encouraged to consult their professional advisors prior to acting on any of the

material contained in this report.

Technopolis Building, 1st Floor,

DLF Golf Course Road, Sector 54

TEL +91 124 456 7500

National Director

Valuation & Advisory

Services and Research

amit.oberoi@colliers.com

Вам также может понравиться

- MUMBAI Residential Property Market Overview - May 2015Документ2 страницыMUMBAI Residential Property Market Overview - May 2015Colliers InternationalОценок пока нет

- NOIDA Residential Property Market Overview - May 2015Документ2 страницыNOIDA Residential Property Market Overview - May 2015Colliers International100% (1)

- DELHI Residential Property Market Overview - May 2015Документ2 страницыDELHI Residential Property Market Overview - May 2015Colliers InternationalОценок пока нет

- Pulse May 2014 FinalДокумент11 страницPulse May 2014 FinalAnonymous P1dMzVxОценок пока нет

- 5 Reasons Why NRI's Should Invest in Silverglades Hightown ResidencesДокумент6 страниц5 Reasons Why NRI's Should Invest in Silverglades Hightown ResidencesTerminal VelocityОценок пока нет

- Real Estate: News Round UpДокумент1 страницаReal Estate: News Round UpSwapnil ShethОценок пока нет

- Indian real estate analysis: Decelerating sales impact sectorДокумент6 страницIndian real estate analysis: Decelerating sales impact sectorsofttech_engineersОценок пока нет

- Real Estate in IndiaДокумент6 страницReal Estate in IndiaVikrant KarhadkarОценок пока нет

- Realty CheckДокумент19 страницRealty Checkangshuman1231Оценок пока нет

- Knowledge GraphДокумент19 страницKnowledge Graphangshuman1231Оценок пока нет

- India Residential Property Market Overview May 2013Документ12 страницIndia Residential Property Market Overview May 2013Colliers InternationalОценок пока нет

- Study - Housing LTDДокумент44 страницыStudy - Housing LTDParag KhandelwalОценок пока нет

- Fact Sheet - Salarpuria Sattva East Crest PDFДокумент7 страницFact Sheet - Salarpuria Sattva East Crest PDFkinhousingОценок пока нет

- FSM Sonamon 354Документ30 страницFSM Sonamon 354Yashu Sharma100% (1)

- Project Report PuravankaraДокумент46 страницProject Report PuravankaraNarendra Kumar100% (1)

- SdxgbdsДокумент9 страницSdxgbdsTushar ShanОценок пока нет

- Real Estate Weekly News Letter 13 October 2014 - 19 October 2014Документ25 страницReal Estate Weekly News Letter 13 October 2014 - 19 October 2014Aayushi AroraОценок пока нет

- Sir Report - Copy To Cross CheckДокумент50 страницSir Report - Copy To Cross CheckmcbaajaОценок пока нет

- September 01Документ108 страницSeptember 01Vishal BatraОценок пока нет

- Trends in Residential Market in BangalorДокумент9 страницTrends in Residential Market in BangalorAritra NandyОценок пока нет

- Real Estate India Industry OverviewДокумент8 страницReal Estate India Industry OverviewTushar ShanОценок пока нет

- Knight Frank H 206Документ12 страницKnight Frank H 206Telemetric SightОценок пока нет

- Prestige Monte Carlo ReviewДокумент5 страницPrestige Monte Carlo ReviewAravind KambhampatiОценок пока нет

- Ireo Skyon - Prop TigerДокумент22 страницыIreo Skyon - Prop Tigersam2011Оценок пока нет

- India Delhi NCR Residential Q1 2021Документ2 страницыIndia Delhi NCR Residential Q1 2021Ramkrishnan MuduliОценок пока нет

- Realty Realm Gurgaon November 2011Документ7 страницRealty Realm Gurgaon November 2011alphaseekerОценок пока нет

- Godrej Park RetreatДокумент8 страницGodrej Park RetreatGagan ShankarappaОценок пока нет

- Hinjewadi Locality Report: of PuneДокумент9 страницHinjewadi Locality Report: of PuneSiddi RamuluОценок пока нет

- Investment in Delhi NCRДокумент42 страницыInvestment in Delhi NCRsunnyОценок пока нет

