Академический Документы

Профессиональный Документы

Культура Документы

Risk Management Class Notes

Загружено:

Masood Ahmad AadamИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Risk Management Class Notes

Загружено:

Masood Ahmad AadamАвторское право:

Доступные форматы

1 | Page

Superior University, Lahore

Risk Management

by: Asif Masood Ahmad

Risk

Management

For MBA/M.Com/BBA Students

By: Prof. Asif Masood Ahmad

MBA, CMA, GCMA

asifmasoodahmad@gmail.com

0321-9842495

2 | Page

Superior University, Lahore

Risk Management

by: Asif Masood Ahmad

What is Risk?

Introduction

Every business faces risks that could present threats to its success.

Risk is defined as the probability of an event and its consequences. Risk management is the

practice of using processes, methods and tools for managing these risks.

Risk management focuses on identifying what could go wrong, evaluating which risks should be

dealt with and implementing strategies to deal with those risks. Businesses that have identified the

risks will be better prepared and have a more cost-effective way of dealing with them.

This guide sets out how to identify the risks your business may face. It also looks at how to

implement an effective risk management policy and program which can increase your business'

chances of success and reduce the possibility of failure.

What is Risk Management?

Risk management is the identification, assessment, and prioritization of risks followed by

coordinated and economical application of resources to minimize, monitor, and control the

probability and/or impact of unfortunate events or to maximize the realization of opportunities.

Risks can come from uncertainty in financial markets, threats from project failures (at any phase in

design, development, production, or sustainment life-cycles), legal liabilities, credit risk,

accidents, natural causes and disasters as well as deliberate attack from an adversary, or events

of uncertain or unpredictable root-cause.

In USA several risk management standards have been developed including the Project

Management Institute, the National Institute of Standards and Technology, actuarial societies, and

ISO standards. Methods, definitions and goals vary widely according to whether the risk

management method is in the context of project management, security, engineering, industrial

processes, financial portfolios, actuarial assessments, or public health and safety.

Risk Management Strategies?

The strategies to manage threats (uncertainties with negative consequences) typically include

transferring the threat to another party, avoiding the threat, reducing the negative effect or

probability of the threat, or even accepting some or all of the potential or actual consequences of a

particular threat, and the opposites for opportunities (uncertain future states with benefits).

The types of risk your business faces

The commonly described main categories of risk to consider are:

Strategic, for example a competitor coming on to the market

Compliance, for example responding to the introduction of new health and safety

legislation

3 | Page

Superior University, Lahore

Risk Management

by: Asif Masood Ahmad

Financial, for example non-payment by a customer or increased interest charges on a

business loan

Operational, for example the breakdown or theft of key equipment

Others, for example natural disaster (floods) and others depend upon the nature and scale

of the industry.

These categories are not rigid and some parts of your business may fall into more than one

category. The risks attached to data protection, for example, could be considered when reviewing

both your operations and your business' compliance.

Strategic risks

Strategic risks are those risks associated with operating in a particular industry.

They include risks arising from:

merger and acquisition activity

changes among customers or in demand

industry changes

research and development

For example you might consider the strategic risks of the possibility of a US company buying one

of your European competitors. This could give the US Company a distribution arm in the UK. In

this situation you might want to consider:

whether there are any US companies which have the cash/share price to do this

whether there are any European competitors who could be a takeover target, perhaps because

of financial difficulties

whether the US company would lower prices or invest more in research and development

Where there's a strong possibility of this happening, you should prepare some sort of response.

Compliance risk

Compliance risks are those associated with the need to comply with laws and regulations. They

also apply to the need to act in a manner which investors and customers expect, for example, by

ensuring proper corporate governance.

You may need to consider whether employment or health and safety legislation could add to your

overheads or force changes in your established ways of working. For advice on how to manage

health and safety risks, read our guide on how to set up a health and safety management system.

You may also want to consider legislative risks to your business. You should ask yourself whether

the products or services you offer could be made less marketable by legislation or taxation - as

4 | Page

Superior University, Lahore

Risk Management

by: Asif Masood Ahmad

has happened with tobacco and asbestos products. For example, concerns about the increase in

obesity may prompt tougher food labeling regulations, which may push up costs or reduce the

appeal of certain types of food.

Financial risks

Financial risks are associated with your business' financial structure and systems and the

transactions your business makes.

Identifying financial risk involves examining your daily financial operations, especially cash-flow. If

your business is too dependent on a single customer and they became unable to pay you, this

could have serious implications for your business' viability. See our guide on how to identify

potential cash-flow problems.

You might examine:

how you extend credit to customers

who owes you money

how you can recover it

insurance to cover large or doubtful debts

Financial risk assessment should take into account external factors such as interest rates and

foreign exchange rates.

Rate changes will affect your debt repayments and the competitiveness of your goods and

services compared with those produced abroad.

If you are involved in international trade, you will be exposed to even greater financial risks. It can

be more difficult to assess the creditworthiness of an overseas client and to recoup unpaid debts.

You may also be adversely affected by movements in the currency markets. In addition,

depending on the trading terms you choose, it may take longer to receive payment when

compared with a UK client. For more information on managing the financial implications of

international trade see our guides on getting paid when selling overseas and foreign currency and

exchange risks.

Operational risks

Operational risks are associated with your business' operational and administrative procedures.

These include:

recruitment

supply chain

transportation

accounting controls

IT systems

regulations

5 | Page

Superior University, Lahore

Risk Management

by: Asif Masood Ahmad

board composition

You should examine these operations in turn, prioritize the risks and make necessary provisions.

For example, if you rely on one supplier for a key component you could source other suppliers to

help you minimize the risk.

If your business makes and receives regular deliveries, consider drawing up a continuity plan to

help you maintain operations in the event of a fuel strike or shortage.

IT risk and data protection are increasingly important to business. If hackers break into your IT

systems, they could steal valuable data and even money from your bank account which at best

would be embarrassing and at worst could put you out of business. A secure IT system employing

encryption will safeguard commercial and customer information.

Other risks

Other risks include:

environmental risks, including natural disasters

employee risk management, such as maintaining sufficient staff numbers and cover,

employee safety and up-to-date skills

political and economic instability in any foreign markets you export goods to

health and safety risks

commercial risks, including the failure of key suppliers or customers

Risk Management Process

Businesses face many risks; therefore risk management should be a central part of any business'

strategic management.

Risk management helps you to identify and address the risks facing your business and in doing so

increase the likelihood of successfully achieving your businesses objectives.

A risk management process involves:

methodically identifying the risks surrounding your business activities

assessing the likelihood of an event occurring

understanding how to respond to these events

putting systems in place to deal with the consequences

monitoring the effectiveness of your risk management approaches and controls

As a result, the process of risk management:

improves decision-making, planning and prioritization

helps you allocate capital and resources more efficiently

6 | Page

Superior University, Lahore

Risk Management

by: Asif Masood Ahmad

allows you to anticipate what may go wrong, minimizing the amount of fire-fighting you

have to do or, in a worst-case scenario, preventing a disaster or serious financial loss

significantly improves the probability that you will deliver your business plan on time and to

budget

Risk management becomes even more important if your business decides to try something new,

for example launch a new product or enter new markets. Competitors following you into these

markets, or breakthroughs in technology which make your product redundant, are two risks you

may want to consider in cases such as these.

