Академический Документы

Профессиональный Документы

Культура Документы

2012 10 31 Filedoc Petitioner I and E

Загружено:

corruptdivorce0 оценок0% нашли этот документ полезным (0 голосов)

32 просмотров7 страницIED

Авторское право

© © All Rights Reserved

Доступные форматы

PDF или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документIED

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

32 просмотров7 страниц2012 10 31 Filedoc Petitioner I and E

Загружено:

corruptdivorceIED

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF или читайте онлайн в Scribd

Вы находитесь на странице: 1из 7

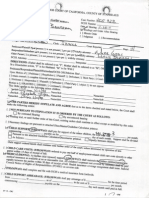

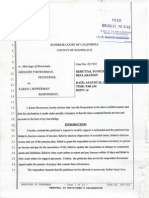

FLA150,

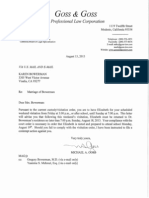

“MICHAEL A. GOSS 84109

GOSS & GOSS - A Professional Law Corporation |

1119 Twelfth Street |

| Modesto, CA 95354 | |

| reisrroveno: (209) 576-1871 (209) 577-8676

cmmronnessionensy —_ mMke@goss-law. com | |

sno |

‘SUPERIOR COURT OF CALIFORNIA, COUNTY OF STANTSTLAUS

stmceranovess 800 Eleventh Street |

manicaooress Post Office Box 1098

crvaorweo Modesto, CA 95353 |

IONE

RESPONDENTIDEFENOANTKAREN BOWERMAN

case mae

455 922

4. Employment (Give information on your current job or, if you'e unemployed, your most recent job.)

[Rach copies] @ Employer: California Emergency Physicians

‘ofyourpay | D. Employers address: 2100 Powell St., #920, Emeryville, CA 94608

| stubs foriast | © Employer's phone number: (888) 267-3880

two months | 4. Occupation: physician

(black out ©. Date job started: 9/1/89

| socit {. tfunempioyed, date job ended: n/a

| security 9. Iwork about 40 hours per week

numbers). | h. I get paid S 25, 556 gross (betore taxes) (EY permontn C) perweek (2) per hour

(if you have more than one job, attach an 8 1/2-by-11-Inch sheet of paper and list the same information as above for your other

jobs. Write “Question 4 - Other Jobs" at the top.)

2. Age and education

My age is (specity): 59

Ihave completed high school or the equivalent: [ZI Yes (C] No. Ifno, highest grace completed (specify)

©. Number of years of college completed (specify): 3 [ED Degree(s) obtained (specify: BS

4d. Number of years of graduate school completed (specify): 4 [A Degree(s) obtained (specify): MO

e

Ihave: EQ) protessionalioccupational icense(s) specify): physici.

2 vocational training (speci:

3. Tax information

a. (Q) | last filed taxes for tax year (specify year): § 2011

b. Mytax fing statusis CL) single) head of household UE) married ing separately

CO imarried, fling jointly with (specify name).

c. I file state tax returns in ED California (C) other (specify state):

4. {claim the folowing number of exemptions (including myse') on my taxes(spectty). 4

n

4. Other party's income. | estimate the gross monthly income (before taxes) of the other party in this case at (specify): Sun knowr

This estimate is based on (explain): Respondent. has submitted to a vocational

examination/assessment

{if you need more space to answer any questions on this form, attach an 8 1/2-by-11-inch sheet of paper and write the

question number before your answer.) Number of pages attached

| declare under penalty of perjury under the laws of the State of California that the information contained on all pages ofthis form and

any attachments is true and correct.

Date: October 31, 2012 )

SREGORY BOWERMAN > a) fF

“INCOME AND EXPENSE DECLARATION ieee

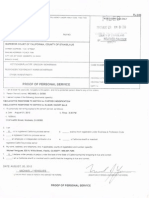

Rowerman, Greg

RESPONDENTIDEFENDANT:XAREN BOWERMAN | 455 922

| PETTIONERPLAINTIF” GREGORY BOWERE cod

(OTHER PARENTICLAIMANT:

‘Attach copies of your pay stubs for the last two months and proof of any other income. Take a copy of your latest federal

tax return to the court hearing. (Black out your social security number on the pay stub and tax return.)

5. Income (For average monthly, add up all the income you received in each category inthe last 12 months Average

‘and divide the total by 12) Last month monthiy

fa, Salary or wages (gross, before taxes) eee

. Overtime (grass, before taxes) [eee yao

©. Commissions or bonuses

‘4. Public assistance (for example: TANF, SSI, GA/GR) (2) currently receiving

fe. Spousal support CL) from this marriage (2) from a different marriage

{Partner support [2 from this domestic partnership) froma different domestic partnership $b

