Академический Документы

Профессиональный Документы

Культура Документы

5 Habbits of Highly Successful Investors

Загружено:

Advisesure.comАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

5 Habbits of Highly Successful Investors

Загружено:

Advisesure.comАвторское право:

Доступные форматы

#5

Habits of

Highly Successful

Investors

I face these challenges

Knowledge

Market is too volatile

Too Many Products

Less Time

Hidden Charges

Too much Information

So What Should I do

# 1 Habit

Investing VS Trading

What I Do

I Trade in shares for short term

returns, which leads to more losses than

profits.

If the share price falls due to negative

change in company fundamentals, I

would not book losses

* Return as on 26 June 2015. Source AdviseSure Research

What should I do

I should invest in shares for a

Long

Term

(Sensex has delivered 11.9%

CAGR in past 5 years*)

I should invest in companies with

track record

good

and recommended by

Best Investment Gurus.

# 2 Habit

Diversification

What I Do

When I get a news, I normally invest most

of my money in one single share

Normally I invest only in Fixed Deposit

and have no investment in any other

product, although I am not happy with the

returns

What should I do

I should ideally invest my money in Bunch

of shares

I should invest in Multiple products

such as shares, mutual funds, bonds, gold

ETFs

# 3 Habit

Follow One Strategy

What I Do

What should I do

I trade on tips given by Many Stock

Market Experts. Incase the price does

not increase, I do not go by stop loss

suggested

It is essential that I follow one single

strategy.

both fundamental

technical experts.

follow

and

It is necessary that I should not rely on

short term tips. Also incase I do invest,

I should strictly adhere to Stop loss

Advised

# 4 Habit

Tax Efficient Investing

What I Do

I dont check tax implications before

Investing in any product.

The returns earned are not enough to

offset my tax liabilities

What should I do

I can do tax efficient investing which will

increase my overall returns by Investing in products with tax free

returns. Or

Investing in products which gives tax

deductions

# 5 Habit

Brokerage Charges

What I Do

What should I do

I pay 0.3% brokerage to my broker on

the trade Amount

You can take service of Brokers with Rs

20 per trade brokerage and save

charges

I dont consider the Commission made

by Agent on Mutual funds

I can save all commissions on Mutual

fund with Offline Mutual fund transaction

Our Offer

Advisory Fees Rs. 365 Per Annum

Customized advise only for you

Regular Review and Rebalancing

Unlimited Long Term Investment Advise

Tax efficient portfolio design

No Minimum investment

Substantial Savings in Commission

( Optional)

Customized , unbiased Wealth Management

@Rs. 1 per day

Our Approach

Right Portfolio

Buy/ Sell

Regular

Monitoring

Risk Profiling

Financial Goals

Knowing-

Knowing-

Risk Capacity- How much

Risk you can afford to take

All Financial Goals of the life

Investment Products right

as per risk profile

With least Brokerage &

Commission

Of Portfolio and Markets

The

Inflation

adjusted

amount required to meet

them

Portfolio

efficient

With Nil hidden costs

Rebalance Investments

when required

Risk Attitude- How much

Risk you want to take

which

is

tax

Financial Management @ Rs 1 per day

Wealth Creation

Advice

Monthly Savings

Advice

Tax Saving

Investments

In case you want to invest

Lump Sum

In case you want to invest On

Monthly basis

In case you want to Make Tax

Saving Investments

Portfolio Restructuring

Advice

Goal Planning

Online

Transaction

If you want to Restructure

your portfolio

In case you want to Plan your

Financial Goals

In case you want to Buy and

Sell any product

Why AdviseSure

Simple & Easy

Our Simple and easy Personal Finance Tools & self-help process, ensures that you take Better control

of your entire Finance in 7 Minutes , to your satisfaction.

Paperless Process

Invest and Manage Online , on a Single Click. No need to Fill boring Physical forms and storing

statements. Manage Your Finance with easy and simple back office..