Risk Management Process Flowchart

1. Risk Identification

1. Introduction

Risk identification is a deliberate and systematic effort to identify and document the Institutions

key risks. The objective of risk identification is to understand what is at risk within the context of

the Institutions explicit and implicit objectives and to generate a comprehensive inventory of risks

based on the threats and events that might prevent, degrade, delay or enhance the achievement

of the objectives. This necessitated the development of risk identification guidelines to ensure that

Institutions manage risk effectively and efficiently.

2. The risk identification process

7 | Page

Superior University, Lahore

Risk Management

by: Asif Masood Ahmad

Comprehensive identification and recording of risks is critical, because a risk that is not identified

at this stage may be excluded from further analysis. In order to manage risks effectively,

Institutions have to know what risks they are faced with. The risk identification process should

cover all risks, regardless of whether or not such risks are within the direct control of the

Institution. Institutions should adopt a rigorous and on-going process of risk identification that also

includes mechanisms to identify new and emerging risks timeously.

Risk identification should be inclusive, not overly rely on the inputs of a few senior officials and

should also draw as much as possible on unbiased independent sources, including the

perspectives of important stakeholders.

2.1 Risk workshops and interviews

Risk workshops and interviews are useful for identifying, filtering and screening risks but it is

important that these judgment based techniques be supplemented by more robust and

sophisticated methods where possible, including quantitative techniques.

Risk identification should be strengthened by supplementing Managements perceptions of risks,

inter alia, with:

review of external and internal audit reports;

review of the reports of the Standing Committee on Public Accounts and the relevant

Parliamentary Committee(s);

financial analyses;

historic data analyses;

actual loss data;

interrogation of trends in key performance indicators;

benchmarking against peer group or quasi peer group;

market and sector information;

scenario analyses; and

Forecasting and stress testing.

2.2 Focus points of risk identification

To ensure comprehensiveness of risk identification the Institution should identify risk factors

through considering both internal and external factors, through appropriate processes of:

2.2.1 Strategic risk identification

Strategic risk identification to identify risks emanating from the strategic choices made by the

Institution, specifically with regard to whether such choices weaken or strengthen the Institution's

ability to execute its Constitutional mandate:

strategic risk identification should precede the finalization of strategic choices to ensure that

potential risk issues are factored into the decision making process for selecting the strategic

options;

risks inherent to the selected strategic choices should be documented, assessed and

managed through the normal functioning of the system of risk management; and

Strategic risks should be formally reviewed concurrently with changes in strategy, or at

8 | Page

Superior University, Lahore

Risk Management

by: Asif Masood Ahmad

least once a year to consider new and emerging risks.

2.2.2 Operational risk identification

Operational risk identification to identify risks concerned with the Institutions operations:

operational risk identification should seek to establish vulnerabilities introduced by

employees, internal processes and systems, contractors, regulatory authorities and external

events;

operational risk identification should be an embedded continuous process to identify new

and emerging risks and consider shifts in known risks through mechanisms such as management

and committee meetings, environmental scanning, process reviews and the like; and

Operational risk identification should be repeated when changes occur, or at least once a

year, to identify new and emerging risks.

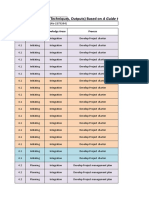

2.2.3 Project risk identification

Project risk identification to identify risks inherent to particular projects:

project risks should be identified for all major projects, covering the whole lifecycle; and

for long term projects, the project risk register should be reviewed at least once a year to

identify new and emerging risks.

3. Risk Identification Methods - 12 Types

3.1 Brainstorming is a technique that is best accomplished when the approach is unstructured

(the facilitator encourages random inputs from the group). Group members verbally identify risks

that provide the opportunity to build on others ideas. To achieve the desired outcome, it is

essential to select participants that are familiar with the topics discussed, relevant documentation

is provided and a facilitator that knows the risk process leads the group.

A note-taker should be appointed to capture the ideas that are being discussed. A structured

brainstorming session, where each group member presents an idea in turn, may be used where

not all group members are participating. Structured brainstorming ensures participation by all

group members. Brainstorming can also be used during planning to generate a list of migration

strategies, possible causes for the risk, or other areas of impact. It is not intended for an in-depth

risk analysis of risk.

3.2 Surveys are a technique where lists of questions are developed to seek out risk in a particular

area. A limitation of this method is that people inherently don't like to complete surveys and may

not provide accurate information. The value of the surveys may be difficult to determine due to

subjectivity in the answers or because of the focus of the questions themselves.

3.3 Interviews are an effective way to identify risk areas. Group interviews can assist in

identifying the baseline of risk on a project. The interview process is essentially a questioning

process. It is limited by the effectiveness of the facilitator and the questions that are being asked.

The interview can be conducted before or after the brainstorming session. However if it is

accomplished before the brainstorming session, the results should be shared with the group after

9 | Page

Superior University, Lahore

Risk Management

by: Asif Masood Ahmad

they have provided their input to the risk list. If the interview(s) are completed after the

brainstorming session has been completed, the list of risks should be provided to all participants

for comment before they are added to the risk list.

3.4 Working Groups are great way to analyze a particular area or topic in a discussion process to

identify risks that may not be obvious to the risk identification group. The working group is usually

a separate group of people working a particular area within the project that is conducting the risk

identification.

3.5 Experiential Knowledge is the collection of information that a person has obtained through

their experience. Caution must be used when using any knowledge based information to ensure it

is relevant and applicable to the current situation.

3.6 Documented Knowledge is the collection of information or data that has been documented

about a particular subject. This is a source of information that provides insight into the risks in a

particular area of concern. Caution must be used when using any knowledge based information

to ensure it is relevant and applicable to the current situation

3.7 Risk Lists are usually lists of risks that have been found in similar municipalities and/or similar

situations. Caution must be used when using this type of information to ensure it is relevant and

applicable to the current situation.

3.8 Risk Trigger Questions are lists of situations or events in a particular area of a municipality

that can lead to risk identification. These are situations or areas where risks have been

discovered within the organization. These trigger questions may be grouped by areas such as

performance, cost, schedule, software, etc.

3.9 Lessons Learned is experiential knowledge that has been organized into information that

may be relevant to the different areas within the organization. This source of information may

guide you in identifying risk in your municipality. Caution must be used when using this type of

information to ensure it is relevant and applicable to the current situation.

3.10 Outputs from Risk-Oriented Analysis - There are various types of risk oriented

analysis. Two such techniques are fault tree analysis and event tree analysis. These are top

down analysis approaches that attempt to determine what events, conditions, or faults could lead

to a specific top level undesirable event. This event with the associated consequence could be a

risk for your program.

