Академический Документы

Профессиональный Документы

Культура Документы

Asssitant Branch Manager Kahama and Nzega

Загружено:

Rashid BumarwaАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Asssitant Branch Manager Kahama and Nzega

Загружено:

Rashid BumarwaАвторское право:

Доступные форматы

Tanzania Postal Bank is an established Bank by

the Act No. 11 of 1991 as amended by Act No. 11

of 1992. TPB is a Bank that provides competitive

financial services to our customers and creates

value for our stakeholders through innovative

products.

TPB is a Bank, whose vision is to be the leading

bank in Tanzania in the provision of affordable,

accessible and convenient financial services. As

part of effective organizational development and

management of its human capital in an effective

way, TPB commits itself towards attaining,

retaining and developing the highly capable and

qualified workforce for TPB betterment and the

Nation at large.

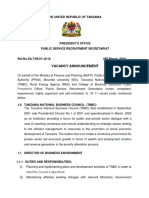

ASSISTANT BRANCH MANAGER - KAHAMA AND NZEGA

(2 POSITIONS)

Tanzania Postal Bank (TPB) seeks to appoint dedicated, self-motivated and highly

organized Assistant Branch Managers (2 position) to join the Technology and

Operations team. The work station is Kahama and Nzega

Reporting Line:

Locations:

Work Schedule:

Division:

Salary:

Branch Manager (BM)

Kahama and Nzega

As per TPB Staff regulations

Branches

Commensurate to the Job Advertised

POSITION OBJECTIVE

1. To run the branch as a profit centre, managing the sales process by acquiring

new business and deepening existing customer relationships and maintaining

operational efficiency while providing the appropriate service standards.

2. Ensure provision of efficient/effective back office and branch operations, health

& safety and issues associated with both branch assets and equipment and staff

3. To undertake periodic self-assessment on key controls to assess the proper

functioning and adequacy of existing controls.

4. Assist in coordinating, facilitating and promoting understanding of operational

risk and in implementation and management of operation risk within the Unit.

KEY RESPONSIBILITIES

Generate new business via sales promotions, out-marketing calls, customer visits

(current/potential), and build relationship with existing customers.

To ensure that there is quality growth of loan portfolio as per the set targets

To mobilize deposits and ensure that growth in deposits conform to the annual

budget plans.

Ensure the highest standards of customer service are provided in order that our

services are perceived as being the best in the local market including handling

customer complaints.

To liaise with the Public and Government officials in the area of operation of the

Branch to maintain good public relations and project good image of the bank;

To carry out regular snap checks for cash in tills/strong-rooms, controlled

stationery, all suspense accounts and stamp accounts.

Supervise back-office processing

Ensure reconciliation of suspense accounts

Monitor branch security, maintenance and Health & Safety issues

Maintain records of Contactors and Overall Maintenance of Bank Assets

Maintain all the required Branch registers as stipulated in the operational

manuals.

Ensure availability of required stationeries and equipment

Control Branch expenses and ensure that they are within the approved budgets

and proper management.

Ensure signature books (both own and correspondents) are properly kept and

updated.

Plan and manage staff administration issues for support staff (i.e. local leave,

training, Dept staff rotation) in consultation with the Branch manager.

Ensure that all Operational Procedures are adhered to by all branch staff.

Print and verify Journal of accounting entries on daily basis.

Follow-up and ensure that all Revenue due to the Bank is collected without a fail.

Counter sign with the Branch manager, all debits to the Profit and Loss accounts

Carry-out routine balancing, snap checks and bulk checks for branch cash in tills,

and in the strong room.

Manage service delivery, to review output of tellers, customer service and

enquiries to ensure adherence to Branch standards.

Ensure counter services key control standards are adhered to and custodian of

Complaint handling process.

Ensure proper handling of customers new ATM cards as well as ATM captured

cards.

Ensure timely submission of Branch reports/returns to Head-office as required.

