Академический Документы

Профессиональный Документы

Культура Документы

1382

Загружено:

anon-2927350 оценок0% нашли этот документ полезным (0 голосов)

283 просмотров6 страницАвторское право

© Attribution Non-Commercial (BY-NC)

Доступные форматы

XLS, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате XLS, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

283 просмотров6 страниц1382

Загружено:

anon-292735Авторское право:

Attribution Non-Commercial (BY-NC)

Доступные форматы

Скачайте в формате XLS, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 6

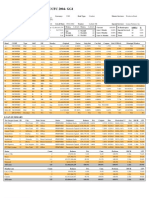

Fahnestock Proprietary Trading Offerings Sheet

Mark Wetzler or Michael J. McIntyre (212) 668-8155 or 1-800-932-4633

Issue Name Type Coupon Maturity Cusip # Moody

Aes Corporation Sr Notes 8.53 12/31/08 00130HAP0 B3

Amerco Sr Notes 7.8500% 05/15/03 023586AA8 Caa2

Amerco Sr Notes 8.8000% 02/04/05 023586AF7 Caa2

AT&T Corporation Sr Notes 6.5000% 03/15/29 001957AW9 Baa2

AT&T Corporation Nts 8.0000% 05/15/25 00206QAN4 Baa2

AT&T Corporation Nts 8.6000% 05/15/25 00206QAS3 Baa2

AT&T Corporation Debentures 8.1250% 01/15/22 001957AJ8 Baa2

AT&T Corporation Debentures 8.1250% 07/15/24 001957AK5 Baa2

AT&T Corporation Sr Notes 8.3500% 01/15/25 001957AQ2 Baa2

AT&T Corporation Debentures 8.6250% 12/31/31 001957AL3 Baa2

Borden Chemical & Plastics Sr Notes 9.5000% 05/01/05 099542AA0 Ca

Calpine Corp Sr Notes 8.2500% 08/15/05 131347AU0 B1

Calpine Corp Sr Notes 8.7500% 07/15/07 131347AF3 B1

Cincinnati Bell Nts 6.3000% 12/01/28 171870AD9 Ba2

Cincinnati Bell Nts 7.2500% 06/15/23 171870AK4 Ba2

CMS Energy Corp Nts 8.0000% 08/15/11 12589SDK5 B3

CMS Energy Corp Nts 8.0000% 09/15/13 12589SDU3 B3

CMS Energy Corp Nts 8.0000% 09/15/13 12589SDY5 B3

CMS Energy Corp Nts 8.0000% 09/15/13 12589SEC2 B3

Coca Cola Femsa Sr Notes 8.9500% 11/01/06 191241AB4 Baa3

Comcast Cable Communication Sr Sub Nts 8.2500% 02/15/08 526055AK4 Ba1

Enron Corporation Nts 6.7500% 08/01/09 293561BA3 Ca

Enron Corporation Nts 7.8750% 06/15/03 293561CB0 Ca

Enron Corporation Debentures 9.8750% 06/15/03 293561AF3 Ca

Exodus Communications Sr Notes 10.7500% 12/15/09 302088AH2 Ca

Exodus Communications Sr Notes 11.6250% 07/15/10 302088AL3 Ca

Finova Group Inc. Sr Notes 7.5000% 11/15/09 317928AA7 NA

Georgia Pacific Corp. Nts 8.1250% 05/15/11 373298BV9 Ba3

Georgia Pacific Corp. Debentures 8.1250% 06/15/23 373298BK3 Ba3

Georgia Pacific Corp. Debentures 8.2500% 03/01/23 373298BJ6 Ba3

Georgia Pacific Corp. Debentures 8.6250% 04/30/25 373298BL1 Ba3

Georgia Pacific Corp. Debentures 9.1250% 07/01/22 373298BH0 Ba3

Georgia Pacific Corp. Debentures 9.6250% 03/15/22 373298BH0 Ba3

Georgia Pacific Corp. Debentures 9.8750% 11/01/21 373298BF4 Ba3

Goodyear Tire & Rubber Nts 7.8570% 08/15/11 382550AH4 Baa3

