Академический Документы

Профессиональный Документы

Культура Документы

Flexible Benefit Plan

Загружено:

Sreenivasa Murthy KotaАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Flexible Benefit Plan

Загружено:

Sreenivasa Murthy KotaАвторское право:

Доступные форматы

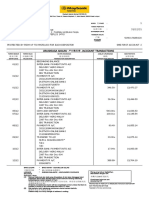

Cognizant Flexible Benefit Plan

Food Reimbursement

House Rent Allowance (HRA)

Coverage: All Associates

Coverage: All Associates

Eligibility Limit: Up to a maximum of Rs. 3000 (PM)

Eligibility limit: 0 to 60% of the basic salary

Key Policy Highlights:

Key Policy Highlights:

Associates need to choose and define the HRA amount in the FBP

definition system on a monthly basis.

Associates can opt for an HRA amount in the range of 0 to 60% of

their respective basic salary.

On selection, Associates will be paid the defined HRA amount as part

of their monthly salary.

In order to claim Tax exemption, Associates need to submit the Rent

receipt/Bank statement and a copy of the Lease Agreement to the

Finance team.

Associates availing Hostel accommodation need to submit the rent

receipts in the hostels letter head or pre-printed receipt book.

Expenses incurred on maintenance charges, electricity bill, food (in

case of paying guest accommodation) are not eligible for any Tax

exemption.

Tax exemption on HRA, if applicable, will be as per the prevailing

Income Tax rules.

Coverage: All Associates

Eligibility Limits: Grade-wise eligibility is as described below

Up to

Associate

Sr. Associate &

Asst. Manager

Manager &

Above

20000

40000

60000

Annual Eligibility

(Rs.)

(*) Meal card: Meal card is a smart & secure way of providing meal

vouchers. It is a preloaded card that can be used at the office cafeterias

as well as at most of the food and beverage outlets across the country.

To procure their meal cards, Associates need to register at

http://www.hdfcbank.com/corporatedesktop/Cognizant/index.html.

Once registered, the meal card will be delivered to the associate within

next 10 calendar days.

To get the meal cards charged / preloaded, Associates need to enter

their card details at https://mypay/bankdetails.

At the end of each month, the cards will be charged / preloaded with the

amount of Food Reimbursement defined by the associates. Once

charged, the card is ready for use.

Leave Travel Allowance (LTA)

Level

Associates can avail the benefit of Food Reimbursement through

meal cards (*)

Associates need to choose and define the Food Reimbursement

amount in the FBP definition system on a monthly basis.

Associates can redefine the amount of Food Reimbursement on a

monthly basis, subject to the prescribed limits.

Food Reimbursement is proportional to the number of days an

associate spends on India payroll in a month.

Key Policy Highlights:

Associates need to choose and define the LTA amount in the FBP

definition system on a monthly basis.

Associates can redefine the LTA amount on a monthly basis, but the

changes would be effective for the month of redefinition & onwards

only.

Associates need to avail a minimum 5 days of vacation leave in order

to claim LTA.

Only travel expenses for associates and their dependants (+) are

reimbursable.

In order to claim the reimbursement of dependants travel expenses,

the Associate must have accompanied them during the travel.

Only expenses incurred on travel within India may be claimed for

reimbursement.

Expenses incurred on accommodation, recreation, sightseeing etc.

cannot be claimed as part of LTA.

Tax exemption on LTA, if applicable, will be as per the prevailing

Income Tax rules.

(+) Dependants include non earning spouse, children (a max. of 2

children up to the age of 18 years), and non-earning parents staying with

the Associate.

As per the prevailing RBI regulations, the maximum maintainable mount

in a meal Card at any point of time is Rs. 20000.

Please note that meal card usage is subject to Governmental

regulations.

Medical Reimbursement

Coverage: All Associates

Eligibility Limit: Up to a maximum of Rs.15000 (PA)

Key Policy Highlights:

Associates need to choose and define the Medical Reimbursement

amount in the FBP definition system on a monthly basis.

On selection, Associates accumulate medical reimbursement upto a

max. of Rs. 1250 (PM).

Associates cannot claim Medical Reimbursement for amount more

than their respective accumulation at any point of time.

Doctors prescriptions are required to claim reimbursement for bills

exceeding Rs. 500.