Multiproduct

We advice on almost all Financial Products except banking accounts. You can transact in all products

through us. Our technology will ensure superior Experience

Cost Effective

We don't Push Products to our Customers Like Agents or Brokers, for commissions or brokerages. You can

continue buying and selling with your current Broker or Agent. However you can also transact through us

at substantial low Cost.

Online Access

You can manage your account from anywhere through multiple support points

AdviseSure Investment Advisors is Indias first only Advise platform where we

help individual, managing personal finance. AdviseSure Investment Advisors is

part of AdviseSure Ventures Private limited. AdviseSure Investment Advisors is a

SEBI registered Investment Advisor and its associate/group company empanelled

with AMFI as a distributor .You can execute transactions with your banker, stock

broker or agent/ financial intermediary . We also offer transaction services

through various associations, at a substantially lesser cost to our clients as

compared to other financial intermediaries, so that you start your financial plan

with AdviseSure Investment Advisors is a safe and secure platform. Our

recommendations rely on historical data. Historical/ past performance is not a

guarantee of future returns. The information and views presented here are

prepared by AdviseSure Investment Advisors. The information contained herein

is based on our analysis and upon sources that we consider reliable. We,

however, do not vouch for the accuracy or the completeness thereof. This

material is for personal information and we are not responsible for any loss

incurred based upon it. This document is solely for the personal information of

the recipient. The investments discussed or recommended here may not be

suitable for all investors. Investors must make their own investment decisions

based on their specific investment objectives and financial position and using

such independent advice, as they believe necessary. While acting upon any

information or analysis mentioned here, investors may please note that neither

AdviseSure Investment Advisors nor any person connected with any associated

companies of AdviseSure Investment Advisors , accepts any liability arising from

the use of this information and views mentioned here. Each recipient of this

document should make such investigations as they deem necessary to arrive at

an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should

consult their own advisors to determine the merits and risks of such an

investment.

AdviseSure Investment Advisors

CORPORATE OFFICE : Level 8, Vibgyor Towers, G Block, C62,Bandra Kurla

Complex, Mumbai 400 098, India

-------------

Website : www.advisesure.com

Email: care@advisesure.com

Вам также может понравиться

- 4 Critical Things Before InvestingДокумент10 страниц4 Critical Things Before InvestingAdvisesure.comОценок пока нет

- Market Secrets: Step-By-Step Guide to Develop Your Financial Freedom - Best Stock Trading Strategies, Complete Explanations, Tips and Finished InstructionsОт EverandMarket Secrets: Step-By-Step Guide to Develop Your Financial Freedom - Best Stock Trading Strategies, Complete Explanations, Tips and Finished InstructionsОценок пока нет

- 3 Reasons Why You Should Avoid FDДокумент10 страниц3 Reasons Why You Should Avoid FDAdvisesure.comОценок пока нет

- How First Time Investor Start Investing in Mutual FundsДокумент12 страницHow First Time Investor Start Investing in Mutual FundsAdvisesure.comОценок пока нет

- Investing for Beginners: How To Be An Intelligent Investor And Make Money On Any MarketОт EverandInvesting for Beginners: How To Be An Intelligent Investor And Make Money On Any MarketРейтинг: 5 из 5 звезд5/5 (44)

- 4 Reasons of Why You Should Invest in SharesДокумент8 страниц4 Reasons of Why You Should Invest in SharesAdvisesure.comОценок пока нет

- Dividend Investing for Beginners: How to Build Your Investment Strategy, Find The Best Dividend Stocks to Buy, and Generate Passive Income: Investing for Beginners, #1От EverandDividend Investing for Beginners: How to Build Your Investment Strategy, Find The Best Dividend Stocks to Buy, and Generate Passive Income: Investing for Beginners, #1Оценок пока нет

- Passive Income Ideas: Opportunities, E-commerce, Earn Money Online, Stocks & InvestmentsОт EverandPassive Income Ideas: Opportunities, E-commerce, Earn Money Online, Stocks & InvestmentsОценок пока нет

