Академический Документы

Профессиональный Документы

Культура Документы

Imp Changes in ITR 1,2,2A and 4S - Income Tax Articles PDF

Загружено:

debasispahiИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Imp Changes in ITR 1,2,2A and 4S - Income Tax Articles PDF

Загружено:

debasispahiАвторское право:

Доступные форматы

7/22/2015

Imp changes in ITR 1,2,2A and 4S - Income Tax Articles

Imp changes in ITR 1,2,2A and 4S

NAVIN AGICHA (../profile.asp?member_id=1428346)

on 27 June 2015

(../profile.asp?

member_id=1428346)

(../report_abuse.asp?module=articles)

FEW IMPORTANT CHANGES IN ITR 1, ITR 2, ITR 2A AND ITR 4S IN AY 2015-16 AS NOTIFIED IN

NOTIFICATION NUMBER 49/2015 DATED 22.06.15:CBDT has vide Notification No. 49/2015 Dated 22.06.2015 notified Form ITR-1, ITR-2 and ITR-4S for

Assessment Year 2015-16 (Financial Year 2014-15). The Notification also made Several Change in

Rule 12 of Income Tax Rules, 1962.

ITR WISE CHANGES IN AY 2015-16 ARE AS FOLLOWS:ITR-1

Introduction of Aadhar Card Number in ITR. (Those Who Give Aadhar Card Details, at present they

also Required To Send ITR V).

Not Applicable for those having agricultural more than Rs. 5000/-( they have to use ITR 2 or 2A)

Not Applicable for those who have income from Capital Gains.

Bank Account in which any Refund will be credited.

All Bank Accounts held during year(Excluding Dormant account) (Details Required are as follows :IFSC Code, Name of Bank, Account Number, Type of Account)

ITR-2

Introduction of Aadhar Card Number in ITR. (Those Who Give Aadhar Card Details, at present they

also Required To Send ITR V).

Option of Giving Two Email IDs

Option to give Passport Number

http://www.caclubindia.com/articles/imp-changes-in-itr-1-2-2a-and-4s--24226.asp

1/12

7/22/2015

Imp changes in ITR 1,2,2A and 4S - Income Tax Articles

Details of Any Assets from located outside india, Signing authority in any account located outside

india, income from any source from outside india.

Details of Amount Utilized and Unutilized in Capital Gain Account Scheme

Details for Non Resident relating to STCG

Details for Non-Residents- STCG not chargeable to tax in India as per DTAA ( Details required like

Country name, Article of DTAA, Weather TRC Obtained?)

Details for Non Resident relating to LTCG

Income From Other Sources for Non Resident ( Details required like Country name, Article of DTAA,

Rate of DTAA, Weather TRC Obtained?)

Not Applicable for those having agricultural more than Rs. 5000/-( they have to use ITR 2 or 2A)

Bank Account in which any Refund will be credited.

All Bank Accounts held during year(Excluding Dormant account) (Details Required are as follows :IFSC Code, Name of Bank, Account Number, Type of Account)

ITR-2A

Introduction of Aadhar Card Number in ITR. (Those Who Give Aadhar Card Details, at present they

also Required To Send ITR V).

Option of Giving Two Email IDs

Option to give Passport Number

Not Applicable for those having agricultural more than Rs. 5000/-( they have to use ITR 2 or 2A)

Bank Account in which any Refund will be credited.

All Bank Accounts held during year(Excluding Dormant account) (Details Required are as follows :IFSC Code, Name of Bank, Account Number, Type of Account)

ITR 4S

Introduction of Aadhar Card Number in ITR. (Those Who Give Aadhar Card Details, at present they

also Required To Send ITR V).

http://www.caclubindia.com/articles/imp-changes-in-itr-1-2-2a-and-4s--24226.asp

2/12

7/22/2015

Imp changes in ITR 1,2,2A and 4S - Income Tax Articles

Not Applicable for those having agricultural more than Rs. 5000/-( they have to use ITR 4)

Not Applicable for those who have income from Capital Gains.

