Академический Документы

Профессиональный Документы

Культура Документы

ACA Principles of Tax Expenses Notes

Загружено:

wguateАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

ACA Principles of Tax Expenses Notes

Загружено:

wguateАвторское право:

Доступные форматы

Expenditure is generally allowable if it is incurred wholly and exclusively for the

purposes of the trade.

Capital expenditure, appropriation of profit, general provisions, non-trade debts, most

entertaining and gifts, and fine and penalties are disallowable.

Some expenditure is specifically allowable such as legal costs on the renewal of a short

lease.

Leasing costs on cars with high emissions are restricted.

Capital expenditure

Capital expenditure is disallowable, however repairs (returning asset to its original

condition) and maintenance (e.g. redecoration) are allowable. Depreciation is also

disallowable as are any (profits/losses on the sale of fixed assets, thus for tax purposes

they are (deducted)/added back to net profit in the accounts.

General provisions

I.e. general provision for bad debt or stock.

The creation of, or increase in, a general provision is disallowable and must be added back

to the accounting profit. Conversely, a decrease must be deducted from accounting profit.

The creation of, increase in a specific provision e.g. relating to a specific debt is allowable

and requires no adjustment.

Bad debts

Trade bad debts are allowable however, non-trade bad debts are disallowable. This would

include loans to employees unless either made in the course of trade or if the write off is

taxable as employment income for the employee.

Entertainment and gifts

Gifts to employees are allowable. Gifts to customers are only allowable if:

they cost less than 50 per person per year

the gift is not food, drink, tobacco or vouchers exchangeable for goods or services

the gift carries a conspicuous advertisement for the business.

Donations and subscriptions

Trade or professional association subscriptions are allowable.

Charitable donations (not made under gift aid) are allowable:

-

if it is wholly and exclusively for trading purposes (e.g. promotion business name),

and it is to a local charity then it is allowable

national charity/political donations are not allowable

Any charitable donations made within the Gift Aid Scheme are given tax relief in the

income tax computation by extending the tax papers basic rate band. To ensure that tax

relief is not given for these donations twice, any donations made with a Gift Aid

declaration are disallowed in arriving at trading profits and must be added back to net

profit.

Fines and penalties

Disallowed unless the fine is paid on behalf of an employee and incurred whilst on business

e.g. employee parking.

Interest

Interest paid on overdue tax is not deductible and interest received on overpaid tax is not

taxable.

Interest paid on money borrowed for business purposes is allowable.

Legal and professional fees

Allowable if connected with trade and are not related to capital items. Specifically

allowed by statute

- costs of obtaining loan finance

- cost of renewing a short lease (50 years or less)

- cost of defending title to an asset (patent/copyright)

Irrecoverable VAT

Irrecoverable VAT is allowable for trading purposes only if the item of expenditure to

which it relates is allowable.

Employment patents and pensions

Earnings paid to employees are generally allowable. If earnings are charged in the

accounts but not paid within nine months of the end of the period of account, the cost is

only allowable in the period in which the earnings are paid.

Redundancy payments and compensation for loss of office are generally allowable.

However, on the cessation of trade, the deduction is restricted to additional payments of

up to three times the amount of statutory redundancy pay.

The cost of education courses for employees is allowed if incurred for trade purposes.

Employers contributions to a registered pension scheme are allowable in the accounting

period of payment, not when accrued.

Payments of employers national insurance contributions in respect of employees are

allowable.

Car leasing and rental costs

In principle, the costs of hiring, leasing or renting plant and equipment are allowable.

However for leases taken out on cars (not motorcycles) a flat rate disallowance of 15% of

the lease payments applies for cars with CO2 emissions above 160g/km for leases take out

prior to 6 April 2013 (1 April for companies) and for cars with CO2 emissions above

130g/km for leases taken out on or after 6 April 2013 (1 April for companies). Thus from 6

April 2013 there is no disallowance if CO2 emissions are less than or equal to 130g/km.

If the sole trader or partner then uses the leased car partly for business and partly for

private purposes a further adjustment would be required to disallow the private usage of

the leased car.