- Dividend Investing I Complete Beginner’s Guide to Learn How to Create Passive Income by Trading Dividend Stocks I Start Achieving Financial Freedom and Planning Your Early RetirementОт EverandDividend Investing I Complete Beginner’s Guide to Learn How to Create Passive Income by Trading Dividend Stocks I Start Achieving Financial Freedom and Planning Your Early RetirementОценок пока нет

- Investing Made Simple - Warren Buffet Strategies To Building Wealth And Creating Passive IncomeОт EverandInvesting Made Simple - Warren Buffet Strategies To Building Wealth And Creating Passive IncomeОценок пока нет

- Passive Income How To Guide The Simple System To Make Money Online Within 30 DaysОт EverandPassive Income How To Guide The Simple System To Make Money Online Within 30 DaysОценок пока нет

- Stock Market Investing For Beginners: 25 Golden Investing Lessons + Proven StrategiesОт EverandStock Market Investing For Beginners: 25 Golden Investing Lessons + Proven StrategiesРейтинг: 1 из 5 звезд1/5 (1)

- Passive Income: Online, Ideas, Investments, Examples, Apps, Podcast, Blog, GuideОт EverandPassive Income: Online, Ideas, Investments, Examples, Apps, Podcast, Blog, GuideОценок пока нет

- Dividend Investing for Beginners: The Ultimate Guide to Double-Digit Your Returns. Learn How to Create Passive Income and Get One Step Closer to Your Financial Freedom.От EverandDividend Investing for Beginners: The Ultimate Guide to Double-Digit Your Returns. Learn How to Create Passive Income and Get One Step Closer to Your Financial Freedom.Оценок пока нет

- Infinite Banking Concept: How to invest in Real Estate with Infinite Banking, #1От EverandInfinite Banking Concept: How to invest in Real Estate with Infinite Banking, #1Рейтинг: 2.5 из 5 звезд2.5/5 (2)

- How To Begin Investing In The Stock Market: Obtaining Financial FreedomОт EverandHow To Begin Investing In The Stock Market: Obtaining Financial FreedomОценок пока нет

- Stock Market Investing Blueprint: Your Best Stock Investing Guide: Simple Strategies to Build a Significant Income: Perfect for Beginners - Forex, Dividend, Options Trading InformationОт EverandStock Market Investing Blueprint: Your Best Stock Investing Guide: Simple Strategies to Build a Significant Income: Perfect for Beginners - Forex, Dividend, Options Trading InformationОценок пока нет

- The 4 biggest Mistakes in Trading: How to become a professional TraderОт EverandThe 4 biggest Mistakes in Trading: How to become a professional TraderРейтинг: 5 из 5 звезд5/5 (1)

- How To Make Money In Stocks Value Investing StrategiesОт EverandHow To Make Money In Stocks Value Investing StrategiesОценок пока нет

- Stock Market Investing for Beginners: Investing Tactics, Tools, Lessons, and Proven Strategies to Make Money by Investing & Trading Like Pro in the Stock Market for BeginnersОт EverandStock Market Investing for Beginners: Investing Tactics, Tools, Lessons, and Proven Strategies to Make Money by Investing & Trading Like Pro in the Stock Market for BeginnersОценок пока нет

- Dividend Investing: Simplified - The Step-by-Step Guide to Make Money and Create Passive Income in the Stock Market with Dividend Stocks: Stock Market Investing for Beginners Book, #1От EverandDividend Investing: Simplified - The Step-by-Step Guide to Make Money and Create Passive Income in the Stock Market with Dividend Stocks: Stock Market Investing for Beginners Book, #1Оценок пока нет

- Day Trading Academy: Complete Day Trading Guide for Beginners and Advanced Investors: Top Trading Strategies that Every Elite Trader is Using: Option and Stock Trading AdviceОт EverandDay Trading Academy: Complete Day Trading Guide for Beginners and Advanced Investors: Top Trading Strategies that Every Elite Trader is Using: Option and Stock Trading AdviceРейтинг: 4.5 из 5 звезд4.5/5 (3)