Goodyear Tire & Rubber Nts 8.5000% 03/15/07 382550AG6 Baa3

Healthsouth Corporation Sr Notes 6.8750% 06/15/05 421924AJ0 Caa1

Healthsouth Corporation Sr Notes 7.0000% 06/15/08 421924AM3 Caa1

Healthsouth Corporation Sr Notes 7.3750% 10/01/06 421924AU5 Caa1

Healthsouth Corporation Sr Notes 7.6250% 06/01/12 421924AZ4 Caa1

Healthsouth Corporation Sr Notes 8.3750% 10/01/11 421924AX9 Caa1

Healthsouth Corporation Sr Notes 8.5000% 02/01/08 421924AR2 Caa1

K Mart Corporation Debentures 7.7500% 10/01/12 482584AP4 Ca

K Mart Corporation Debentures 7.9500% 02/01/23 482584AQ2 Ca

K Mart Corporation Nts 8.1250% 12/01/06 482584AL3 Ca

K Mart Corporation Debentures 8.2500% 01/01/22 482584AM1 Ca

K Mart Corporation Debentures 8.3750% 07/01/22 482584AN9 Ca

K Mart Corporation Sec Nts 8.5400% 01/02/15 482584AH2 Caa2

K Mart Corporation Nts 8.9600% 12/10/19 482584BC3 Ca

K Mart Corporation Pass Thru Cert 8.9900% 07/05/10 48258VAF6 Caa2

K Mart Corporation Pass Thru Cert 9.4400% 07/01/18 48258WAG2 Caa2

K Mart Corporation Pass Thru Cert 9.7800% 01/05/20 48258VAG4 Caa2

K Mart Corporation Debentures 12.5000% 03/01/05 482584AG4 Ca

K Mart Funding Corp. Sec Nts 8.8000% 07/01/10 48258WAF4 Caa2

K Mart Funding Corp. Pass Thru Cert 9.3500% 01/02/20 48258VAJ8 Caa2

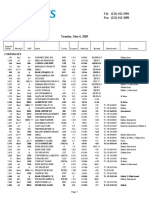

Level 3 Communications Sr Notes 9.1250% 05/01/08 52729NAC4 Caa3

Level 3 Communications Sr Disc Notes 10.5000% 12/01/08 52729NAE0 Caa3

Level 3 Communications Sr Notes 11.0000% 03/15/08 52729NAK6 Caa3

Level 3 Communications Sr Notes 11.2500% 03/15/10 52729NAN0 Caa3

Level 3 Communications Sr Disc Nts 12.8750% 03/15/10 52729NAR1 Caa3

Lucent Technologies Nts 5.5000% 11/15/08 549463AD9 Caa1

Lucent Technologies Debentures 6.5000% 01/15/28 549463AC1 Caa1

Lucent Technologies Debentures 6.4500% 03/15/29 549463AE7 Caa1

Lucent Technologies Nts 7.2500% 07/15/06 549463AB3 Caa1

Lucent Technologies Nts 7.7000% 05/19/10 54946EAD5 Caa1

Mountain States Tel & Teleg Co. Debentures 5.5000% 06/01/05 624284AH8 Baa2

Mountain States Tel & Teleg Co. Debentures 7.3750% 05/01/30 624284BD6 Baa2

Northwestern Bell Telephone Debentures 6.2500% 01/01/07 668027AG0 Baa2

Ogden Corporation Convertible 5.7500% 10/20/02 676346AD1 Ba2

Ogden Corporation Convertible 6.0000% 06/01/02 676346AC3 Ba2

Owens Corning Sr Notes 7.0000% 03/15/09 69073FAE3 Ca

Owens Corning Sr Notes 7.5000% 05/01/05 69073FAB9 Ca

Owens Corning Sr Notes 7.5000% 08/01/18 69073FAD5 Ca

Owens Corning Sr Notes 7.7000% 05/08/08 69073FAC7 Ca

Pacific Gas & Electric 1st Mtg Nts 5.8750% 10/01/05 694308EW3 B3

Pacific Gas & Electric 1st Mtg Nts 6.2500% 08/01/03 694308EU7 B3

Pacific Gas & Electric 1st Mtg Nts 6.2500% 03/01/04 694308FA0 B3

Pacific Gas & Electric 1st Mtg Nts 6.7500% 10/01/23 694308EY9 B3

Pacific Gas & Electric 1st Mtg Nts 7.0500% 03/01/24 694308FB8 B3

Pacific Gas & Electric 1st Mtg Nts 7.2500% 03/01/26 694308EM5 B3

