Академический Документы

Профессиональный Документы

Культура Документы

Kompella July 2011

Загружено:

reachanujИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Kompella July 2011

Загружено:

reachanujАвторское право:

Доступные форматы

Free

e-edition

I NVESTMENT A DVICE

Kompella Portfolio

Apollo Hospitals

ASM

Technologies

Banswara

Syntex

Tamilnad

Mercantile Bank

State Bank of

Travancore

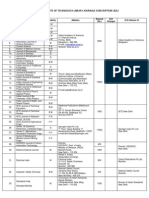

www.investmentadvice.in Indias No.1 Investment Magazine, Since 1987. Vol. XXIV, No.7, JULY, 2011. Rs.45/-

A P STOCKS : ATTRACTIVE VALUATIONS

Year ended 31/03/11

NCC : HUGE ORDER BOOK POSITION

OF RS.16,180 CRS

DR A V S RAJU, CHAIRMAN

NCC

COMPANY

PAT

TO

(RS. CRS) (RS. CRS)

Amara Raja Batteries 1,765

Andhra Bank

9,189

Apollo Hospitals

2,332

Astra Microwave

163

Aurobindo Pharma

4,381

B S Transcomm

872

D Q Entertainment

208

Dr.Reddys Labs

7,469

Dredging Corporation

458

Gulf Oil Corporation

1,103

HBL Power Systems

995

Kakatiya Cement

101

Kallam Spinning

136

Lokesh Machines

146

Midfield Industries

132

Natco Pharma

483

NCC

6,230

NCL Industries

365

NMDC

11,369

Oil Country Tubular

326

Pennar Industries

1,373

Premier Explosives

95

Ramky Infrastructure

3,147

Sagar Cements

498

Sathavahana Ispat

679

Suryalakshmi Cotton

612

Suven Life Sciences

150

VBC Ferro Alloys

112

Visaka Industries

653

Vishnu Chemicals

284

Vivimed Labs

417

VST Industries

585

148

1,268

182

19

563

51

31

1,104

40

57

16

4

14

7

13

54

222

23

6,499

30

76

10

206

18

57

35

10

11

45

11

49

95

MP

(RS.)

P/E

RATIO

215

129

469

27

170

114

40

1515

304

81

16

69

40

40

36

263

79

36

258

71

38

72

265

136

46

68

20

204

97

86

271

927

13

6

31

14

9

5

10

23

22

14

16

14

2

7

4

14

9

5

16

10

6

6

7

11

3

3

20

8

3

9

6

15

INVESTMENT SCRIPS

INVESTMENT SCRIPS:

The following fundamentally strong scrips may be considered for

long term investment at a sharp fall in a technically weak market .

1. POWER FINANCE CORPORATION

3. SHIPPING CORPORATION OF INDIA

2. RURAL ELECTRIFICATION CORPORATION

4. V-GUARD INDUSTRIES

VARDHMAN TEXTILES : TECHNICAL RECOVERY IS EXPECTED

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

300

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

290

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

280

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

270

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

260

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

250

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

240

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

230

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

220

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

210

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

200

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

J

F

M

A

M

J

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

123456789012345678901234567890121234567890123456789012345678901212345678901234567890123456789

KOMPELLA PORTFOLIO INVESTMENT ADVICE

JULY, 2011

CONTENTS

CONTENTS

A P STOCKS : ATTRACTIVE VALUATIONS

The performance of Corporate Sector in the State of Andhra Pradesh is improving day by day. Infact, the

corporate sector in Andhra Pradesh is playing a vital role not only in the States GDP growth rate but is also contributing

to Indias GDP growth rate. It is creating large scale employment opportunities, industrial output, modern infrastructure,

higher growth rate of exports, improved revenue to the Centre & State, inter-State trade & business, demand for

national & global goods and services, inturn improved economic conditions of the people and above all serving the

investors to the maximum extent possible. The Industrial Revolution of A P has however started only in the 1980s

and that too majority of the promoters are first generation ones - mostly from Agricultural families. However, they have

shown remarkable ability to withstand against the National and Global competition. (Cover Story - Page 9).

INVESTMENT SCRIPS

1

NMDC

Power Finance Corporation

Rural Electrification Corporation

Shipping Corporation

Vardhman Textiles

V-Guard Industries

SPECIAL REPORTS

1

1

1

1

1

36

Ramky Infrastructure

Suven Life Sciences

EDITORIAL

BANKING

Banswara Syntex

MARCH QUARTER :

BEST PERFORMERS

50-53

FULL YEAR :

BEST PERFORMERS

54-58

BOOK CLOSURES/ RD

59-61

Canara Bank

Orchid Chemicals

38

LETTERS TO THE EDITOR

62

TECHNICAL ANALYSIS

63

Shanthi Gears

V-Guard Industries

63

63

INDEX

64

BSE Sensex

NSE Nifty

64

64

14-19, 39-40 & 65-72

Corporation Bank

39-40 & 65

66-67

Indian Bank

Sumeet Industries

68-69

8-12, 33-38

State Bank of Travan.

A PStocks :

Attractive Valuations

27-32 & 41-49

3, 5-7

ASM Technologies

COVER STORY

37

FUNDAMENTALS

READY REFERENCE

70

9-12

Tamilnad Merca. Bank 71-72

Apollo Hospitals

NCC

8 & 33

34-35

CORPORATE NEWS

20-23

MARKET WATCH

24-26

JULY, 2011

KOMPELLA PORTFOLIO INVESTMENT ADVICE

SPECIAL REPORTS

ASM TECHNOLOGIES : HIGH GROWTH STOCK

ASM Technologies Ltd., a global IT Service provider, has reported jump in Turnover & Profits for

the fourth quarter and year ended March 31, 2011. For the quarter the Turnover has jumped by 104% from

Rs.20crs to Rs.41crs while the Gross Profit has jumped by 333% from Rs.82 lakhs to Rs.3.55crs and Net

Profit by 246% from Rs.56 lakhs to Rs.1.94crs. The EPS for the quarter is Rs.4/-. For the year, the Turnover

has jumped by 65%, Gross Profit by 118% and Net Profit by 95%. The EPS for the year is Rs.13/- against

Rs.6/-. It has announced 20% Dividend for the year against 15% last year. The Company has strong

fundamentals. The Paid-up Capital of the Company is small at Rs.5crs against high Networth of Rs.21crs.

However, the Return on Networth is high at 9% for the quarter and 30% for the year on increased

Networth of 30%. Technically the scrip is moving around Rs.62/- with a low P/E Ratio of 5 and Book Value

of Rs.41/-.

FH (in crs)

MR RABINDRA SRIKANTAN, MD

Highlights : Standalone Results F Y 2011

Revenue from operations was Rs.6,232.75 lakhs, up 45.65%

YoY.

EBIDTA was Rs.1,000.67 lakhs, up 88.12% YoY.

PAT was Rs.651.94 lakhs, as against Rs.342.82 lakhs the

same period ended 31st March 2010, up 90.17% YoY.

Quarter ended March 31, 2011: Standalone

Revenue from operations stood at Rs.1,879.79 lakhs, up

66.26% YoY and 17.42% QoQ.

EBIDTA was at Rs.350.59 lakhs, up 284.38% YoY.

PAT was Rs.195.66 lakhs, up 299.38% YoY and 10.59%

QoQ.

ASM Technologies acquires Abacus Business

Solutions Inc (Abacus)

Acquisition gives ASM an entry into high end ERP

consulting

ASM Technologies announced that it has signed a definitive

agreement to acquire 100% of Abacus Business Solutions,

Inc. a US based firm, in an all cash deal. As part of the deal

ASM will offer to acquire all of the outstanding stock of Abacus

through ASMs wholly owned Singapore subsidiary, Advanced

Synergic Pte Ltd.

ASM Technologies, established in 1992, a public Limited

company in India is a pioneer in providing world Class

Consulting Services in Enterprise Solutions for the Packaged

ERP Products and in Enterprise Product Development for SMB

Segment and in Technology Solutions covering Embedded

Systems and System Software to its Global Clientele.