- Decoded Money: The Secrets Of How To Get Rid Off Financial Worries/insecurities and Peace Of Mind With MoneyОт EverandDecoded Money: The Secrets Of How To Get Rid Off Financial Worries/insecurities and Peace Of Mind With MoneyОценок пока нет

- Dividend Growth Investing: The Ultimate Investing Guide. Learn Effective Strategies to Create Passive Income for Your Future.От EverandDividend Growth Investing: The Ultimate Investing Guide. Learn Effective Strategies to Create Passive Income for Your Future.Оценок пока нет

- Income Investing Secrets: How to Receive Ever-Growing Dividend and Interest Checks, Safeguard Your Portfolio and Retire WealthyОт EverandIncome Investing Secrets: How to Receive Ever-Growing Dividend and Interest Checks, Safeguard Your Portfolio and Retire WealthyОценок пока нет

- How to Make Money in the Stock Market: Investing for BeginnersОт EverandHow to Make Money in the Stock Market: Investing for BeginnersОценок пока нет

- How to Retire Early on Dividends: Dividend Growth Machine: Mastering the Art of Maximizing Returns Through Dividend InvestingОт EverandHow to Retire Early on Dividends: Dividend Growth Machine: Mastering the Art of Maximizing Returns Through Dividend InvestingОценок пока нет

- Real Estate Investing: 7 Ways ANYONE Can Use to Make Money in Real EstateОт EverandReal Estate Investing: 7 Ways ANYONE Can Use to Make Money in Real EstateОценок пока нет

- Defying expectations: A housewife guide to financial empowermentОт EverandDefying expectations: A housewife guide to financial empowermentОценок пока нет

- Option Trading Demystified: Six Simple Trading Strategies That Will Give You An EdgeОт EverandOption Trading Demystified: Six Simple Trading Strategies That Will Give You An EdgeРейтинг: 3.5 из 5 звезд3.5/5 (3)

- Dividend Growth Investing: How to Build Future Income Streams Using Dividend AristocratsОт EverandDividend Growth Investing: How to Build Future Income Streams Using Dividend AristocratsОценок пока нет

- Why you need a Fee-Only Financial Advisor and how to choose oneДокумент2 страницыWhy you need a Fee-Only Financial Advisor and how to choose onesheikh abdullah aleemОценок пока нет

- Mutual Fund Investors, Common Mistakes & Myths: INVESTMENTS, #1От EverandMutual Fund Investors, Common Mistakes & Myths: INVESTMENTS, #1Рейтинг: 4 из 5 звезд4/5 (2)

- Indian Mutual funds for Beginners: A Basic Guide for Beginners to Learn About Mutual Funds in IndiaОт EverandIndian Mutual funds for Beginners: A Basic Guide for Beginners to Learn About Mutual Funds in IndiaРейтинг: 3.5 из 5 звезд3.5/5 (8)

- The Short Book of Being an Investor not a Speculator: How to achieve a fair return from investment marketsОт EverandThe Short Book of Being an Investor not a Speculator: How to achieve a fair return from investment marketsОценок пока нет

- 401(k) & IRA the Basics: Your Life - Your Future Get Started NowОт Everand401(k) & IRA the Basics: Your Life - Your Future Get Started NowОценок пока нет

- "The Wise Investor: Timeless Principles for Successful Investing"От Everand"The Wise Investor: Timeless Principles for Successful Investing"Оценок пока нет

- How to Make Passive Income: Quit your Job, Create Multiple Streams, Secret Strategies for Investing, Blogging, Ecommerce, & MoreОт EverandHow to Make Passive Income: Quit your Job, Create Multiple Streams, Secret Strategies for Investing, Blogging, Ecommerce, & MoreОценок пока нет