Pacific Gas & Electric 1st Mtg Nts 7.2500% 03/01/26 694308ET0 Aaa

Pacific Gas & Electric 1st Mtg Nts 7.2500% 08/01/26 694308EV5 B3

Pacific Gas & Electric 1st Mtg Nts 8.2500% 11/01/22 694308EG8 B3

Pacific Gas & Electric 1st Mtg Nts 8.3750% 05/01/25 694308EF0 B3

PSEG Energy Holdings Sr Notes 8.6250% 02/15/08 69361LAF8 Baa3

PSEG Energy Holdings Sr Notes 9.1250% 02/10/04 69361LAD3 Baa3

PSEG Energy Holdings Sr Notes 10.0000% 10/01/09 69361LAC5 Baa3

Qwest Capital Funding Corp. Co. Guarnt 6.2500% 07/15/05 912912AN2 Ba2

Qwest Capital Funding Corp. Co. Guarnt 6.8750% 07/15/28 912912AQ5 Ba2

Qwest Capital Funding Corp. Co. Guarnt 7.6250% 08/03/21 74913EAQ3 Ba2

Qwest Corporation Nts 6.1250% 11/15/05 912920AE5 Ba3

Qwest Corporation Nts 6.6250% 09/15/05 912920AF2 Ba3

Qwest Corporation Debentures 6.8750% 09/15/33 912920AC9 Ba3

Qwest Corporation Nts 7.2000% 11/01/04 912920AU9 Ba3

Qwest Corporation Nts 7.2000% 11/10/26 912920AL9 Ba3

Qwest Corporation Debentures 7.2500% 10/15/35 912920AM7 Ba3

Qwest Corporation Debentures 7.5000% 06/15/23 912920AB1 Ba3

Republic of Argentina Sovereign 9.7500% 09/19/27 040114AV2 B2

Republic of Argentina Sovereign 11.3750% 03/15/10 040114FC9 B2

Republic of Argentina Sovereign 11.7500% 06/15/15 040114GA2 B2

Republic of Argentina Sovereign 12.3750% 02/21/12 040114GD6 B2

Republic of Brazil Sovereign 10.1250% 05/15/27 105756AE0 B1

Republic of Brazil Sovereign 11.0000% 08/17/40 105756AP5 B1

Republic of Brazil Sovereign 11.2500% 07/26/07 105756AM2 B1

Republic of Brazil Sovereign 14.5000% 10/15/09 105756AJ9 B1

Southern Calif Edison Sr Notes 6.3750% 01/15/06 842400DX8 Ba3

Southern Calif Edison Sr Notes 6.6500% 04/01/29 842400EB5 Ba3

Southern Calif Edison 1st Mtg Nts 6.9000% 10/01/18 842400DJ9 Ba2

Southern Calif Edison 1st Mtg Nts 7.1250% 07/15/25 842400DG5 Ba2

Southern Calif Edison 1st Mtg Nts 7.2500% 03/01/26 842400DC4 Ba2

Southern Calif Edison Sr Notes 7.6250% 01/15/10 842400EE9 Ba3

Sprint Capital Corp. Co. Guarnt 6.8750% 11/15/28 852060AD4 Baa3

Telefonica De Argentina Sr Notes 11.8750% 11/01/04 879378AC1 B2

Tennessee Gas Pipeline Co. Debentures 6.0000% 12/15/11 880451AJ8 Baa2

Tennessee Gas Pipeline Co. Debentures 7.0000% 10/15/28 880451AV1 Baa2

Time Warner Inc. Debentures 9.1250% 01/15/13 887315AK5 Baa1

Time Warner Inc. Debentures 9.1500% 02/01/23 887315AM1 Baa1

West Penn Power Co Nts 6.3750% 06/01/04 95527PAC2 Baa1

West Penn Power Co Nts 6.6250% 04/15/12 955278BF2 Baa1

Williams Cos Inc. Nts 6.5000% 12/01/08 968905AD1 Caa1

Williams Cos Inc. Nts 7.1250% 09/01/11 969457BF6 Caa1

Williams Cos Inc. Nts 7.5000% 01/15/31 969457BB5 Caa1

Williams Cos Inc. Nts 7.7500% 06/15/31 969457BD1 Caa1

Williams Cos Inc. Nts 7.8750% 09/01/21 969457BG4 Caa1

Worldcom Inc. Sr Notes 6.4000% 08/15/05 98155KAH5 Ca