Abacus has been in the business for more than a decade

assisting large corporations and Fortune 500 Companies with

Enterprise Applications , Oracle Applications, Oracle Tools

and Technology, E-Commerce, Reporting and Data

warehousing. Abacus believes in establishing long term

relationships with its business partners by providing full

integration and interaction between processes, organizations,

people, systems and corporate culture . Striving to deliver the

best Abacuss experience with Enterprise and Oracle

Applications is based on successful implementations at

several companies. Some of Abacuss clients include Cisco

Systems, Adobe, Seagate Technologies, Sun Microsystems,

Hitachi Data Systems and many others.

The principals of Abacus come with a strong ERP background

and the business model of Abacus is focused on providing

value by focusing on the strategy of the business and tailoring

the offering in line with what is required to help the customer

with strategic direction.

Abacuss relationships are built on the principle of adding

strategic value to the information system for efficient business

operation. With a skilled team of IT professional of industry

Capital

R&S

Networth

Return on Nw

B.V. (Rs.)

F.V.

T.O.

O.P.

G.P.

Dep.

PBT

Tax

PAT

EPS (Rs.)

DPS (Rs.)

MP (Rs.)

P/E Ratio

PAT as % T.O.

OP as % T.O.

31.03.11

(3M)

5.00

15.91

20.91

9.28

40.82

10.00

40.87

3.81

3.55

0.42

3.13

0.71

1.94

3.88

62.35

4.02

4.75

9.32

(Consolidated)

31.03.10 % CH

31.03.11

(3 M)

(12 M)

5.00

5.00

11.08

43.59

15.91

16.08

30.04

20.91

3.48 166.67

30.03

32.16

26.93

40.82

10.00

10.00

20.03 104.04

113.84

1.01 277.23

10.25

0.82 332.93

9.74

0.16 162.50

0.74

0.66 374.24

9.00

0.15 373.33

2.17

0.56 246.43

6.28

1.12 246.43

12.56

2.00

62.35

4.96

2.80

69.64

5.52

5.04

84.92

9.00

31.03.10

(12 M)

5.00

11.08

16.08

20.02

32.16

10.00

69.12

5.09

4.47

0.50

3.97

0.88

3.22

6.44

1.50

%CH

43.59

30.04

50.00

26.93

64.70

101.38

117.90

48.00

126.70

146.59

95.03

95.03

-

4.66

7.36

18.45

22.28

expertise in the ERP solutions Abacuss implementations have improved

business efficiency and helped customers gain competitive edge in the

global market place.

Jay Belur who co-founded Abacus is a well known expert in the Oracle

world. He has held various leadership positions in Oracles product

development, architecture and consulting groups.

We are very fortunate to have an expert like Jay Belur join us and look

forward to growing our Oracle practice under his guidance and leadership.

For ASM, with its global delivery model , the combination of two companies

will provide an opportunity to add new clients and provide greater value

to its existing clients said Mr.Sundar Ramanathan, Asst Director,

ASM.

We strive to be the premier providers of innovative IT solutions through

Industry expertise in the ERP solutions.said Mr. Jay Belur , CEO,

Abacus.

The acquisition gives ASM an opportunity to expand its offerings to a

larger ERP client base in the US . ASMs Center of Excellence (COE)

located in India provides complimentary solutions for Abacus`s clients to

leverage and manage their Enterprise Applications said Mr.Rabindra

Srikantan, M D, ASM.

About ASM

ASM Technologies is a Bangalore based company and a pioneer in

Enterprise Applications and Enterprise Product Development for

Manufacturing, Retail, Oil& Gas verticals. ASM has over 800 employees

with operations in the US , APAC , UK and India serving Global clientele

and several Fortune 500 companies.

About Abacus

Abacus Business Solutions Inc incorporated in 1998 is a US based firm

involved in strategic Oracle consulting for Fortune 500 and SME companies

in the US . Abacus has helped many companies in their ERP strategy and

assisted them roll out successful Oracle implementations and upgrades.

J

JULY, 2011

KOMPELLA PORTFOLIO INVESTMENT ADVICE

EDITORIAL

KOMPELLA PORTFOLIO

FURTHER RECOVERY

INVESTMENT ADVICE

(SINCE 1987) VOL. XXIV NO.7 JULY, 2011.

www.investmentadvice.in

OWNERS:

KOMPELLA FINANCE & INVESTMENT

CONSULTANTS LIMITED

(Established in 1986 )

Managing Director & Editor

K. V. Satyanarayana

Wholetime Director

Smt. K. Radha Kumari

Investment Research Analysts

Ms. Kalyani

Ms. Visala

Cover Price : Rs.45/Subscription Rates for Print Edition:

Years

he BSE Sensex has increased from 18,503.28 on 31.05.2011 to

18,693.86 on 29.06.2011 -i.e., a gain of 1.03% in one month. The NSE

Nifty has increased from 5,560.15 on 31.05.2011 to 5,600.45 on

29.06.2011 -i.e., a gain of 0.72% in one month. Fall in global oil &

commodity prices and reduction of excise & customs duty on petroleum

products by the Finance Minister, higher diesel, kerosene & LPG prices

have led to the dramatic recovery of the market. The BSE Sensex has

rallied from 17,550.63 on 22nd June, 2011 to 18,693.86 on 29th June,

2011 i.e. a gain of 1,143 points in a week. Similarly, the NSE Nifty has

gained from 5,278.30 on 22nd June, 2011 to 5,600.45 on 29th June, 2011

i.e. a gain of 322 points in a week. The market behaviour depends on the

global oil prices, the South-West Monsoon and the June quarter corporate

performance etc.

India

One Year

Three Years

Overseas

(Airmail)

Rs.450 US $70

Rs.1,250 US $180

BSE Sensex at 18,693.86 on 29.06.2011

NSE Nifty at 5,600.45 on 29.06.2011

DD/Cheque should be drawn in Favour of

Kompella Finance & Investment

Consultants Ltd.,

and payable at Hyderabad.

Add Rs.25/- for Outstation Cheques & Mail to:

REGISTERED OFFICE:

Plot No : A-31, Kompella House,

Journalist Colony, Jubilee Hills,

Hyderabad - 500 033.

Ph. No. 23547687/23547758

Fax : 040-23543120

e-mail: kompella@investmentadvice.in

kompellafinance@investmentadvice.in

kompella_1986@vsnl.net

Magazine Distribution Centres:

AHMEDABAD, BANGALORE, CHENNAI,

HYDERABAD, KOLKATA, MUMBAI,

NEW DELHI, etc.

Either the owner or the publisher or the Editor does not

take any financial responsibility for any loss due to buy/

hold/sell/book profit/apply etc., recommendations.

Investors are adviced to use their own discretion while

taking market decisions.

Jurisdiction : HYDERABAD

Printed and Published by Mr. K.V.Satyanarayana on behalf

ofKOMPELLAFINANCE&INVESTMENTCONSULTANTS

LTD. Printed at Sri Vani Press , Hyderabad , and

Published from Plot No.A-31, Journalist Colony, Jubilee

Hills, Hyderabad-500 033.

KOMPELLA PORTFOLIO INVESTMENT ADVICE

A P STOCKS : WEALTH CREATORS

A

P Stocks have created enormous wealth to the stakeholders

during the last few years and many stocks are at attractive levels due to

technically weak market conditions. For instance, Agro Tech Foods has a

Networth of Rs.178crs with a Return on Networth of 18% for the year

ended 31st March, 2011. Amara Raja Batteries has a Networth of Rs.646crs

with a Return on Networth of 23% for the year ended 31st March, 2011.

Andhra Bank has a Networth of Rs.6,514crs with a Return on Networth of

19% for the year ended 31st March, 2011. Andhra Petrochemicals has a

Networth of Rs.188crs with a Return on Networth of 19% for the year

ended 31st March, 2011. Apollo Hospitals has a Networth of Rs.1,704crs

with a Return on Networth of 11% for the year ended 31st March, 2011.

