Академический Документы

Профессиональный Документы

Культура Документы

Allowable Deduction by Industry

Загружено:

Anonymous XvwKtnSrMRАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Allowable Deduction by Industry

Загружено:

Anonymous XvwKtnSrMRАвторское право:

Доступные форматы

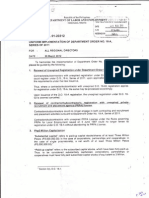

CLARK FREEPORT ZONE

Investors Guide - 03

ALLOWABLE DEDUCTIONS BY INDUSTRY

Gross Income Earned (GIE)

shall refer to gross sales or

gross revenues derived from business activities within the subject

Ecozone or Freeport, net of sales discounts, sales returns and

allowances minus cost of sales or direct costs but before any deduction

for administrative, marketing, selling, and/or operating expenses or

incidental losses during a given taxable year. Provided, that, in the

case of financial enterprises within Freeports, gross income shall

include interest income, gains from sales, and other income, net of

costs of funds.

Only the following cost of sales/direct cost shall be allowed as

deductions for purposes of calculating the GIE earned for the following

Ecozone or Freeport Enterprises/industries, to wit:

TRADING ENTERPRISES

Costs of Sales (beginning inventory plus purchases,

minus ending inventory of goods).

MANUFACTURING ENTERPRISES

Direct salaries, wages, or labor expenses, inclusive of

training directly related to the registered activity;

Production supervision salaries

Raw materials used in the manufacture of products;

Decrease in goods in process account (intermediate

goods);

Decrease in finished goods account;

Supplies and fuels used in production;

Depreciation of machinery and equipment used in

production, and of that portion of the building owned or

constructed by the registered enterprise that is used

exclusively in the production of goods;

Rent and utility charges associated with building,

equipment and warehouses used in production; and

Note: Allowable Deductions by Industry was obtained from Dept. of Finance (DOF) Dept.

Order No. 3-08

RULES AND REGULATIONS TO IMPLEMENT R.A. 9400

CLARK FREEPORT ZONE

Investors Guide - 03

Financing charges associated with fixed assets used in

production, the amount of which was not previously

capitalized.

SERVICE ENTERPRISES

Direct salaries, wages, or labor expenses, inclusive of

training directly related to the registered activity;

Service supervision salaries;

Direct materials, supplied used;

Depreciation of machinery, equipment used in the

rendition of registered services, and of that portion of

the building owned or constructed by the registered

enterprise that is used exclusively in the rendition of the

registered service;

Rent and utility charges for buildings and capital

equipment used in the rendition of registered services;

Financing charges associated with fixed assets used in

the registered service business the amount of which

was not previously capitalized.

FINANCIAL INSTITUTIONS

None

NOTE:

For purposes of implementing the 5% tax on Gross Income Earned, in

lieu of national and local taxes, granted to PEZA Ecozone Enterprises in

CSEZ, CFZ, MSEZ and JHSEZ, the relevant provisions of R. A. No. 7916,

its implementing Rules and Regulations, Circulars, Memoranda of

Agreement with other government agencies, and all other relevant

issuances of PEZA and of other government agencies relative to the

implementation of the tax incentives under R. A. 7916, shall apply.

Payment and Remittance of the 5% Tax on Gross

Income Earned

The 5% Tax on Gross Income Earned shall be paid and remitted by

Ecozone Enterprises and Freeport Enterprises as follows;

Note: Allowable Deductions by Industry was obtained from Dept. of Finance (DOF) Dept.

Order No. 3-08

RULES AND REGULATIONS TO IMPLEMENT R.A. 9400

CLARK FREEPORT ZONE

Investors Guide - 03

a) 3% to the National Government

b) 2% to the Local Government Units (LGUs) through the

Treasurers Office of the Municipality or City where the

Ecozone Enterprise or Freeport Enterprise is located.

Note: Allowable Deductions by Industry was obtained from Dept. of Finance (DOF) Dept.