Worldcom Inc. Nts 6.5000% 05/15/04 98157DAH9 Ca

Worldcom Inc. Sr Notes 7.5000% 05/15/11 98157DAJ5 Ca

Worldcom Inc. Sr Notes 7.8750% 05/15/03 98157DAB2 Ca

Worldcom Inc. Sr Notes 8.2500% 05/15/31 98157DAK2 Ca

S&P Delivery Quanity Ask Price

B- DTC 145.4 93.000

CC DTC 105 100.000

CC DTC 100 90.000

BBB+ DTC 100 92.000

BBB+ DTC 66 103.000

BBB+ DTC 8 104.000

BBB+ DTC 100 103.500

BBB+ DTC 100 103.500

BBB+ DTC 100 104.000

BBB+ DTC 100 104.000

NR DTC 100 1.500

B+ DTC 250 87.000

B+ DTC 250 77.000

B- DTC 250 84.000

B- DTC 250

B+ DTC 169 89.000

B+ DTC 38 92.000

B+ DTC 74 92.000

B+ DTC 164 91.000

BBB- DTC 100 118.000

BBB DTC 355 104.750

D DTC 100 19.000

D DTC 100 19.000

D DTC 100 19.000

NR DTC 100 8.000

NR DTC 100 8.000

NA DTC 250 43.000

BB+ DTC 100 102.000

BB+ DTC 100 88.000

BB+ DTC 100 88.000

BB+ DTC 100 88.000

BB+ DTC 100 94.000

BB+ DTC 100 96.000

BB+ DTC 500 98.000

BB+ DTC 200 77.000

BB+ DTC 100 89.000

CCC- DTC 100 73.000

CCC- DTC 100 69.000

CCC- DTC 100 73.000

CCC- DTC 100 69.000

CCC- DTC 100 69.000

CCC- DTC 100 69.000

D DTC 100 18.000

D DTC 100 18.000

D DTC 100 18.000

D DTC 100 18.000

D DTC 100 18.000

CCC- DTC 100 70.000

D DTC 100 18.000

CCC- DTC 100 80.000

D DTC 100 65.000

CCC- DTC 100 65.000

D DTC 100 21.000

D DTC 100 70.000

CCC- DTC 100 70.000

CC DTC 100 84.000

CC DTC 100 80.000

CC DTC 100 91.000

CC DTC 100 89.000

CC DTC 250 64.500

CCC+ DTC 100 87.000

CCC+ DTC 100 76.000

CCC+ DTC 100 76.000

CCC+ DTC 100 98.000

CCC+ DTC 75 87.000

BBB DTC 100 98.000

BBB DTC 100 88.000

BBB DTC 100 96.500

BBB- DTC 100 12.000

BBB- DTC 100 12.000

D DTC 100 28.000

D DTC 100 28.000

D DTC 100 28.000

D DTC 100 28.000

CCC DTC 100 102.000

CCC DTC 25 100.125

CCC DTC 20 100.750

CCC DTC 100 100.500

CCC DTC 100 101.000

CCC DTC 100 102.000

AAA DTC 12 102.500

CCC DTC 125 102.000

CCC DTC 100 103.000

CCC DTC 100 103.000

BBB- DTC 100 110.000

BBB- DTC 100 108.000

BBB- DTC 100 115.000

BB DTC 100 93.000

BB DTC 100 80.000

BB DTC 100 78.000

B- DTC 100 100.000

B- DTC 100 102.000

B- DTC 100 88.000

B- DTC 100 102.000

B- DTC 100 90.000

B- DTC 100 90.000

B- DTC 100 92.000

B+ DTC 200 34.000

B+ DTC 200 34.000

B+ DTC 200 34.000

B+ DTC 200 34.000

BB- DTC 200 86.500

BB- DTC 200 92.000

BB- DTC 200 102.500

BB- DTC 200 116.000

B+ DTC 100 102.000

B+ DTC 30 90.000

CC DTC 100 100.000

CC DTC 48 101.500

CC DTC 5 102.000

B+ DTC 100 103.500

BBB- DTC 100 95.000

BB+ DTC 44 94.000

BBB+ DTC 400 92.000

BBB+ DTC 50 85.000

BBB+ DTC 100 124.000

BBB+ DTC 100 122.000

BB DTC 500 102.500

BB DTC 100 104.000

B DTC 100 97.000

B DTC 100 96.500

B DTC 100 92.000

B DTC 100 92.000

B DTC 100 95.000

D DTC 100 30.000

D DTC 100 30.000

D DTC 100 30.000

D DTC 100 30.000

D DTC 100 30.000

Вам также может понравиться