Bank Account in which any Refund will be credited.

All Bank Accounts held during year(Excluding Dormant account) (Details Required are as follows :IFSC Code, Name of Bank, Account Number, Type of Account)

THANKS AND REGARDS

NAVIN AGICHA

agicha.navin@gmail.com

(https://www.facebook.com/sharer/sharer.php?

u=http%3A%2F%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fimp%2Dchanges%2Din%2Ditr%2D1%2D2%2D2a%2

(https://twitter.com/intent/tweet?

Published in Income Tax (article_display_list_by_category.asp?cat_id=3)

url=http%3A%2F%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fimp%2Dchanges%2Din%2Ditr%2D1%2D2%2D2a%

Views : 8359

changes

(https://plus.google.com/share?

in ITR

url=http%3A%2F%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fimp%2Dchanges%2Din%2Ditr%2D1%2D2%2D2a%

1,2,2A

(https://www.linkedin.com/shareArticle?

tm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharestrip%26utm%5Fcampaign%3Dsocialshare)

and

4S url=http%3A%2F%2Fwww%2Ecaclubindia%2Ecom%2Farticles%2Fimp%2Dchanges%2Din%2Ditr%2D1%2D2%2D2a%

Income

utm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharestrip%26utm%5Fcampaign%3Dsocialshare&text=Imp

Tax)

utm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharestrip%26utm%5Fcampaign%3Dsocialshare)

utm%5Fsource%3Darticles%26utm%5Fmedium%3Dsharestrip%26utm%5Fcampaign%3Dsocialshare)

Previous (check_next.asp?article_id=24226&mode=0)

Next (check_next.asp?article_id=24226&mode=1)

Recent Comments

Total: 15

Login (../user_login.asp)

http://www.caclubindia.com/articles/imp-changes-in-itr-1-2-2a-and-4s--24226.asp

to post comment

3/12

7/22/2015

Imp changes in ITR 1,2,2A and 4S - Income Tax Articles

NAVIN

(/coaching/default.asp)

AGICHA (../profile.asp?member_id=1428346) 29 June 2015

Ganshyam read my comment regarding correction in above

ghanshyam maheshw ari (../profile.asp?member_id=1333361) 29 June 2015

Dear sir , I appreciate you discussion but you've committed a mistake

here stating, in case of ITR 2 & ITR 2A , that it is not applicable to those

having agriculture income more than Rs. 5000/- whereas at the same

time you are stating that they have to use ITR 2 & 2A. Thanking you

NAVIN AGICHA (../profile.asp?member_id=1428346) 29 June 2015

Agam I have already clarified this about agricultural income in comment,

that will solve your confusion, else email me personally I will clarify there

again.

Show more

View All Comments :: 15

Related Articles

Proposed corporate tax rate cut in Budget 2015 and its impact on AS-22

(http://www.caclubindia.com/articles/proposed-corporate-tax-rate-cut-in-budget-2015-andits-impact-on-as-22-23931.asp)

Some important judgments of service tax (http://www.caclubindia.com/articles/someimportant-judgments-of-service-tax-24077.asp)

Recent changes in voting methodology (http://www.caclubindia.com/articles/recent-changesin-voting-methodology-24079.asp)

Some recent case decisions on important issues (http://www.caclubindia.com/articles/somerecent-case-decisions-on-important-issues-24092.asp)

Some important judgment of Service Tax (http://www.caclubindia.com/articles/someimportant-judgment-of-service-tax--24143.asp)

http://www.caclubindia.com/articles/imp-changes-in-itr-1-2-2a-and-4s--24226.asp

4/12

7/22/2015

Imp changes in ITR 1,2,2A and 4S - Income Tax Articles

An opportunity to file six year ITR to claim TDS (http://www.caclubindia.com/articles/anopportunity-to-file-six-year-itr-to-claim-tds-24153.asp)