Вам также может понравиться

- CAPITAL GAINS TAXДокумент6 страницCAPITAL GAINS TAXMuskanDodejaОценок пока нет

- Direct Tax Code: Kunal Vora Bhavik BhanderiДокумент11 страницDirect Tax Code: Kunal Vora Bhavik BhanderiBhavik BhanderiОценок пока нет

- Short-Life AssetsДокумент5 страницShort-Life AssetssupriyoОценок пока нет

- Taxation fringe benefits ZimbabweДокумент5 страницTaxation fringe benefits ZimbabweTawanda Tatenda HerbertОценок пока нет

- Tax by Shivin VargheseДокумент5 страницTax by Shivin VargheseManu VargheseОценок пока нет

- Taxation All NotesДокумент429 страницTaxation All NotesBryson Musembi0% (1)

- Business Income SummaryДокумент3 страницыBusiness Income SummaryShivani JatakiyaОценок пока нет

- Analysis Group 4Документ5 страницAnalysis Group 4Clarise DatayloОценок пока нет

- P6MYS AnsДокумент12 страницP6MYS AnsLi HYu ClfEiОценок пока нет

- A Quick Revision For NET/GSET Examination Prepared By-Anuj Bhatia Assistant Professor, Anand Institute of Business Studies ContactДокумент26 страницA Quick Revision For NET/GSET Examination Prepared By-Anuj Bhatia Assistant Professor, Anand Institute of Business Studies ContactPankaj KhindriaОценок пока нет

- Income Tax - Chap 07Документ6 страницIncome Tax - Chap 07ZainioОценок пока нет

- South African Tax Thesis TopicsДокумент6 страницSouth African Tax Thesis Topicsdnr68wp2100% (2)

- Business Tax DeductionsДокумент4 страницыBusiness Tax DeductionsGab VillahermosaОценок пока нет

- Allowable Deductible Expenses in The PhilippinesДокумент2 страницыAllowable Deductible Expenses in The PhilippinesmtscoОценок пока нет

- Chapter 13 AДокумент22 страницыChapter 13 AAdmОценок пока нет

- FAQ For PIC and Cash GrantДокумент4 страницыFAQ For PIC and Cash GrantSathis KumarОценок пока нет

- Chapter 10 Deduction From The Gross IncomeДокумент4 страницыChapter 10 Deduction From The Gross IncomemyblnbonifacioОценок пока нет

- Taxation in Companies-Module IIIДокумент10 страницTaxation in Companies-Module IIIlathaharihimaОценок пока нет

- Income Tax BotswanaДокумент15 страницIncome Tax BotswanaFrancisОценок пока нет

- Temporary Differences (Result in Deferred Taxes) :: Royalties Received in AdvanceДокумент41 страницаTemporary Differences (Result in Deferred Taxes) :: Royalties Received in AdvanceIrfanali Jusab100% (1)

- Allowable Deductions (Prediscussion File)Документ54 страницыAllowable Deductions (Prediscussion File)Chantal Pascual67% (3)

- Tax Planning / Tax Saving Tips For Financial Year 2018-19: Taxguru - In/income-Tax/tax-Planning-Save-Tax - HTMLДокумент7 страницTax Planning / Tax Saving Tips For Financial Year 2018-19: Taxguru - In/income-Tax/tax-Planning-Save-Tax - HTMLmansiОценок пока нет

- Business Tax Laws (Phils)Документ15 страницBusiness Tax Laws (Phils)Jean TanОценок пока нет

- Guidance For Claiming ExpensesДокумент5 страницGuidance For Claiming Expensesrekha_angurajОценок пока нет

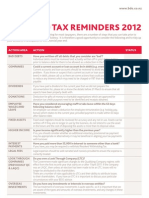

- Year-End Tax Reminders 2012: Action Area Action StatusДокумент2 страницыYear-End Tax Reminders 2012: Action Area Action Statusapi-129279783Оценок пока нет

- Business Tax Laws in The PhilippinesДокумент12 страницBusiness Tax Laws in The PhilippinesEthel Joi Manalac MendozaОценок пока нет

- Buckwold 21e - CH 4 Selected SolutionsДокумент18 страницBuckwold 21e - CH 4 Selected SolutionsLucy50% (2)

- 2023 Tax Deduction Cheat Sheet and LoopholesДокумент24 страницы2023 Tax Deduction Cheat Sheet and LoopholesKrisstian AnyaОценок пока нет

- Final MF0003 2nd AssigДокумент6 страницFinal MF0003 2nd Assignigistwold5192Оценок пока нет

