Академический Документы

Профессиональный Документы

Культура Документы

Revised Schedule Vi

Загружено:

SridharquestАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Revised Schedule Vi

Загружено:

SridharquestАвторское право:

Доступные форматы

SCHEDULE VI OF COMPANIES ACT, 1956 (AS REVISED)

Schedule VI of Companies Act, 1956 (As Revised)

1. APPLICABILITY

NOTIFICATION F. NO. 2/6/2008-C.L-V, DATED 30-3-2011

"The notification shall come into force for the Balance Sheet and Profit and Loss Account to be

prepared for the financial year commencing on or after 1.4.2011".

Early adoption of the Revised Schedule VI is not permitted since Schedule VI is a statutory

format.

Comparative information will have to be presented starting from the first year of application.

Thus for the financial statements prepared for the year 2011-12, comparative amounts need to

be given for the financial year 2010-11, except if it is the first year of the entity.

As per MCAs Circular financial statements for the purpose of IPO/FPO during the financial year

2011-12 maybe in the format of the pre revised schedule VI. However, for period beyond 31st

March 2012, new format is applicable.

Revised Schedule VI has been framed as per the existing non-converged Indian Accounting

Standards notified under the Companies (Accounting Standards), Rules, 2006;

2. PRINCIPALS OF SCHEDULE VI (AS REVISED)

The requirements of the Companies Act and AS will prevail over Schedule VI. Terms to be

interpreted as per applicable Accounting Standards, e.g. Associates, Related Parties.

Disclosure on the face of the financial statements or in Notes are minimum requirements.

The concept of schedule is now eliminated and such information is now to be furnished in the

Notes to Accounts.

Terms in the Revised Schedule VI will carry the meaning as defined by the applicable Accounting

Standards.

CA KUNAL AGRAWAL

(4) Current Liabilities

(a) Short-term borrowings

(b) Trade payables

(c) Other current liabilities

Page

Now before discussing Requirement, we shall once look at format of Schedule VI (As Revised)

3. REQUIREMENT OF SCHEDULE VI (AS REVISED)

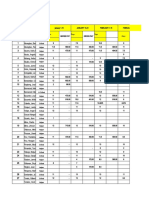

Balance Sheet as at 31st March, 2011

Figures as

at the end

Note

Particulars

of current

No

reporting

period

Figures as

at the end

of previous

reporting

period

I. EQUITY AND LIABILITIES

(1) Shareholder's Funds

(a) Share Capital

(b) Reserves and Surplus

(c) Money received against share warrants

(2) Share application money pending allotment

(3) Non-Current Liabilities

(a) Long-term borrowings

(b) Deferred tax liabilities (Net)

(c) Other Long term liabilities

(d) Long term provisions

A U T H O R E D B Y C A K UN A L A GR A WA L [ A C A, D IS A( I C A I) , B .C O M ] : :

:: www.facebook.com/page.kunal :: cakunal.wordpress.com :: contact at +91-99295-03735 ::

SCHEDULE VI OF COMPANIES ACT, 1956 (AS REVISED)

(d) Short-term provisions

Total

II.Assets

(1) Non-current assets

(a) Fixed assets

(i) Tangible assets

(ii) Intangible assets

(iii) Capital work-in-progress

(iv) Intangible assets under development

(b) Non-current investments

(c) Deferred tax assets (net)

(d) Long term loans and advances

(e) Other non-current assets

(2) Current assets

(a) Current investments

(b) Inventories

(c) Trade receivables

(d) Cash and cash equivalents

(e) Short-term loans and advances

(f) Other current assets

Total

See accompanying notes to the financial statements

Format of Statement of Profit & Loss

Particulars

Note

No

Figures as

at the end

of current

reporting

period

Figures as

at the end

of

previous

reporting

period

V. Profit before exceptional and extraordinary

items and tax

CA KUNAL AGRAWAL

I. Revenue from operations

II. Other Income

III. Total Revenue (I +II)

IV. Expenses:

Cost of materials consumed

Purchase of Stock-in-Trade

Changes in inventories of finished goods, work-inprogress and Stock-in-Trade

Employee benefit expense

Financial costs

Depreciation and amortization expense

Other expenses

Total Expenses

(III IV)