- NYSE Bonds Ex Clearing SecuritiesДокумент29 страницNYSE Bonds Ex Clearing SecuritiesAchilleas ManousakisОценок пока нет

- UC General Endowment Pool Bond PortfolioДокумент62 страницыUC General Endowment Pool Bond PortfolioSpotUsОценок пока нет

- 31mar2010 HoldingsДокумент10 страниц31mar2010 HoldingsTroy UhlmanОценок пока нет

- Dealer 2Документ12 страницDealer 2anon-798814Оценок пока нет

- Pension FundДокумент14 страницPension Fundanon-798814Оценок пока нет

- CombinedДокумент114 страницCombinedSpotUsОценок пока нет

- Whole Year AP PaymentsДокумент397 страницWhole Year AP PaymentsspydraОценок пока нет

- Bonos AfueraДокумент9 страницBonos AfueraMatias VargasОценок пока нет

- Whole Year AP PaymentsДокумент45 страницWhole Year AP PaymentsspydraОценок пока нет

- GCCFC 2004-gg1Документ6 страницGCCFC 2004-gg1ZerohedgeОценок пока нет

- Barclays 1Документ12 страницBarclays 1anon-292735Оценок пока нет

- Nfholdings 2001028Документ184 страницыNfholdings 2001028Ramon RogersОценок пока нет

- Vdocuments - MX Barclays1Документ7 страницVdocuments - MX Barclays1Hariom BaseloОценок пока нет

- Statement of Account: State Bank of IndiaДокумент2 страницыStatement of Account: State Bank of Indiagaurav sharmaОценок пока нет

- Worksheet in Basis 29 April 2020Документ117 страницWorksheet in Basis 29 April 2020Afandi AffanОценок пока нет

- Dec2023 Water Sampling Report by ChemtronicsДокумент1 страницаDec2023 Water Sampling Report by Chemtronicsmechanicalccr2Оценок пока нет

- March Alcon StatementДокумент2 страницыMarch Alcon Statementapexindustries5199Оценок пока нет

- Ira WithdrawalsДокумент12 страницIra Withdrawalsatworkkai240Оценок пока нет

- Aug'22 Cash BookДокумент6 страницAug'22 Cash BookJAMES AMARAОценок пока нет

- Practice Competency 2023 2024 AK Final v2Документ39 страницPractice Competency 2023 2024 AK Final v2Alhaider LagiОценок пока нет

- Exp No 7Документ10 страницExp No 7raghgk2012Оценок пока нет

- 2020 11 03 - Distressed and Illiqquid BondsДокумент1 страница2020 11 03 - Distressed and Illiqquid BondsSouthey CapitalОценок пока нет

- Ytd Beml Ocp5 OctДокумент69 страницYtd Beml Ocp5 Octsami abdulОценок пока нет

- Ratch de Frenos - Pai - Catalog - Sheet - 8057Документ1 страницаRatch de Frenos - Pai - Catalog - Sheet - 8057Alexis ValleОценок пока нет

- Compras 2019Документ64 страницыCompras 2019Arlette YariОценок пока нет

- NYSE Traded Listed Bonds SymbolДокумент153 страницыNYSE Traded Listed Bonds SymbolbboyvnОценок пока нет

- Ametek Technical - PublicationДокумент105 страницAmetek Technical - PublicationWallyОценок пока нет

- Promissory Note: Outstanding Receivable Assumed by Mr. Jude Torres Inception DateДокумент2 страницыPromissory Note: Outstanding Receivable Assumed by Mr. Jude Torres Inception DateGoyo VitoОценок пока нет

- ABS Pricing Guide - August 2006Документ6 страницABS Pricing Guide - August 2006yukiyurikiОценок пока нет