- Limitations: Interest Expense For Passenger Vehicle:$300. Leasing Cost of Passenger Vehicle:$800. Capital Cost of Auto: $30000Документ1 страницаLimitations: Interest Expense For Passenger Vehicle:$300. Leasing Cost of Passenger Vehicle:$800. Capital Cost of Auto: $30000f6linОценок пока нет

- Direct Tax CodeДокумент8 страницDirect Tax CodeImran HassanОценок пока нет

- Cheat Sheet Ac2301Документ3 страницыCheat Sheet Ac2301Christopher OngОценок пока нет

- Taxation of Income From Business or ProfessionДокумент5 страницTaxation of Income From Business or ProfessionKumar NaveenОценок пока нет

- Withholding Tax Guide for Philippines BusinessesДокумент3 страницыWithholding Tax Guide for Philippines BusinessesJera Realyn SabayОценок пока нет

- Withholding Tax Guide for Philippines BusinessesДокумент4 страницыWithholding Tax Guide for Philippines BusinessesJera Realyn SabayОценок пока нет

- Summary of Thailand-Tax-Guide and LawsДокумент34 страницыSummary of Thailand-Tax-Guide and LawsPranav BhatОценок пока нет

- The Income Tax ActДокумент15 страницThe Income Tax ActfbuameОценок пока нет

- PGBPДокумент61 страницаPGBPJyoti Kalotra0% (1)

- JK Lasser's Small Business Taxes 2010: Your Complete Guide to a Better Bottom LineОт EverandJK Lasser's Small Business Taxes 2010: Your Complete Guide to a Better Bottom LineОценок пока нет

- Salary Packaging Information GuideДокумент16 страницSalary Packaging Information GuideShoaib KhanОценок пока нет

- R2 NotesДокумент15 страницR2 NotesAmar Guli100% (2)

- LLPs Offer Limited Liability for PartnersДокумент5 страницLLPs Offer Limited Liability for PartnersGiancarlo CobinoОценок пока нет

- How To Calculate Your Taxable Profits: Helpsheet 222Документ14 страницHow To Calculate Your Taxable Profits: Helpsheet 222subtle69Оценок пока нет

- Expenses and Benefits GuideДокумент3 страницыExpenses and Benefits GuidetalupurumОценок пока нет

- Deloitte Tax Pocket Guide 2014Документ20 страницDeloitte Tax Pocket Guide 2014YHОценок пока нет

- Acc212 Handout:: Midlands State University Department of AccountingДокумент23 страницыAcc212 Handout:: Midlands State University Department of AccountingPhebieon MukwenhaОценок пока нет

- Adjustments For Agi - "Above The Line" Deductions - Deductions To Arrive at AgiДокумент47 страницAdjustments For Agi - "Above The Line" Deductions - Deductions To Arrive at Agiesoniat51Оценок пока нет

- 132.tax On Dividends - FDD.02.25.10 PDFДокумент3 страницы132.tax On Dividends - FDD.02.25.10 PDFKarla BarbacenaОценок пока нет

- Income Tax QuestionsДокумент2 страницыIncome Tax QuestionsSanthosh PanickerОценок пока нет

- Module 13 Regular Deductions 3Документ16 страницModule 13 Regular Deductions 3Donna Mae FernandezОценок пока нет

- Taxation General RulesДокумент7 страницTaxation General RulesAnurag BhardwajОценок пока нет

- CWC Tax PresentationДокумент61 страницаCWC Tax PresentationRajani AthanimathОценок пока нет

- Quick Notes on “The Trump Tax Cut: Your Personal Guide to the New Tax Law by Eva Rosenberg”От EverandQuick Notes on “The Trump Tax Cut: Your Personal Guide to the New Tax Law by Eva Rosenberg”Оценок пока нет

- Tax Midterm PrepДокумент28 страницTax Midterm PrepDhruv MehtaОценок пока нет

- Taxation - Allowable Business DeductionsДокумент51 страницаTaxation - Allowable Business DeductionsHannah OrosОценок пока нет

- Introduction To Mass Communication Solved MCQs (Set-3)Документ5 страницIntroduction To Mass Communication Solved MCQs (Set-3)Abdul karim MagsiОценок пока нет

- CFA三级百题 答案Документ163 страницыCFA三级百题 答案vxm9pctmrrОценок пока нет

- Intertrigo and Secondary Skin InfectionsДокумент5 страницIntertrigo and Secondary Skin Infectionskhalizamaulina100% (1)

- CL Commands IVДокумент626 страницCL Commands IVapi-3800226100% (2)