Order No. 3-08

RULES AND REGULATIONS TO IMPLEMENT R.A. 9400

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- DO 18-A Uniform ImplementationДокумент3 страницыDO 18-A Uniform ImplementationAl BaljonОценок пока нет

- FAQs On CARPДокумент15 страницFAQs On CARPMichelleOgatisОценок пока нет

- Magna Financial v. ColarinaДокумент3 страницыMagna Financial v. ColarinaAnonymous XvwKtnSrMR100% (1)

- Simex v. CAДокумент3 страницыSimex v. CAAnonymous XvwKtnSrMRОценок пока нет

- Onapal v. CA FPIB v. CAДокумент5 страницOnapal v. CA FPIB v. CAAnonymous XvwKtnSrMR0% (1)

- Inter-Country Adoption ReportДокумент8 страницInter-Country Adoption ReportAnonymous XvwKtnSrMRОценок пока нет

- Salcedo v. ComelecДокумент4 страницыSalcedo v. ComelecAnonymous XvwKtnSrMRОценок пока нет

- Comparison of Laws On IncentivesДокумент28 страницComparison of Laws On IncentivesAnonymous XvwKtnSrMRОценок пока нет

- Handbook of Statutory Monetary Benefits 2016 PDFДокумент75 страницHandbook of Statutory Monetary Benefits 2016 PDFAnonymous XvwKtnSrMRОценок пока нет

- PNB v. PinedaДокумент3 страницыPNB v. PinedaAnonymous XvwKtnSrMRОценок пока нет

- Cosare v. BroadcomДокумент4 страницыCosare v. BroadcomAnonymous XvwKtnSrMRОценок пока нет

- Merrill v. CAДокумент2 страницыMerrill v. CAAnonymous XvwKtnSrMR50% (2)

- Memo On Uniform Implementation of DO 174Документ3 страницыMemo On Uniform Implementation of DO 174Anonymous XvwKtnSrMR100% (2)

- Candijay v. CAДокумент2 страницыCandijay v. CAAnonymous XvwKtnSrMRОценок пока нет

- People v. CarantoДокумент4 страницыPeople v. CarantoAnonymous XvwKtnSrMR100% (1)

- Alhambra Cigar v. SECДокумент3 страницыAlhambra Cigar v. SECAnonymous XvwKtnSrMRОценок пока нет

- Salcedo v. ComelecДокумент4 страницыSalcedo v. ComelecAnonymous XvwKtnSrMRОценок пока нет

- Integrated Realty V CAДокумент3 страницыIntegrated Realty V CAAnonymous XvwKtnSrMRОценок пока нет

- CBC vs. CAДокумент2 страницыCBC vs. CAAnonymous XvwKtnSrMRОценок пока нет

- CSC V BelaganДокумент3 страницыCSC V BelaganAnonymous XvwKtnSrMRОценок пока нет

- Marohombsar v. AlontoДокумент2 страницыMarohombsar v. AlontoAnonymous XvwKtnSrMRОценок пока нет

- Nieva v. Alvarez-EdadДокумент2 страницыNieva v. Alvarez-EdadAnonymous XvwKtnSrMRОценок пока нет

- Hassan v. ComelecДокумент2 страницыHassan v. ComelecAnonymous XvwKtnSrMRОценок пока нет

- Union Bank vs. CIRДокумент6 страницUnion Bank vs. CIRAnonymous XvwKtnSrMRОценок пока нет

- Iglesia Evangelica v. Bishop LazaroДокумент3 страницыIglesia Evangelica v. Bishop LazaroAnonymous XvwKtnSrMR100% (1)

- ICC Elements of Crimes PDFДокумент50 страницICC Elements of Crimes PDFKaye de LeonОценок пока нет

- Case Concerning Oil Platforms (Iran V US)Документ9 страницCase Concerning Oil Platforms (Iran V US)Anonymous XvwKtnSrMRОценок пока нет

- Tax Syllabus (Spit) 2015Документ15 страницTax Syllabus (Spit) 2015Anonymous XvwKtnSrMRОценок пока нет

- Basic Rules of The Geneva Conventions and Their Additional ProtocolsДокумент32 страницыBasic Rules of The Geneva Conventions and Their Additional ProtocolsInternational Committee of the Red Cross100% (1)

- Compiled Digests Letters of CreditДокумент9 страницCompiled Digests Letters of CreditAnonymous XvwKtnSrMRОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (120)

- Feb 1Документ1 страницаFeb 1vishnuvardhan reddyОценок пока нет

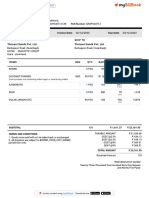

- MR Sharanabasappa Hosamani 01386452: Sap Labs India Pvt. LTDДокумент1 страницаMR Sharanabasappa Hosamani 01386452: Sap Labs India Pvt. LTDSharanu HosamaniОценок пока нет

- 1-Sales - Invoice-Thriveni Sainik PVT LTDДокумент1 страница1-Sales - Invoice-Thriveni Sainik PVT LTDdavidraj172122Оценок пока нет