Claims for expenses incurred on spectacles / lens is restricted to a

max. of Rs. 1,500 (PA).

Bills for dental treatment need to be supported with doctors

prescription.

Expenses incurred on cosmetics and provisions must not be

submitted for Medical Reimbursement claim.

Cognizant Flexible Benefit Plan

Reimbursement of Mobile phone expenses

Reimbursement of Car running

Coverage: Asst. Manager & below.

Coverage: Sr. Associate & above

Eligibility Limit: Grade-wise eligibility is as described below

Eligibility Limit: Eligibility (in Rs. Per month) based on the car engine

capacity as described below.

Level

Monthly Eligibility (Rs.)

Up to Associate

Sr. Associate &

Asst. Manager

500

1000

Key Policy Highlights:

Associates need to choose and define the amount of Mobile

reimbursement in the FBP definition system on a monthly basis.

Associates will be reimbursed to the extent of their respective

monthly eligibility only.

Associates will be reimbursed for a single Post Paid connection

registered in their names only.

On selection, Associates need to pay their mobile phone bills through

the prescribed banker / vendor.

Associates are reimbursed on the basis of the bill payment

information shared by the banker / vendor with Cognizant.

If the bill amount in a month is less than the amount defined in the

FBP definition system, the balance is carried forward to the next

month for reimbursement.

Superannuation Fund Contribution

Coverage: All Associates

Eligibility Limit: A minimum contribution of Rs. 500 (PM) to a maximum

ceiling of 15% of basic salary or Rs. 100,000 (PA), whichever is lesser.

Key Policy Highlights:

Superannuation Fund is an optional post-retirement benefit extended

to all Associates of Cognizant.

Associates need to choose and define the contribution amount

towards Superannuation Fund in the FBP definition system on a

monthly basis.

If opted, Cognizant would contribute to the Superannuation Fund on

a monthly basis.

Associates opting for Superannuation Fund Contribution can change

the amount of contribution on a monthly basis.

Once opted, an Associate will have to continue contributing to the

fund throughout his / her employment tenure with Cognizant.

Associates are not eligible to withdraw any amount from the

Superannuation Fund during their employment tenure in Cognizant.

New Joiners can opt for this benefit through their first FBP definition

and enroll in the first month of their joining. Failure to define this as a

part of the first FBP definition would make the associate ineligible for

enrolling this benefit thereafter.

Engine Capacity

Only Fuel &

Maintenance

Fuel, Maintenance &

Driver Salary

< = 1.6 litres

1800

2700

> 1.6 litres

2400

3300

Key Policy Highlights:

It is aimed to help associates to get the car expenses incurred by

them for official purposes reimbursed.

Associates need to choose & define the amount in the FBP

definition system on a monthly basis.

Car expenses include the expenses incurred on fuel,

maintenance, and drivers salary.

In order to avail the benefit, Associates need to use cars

registered in their names at their respective current locations only.

Associates not opting for this benefit may opt for Conveyance

Allowance. Associates will be paid Rs. 800 monthly, without

submission of any bills, if they opt for Conveyance Allowance.

Вам также может понравиться

- CTS Hiring PolicyДокумент9 страницCTS Hiring PolicynivasshaanОценок пока нет

- Corporation True or FalseДокумент2 страницыCorporation True or FalseAllyza Magtibay50% (2)

- Exit PolicyДокумент16 страницExit PolicyRangunwalaОценок пока нет

- Compensation PolicyДокумент6 страницCompensation PolicyAnmol TongyaОценок пока нет

- Relocation Policy For Altran Technologies India PVT LTDДокумент3 страницыRelocation Policy For Altran Technologies India PVT LTDswathi100% (1)

- Domestic Relocation Policy - V 1 0 PDFДокумент2 страницыDomestic Relocation Policy - V 1 0 PDFNneka100% (1)

- HR Practices - IBM Vs WiproДокумент8 страницHR Practices - IBM Vs WiproMohit SharmaОценок пока нет

- Flexible Benefits: Cost Optimization & Talent RetentionДокумент36 страницFlexible Benefits: Cost Optimization & Talent RetentionAndrew100% (1)

- Benefits HandbookДокумент29 страницBenefits Handbooksjn100% (1)

- FBP - Policy DocumentДокумент60 страницFBP - Policy DocumentDiwanDipesh SunilОценок пока нет