Astra Microwave has a Networth of Rs.146crs with a Return on Networth of

13% for the year ended 31st March, 2011. Aurobindo Pharma has a

Networth of Rs.2,445crs with a Return on Networth of 23% for the year

ended 31st March, 2011. Bartronics has a Networth of Rs.557crs with a

Return on Networth of 21% for the year ended 31st March, 2011. B S

Transcomm has a Networth of Rs.324crs with a Return on Networth of

16% for the year ended 31st March, 2011. Coromandel International has a

Networth of Rs.1,904crs with a Return on Networth of 36% for the year

ended 31st March, 2011. Divis Labs has a Networth of Rs.1,797crs with a

Return on Networth of 24% for the year ended 31st March, 2011. Dr.Reddys

Labs has a Networth of Rs.4,599crs with a Return on Networth of 24% for

the year ended 31st March, 2011. Gulf Oil Corp. has a Networth of Rs.369crs

with a Return on Networth of 15% for the year ended 31st March, 2011.

Lanco Infratech has a Networth of Rs.4,623crs with a Return on Networth

of 20% for the year ended 31st March, 2011. Midfield Industries has a

Networth of Rs.108crs with a Return on Networth of 12% for the year

ended 31st March, 2011. NCC has a Networth of Rs.2,494crs with a Return

on Networth of 9% for the year ended 31st March, 2011. NMDC has a

Networth of Rs.19,215crs with a Return on Networth of 34% for the year

ended 31st March, 2011. Oil Country Tubular has a Networth of Rs.194crs

with a Return on Networth of 16% for the year ended 31st March, 2011.

Ramky Infrastructure has a Networth of Rs.1,065crs with a Return on

Networth of 19% for the year ended 31st March, 2011. Sathavahana Ispat

has a Networth of Rs.246crs with a Return on Networth of 23% for the year

ended 31st March, 2011. SBH has a Networth of Rs.5,315crs with a Return

on Networth of 22% for the year ended 31st March, 2011. Suryalakshmi

Cotton has a Networth of Rs.139crs with a Return on Networth of 25% for

the year ended 31st March, 2011. Visaka Industries has a Networth of

Rs.261crs with a Return on Networth of 17% for the year ended 31st

March, 2011. VST Industries has a Networth of Rs.261crs with a Return on

Networth of 36% for the year ended 31st March, 2011 etc.

J

JULY, 2011

SPECIAL REPORTS

BANSWARA SYNTEX :

EXCELLENT GROWTH RATE

MR R L TOSHNIWAL, CMD

answara Syntex Ltd., has reported excellent working results for the fourth

quarter and year ended March 31, 2011. For the quarter the Turnover has increased by

37% from Rs.182crs to Rs.251crs while the Operating Profit has jumped by 83% from

Rs.20crs to Rs.36crs and Net Profit from Rs.9crs to Rs.17crs. The EPS for the quarter is

Rs.12/- against Rs.7/-. For the year, the Turnover has increased by 28% whereas the

Operating Profit has jumped by 56% and Net Profit by 52%. The EPS for the year is

Rs.32/- against Rs.24/-. It has hiked the Dividend from 35% to 50% for the year. The

Company has strong fundamentals. The Paid-up Capital of the Company is small at

Rs.15crs against high Networth of Rs.160crs. However, the Return on Networth is high

at 11% for the quarter and 29% for the year on increased Networth of 40%. Technically

the scrip is moving around Rs.132/- with a low P/E Ratio of 4 and high Book Value of

Rs.108/-.

Banswara Syntex Ltd. (BSL) is a vertically integrated textile

mill manufacturing man-made synthetic blended Yarn, wool

and wool mixed yarn, all type of Fabrics, Jacquard Furnishing

Fabrics, besides production of Readymade Garments and

Made-ups.

Products

YARN

Good quality yarn is a pre-requisite to produce quality finished

fabrics. The company has always focused on innovation.

Being aware of the changing needs of the fashion industry,

it has been at the forefront of new developments to make

dreams come true.

The company specializes in producing blends of viscose

staple fibre, polyester staple fibre, acrylic staple fibre, lycra,

cotton, linen and wool. It has a total production capacity of

30,000 tones of yarn per annum. It includes 28,000 tones

polyester blended dyed yarns and 2000 tones wool mix yarn

per annum. The Company also specializes in producing

various type of fancy spun yarns. 90% of its production

consists of fibre-dyed yarns only. It is one of the largest

single mill setup producing spun fibre-dyed yarns in Asia.

BSL manufactures inter alias the following variety yarns:

100% Polyester, 100% Viscose, 100% Acrylic,100% Wool,

Polyester/Viscose, P/V/Wool, P/V/Lycra, P/V/Linen, P/V/High

Twists

Count Range 8s - 60s NE available in Fibre Dyed / Ecru in

case of cotton system ring spun yarn and 6s-55s NE (10s90s NM) in case of worsted system spun yarns.

FABRICS

BSL produces Hi-Quality Hi-Performance Textile wear finished

fabric for both domestic and Exports. It has highly qualified,

skilled and dedicated Technical team hence it produces textile

fabrics from fibre stage to yarn, weaving, finishing and

Garmenting .

BSL Specialty in textile include:

Stretch fabrics Lycra assured and accredited

Specialty finishes for touch (Stain, Wrinkle, Moisture

Management, Water repellant etc.)

Fire Retardant Fabric

Fabric Design and Development innovations

At present, BSL manufactures the following fabrics for mens

& womens wear and home textile furnishing fabrics in various

blends such as:

Mono, Bi-stretch and Rigid fabrics in the following blends:

Worsted Spun Polyester/Wool, 100% Wool Specialties, 100%

Viscose, Polyester / Viscose, Polyester/Modal, Polyester/

FH (in crs)

Capital

R&S

Networth

Return on Nw

B.V. (Rs.)

F.V.

T.O.

O.P.

G.P.

Dep.

PBT

Tax

PAT

EPS (Rs.)

DPS (Rs.)

MP (Rs.)

P/E Ratio

PAT as % T.O.

OP as % T.O.

31.03.11

(3M)

14.74

145.18

159.92

10.78

108.49

10.00

250.62

35.78

29.35

9.27

20.08

2.84

17.24

11.70

31.03.10

(3 M)

13.08

101.31

114.39

8.29

87.45

10.00

182.30

19.59

20.07

8.08

11.99

2.51

9.48

7.25

% CH

132.20

2.82

6.88

14.28

5.20

10.75

32.31

32.84

12.69

43.30

39.80

30.04

24.06

37.48

82.64

46.24

14.73

67.47

13.15

81.86

61.38

31.03.11

(12 M)

14.74

145.18

159.92

29.35

108.49

10.00

808.45

105.13

95.08

34.02

61.06

14.13

46.93

31.84

5.00

132.20

4.15

5.80

13.00

31.03.10

(12 M)

13.08

101.31

114.39

27.00

87.45

10.00

630.97

67.27

67.98

30.73

37.25

6.37

30.88

23.61

3.50

%CH

12.69

43.30

39.80

8.70

24.06

28.13

56.28

39.86

10.71

63.92

121.82

51.98

34.86

-

4.89

10.66

18.61

21.95

Viscose/Lycra, Polyester/Viscose/Cotton, Polyester/Wool, Polyester/

Wool/Lycra, Upholstery and Technical Fabric

READYMADE GARMENTS AND HOME TEXTILE

Banswara Garments is located in Daman and SEZ Surat. The garment

units are a specialized in Trousers and Jackets production. It makes the

offering of Banswara complete textile vertical. The installed capacity is

for about 225,000 trousers and 10,000 jackets per month. The entire

focus of the factory is on producing Trousers and Jackets that are able

to match the highest standards of workmanship, quality and appearance.

HOME TEXTILE

Made Ups :

The Company also has a speciality jacquard made up section at Banswara.

Producing about 12500 pcs/month for export. The company has 12

Jacquard Weaving Machines to produce upholstery fabrics. The company

is producing fabric suited for curtains, interior decoration and speciality

bed sheets and bed covers. The company is doing export of made-ups

to European market.