Ensure that the Anti-Money Laundering requirements are followed as follows:

a) Take all reasonable steps to verify and identify customers, including

performing Quality Assurance on accounts opened, and the general KYC

issues

b) Retain adequate records of identification, account opening and

transactions and ensure timely and properly filling of customer mandates

c) Make/assist to effective reporting of suspicious transactions

d) Raise awareness of Money Laundering prevention by training all branch

staff.

Co-Custodian of Vault Cash.

Safe custodianship and BCP (Branch Continuity Program) custodian.

Act as Operational Risk Coordinator for the branch

To identify and report all exceptions on non-compliance with standard controls

To identify and report all weaknesses inherent in the standard controls

To assist Risk Manager in developing and updating of procedures, controls and

monitoring plans for Operational Risk Management.

To report Branchs Operational Risk issues and losses to Risk Manager

To maintain proper record keeping on all Key Control Self-Assessment (KCSA)

and KRI related activities.

To maintain independence in the conduct of KCSA, i.e not selecting and

reviewing sample of self-performed transactions.

Ensure tidiness across the branch premises and clean-desk policy is exercised.

Perform any other duties as may be assigned by Branch manager from time to

time.

Comply with the Policies and standards, Local laws and Regulations, Controls and

Procedures of the Bank.

Report Suspicious Transactions

Ensure proper filling of customer credit documents and correspondents.

Ensure Dual control is in place in the record room at the branch.

EXPERIENCE AND KNOWLEDGE REQUIRED

Education:

Bachelor degree/Advanced diploma in Banking, Economics, and

commerce, Business Administration, Finance or Accounting from any

recognized University or equivalent.

Experience:

Skills / Attributes:

At least 3 years of relevant Banking experience

Working knowledge of Equinox Functionality

Strong leadership & people management skills

Prioritize Tasks

Team player

The position will attract a competitive salary package, which include benefits.

Applicants are invited to submit their resume (indicating the position title in the

subject heading) via e-mail to: recruitment@postalbank.co.tz. Applications via

other methods will not be considered. Applicants need to submit only the

Curriculum Vitae (CV) and the letter of applications starting the job

advertised and the location. Other credentials will have to be submitted

during the interview for authentic check and other administrative

measures and should not in any way be attached during application.

Avoid scams: NEVER pay to have your CV / Application pushed forward.

Any job vacancy requesting payment for any reason is a SCAM. If you are

requested to make a payment for any reason, please call +255 22 2110621-2 to

report the scam. You also dont need to know one in TPB to be employed. TPB is

merit based institution and to achieve this vision, it always go for the best.

Tanzania Postal Bank is an Equal Opportunity Employer and is very

committed to environmental, health and safety Management.

Tanzania Postal Bank has a strong commitment to environmental, health and safety

management. Late applications will not be considered. Short listed candidates may

be subjected to any of the following: a security clearance; a competency

assessment; physical capability assessment and reference checking.

Please forward your applications before 2nd September, 2015

Вам также может понравиться

- Asssitant Branch Manager NachingweaДокумент4 страницыAsssitant Branch Manager NachingweaRashid BumarwaОценок пока нет

- Job Advert - Asstant BMДокумент4 страницыJob Advert - Asstant BMRashid BumarwaОценок пока нет

- Advert Assistant Branch Manager Mto Wa Mbu 2Документ5 страницAdvert Assistant Branch Manager Mto Wa Mbu 2Rashid BumarwaОценок пока нет

- Job Advert - Branch Operation OfficerДокумент3 страницыJob Advert - Branch Operation OfficerRashid BumarwaОценок пока нет

- BOO Mbinga Ifakara Karagwe and Mafinga Oct 2015Документ3 страницыBOO Mbinga Ifakara Karagwe and Mafinga Oct 2015Rashid BumarwaОценок пока нет

- Advert-Tanzania Postal Bank-Bank Operation Oficer - Mwanza and Sengerema Mini BranchДокумент3 страницыAdvert-Tanzania Postal Bank-Bank Operation Oficer - Mwanza and Sengerema Mini BranchRashid BumarwaОценок пока нет

- Branch Manager KigomaДокумент4 страницыBranch Manager KigomaRashid BumarwaОценок пока нет