- AccountsДокумент5 страницAccountsnaveen kumarОценок пока нет

- Compilado AgingДокумент825 страницCompilado AgingWagner CorrêaОценок пока нет

- CitiBusiness Online Deposit AccountsДокумент1 страницаCitiBusiness Online Deposit AccountsDanna GutierrezОценок пока нет

- Daily Top 10 Worst Cell Report - 2G & 3G: Date: 7-Dec-08Документ8 страницDaily Top 10 Worst Cell Report - 2G & 3G: Date: 7-Dec-08Bona RadiantoОценок пока нет

- AMETEKДокумент103 страницыAMETEKChristian0% (1)

- UC025Документ1 страницаUC025Wael ElSayedОценок пока нет

- PPK P0180Документ546 страницPPK P0180Erinson Paúl Condori SáenzОценок пока нет

- Bu040815 PDFДокумент86 страницBu040815 PDFNikita JoshiОценок пока нет

- Bloomberg BondsДокумент2 страницыBloomberg BondsVicky RajoraОценок пока нет

- FahimДокумент44 страницыFahimricha shahОценок пока нет

- Invoice 2 Des 2022Документ6 страницInvoice 2 Des 2022Naufal UmamiОценок пока нет

- Confidential and Proprietary - Qualcomm Technologies, IncДокумент4 страницыConfidential and Proprietary - Qualcomm Technologies, Incshawn longОценок пока нет

- Portfolio Name AFRF: Pension Section Portfolio Currency Kenyan Shillings Valuation Date 10/19/2009Документ9 страницPortfolio Name AFRF: Pension Section Portfolio Currency Kenyan Shillings Valuation Date 10/19/2009MaheshRamchurnОценок пока нет

- Oct 2020 Mumbai ZoneДокумент39 страницOct 2020 Mumbai ZoneYakshit JainОценок пока нет

- Bahan Janjun 2019Документ707 страницBahan Janjun 2019adityakurniawan pratamaОценок пока нет

- SaleДокумент3 страницыSaleSurender SainiОценок пока нет

- S.No Date Bilty. No Damper - No Size Qty. RemarksДокумент14 страницS.No Date Bilty. No Damper - No Size Qty. RemarksEngr Ghulam MustafaОценок пока нет

- List Attaching To and Forming An Integral Part of Comprehensive Motor Insurance Policy No.1204/0812/MTP/MNABДокумент149 страницList Attaching To and Forming An Integral Part of Comprehensive Motor Insurance Policy No.1204/0812/MTP/MNABSew BigОценок пока нет

- TransferДокумент2 страницыTransferSofia Vicol GurăuОценок пока нет

- Cmbs Odd-20101208Документ2 страницыCmbs Odd-20101208jake_freifeld7999Оценок пока нет

- Book8 2Документ175 страницBook8 2NicolasОценок пока нет

- Selec Controls PVT LTD.,: Product MRPДокумент2 страницыSelec Controls PVT LTD.,: Product MRPSourabh ChoudharyОценок пока нет

- U.S. Dividend Champions: End-Of-Month Update atДокумент26 страницU.S. Dividend Champions: End-Of-Month Update atALFONSO ARREOLAОценок пока нет

- Whitehall: Monitoring The Markets Vol. 5 Iss. 29 (August 13, 2015)Документ2 страницыWhitehall: Monitoring The Markets Vol. 5 Iss. 29 (August 13, 2015)Whitehall & CompanyОценок пока нет

- StocksДокумент13 страницStocksrajsekhar gudeОценок пока нет

- US Internal Revenue Service: 2007p1212 Sect I-IiiДокумент206 страницUS Internal Revenue Service: 2007p1212 Sect I-IiiIRSОценок пока нет

- 1637Документ24 страницы1637anon-292735Оценок пока нет

- DUBH Charger and Battery DetailsДокумент2 страницыDUBH Charger and Battery DetailsRavi PrakashОценок пока нет

- How to Rebuild & Modify Rochester Quadrajet CarburetorsОт EverandHow to Rebuild & Modify Rochester Quadrajet CarburetorsРейтинг: 5 из 5 звезд5/5 (2)