- Domestic Relocation PolicyДокумент2 страницыDomestic Relocation PolicyasanjeevraoОценок пока нет

- MERCER '09 - Flexible Benefits & Asia's ExperienceДокумент34 страницыMERCER '09 - Flexible Benefits & Asia's ExperienceBurn HallОценок пока нет

- Flexible Benefit Plan - v1.17Документ58 страницFlexible Benefit Plan - v1.17Mukesh SinghОценок пока нет

- Transfer Support PolicyДокумент3 страницыTransfer Support PolicyPranav SahilОценок пока нет

- Security Information and Event Management (SIEM) - 2021Документ4 страницыSecurity Information and Event Management (SIEM) - 2021HarumОценок пока нет

- Ctsecmin 41877128Документ37 страницCtsecmin 41877128ashutosh shekher singh100% (1)

- CTS Provident Fund (PF), Pension Scheme, and Employees Deposit Linked Insurance (EDLI) PolicyДокумент9 страницCTS Provident Fund (PF), Pension Scheme, and Employees Deposit Linked Insurance (EDLI) PolicyshaannivasОценок пока нет

- Journal - Problems & SolutionsДокумент5 страницJournal - Problems & SolutionsSreenivasa Murthy Kota83% (6)

- CTS Employees Compensation Insurance PolicyДокумент21 страницаCTS Employees Compensation Insurance Policynivasshaan0% (1)

- Travel Policy - India W IDC PDFДокумент30 страницTravel Policy - India W IDC PDFmahakagrawal3Оценок пока нет

- SR No. Description of Change Date of Release Version NoДокумент10 страницSR No. Description of Change Date of Release Version NoRavi KumarОценок пока нет

- Flexible CompensationДокумент27 страницFlexible Compensationace-winnieОценок пока нет

- DGM Annexure B Know Your Pay ComponentsДокумент3 страницыDGM Annexure B Know Your Pay ComponentsaakritishellОценок пока нет

- India Policy - NSAДокумент11 страницIndia Policy - NSALokesh Gupta100% (1)

- Rewards and Benefits AnnexureДокумент2 страницыRewards and Benefits Annexureriteshh05Оценок пока нет

- FAQ (Flexi) PDFДокумент4 страницыFAQ (Flexi) PDFDivyansh Chand BansalОценок пока нет

- CTS 6th Day Allowance PolicyДокумент5 страницCTS 6th Day Allowance Policynivasshaan50% (2)

- Flexi Benefits Plan April 2016Документ25 страницFlexi Benefits Plan April 2016Shishir MishraОценок пока нет

- Cisco Global BenefitsДокумент12 страницCisco Global BenefitsamaranthОценок пока нет

- FBP To-Be Process - April 1 India ReleaseДокумент24 страницыFBP To-Be Process - April 1 India Releaseraghava_cseОценок пока нет

- Induction V23 PDFДокумент20 страницInduction V23 PDFNagendra KumarОценок пока нет

- Domestic Travel PolicyДокумент2 страницыDomestic Travel PolicyGarima MittalОценок пока нет

- FAQ - India-Leave Policy Ver1.5Документ5 страницFAQ - India-Leave Policy Ver1.5Amarnath Reddy100% (1)

- The Theory of Paulo FreireДокумент8 страницThe Theory of Paulo FreireLola Amelia100% (3)

- India - Relocation Policy - 2014 PDFДокумент5 страницIndia - Relocation Policy - 2014 PDFmahakagrawal3100% (1)

- Car Lease Policy Ver 2.0Документ5 страницCar Lease Policy Ver 2.0PF SOLUTIONSОценок пока нет

- Relocation PolicyДокумент2 страницыRelocation PolicyMegha NandiwalОценок пока нет

- CompensationДокумент28 страницCompensationSomalKantОценок пока нет

- Power To People: Indiafirst Employee Benefit PlanДокумент14 страницPower To People: Indiafirst Employee Benefit PlanBhawzОценок пока нет

- Leave Policy - FAQДокумент4 страницыLeave Policy - FAQkedar gadkari100% (1)

- Separation and FNF PolicyДокумент7 страницSeparation and FNF Policyiaj78Оценок пока нет

- Retention Strategies in ITESДокумент12 страницRetention Strategies in ITESmunmun4Оценок пока нет