- Literature Review of Real Estate Sector in IndiaДокумент6 страницLiterature Review of Real Estate Sector in Indiagvyztm2f100% (1)

- JLL Research ReportДокумент10 страницJLL Research Reportkrishnachaitanya_888Оценок пока нет

- CBRE - PR - Industrial & Logistics Sector Leasing Increases by 26% Y-o-Y To 8.0 Mn. Sq. Ft. in Jan-Mar'23Документ5 страницCBRE - PR - Industrial & Logistics Sector Leasing Increases by 26% Y-o-Y To 8.0 Mn. Sq. Ft. in Jan-Mar'23Moiz SayОценок пока нет

- JLL Pulse Real Estate Monitor June 2012 IndiaДокумент9 страницJLL Pulse Real Estate Monitor June 2012 IndiaConcrete JungleОценок пока нет

- Sip Project VikasДокумент31 страницаSip Project VikasAkhtar AbbasОценок пока нет

- Latest Property News On Real Estate Developers: Avenue Venture Invests Rs 55 Cror e in Rohan Builders' Housing ProjectДокумент9 страницLatest Property News On Real Estate Developers: Avenue Venture Invests Rs 55 Cror e in Rohan Builders' Housing Projectangshuman1231Оценок пока нет

- Bangalore Real Estate ReportДокумент5 страницBangalore Real Estate ReportIndiaproperty_comОценок пока нет

- Case Study Final VersionДокумент21 страницаCase Study Final VersionAnkit GangwarОценок пока нет

- A Study On Retail Real Estate in BengaluruДокумент7 страницA Study On Retail Real Estate in BengaluruPrabodh KuncheОценок пока нет

- India Residential Market Review Q309Документ56 страницIndia Residential Market Review Q309Abhyudaya KanoriaОценок пока нет

- Curo India Private Limited: Instrument Amount Rating ActionДокумент3 страницыCuro India Private Limited: Instrument Amount Rating ActiongurvinderОценок пока нет

- Bangalore Market ScenarioДокумент3 страницыBangalore Market ScenarioaishОценок пока нет

- August 30, 2013Документ3 страницыAugust 30, 2013urvashiakshayОценок пока нет

- Thinking Beyond PIN CodesДокумент9 страницThinking Beyond PIN CodesSenthil kumar NatarajanОценок пока нет

- AhmedabadДокумент4 страницыAhmedabadSubodh KumarОценок пока нет

- India Residential Property Market Overview August 2013Документ12 страницIndia Residential Property Market Overview August 2013Colliers InternationalОценок пока нет

- Investors Perception About Real Estate Investments in Northern IndiaДокумент90 страницInvestors Perception About Real Estate Investments in Northern IndiaGaurav MAlikОценок пока нет

- Sobha Valley View Pre-Launch AnalysisДокумент6 страницSobha Valley View Pre-Launch AnalysisProperjiОценок пока нет

- Mumbai property market shows signs of revivalДокумент18 страницMumbai property market shows signs of revivalroypiyushОценок пока нет

- DBRealty AnandRathi 061010Документ135 страницDBRealty AnandRathi 061010Adishree AgarwalОценок пока нет

- Presentation by Tanjim AnsariДокумент7 страницPresentation by Tanjim Ansaritanjim ansariОценок пока нет

- Affordable Housing Demand to Drive Realty in 2018Документ2 страницыAffordable Housing Demand to Drive Realty in 2018Raja SekharОценок пока нет

- Real Estate Marketing Plan SummaryДокумент41 страницаReal Estate Marketing Plan Summarynischal1100% (1)

- Shapoorji PallonjiДокумент2 страницыShapoorji PallonjiAfshanОценок пока нет

- Shivam Real EstateДокумент46 страницShivam Real EstateTasmay EnterprisesОценок пока нет

- Bangalore Residential Traction@Glance Sept'13Документ6 страницBangalore Residential Traction@Glance Sept'13Soumi DasОценок пока нет

- Bangalore Real Estate Sector to See 30-40% Price FallДокумент53 страницыBangalore Real Estate Sector to See 30-40% Price FallArvind KaliaОценок пока нет

- Anand Rathi Jan 11Документ44 страницыAnand Rathi Jan 11rvs2020Оценок пока нет

- Chetan & Neha GPДокумент131 страницаChetan & Neha GPKaush DholiyaОценок пока нет