VI. Exceptional Items

VII. Profit before extraordinary items and tax (V VI)

VIII. Extraordinary Items

FOR REGULAR CLASSES OF ITSM (CA-IPCC)& ISCA (CA-FINAL)

Page

IX. Profit before tax (VII - VIII)

CONTACT CA KUNAL AGRAWAL

SCHEDULE VI OF COMPANIES ACT, 1956 (AS REVISED)

X. Tax expense:

(1) Current tax

(2) Deferred tax

XI. Profit(Loss) from the period from continuing

operations

(VIIVIII)

XII. Profit/(Loss) from discontinuing operations

XIII. Tax expense of discounting operations

XIV. Profit/(Loss) from Discontinuing operations

(XII - XIII)

XV. Profit/(Loss) for the period (XI + XIV)

XVI. Earning per equity share:

(1) Basic

(2) Diluted

Page

CA KUNAL AGRAWAL

Key Highlights/ Major Changes

Only vertical form of balance sheet is permitted.

Shareholders funds to be shown after deduction of debit balance of profit and loss account.

As a result, shareholders funds can be negative

Separate head for Miscellaneous Expenditure to the extent not written off or adjusted

discontinued.

Current and non current classification of assets and liabilities required on the lines of Ind AS

and IFRS

Concept of operating cycle introduced

Separate head for

o money received against share warrants

o intangible assets

o intangible assets under development

o cash and cash equivalents

Source of Funds now is Equity and Liabilities;

Application of Funds now is Assets;

Shareholding of more than 5% shares in the company now needs to be disclosed;

Share allotments for non-cash consideration, buy back to be disclosed;

Debtors are now Trade receivables, their ageing disclosures are now based on outstanding

from Due date against Bill date.

All types of commitments are to be disclosed.

Default in repayment of loans and interest to be disclosed.

Changes Related to Statement of Profit & Loss

Specific format prescribed. In old schedule VI NO FORMAT was prescribed.

It is now a Statement and no longer Account.

Separate disclosures for items exceeding 1% of revenue from operations or Rs 100,000,

whichever is higher.

Dividend income from subsidiary is now to be recognized under AS 9 -Revenue Recognition,

when the right to receive is established.

Revenue from operations disclosed as (a) Sale of Products, (b) Sale of services and (c) Other

operating revenue.

Exchange difference considered as Interest Cost as per AS 16 Borrowing Cost, now needs

to be disclosed separately as finance cost.

Now we shall discuss Head-Wise requirement of Schedule VI (as revised)

A U T H O R E D B Y C A K UN A L A GR A WA L [ A C A, D IS A( I C A I) , B .C O M ] : :

:: www.facebook.com/page.kunal :: cakunal.wordpress.com :: contact at +91-99295-03735 ::

SCHEDULE VI OF COMPANIES ACT, 1956 (AS REVISED)

1. Share Capital

1) Includes both Equity as well as Preference Capital

2) Early adoption of AS 30 and AS 31 on Financial Instruments based on which Preference

shares have been treated as Liability

3) Reconciliation of number of shares outstanding at the beginning and end of the period

4) Rights, preference and restrictions attaching to each class are to be disclosed

5) Shares in respect of each class held by holding company, ultimate holding company and

subsidiaries or associates of the holding or ultimate holding company

2. Share Application Money Pending Allottment

1) Required to be shown as a separate line item on the face of the Balance Sheet after

Shareholders Funds.

2) Share application money not exceeding the issued capital and to the extent not refundable

shall be shown under this head.

3) Share application money to the extent refundable i.e., the amount in excess of subscription

or in case the requirements of minimum subscription are not met, shall be separately shown

under Other current liabilities.

3. Noncurrent liabilities

4

Page

Example of Current Liabilities:

Short-term borrowings (secured / unsecured);

Trade payables;

Other current liabilities;

o Current maturities of long-term debt, finance lease

o Interest accrued on borrowings (due and not due);

o Income received in advance;

o Unpaid dividends;

o Application money received with accrued interest

o Unpaid matured deposits and interest accrued thereon;

o Unpaid matured debentures and interest accrued thereon;

o Other payables (specify nature).

Short-term provisions Employee benefits & others

CA KUNAL AGRAWAL

A liability shall be classified as current when it satisfies any one of the following criteria:

It is expected to be settled in the companys normal operating cycle;

It is held primarily for the purpose of being traded;

It is due to be settled within twelve months after the reporting date;

The company does not have an unconditional right to defer settlement of the liability for at

least twelve months after the reporting date. Terms of a liability that could, at the option of

the counterparty, result in its settlement by the issue of equity instruments do not affect its

classification.