- Advert-Tanzania Postal Bank-Bank Operation Oficer - Tunduma Mini Branch 2Документ3 страницыAdvert-Tanzania Postal Bank-Bank Operation Oficer - Tunduma Mini Branch 2Aaron DelaneyОценок пока нет

- Silk Bank: 1. Key Responsibilities (Customer Relationship Officer)Документ5 страницSilk Bank: 1. Key Responsibilities (Customer Relationship Officer)Muhammad_Usama92Оценок пока нет

- Advert Credit Officer Group Lending Tabora - 2015Документ3 страницыAdvert Credit Officer Group Lending Tabora - 2015Rashid BumarwaОценок пока нет

- Banking Operations Officer PDFДокумент2 страницыBanking Operations Officer PDFRashid BumarwaОценок пока нет

- Advert - Collection and Recovery Manager April 2015Документ3 страницыAdvert - Collection and Recovery Manager April 2015Rashid BumarwaОценок пока нет

- Credit Officer Mwanza 2015Документ3 страницыCredit Officer Mwanza 2015Rashid BumarwaОценок пока нет

- Advert Agency Banking SupportДокумент3 страницыAdvert Agency Banking SupportRashid BumarwaОценок пока нет

- Advert-Tanzania Postal Bank-Bank Operation Oficers - 2 Vacancies - Arusha BranchДокумент3 страницыAdvert-Tanzania Postal Bank-Bank Operation Oficers - 2 Vacancies - Arusha BranchRashid BumarwaОценок пока нет

- Advert Senior Credit Officer GL 2Документ3 страницыAdvert Senior Credit Officer GL 2Rashid BumarwaОценок пока нет

- Advert Credit Officer NachingweaДокумент4 страницыAdvert Credit Officer NachingweaRashid BumarwaОценок пока нет

- Job Advert - Relationship Officer KijitonyamaДокумент3 страницыJob Advert - Relationship Officer KijitonyamaRashid BumarwaОценок пока нет

- Credit Officer Microl Loans .Документ3 страницыCredit Officer Microl Loans .Rashid BumarwaОценок пока нет

- Job Advert - Credit RiskДокумент2 страницыJob Advert - Credit RiskRashid BumarwaОценок пока нет

- Advert - Relationship Officers-Directorate of Retail Banking - 12 Positions - February 2014Документ4 страницыAdvert - Relationship Officers-Directorate of Retail Banking - 12 Positions - February 2014Rashid BumarwaОценок пока нет

- Advert For Six Banking Operation Officers Upcountry March 2023Документ3 страницыAdvert For Six Banking Operation Officers Upcountry March 2023Benjamin YusuphОценок пока нет

- Advert Temporary Data Entry Officers January 2016Документ2 страницыAdvert Temporary Data Entry Officers January 2016Rashid BumarwaОценок пока нет

- Advert Senior Procurement OfficerДокумент3 страницыAdvert Senior Procurement OfficerRashid BumarwaОценок пока нет

- Job Advert - Credit Officer Group LendingДокумент3 страницыJob Advert - Credit Officer Group LendingRashid BumarwaОценок пока нет

- Advert Corporate Sales ExecutiveДокумент2 страницыAdvert Corporate Sales ExecutiveRashid BumarwaОценок пока нет

- Job Advert - Credit OfficerДокумент3 страницыJob Advert - Credit OfficerRashid BumarwaОценок пока нет

- Advert For The Position of Chief Procurement ManagerДокумент5 страницAdvert For The Position of Chief Procurement ManagerRashid BumarwaОценок пока нет

- Ajiranasi.com BOA New JOB 1Документ3 страницыAjiranasi.com BOA New JOB 1Leonard ngoboleОценок пока нет

- Advert For Vacancy AnnouncementДокумент36 страницAdvert For Vacancy AnnouncementDickОценок пока нет

- Advert Credit Risk AnalystДокумент3 страницыAdvert Credit Risk AnalystRashid BumarwaОценок пока нет

- Internship Report Chap 2Документ11 страницInternship Report Chap 2Faizan MalikОценок пока нет

- Vacancies Tib CBL July 2017Документ15 страницVacancies Tib CBL July 2017Anonymous iFZbkNwОценок пока нет