Fire Retardant Fabric

BSL is a leading manufacturer of Permanent Inherent Fire Retardant Fabric.

The fabrics can be fabricated as Curtains, Upholstery, Drapes, Wall

Paneling, Cushion Covers, Sheets and as Lining for Tents. These fabrics

are used for furnishing of Auditoriums, Multiplexes, Cinema Halls, Hotels,

Railway Coaches, Airlines, Ships & Cruise and Luxury Buses & Coaches.

Permanent Inherent Fire Retardant Fabrics doesnt allow the fire to spread

and thus minimize the risk of fire and its hazards. The Inherent property

makes the fire retardancy permanent in the fabric i.e. the property doesnt

diminish with usage and washes.

J

JULY, 2011

KOMPELLA PORTFOLIO INVESTMENT ADVICE

SPECIAL REPORTS

ORCHID CHEMICALS : ALLROUND PROGRESS

Orchid Chemicals & Pharmaceuticals Ltd., has made remarkable turnaround for the year

ended March 31, 2011. For the year (standalone), the Total Income has increased by 33% from

Rs.1,251crs to Rs.1,668crs while the Operating Profit stood at Rs.285crs and Net Profit at Rs.159crs.

The EPS for the quarter is Rs.23/-. For the year (consolidated), the Total Income has increased by

33% whereas the Operating Profit stood at Rs.286crs and Net Profit at Rs.156crs. The EPS for the

year is Rs.22/-. It has announced 30% Dividend for the year. We believe that our performance of the

fiscal year 2010-11 is the start of a strong, growth journey for the company. We have put in place

an operating canvas that incorporates long term supply arrangements involving niche products

thereby ensuring sustainable growth with strong margins going forward. Our shift to a more sustainable and robust business model has also helped us significantly deleverage our balance sheet

improving key parameters like working capital, debt equity and asset turnover. Given the strong

order book and supply arrangements, we are confident of delivering a 25% increase in revenues

and a more than proportionate growth in profits during the current financial year FY12, said Mr K

Raghavendra Rao, CMD. The Company has strong fundamentals. The Paid-up Capital of the

Company is small at Rs.70crs against high Networth of Rs.1,069crs. However, the Return on

Networth is high at 15% for the for the year on increased Networth of 14%. Technically the scrip is

moving around Rs.264/- with a P/E Ratio of 12 and Book Value of Rs.161/-.

Figures for the previous year ended March 31, 2010 are not comparable as the company

transferred its Injectable formulation business to Hospira in March 2010.

(Standalone)

Orchid announced on June 22, 2011 that its Cephalosporin

API manufacturing complex located in Alathur, Chennai has

successfully cleared the recent USFDA inspection that it went

through. The facility manufactures a range of oral and sterile

Cephalosporin APIs and caters to the developed markets like

USA, Europe and Japan. This successful inspection would

help the continuing supply of the niche APIs manufactured by

Orchid in this location to the developed markets.

Highlights of the Assets & Liabilities statement for

the fiscal ended March 31, 2011

(Consolidated basis)

Reduced receivable days - 105 days in FY11 (200 days in

FY10)

Lower Inventory days - 126 days in FY11 (164 days in

FY10)

Net Debt / equity ratio stood at 1.52 (Net debt Rs 1633.18

crore & Net worth Rs 1069 crore)

Regulatory update

Formulations

United States

Orchids cumulative ANDA (Abbreviated New Drug Application)

filings for the US market stands at 42. This includes 8 Para IV

FTF (FirstToFile) filings. The break-up of the total ANDA

filings is 13 in Cephalosporins space and 29 in the NPNC

(Non-penicillin, Non-cephalosporin) space.

The final approved ANDAs count stood at 21 at the end of

FY11. During this quarter Orchid has also received 1 tentative

ANDA approval for Eszopiclone Tabs. The final ANDA approval

is expected in due course on patent expiration. The break-up

of the total final ANDAs approval count comprises of 11 in

Cephalosporin space and 10 in the NPNC space.

European Union

In the EU region the cumulative count of Marketing

Authorizations (MAs) filed stood at 25. The break-up of the

FH (in crs)

Capital

R&S

Networth

Return on Nw

B.V. (Rs.)

F.V.

T.I.

O.P.

G.P.

Dep.

PBT

Tax

Extraord. Inc.

PAT

EPS (Rs.)

DPS (Rs.)

MP (Rs.)

P/E Ratio

PAT as % T.I.

OP as % T.I.

31.03.11

(12 M)

70.44

1063.58

1134.02

14.06

160.99

10.00

1668.28

284.95

302.25

128.45

173.80

14.32

159.48

22.64

3.00

264.00

11.66

9.56

17.08

MR K RAGHAVENDRA RAO,

CMD

(Audited)

31.03.10

(12 M)

70.44

909.19

979.63

33.82

139.07

10.00

1251.04

-322.26

-404.15

151.10

-555.25

886.59

331.34

47.04

10.00

26.49

-

% CH

16.98

15.76

-58.43

15.76

33.35

-14.99

-51.87

-51.87

-

-63.91

-

(Consolidated)

31.03.11

(12 M)

70.44

998.80

1069.24

14.61

151.79

10.00

1785.57

286.34

305.07

133.50

171.57

15.38

156.19

22.17

3.00

264.00

11.91

8.75

16.04

31.03.10

(12 M)

70.44

867.22

937.66

36.18

133.11

10.00

1343.45

-311.44

-390.57

154.90

-545.47

884.72

339.25

48.16

10.00

25.25

-

%CH

15.17

14.03

-59.62

14.03

32.91

-13.82

-53.96

-53.97

-

-65.35

-

total MA filings is 13 in the Cephalosporin space and 12 in the NPNC

space. A few more dossiers have been lined up for filing during 2011,

based on the DCP slots allotted by the respective RMS (Reference Member

States) countries in the EU. This is likely to increase the cumulative filing

count in the coming quarters.

In the EU region the cumulative count of Marketing Authorizations (MA)

approved stands at 17. The break-up of the total MA approval count is 9

in the Cephalosporin space and 8 in the NPNC space.

API segment

In the API (Active Pharmaceutical Ingredients) space, Orchids cumulative

US DMFs filed stood at 81. The break-up of the total filings is 27 in the

Cephalosporin space, 41 in NPNC space, 2 in the Betalactam segment

and 11 in the Carbapenems segment. The cumulative filings of COS

(Certificate of Suitability) for the European market stood at 21 which

includes 14 in Cephalosporin space, 6 in NPNC space and 1 in the

Betalactam segment. With staunch efforts on product development,

Orchids filing and approval count is poised to increase in the coming

months and quarters.

J

JULY, 2011

KOMPELLA PORTFOLIO INVESTMENT ADVICE

SPECIAL REPORTS

SUMEET INDUSTRIES : JUMP IN TURNOVER & PROFITS

Sumeet Industries Ltd. is a high growth stock. It has reported

jump in Turnover & Profits for the fourth quarter and year ended March

31, 2011 under the dynamic leadership of Mr.Shankarlal Somani, Chairman. For the quarter the Turnover has increased by 86% from Rs.135crs

to Rs.251crs while the Gross Profit has jumped by 214% from Rs.5crs to

Rs.17crs and Net Profit by 356% from Rs.2crs to Rs.10crs. The EPS for

the quarter is Rs.3/-. For the year, the Turnover has jumped by 119%,

Gross Profit by 133% and Net Profit by 181%. The EPS for the year is

Rs.8/- against Rs.3/-. It has announced 10% Dividend for the year. The

Company has strong fundamentals. The Paid-up Capital of the Company

is small at Rs.40crs against high Networth of Rs.99crs. However, the

Return on Networth is high at 11% for the quarter and 31% for the year

on increased Networth of 45%. Technically the scrip is moving around

Rs.36/- with a low P/E Ratio of 5 and Book Value of Rs.25/-.