- Stock Investing for Beginners : Ultimate Stock Investing Guide & Strategies for Wealth BuildingОт EverandStock Investing for Beginners : Ultimate Stock Investing Guide & Strategies for Wealth BuildingОценок пока нет

- The Story of Mr. Mutual FundДокумент50 страницThe Story of Mr. Mutual Fundshah_rohit5272Оценок пока нет

- Volume Profile: The Insider's Guide to TradingОт EverandVolume Profile: The Insider's Guide to TradingРейтинг: 4.5 из 5 звезд4.5/5 (18)

- The How To Book on Dividend Growth Investing: Create Generational Wealth and Passive Income for Life!От EverandThe How To Book on Dividend Growth Investing: Create Generational Wealth and Passive Income for Life!Оценок пока нет

- Day Trading for Beginners in 2020: The Complete Guide with Day Trading Options Techniques and Strategies: Day Trading For Beginners Guide, #1От EverandDay Trading for Beginners in 2020: The Complete Guide with Day Trading Options Techniques and Strategies: Day Trading For Beginners Guide, #1Оценок пока нет

- Day Trading for Beginners: The Complete Guide With Day Trading Options Techniques And Strategies: Day Trading For Beginners GuideОт EverandDay Trading for Beginners: The Complete Guide With Day Trading Options Techniques And Strategies: Day Trading For Beginners GuideОценок пока нет

- Stock Market Investing Strategies For Beginners A Simple Trading Guide On Investing In Stocks And How To Start Making Profits On Your Money TodayОт EverandStock Market Investing Strategies For Beginners A Simple Trading Guide On Investing In Stocks And How To Start Making Profits On Your Money TodayОценок пока нет

- Dividend Investing: The Ultimate Guide to Create Passive Income Using Stocks. Make Money Online, Gain Financial Freedom and Retire Early Earning Double-Digit ReturnsОт EverandDividend Investing: The Ultimate Guide to Create Passive Income Using Stocks. Make Money Online, Gain Financial Freedom and Retire Early Earning Double-Digit ReturnsОценок пока нет

- Variable Annuity Pros & Cons: Financial Freedom for Smart PeopleОт EverandVariable Annuity Pros & Cons: Financial Freedom for Smart PeopleРейтинг: 5 из 5 звезд5/5 (2)

- Real Estate: 28 Essential Strategies for Investing, Buying, and Flipping Real EstateОт EverandReal Estate: 28 Essential Strategies for Investing, Buying, and Flipping Real EstateОценок пока нет

- Dividend Growth Machine: Mastering the Art of Maximizing Returns Through Dividend InvestingОт EverandDividend Growth Machine: Mastering the Art of Maximizing Returns Through Dividend InvestingОценок пока нет

- 4 Emerging Stories For Your PortfolioДокумент13 страниц4 Emerging Stories For Your PortfolioAdvisesure.comОценок пока нет

- 4 Evergren Large Cap StocksДокумент13 страниц4 Evergren Large Cap StocksAdvisesure.comОценок пока нет

- 4 Hidden Jewels For Long Term Wealth CreationДокумент13 страниц4 Hidden Jewels For Long Term Wealth CreationAdvisesure.com100% (1)

- Best Mid-Cap Mutual Funds in India For 2015Документ10 страницBest Mid-Cap Mutual Funds in India For 2015Advisesure.comОценок пока нет

- How To Start Investing in Mutual Fund SipДокумент12 страницHow To Start Investing in Mutual Fund SipAdvisesure.comОценок пока нет

- Best Tax Saving ELSS Mutual Fund in IndiaДокумент13 страницBest Tax Saving ELSS Mutual Fund in IndiaAdvisesure.comОценок пока нет

- Top 3 Mid Cap Equity Mutual Funds in IndiaДокумент13 страницTop 3 Mid Cap Equity Mutual Funds in IndiaAdvisesure.comОценок пока нет

- Top 3 Diversified Equity Mutual Funds To Invest in IndiaДокумент13 страницTop 3 Diversified Equity Mutual Funds To Invest in IndiaAdvisesure.comОценок пока нет

