Академический Документы

Профессиональный Документы

Культура Документы

Notice: Agency Information Collection Activities Proposals, Submissions, and Approvals

Загружено:

Justia.comОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Notice: Agency Information Collection Activities Proposals, Submissions, and Approvals

Загружено:

Justia.comАвторское право:

Доступные форматы

Federal Register / Vol. 71, No.

191 / Tuesday, October 3, 2006 / Notices 58471

Revenue Code of 19086, the Department copies of the form and instructions maintenance, and purchase of services

of the Treasury is publishing a current should be directed to R. Joseph Durbala to provide information.

list of countries which require or may at Internal Revenue Service, room 6516, Approved: September 25, 2006.

require participation in, or cooperation 1111 Constitution Avenue, NW., Glenn Kirkland,

with, an international boycott (within Washington, DC 20224, or at (202) 622– IRS Reports Clearance Officer.

the meaning of section 999(b)(3) of the 3634, or through the internet at

[FR Doc. E6–16236 Filed 10–2–06; 8:45 am]

Internal Revenue Code of 1986). RJoseph.Durbala@irs.gov.

BILLING CODE 4830–01–P

On the basis of the best information

SUPPLEMENTARY INFORMATION:

currently available to the Department of Title: Claim of Income Tax Return

the Treasury, the following countries Preparer Penalties. DEPARTMENT OF THE TREASURY

require or may require participation in, OMB Number: 1545–0240.

or cooperation with, an international Form Number: 6118. Internal Revenue Service

boycott (within the meaning of section Abstract: Form 6118 is used by tax

999(b)(3) of the Internal Revenue Code return preparers to file for a refund of Proposed Collection; Comment

of 1986). penalties incorrectly charged. The Request for Form 972

Kuwait. information enables the IRS to process

Lebanon. AGENCY: Internal Revenue Service (IRS),

Libya. the claim and have the refund issued to Treasury.

Qatar. the tax return preparer. ACTION: Notice and request for

Saudi Arabia. Current Actions: There are no changes comments.

Syria. being made to the form at this time.

United Arab Emirates. Type of Review: Extension of a SUMMARY: The Department of the

Yemen, Republic of. currently approved collection. Treasury, as part of its continuing effort

Iraq is not included in this list, but its Affected Public: Business or other for- to reduce paperwork and respondent

status with respect to future lists profit organizations and individuals or burden, invites the general public and

remains under review by the households. other Federal agencies to take this

Department of the Treasury. Estimated Number of Respondents: opportunity to comment on proposed

Dated: September 26, 2006. 10,000. and/or continuing information

Estimated Time per Respondent: 56 collections, as required by the

Harry J. Hicks III,

minutes. Paperwork Reduction Act of 1995,

International Tax Counsel (Tax Policy). Public Law 104–13 (44 U.S.C.

Estimated Total Annual Burden

[FR Doc. 06–8437 Filed 10–2–06; 8:45 am] Hours: 9,300. 3506(c)(2)(A)). Currently, the IRS is

BILLING CODE 4870–25–M The following paragraph applies to all soliciting comments concerning Form

of the collections of information covered 972, Consent of Shareholder To Include

by this notice: Specific Amount in Gross Income.

DEPARTMENT OF THE TREASURY An agency may not conduct or DATES: Written comments should be

Internal Revenue Service sponsor, and a person is not required to received on or before December 4, 2006

respond to, a collection of information to be assured of consideration.

Proposed Collection; Comment unless the collection of information ADDRESSES: Direct all written comments

Request for Form 6118 displays a valid OMB control number. to Glenn Kirkland, Internal Revenue

Books or records relating to a collection Service, room 6516, 1111 Constitution

AGENCY: Internal Revenue Service (IRS), of information must be retained as long Avenue, NW., Washington, DC 20224.