(Unaudited)

FH (in crs)

MR SHANKARLAL SOMANI, CHAIRMAN

Expansion

Sumeet Industries, an emerging integrated producer of Pet Chips,

superior quality of POY/ FDY, Multifilament Polypropylene Yarns

is planning for major expansion of Rs.350crs for enhancing its

manufacturing capacity of both POY and FDY and Pet Chips in

two phases. Under the present expansion program production

capacity of POY and FDY will be increased from 50000TPA to

100000TPA and setting up another 8 MW gas based genset

captive power plant.

Products

PET Chips

The company has setup fully imported C.P. PLANT (Continuous

Poly Condensation Plant) of 100000 Tons per annum capacity

under technical guidance of Huitong Chemical Engineering

Technique Co. Ltd., China and 10 lines of Polyester POY /

FDY Spinning Plant with annual installed capacity of 48300

Tons per annum as Expansion Cum Backward Integration

Project with total cost of Rs. 1450 Million. Under this project

POY / FDY will be produced directly from PTA A and MEG

which will reduce cost substantially and will also be very

much competitive and the company will be in a position to

compete in the market in its price strategy with its peer group.

Apart from its cost advantages, company can ensure good

consistent quality of POY/FDY produced on CP Lines because

product will be much better than existing one. The Company

is also in the process of setting up another 6 MW captive

power plant imported from Deutz, Germany, at its existing unit

for its proposed project.

Polyester Division

The company started its polyester operations in 2004. It has

installed new state of art automatic craft winder plant imported

from Barmag, Germany, which is the most latest & cost efficient

technology in the world. The initial capacity is 12500 M.Tones

per annum, but it is proposed to be increased in near future.

The Company is importing PET chips or buying locally from

Capital

R&S

Networth

Return on Nw

B.V. (Rs.)

F.V.

T.O.

O.P.

G.P.

Dep.

PBT

Tax

PAT

EPS (Rs.)

DPS (Rs.)

MP (Rs.)

P/E Ratio

PAT as % T.O.

OP as % T.O.

31.03.11

(3M)

40.00

58.58

98.58

10.63

24.65

10.00

250.65

13.94

16.80

2.84

13.96

3.48

10.48

2.62

31.03.10

(3 M)

40.00

28.05

68.05

3.38

17.01

10.00

134.90

6.06

5.35

1.87

3.48

1.18

2.30

0.58

% CH

108.84

44.86

214.50

44.91

85.80

130.03

214.02

51.87

301.15

194.92

355.65

351.72

36.25

3.46

4.18

5.56

1.70

4.49

145.88

23.83

31.03.11

(12 M)

40.00

58.58

98.58

30.97

24.65

10.00

821.82

45.86

54.06

11.68

42.38

11.85

30.53

7.63

1.00

36.25

4.75

3.71

5.58

31.03.10

(12 M)

40.00

28.05

68.05

15.94

17.01

10.00

376.04

23.83

23.21

6.43

16.78

5.93

10.85

2.71

2.89

6.34

%CH

108.84

44.86

94.29

44.91

118.55

92.45

132.92

81.65

152.56

99.83

181.38

181.55

28.37

-11.99

suppliers of international repute. The spin finish oil is imported from Tako

Moto, Japan.

Polypropylene Division

The company started its Polypropylene plant way back in 1992. The

technology was imported from Neumag, Germany who is the pioneer in

Polypropylene plant in the world. It produces dope dyed polypropylene

yarn in which accuracy and uniformity of colour is guaranteed. The

products are marketed under brand name SUMILON. Capacity:

Polypropylene Partially Oriented yarn : 4000 M.Tones p.a.

Polypropylene Textured / Crimp yarn : 3900 M.Tones p.a.

Polypropylene Twisted Yarn : 1200 M.Tones p.a.

Weaving Division

There are enormous weaving units in Surat where various weaving

technologies are used. The company started its weaving operations in

2005. It has installed 60 waterjet looms plain as well as dobby to

manufacture woven fabric. The machinery is from Tsudakoma, Japan.

Tsudakoma is pioneer in the world for waterjet looms. Sumeet produces

almost zero defect fabric. The production capacity of this division is 4

million meters per annum.

Menthol Division

Sumeet started its menthol operations in 2006. It has installed a capacity

to produce 900 M.Tonnes of Peppermint oil & 300 M.Tonnes Menthol

Crystal (with/without Turpentine). The company is already in the process

of installing huge capacities of Menthol Flakes & Menthol Crystals. The

total plant is made up of stainless steel to avoid contamination in the

product.

J

JULY, 2011

KOMPELLA PORTFOLIO INVESTMENT ADVICE

COVER STORY

APOLLO HOSPITALS : HIGH GROWTH RATE

A

pollo Hospitals Enterprise Ltd., one of Asias largest healthcare groups

has reported impressive working results for the fourth quarter and year ended

March 31, 2011. For the quarter the Total Income has increased by 29% from

Rs.483crs to Rs.621crs whereas the Operating Profit has jumped by 58% from

Rs.48crs to Rs.76crs and Net Profit by 61% from Rs.29crs to Rs.47crs. The EPS

for the quarter is Rs.4/-. For the year, the Total Income has increased by 28% while

the Gross Profit has improved by 23% and Net Profit by 20%. The EPS for the year

is Rs.15/- against Rs.12/-. Encouraged by the performance, it has announced

75% Dividend against 70% last year. The Company has strong fundamentals.

The Paid-up Capital of the Company is small at Rs.62crs against high Networth

of Rs.1,704crs. However, the Return on Networth is high at 11% for the year on

increased Networth of 11%. Technically the scrip is moving around Rs.469/- with

a P/E Ratio of 32 and Book Value of Rs.137/-.

FH (in crs)

DR PRATHAP C REDDY, CHAIRMAN

Highlights:

Continued Strong performance in Q4

Delivers Industry leading growth in FY11

Consolidated Annual Revenues cross Rs. 25 billion

Board recommends dividend of Rs. 3.75 per share (75%)

Apollo Hospitals Chennai completes 100 Liver Transplants

and the Group now ranks amongst the busiest in the world in

Solid Organ Transplants

FY11 Standalone Revenues up by 28% at Rs. 23,320 million

EBITDA up by 34% at Rs. 3,773 million

PAT up by 20% to Rs. 1,817 million

FY11 Consolidated Revenues up by 29% at Rs. 26,054 million

EBITDA up by 39% at Rs. 4,189 million

PAT up by 34% to Rs. 1,839 million

Q4FY11 Standalone Revenues at Rs. 6,214 million, up by

28.7%

EBITDA at Rs. 948 million, up by 50.6%

Apollo Hospitals added a capacity of over 700 beds in the

last 15 months at its hospitals in Bhubaneswar, Hyderabad,

Karaikudi, Lavasa & Secunderabad.

SAP (Standalone pharmacies) posts record annual revenues

of Rs 6,614 million. First ever quarterly EBIT of Rs. 6 million

driven by good revenue growth and operating leverage.

Financial Highlights

Audited Standalone FY11 Performance (in comparison to

FY10)

o Revenues grew 27.7% to Rs. 23,320 million compared to

Rs.18,258 million in FY10.

o EBITDA grew 34% to Rs.3,773 million as against Rs. 2,816

million in FY10. The EBITDA margin improved by 75 basis points

to 16.2%.

o PAT was Rs. 1,817 million in FY11 vs. Rs. 1,520 million in

FY10.

o Recommended a dividend of Rs. 3.75 per share.

Audited Consolidated FY11 Performance

o Revenues grew 28.6% to Rs. 26,054 million compared to

Rs.20,265 million in FY10.

o EBITDA grew 39.0% to Rs. 4,189 million as against Rs.

3,013 million in FY10. The EBITDA margin improved by 121

basis points to 16.1%.

o PAT was Rs. 1,839 million in FY11 vs. Rs.1,376 million in

FY10.

Audited Standalone Q4FY11 Performance (in comparison to

Q4 FY10)

Capital

R&S

Networth

Return on Nw

B.V. (Rs.)

F.V.

T.I.

O.P.

G.P.