3.11 Historical Information is basically the same as documented knowledge. The difference is

that historical information is usually widely accepted as fact.

3.12 Engineering Templates are a set of flow charts for various aspects of the development

process. These templates are preliminary in nature and are intended as general guidance to

accomplish a top down assessment of activities.

4. How to perform risk identification

It is crucial to have knowledge of the business before commencing with risk identification process.

It is also important to learn from both past experience and experience of others when considering

the risks to which an Institution may be exposed and the best strategy available for responding to

10 | Page

Superior University, Lahore

Risk Management

by: Asif Masood Ahmad

those risks.

Risk identification starts with understanding the Institutional objectives, both implicit and

explicit. The risk identification process must identify unwanted events, undesirable outcomes,

emerging threats, as well as existing and emerging opportunities. By virtue of an Institution's

existence, risks will always prevail, whether the Institution has controls or not.

When identifying risks, it is also important to bear in mind that "risk" also has an opportunity

component. This means that there should also be a deliberate attention to identifying potential

opportunities that could be exploited to improve Institutional performance. In identifying risks,

consideration should be given to risks associated with not pursuing an opportunity, e.g. failure to

implement an IT system to collect municipal rates.

Risk identification exercise should not get bogged down in conceptual or theoretical detail. It

should also not limit itself to a fixed list of risk categories, although such a list may be helpful.

The following are key steps necessary to effectively identify risks from across the Institution:

Understand what to consider when identifying risks;

Gather information from different sources to identify risks;

Apply risk identification tools and techniques;

Document the risks;

Document the risk identification process; and

Assess the effectiveness of the risk identification process.

4.1 Understand what to consider when identifying risks

In order to develop a comprehensive list of risks, a systematic process should be used that starts

with defining objectives and key success factors for their achievement. This can help provide

confidence that the process of risk identification is complete and major issues have not been

missed.

4.2 Gather information from different sources to identify risks

Good quality information is important in identifying risks. The starting point for risk identification

may be historical information about this or similar Institutions and then discussions with a wide

range of stakeholders about historical, current and evolving issues, data analysis, review of

performance indicators, economic information, loss data, scenario planning and the like can

produce important risk information.

Furthermore, processes used during strategic planning like Strength Weakness Opportunity and

Threat SWOT Analysis, Political Economic Social Technological Environment & Legal. PEST (EL)

Analysis and benchmarking will have revealed important risks and opportunities that should not be

ignored, i.e. they should be included in the risk register.

Certain disciplines like IT, Strategic Management, Health and Safety etc. already have in place

established risk identification methodologies as informed by their professional norms and

standards. The risk identification process should recognize and utilize the outputs of these

techniques in order not to "re-invent the wheel".

11 | Page

Superior University, Lahore

Risk Management

by: Asif Masood Ahmad

4.3 Apply risk identification tools and techniques

An Institution should apply a set of risk identification tools and techniques that are suited to its

objectives and capabilities, and to the risk the Institution faces. Relevant and up-to-date

information is important in identifying risks. This should include suitable background information

where possible. People with appropriate knowledge should be involved in identifying risks.

Approaches used to identify risks could include the use of checklists, judgments based on

experience and records, flow charts, brainstorming, systems analysis, scenario analysis, and

system engineering techniques.

The approach used will depend on the nature of the activities under review, types of risks,

the Institutional context, and the purpose of the risk management exercise.

Team-based brainstorming for example, where facilitated workshops is a preferred

approach as it encourages commitment, considers different perspectives and incorporates

differing experiences.

Structured techniques such as flow charting, system design review, systems analysis,

Hazard and Operability (HAZOP) studies and operational modeling should be used where the

potential consequences are catastrophic and the use of such intensive techniques are cost

effective.

Since risk workshops are useful only for filtering and screening of possible risks, it is

important that the workshops are supplemented by more sophisticated or structured techniques

described above.

For less clearly defined situations, such as the identification of strategic risks, processes

with a more general structure, such as 'what-if' and scenario analysis could be used.

Where resources available for risk identification and analysis are constrained, the structure

and approach may have to be adapted to achieve efficient outcomes within budget limitations. For

example, where less time is available, a smaller number of key elements may be considered at a

higher level, or a checklist may be used.

4.4 Document the risks identified

The risks identified during the risk identification are typically documented in a risk register that,

includes (at this stage):

risk description;

how and why the risk can happen (i.e. causes and consequences); and

the existing internal controls that may reduce the likelihood or consequences of the risks.

It is essential when identifying a risk to consider the following three elements:

description/event - an occurrence or a particular set of circumstances;

causes - the factors that may contribute to a risk occurring or increase;

the likelihood of a risk occurring; and

consequences - the outcome(s) or impact(s) of an event.

It is the combination of these elements that make up a risk and this level of detail will enable an

Institution to better understand its risks.

4.5 Document your risk identification process

12 | Page

Superior University, Lahore

Risk Management

by: Asif Masood Ahmad

In addition to documenting identified risks, it is also necessary to document the risk identification

process to help guide future risk identification exercises and to ensure good practices are

maintained by drawing on lessons learned through previous exercises. Documentation of this

step should include:

the approach or method used for identifying risks;

the scope covered by the identification; and

the participants in the risk identification and the information sources consulted.

Experience has shown that management often disregards well controlled risks when documenting

the risk profile of the Institution. It is stressed that a well-controlled risk must still be recorded in

the risk profile of the Institution. The reason for this logic is that the processes for identifying risks

should ignore at that point any mitigating factors (these will be considered when the risk is being

assessed).

5. The outputs of risk identification

The document in which the risks are recorded is known as the "risk register" and it is the main

output of a risk identification exercise.

A risk register is a comprehensive record of all risks across the Institution or project depending on

the purpose/context of the register. There is no single blueprint for the format of a risk register and

Institutions have a great degree of flexibility regarding how they lay out their documents.

The risk register serves three main purposes

It is a source of information to report the key risks throughout the Institution, as well as to key stakeholders.

Management uses the risk register to focus their priorities risks.

It is to help the auditors to focus their plans on the Institution's top risks.

As a minimum, the risks register records:

the risk;

risk category;

how and why the risk can happen "cause of risk";

how will the risk impact the Institution if it materializes "impact on Institution";

the qualitative and / or quantitative cost should the risk materialize;

the likelihood and consequences of the risk to the Institution;

the existing internal controls that may minimize the likelihood of the risk occurring;

a risk level rating based on pre-established criteria;

framework, including an assessment of whether the risk is acceptable or whether it needs

to be treated;

a clear prioritization of risks (risk profile);

accountability for risk treatment (may be part of the risk treatment plan); and

Timeframe for risk treatment.