Treasury. as their contents may become material FOR FURTHER INFORMATION CONTACT:

ACTION: Notice and request for in the administration of any internal Requests for additional information or

comments. revenue law. Generally, tax returns and copies of the form and instructions

tax return information are confidential, should be directed to R. Joseph Durbala

SUMMARY: The Department of the

as required by 26 U.S.C. 6103. at Internal Revenue Service, room 6516,

Treasury, as part of its continuing effort Request for Comments: Comments

to reduce paperwork and respondent 1111 Constitution Avenue, NW.,

submitted in response to this notice will Washington, DC 20224, or at (202) 622–

burden, invites the general public and be summarized and/or included in the

other Federal agencies to take this 3634, or through the internet at

request for OMB approval. All RJoseph.Durbal@irs.gov.

opportunity to comment on proposed comments will become a matter of

and/or continuing information SUPPLEMENTARY INFORMATION:

public record. Comments are invited on: Title: Consent of Shareholder To

collections, as required by the (a) Whether the collection of

Paperwork Reduction Act of 1995, Include Specific Amount in Gross

information is necessary for the proper Income.

Public Law 104–13 (44 U.S.C. performance of the functions of the

3506(c)(2)(A)). Currently, the IRS is OMB Number: 1545–0043.

agency, including whether the Form Number: 972.

soliciting comments concerning Form information shall have practical utility; Abstract: Form 972 is filed by

6118, Claim of Income Tax Return (b) the accuracy of the agency’s estimate shareholders of corporations who agree

Preparer Penalties. of the burden of the collection of to include a consent dividend in gross

DATES: Written comments should be information; (c) ways to enhance the income as a taxable dividend. The IRS

received on or before December 4, 2006 quality, utility, and clarity of the uses Form 972 as a check to see if an

to be assured of consideration. information to be collected; (d) ways to amended return is filed by the

ADDRESSES: Direct all written comments minimize the burden of the collection of shareholder to include the amount in

rwilkins on PROD1PC63 with NOTICES

to Glenn Kirkland, Internal Revenue information on respondents, including income and to determine if the

Service, room 6516, 1111 Constitution through the use of automated collection corporation claimed the correct amount

Avenue, NW., Washington, DC 20224. techniques or other forms of information as a deduction on its tax return.

FOR FURTHER INFORMATION CONTACT: technology; and (e) estimates of capital Current Actions: There are no changes

Requests for additional information or or start-up costs and costs of operation, being made to the form at this time.

VerDate Aug<31>2005 19:59 Oct 02, 2006 Jkt 211001 PO 00000 Frm 00107 Fmt 4703 Sfmt 4703 E:\FR\FM\03OCN1.SGM 03OCN1

Вам также может понравиться

- TIMTAДокумент6 страницTIMTAKarl Anthony Rigoroso MargateОценок пока нет

- Donor's Tax Post QuizДокумент12 страницDonor's Tax Post QuizMichael Aquino0% (1)

- Module 7 - Materials Management Configuration For Goods Receipts Reach - Ucf.eduДокумент12 страницModule 7 - Materials Management Configuration For Goods Receipts Reach - Ucf.eduAjitabh SinghОценок пока нет

- Starbucks Delivering Customer Service Case Solution PDFДокумент2 страницыStarbucks Delivering Customer Service Case Solution PDFRavia SharmaОценок пока нет

- Astm D7830 - D7830M-2013 - 8750Документ3 страницыAstm D7830 - D7830M-2013 - 8750Wael SeoulОценок пока нет

- J.R.a. Philippines, Inc. vs. Commissioner of Internal RevenueДокумент5 страницJ.R.a. Philippines, Inc. vs. Commissioner of Internal Revenuevince005Оценок пока нет

- Taxbits 20 Vol5 July - August 2013Документ16 страницTaxbits 20 Vol5 July - August 2013John Dx LapidОценок пока нет

- Tax Cases Kabalikat para Sa Maunlad Na Buhay, Inc., - Versus - Commissioner of Internal Revenue and Association of International Shipping Lines v. Sec. of Finance G.R. No. 222239, January 15, 2020Документ7 страницTax Cases Kabalikat para Sa Maunlad Na Buhay, Inc., - Versus - Commissioner of Internal Revenue and Association of International Shipping Lines v. Sec. of Finance G.R. No. 222239, January 15, 2020Rose Ann VeloriaОценок пока нет

- Upreme Ourt: 3aepublic of Tbe !) Bilippines !manilaДокумент12 страницUpreme Ourt: 3aepublic of Tbe !) Bilippines !manilaChristine Aev OlasaОценок пока нет