- Best Tax Saving Schemes As Per Section 80cДокумент16 страницBest Tax Saving Schemes As Per Section 80cAdvisesure.comОценок пока нет

- 5 Critical Things While Choosing Fixed DepositДокумент13 страниц5 Critical Things While Choosing Fixed DepositAdvisesure.comОценок пока нет

- 3 Best Small Cap Equity Mutual Fund in India For 2015Документ9 страниц3 Best Small Cap Equity Mutual Fund in India For 2015Advisesure.comОценок пока нет

- Best Small Cap Mutual Funds June 2016Документ13 страницBest Small Cap Mutual Funds June 2016Advisesure.comОценок пока нет

- How First Time Investor Start Investing in ElssДокумент11 страницHow First Time Investor Start Investing in ElssAdvisesure.comОценок пока нет

- 5 Critical Things While Choosing Fixed DepositДокумент13 страниц5 Critical Things While Choosing Fixed DepositAdvisesure.comОценок пока нет

- What Is ELSS and Which Are Top ELSS Funds To InvestДокумент17 страницWhat Is ELSS and Which Are Top ELSS Funds To InvestAdvisesure.comОценок пока нет

- Top 3 Mutual Fund Sip For Monthly SavingsДокумент9 страницTop 3 Mutual Fund Sip For Monthly SavingsAdvisesure.comОценок пока нет

- 4 Best Tax Saving ELSS Mutual Funds For 2015Документ11 страниц4 Best Tax Saving ELSS Mutual Funds For 2015Advisesure.comОценок пока нет

- 4 Reasons of Why You Should Invest in Shares & EquitiesДокумент12 страниц4 Reasons of Why You Should Invest in Shares & EquitiesAdvisesure.comОценок пока нет

- Top Monthly Saving Schemes For Wealth CreationДокумент13 страницTop Monthly Saving Schemes For Wealth CreationAdvisesure.comОценок пока нет

- 5 Best Mid Cap Stocks To Invest in 2015Документ12 страниц5 Best Mid Cap Stocks To Invest in 2015Advisesure.comОценок пока нет

- Best Tax Saving Schemes As Per Section 80cДокумент16 страницBest Tax Saving Schemes As Per Section 80cAdvisesure.comОценок пока нет

- Top 4 Financial Goals, Everyone Should PlanДокумент11 страницTop 4 Financial Goals, Everyone Should PlanAdvisesure.comОценок пока нет

- 5 Mutual Funds To Financial IndependenceДокумент12 страниц5 Mutual Funds To Financial IndependenceAdvisesure.comОценок пока нет

- 5 Benefits of Investing in Mutual FundsДокумент13 страниц5 Benefits of Investing in Mutual FundsAdvisesure.comОценок пока нет

- 5 Shares For Financial Freedom This Independce DayДокумент12 страниц5 Shares For Financial Freedom This Independce DayAdvisesure.comОценок пока нет

- 3 Sips For Wealth Creation This 15th AugustДокумент10 страниц3 Sips For Wealth Creation This 15th AugustAdvisesure.comОценок пока нет

- 3 Steps To Financial Freedom This 15th AugustДокумент11 страниц3 Steps To Financial Freedom This 15th AugustAdvisesure.comОценок пока нет

- Deed of Conditional Sale of Motor VehicleДокумент1 страницаDeed of Conditional Sale of Motor Vehicle4geniecivilОценок пока нет

- BOI - New LetterДокумент5 страницBOI - New Lettersandip_banerjeeОценок пока нет

- Indian Economy 1950-1990 - Question BankДокумент5 страницIndian Economy 1950-1990 - Question BankHari prakarsh NimiОценок пока нет

- Detailed Project Report On Establishment of Rural Home-Stay Tourism For A Tourism Cooperative SocietyДокумент20 страницDetailed Project Report On Establishment of Rural Home-Stay Tourism For A Tourism Cooperative SocietysauravОценок пока нет