Verification of ITR with Aadhar card introduced

(http://www.caclubindia.com/articles/verification-of-itr-with-aadhar-card-introduced24183.asp)

Key changes in new ITR Forms for F.Y. 2015-2016 (http://www.caclubindia.com/articles/keychanges-in-new-itr-forms-for-f-y-2015-2016-24197.asp)

All about ITR - 2A Form (http://www.caclubindia.com/articles/all-about-itr-2a-form-24203.asp)

Key Changes in New ITRs and Eligibility - AY 2015-16 (FY 2014-15)

(http://www.caclubindia.com/articles/key-changes-in-new-itrs-and-eligibility-ay-2015-16-fy2014-15--24212.asp)

More (article_display_list_by_category.asp?cat_id=3)

Other Latest Articles

Irony in CA ranking system (/articles/irony-in-ca-ranking-system-24478.asp)

Lets retrieve from the brink: Plan your retirement (/articles/lets-retrieve-from-the-brink-planyour-retirement-24477.asp)

Depressed due to depreciation (/articles/depressed-due-to-depreciation-24475.asp)

The big Greek tragedy (/articles/the-big-greek-tragedy-24473.asp)

Why Foreign Contribution Act (FCRA) (/articles/why-foreign-contribution-act-fcra-24469.asp)

How I dealt with negative CA Final results (/articles/how-i-dealt-with-negative-ca-final-results-24465.asp)

Decoding a National Debt Crisis (/articles/decoding-a-national-debt-crisis-24464.asp)

A Bird's eye view on Accounts and Audit under The Companies Act, 2013 (/articles/a-bird-seye-view-on-accounts-and-audit-under-the-companies-act-2013-24463.asp)

Procedure for changes in particulars of name / address or other details of Directors

(/articles/procedure-for-changes-in-particulars-of-name-address-or-other-details-ofdirectors-24461.asp)

Passing IPCC - Basic and other things (/articles/passing-ipcc-basic-and-other-things24449.asp)

More (default.asp)

http://www.caclubindia.com/articles/imp-changes-in-itr-1-2-2a-and-4s--24226.asp

5/12

7/22/2015

Imp changes in ITR 1,2,2A and 4S - Income Tax Articles

You may also like

Section 80C simplified. (A summary view).. (section-80c-simplified-asummary-view--24387.asp)

DEDUCTION UNDER SECTION 80 C F.Y. 2014-15(A.Y. 2015-16)(AN INVESTMENT LINKED

DEDUCTION) 1. LIMIT:With effect from 01-04-2015 the maximu...

View full Article (section-80c-simplified-a-summary-view--24387.asp)

Bhaijaan, TDS se kar lo Pehchaan.. (bhaijaan-tds-se-kar-lo-pehchaan24388.asp)

Karneeti Part 106Bhaijaan, TDS se kar lo PehchaanArjuna (Fictional Character): Krishna, the

festival of Eid is approaching. But the Taxpayer...

View full Article (bhaijaan-tds-se-kar-lo-pehchaan-24388.asp)

Taxation under MAT.. (taxation-under-mat-23718.asp)

Normally, a company is liable to pay tax on the income computed in accordance with the

provisions of the Income-Tax Act, but the profit and ...

http://www.caclubindia.com/articles/imp-changes-in-itr-1-2-2a-and-4s--24226.asp

6/12

7/22/2015

Imp changes in ITR 1,2,2A and 4S - Income Tax Articles

View full Article (taxation-under-mat-23718.asp)

Procedure of re-assessment u/s 147 .. (procedure-of-re-assessment-u-s147--24208.asp)

Assessment is a procedure adopted to determine the correctness of the income disclosed by

the assessee and tax payable thereon. Than what is...