- Leave Policy - GTSДокумент7 страницLeave Policy - GTSSupreet SinghОценок пока нет

- View The PoliciesДокумент9 страницView The PoliciesSameer DubeyОценок пока нет

- Leave PolicyДокумент5 страницLeave PolicyraviОценок пока нет

- Leave Policy and Public HolidaysДокумент5 страницLeave Policy and Public HolidaysKrishna HarshitaОценок пока нет

- Guideline For Grade and Compensation FitmentДокумент5 страницGuideline For Grade and Compensation FitmentVijit MisraОценок пока нет

- Travel Policy 01-01-2020 AmendmentДокумент10 страницTravel Policy 01-01-2020 Amendmentmansi srivastavaОценок пока нет

- Dirac Equation Explained at A Very Elementary LevelДокумент16 страницDirac Equation Explained at A Very Elementary Levelsid_senadheera100% (2)

- FlexiДокумент4 страницыFlexiManish Mani100% (1)

- Sub: Letter of Offer and Terms of EmploymentДокумент9 страницSub: Letter of Offer and Terms of Employmentmayur gholapОценок пока нет

- Annexure - Flexible Benefit PlanДокумент3 страницыAnnexure - Flexible Benefit PlanpvkmanoharОценок пока нет

- Flexible Benefit Plan - v1.17Документ58 страницFlexible Benefit Plan - v1.17Mukesh SinghОценок пока нет

- Referral PolicyДокумент2 страницыReferral PolicyDipikaОценок пока нет

- MyBenefits@Philips LeafletДокумент2 страницыMyBenefits@Philips Leafletsubodhtaneja100% (1)

- Adobe India Benefits SummaryДокумент3 страницыAdobe India Benefits SummaryShobhita SoodОценок пока нет

- HR PolicyДокумент25 страницHR PolicySaurabh DwivediОценок пока нет

- Local On Site Policy 2Документ4 страницыLocal On Site Policy 2Pravir Karna100% (1)

- Neha Soni - Pune - Offer of EmploymentДокумент10 страницNeha Soni - Pune - Offer of EmploymentRahul JagdaleОценок пока нет

- Whichever Is Lower Is Exempt From Tax. For ExampleДокумент13 страницWhichever Is Lower Is Exempt From Tax. For ExampleNasir AhmedОценок пока нет

- Exit in T PolicyДокумент4 страницыExit in T PolicySyed Fazal HussainОценок пока нет

- Employee Benefits IndiaДокумент2 страницыEmployee Benefits Indiabaskarbaju1Оценок пока нет

- Aviva PoliciesДокумент14 страницAviva PoliciesKirtan ShahОценок пока нет

- Daksh Leave Policy (India)Документ12 страницDaksh Leave Policy (India)ajithk75733Оценок пока нет

- Compensation PolicyДокумент6 страницCompensation PolicylonewolfОценок пока нет

- General Teaching English NotificationДокумент19 страницGeneral Teaching English NotificationSreenivasa Murthy KotaОценок пока нет

- M.B.A (III Year)Документ11 страницM.B.A (III Year)Sreenivasa Murthy KotaОценок пока нет

- Indian Financial SystemДокумент91 страницаIndian Financial SystemSreenivasa Murthy KotaОценок пока нет

- Advertisement Faculty Positions OdishaДокумент9 страницAdvertisement Faculty Positions OdishaAnonymous ZVyShhiОценок пока нет

- Fee SRTДокумент28 страницFee SRTSandeepVermaОценок пока нет

- SVUCE AcademicConsultantДокумент1 страницаSVUCE AcademicConsultantSreenivasa Murthy KotaОценок пока нет

- SVUCE AcademicConsultantДокумент1 страницаSVUCE AcademicConsultantSreenivasa Murthy KotaОценок пока нет

- Growth and Performance of Non-Banking Financial Institute in IndiaДокумент19 страницGrowth and Performance of Non-Banking Financial Institute in IndiaSreenivasa Murthy KotaОценок пока нет

- SVUCE AcademicConsultantДокумент1 страницаSVUCE AcademicConsultantSreenivasa Murthy KotaОценок пока нет

- PBAS Proforma For Associate ProfessorsДокумент7 страницPBAS Proforma For Associate ProfessorsSreenivasa Murthy KotaОценок пока нет