- Name: Jhunard C. Bamuya Abm-12-B Activity 1. Solve For The Elements of Comprehensive Income For The FollowingДокумент2 страницыName: Jhunard C. Bamuya Abm-12-B Activity 1. Solve For The Elements of Comprehensive Income For The FollowingIrish C. BamuyaОценок пока нет

- GST Search Dimensions Original ArticleДокумент17 страницGST Search Dimensions Original Articleratneet_dhaliwalОценок пока нет

- PIN Certificate: This Is To Certify That Taxpayer Shown Herein Has Been Registered With Kenya Revenue AuthorityДокумент1 страницаPIN Certificate: This Is To Certify That Taxpayer Shown Herein Has Been Registered With Kenya Revenue AuthorityFelix BrianОценок пока нет

- EITCДокумент2 страницыEITCrobertwiblinОценок пока нет

- Xpress Bees: COD: Collect Amount Rs 1297Документ1 страницаXpress Bees: COD: Collect Amount Rs 1297Yash KashyapОценок пока нет

- Multilateral Instrument (Mli) ConventionДокумент8 страницMultilateral Instrument (Mli) ConventionTaxpert Professionals Private LimitedОценок пока нет

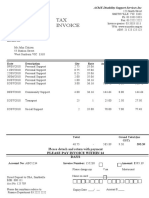

- Sample Invoice For Service ProvidersДокумент2 страницыSample Invoice For Service Providers? New Emoji CharacterОценок пока нет

- Revenue Memorandum Order No. 34-01Документ8 страницRevenue Memorandum Order No. 34-01johnnayelОценок пока нет

- TAX SITUS-It Is The Place or Authority That Has The Right To Impose and Collect TaxesДокумент58 страницTAX SITUS-It Is The Place or Authority That Has The Right To Impose and Collect TaxesTJ Julian BaltazarОценок пока нет

- Pascual V CIRДокумент4 страницыPascual V CIRFlorence UdaОценок пока нет

- 01 Chap 14 RosenДокумент64 страницы01 Chap 14 RosenSagar ChowdhuryОценок пока нет

- Revenue Memorandum Circulars PDFДокумент90 страницRevenue Memorandum Circulars PDFJewellrie Dela CruzОценок пока нет

- Reimbursement Expense Receipt (RER)Документ1 страницаReimbursement Expense Receipt (RER)JoemarAlcantaraBueno100% (3)

- 1600 August 2022Документ1 страница1600 August 2022Analyn DomingoОценок пока нет

- F6mys 2017 Sept Dec QДокумент12 страницF6mys 2017 Sept Dec QMuhammad ZabhaОценок пока нет

- EO No. 157 s.2021 - RPT Reduction and Condonation - CY 2021Документ2 страницыEO No. 157 s.2021 - RPT Reduction and Condonation - CY 2021AnneОценок пока нет

- Tax Configuration - FIДокумент5 страницTax Configuration - FIatlanta00100% (1)

- Treaty-Based Return Position Disclosure Under Section 6114 or 7701 (B)Документ5 страницTreaty-Based Return Position Disclosure Under Section 6114 or 7701 (B)Mohammed Ziaur RahamanОценок пока нет

- Kendriya Vidyalaya: Bulandshahar: Near Numaise Ground, Bulandshahar (U.P.) - 203001Документ10 страницKendriya Vidyalaya: Bulandshahar: Near Numaise Ground, Bulandshahar (U.P.) - 203001Nihit SandОценок пока нет

- Benefit Illustration: UIN: 104N116V04 Page 1 of 2Документ2 страницыBenefit Illustration: UIN: 104N116V04 Page 1 of 2vivek0955158Оценок пока нет

- Accounting - UCO Bank - Assignment4Документ1 страницаAccounting - UCO Bank - Assignment4KummОценок пока нет

- 085 Invoice Goli SodaДокумент1 страница085 Invoice Goli SodawarehouseОценок пока нет

- 74 Filipinas Life Assurance Co. v. CTAДокумент12 страниц74 Filipinas Life Assurance Co. v. CTACharles MagistradoОценок пока нет

- قراءة نظرية في الضريبة على الأجور والمرتبات في التشريع الجزائريДокумент19 страницقراءة نظرية في الضريبة على الأجور والمرتبات في التشريع الجزائريAhlam Halima BenОценок пока нет

- Billions Worth of Indian Wealth in Swiss Banks'Документ2 страницыBillions Worth of Indian Wealth in Swiss Banks'rvaidya2000Оценок пока нет

- Problem Set - Deferred TaxesДокумент2 страницыProblem Set - Deferred TaxeslykaОценок пока нет

- Manajemen SNДокумент3 страницыManajemen SNDWI ANDINIОценок пока нет