9, Pension/retrement fund payments so

1h. Social security retirement (not SSI) s

i. Disability CQ) Social securty (not SS!) C2) State cisabilty (SO!) (CC) Private insurance, $

j, Unemployment compensation sn

k. Workers’ compensation s___o

L. Other (military BAQ, royalty payments, etc.) (specify) so

6. Investment income (Attach a schedule showing gross receipts less cash expenses for each piece of property.)

a, Dividendsiinterest oe

bb. Rental property income Bloxham is Listed, but not currently rented s__0 ____0

cc Trustincome Bo

6. Other (specity) eee D

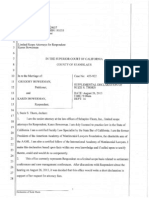

7. Income from self-employment, after business expenses for all businesses $25,556 44,641

Lam the [QQ ownerlsole proprietor CEJ business partner CL) other (speaify): per October 2012 check

Number of years in this business (specify)

Name of business (speci): CEP America

‘Type of business (specify) medical; K-1 issued

{Attach a profit and loss statement for the last two years or a Schedule C from your last federal tax return. Black out your

‘social security number. If you have more than one business, provide the information above for each of your businesses,

8 Co) Additional income. | received one-time money (lottery winnings, inheritance, etc.) in the last 12 months (specify source anc

amount)

8. [EA Change in income. My financial situation has changed significantly over the last 12 months because (specify)

No longer received $1200 admin stipend from Los Banos nor $50/ho

r bonus for working

10. Deductions Los Banos; shifts being decreased from 20 to 16 per month which Last month

Required union dues are be reflected.on 10/15/12 check

Required retirement payments (not social security, FICA, 401(k), or RA)

Medical, hospital, dental, and other health insurance premiums (total monthly amount}

CChild suppor that | pay for children from other relationships

Spousal support that | pay by court order trom a different mariage

Pariner support that | pay by court order from a different domestic partnership

Necessary job-related expenses not reimbursed by my employer attach explanation labeled "Question 10g"

11. Assets Total

fa. Cash and checking accounts, savings, credit union, money market, and other deposit accounts $12,000

bb. Stocks, bonds, and other assets I could easily sell OF-Y Lhe contents of storage units sunknown

cc Allother property, G&D real and (L} personal estimate fair market value minus the debts you owe) so

Ventcles-53,700; both Carolyn and Blowtiam properties are upside down: $1.7 milion 3

YSRESTAD catvené back cones! stm, Ul0. Ioan Pom rerifenents approx, 360,000 tama on debt forgiveness

“INCOME AND EXPENSE DECLARATION —

- . Bowerman, -Greg—

BETITIONERIPLAINTIFF: GREGORY BOWERMAN case MoE ol

|_RESPONDENTIDEFENDANTKAREN BOWERMAN 455 922 |

OTHER PARENTICLAIMANT:

12_The following people live with me:

{ilame T Age” | How the parson is Baye some ofthe

_ ‘elated 19 me? (x: son household expenses?

a William | son (ives “CaNo |

b. Olivia | daughter Ghves Eno |

ce Elizabeth | daughter Ch ves [No

4 | Gye Cio

eo _ ae Oo ves CY No

13. average monthly expenses (EI Estimated expenses [EQ Acualexpenses (El) Proposed needs

a. Home

(1) ED Rent or CY morgage 00 ee eee *

—— 1 Clothes s

(a) average principal: s 0 i. Education lessons, lunches........§___400.

(©) average interest: : a k. Entertainment, gifts, and vacation a Ao

(2) Real property axes for Carolyn $488. |, Auto expenses and transportation

(2) Homeowners or ent’ insurance (insurance. gas, repairs, bus.etc) S80

(if mot included above) S.see umbrella — iy insurance (life, accident, etc.; do not

a) Mantnance anéopar sy, indude auto, home, or heath insurance) $_

Heal tite C88 ROK BSIEBY insurance s__200. Savings and investments

0, Charitable contibutions

c. Child care $___1, 000 p. Monthly payments listed in item 14

{iemize below in 14 and insert totat here) $1, 972

4. Groceries andhovsehold supplies $1,202 4 ier speci ao

fe. Eating out 4 ao sonal grooming, ete. 4

|r. TOTAL EXPENSES (a-0) (do notaddin $ 12.225]

1. Ulliies (ges, elctic, water, trash) $900.) ) i

includes utilities ar rental

4g" Telephone, cellphone, andemal $470. $ Amount of expenses paid by others, $__

14. Installment payments and debts not listed above

16. Attorney fees (This is required if either party is requesting attomey fees.

fa. To date, | have paid my attornay this amount for fees and costs (specify): $ 28,532

b. The source of this money was (specify): earnings:

Вам также может понравиться

- 2013-2-20-Filedoc - Judge Jacobson Order Re Atty FeesДокумент6 страниц2013-2-20-Filedoc - Judge Jacobson Order Re Atty FeescorruptdivorceОценок пока нет

- Elisor Motion 7-20-2012Документ20 страницElisor Motion 7-20-2012corruptdivorceОценок пока нет

- 2013-7-17 Thru 26 - EMAIL-Karen To Greg Re Visitation - Support - CustodyДокумент21 страница2013-7-17 Thru 26 - EMAIL-Karen To Greg Re Visitation - Support - CustodycorruptdivorceОценок пока нет

- 2013 6 21 Filedoc Petitioner Final DisclosureДокумент72 страницы2013 6 21 Filedoc Petitioner Final DisclosurecorruptdivorceОценок пока нет