All other liabilities shall be classified as non-current.

FOR REGULAR CLASSES OF ITSM (CA-IPCC)& ISCA (CA-FINAL)

CONTACT CA KUNAL AGRAWAL

SCHEDULE VI OF COMPANIES ACT, 1956 (AS REVISED)

4. Tangible Assets

Classification shall be given as:

o Land;

o Buildings;

o Plant and Equipment;

o Furniture and Fixtures;

o Vehicles;

o Office equipment;

o Others (specify nature).

Assets under lease shall be separately specified under each class of asset.

Capital advances to be disclosed under long term loans and advances and not under CWIP.

5. Intangible Assets

Classification of intangible assets was not there in Old Schedule VI

Intangibles assets to be classified as Goodwill, Brands/trademarks, Computer software,

Mastheads and publishing titles, Mining rights, Copyrights, patents and other intellectual

property rights, services and operating rights, Others (specify)

6. Investments

To be classified into Current and Non-current.

Further bifurcated in Trade and Non trade.

Current Investment is an investment that is by its nature readily realisable and is intended to

be held not more than one year from the date on which such investment is made.

Long term investment is an investment other than a current investment.

Investments in Equity, Preference shares, Govt or trust securities, debentures or bonds,

Mutual funds, Partnership, Others.

Basis of valuation to be disclosed

Page

CA KUNAL AGRAWAL

7. Long Term Advances & Other Assets

To be bifurcated in to long term and short term and secured, unsecured and doubtful.

Further classified as Capital advances , Securities deposits (long term), Loans and advances

to related parties and Others (specify)

Capital advances default non-current

Other inclusions:

Prepaid Expenses, Advance tax, CENVAT, VAT recoverable etc which are not expected to be

realised within next 12 months or operating cycle whichever is longer as on the balance

sheet date.

No due date / on demand loans and advances - Current

Other non-current assets to be bifurcated in to Long term trade receivables (secured,

unsecured and doubtful) and Others (specify)

8. Trade Receivable

Trade receivable for period exceeding six months from Due Date

Secured, Unsecured, Doubtful

Debts due by directors or other officers of the company

9. Cash & Cash equivalents

1) Cash & bank balances" in the Old Schedule VI is replaced with Cash & Cash Equivalents

2) Cash and cash equivalents include

a. Cash & Cash Equivalents as:

i. Balances with banks;

ii. Cheques, drafts on hand;

iii. Cash on hand;

A U T H O R E D B Y C A K UN A L A GR A WA L [ A C A, D IS A( I C A I) , B .C O M ] : :

:: www.facebook.com/page.kunal :: cakunal.wordpress.com :: contact at +91-99295-03735 ::

SCHEDULE VI OF COMPANIES ACT, 1956 (AS REVISED)

iv. Others (specify nature)

b. Margin Deposit with Banks

c. Earmarked balances with banks

d. Balances with repatriation restrictions

3) Removed disclosures of scheduled and non-scheduled banks.

10.

Contingent liabilities and commitments

Contingent liabilities shall be classified as:

(a) Claims against the company not acknowledged as debt;

(b) Guarantees;

(c) Other money for which the company is contingently liable

Commitments shall be classified as:

a. Estimated amount of contracts remaining to be executed on capital account and not

provided for;

b. Uncalled liability on shares and other investments partly paid

c. Other commitments

Examples may include commitments in the nature of buy-back arrangements, commitments to fund

subsidiaries and associates, non-disposal of investments in subsidiaries and undertakings, derivative

related commitments, etc.

Other significant disclosures

1. The amount of dividends proposed to be distributed to equity and preference shareholders

for the period and the related amount per share should be disclosed separately.

2. Arrears of fixed cumulative dividends on preference shares should also be disclosed

separately.

3. Where in respect of issue of Securities made for specific purpose, the whole or part of the

amount has not been used for the specific purpose at balance sheet date, it should be

disclosed by way of note that how such unutilized amount have been used or invested.

4. If, in the opinion of the Board, any of the assets other than fixed assets and noncurrent

investments do not have a value on realization in the ordinary course of business at least

equal to the amount at which they are stated, the fact that the Board is of that opinion,

should be stated.