- Accountant - Cash and ARДокумент1 страницаAccountant - Cash and ARmknhanoОценок пока нет

- Job Description of Branch StaffДокумент3 страницыJob Description of Branch StaffEleanor JamcoОценок пока нет

- Adverts - Credit Clerk Kigoma - August 2015Документ3 страницыAdverts - Credit Clerk Kigoma - August 2015Rashid BumarwaОценок пока нет

- CSOResponsibilitiesДокумент6 страницCSOResponsibilitiesA N Hassan SyedОценок пока нет

- Kashf BankДокумент2 страницыKashf BankUmar IqbalОценок пока нет

- Advert_FinancialManager2024Документ2 страницыAdvert_FinancialManager2024u11082390Оценок пока нет

- Advert Corporate Affairs OfficerДокумент3 страницыAdvert Corporate Affairs OfficerRashid BumarwaОценок пока нет

- Career Oppoertunities - 1Документ3 страницыCareer Oppoertunities - 1Charles JumaОценок пока нет

- Description For Clerks in Non-Officer Cadre: 1. Cost To CompanyДокумент2 страницыDescription For Clerks in Non-Officer Cadre: 1. Cost To CompanyShweta PatilОценок пока нет

- Tariq Abdelhadi CVДокумент5 страницTariq Abdelhadi CVtariq601Оценок пока нет

- Job Description Trade Finance OfficerДокумент3 страницыJob Description Trade Finance OfficerSAIDI NYAHEGOОценок пока нет

- Papia SultanaДокумент3 страницыPapia Sultanamd ashikuzzamanОценок пока нет

- Job Advert - ProcurementДокумент4 страницыJob Advert - ProcurementRashid BumarwaОценок пока нет

- Credit Officer1Документ2 страницыCredit Officer1Rashid BumarwaОценок пока нет

- Resume Sample For Teller PositionДокумент9 страницResume Sample For Teller Positiongt58x6w9100% (1)

- Accounts Clerk Job DutiesДокумент13 страницAccounts Clerk Job DutiesV SugrimОценок пока нет

- JD BranchAccountant ManchesteraДокумент5 страницJD BranchAccountant ManchesteranumlumairОценок пока нет

- NBC New VacanciesДокумент10 страницNBC New VacanciesSamson Nyaitwang'aОценок пока нет

- Teller ResumeДокумент7 страницTeller Resumevyp0wosyb1m3100% (2)

- Senior Vsla Manager (1 Position) : Key ResponsibilitiesДокумент3 страницыSenior Vsla Manager (1 Position) : Key ResponsibilitiesRashid BumarwaОценок пока нет

- Curriculum+Vitae+ Alphonse 3Документ4 страницыCurriculum+Vitae+ Alphonse 3Pal D' ColloОценок пока нет

- HIRING FOR Finance AccountsДокумент2 страницыHIRING FOR Finance AccountsgrowmoneycОценок пока нет

- Career Objective: M. Khalid SaeedДокумент4 страницыCareer Objective: M. Khalid SaeedisheloneОценок пока нет

- Finance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersОт EverandFinance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersОценок пока нет

- Basic Accounting: Service Business Study GuideОт EverandBasic Accounting: Service Business Study GuideРейтинг: 5 из 5 звезд5/5 (2)

- CRDB Bank Job Opportunities Branch Managers 2Документ4 страницыCRDB Bank Job Opportunities Branch Managers 2Rashid BumarwaОценок пока нет

- Job Advert Central Zone - 2019Документ8 страницJob Advert Central Zone - 2019Rashid BumarwaОценок пока нет

- Job Opportunity Laboratory Technologist March 2019Документ2 страницыJob Opportunity Laboratory Technologist March 2019Rashid BumarwaОценок пока нет

- Nafasi Za TaalumaДокумент6 страницNafasi Za TaalumaRashid BumarwaОценок пока нет

- Job Opportunities 22.08.2017 PDFДокумент2 страницыJob Opportunities 22.08.2017 PDFRashid BumarwaОценок пока нет