- Findings and Order After Hearing - November 28 2011Документ4 страницыFindings and Order After Hearing - November 28 2011corruptdivorceОценок пока нет

- 2012-8-21-Filedoc-Respondents Declarative Response To Custdody ModificationДокумент65 страниц2012-8-21-Filedoc-Respondents Declarative Response To Custdody Modificationcorruptdivorce100% (1)

- 2013 2 19 Filedoc Petitioner Income and ExpenseДокумент10 страниц2013 2 19 Filedoc Petitioner Income and ExpensecorruptdivorceОценок пока нет

- 2013 2 19 Filedoc Hearing Transcript Attorney Fees OtherДокумент33 страницы2013 2 19 Filedoc Hearing Transcript Attorney Fees OthercorruptdivorceОценок пока нет

- 2013-2-19-Filedoc-Finding and Order After Hearing FormДокумент3 страницы2013-2-19-Filedoc-Finding and Order After Hearing FormcorruptdivorceОценок пока нет

- 2013 8 26 Filedoc Petitioner I and EДокумент23 страницы2013 8 26 Filedoc Petitioner I and EcorruptdivorceОценок пока нет

- 2011 11 22 Filedoc Petitioner Income and ExpenseДокумент25 страниц2011 11 22 Filedoc Petitioner Income and ExpensecorruptdivorceОценок пока нет

- 2013 8 26 Filedoc DVRO Supplemental DeclarationДокумент67 страниц2013 8 26 Filedoc DVRO Supplemental DeclarationcorruptdivorceОценок пока нет

- 2013 2 19 Filedoc Petitioner Income and ExpenseДокумент10 страниц2013 2 19 Filedoc Petitioner Income and ExpensecorruptdivorceОценок пока нет

- 2013-6-20-Filedoc - Petitioner Income and Expense DeclДокумент19 страниц2013-6-20-Filedoc - Petitioner Income and Expense DeclcorruptdivorceОценок пока нет

- 2013-8-29-Filedoc-Finding and Order After Hearing - Support and Atty FeesДокумент5 страниц2013-8-29-Filedoc-Finding and Order After Hearing - Support and Atty FeescorruptdivorceОценок пока нет

- 2012 10 31 Filedoc Petitioner I and EДокумент7 страниц2012 10 31 Filedoc Petitioner I and EcorruptdivorceОценок пока нет

- November 22 2012 Petitioner Income and ExpenseДокумент25 страницNovember 22 2012 Petitioner Income and ExpensecorruptdivorceОценок пока нет

- 2013-10-31-Filedoc-Substitution of Attorney-Schapiro Thorn To WagnerДокумент1 страница2013-10-31-Filedoc-Substitution of Attorney-Schapiro Thorn To WagnercorruptdivorceОценок пока нет

- Bowerman Pension Plan - Tax IssuesДокумент2 страницыBowerman Pension Plan - Tax IssuescorruptdivorceОценок пока нет

- 2013-11-6-Filedoc-Motion To Compel PDFДокумент130 страниц2013-11-6-Filedoc-Motion To Compel PDFcorruptdivorceОценок пока нет

- 2013 8 26 Filedoc Petitioner I and EДокумент23 страницы2013 8 26 Filedoc Petitioner I and EcorruptdivorceОценок пока нет

- 2013 8 26 Filedoc Karen Income ExpenseДокумент5 страниц2013 8 26 Filedoc Karen Income ExpensecorruptdivorceОценок пока нет

- 2013 8 26 Filedoc Hearing TranscriptДокумент20 страниц2013 8 26 Filedoc Hearing TranscriptcorruptdivorceОценок пока нет

- 2012-2-17-LTR-Pension-PCG To Greg Re New Regs - AgreementДокумент16 страниц2012-2-17-LTR-Pension-PCG To Greg Re New Regs - AgreementcorruptdivorceОценок пока нет

- 2013-9-23-Filedoc-Petitioner Response To Motion To CompelДокумент3 страницы2013-9-23-Filedoc-Petitioner Response To Motion To CompelcorruptdivorceОценок пока нет

- 2013 8 26 Filedoc Declaration of Gregory BowermanДокумент54 страницы2013 8 26 Filedoc Declaration of Gregory BowermancorruptdivorceОценок пока нет

- 2013 8 26 Filedoc Declaration of Suzie ThornДокумент3 страницы2013 8 26 Filedoc Declaration of Suzie ThorncorruptdivorceОценок пока нет

- Supplemental Declaration For Karen Bowerman - Attoreny Fees-Support - Access Pension PlanДокумент114 страницSupplemental Declaration For Karen Bowerman - Attoreny Fees-Support - Access Pension PlancorruptdivorceОценок пока нет

- 2013 8 21 Filedoc Rebuttal To Petitioners DeclarationДокумент28 страниц2013 8 21 Filedoc Rebuttal To Petitioners DeclarationcorruptdivorceОценок пока нет

- 2013-8-16-LTR-Goss To Karen Re Threat of Contempt - VisitationДокумент1 страница2013-8-16-LTR-Goss To Karen Re Threat of Contempt - VisitationcorruptdivorceОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (120)