- The Versatility of the Real Estate Asset Class - the Singapore ExperienceОт EverandThe Versatility of the Real Estate Asset Class - the Singapore ExperienceОценок пока нет

- India Residential Property Market Overview - Feb 2016Документ17 страницIndia Residential Property Market Overview - Feb 2016Colliers InternationalОценок пока нет

- India Office Report 2015 - ColliersДокумент23 страницыIndia Office Report 2015 - CollierssmbhattaОценок пока нет

- NOIDA Office Property Market Overview April 2015Документ3 страницыNOIDA Office Property Market Overview April 2015Colliers International100% (1)

- Kolkata Office Property Market Overview April 2015Документ3 страницыKolkata Office Property Market Overview April 2015Colliers InternationalОценок пока нет

- India Residential Research & Forecast Report - Feb - 2015Документ13 страницIndia Residential Research & Forecast Report - Feb - 2015Colliers InternationalОценок пока нет

- Pune Office Property Market Overview April 2015Документ3 страницыPune Office Property Market Overview April 2015Colliers InternationalОценок пока нет

- PUNE Residential Property Market Overview - May 2015Документ2 страницыPUNE Residential Property Market Overview - May 2015Colliers InternationalОценок пока нет

- Mumbai Office Property Market Overview April 2015Документ3 страницыMumbai Office Property Market Overview April 2015Colliers InternationalОценок пока нет

- Workspace Trends in India 2015Документ5 страницWorkspace Trends in India 2015Colliers InternationalОценок пока нет

- Kolkata Office Property Market Overview April 2015Документ3 страницыKolkata Office Property Market Overview April 2015Colliers InternationalОценок пока нет

- Chennai Residential Property Market Overview - May 2015Документ2 страницыChennai Residential Property Market Overview - May 2015Colliers InternationalОценок пока нет

- Gurgaon Office Property Market Overview April 2015Документ3 страницыGurgaon Office Property Market Overview April 2015Colliers InternationalОценок пока нет

- India Office Property Market Overview April 2015 PDFДокумент20 страницIndia Office Property Market Overview April 2015 PDFColliers InternationalОценок пока нет

- India Office Rental Insight - Apr 2015Документ6 страницIndia Office Rental Insight - Apr 2015Colliers InternationalОценок пока нет

- India Office Property Market Overview April 2015 PDFДокумент20 страницIndia Office Property Market Overview April 2015 PDFColliers InternationalОценок пока нет

- Mumbai Office Rental Insight - Apr 2015Документ1 страницаMumbai Office Rental Insight - Apr 2015Colliers InternationalОценок пока нет

- Delhi Office Property Market Overview April 2015Документ3 страницыDelhi Office Property Market Overview April 2015Colliers InternationalОценок пока нет

- DELHI Residential Property Market Overview - May 2015Документ2 страницыDELHI Residential Property Market Overview - May 2015Colliers InternationalОценок пока нет

- Bengaluru Residential Property Market Overview - May 2015Документ2 страницыBengaluru Residential Property Market Overview - May 2015Colliers InternationalОценок пока нет

- Kolkata Office Rental Insight - Apr 2015Документ1 страницаKolkata Office Rental Insight - Apr 2015Colliers InternationalОценок пока нет

- Bengaluru Office Property Market Overview April 2015Документ3 страницыBengaluru Office Property Market Overview April 2015Colliers InternationalОценок пока нет

- Chennai Office Rental Insight - Apr 2015Документ1 страницаChennai Office Rental Insight - Apr 2015Colliers InternationalОценок пока нет

- Bengaluru Office Property Market Overview April 2015Документ3 страницыBengaluru Office Property Market Overview April 2015Colliers InternationalОценок пока нет

- Bengaluru Office Rental Insight - Apr 2015Документ1 страницаBengaluru Office Rental Insight - Apr 2015Colliers InternationalОценок пока нет

- Pune Office Rental Insight - Apr 2015Документ1 страницаPune Office Rental Insight - Apr 2015Colliers InternationalОценок пока нет

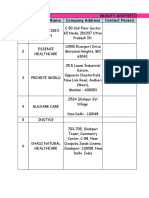

- Big Bazar Store ListДокумент29 страницBig Bazar Store List2021bpa015Оценок пока нет