Once the risks have been identified and existing control have been assessed and it is has been

established that controls are inadequate, an assessment of whether the risk is acceptable or

13 | Page

Superior University, Lahore

Risk Management

by: Asif Masood Ahmad

whether it needs to be treated needs to be performed.

2. Risk assessment

Businesses face many risks; therefore risk management should be a central part of any business'

strategic management.

Risk management helps you to identify and address the risks facing your business and in doing so

increase the likelihood of successfully achieving your businesses objectives.

A risk management process involves:

methodically identifying the risks surrounding your business activities

assessing the likelihood of an event occurring

understanding how to respond to these events

putting systems in place to deal with the consequences

monitoring the effectiveness of your risk management approaches and controls

As a result, the process of risk management:

improves decision-making, planning and prioritization

helps you allocate capital and resources more efficiently

allows you to anticipate what may go wrong, minimizing the amount of fire-fighting you have to do

or, in a worst-case scenario, preventing a disaster or serious financial loss

significantly improves the probability that you will deliver your business plan on time and to budget

Risk management becomes even more important if your business decides to try something new,

for example launch a new product or enter new markets. Competitors following you into these

markets, or breakthroughs in technology which make your product redundant, are two risks you

may want to consider in cases such as these.

Risk assessment Definition

Risk assessment is the determination of quantitative or qualitative value of risk related to a

concrete situation and a recognized threat (also called hazard). Quantitative risk

assessment requires calculations of two components of risk (R), the magnitude of the potential

loss (L), and the probability (P) that the loss will occur. Acceptable risk is a risk that is

understood and tolerated usually because the cost or difficulty of implementing an effective

countermeasure for the associated vulnerability exceeds the expectation of loss.

In all types of engineering of complex systems sophisticated risk assessments are often made

within Safety engineering and Reliability engineering when it concerns threats to life,

environment or machine functioning. The nuclear, aerospace, oil, rail and military industries have

a long history of dealing with risk assessment. Also, medical, hospital, social service and food

14 | Page

Superior University, Lahore

Risk Management

by: Asif Masood Ahmad

industries control risks and perform risk assessments on a continual basis. Methods for

assessment of risk may differ between industries and whether it pertains to general financial

decisions or environmental, ecological, or public health risk assessment.

Explanation

Risk assessment consists of an objective evaluation of risk in which assumptions and

uncertainties are clearly considered and presented. Part of the difficulty in risk management is that

measurement of both of the quantities in which risk assessment is concerned potential loss and

probability of occurrence can be very difficult to measure. The chance of error in measuring

these two concepts is high. Risk with a large potential loss and a low probability of occurrence, is

often treated differently from one with a low potential loss and a high likelihood of occurrence. In

theory, both are of near equal priority, but in practice it can be very difficult to manage when faced

with the scarcity of resources, especially time, in which to conduct the risk management process.

Expressed mathematically,

Risk assessment from a financial point of view.

Financial decisions, such as insurance, express loss in terms of dollar amounts. When risk

assessment is used for public health or environmental decisions, loss can be quantified in a

common metric such as a country's currency or some numerical measure of a location's quality of

life. For public health and environmental decisions, loss is simply a verbal description of the

outcome, such as increased cancer incidence or incidence of birth defects. In that case, the "risk"

is expressed as

If the risk estimate takes into account information on the number of individuals exposed, it is

termed a "population risk" and is in units of expected increased cases per a time period. If the risk

15 | Page

Superior University, Lahore

Risk Management

by: Asif Masood Ahmad

estimate does not take into account the number of individuals exposed, it is termed an "individual

risk" and is in units of incidence rate per a time period. Population risks are of more use for

cost/benefit analysis; individual risks are of more use for evaluating whether risks to individuals

are "acceptable".

Risk Assessment?

Essential steps for performing a risk assessment

How to evaluate risks?

Risk evaluation allows you to determine the significance of risks to the business and decide to

accept the specific risk or take action to prevent or minimize it.

To evaluate risks, it is worthwhile ranking these risks once you have identified them.

This can be done by considering the consequence and probability of each risk. Many

businesses find that assessing consequence and probability as high, medium or low is adequate

for their needs.

These can then be compared with your business plan - to determine which risks may affect your

objectives - and evaluated in the light of legal requirements, costs and investor concerns. In some

cases, the cost of mitigating a potential risk may be so high that doing nothing makes more

business sense.

There are some tools you can use to help evaluate risks. You can plot on a risk map the

significance and likelihood of the risk occurring. Each risk is rated on a scale of one to ten. If a risk

is rated ten this means it is of major importance to the company. One is the least significant. The

map allows you to visualize risks in relation to each other, gauge their extent and plan what type

of controls should be implemented to mitigate the risks.

Prioritizing risks, however you do this, allows you to direct time and money toward the most

important risks. You can put systems and controls in place to deal with the consequences of an

event. This could involve defining a decision process and escalation procedures that your

company would follow if an event occurred.

Types of Risk assessment

Risk assessment can therefore be conducted at various levels of the organization. The objectives

and events under consideration determine the scope of the risk assessment to be undertaken.

Examples of frequently performed risk assessments include:

Strategic risk assessment. Evaluation of risks relating to the organizations mission and

strategic objectives, typically performed by senior management teams in strategic planning

meetings, with varying degrees of formality.

16 | Page

Superior University, Lahore

Risk Management

by: Asif Masood Ahmad

Operational risk assessment. Evaluation of the risk of loss (including risks to financial

performance and condition) resulting from inadequate or failed internal processes, people, and

systems, or from external events. In certain industries, regulators have imposed the requirement

that companies regularly identify and quantify their exposure to such risks. While responsibility for

managing the risk lies with the business, an independent function often acts in an advisory

capacity to help assess these risks.

Compliance risk assessment. Evaluation of risk factors relative to the organizations

compliance obligations, considering laws and regulations, policies and procedures, ethics and

business conduct standards, and contracts, as well as strategic voluntary standards and best

practices to which the organization has committed. This type of assessment is typically performed

by the compliance function with input from business areas.

Internal audit risk assessment. Evaluation of risks related to the value drivers of the

organization, covering strategic, financial, operational, and compliance objectives. The

assessment considers the impact of risks to shareholder value as a basis to define the audit plan

and monitor key risks. This top-down approach enables the coverage of internal audit activities to

be driven by issues that directly impact shareholder and customer value, with clear and explicit

linkage to strategic drivers for the organization.

Financial statement risk assessment. Evaluation of risks related to a material misstatement of

the organizations financial statements through input from various parties such as the controller,

internal audit, and operations. This evaluation, typically performed by the finance function,

considers the characteristics of the financial reporting elements (e.g., materiality and susceptibility

of the underlying accounts, transactions, or related support to material misstatement) and the

effectiveness of the key controls (e.g., likelihood that a control might fail to operate as intended,

and the resultant impact).