View full Article (procedure-of-re-assessment-u-s-147--24208.asp)

Key changes in new ITR Forms for F.Y. 2015-2016.. (key-changes-in-newitr-forms-for-f-y-2015-2016-24197.asp)

Scrutiny of refurbished return forms for Assessment year 2015-16 I. Introduction to New Rule

12The Rule 12 of the Income-tax Rules was amend...

View full Article (key-changes-in-new-itr-forms-for-f-y-2015-2016-24197.asp)

http://www.caclubindia.com/articles/imp-changes-in-itr-1-2-2a-and-4s--24226.asp

7/12

7/22/2015

Imp changes in ITR 1,2,2A and 4S - Income Tax Articles

All about ITR - 2A Form.. (all-about-itr-2a-form-24203.asp)

1. Who can use this Return Form? This Return Form is to be used by an individual or a Hindu

Undivided Family whose total income for the a...

View full Article (all-about-itr-2a-form-24203.asp)

CCI Articles

You can also submit your article by sending to article@caclubindia.com

Submit article (article_list_add.asp)

Search Articles

GO

Featured Articles

(articles_featured.asp)

How I dealt with negative CA Final results (/articles/how-i-dealt-with-negative-ca-final-results-24465.asp)

We are the CA!- CA Theme Song (/articles/we-are-the-ca-ca-theme-song-24428.asp)

5 observations on CA career (/articles/5-observations-on-ca-career-24357.asp)

Do companies consider these factors to declare dividend? (/articles/do-companies-considerthese-factors-to-declare-dividend--24293.asp)

What's going on with Greece and its economy? (/articles/what-s-going-on-with-greece-andits-economy--24321.asp)

http://www.caclubindia.com/articles/imp-changes-in-itr-1-2-2a-and-4s--24226.asp

8/12

7/22/2015

Imp changes in ITR 1,2,2A and 4S - Income Tax Articles

Gearing up For GST - 2017? (/articles/gearing-up-for-gst-2017--24317.asp)

Present Taxation Vs. Expected GST - A Comparitive Analysis (/articles/present-taxation-vsexpected-gst-a-comparitive-analysis-24225.asp)

view more (articles_featured.asp)

Browse by Category

(article_category_stats.asp)

Recent Comments

(recent_comments.asp)

Popular Articles

(articles_popular.asp)

Popular

Most Commented

10 Golden Rules by a Chartered Accountant (/articles/10-golden-rules-by-a-charteredaccountant-24223.asp)

5 observations on CA career (/articles/5-observations-on-ca-career-24357.asp)

What's going on with Greece and its economy? (/articles/what-s-going-on-withgreece-and-its-economy--24321.asp)

10 quotes for CA Final students May 2015 (/articles/10-quotes-for-ca-final-studentsmay-2015--24432.asp)

Filing ITR of AY 2015-16 (/articles/filing-itr-of-ay-2015-16-24379.asp)

Section 80C simplified. (A summary view) (/articles/section-80c-simplified-a-summaryview--24387.asp)

We are the CA!- CA Theme Song (/articles/we-are-the-ca-ca-theme-song-24428.asp)

Study tips & examination techniques (/articles/study-tips-examination-techniques24433.asp)

Key Changes in New ITRs and Eligibility - AY 2015-16 (FY 2014-15) (/articles/keychanges-in-new-itrs-and-eligibility-ay-2015-16-fy-2014-15--24212.asp)

How I dealt with negative CA Final results (/articles/how-i-dealt-with-negative-cafinal-results--24465.asp)

More (articles_popular.asp)

http://www.caclubindia.com/articles/imp-changes-in-itr-1-2-2a-and-4s--24226.asp

9/12

7/22/2015

Imp changes in ITR 1,2,2A and 4S - Income Tax Articles

Subscribe to Articles Feed

(http://feedproxy.google.com/CaclubindiacomArticles)

Enter your email address

Submit

Browse by Category

Income Tax (article_display_list_by_category.asp?cat_id=3)