- Budget LineДокумент6 страницBudget Linegyan|_vermaОценок пока нет

- Prepare Bank and Financial ReceiptДокумент26 страницPrepare Bank and Financial ReceiptTavya JamesОценок пока нет

- HR Practices in Automobile IndustryДокумент13 страницHR Practices in Automobile IndustryNEENDI AKSHAY THILAKОценок пока нет

- 20 Important Uses of PLR Rights Material PDFДокумент21 страница20 Important Uses of PLR Rights Material PDFRavitОценок пока нет

- Lec 6 QuizДокумент3 страницыLec 6 QuizWennie NgОценок пока нет

- EUR Statement: Account Holder Iban Bank Code (SWIFT/BIC)Документ3 страницыEUR Statement: Account Holder Iban Bank Code (SWIFT/BIC)jahan najahОценок пока нет

- Presentation 6Документ14 страницPresentation 6Akshay MathurОценок пока нет

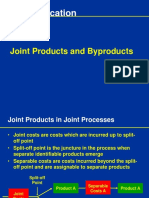

- Joint Cost Allocation Methods for Multiple ProductsДокумент17 страницJoint Cost Allocation Methods for Multiple ProductsATLASОценок пока нет

- How to calculate average employee numbersДокумент8 страницHow to calculate average employee numbersштттОценок пока нет

- CH 1 VPO - Guest Weekly BillДокумент17 страницCH 1 VPO - Guest Weekly BillKhushali OzaОценок пока нет

- Stock Market SimulationДокумент4 страницыStock Market SimulationROBERTO BRYAN CASTROОценок пока нет

- Greeting Card Business PlanДокумент52 страницыGreeting Card Business PlanChuck Achberger50% (2)

- Second Statement: For The Purpose of Donor's Tax, A Stranger Is A Person Who Is Not AДокумент2 страницыSecond Statement: For The Purpose of Donor's Tax, A Stranger Is A Person Who Is Not AAllen KateОценок пока нет

- Barriers To Entry: Resilience in The Supply ChainДокумент3 страницыBarriers To Entry: Resilience in The Supply ChainAbril GullesОценок пока нет

- American Rescue Plan - Ulster County Survey ResultsДокумент2 страницыAmerican Rescue Plan - Ulster County Survey ResultsDaily FreemanОценок пока нет

- ICODEV Abstract FixДокумент49 страницICODEV Abstract Fixbp bpОценок пока нет

- MBSA1523 Managerial Economic and Policy Analysis: Page - 1Документ16 страницMBSA1523 Managerial Economic and Policy Analysis: Page - 1HO JING YI MBS221190Оценок пока нет

- Fa Ii. ObjДокумент5 страницFa Ii. ObjSonia ShamsОценок пока нет

- Politicas Publicas EnergeticasДокумент38 страницPoliticas Publicas EnergeticasRodrigo Arce RojasОценок пока нет

- Etr Template ExampleДокумент56 страницEtr Template ExampleNur Fadhlin SakinaОценок пока нет

- Cabwad CF September 2019Документ2 страницыCabwad CF September 2019EunicaОценок пока нет

- Pharma ClusterДокумент5 страницPharma ClusterinfooncoОценок пока нет

- Tesalt India Private LimitedДокумент16 страницTesalt India Private LimitedSaiganesh JayakaranОценок пока нет

- King Abdul Aziz University: IE 255 Engineering EconomyДокумент11 страницKing Abdul Aziz University: IE 255 Engineering EconomyJomana JomanaОценок пока нет

- Asian Eye covers all bases to help over 330,000 blind FilipinosДокумент7 страницAsian Eye covers all bases to help over 330,000 blind FilipinosLouis KweyambaОценок пока нет

- ALTHURUPADU BID DOCUMENT Judicial Preview (7 - 11-2019)Документ125 страницALTHURUPADU BID DOCUMENT Judicial Preview (7 - 11-2019)Habeeb ShaikОценок пока нет