Fraud risk assessment. Evaluation of potential instances of fraud that could impact the

organizations ethics and compliance standards, business practice requirements, financial

reporting integrity, and other objectives. This is typically performed as part of Sarbanes-Oxley

compliance or during a broader organization-wide risk assessment, and involves subject matter

experts from key business functions where fraud could occur (e.g., procurement, accounting, and

sales) as well as forensic specialists.

Market risk assessment. Evaluation of market movements that could affect the organizations

performance or risk exposure, considering interest rate risk, currency risk, option risk, and

commodity risk. This is typically performed by market risk specialists.

Credit risk assessment. Evaluation of the potential that a borrower or counterparty will fail to

meet its obligations in accordance with agreed terms. This considers credit risk inherent to the

entire portfolio as well as the risk in individual credits or transactions, and is typically performed by

credit risk specialists.

Customer risk assessment. Evaluation of the risk profile of customers that could potentially

impact the organizations reputation and financial position. This assessment weighs the

customers intent, creditworthiness, affiliations, and other relevant factors. This is typically

performed by account managers, using a common set of criteria and a central repository for the

assessment data.

17 | Page

Superior University, Lahore

Risk Management

by: Asif Masood Ahmad

Supply chain risk assessment. Evaluation of the risks associated with identifying the inputs

and logistics needed to support the creation of products and services, including selection and

management of suppliers (e.g., up-front due diligence to qualify the supplier, and ongoing quality

assurance reviews to assess any changes that could impact the achievement of the organizations

business objectives).

How risk is determined

In the estimation of risks, three or more steps are involved that require the inputs of different

disciplines:

1. Hazard Identification aims to determine the qualitative nature of the potential adverse

consequences of the contaminant (chemical, radiation, noise, etc.) and the strength of the

evidence it can have that effect. This is done, for chemical hazards, by drawing from the

results of the sciences of toxicology and epidemiology. For other kinds of hazard,

engineering or other disciplines are involved.

2. Dose-Response Analysis is determining the relationship between dose and the probability

or the incidence of effect (dose-response assessment). The complexity of this step in many

contexts derives mainly from the need to extrapolate results from experimental animals

(e.g. mouse, rat) to humans, and/or from high to lower doses. In addition, the differences

between individuals due to genetics or other factors mean that the hazard may be higher

for particular groups, called susceptible populations. An alternative to dose-response

estimation is to determine a concentration unlikely to yield observable effects, that is, a no

effect concentration. In developing such a dose, to account for the largely unknown effects

of animal to human extrapolations, increased variability in humans, or missing data, a

prudent approach is often adopted by including safety factors in the estimate of the "safe"

dose, typically a factor of 10 for each unknown step.

3. Exposure Quantification aims to determine the amount of a contaminant (dose) that

individuals and populations will receive. This is done by examining the results of the

discipline of exposure assessment. As different location, lifestyles and other factors likely

influence the amount of contaminant that is received, a range or distribution of possible

values is generated in this step. Particular care is taken to determine the exposure of the

susceptible population(s).

Finally, the results of the three steps above are then combined to produce an estimate of risk.

Because of the different susceptibilities and exposures, this risk will vary within a population.

Small sub-populations

When risks apply mainly to small sub-populations, there is uncertainty at which point intervention

is necessary. For example, there may be a risk that is very low for everyone, other than 0.1% of

the population. It is necessary to determine whether this 0.1% is represented by:

all infants younger than X days or

recreational users of a particular product.

18 | Page

Superior University, Lahore

Risk Management

by: Asif Masood Ahmad

If the risk is higher for a particular sub-population because of abnormal exposure rather than

susceptibility, strategies to further reduce the exposure of that subgroup are considered. If an

identifiable sub-population is more susceptible due to inherent genetic or other factors, public

policy choices must be made. The choices are:

to set policies for protecting the general population that are protective of such groups, e.g. for

children when data exists, the Clean Air Act for populations such as asthmatics or

not to set policies, because the group is too small, or the costs too high.

Acceptable risk criteria

The idea of not increasing lifetime risk by more than one in a million has become commonplace in

public health discourse and policy. It is a heuristic measure. It provides a numerical basis for

establishing a negligible increase in risk.

Environmental decision making allows some discretion for deeming individual risks potentially

"acceptable" if less than one in ten thousand chance of increased lifetime risk. Low risk criteria

such as these provide some protection for a case where individuals may be exposed to multiple

chemicals e.g. pollutants, food additives or other chemicals.

In practice, a true zero-risk is possible only with the suppression of the risk-causing activity.

Stringent requirements of 1 in a million may not be technologically feasible or may be so

prohibitively expensive as to render the risk-causing activity unsustainable, resulting in the optimal

degree of intervention being a balance between risks vs. benefit. For example, emissions from

hospital incinerators result in a certain number of deaths per year. However, this risk must be

balanced against the alternatives. There are public health risks, as well as economic costs,

associated with all options. The risk associated with no incineration is potential spread of

infectious diseases, or even no hospitals. Further investigation identifies options such as

separating noninfectious from infectious wastes, or air pollution controls on a medical incinerator.

Intelligent thought about a reasonably full set of options is essential. Thus, it is not unusual for

there to be an iterative process between analyses, consideration of options, and follow up

analysis.

Risk Assessment in Various Sectors

In public health

In the context of public health, risk assessment is the process of quantifying the probability of a

harmful effect to individuals or populations from certain human activities. In most countries the use

of specific chemicals or the operations of specific facilities (e.g. power plants, manufacturing

plants) is not allowed unless it can be shown that they do not increase the risk of death or illness

above a specific threshold. For example, the American Food and Drug Administration (FDA)

regulate food safety through risk assessment. The FDA required in 1973 that cancer-causing

compounds must not be present in meat at concentrations that would cause a cancer risk greater

19 | Page

Superior University, Lahore

Risk Management

by: Asif Masood Ahmad

than 1 in a million over a lifetime. The US Environmental Protection Agency provides basic

information about environmental risk assessments for the public via its risk assessment

portal. The Stockholm Convention on persistent organic pollutants (POPs) supports a qualitative

risk framework for public health protection from chemicals that display environmental and

biological persistence, bioaccumulation, toxicity (PBT) and long range transport; most global

chemicals that meet this criteria have been previously assessed quantitatively by national and

international health agencies.

In auditing

For audits performed by an outside audit firm, risk assessment is a very crucial stage before

accepting an audit engagement. According to ISA315 Understanding the Entity and its

Environment and Assessing the Risks of Material Misstatement, "the auditor should perform risk

assessment procedures to obtain an understanding of the entity and its environment, including its

internal control. Evidence relating to the auditors risk assessment of a material misstatement in

the clients financial statements. Then, the auditor obtains initial evidence regarding the classes of

transactions at the client and the operating effectiveness of the clients internal controls. In

auditing, audit risk is defined as the risk that the auditor will issue a clean unmodified opinion

regarding the financial statements, when in fact the financial statements are materially misstated,

and therefor do not qualify for a clean unmodified opinion. As a formula, audit risk is the product of

two other risks: Risk of Material Misstatement and Detection risk. This formula can be further

broken down as follows: (inherent risk X control risk X detection risk).

