Академический Документы

Профессиональный Документы

Культура Документы

FM - Chapter 26

Загружено:

Amit SukhaniАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

FM - Chapter 26

Загружено:

Amit SukhaniАвторское право:

Доступные форматы

CHAPTER 26

FINANCIAL PLANNING AND STRATEGY

Q.1.

A.1.

What is a financial planning? How does it differ from financial forecasting?

The process of estimating the funds requirements of a firm; to finance its current and fixed assets

to meet the expected growth in business; and determining the sources of funds is called financial

planning. Financial forecasting is an integral part of financial planning. Forecasting uses past

data to estimate the future financial requirements.

Forecasts are merely estimates based on the past data; planning means what a company

would like to happen in the future, and includes necessary action plans for realizing the

predetermined intensions. Financial planning is a means for achievement of growth and

profitability objectives by making planned investment and financing decisions.

Q.2.

Explain the steps involved in preparing a financial plan. What are the merits of a financial

planning?

The following steps are involved in preparing a financial plan.

(1) Analyse the firms past performance and establish relationships between financial

variables.

(2) Analyse the firms strength with respect to operating characteristics, like product, market

competition, production and operating risks.

(3) Workout the firms investment needs and its capacity to generate cash flows from

operations.

(4) Also workout the appropriate means to raise the external funds, based on investment and

dividend policies; and also the long-term financial health and survival plan.

Financial planning supports the management to ascertain the need of assets to sustain the

higher growth in sales, by taking proper investment and financing decision, based on long-term

projections (normally of three or five years).

A.2.

Q.3.

A.3.

Is there a relationship between strategic planning and financial planning? Explain.

Financial planning of a company has close links with strategic planning. Strategic planning

considers all markets, including product, labour and capital, as imperfect and changing.

Strategies are developed to manage the business firm in uncertain and imperfect market

conditions and environment and exploit opportunities. The companys strategy establishes an

effective and efficient match between its resources, opportunities and risks. Firms develop

financial plan within the overall framework of strategic plan.

Q.4.

What is a financial model? Illustrate the development of a simple financial model. What are the

advantages and limitations of a financial model?

A financial planning model establishes the relationship between financial variables and targets,

and facilitates the financial forecasting and planning process. A model makes it easy for the

financial managers to prepare financial forecasts. It makes financial forecasting automatic and

saves the financial managers time and efforts in performing a tedious activity. Financial

planning models help in examining the consequences of alternative financial strategies. A

financial planning model has three components Inputs, Model and Output.

A.4.

Q.5.

A.5.

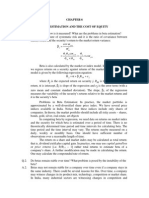

What is meant by sustainable growth? Explain sustainable growth models with illustrations.

Sustainable growth may be defined as the annual percentage growth in sales that is consistent

with the firms financial policies (assuming no issue of fresh equity). The following model can

be used to determine the sustainable growth (gs) in sales:

net margin retention leverage

sustainable growth =

assets - to - sales (net margin retention leverage)

The net asset to sales ratio determines the requirement of funds for investing in assets to

support a given level of sales. The requirement for funds would increase with expanding sales.

The net profit minus the dividends is an internal source of funds. Thus, the product of net profit

to sales ratio and retained profit to net profit (net margin retention ratio) gives an idea of the

funds available internally to support the growth of the firm. Retained earnings increase the debt

raising capacity of the firm. Thus, given the target capital structure, the total funds would be

equal to retained earnings plus debt supported by the retained earnings. Net assets or capital

employed (viz., debt plus equity) to equity is a leverage measure, and is equal to one plus debt

equity ratio. Suppose the following information for a firm: PAT = Rs 100; Sales = Rs 5,000;

dividends = Rs 400; NA= Debt + NW (equity) = Rs 2,500; NW = Rs 1,250. The sustainable

growth is:

100/5000 60/100 2500/1250

2500/5000 (100/5000 60/100 2500/1250)

0.02 0.6 2

=

= 0.05 = 5%

0.5 (0.02 0.6 2)

sustainable growth =

A more general method of determining the sustainable growth rate in the case of multiproduct or multi-division company is to calculate the sustainable growth rate at the corporate

level in terms of growth in assets.

Sustainable growth = asset turnover profit margin income leverage

retention ratio financial leverage

S PBIT PAT RE NA

gs =

NA

S

PBIT PAT NW

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Visual AnalysisДокумент4 страницыVisual Analysisapi-35602981850% (2)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- 5E Lesson PlanДокумент3 страницы5E Lesson PlanSangteablacky 09100% (8)

- Nature of Financial ManagementДокумент3 страницыNature of Financial ManagementDurga Prasad100% (6)

- Method Statement Soil NailedДокумент2 страницыMethod Statement Soil NailedFa DylaОценок пока нет

- FM - Chapter 32Документ5 страницFM - Chapter 32Amit SukhaniОценок пока нет

- FM - Chapter 32Документ5 страницFM - Chapter 32Amit SukhaniОценок пока нет

- FM - Chapter 6Документ2 страницыFM - Chapter 6Amit SukhaniОценок пока нет

- FM - Chapter 26Документ2 страницыFM - Chapter 26Amit SukhaniОценок пока нет

- FM - Chapter 33Документ3 страницыFM - Chapter 33Amit SukhaniОценок пока нет

- FM - Chapter 30Документ5 страницFM - Chapter 30Amit SukhaniОценок пока нет

- FM - Chapter 28Документ5 страницFM - Chapter 28Amit SukhaniОценок пока нет

- Chapter 27 of FMДокумент12 страницChapter 27 of FMAsfi Abbasi100% (1)