Dep.

PBT

Tax

PAT

EPS (Rs.)

DPS (Rs.)

MP (Rs.)

P/E Ratio

PAT as % T.I.

OP as % T.I.

31.03.11

(3M)

62.36

1641.30

1703.66

2.76

136.60

5.00

621.40

76.48

84.84

18.28

66.56

19.47

47.09

3.78

31.03.10

(3 M)

61.78

1479.99

1541.77

1.89

124.78

5.00

482.90

48.46

57.72

14.41

43.31

14.11

29.20

2.36

% CH

468.75

31.00

7.58

12.31

6.05

10.04

25.29

22.61

0.94

10.90

10.50

46.03

9.47

28.68

57.82

46.99

26.86

53.68

37.99

61.27

60.17

31.03.11

(12 M)

62.36

1641.30

1703.66

10.67

136.60

5.00

2331.96

306.69

339.59

70.26

269.33

87.61

181.72

14.57

3.75

468.75

32.17

7.79

13.15

31.03.10

(12 M)

61.78

1479.99

1541.77

9.86

124.78

5.00

1825.78

226.95

276.48

54.31

222.17

70.20

151.97

12.30

3.50

%CH

8.32

12.43

0.94

10.90

10.50

8.22

9.47

27.72

35.14

22.83

29.37

21.23

24.80

19.58

18.46

-

-6.37

5.79

o Revenues grew 28.7% to Rs. 6,214 million compared to Rs. 4,829

million in Q4FY10.

o EBITDA grew 50.6% to Rs. 948 million as against Rs. 629 million in

Q4FY10.

o PAT was Rs. 471 million vs. Rs. 292 million in Q4FY10, a growth of

61.3%.

Audited Consolidated Q4FY11 Performance

o Revenues grew 32.3% to Rs. 7,062 million compared to Rs. 5,355

million in Q4FY10.

o EBITDA grew 60.2% to Rs. 1,024 million as against Rs. 639 million in

Q4FY10. The EBITDA margin improved by 252 basis points to 14.5%.

o PAT was Rs. 466 million in Q4FY11 vs. Rs. 261 million in Q4FY10.

Commenting on the groups performance Dr. Prathap C Reddy, Chairman

said, FY11 has been a landmark year for us as we have crossed Rs 25

billion in consolidated annual revenues. This has been made possible by

steady growth in revenues from our increasing network of hospitals and

an outstanding performance of our Standalone Pharmacies (SAP)

segment.

We believe that this has come about due to our highly patient centric

model where everyone at Apollo is committed to provide the best clinical

and service experience to our patients. We focus on our chosen Centers

of Excellence; Cardiology, Oncology, Neurosciences, Critical Care,

Orthopedics, and Transplants, best in class clinical outcomes, adoption

of the latest technologies as well as our gradually expanding presence

across the country though our REACH hospitals have also been key

contributors to our success.

JULY, 2011

KOMPELLA PORTFOLIO INVESTMENT ADVICE

COVER STORY

A P STOCKS : ATTRACTIVE VALUATIONS

T

he performance of Corporate Sector in the State of Andhra Pradesh is improving day by day. Infact, the corporate

sector in Andhra Pradesh is playing a vital role not only in the States GDP growth rate but is also contributing to Indias GDP

growth rate. It is creating large scale employment opportunities, industrial output, modern infrastructure, higher growth rate

of exports, improved revenue to the Centre & State, inter-State trade & business, demand for national & global goods and

services, inturn improved economic conditions of the people and above all serving the investors to the maximum extent

possible. The Industrial Revolution of A P has however started only in the 1980s and that too majority of the promoters are

first generation ones - mostly from Agricultural families. However, they have shown remarkable ability to withstand against

the National and Global competition. With the emergence of I T Sector in the 1990s the Industrial map of the State has

changed dramatically. The I T exports (alone) of around Rs.35,000crs from A P during 2010-11 indicates the States economic

dominance is improving significantly at the National level. It shows that the State has produced brilliant first generation

entreprenuers who have built national & global business empires. We have selected a sample of 117 companies (who have

created wealth to the shareholders) of different sectors in A P. Many stocks have attractive valuations due to technically weak

market conditions. The entire analysis has been done from the investors point of view.

For instance, Agro Tech Foods has

reported an Operating Profit of Rs.25crs and

Net Profit of Rs.32crs on a Total Income of

Rs.721crs for the year ended 31st March,

2011. Technically the scrip is moving around

Rs.360/- with a P/E Ratio of 28 and B V of

Rs.73/-.

Amara Raja Batteries has reported

an O P of Rs.217crs and PAT of Rs.148crs

on a Total Income of Rs.1,765crs for the year

ended 31st March, 2011. Technically the scrip

is moving around Rs.215/- with a P/E Ratio of

13 and B V of Rs.76/-.

Andhra Bank has reported an O P

of Rs.2,414crs and PAT of Rs.1,268crs on a

Total Income of Rs.9,189crs for the year

ended 31st March, 2011. Technically the scrip

is moving around Rs.129/- with a low P/E

Ratio of 6 and high B V of Rs.116/-.

Apollo Hospitals has reported an

O P of Rs.307crs and PAT of Rs.182crs on a

Total Income of Rs.2,332crs for the year

ended 31st March, 2011. Technically the scrip

is moving around Rs.469/- with a P/E Ratio of

31 and B V of Rs.137/-.

Astra Microwave has reported an

O P of Rs.30crs and PAT of Rs.24crs on a

Total Income of Rs.163crs for the year ended

31st March, 2011. Technically the scrip is

moving around Rs.27/- with a P/E Ratio of 14

and B V of Rs.18/-.

Aurobindo Pharma has reported

an O P of Rs.788crs and PAT of Rs.563crs

on a Total Income of Rs.4,381crs for the year

ended 31st March, 2011. Technically the scrip

is moving around Rs.170/- with a P/E Ratio of

9 and B V of Rs.84/-.

B S Transcomm has reported an

OP of Rs.111crs and PAT of Rs.51crs on a

Total Income of Rs.872crs for the year ended

31st March, 2011. Technically the scrip is

moving around Rs.114/- with a low P/E Ratio

of 5 and high B V of Rs.148/-.

Coromandel International has

reported an O P of Rs.923crs and PAT of

Rs.694crs on a Total Income of Rs.7,636crs

for the year ended 31st March, 2011.

Technically the scrip is moving around Rs.330/

- with a P/E Ratio of 13 and B V of Rs.68/-.

Divis Labs has reported an O P of

Rs.449crs and PAT of Rs.429crs on a Total

Income of Rs.1,318crs for the year ended

31st March, 2011. Technically the scrip is

moving around Rs.750/- with a P/E Ratio of

23 and B V of Rs.136/-.

D Q Entertainment has reported an

O P of Rs.38crs and PAT of Rs.4crs on a

Total Income of Rs.208crs for the year ended

31st March, 2011. Technically the scrip is

moving around Rs.40/- with a P/E Ratio of 10

and B V of Rs.45/-.

Dr.Reddys Labs has reported an

O P of Rs.1,263crs and PAT of Rs.1,104crs

on a Total Income of Rs.7,469crs for the year

ended 31st March, 2011. Technically the scrip

is moving around Rs.1,515/- with a P/E Ratio

of 23 and B V of Rs.272/-.

Gulf Oil Corporation has reported

an O P of Rs.39crs and PAT of Rs.57crs on a

Total Income of Rs.1,103crs for the year

ended 31st March, 2011. Technically the scrip

is moving around Rs.81/- with a P/E Ratio of

14 and B V of Rs.37/-.

HBL Power Systems has reported

an O P of Rs.32crs and PAT of Rs.16crs on a

Total Income of Rs.995crs for the year ended

31st March, 2011. Technically the scrip is

moving around Rs.16/- with a P/E Ratio of 16

and B V of Rs.20/-.

Kallam Spinning Mills has reported

an O P of Rs.26crs and PAT of Rs.14crs on a

Total Income of Rs.136crs for the year ended

31st March, 2011. Technically the scrip is

moving around Rs.40/- with a low P/E Ratio

of 2 and high B V of Rs.57/-.