- CTA Case No 6426 Dated December 18, 2007Документ14 страницCTA Case No 6426 Dated December 18, 2007Jeffrey JosolОценок пока нет

- Preweek Taxation Law 2017 PDFДокумент48 страницPreweek Taxation Law 2017 PDFAnonymous kiom0L1FqsОценок пока нет

- Republic of The Philippines of Tax Quezon: Court Appeals CityДокумент22 страницыRepublic of The Philippines of Tax Quezon: Court Appeals Citylantern san juanОценок пока нет

- Sutherland-CTA 3D CV 08180 D 2014JAN13 REFДокумент22 страницыSutherland-CTA 3D CV 08180 D 2014JAN13 REFEzi AngelesОценок пока нет

- Ent - X: Special Second DivisionДокумент36 страницEnt - X: Special Second DivisionEugene SardonОценок пока нет

- Tax 1Документ25 страницTax 1Princess Janine SyОценок пока нет

- UДокумент53 страницыUvmanalo16Оценок пока нет

- Upreme QI:ourt: L/epublic of Tbe TlbilippineДокумент26 страницUpreme QI:ourt: L/epublic of Tbe Tlbilippinejemybanez81Оценок пока нет

- $ - Upreme ( (Ourt: of Tbe Llbilippines FflanilnДокумент2 страницы$ - Upreme ( (Ourt: of Tbe Llbilippines FflanilnErika Mariz CunananОценок пока нет

- Tax Alert (December 2020)Документ10 страницTax Alert (December 2020)Rheneir MoraОценок пока нет

- Republic of The Philippines Court of Tax Appeals Quezon Second DivisionДокумент32 страницыRepublic of The Philippines Court of Tax Appeals Quezon Second DivisionIan InandanОценок пока нет

- Republic Act No. 10963Документ46 страницRepublic Act No. 10963Wilson MoranoОценок пока нет

- 8 Watsons v. CIRДокумент20 страниц8 Watsons v. CIRFilouie VisayaОценок пока нет

- Digest of Sele T Supreme Court On Ta Ation,: CasesДокумент31 страницаDigest of Sele T Supreme Court On Ta Ation,: Casesric tanОценок пока нет

- Paseo Realty - Development Corporation v. Court of Appeals, GR No. 119286, 2004Документ17 страницPaseo Realty - Development Corporation v. Court of Appeals, GR No. 119286, 2004citizenОценок пока нет

- Cta 2D CV 06681 D 2006aug31 Ref PDFДокумент17 страницCta 2D CV 06681 D 2006aug31 Ref PDFKevin Ken Sison GancheroОценок пока нет

- Paseo V CIRДокумент16 страницPaseo V CIRzacОценок пока нет

- Taxrem - MemaidДокумент116 страницTaxrem - MemaidKyla ReyesОценок пока нет

- 2023 Omnibus Notes - Part 2 - Taxation Law LawДокумент18 страниц2023 Omnibus Notes - Part 2 - Taxation Law LawAPRIL BETONIOОценок пока нет

- G.R. No. 187485: en HancДокумент26 страницG.R. No. 187485: en HancQueen Ann NavalloОценок пока нет

- Search Result: Case TitleДокумент28 страницSearch Result: Case Titleic corОценок пока нет

- Cta Eb CV 02495 D 2023apr18 RefДокумент42 страницыCta Eb CV 02495 D 2023apr18 RefFirenze PHОценок пока нет

- Digest Consolidated Cases G.R. Nos. 187485, 196113 and 197156Документ6 страницDigest Consolidated Cases G.R. Nos. 187485, 196113 and 197156Rebecca S. Ofalsa100% (2)

- Republic of The Philippines of Tax Quezon: Court Appeals CityДокумент15 страницRepublic of The Philippines of Tax Quezon: Court Appeals CityElvin LouieОценок пока нет

- Statutory Construction CasesДокумент83 страницыStatutory Construction CasesSherlock YookieОценок пока нет

- Republic of The Philippines Court of Tax Appea Quezon CityДокумент10 страницRepublic of The Philippines Court of Tax Appea Quezon CitySonnyОценок пока нет