Audit (article_display_list_by_category.asp?cat_id=2)

Students (article_display_list_by_category.asp?cat_id=8)

Accounts (article_display_list_by_category.asp?cat_id=1)

Custom (article_display_list_by_category.asp?cat_id=4)

VAT (article_display_list_by_category.asp?cat_id=5)

Career (article_display_list_by_category.asp?cat_id=41)

Service Tax (article_display_list_by_category.asp?cat_id=6)

http://www.caclubindia.com/articles/imp-changes-in-itr-1-2-2a-and-4s--24226.asp

10/12

7/22/2015

Imp changes in ITR 1,2,2A and 4S - Income Tax Articles

Corporate Law (article_display_list_by_category.asp?cat_id=7)

Info Technology (article_display_list_by_category.asp?cat_id=9)

Excise (article_display_list_by_category.asp?cat_id=11)

Shares & Stock (article_display_list_by_category.asp?cat_id=44)

Exams (article_display_list_by_category.asp?cat_id=45)

LAW (article_display_list_by_category.asp?cat_id=46)

Professional Resource (article_display_list_by_category.asp?cat_id=51)

Union Budget (article_display_list_by_category.asp?cat_id=53)

Others (article_display_list_by_category.asp?cat_id=10)

Taxpayers (article_display_list_by_category.asp?cat_id=52)

Our Network Sites

(http://www.lawyersclubindia.com)

(http://www.mbaclubindia.com)

2015 CAclubindia.com. Let us grow stronger by mutual exchange of know ledge.

About (/about_us.asp)

We are Hiring (http://www.interactivemedia.co.in/jobs/)

(http://www.caclubindiablog.com/)

Advertise (/advertise_with_us.asp)

Blog

Terms of Use

(/terms_of_use.asp)

Disclaimer (/disclaimer.asp)

Privacy Policy (/privacy_policy.asp)

Contact Us

(/contact_us.asp)

http://www.caclubindia.com/articles/imp-changes-in-itr-1-2-2a-and-4s--24226.asp

11/12

7/22/2015

Imp changes in ITR 1,2,2A and 4S - Income Tax Articles

s.apple.com/in/app/caclubindia/id891671199?

google.com/store/apps/details?

activemedia.caclubindia)

com/caclubindia)

acebook.com/caclubindia)

nkedin.com/groups?gid=752057) (/rss/)

us.google.com/+caclubindia)

youtube.com/caclubindia?

ation=1)

http://www.caclubindia.com/articles/imp-changes-in-itr-1-2-2a-and-4s--24226.asp

12/12

Вам также может понравиться

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- A Study On Relationship Between Profitability and Dividend Payment in Iron & Steel Industries in IndiaДокумент9 страницA Study On Relationship Between Profitability and Dividend Payment in Iron & Steel Industries in IndiadebasispahiОценок пока нет

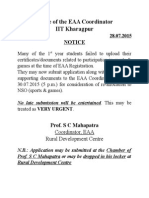

- EAA NoticeДокумент1 страницаEAA NoticedebasispahiОценок пока нет

- Chap 010Документ17 страницChap 010debasispahiОценок пока нет

- Chap 003Документ17 страницChap 003debasispahiОценок пока нет

- Dimensions Economic: Nation State Global GovernanceДокумент1 страницаDimensions Economic: Nation State Global GovernancedebasispahiОценок пока нет

- The Main Features of Advertise Are As UnderДокумент5 страницThe Main Features of Advertise Are As UnderdebasispahiОценок пока нет

- CSR of BricsДокумент2 страницыCSR of BricsdebasispahiОценок пока нет

- A Brief On MncsДокумент102 страницыA Brief On MncsAjit Pal Singh HarnalОценок пока нет

- A Study On Human Resource Accounting Methods and Practices in IndiaДокумент8 страницA Study On Human Resource Accounting Methods and Practices in IndiadebasispahiОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Pathfinder CharacterSheet.1.8InterActiveДокумент3 страницыPathfinder CharacterSheet.1.8InterActiveJessica AlvisОценок пока нет