Lokesh Machines has reported an

O P of Rs.19crs and PAT of Rs.7crs on a

Total Income of Rs.146crs for the year ended

31st March, 2011. Technically the scrip is

moving around Rs.40/- with a P/E Ratio of 7

and high B V of Rs.72/-.

Midfield Industries has reported an

O P of Rs.25crs and PAT of Rs.13crs on a

Total Income of Rs.132crs for the year ended

31st March, 2011. Technically the scrip is

moving around Rs.36/- with a low P/E Ratio

of 4 and high B V of Rs.84/-.

Natco Pharma has reported an O P

of Rs.80crs and PAT of Rs.54crs on a Total

Income of Rs.483crs for the year ended 31st

March, 2011. Technically the scrip is moving

around Rs.263/- with a P/E Ratio of 14 and B

V of Rs.125/-.

NCC has reported an O P of

Rs.579crs and PAT of Rs.222crs on a Total

Income of Rs.6,230crs for the year ended

31st March, 2011. Technically the scrip is

moving around Rs.79/- with a low P/E Ratio

of 9 and high B V of Rs.97/-.

NMDC has reported an O P of

Rs.8,521crs and PAT of Rs.6,499crs on a

Total Income of Rs.11,369crs for the year

ended 31st March, 2011. Technically the scrip

is moving around Rs.258/- with a P/E Ratio

of 16 and B V of Rs.48/-.

Pennar Industries has reported an

O P of Rs.150crs and PAT of Rs.121crs on a

Total Income of Rs.1,373crs for the year

ended 31st March, 2011. Technically the scrip

is moving around Rs.38/- with a low P/E Ratio

of 6.

Ramky Infrastructure has reported

a G P of Rs.319crs and PAT of Rs.206crs on

a Total Income of Rs.3,147crs for the year

ended 31st March, 2011. Technically the scrip

is moving around Rs.265/- with a P/E Ratio

of 7 and B V of Rs.186/-.

Sathavahana Ispat has reported

an O P of Rs.94crs and PAT of Rs.57crs on

a Total Income of Rs.679crs for the year

ended 31st March, 2011. Technically the scrip

is moving around Rs.46/- with a low P/E Ratio

of 3 and high B V of Rs.71/-.

Suryalakshmi Cotton has reported

an O P of Rs.73crs and PAT of Rs.35crs on

a Total Income of Rs.612crs for the year

ended 31st March, 2011. Technically the scrip

is moving around Rs.68/- with a low P/E Ratio

of 3 and high B V of Rs.104/-.

Suven Life Sciences has reported

an O P of Rs.7crs and PAT of Rs.10crs on a

Total Income of Rs.150crs for the year ended

31st March, 2011. Technically the scrip is

moving around Rs.20/- with a P/E Ratio of 20

and B V of Rs.11/-.

For more details see the following pages.

J

JULY, 2011

KOMPELLA PORTFOLIO INVESTMENT ADVICE

COVER STORY

A P STOCKS :

ATTRACTIVE VALUATIONS

Year ended 31st Mar., 2011

Company (FV)

PAT

Equity Networth RNW

TO

OP

GP

PBT

EPS

(Rs. crs) (Rs. crs) (%) (Rs. crs) (Rs. crs) (Rs. crs) (Rs. crs) (Rs. crs) (Rs.)

8k Miles Software (10)

21

10

16

Agro Tech Foods (10)

24

178

18

721

25

52

47

32

13

DPS

(Rs.)

1.75

B V M P(Rs.) P/E

(Rs.) 22.06.11 Ratio

37

57 14.25

73

360 27.69

Aishwarya Telecom (5)

11

40

37

19

12 12.00

Amara Raja Batt (2)

17

646

23

1765

217

263

221

148

17

2.60

76

215 12.65

Andhra Bank (10)

560

6514

19

9189

2414

1768

1268

23

5.50

116

129

5.61

Andhra Petro (10)

85

188

19

457

66

75

52

36

1.00

22

26

6.50

Andhra Sugars (10)

27

413

470

70

92

54

35

13

152

89

6.85

Anus Labs (1)

24

162

11

270

40

28

25

17

3.00

A P Paper Mills (10)

40

578

793

91

124

57

45

11

145

358 32.55

Apollo Hospital (5)

62

1704

11

2332

307

340

269

182

15

3.75

137

469 31.27

Astra Microwave (2)

16

146

13

163

30

37

24

19

0.50

18

27 13.50

Aurobindo Pharma (1)

29

2445

23

4381

788

970

799

563

19

Avanti Feeds (10)

84

170

8.95

71

208

89

38

9.50

Avon Organics (10)

23

61

16

162

23

16

10

10

27

32

8.00

Bartronics (10)

34

557

21

907

146

157

104

118

35

164

59

1.69

Bhagyanagar India (2)

14

231

186

19

14

10

34

BS Transcomm (10)

22

324

16

872

111

90

77

51

23

Cat Technologies (10)

79

355

57

57

57

Comp-u-Learn Tech (10)

19

28

33

78

17

15

14

14

Coromandel Int. (1)

28

1904

36

7636

923

1050

988

694

25

68

330 13.20

Cura Technologies (10)

10

83

17

88

210 70.00

Cybermate Info (10)

63

104

13

0.14

17

Divis Labs (2)

27

1797

24

1318

449

526

472

429

32

DQ Entertainment (10)

79

355

208

38

71

37

31

Dr.Reddys Lab (5)

85

4599

24

7469

1263

1244

1104

65

Dredging Corporat (10)

28

1369

458

-20

115

45

40

14

Facor Alloys (1)

20

395

48

52

49

33

Fenoplast (10)

Ferro Alloys (1)

19

Four Soft (5)

19

158

389

7667

GMR Infrastructure (1)

25

10

1.00

10.00

11.25

148

17 17.00

114

4.96

10

1.43

10

2.00

7.14

136

750 23.44

45

40 10.00

272

1515 23.31

489

304 21.71

2.00

40

8.00

15

7.50

172

494

62

69

59

38

122

41

14 14.00

5774

695

-162

-1023

-930

20

31

74

Goldstone Infra (4)

14

Granules India (10)

20

218

10

475

38

45

27

21

10

Gulf Oil Corp (2)

20

369

15

1103

39

88

69

57

GVK Power (1)

158

3387

1915

322

279

96

155

HBL Power System (1)

25

511

995

32

36

16

Hindustan Dorr-Oliv (2)

14

238

16

1072

75

74

64

39

Hindustan Fluoro (10)

20

30

Hyderabad Inds (10)

293

17

724

72

92

74

51

68

53

18 18.00

109

2.00

84

8.40

37

81 13.50

21

19 19.00

0.10

20

16 16.00

0.80

33

48

9.60

11

11.00

16.00

392

372

5.47

Note- Figures rounded off, consolidated figures taken wherever possible, **18 months, ***Year ended 30.06.10, #Year ended 31.12.10,^6months

JULY, 2011

KOMPELLA PORTFOLIO INVESTMENT ADVICE

10

COVER STORY

A P STOCKS :

ATTRACTIVE VALUATIONS

Year ended 31st Mar., 2011

Company (FV)

PAT

Equity Networth RNW

TO

OP

GP

PBT

EPS

(Rs. crs) (Rs. crs) (%) (Rs. crs) (Rs. crs) (Rs. crs) (Rs. crs) (Rs. crs) (Rs.)

ICSA (India) (2)

10

836

Infotech Enter. (5)

15

1404

266

199

179

126

DPS

(Rs.)