Now dealing with items of Statement of Profit & Loss

It is no more an account

Functional classification not permitted

Requirement of parent company to recognize dividends declared by subsidiary companies

even after the date of the Balance Sheet no longer exists in the Revised Schedule VI. AS-9 is

required to be followed. (Consolidation point!!)

Any item of income or expense which exceeds 1% of the revenue from operations or

Rs.100,000 (earlier 1 % of total revenue or Rs.5,000), whichever is higher, needs to be

disclosed separately.

Specific disclosure required by AS-24 Discontinuing Operations is now on the face of the

Statement.

12.

Revenue from Operations

xx

xx

xx

xx

Page

Sale of products

Sale of services

Other operating revenues

Less: Excise duty

CA KUNAL AGRAWAL

11.

FOR REGULAR CLASSES OF ITSM (CA-IPCC)& ISCA (CA-FINAL)

CONTACT CA KUNAL AGRAWAL

SCHEDULE VI OF COMPANIES ACT, 1956 (AS REVISED)

13.

Other Income

Interest Income (for non-finance company);

Dividend Income;

Net gain / loss on sale of investments;

Other non-operating income (net of expenses directly

attributable to such income).

Page

CA KUNAL AGRAWAL

14.

xx

xx

xx

xx

Requirements: relating to Expenses

14.1 Raw material & Work in Progress

14.2 Finance costs

1. Interest Expenses

2. Other borrowing cost

3. Applicable net gain/loss on foreign currency transactions and translation (AS 16)

14.3 Employee benefits expense

The following amounts in respect of employee benefit expenses should be shown:

i. Salaries and wages;

ii. Contribution to provident & other funds;

iii. Expense on ESOP & EOPP;

iv. Staff welfare Expenses.

14.4 Depreciation & Amortisation expense

1. Depreciation

2. Amortisation

3. Impairment ((impairment amount would need to be shown virtue of AS 28)

14.4 Payment to auditors

1. auditor;

2. taxation matters

3. company law matters

4. management services

5. other services

6. reimbursement of expenses

14.5 Other Expenses

1. Consumption of stores and spare parts.

2. Power and fuel.

3. Rent.

4. Repairs to buildings.

5. Repairs to machinery.

6. Insurance.

7. Rates and taxes, excluding, taxes on income.

Besides, the following items would also require a separate disclosure:

1. Item exceed 1,00,000 or 1% limit

2. Net gain/loss on sale of investments

3. Adjustments to the carrying amount of investments

4. Net gain or loss on foreign currency transaction and translation (other than

considered as finance cost).

14.6 Imports/ foreign exchange income, expenditure etc.

The profit and loss account should contain following information by way of a note:

(a) Value of imports calculated on C.I.F basis by the company during FY on Raw materials,

Components & spare parts and Capital goods

(b) Expenditure in foreign currency during the FY on account of royalty, knowhow, professional,

consultation fees, interest, and other matters.

(c) Total value if all imported raw materials, spare parts and components consumed during the

financial year and the total value of all indigenous raw materials, spare parts and

components similarly consumed and the percentage of each to the total consumption.

(d) The amount remitted during the year in foreign currencies on account of dividends with a

specific mention of the total number of nonresident shareholders, the total number of

A U T H O R E D B Y C A K UN A L A GR A WA L [ A C A, D IS A( I C A I) , B .C O M ] : :

:: www.facebook.com/page.kunal :: cakunal.wordpress.com :: contact at +91-99295-03735 ::

SCHEDULE VI OF COMPANIES ACT, 1956 (AS REVISED)

shares held by them on which the dividends were due and the year to which the dividends

related.

(e) Earnings in foreign exchange classified under the following heads

a. Export of goods calculated on F.O.B. basis;

b. Royalty, knowhow, professional and consultation fees;

c. Interest and dividend;

d. Other income, indicating the nature thereof.

15.