Human health

There are many resources that provide health risk information.

The National Library of Medicine provides risk assessment and regulation information tools for a

varied audience. These include:

TOXNET (databases on hazardous chemicals, environmental health, and toxic releases)

the Household Products Database (potential health effects of chemicals in over 10,000

common household products).

TOXMAP (maps of the U.S. Environmental Protection Agency Superfund and Toxics Release

Inventory data).

The United States Environmental Protection Agency provides basic information about

environmental risk assessments for the public.

In information security

IT risk assessment can be performed by a qualitative or quantitative approach, following different

methodologies.

20 | Page

Superior University, Lahore

Risk Management

by: Asif Masood Ahmad

In project management

In project management, risk assessment is an integral part of the risk management plan, studying

the probability, the impact, and the effect of every known risk on the project, as well as the

corrective action to take should that risk occur. Of special consideration in this area is the relevant

codes of practice that are enforce in the specific jurisdiction. Understanding the regime of

regulations that risk management must abide by is integral to formulating safe and compliant risk

assessment practices.

For megaprojects

Megaprojects (sometimes also called "major programs") are extremely large-scale investment

projects, typically costing more than US$1 billion per project. Megaprojects include bridges,

tunnels, highways, railways, airports, seaports, power plants, dams, wastewater projects, coastal

flood protection, oil and natural gas extraction projects, public buildings, information technology

systems, aerospace projects, and defence systems. Megaprojects have been shown to be

particularly risky in terms of finance, safety, and social and environmental impacts.

Quantitative risk assessment

Quantitative risk assessments include a calculation of the single loss expectancy (SLE) of an

asset. The single loss expectancy can be defined as the loss of value to asset based on a single

security incident. The team then calculates the Annualized Rate of Occurrence (ARO) of the threat

to the asset. The ARO is an estimate based on the data of how often a threat would be successful

in exploiting vulnerability. From this information, the Annualized Loss Expectancy (ALE) can be

calculated. The annualized loss expectancy is a calculation of the single loss expectancy

multiplied by the annual rate of occurrence, or how much an organization could estimate to lose

from an asset based on the risks, threats, and vulnerabilities. It then becomes possible from a

financial perspective to justify expenditures to implement countermeasures to protect the asset.

In software evolution

Studies have shown that early parts of the system development cycle such as requirements and

design specifications are especially prone to error. This effect is particularly notorious in projects

involving multiple stakeholders with different points of view. Evolutionary software processes offer

an iterative approach to requirement engineering to alleviate the problems of uncertainty,

ambiguity and inconsistency inherent in software developments.

In shipping industry

In July 2010, shipping companies agreed to use standardized procedures in order to assess risk

in key shipboard operations. These procedures were implemented as part of the amended ISM

code.

3. Risk Prioritization

21 | Page

Superior University, Lahore

Risk Management

by: Asif Masood Ahmad

Risk analysis and evaluation criteria to prioritize risk

The next step is to evaluate the risk arising from each hazard. This can be done by considering:

how likely it is that a hazard will cause harm (e.g. whether it is improbable, possible but not

very likely, probable, or inevitable over time)

how serious that harm is likely to be (e.g. resulting in minor damage, a non-injury incident,

a minor injury (bruise, laceration), a serious injury (fracture, amputation, chronic ill-health), a

fatality, or a multiple-fatality)

How often (and how many) workers are exposed.

A straightforward process based on judgment and requiring no specialist skills or complicated

techniques could be sufficient for many workplace hazards or activities. These include activities

with hazards of low concern, or workplaces where risks are well known or readily identified and

where a means of control is readily available. This is probably the case for most businesses

(mainly small and medium-sized enterprises SMEs).

In some other cases it may not be possible to identify the hazards and evaluate risks without

professional knowledge, support and advice. This may arise in respect of the more complex

processes and technologies in the workplace, or hazards, such as those related to health, which

may not be readily or easily identifiable, and may require analysis and measurements.

Evaluate Risk

In the risk analysis stage, each risk has been assigned a level based on likelihood and

consequences. The purpose of evaluation is to compare the levels of risk and decide whether the

level of each risk is acceptable or not. There may also be a number of risks that fall into the same

level where each of them would not be treated equally.

In determining whether a risk is acceptable or not, the evaluation would take into account a

number of factors:

How does the level of each risk (from the analysis step in 'Analyse risks') stand up

against the level of acceptable risk in 'About establishing the context'?

Is the level of the risk so low that treatment is not appropriate? (As Low As

Reasonably Practicable - ALARP)

Do the opportunities outweigh the threats to such a degree that the risk is justified?

Is the cost excessive compared to the benefit?

Is there no treatment available?

If risk criteria were established when setting the context, the level of risk would now be compared

against this criteria in order to determine whether the risk is acceptable. If acceptable, there would

be no further action taken. The justification for this would be documented and the risk monitored to

ensure that no factors arise that would require assessment of the risk to be reviewed.

22 | Page

Superior University, Lahore

Risk Management

by: Asif Masood Ahmad

If the risk is not acceptable, then the risk assessment process would continue to determine

appropriate treatment options in order that the risk is reduced to As Low as Reasonably

Practicable (ALARP).

Level of risk

Sample response expectations

Severe risk

must be managed by senior management with a detailed plan

High risk

detailed research and management planning required at senior levels

Major risk

senior management attention is needed

Significant risk management responsibility must be specified

Moderate risk

manage by specific monitoring or response procedures

Low risk

manage by routine procedures

Trivial risk

unlikely to need specific application of resources

As Low As Reasonably Practicable (ALARP)

In general two criteria can be defined using the ALARP concept:

risk is negligible and can be accepted without specific treatment other than

monitoring

risk is intolerable and the activity must cease, unless risk can be reduced.

Between these levels is a region where costs and benefits are taken into account. When risk is

close to the intolerable level the expectation is that risk will be reduced unless the cost of reducing

the risk is grossly disproportionate to the benefits gained. Where risks are close to the negligible

level then action may only be taken to reduce risk where benefits exceed the costs of reduction.

23 | Page

Superior University, Lahore

Risk Management

by: Asif Masood Ahmad

Prioritizing Risk

Once the level of risk has been determined for each risk, this information can be entered onto a

risk register showing the level of risks. The evaluation will decide the risk priority, showing which

risk must be managed first in order to reduce the exposure of the organisation to serious loss. Of

course, small or insignificant risks might be treated immediately where it would be quick and / or

low cost to do so.

Once the priority is determined and risks are to be treated, those will then be included on a risk

treatment schedule where they can be tracked until the risks are treated.

Risk Register

Risk Register Definition

A Risk Register, also referred to as a Risk Log, is a master document which is created during the early

stages of your project. It is a tool that plays an important part in your Risk Management Plan, helping

you to track issues and address problems as they arise.