- Job Vacancies - TPBДокумент2 страницыJob Vacancies - TPBRashid BumarwaОценок пока нет

- Curiculum VitaeДокумент8 страницCuriculum VitaeRashid BumarwaОценок пока нет

- Students Selected For Undergraduate Programs 2017 18Документ8 страницStudents Selected For Undergraduate Programs 2017 18Rashid BumarwaОценок пока нет

- Tangazo La Kazi 28 Machi 2019 TNBC Ministry of Finance and Planning Rea Mu and CbeДокумент10 страницTangazo La Kazi 28 Machi 2019 TNBC Ministry of Finance and Planning Rea Mu and CbeRashid BumarwaОценок пока нет

- Selected Bachelor Degree Students - MustДокумент12 страницSelected Bachelor Degree Students - MustRashid BumarwaОценок пока нет

- Selected Students - SautДокумент31 страницаSelected Students - SautRashid BumarwaОценок пока нет

- Job Opportunities 22.08.2017 PDFДокумент2 страницыJob Opportunities 22.08.2017 PDFRashid BumarwaОценок пока нет

- Advert-Credit Supervisor 2Документ5 страницAdvert-Credit Supervisor 2Rashid BumarwaОценок пока нет

- TPA ICT VacanciesДокумент13 страницTPA ICT VacanciesRashid BumarwaОценок пока нет

- Sokoine University of Agriculture Morogoro: Job OpportunitiesДокумент2 страницыSokoine University of Agriculture Morogoro: Job OpportunitiesRashid BumarwaОценок пока нет

- Research Coordinator Post Re AdvertisedДокумент2 страницыResearch Coordinator Post Re AdvertisedRashid BumarwaОценок пока нет

- UTUMISHIДокумент3 страницыUTUMISHIRashid BumarwaОценок пока нет

- Scholarships ThailandДокумент2 страницыScholarships ThailandRashid BumarwaОценок пока нет

- Vacancy Sacids March2017Документ3 страницыVacancy Sacids March2017Rashid BumarwaОценок пока нет

- Advert-Manager-Operational Risk and ComplianceДокумент4 страницыAdvert-Manager-Operational Risk and ComplianceRashid BumarwaОценок пока нет

- Advert Temporary Credit Officer Sumbawanga 5Документ4 страницыAdvert Temporary Credit Officer Sumbawanga 5Rashid BumarwaОценок пока нет

- Advert Receptionist 2Документ3 страницыAdvert Receptionist 2Rashid BumarwaОценок пока нет

- Job Advert MSDДокумент24 страницыJob Advert MSDRashid BumarwaОценок пока нет

- The International AssociationScholarships 2017Документ1 страницаThe International AssociationScholarships 2017Rashid BumarwaОценок пока нет

- Job Vacancies - SUZAДокумент3 страницыJob Vacancies - SUZARashid BumarwaОценок пока нет

- Vacancy Research Assistant March2017Документ2 страницыVacancy Research Assistant March2017Rashid BumarwaОценок пока нет

- HESLBДокумент32 страницыHESLBKarim MtilahОценок пока нет

- Apopo Job Vacancy 2017Документ3 страницыApopo Job Vacancy 2017musa hauleОценок пока нет

- Employment Vacancies - Postal BankДокумент3 страницыEmployment Vacancies - Postal BankRashid BumarwaОценок пока нет

- Makato and The Cowrie ShellДокумент3 страницыMakato and The Cowrie ShellMhay Serna80% (5)

- Complete Spanish Grammar 0071763430 Unit 12Документ8 страницComplete Spanish Grammar 0071763430 Unit 12Rafif Aufa NandaОценок пока нет

- United Nations Industrial Development Organization (Unido)Документ11 страницUnited Nations Industrial Development Organization (Unido)Ayesha RaoОценок пока нет

- 2021 Pslce Selection - ShedДокумент254 страницы2021 Pslce Selection - ShedMolley KachingweОценок пока нет