- FM - Chapter 29Документ6 страницFM - Chapter 29Amit Sukhani100% (3)

- FM - Chapter 34Документ7 страницFM - Chapter 34Amit SukhaniОценок пока нет

- FM - Chapter 31Документ2 страницыFM - Chapter 31Amit SukhaniОценок пока нет

- Capital StructureДокумент21 страницаCapital StructureAmit SukhaniОценок пока нет

- FM - Chapter 35Документ4 страницыFM - Chapter 35Amit SukhaniОценок пока нет

- Capital Market Theory ChapterДокумент3 страницыCapital Market Theory ChapterAmit SukhaniОценок пока нет

- FM QuestionsДокумент73 страницыFM QuestionsPOOONIASAUMYAОценок пока нет

- Time Value of MoneyДокумент15 страницTime Value of MoneytamtradeОценок пока нет

- Study of Storm and Sewer Drains For Rajarhat (Ward No 4) in West Bengal Using Sewergems SoftwareДокумент47 страницStudy of Storm and Sewer Drains For Rajarhat (Ward No 4) in West Bengal Using Sewergems SoftwareRuben Dario Posada BОценок пока нет

- The Apostolic Church, Ghana English Assembly - Koforidua District Topic: Equipping The Saints For The MinistryДокумент2 страницыThe Apostolic Church, Ghana English Assembly - Koforidua District Topic: Equipping The Saints For The MinistryOfosu AnimОценок пока нет

- MCQ CH 5-Electricity and Magnetism SL Level: (30 Marks)Документ11 страницMCQ CH 5-Electricity and Magnetism SL Level: (30 Marks)Hiya ShahОценок пока нет

- Portfolio HistoryДокумент8 страницPortfolio Historyshubham singhОценок пока нет

- BiblicalДокумент413 страницBiblicalMichael DiazОценок пока нет

- Student Worksheet 8BДокумент8 страницStudent Worksheet 8BLatomeОценок пока нет

- Deforestation Contributes To Global Warming: Bruno GERVETДокумент11 страницDeforestation Contributes To Global Warming: Bruno GERVETMajid JatoiОценок пока нет

- Superstitious Beliefs of MaranaoДокумент13 страницSuperstitious Beliefs of MaranaoKhent Ives Acuno SudariaОценок пока нет

- JKFBDДокумент2 страницыJKFBDGustinarsari Dewi WОценок пока нет

- How to use fireworks displays at Indian weddings to create magical memoriesДокумент3 страницыHow to use fireworks displays at Indian weddings to create magical memoriesChitra NarayananОценок пока нет

- Lumafusion Shortcuts LandscapeДокумент2 страницыLumafusion Shortcuts Landscapepocho clashОценок пока нет

- Midterm Exam ADM3350 Summer 2022 PDFДокумент7 страницMidterm Exam ADM3350 Summer 2022 PDFHan ZhongОценок пока нет

- Spain Usa ExtraditionДокумент2 страницыSpain Usa ExtraditionAdrian BirdeaОценок пока нет

- KINGS OF TURKS - TURKISH ROYALTY Descent-LinesДокумент8 страницKINGS OF TURKS - TURKISH ROYALTY Descent-Linesaykutovski100% (1)

- Compiled May 5, 2017 Case DigestДокумент16 страницCompiled May 5, 2017 Case DigestGrace CastilloОценок пока нет

- Terrestrial EcosystemДокумент13 страницTerrestrial Ecosystemailene burceОценок пока нет

- Bach Invention No9 in F Minor - pdf845725625Документ2 страницыBach Invention No9 in F Minor - pdf845725625ArocatrumpetОценок пока нет

- Apple Mango Buche'es Business PlanДокумент51 страницаApple Mango Buche'es Business PlanTyron MenesesОценок пока нет

- Explore the rules and history of American football and basketballДокумент2 страницыExplore the rules and history of American football and basketballAndrei IoneanuОценок пока нет

- Epitalon, An Anti-Aging Serum Proven To WorkДокумент39 страницEpitalon, An Anti-Aging Serum Proven To Workonæss100% (1)

- Size, Scale and Overall Proportion of Form, Basic Understanding of Various Shapes, Inter-Relationship of Visual FormsДокумент17 страницSize, Scale and Overall Proportion of Form, Basic Understanding of Various Shapes, Inter-Relationship of Visual FormsJabbar AljanabyОценок пока нет

- Molly C. Dwyer Clerk of CourtДокумент3 страницыMolly C. Dwyer Clerk of CourtL. A. PatersonОценок пока нет

- Easy Gluten Free RecipesДокумент90 страницEasy Gluten Free RecipesBrandon Schmid100% (1)

- Zeal Study 10th English Synonym Unit 1 - 7Документ24 страницыZeal Study 10th English Synonym Unit 1 - 7viaanenterprises2008Оценок пока нет

- Reaction PaperДокумент1 страницаReaction Papermarvin125Оценок пока нет

- Business Plan Presentation ON Air Conditioner: Presented By-V.Sowmith REG NO-2121BM010112Документ16 страницBusiness Plan Presentation ON Air Conditioner: Presented By-V.Sowmith REG NO-2121BM010112Kavya Madanu100% (1)