26

B V M P(Rs.) P/E

(Rs.) 22.06.11 Ratio

175

56

1046

13

1188

132

208

160

140

13

1.25

94

Jocil (10)

120

16

383

27

35

28

19

44

8.00

271

Kakatiya Cement (10)

136

101

11

176

103

3.96

139 10.69

256

5.82

69 13.80

Kallam Spinning (10)

39

36

136

26

26

20

14

20

1.80

57

Kaveri Seed Co (10)

14

189

20

235

51

40

38

27

2.50

138

382 14.15

Kernex Micro (10)

13

128

43

103

90 22.50

KSK Energy (10)

373

2839

1144

433

315

193

182

76

113 22.60

Lanco Infratech (1)

239

4623

20

7784

1537

1851

1498

945

19

26

6.50

25

174

30

486

74

67

61

52

20

68

44

2.20

^LN Polyesters (10)

89

187

74

0.26

21

27

Lokesh Machines (10)

12

85

146

19

19

11

72

40

6.67

235

1725

5145

270

-99

-86

-147

15

84

LGS Global (10)

Mahindra Satyam (2)

40

2.00

Manjeera Construc (10)

13

63

23

125

23

21

15

12

1.00

51

97

8.08

Midfield Inds (10)

13

108

12

132

25

20

19

13

10

84

36

3.60

Nagarjuna Agriche (10)

15

570

30

30

Natco Pharma (10)

28

352

16

483

80

81

67

54

19

Nava Bharat Venture(2)

15

1890

18

1100

263

399

352

332

44

NCC (2)

51

2494

6230

579

461

325

222

1.00

97

79

8.78

NCL Industries (10)

35

155

15

365

68

60

29

23

1.50

44

36

5.14

Nelcast (10)

17

215

40

507

22

27

18

*87

50

3.00

123

100

2.00

67

398

33

20

122

124 13.78

428

1020

12

3091

331

293

198

117

24

31 10.33

115 57.50

6.00

125

263 13.84

248

205

4.66

(*includes E I Rs.75crs)

Neuland Labs (10)

NFCL (10)

Nile (10)

32

22

299

17

12

10

24

396

19215

34

11369

8521

9852

9727

6499

16

49

340

0.31

130

0.21

Oil Country (10)

44

194

16

Pennar Inds. (5)

61

NMDC (1)

Northgate Tech (10)

Pitti Laminations (10)

Pochiraju Inds (10)

326

54

46

30

2.00

150

136

121

76

1.25

1.00

67

13

256

25

20

13

19

89

13

55

12

14

12

12

36

28

95

15

17

15

10

12

Prithvi Information (10)

18

389

1530

-23

24

15

12

Priyadarshini Spin (10)

11

260

15

10

27

275

41

32

21

14

47

Ramky Infra (10)

54

107

3.30

1373

Premier Explosives (10)

Rajvir Industries (10)

1.00

2.00

6.83

258 16.13

69

12 57.14

44

71 10.14

38

6.33

71

36

4.00

47

16

2.67

44

72

6.00

215

4.00

164

48

27

3.86

72

9.00

176

157

3.34

57

1065

19

3147

319

296

206

36

186

265

7.36

Ranklin Solutions (10)

27

26

48

10

10

14

54

14

1.00

Reil Electricals (10)

12

35

32

11

31

Sagar Cements (10)

15

225

498

35

50

23

18

12

150

136

11.33

17

10

16

Sagarsoft (10)

3.00

Note- Figures rounded off, consolidated figures taken wherever possible, **18 months, ***Year ended 30.06.10, #Year ended 31.12.10,^6months

JULY, 2011

KOMPELLA PORTFOLIO INVESTMENT ADVICE

11

COVER STORY

A P STOCKS :

ATTRACTIVE VALUATIONS

Year ended 31st Mar., 2011

Company (FV)

PAT

Equity Networth RNW

TO

OP

GP

PBT

EPS

(Rs. crs) (Rs. crs) (%) (Rs. crs) (Rs. crs) (Rs. crs) (Rs. crs) (Rs. crs) (Rs.)

Samkrg Pistons (10)

10

51

19

Sathavahana Ispat (10)

SBH (100)

170

17

24

35

246

23

21

5315

22

SKS Microfinance (10)

72

1771

1245

SMS Pharma (10)

15

10

679

94

96

79

8835

2319

1766

496

189

172

112

B V M P(Rs.) P/E

(Rs.) 22.06.11 Ratio

10

4.50

57

16

1.80

1166

5620

15

245

10

224

25

23

10

Sree Akkamamba (10)

124

17

17

12

49

Sree Rayala. Hi-St (10)

11

76

218

29

30

19

21

19

Sree Rayala. Alka (10)

68

188

697

61

62

27

14

Srinivasa Hatcher (10)

10

84

23

143

26

33

29

20

20

SSPDL (10)

13

67

10

64

27

DPS

(Rs.)

52

78

7.80

71

46

2.88

25615

NL

363 24.20

198 24.75

70

2.50

41

2.16

28

4.50

86

95

4.75

52

20

4.00

Steel Exchange (10)

43

1156

70

40

29

18

Sujana Metal Prod (5)

98

721

4555

244

120

50

23

37

40 10.00

9

9.00

**Sujana Towers (1)

49

672

12

1749

209

140

114

79

14

28

**Sujana Univers (10)

130

28

15 15.00

3444

93

93

54

40

Surana Telecom (5)

10

59

62

-12

Surana Ventures (10)

25

44

38

102

22

22

21

16

18

44

Suryaamba Spin (10)

0.50

6.29

23

15

120

15

102

37

2.47

Suryachakra Power (10)

77

143

143

10

12

19

11

11.00

Suryajyoti Spinning (10)

18

100

16

395

41

41

22

16

54

30

3.33

Suryalakshmi Cot. (10)

13

139

25

612

73

73

51

35

26

2.50

104

68

2.62

Suryalata Spinning (10)

35

56

248

37

37

31

20

61

3.00

102

109

1.79

1.33

Suryavanshi Spin (10)

13

52

31

289

24

24

16

16

12

39

16

Suven Life Sciences (1)

12

127

150

10

0.25

11

20 20.00

Taj GVK Hotels (2)

13

321

13

261

77

86

66

43

2.00

51

100 14.29

Telecanor Global (10)

11

35

15

13

28

7.00

Tera Software (10)

13

67

14

125

17

18

15

10

53

49

6.13

Tyche Industries (10)

10

31

46

30

13

6.50

21

24

4.80

335

204

7.85

472

Vamshi Rubber (10)

25

66

VBC Ferro Alloys (10)

147

112

19

18

16

11

26

**Veljan Denison (10)

31

26

17

92

100

Virinchi Tech (10)

15

65

12

Visaka Industries (10)

16

261

17

653

85

69

45

28

Vishnu Chemicals (10)

12

43

27

284

43

27

16

11

10

Vivimed Labs (10)

10

188

26

417

76

64

55

49

48

VST Industries (10)

15

261

36

585

118

160

135

95

62

1.00

5.00

45

10

3.33

165

97

3.46

36

86

8.60

5.65

185

271

169

927 14.95

***GSS Infotech (10)

14

446

13

428

85

69

56

40

315

159

3.98

***MIC Electronics (2)

21

381

15

279

72

69

65

55

37

14

2.80

***Neha Inter (10)

15

58

21

56

13

14

10

12

39

#Rain Commod (2)

71

1393

17

3756

634

453

338

241

39

157 19.63

33

Note- Figures rounded off, consolidated figures taken wherever possible, **18 months, ***Year ended 30.06.10, #31.12.10,^6months

JULY, 2011

KOMPELLA PORTFOLIO INVESTMENT ADVICE

12

4.71

KOMPELLA PORTFOLIO

INVESTMENT ADVICE

(Monthly Magazine)

FREE e-edition !!

For Sample copy of our e-edition log on to

www.investmentadvice.in

Subscription Rates for Monthly Magazine

Print Edition

PERIOD

One Year

Three Years

INDIA

Rs.450

Rs.1,250

OVERSEAS

US $70

US $180

(Subscription is not refundable) (Please add Rs.25/- for Outstation Cheques.)

Yes, I/We want to subscribe KPIA (Monthly Magazine- Print Edition ) for Three years / One Year and I am

sending the Cheque / DD for an amount of Rs......../-.

Name .......................................................................................................................

Address....................................................................................................................

.................................................................................................................................