- Trai Entity Report 02 Oct 2021Документ221 страницаTrai Entity Report 02 Oct 2021Ajay chowdary ajayОценок пока нет

- Company First Name Last Name Sl. NoДокумент18 страницCompany First Name Last Name Sl. NoAdhilОценок пока нет

- GurgaonДокумент88 страницGurgaonEkta Adlakha100% (3)

- One Mobikwik Systems Limited: (Please Read Section 32 of The Companies Act, 2013)Документ411 страницOne Mobikwik Systems Limited: (Please Read Section 32 of The Companies Act, 2013)manmath91Оценок пока нет

- Site Analysis AshДокумент3 страницыSite Analysis AshHimanshu SainiОценок пока нет

- Industrial EquipmentДокумент77 страницIndustrial EquipmentJackson ButlerОценок пока нет

- Grant of Lease of Land For Developing and Operating A Convention & Exhibition Centre & Allied Facilities at Dwarka, Delhi, IndiaДокумент0 страницGrant of Lease of Land For Developing and Operating A Convention & Exhibition Centre & Allied Facilities at Dwarka, Delhi, IndiaVasudha GandhiОценок пока нет

- Cio NCRДокумент16 страницCio NCRVirender RawatОценок пока нет

- Cab Services 2017Документ135 страницCab Services 2017Akash GolaОценок пока нет

- THESIS TopicsДокумент39 страницTHESIS TopicsFaraz AhmedОценок пока нет

- Trigun SeoДокумент14 страницTrigun SeoAkshay ChauhanОценок пока нет

- Add. Add2Документ81 страницаAdd. Add2Shashi RajputОценок пока нет

- KsДокумент7 страницKsSwatiОценок пока нет

- Mohit Bhalla CV 5Документ2 страницыMohit Bhalla CV 5imadОценок пока нет

- INDOKOTE Company Profile-4Документ8 страницINDOKOTE Company Profile-4AvijitSinghОценок пока нет

- Email Mobile Database of Demat Acc Holders SampleДокумент7 страницEmail Mobile Database of Demat Acc Holders SampleVijay kumar0% (1)

- Ranvir Singh Vs Land Acquisition Collector and ... On 16 January, 2019Документ13 страницRanvir Singh Vs Land Acquisition Collector and ... On 16 January, 2019super smithОценок пока нет

- BPTP Terra 37d Sales - DeckДокумент95 страницBPTP Terra 37d Sales - DeckAayush SharmaОценок пока нет

- Golfestate@SCDAДокумент48 страницGolfestate@SCDARoopam BholaОценок пока нет

- Print - Udyam Registration CertificateДокумент2 страницыPrint - Udyam Registration CertificateshivamОценок пока нет

- Commercial Kitchen EquipmentsДокумент7 страницCommercial Kitchen EquipmentsShailendra SinghОценок пока нет

- FT Beauty and HealthДокумент223 страницыFT Beauty and Healthkiran raoОценок пока нет

- List of Insolvency Professionals Empanelled Wef 03 06 2021Документ50 страницList of Insolvency Professionals Empanelled Wef 03 06 2021Siddharth SharmaОценок пока нет

- Ansals HeightДокумент55 страницAnsals HeightDipanshu NassaОценок пока нет

- Prices: Residential Apartments Complex by Ambience Sector 22, Gurgaon, HaryanaДокумент5 страницPrices: Residential Apartments Complex by Ambience Sector 22, Gurgaon, Haryanasushil aroraОценок пока нет

- 1 Page Docuri - Com-Copy-Of-Copy-Of-Administration-Facilities-Head-Detailsnew PDFДокумент26 страниц1 Page Docuri - Com-Copy-Of-Copy-Of-Administration-Facilities-Head-Detailsnew PDFAnonymous RjIueYSlОценок пока нет

- Haryana Real Estate Regulatory Authority, GurugramДокумент60 страницHaryana Real Estate Regulatory Authority, GurugramREWARI ONEОценок пока нет

- Haryana Real Estate Regulatory Authority, GurugramДокумент85 страницHaryana Real Estate Regulatory Authority, GurugramSatish Khola (Rewari)Оценок пока нет

- An ISO 9001 Co.: Delta Cooling Towers P. LTDДокумент25 страницAn ISO 9001 Co.: Delta Cooling Towers P. LTDRaja ManiОценок пока нет