The Risk Register will generally be shared between project stakeholders, allowing those involved in

the project to be kept aware of issues and providing a means of tracking the response to issues. It can

be used to flag new project risks and to make suggestions on what course of action to take to resolve

any issues.

All corporate and organizational projects face risk at one time or another. Having a Risk Register in

place simply provides a better means of responding to problems as they arise. The Risk Register is

there to help with the decisions making process and enables managers and project stakeholders to

handle risk in the most appropriate way. A risk needn't be a threat to your project, it is simply an issue

that can arise during the project; if effectively managed, it shouldn't prevent your project from attaining

its goals and objectives. The Risk Register is a document that contains information about identified

project risks, analysis of risk severity and evaluations of the possible solutions to be applied.

24 | Page

Superior University, Lahore

Risk Management

by: Asif Masood Ahmad

Presenting this in a spreadsheet if often the easiest way to manage things, so that key information can

be found and applied quickly and easily.

How Risk Register is created?

If you're going to create a Risk Register and the following is a brief guide on how to get started in just a

few steps:

1. Create the Risk Register - this step will be undertaken when the project plan is approved and

the Risk Section of the project plan should serve as the basis for the document.

2. Record active risks - keep track of active risks by recording them in the Risk Register along

with the date identified, date updated, target date and closure date. Other useful information to

include is the risk identification number, a description of the risk, type and severity of risk, its

impact, possible response action and the current status of risk.

3. Assign a unique number to each risk element - this will help to identify each unique risk, so that

you know if that risk eventuates during the project and what the status of the risk is at any given

time. Keeping this number consistent throughout the project will make it easy to see how this

risk links in to the Project Status Report, Risk Identification and Risk Impact Form.

4. The risk register addresses risk management in four key steps:

(1) identifying the risk,

(2) evaluating the severity of any identified risks,

25 | Page

Risk Management

by: Asif Masood Ahmad

Superior University, Lahore

(3) applying possible solutions to those risks and

(4) monitoring and analysing the effectiveness of any subsequent steps taken.

5. By learning how to create a Risk Register, you can be proactive about managing your projects

and handling any risks associated with them. Any issues that are likely to impact upon the

success of your project and the speedy completion of the project is categorised as risk.

Implementing strategies to handle this, such as a risk register, will help to prevent risk from

becoming an issue that may cause significant delays or even lead to the project failing.

RISK REGISTER TEMPLATE

Risk Identification

Qualitative Rating

Risk Risk

Category

Probability Impact Risk

Score

Risk Response

Risk

Ranking

Risk

Response

Trigger Risk

Owner

Example of a risk register

The risk: what can happen and Injury caused by falling

how it can happen tree branch

Consequences of an event

happening

Likelihood of an event

happening

Adequacy of current controls

Consequence rating

Likelihood rating

Level of risk

Serious injury

Rare, trees are not in

immediate vicinity

Adequate

3

D

M

Moderate risk

Risk priority Accept and monitor

Not possible within

context to treat the trees.

River could be polluted by waste from

festival grounds

Non-toxic waste, cost of clean-up

Likely to be some rubbish blown in by wind

Adequate

1

C

L

Low risk

Manage

Easy and cheap to control. Low cost

placement of bins and staff to pick up

rubbish.

Risk Matrix

A Risk Matrix is a matrix that is used during Risk Assessment to define the various levels of risk

as the product of the harm probability categories and harm severity categories. This is a simple

mechanism to increase visibility of risks and assist management decision making.

Although many standard risk matrices exist in different contexts (US DoD, NASA, ISO), individual

projects and organizations may need to create their own or tailor an existing risk matrix.

26 | Page

Superior University, Lahore

Risk Management

by: Asif Masood Ahmad

The matrix below is adapted from the Risk Management Standard. It can be used to record a

priority rating for each risk identified in the risk audit. Each risk identified must be evaluated in

terms of:

The probability of occurrence (the likelihood).

The severity of the consequence should the risk actually occur.

A risk exposure that has both a high likelihood and a high severity of consequence should be

given the greatest consideration for elimination or control. A risk that is both low in likelihood and

low in severity can easily be retained and self-funded.

If an evaluation of a risk gives rise to a rating of "Extreme", it must be dealt with straight away.

Legend

Extreme Risk

Immediate action required

High Risk

Senior management attention needed

Moderate Risk

Management responsibility must be specified

Low Risk

Manage by routine procedures

Here are few other of the examples of Risk Matrix:

27 | Page

Superior University, Lahore

Risk Management

by: Asif Masood Ahmad

4. Risk Mitigation Planning and Implementation

Definition: Risk mitigation planning is the process of developing options and actions to enhance

opportunities and reduce threats to project objectives. Risk mitigation implementation is the

process of executing risk mitigation actions. Risk mitigation progress monitoring includes tracking

28 | Page

Superior University, Lahore

Risk Management

by: Asif Masood Ahmad

identified risks, identifying new risks, and evaluating risk process effectiveness throughout the

project.

Background

Risk mitigation planning, implementation, and progress monitoring are depicted in Figure 1. As

part of an iterative process, the risk tracking tool is used to record the results of risk prioritization

analysis (step 3) that provides input to both risk mitigation (step 4) and risk impact assessment

(step 2).

Figure 1. Risk Management: Fundamental Steps [3]

The risk mitigation step involves development of mitigation plans designed to manage, eliminate,

or reduce risk to an acceptable level. Once a plan is implemented, it is continually monitored to

assess its efficacy with the intent of revising the course-of-action if needed.

Risk Mitigation Strategies

General guidelines for applying risk mitigation handling options are shown in Figure 2. These

options are based on the assessed combination of the probability of occurrence and severity of

the consequence for an identified risk. These guidelines are appropriate for many, but not all,

projects and programs.

29 | Page

Superior University, Lahore

Risk Management

by: Asif Masood Ahmad

Figure 2. Risk Mitigation Handling Options [3]

Risk mitigation handling options include:

Assume/Accept: Acknowledge the existence of a particular risk, and make a

deliberate decision to accept it without engaging in special efforts to control it. Approval of

project or program leaders is required.

Avoid: Adjust program requirements or constraints to eliminate or reduce the risk.

This adjustment could be accommodated by a change in funding, schedule, or technical

requirements.

Control: Implement actions to minimize the impact or likelihood of the risk.

Transfer: Reassign organizational accountability, responsibility, and authority to

another stakeholder willing to accept the risk.

Watch/Monitor: Monitor the environment for changes that affect the nature and/or

the impact of the risk.

Each of these options requires developing a plan that is implemented and monitored for

effectiveness. More information on handling options is discussed under best practices and lessons

learned below.

From a systems engineering perspective, common methods of risk reduction or mitigation with

identified program risks include the following, listed in order of increasing seriousness of the risk:

1.

2.

3.

4.

5.

6.