Rounding off of Figures appearing in financial

statement

Turnover of less than 100 Crores - Rounding off to the nearest Hundreds, thousands, lakhs or

millions or decimal thereof

Page

CA KUNAL AGRAWAL

Turnover of 100 Crores or more Rounding off to the nearest lakhs, millions or crores, or decimal

thereof

FOR REGULAR CLASSES OF ITSM (CA-IPCC)& ISCA (CA-FINAL)

CONTACT CA KUNAL AGRAWAL

Вам также может понравиться

- SChedule VIДокумент88 страницSChedule VIbhushan2011Оценок пока нет

- WebcastonRevSchVI AsДокумент76 страницWebcastonRevSchVI AsAayushi AroraОценок пока нет

- Issues in Revised Schedule VI - Sushrut Chitale 15072012Документ64 страницыIssues in Revised Schedule VI - Sushrut Chitale 15072012Anish NairОценок пока нет

- AFS Revised Schedule VIДокумент17 страницAFS Revised Schedule VIShivkarVishalОценок пока нет

- of Revised Schdule Vi1Документ43 страницыof Revised Schdule Vi1Jay RoyОценок пока нет

- Schedule IVДокумент57 страницSchedule IVAbhishekОценок пока нет

- BASIC FEATURE OF Financial StatementДокумент6 страницBASIC FEATURE OF Financial StatementmahendrabpatelОценок пока нет

- 43 - Schedule of Companies Act 1956 PDFДокумент52 страницы43 - Schedule of Companies Act 1956 PDFThakur Ranvijay SinghОценок пока нет

- Schedule Vi (Revised) Checklist: S JaykishanДокумент19 страницSchedule Vi (Revised) Checklist: S JaykishanGollu JainОценок пока нет

- Block 2Документ82 страницыBlock 2Shreya PansariОценок пока нет

- Schedule VI Revised: Key Changes Related To Disclosure Requirements of Balance SheetДокумент3 страницыSchedule VI Revised: Key Changes Related To Disclosure Requirements of Balance SheetmercatuzОценок пока нет

- Final PPT of Balance SheetДокумент23 страницыFinal PPT of Balance SheetShailesh SatarkarОценок пока нет

- Revised Schedule ViДокумент20 страницRevised Schedule VialkaОценок пока нет

- ACMA Unit 2Документ47 страницACMA Unit 2Subhodeep Roy ChowdhuryОценок пока нет

- NEW Schedule VIДокумент22 страницыNEW Schedule VISanjay BhatterОценок пока нет

- Paper 18Документ153 страницыPaper 18ahmedОценок пока нет

- ScheduleVI Companies ActДокумент53 страницыScheduleVI Companies Actowaiskhan007Оценок пока нет

- Section 4Документ22 страницыSection 4Abata BageyuОценок пока нет

- Final Theories ReviewerДокумент16 страницFinal Theories Reviewermary jane facerondaОценок пока нет

- Icai Faqs Revised Schedule Vi IcaiДокумент17 страницIcai Faqs Revised Schedule Vi IcaiCharan AdharОценок пока нет

- Canadian Gaap - Ifrs Comparison Series: Issue 15: IAS 1 Presentation of Financial StatementsДокумент6 страницCanadian Gaap - Ifrs Comparison Series: Issue 15: IAS 1 Presentation of Financial StatementsBooky7Оценок пока нет

- Chapter 3 Ias 1 Presentation of Financial StatementsДокумент5 страницChapter 3 Ias 1 Presentation of Financial StatementsKent YpilОценок пока нет

- Adoption of Schedule VI To The Companies Act 1956 Class 12Документ52 страницыAdoption of Schedule VI To The Companies Act 1956 Class 12CrismonОценок пока нет

- Paper 16Документ71 страницаPaper 16pkaul1Оценок пока нет

- PT B Acc NotesДокумент7 страницPT B Acc Notesfathima hamnaОценок пока нет

- Sedul 6Документ19 страницSedul 6Sanoj Kumar YadavОценок пока нет

- Final Accounts of CompaniesДокумент32 страницыFinal Accounts of CompaniesbE SpAciAlОценок пока нет

- As Quick PDFДокумент23 страницыAs Quick PDFChandreshОценок пока нет

- Cash Flow Statements Exercises and AnswersДокумент39 страницCash Flow Statements Exercises and Answersszn189% (9)

- Presentation On Revised Schedule ViДокумент65 страницPresentation On Revised Schedule ViSangram PandaОценок пока нет

- FARAP-4516Документ10 страницFARAP-4516Accounting StuffОценок пока нет

- FAQs For Revised Schedule VIДокумент11 страницFAQs For Revised Schedule VIVishy2201Оценок пока нет