- Data Report Northside19Документ3 страницыData Report Northside19api-456796301Оценок пока нет

- Minotaur Transformation by LionWarrior (Script)Документ7 страницMinotaur Transformation by LionWarrior (Script)Arnt van HeldenОценок пока нет

- Cultural Briefing: Doing Business in Oman and the UAEДокумент2 страницыCultural Briefing: Doing Business in Oman and the UAEAYA707Оценок пока нет

- Crypt of Cthulhu 49 1987 Cosmic-JukeboxДокумент71 страницаCrypt of Cthulhu 49 1987 Cosmic-JukeboxNushTheEternal100% (3)

- Review For Development of Hydraulic Excavator Attachment: YANG Cheng Huang Kui LI Yinwu WANG Jingchun ZHOU MengДокумент5 страницReview For Development of Hydraulic Excavator Attachment: YANG Cheng Huang Kui LI Yinwu WANG Jingchun ZHOU MengZuhaib ShaikhОценок пока нет

- Ramesh Dargond Shine Commerce Classes NotesДокумент11 страницRamesh Dargond Shine Commerce Classes NotesRajath KumarОценок пока нет

- Bluetooth® (SAP) Telephone Module, Version 4Документ2 страницыBluetooth® (SAP) Telephone Module, Version 4Željko BokanovićОценок пока нет

- Design and Implementation of Land and Property Ownership Management System in Urban AreasДокумент82 страницыDesign and Implementation of Land and Property Ownership Management System in Urban AreasugochukwuОценок пока нет

- 02-Procedures & DocumentationДокумент29 страниц02-Procedures & DocumentationIYAMUREMYE EMMANUELОценок пока нет

- Understanding key abdominal anatomy termsДокумент125 страницUnderstanding key abdominal anatomy termscassandroskomplexОценок пока нет

- Write The Missing Words of The Verb To Be (Affirmative Form)Документ1 страницаWrite The Missing Words of The Verb To Be (Affirmative Form)Daa NnaОценок пока нет

- 13 Years of Unremitting Tracking of Chinese Scientists To Find The Source of SARS Virus - NewsДокумент14 страниц13 Years of Unremitting Tracking of Chinese Scientists To Find The Source of SARS Virus - NewsWillSmathОценок пока нет

- Resume John BunkerДокумент8 страницResume John BunkerJohn BunkerОценок пока нет

- PDF To Sas DatasetsДокумент6 страницPDF To Sas DatasetsSiri KothaОценок пока нет

- E GCOct 2013 NsДокумент0 страницE GCOct 2013 Nsvae2797Оценок пока нет

- Motivate! 2 End-Of-Term Test Standard: Units 1-3Документ6 страницMotivate! 2 End-Of-Term Test Standard: Units 1-3Oum Vibol SatyaОценок пока нет

- Managerial Accounting 12th Edition Warren Test Bank DownloadДокумент98 страницManagerial Accounting 12th Edition Warren Test Bank DownloadRose Speers100% (21)

- 5.1 Physical Farming Constraints in Southern CaliforniaДокумент1 страница5.1 Physical Farming Constraints in Southern CaliforniaTom ChiuОценок пока нет

- Isha Hatha Yoga - Program Registration FormДокумент2 страницыIsha Hatha Yoga - Program Registration FormKeyur GadaОценок пока нет

- 5.3.2 Generation of Dislocations: Dislocations in The First Place!Документ2 страницы5.3.2 Generation of Dislocations: Dislocations in The First Place!Shakira ParveenОценок пока нет

- Global GovernanceДокумент20 страницGlobal GovernanceSed LenОценок пока нет

- Sarawak Energy FormДокумент2 страницыSarawak Energy FormIvy TayОценок пока нет

- BRT vs Light Rail Costs: Which is Cheaper to OperateДокумент11 страницBRT vs Light Rail Costs: Which is Cheaper to Operatejas rovelo50% (2)

- Biochemical Aspect of DiarrheaДокумент17 страницBiochemical Aspect of DiarrheaLiz Espinosa0% (1)

- A Study On Effectiveness of Ware Housing System in Flyton XpressДокумент23 страницыA Study On Effectiveness of Ware Housing System in Flyton XpressmaheshОценок пока нет

- IAS 8 Tutorial Question (SS)Документ2 страницыIAS 8 Tutorial Question (SS)Given RefilweОценок пока нет