- 116162-2007-Commissioner - of - Internal - Revenue - v. - Placer20181019-5466-W8a0su PDFДокумент12 страниц116162-2007-Commissioner - of - Internal - Revenue - v. - Placer20181019-5466-W8a0su PDFVener Angelo MargalloОценок пока нет

- Republic of The Philippines Court of Tax Appeals Quezon CityДокумент19 страницRepublic of The Philippines Court of Tax Appeals Quezon CityMarcy BaklushОценок пока нет

- $ Upreme Ql:ourt: 3aepublic Tbe BilippineДокумент16 страниц$ Upreme Ql:ourt: 3aepublic Tbe BilippineCesar ValeraОценок пока нет

- Tax Review Case Digests PartialДокумент24 страницыTax Review Case Digests PartialAnne sherly OdevilasОценок пока нет

- Other Matters PDFДокумент29 страницOther Matters PDFEunice Jean AquinoОценок пока нет

- Siciiid Divis/Iii: Ciiit If Tu AppealsДокумент27 страницSiciiid Divis/Iii: Ciiit If Tu AppealsLeamieRetalesОценок пока нет

- Special Second Division: Deci ONДокумент33 страницыSpecial Second Division: Deci ONEmmah MadkiОценок пока нет

- Tax Cases - VatДокумент55 страницTax Cases - VatKim RoxasОценок пока нет

- IFC Capitalization (Equity) Fund V CIRДокумент8 страницIFC Capitalization (Equity) Fund V CIRLino MomonganОценок пока нет

- RMO No.48-2018Документ2 страницыRMO No.48-2018PAMELA KALAWОценок пока нет

- Decision: Republic of The Philippines Court of Tax Appeals Quezon CityДокумент10 страницDecision: Republic of The Philippines Court of Tax Appeals Quezon CityJenMarlon Corpuz AquinoОценок пока нет

- CIR V CTAДокумент2 страницыCIR V CTAralph_atmosferaОценок пока нет

- CTA EB 00853 - August 22, 2013Документ26 страницCTA EB 00853 - August 22, 2013LeoAngeloLarciaОценок пока нет

- Cta 3D CV 09015 D 2017nov17 RefДокумент23 страницыCta 3D CV 09015 D 2017nov17 Refmimaymi120987Оценок пока нет

- Republic of The Philippines Quezon City: Court of Tax AppealsДокумент20 страницRepublic of The Philippines Quezon City: Court of Tax AppealsIan InandanОценок пока нет

- Western Mindanao Power Corporation vs. Commissioner of Internal RevenueДокумент7 страницWestern Mindanao Power Corporation vs. Commissioner of Internal RevenueJonjon BeeОценок пока нет

- Court of Tax Appeals: DecisionДокумент40 страницCourt of Tax Appeals: DecisionNoznuagОценок пока нет

- Commissioner of Internal Revenue v. GS GrainsДокумент12 страницCommissioner of Internal Revenue v. GS GrainsimianmoralesОценок пока нет

- 9 Coral Bay VS CIRДокумент5 страниц9 Coral Bay VS CIRHenry LОценок пока нет

- Coral Vs CirДокумент13 страницCoral Vs CirJAMОценок пока нет

- Republic Act No. 10963: Summon, Examine, and Take Testimony of Persons. - in Ascertaining TheДокумент55 страницRepublic Act No. 10963: Summon, Examine, and Take Testimony of Persons. - in Ascertaining TheAra LimОценок пока нет

- Be It Enacted by The Senate and House of Representatives of The Philippine Congress AssembledДокумент3 страницыBe It Enacted by The Senate and House of Representatives of The Philippine Congress AssembledCyruss Xavier Maronilla NepomucenoОценок пока нет

- CIR Vs AIGДокумент41 страницаCIR Vs AIGmayaОценок пока нет

- Gulf Air Philippines Vs CIRДокумент16 страницGulf Air Philippines Vs CIRJeanne CalalinОценок пока нет

- 2 - CBNC vs. CIRДокумент13 страниц2 - CBNC vs. CIRJeanne CalalinОценок пока нет