- 14.30 GrimwadeДокумент32 страницы14.30 GrimwadeJuan QuintanillaОценок пока нет

- Afi11 214Документ3 страницыAfi11 214amenendezamОценок пока нет

- Case No. 23 - Maderada Vs MediodeaДокумент3 страницыCase No. 23 - Maderada Vs MediodeaAbbyAlvarezОценок пока нет

- Apply For Cabin Crew (Airbus) at IndiGoДокумент6 страницApply For Cabin Crew (Airbus) at IndiGov.kisanОценок пока нет

- JPM The Audacity of BitcoinДокумент8 страницJPM The Audacity of BitcoinZerohedge100% (3)

- Shareholding Agreement PFLДокумент3 страницыShareholding Agreement PFLHitesh SainiОценок пока нет

- Agrade CAPSIM SECRETS PDFДокумент3 страницыAgrade CAPSIM SECRETS PDFAMAN CHAVANОценок пока нет

- Allodial InterestДокумент17 страницAllodial InterestSarah75% (4)

- Innovation Simulation: Breaking News: HBP Product No. 8678Документ9 страницInnovation Simulation: Breaking News: HBP Product No. 8678Karan ShahОценок пока нет

- Assignment World Group6 SectionBДокумент3 страницыAssignment World Group6 SectionBWanderer InneverlandОценок пока нет

- MOWILEX Balinese Woodcarving A Heritage To Treasure LatestДокумент85 страницMOWILEX Balinese Woodcarving A Heritage To Treasure LatestBayus WalistyoajiОценок пока нет

- Listof Licenced Security Agencies Tamil NaduДокумент98 страницListof Licenced Security Agencies Tamil NadudineshmarineОценок пока нет

- 2014 10 A Few Good Men Playbill PDFДокумент8 страниц2014 10 A Few Good Men Playbill PDFhasrat natrajОценок пока нет

- Charlotte Spencer - Student - SalemMS - Manifest Destiny and Sectionalism Unit PacketДокумент9 страницCharlotte Spencer - Student - SalemMS - Manifest Destiny and Sectionalism Unit Packetcharlotte spencerОценок пока нет

- SOP For Master of Business Administration: Eng. Thahar Ali SyedДокумент1 страницаSOP For Master of Business Administration: Eng. Thahar Ali Syedthahar ali syedОценок пока нет

- Achieving Excellence Guide 3 - Project Procurement LifecycleДокумент27 страницAchieving Excellence Guide 3 - Project Procurement LifecycleMoath AlhajiriОценок пока нет

- Problem 7 - 16Документ2 страницыProblem 7 - 16Jao FloresОценок пока нет

- Computer Shopee - Final Project SummaryДокумент3 страницыComputer Shopee - Final Project Summarykvds_2012Оценок пока нет

- Mutual Fund: Advnatages and Disadvantages To InvestorsДокумент11 страницMutual Fund: Advnatages and Disadvantages To InvestorsSnehi GuptaОценок пока нет

- Philippines-Expanded Social Assistance ProjectДокумент2 страницыPhilippines-Expanded Social Assistance ProjectCarlos O. TulaliОценок пока нет

- Lawrkhawm: Kum 2014 Branch Kumtir Com-Mittee Neih A NiДокумент4 страницыLawrkhawm: Kum 2014 Branch Kumtir Com-Mittee Neih A NibawihpuiapaОценок пока нет

- A Gateway For SIP Event Interworking: - Sasu Tarkoma & Thalainayar Balasubramanian RamyaДокумент20 страницA Gateway For SIP Event Interworking: - Sasu Tarkoma & Thalainayar Balasubramanian RamyaMadhunath YadavОценок пока нет

- University of ST Andrews 2009 ArticleДокумент156 страницUniversity of ST Andrews 2009 ArticleAlexandra SelejanОценок пока нет

- Why The Irish Became Domestics and Italians and Jews Did NotДокумент9 страницWhy The Irish Became Domestics and Italians and Jews Did NotMeshel AlkorbiОценок пока нет

- IVAN's TEST UAS 1Документ9 страницIVAN's TEST UAS 1gilangОценок пока нет

- Hippo 3 Use 2020 V1.EДокумент2 страницыHippo 3 Use 2020 V1.ECherry BushОценок пока нет