- Financial StatementsДокумент35 страницFinancial StatementsTapish GroverОценок пока нет

- Revised Schedule VIДокумент3 страницыRevised Schedule VIRohit BhallaОценок пока нет

- Financial Results For June 30, 2015 (Standalone) (Result)Документ5 страницFinancial Results For June 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Revised Schedule ViДокумент87 страницRevised Schedule ViAnupam BaliОценок пока нет

- Format of Financial Statements Under The Revised Schedule VIДокумент97 страницFormat of Financial Statements Under The Revised Schedule VIDebadarshi RoyОценок пока нет

- Revised Schedule VI in Excel FormatДокумент97 страницRevised Schedule VI in Excel FormatRaghavendran ThiyagarajanОценок пока нет

- Preparation of Company Accounts: Chapter-01Документ18 страницPreparation of Company Accounts: Chapter-01My ComputerОценок пока нет

- 74847bos60515 IntermediateДокумент21 страница74847bos60515 IntermediateShubhamОценок пока нет

- Ch-2 FINANCIAL Statment AnalysisДокумент40 страницCh-2 FINANCIAL Statment AnalysishitekshaОценок пока нет

- FR Tutorials 2022 - Some Theory Question SolutionДокумент26 страницFR Tutorials 2022 - Some Theory Question SolutionLaud Listowell100% (2)

- Finance AssignmentДокумент10 страницFinance AssignmentAnshuman PandeyОценок пока нет

- FAR-4201 (Financial Statements)Документ8 страницFAR-4201 (Financial Statements)Gwyneth CartallaОценок пока нет

- 5 6271340859971602635Документ23 страницы5 6271340859971602635Sidharth JainОценок пока нет

- Cash Flow AnalysisДокумент15 страницCash Flow AnalysisElvie Abulencia-BagsicОценок пока нет

- Objective of IAS 1Документ8 страницObjective of IAS 1mahekshahОценок пока нет

- Fifth ScheduleДокумент47 страницFifth Schedulezulfi100% (1)

- Summary On Revised Schedule VIДокумент3 страницыSummary On Revised Schedule VIDeepak GargОценок пока нет

- Important Features of IAS 1 PDFДокумент6 страницImportant Features of IAS 1 PDFJayedОценок пока нет

- Schedule III of Companies Act 2013 in Excel Format-2Документ48 страницSchedule III of Companies Act 2013 in Excel Format-2divya shindeОценок пока нет

- Final Audit - Insurance Audit Notes PDFДокумент9 страницFinal Audit - Insurance Audit Notes PDFBhavin Nilesh PandyaОценок пока нет

- TYBBA Sem 5 ANALYSIS OF FINANCIAL STATEMENTS Prof. Kavita PareekДокумент105 страницTYBBA Sem 5 ANALYSIS OF FINANCIAL STATEMENTS Prof. Kavita Pareeksarvesh dhatrakОценок пока нет

- Revised Schedule VI RequirementsДокумент23 страницыRevised Schedule VI RequirementsBharadwaj GollapudiОценок пока нет

- Workshop On The Revised Fifth Schedule: Facilitator: Tahmeen Ahmad, ACAДокумент47 страницWorkshop On The Revised Fifth Schedule: Facilitator: Tahmeen Ahmad, ACAShahid AliОценок пока нет

- Revisionary Test Paper: Group IvДокумент107 страницRevisionary Test Paper: Group IvRama AnandОценок пока нет

- 2.3.1 Financial Statement PresentationДокумент10 страниц2.3.1 Financial Statement PresentationRichard Jr RjОценок пока нет

- As 17 Segment ReportingДокумент5 страницAs 17 Segment ReportingcalvinroarОценок пока нет

- Wiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsОт EverandWiley GAAP for Governments 2012: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsОценок пока нет

- Cleanoorja Systems PVT LTDДокумент35 страницCleanoorja Systems PVT LTDganesh zoreОценок пока нет

- Janice Suyo MergedДокумент23 страницыJanice Suyo MergedLolzОценок пока нет

- Overview of Government Accounting SystemДокумент5 страницOverview of Government Accounting SystemMichael GotongОценок пока нет

- A Project Report On Financial Performance IN NTPC Ltd. RamagundamДокумент81 страницаA Project Report On Financial Performance IN NTPC Ltd. RamagundamMulukallavinay ReddyОценок пока нет