- Fort Bonifacio Development Vs CIR GR No 158885Документ3 страницыFort Bonifacio Development Vs CIR GR No 158885Alfonso Dimla100% (1)

- 380 Supreme Court Reports Annotated: Equivalent To Two Per Centum of Their Monthly Gross ReceiptsДокумент4 страницы380 Supreme Court Reports Annotated: Equivalent To Two Per Centum of Their Monthly Gross ReceiptsKenmar NoganОценок пока нет

- CIR v. Team Sual CorporationДокумент21 страницаCIR v. Team Sual CorporationAronJamesОценок пока нет

- Divorced Husband's $48,000 Lawsuit Over Wedding Pics, VideoДокумент12 страницDivorced Husband's $48,000 Lawsuit Over Wedding Pics, VideoJustia.comОценок пока нет

- Stipulation: SAP Subsidiary TomorrowNow Pleading Guilty To 12 Criminal Counts Re: Theft of Oracle SoftwareДокумент7 страницStipulation: SAP Subsidiary TomorrowNow Pleading Guilty To 12 Criminal Counts Re: Theft of Oracle SoftwareJustia.comОценок пока нет

- U.S. v. Rajat K. GuptaДокумент22 страницыU.S. v. Rajat K. GuptaDealBook100% (1)

- Arbabsiar ComplaintДокумент21 страницаArbabsiar ComplaintUSA TODAYОценок пока нет

- Signed Order On State's Motion For Investigative CostsДокумент8 страницSigned Order On State's Motion For Investigative CostsKevin ConnollyОценок пока нет

- U.S. v. TomorrowNow, Inc. - Criminal Copyright Charges Against SAP Subsidiary Over Oracle Software TheftДокумент5 страницU.S. v. TomorrowNow, Inc. - Criminal Copyright Charges Against SAP Subsidiary Over Oracle Software TheftJustia.comОценок пока нет

- USPTO Rejection of Casey Anthony Trademark ApplicationДокумент29 страницUSPTO Rejection of Casey Anthony Trademark ApplicationJustia.comОценок пока нет

- Amended Poker Civil ComplaintДокумент103 страницыAmended Poker Civil ComplaintpokernewsОценок пока нет

- Rabbi Gavriel Bidany's Sexual Assault and Groping ChargesДокумент4 страницыRabbi Gavriel Bidany's Sexual Assault and Groping ChargesJustia.comОценок пока нет

- Guilty Verdict: Rabbi Convicted of Sexual AssaultДокумент1 страницаGuilty Verdict: Rabbi Convicted of Sexual AssaultJustia.comОценок пока нет

- Clergy Abuse Lawsuit Claims Philadelphia Archdiocese Knew About, Covered Up Sex CrimesДокумент22 страницыClergy Abuse Lawsuit Claims Philadelphia Archdiocese Knew About, Covered Up Sex CrimesJustia.comОценок пока нет

- Emmanuel Ekhator - Nigerian Law Firm Scam IndictmentДокумент22 страницыEmmanuel Ekhator - Nigerian Law Firm Scam IndictmentJustia.comОценок пока нет

- Deutsche Bank and MortgageIT Unit Sued For Mortgage FraudДокумент48 страницDeutsche Bank and MortgageIT Unit Sued For Mortgage FraudJustia.com100% (1)

- Rabbi Gavriel Bidany's Federal Criminal Misdemeanor Sexual Assault ChargesДокумент3 страницыRabbi Gavriel Bidany's Federal Criminal Misdemeanor Sexual Assault ChargesJustia.comОценок пока нет

- FBI Records: Col. Sanders (KFC - Kentucky Fried Chicken Founder) 1974 Death ThreatДокумент15 страницFBI Records: Col. Sanders (KFC - Kentucky Fried Chicken Founder) 1974 Death ThreatJustia.comОценок пока нет

- Supreme Court Order Staying TX Death Row Inmate Cleve Foster's ExecutionДокумент1 страницаSupreme Court Order Staying TX Death Row Inmate Cleve Foster's ExecutionJustia.comОценок пока нет

- Van Hollen Complaint For FilingДокумент14 страницVan Hollen Complaint For FilingHouseBudgetDemsОценок пока нет