- Computerised Accounting.Документ12 страницComputerised Accounting.Ʀƛj ThålèswäřОценок пока нет

- Ijrcm 1 Vol 3 Issue 9 Art 11Документ17 страницIjrcm 1 Vol 3 Issue 9 Art 11Sreenivasa Murthy KotaОценок пока нет

- Sourabh ResumeДокумент2 страницыSourabh ResumeVijay RajОценок пока нет

- A Day in The Life of A Scrum MasterДокумент4 страницыA Day in The Life of A Scrum MasterZahid MehmoodОценок пока нет

- Distribution Optimization With The Transportation Method: Risna Kartika, Nuryanti Taufik, Marlina Nur LestariДокумент9 страницDistribution Optimization With The Transportation Method: Risna Kartika, Nuryanti Taufik, Marlina Nur Lestariferdyanta_sitepuОценок пока нет

- GSRTCДокумент1 страницаGSRTCAditya PatelОценок пока нет

- Intel Corporation Analysis: Strategical Management - Tengiz TaktakishviliДокумент12 страницIntel Corporation Analysis: Strategical Management - Tengiz TaktakishviliSandro ChanturidzeОценок пока нет

- Upvc CrusherДокумент28 страницUpvc Crushermaes fakeОценок пока нет

- TRIAD: A Sustainable Approach To ForestryДокумент25 страницTRIAD: A Sustainable Approach To ForestryInstitut EDSОценок пока нет

- Becg Unit-1Документ8 страницBecg Unit-1Bhaskaran Balamurali0% (1)

- May 11-Smart LeadersДокумент28 страницMay 11-Smart LeaderstinmaungtheinОценок пока нет

- 1001 Books I Must Read Before I DieДокумент44 страницы1001 Books I Must Read Before I DiemamaljОценок пока нет

- Dua e Mujeer Arabic English Transliteration PDFДокумент280 страницDua e Mujeer Arabic English Transliteration PDFAli Araib100% (2)

- Business Law Term PaperДокумент19 страницBusiness Law Term PaperDavid Adeabah OsafoОценок пока нет

- How 50 Actors Got Their Agents and ManagersДокумент5 страницHow 50 Actors Got Their Agents and ManagersОля МовчунОценок пока нет

- Design and Implementation of A Computerised Stadium Management Information SystemДокумент33 страницыDesign and Implementation of A Computerised Stadium Management Information SystemBabatunde Ajibola TaofeekОценок пока нет

- Lista Destinatari Tema IДокумент4 страницыLista Destinatari Tema INicola IlieОценок пока нет

- Ernest Renan What Is Nation PDFДокумент2 страницыErnest Renan What Is Nation PDFJohnny0% (1)

- Mettler Ics429 User ManualДокумент60 страницMettler Ics429 User ManualJhonny Velasquez PerezОценок пока нет

- 34 The Aby Standard - CoatДокумент5 страниц34 The Aby Standard - CoatMustolih MusОценок пока нет

- The Impact of Social Media: AbstractДокумент7 страницThe Impact of Social Media: AbstractIJSREDОценок пока нет

- Competitive Benchmarking Created On 20230208T0816ZДокумент1 страницаCompetitive Benchmarking Created On 20230208T0816ZRrKartika RatnasariОценок пока нет

- Lesson On Inferring Tone and MoodДокумент32 страницыLesson On Inferring Tone and MoodAngel PabilloОценок пока нет

- Kangar 1 31/12/21Документ4 страницыKangar 1 31/12/21TENGKU IRSALINA SYAHIRAH BINTI TENGKU MUHAIRI KTNОценок пока нет

- IAD 2023 Camporee Information Sheet - CARU - UPDATED 08.09.2022Документ8 страницIAD 2023 Camporee Information Sheet - CARU - UPDATED 08.09.2022Evelyn SaranteОценок пока нет

- Argumentative EssayДокумент5 страницArgumentative EssayParimalar D/O RathinasamyОценок пока нет

- Menken & Sanchez (2020) - Translanguaging in English-Only SchoolsДокумент27 страницMenken & Sanchez (2020) - Translanguaging in English-Only SchoolsSumirah XiaomiОценок пока нет

- Serenity Dormitory PresentationДокумент16 страницSerenity Dormitory PresentationGojo SatoruОценок пока нет