- Business Requirement Document - CRF# 1905 - LATAM AMEX - CONCUR Posting V4Документ19 страницBusiness Requirement Document - CRF# 1905 - LATAM AMEX - CONCUR Posting V4KolluriRajubhaiChowdaryОценок пока нет

- Income Taxation - Ampongan (SolMan)Документ25 страницIncome Taxation - Ampongan (SolMan)John Dale Mondejar77% (13)

- Assessment of Tax Collection Problems (The Case of Wolkite Town)Документ25 страницAssessment of Tax Collection Problems (The Case of Wolkite Town)kassahun mesele100% (6)

- Testate Estate of Felix de GuzmanДокумент3 страницыTestate Estate of Felix de GuzmanTine TineОценок пока нет

- CLASSIFICATION OF COSTS: Manufacturing: Subhash Sahu (Cs Executive Student of Jaipur Chapter)Документ85 страницCLASSIFICATION OF COSTS: Manufacturing: Subhash Sahu (Cs Executive Student of Jaipur Chapter)shubhamОценок пока нет

- Salaries and Wages Adjustments (2020-2021)Документ38 страницSalaries and Wages Adjustments (2020-2021)CarloCabanayanОценок пока нет

- Latihan Budget 20142015Документ48 страницLatihan Budget 20142015AnnaОценок пока нет

- Entrepreneurship Business Idea ReportДокумент26 страницEntrepreneurship Business Idea ReportMuzafar Alee100% (1)

- CFR ProblemsДокумент28 страницCFR ProblemsMadhu kumarОценок пока нет

- Minutes NH 2015-12-02Документ2 страницыMinutes NH 2015-12-02api-205664725Оценок пока нет

- Problem Mr. Lindbergh Lendl S. Soriano Practice Set MerchandisingДокумент5 страницProblem Mr. Lindbergh Lendl S. Soriano Practice Set MerchandisingRayna AbrenicaОценок пока нет

- Abjamesola Tailoring Services Case StudyДокумент17 страницAbjamesola Tailoring Services Case StudyTintin Tao-onОценок пока нет

- Specimen & Key Points of The Chapter: Errors Causing Disagreement of Trial BalanceДокумент10 страницSpecimen & Key Points of The Chapter: Errors Causing Disagreement of Trial BalanceArham RajpootОценок пока нет

- FAR.2806-PPE Depn.Документ4 страницыFAR.2806-PPE Depn.Kristian ArdoñaОценок пока нет

- Income Statement and Balance Sheet - Handout 4AДокумент10 страницIncome Statement and Balance Sheet - Handout 4AsakthiОценок пока нет

- Magazine Publishing Business PlanДокумент60 страницMagazine Publishing Business PlanChuck Achberger100% (4)

- Class PPT DesignsДокумент78 страницClass PPT DesignsZubairОценок пока нет

- AEON - AR2021 (Part 4)Документ66 страницAEON - AR2021 (Part 4)SITI NAJIBAH BINTI MOHD NORОценок пока нет

- Accoting Process AssignmentДокумент8 страницAccoting Process Assignmentpramod Kumar0% (4)

- Professionalism Skills For Workplace Success 3rd Edition Anderson Test BankДокумент12 страницProfessionalism Skills For Workplace Success 3rd Edition Anderson Test BankMichaelGarciamwpge100% (18)

- Acc101 RevCh1 3 PDFДокумент29 страницAcc101 RevCh1 3 PDFWaqar AliОценок пока нет

- Correction of ErrorДокумент1 страницаCorrection of ErrorElmer JuanОценок пока нет

- Annual Report 2 0 0 1 - 2 0 0 2: Relaxo Footwears LimitedДокумент51 страницаAnnual Report 2 0 0 1 - 2 0 0 2: Relaxo Footwears LimitedSeerat JangdaОценок пока нет

- This Study Resource Was: UP Junior Philippine Institute of Accountants Education and Research CommitteeДокумент7 страницThis Study Resource Was: UP Junior Philippine Institute of Accountants Education and Research CommitteeGervinBulataoОценок пока нет

- Classification of Elements: Overheads - Accounting and ControlДокумент11 страницClassification of Elements: Overheads - Accounting and ControlAyushi GuptaОценок пока нет

- Mess Expense SheetДокумент13 страницMess Expense SheetMuhammad rehan baigОценок пока нет