- Ant TestДокумент4 страницыAnt Testanon-292735Оценок пока нет

- 1382Документ6 страниц1382anon-292735Оценок пока нет

- 1637Документ24 страницы1637anon-292735Оценок пока нет

- Issue Name Type Coupon Maturity Cusip # MoodyДокумент2 страницыIssue Name Type Coupon Maturity Cusip # Moodyanon-292735Оценок пока нет

- Barclays 1Документ12 страницBarclays 1anon-292735Оценок пока нет

- 1637Документ24 страницы1637anon-292735Оценок пока нет

- Issue Name Type Coupon Maturity Cusip # MoodyДокумент2 страницыIssue Name Type Coupon Maturity Cusip # Moodyanon-292735Оценок пока нет

- EIA NaturalGasPipelineProjectsДокумент8 страницEIA NaturalGasPipelineProjectsThanh Tung LeОценок пока нет

- Full TLOДокумент18 страницFull TLOelhard shalloОценок пока нет

- WIC System MapДокумент1 страницаWIC System MapJoeОценок пока нет

- Contractors Electrical WebpageДокумент4 страницыContractors Electrical WebpageJAGUAR GAMINGОценок пока нет

- Inventário LatelДокумент18 страницInventário LatelAlessandro Santos LeléОценок пока нет

- TodayДокумент37 страницTodayMonica LewisОценок пока нет

- Oil and Gas WyomingДокумент4 страницыOil and Gas WyomingJohnPaulRomeroОценок пока нет

- ?? Disney PlusДокумент28 страниц?? Disney PlusLUFERОценок пока нет

- State DataДокумент91 страницаState DataJocelyn CyrОценок пока нет

- Utilities Info (Oh - Pa)Документ14 страницUtilities Info (Oh - Pa)samiullahmazari3Оценок пока нет

- Active OperatorsДокумент7 страницActive OperatorsGhulam MurtazaОценок пока нет

- 4 Base Captacion Pronto Agosto 2022Документ446 страниц4 Base Captacion Pronto Agosto 2022Carlos CruzОценок пока нет

- Blue Spruce Energy ServicesДокумент5 страницBlue Spruce Energy ServicesRegency Baptist ChurchОценок пока нет

- AT&T LocationsДокумент4 страницыAT&T LocationsSanjay Hari HaranОценок пока нет

- PG&E PSPS MapДокумент1 страницаPG&E PSPS MapDeborah AnderaosОценок пока нет

- Frontier Repair Contact and Escalation ListsДокумент15 страницFrontier Repair Contact and Escalation ListsWellingtonОценок пока нет

- 20210531-8012 Form71420201200253Документ33 страницы20210531-8012 Form71420201200253turbinetimeОценок пока нет

- Blessdajwett TloДокумент2 страницыBlessdajwett TloLàürâ BøyОценок пока нет

- Emeter 11-05-12 Smart Meter Projects For AmyДокумент3 страницыEmeter 11-05-12 Smart Meter Projects For Amyamy_gahranОценок пока нет

- New JerseyДокумент7 страницNew JerseybobОценок пока нет

- US Municipality UtilitiesДокумент3 страницыUS Municipality UtilitiesMichael QuinlanОценок пока нет

- U.S. National Committee CigréДокумент5 страницU.S. National Committee CigrériddhiОценок пока нет

- 191 Field Level Storage Data (Annual)Документ27 страниц191 Field Level Storage Data (Annual)venu narlaОценок пока нет

- FNKAW19 Reg ListДокумент13 страницFNKAW19 Reg ListVasanth KumarОценок пока нет

- Sydney 1757414384Документ3 страницыSydney 1757414384otsrОценок пока нет

- Voicemail Pilot Numbers (A.k.a. Local Access or 'Backdoor' Numbers)Документ10 страницVoicemail Pilot Numbers (A.k.a. Local Access or 'Backdoor' Numbers)makehimpay100% (1)

- Print Page: About UsДокумент20 страницPrint Page: About UssurajitbijoyОценок пока нет

- Patrick C Hall@yahoo - com-TruthfinderReportДокумент13 страницPatrick C Hall@yahoo - com-TruthfinderReportsmithsmithsmithsmithsmithОценок пока нет

- 504 AreaCodeДокумент14 страниц504 AreaCodeBruceОценок пока нет

- Cdma Sid ListДокумент112 страницCdma Sid Listdilligas1234Оценок пока нет