Intensified technical and management reviews of the engineering process

Special oversight of designated component engineering

Special analysis and testing of critical design items

Rapid prototyping and test feedback

Consideration of relieving critical design requirements

Initiation of fallback parallel developments

30 | Page

Superior University, Lahore

Risk Management

by: Asif Masood Ahmad

When determining the method for risk mitigation, the MITRE SE can help the customer assess the

performance, schedule, and cost impacts of one mitigation strategy over another. For something

like "parallel" development mitigation, MITRE SEs could help the government determine whether

the cost could more than double, while time might not be extended by much (e.g., double the cost

for parallel effort, but also added cost for additional program office and user engagement). For

conducting rapid prototyping or changing operational requirements, MITRE SEs can use

knowledge in creating prototypes and using prototyping and experimenting (see SE Guide article

on Special Considerations for Conditions of Uncertainty: Prototyping and Experimentation and

the Requirements Engineering topic) for projecting the cost and time to conduct a prototype to

help mitigate particular risks (e.g., requirements). Implementing more engineering reviews and

special oversight and testing may require changes to contractual agreements. MITRE systems

engineers can help the government assess these (schedule and cost) by helping determine the

basis of estimates for additional contractor efforts and providing a reality check for these

estimates. MITRE's CASA [Center for Acquisition and Systems Analysis] and the CCG [Center for

Connected Government] Investment Management practice department have experience and a

knowledge base in many development activities across a wide spectrum of methods and can help

with realistic assessments of mitigation alternatives.

For related information, refer to the other articles in this Risk Management topic area of the SE

Guide.

Best Practices and Lessons Learned

What actions are needed?

When must actions be completed?

Handling Options

o

Assume/Accept. Collaborate with the operational users to create a collective

understanding of risks and their implications. Risks can be characterized as

impacting traditional cost, schedule, and performance parameters. Risks should also

be characterized as impact to mission performance resulting from reduced technical

performance or capability. Develop an understanding of all these impacts. Bringing

users into the mission impact characterization is particularly important to selecting

which "assume/accept" option is ultimately chosen. Users will decide whether

accepting the consequences of a risk is acceptable. Provide the users with the

vulnerabilities affecting a risk, countermeasures that can be performed, and residual

risk that may occur. Help the users understand the costs in terms of time and

money.

o

Avoid. Again, work with users to achieve a collective understanding of the

implications of risks. Provide users with projections of schedule adjustments needed

to reduce risk associated with technology maturity or additional development to

improve performance. Identify capabilities that will be delayed and any impacts

resulting from dependencies on other efforts. This information better enables users

to interpret the operational implications of an "avoid" option.

o

Control. Help control risks by performing analyses of various mitigation

options. For example, one option is to use a commercially available capability

instead of a contractor developed one. In developing options for controlling risk in

31 | Page

Superior University, Lahore

Risk Management

by: Asif Masood Ahmad

your program, seek out potential solutions from similar risk situations of other MITRE

customers, industry, and academia. When considering a solution from another

organization, take special care in assessing any architectural changes needed and

their implications.

o

Transfer. Reassigning accountability, responsibility, or authority for a risk area

to another organization can be a double-edged sword. It may make sense when the

risk involves a narrow specialized area of expertise not normally found in program

offices. But, transferring a risk to another organization can result in dependencies

and loss of control that may have their own complications. Position yourself and your

customer to consider a transfer option by acquiring and maintaining awareness of

organizations within your customer space that focus on specialized needs and their

solutions. Acquire this awareness as early in the program acquisition cycle as

possible, when transfer options are more easily implemented.

o

Watch/Monitor. Once a risk has been identified and a plan put in place to

manage it, there can be a tendency to adopt a "heads down" attitude, particularly if

the execution of the mitigation appears to be operating on "cruise control." Resist

that inclination. Periodically revisit the basic assumptions and premises of the risk.

Scan the environment to see whether the situation has changed in a way that affects

the nature or impact of the risk. The risk may have changed sufficiently so that the

current mitigation is ineffective and needs to be scrapped in favor of a different one.

On the other hand, the risk may have diminished in a way that allows resources

devoted to it to be redirected.

Determining Mitigation Plans

o

Understand the users and their needs. The users/operational decision makers

will be the decision authority for accepting and avoiding risks. Maintain a close

relationship with the user community throughout the system engineering life cycle.

Realize that mission accomplishment is paramount to the user community and

acceptance of residual risk should be firmly rooted in a mission decision.

o

Seek out the experts and use them. Seek out the experts within and outside

MITRE. MITRE's technical centers exist to provide support in their specialty areas.

They understand what's feasible, what's worked and been implemented, what's

easy, and what's hard. They have the knowledge and experience essential to risk

assessment in their area of expertise. Know our internal centers of excellence,

cultivate relationships with them, and know when and how to use them.

o

Recognize risks that recur. Identify and maintain awareness of the risks that

are "always there" interfaces, dependencies, changes in needs, environment and

requirements, information security, and gaps or holes in contractor and program

office skill sets. Help create an acceptance by the government that these risks will

occur and recur and that plans for mitigation are needed up front. Recommend

various mitigation approaches including adoption of an evolution strategy,

prototyping, experimentation, engagement with broader stakeholder community, and

the like.

o

Encourage risk taking. Given all that has been said in this article and its

companions, this may appear to be an odd piece of advice. The point is that there

are consequences of not taking risks, some of which may be negative. Help the

customer and users understand that reality and the potential consequences of being

32 | Page

Superior University, Lahore

Risk Management

by: Asif Masood Ahmad

overly timid and not taking certain risks in your program. An example of a negative

consequence for not taking a risk when delivering a full capability is that an

adversary might realize a gain against our operational users. Risks are not defeats,

but simply bumps in the road that need to be anticipated and dealt with.

o

Recognize opportunities. Help the government understand and see

opportunities that may arise from a risk. When considering alternatives for managing

a particular risk, be sure to assess whether they provide an opportunistic advantage

by improving performance, capacity, flexibility, or desirable attributes in other areas

not directly associated with the risk.

o

Encourage deliberate consideration of mitigation options. This piece of advice

is good anytime, but particularly when supporting a fast-paced, quick reaction

government program that is juggling many competing priorities. Carefully analyze

mitigation options and encourage thorough discussion by the program team. This is

the form of the wisdom "go slow to go fast."

o

Not all risks require mitigation plans. Risk events assessed as medium or

high criticality should go into risk mitigation planning and implementation. On the

other hand, consider whether some low criticality risks might just be tracked and

monitored on a watch list. Husband your risk-related resources.

Mitigation Plan Content

o

Determine the appropriate risk manager. The risk manager is responsible for

identifying and implementing the risk mitigation plan. He or she must have the

knowledge, authority, and resources to implement the plan. Risk mitigation activities

will not be effective without an engaged risk manager. It may be necessary to

engage higher levels in the customer organization to ensure the need for the risk

manager is addressed. This can be difficult and usually involves engaging more

senior levels of the MITRE team as well.

o

Develop a high-level mitigation strategy. This is an overall approach to reduce