- Ad1 MCQДокумент11 страницAd1 MCQYashwanth Srinivasa100% (1)

- Contracts 2 Special ContractsДокумент11 страницContracts 2 Special ContractsAbhikaamОценок пока нет

- Chapter 8 - FluidДокумент26 страницChapter 8 - FluidMuhammad Aminnur Hasmin B. HasminОценок пока нет

- D8.1M 2007PV PDFДокумент5 страницD8.1M 2007PV PDFkhadtarpОценок пока нет

- The John Molson School of Business MBA 607 Final Exam June 2013 (100 MARKS)Документ10 страницThe John Molson School of Business MBA 607 Final Exam June 2013 (100 MARKS)aicellОценок пока нет

- Level 5 - LFH 6-10 SepДокумент14 страницLevel 5 - LFH 6-10 SepJanna GunioОценок пока нет

- Workshop 02.1: Restart Controls: ANSYS Mechanical Basic Structural NonlinearitiesДокумент16 страницWorkshop 02.1: Restart Controls: ANSYS Mechanical Basic Structural NonlinearitiesSahil Jawa100% (1)

- Multiple Linear RegressionДокумент26 страницMultiple Linear RegressionMarlene G Padigos100% (2)

- Tugas 3Документ20 страницTugas 3dellaayuОценок пока нет

- RBMWizardДокумент286 страницRBMWizardJesus EspinozaОценок пока нет

- Reported Speech Step by Step Step 7 Reported QuestionsДокумент4 страницыReported Speech Step by Step Step 7 Reported QuestionsDaniela TorresОценок пока нет

- Action List 50Документ4 страницыAction List 50hdfcblgoaОценок пока нет

- ReadingДокумент2 страницыReadingNhư ÝОценок пока нет

- Indus Valley Sites in IndiaДокумент52 страницыIndus Valley Sites in IndiaDurai IlasunОценок пока нет

- Department of Education: Republic of The PhilippinesДокумент2 страницыDepartment of Education: Republic of The PhilippinesShailac RodelasОценок пока нет

- Dark Witch Education 101Документ55 страницDark Witch Education 101Wizard Luxas100% (2)

- Mwa 2 - The Legal MemorandumДокумент3 страницыMwa 2 - The Legal Memorandumapi-239236545Оценок пока нет

- Hygiene and HealthДокумент2 страницыHygiene and HealthMoodaw SoeОценок пока нет

- Business Administration: Hints TipsДокумент11 страницBusiness Administration: Hints Tipsboca ratonОценок пока нет

- Discussion #3: The Concept of Culture Learning ObjectivesДокумент4 страницыDiscussion #3: The Concept of Culture Learning ObjectivesJohn Lery SurellОценок пока нет

- Bagon-Taas Adventist Youth ConstitutionДокумент11 страницBagon-Taas Adventist Youth ConstitutionJoseph Joshua A. PaLaparОценок пока нет

- "We Like": Rohit Kiran KeluskarДокумент43 страницы"We Like": Rohit Kiran Keluskarrohit keluskarОценок пока нет

- Spelling Master 1Документ1 страницаSpelling Master 1CristinaОценок пока нет

- DissertationДокумент59 страницDissertationFatma AlkindiОценок пока нет

- Introduction To Political ScienceДокумент18 страницIntroduction To Political Sciencecyrene cayananОценок пока нет

- Oldham Rules V3Документ12 страницOldham Rules V3DarthFooОценок пока нет

- Em - 1110 1 1005Документ498 страницEm - 1110 1 1005Sajid arОценок пока нет

- DBA Daily StatusДокумент9 страницDBA Daily StatuspankajОценок пока нет

- MPCДокумент193 страницыMPCpbaculimaОценок пока нет