- Brandon Marshall Stabbing by Wife: Domestic Violence Arrest ReportДокумент1 страницаBrandon Marshall Stabbing by Wife: Domestic Violence Arrest ReportJustia.comОценок пока нет

- Bank Robbery Suspects Allegedly Bragged On FacebookДокумент16 страницBank Robbery Suspects Allegedly Bragged On FacebookJustia.comОценок пока нет

- Online Poker Indictment - Largest U.S. Internet Poker Cite Operators ChargedДокумент52 страницыOnline Poker Indictment - Largest U.S. Internet Poker Cite Operators ChargedJustia.comОценок пока нет

- Sweden V Assange JudgmentДокумент28 страницSweden V Assange Judgmentpadraig2389Оценок пока нет

- Wisconsin Union Busting LawsuitДокумент48 страницWisconsin Union Busting LawsuitJustia.comОценок пока нет

- Court's TRO Preventing Wisconsin From Enforcing Union Busting LawДокумент1 страницаCourt's TRO Preventing Wisconsin From Enforcing Union Busting LawJustia.comОценок пока нет

- Federal Charges Against Ariz. Shooting Suspect Jared Lee LoughnerДокумент6 страницFederal Charges Against Ariz. Shooting Suspect Jared Lee LoughnerWBURОценок пока нет

- 60 Gadgets in 60 Seconds SLA 2008 June16Документ69 страниц60 Gadgets in 60 Seconds SLA 2008 June16Justia.com100% (10)

- Defamation Lawsuit Against Jerry Seinfeld Dismissed by N.Y. Judge - Court OpinionДокумент25 страницDefamation Lawsuit Against Jerry Seinfeld Dismissed by N.Y. Judge - Court OpinionJustia.comОценок пока нет

- OJ Simpson - Nevada Supreme Court Affirms His ConvictionДокумент24 страницыOJ Simpson - Nevada Supreme Court Affirms His ConvictionJustia.comОценок пока нет

- NY Judge: Tricycle Riding 4 Year-Old Can Be Sued For Allegedly Hitting, Killing 87 Year-OldДокумент6 страницNY Judge: Tricycle Riding 4 Year-Old Can Be Sued For Allegedly Hitting, Killing 87 Year-OldJustia.comОценок пока нет

- Lee v. Holinka Et Al - Document No. 4Документ2 страницыLee v. Holinka Et Al - Document No. 4Justia.com100% (4)

- City of Seattle v. Professional Basketball Club LLC - Document No. 36Документ2 страницыCity of Seattle v. Professional Basketball Club LLC - Document No. 36Justia.comОценок пока нет

- Surface Treatments & Coatings Ref: S. KalpakjianДокумент22 страницыSurface Treatments & Coatings Ref: S. KalpakjianjojoОценок пока нет

- Fresher Jobs July 31Документ18 страницFresher Jobs July 31Harshad SonarОценок пока нет

- Moral IssuesДокумент34 страницыMoral IssuesDaryll Jade PoscabloОценок пока нет

- Research and Practice in HRM - Sept 8Документ9 страницResearch and Practice in HRM - Sept 8drankitamayekarОценок пока нет

- Delta CaseДокумент8 страницDelta CaseSeemaОценок пока нет

- Module 2 - Part 2Документ85 страницModule 2 - Part 2Tanvi DeoreОценок пока нет

- Lect7 Grinding Advanced ManufacturingДокумент33 страницыLect7 Grinding Advanced Manufacturingsirac topcuОценок пока нет

- ManualДокумент36 страницManual2009tamerОценок пока нет

- Maneesh Misra CV - 1Документ3 страницыManeesh Misra CV - 1Rohit KarhadeОценок пока нет

- Gen. Coll.-2014fДокумент8 152 страницыGen. Coll.-2014fVeron Golocan Sowagen JovenОценок пока нет

- COO Direct Response Marketing in Miami FL Resume Mark TaylorДокумент2 страницыCOO Direct Response Marketing in Miami FL Resume Mark TaylorMarkTaylor1Оценок пока нет

- 010 Informed Search 2 - A StarДокумент20 страниц010 Informed Search 2 - A StarRashdeep SinghОценок пока нет

- BBBB - View ReservationДокумент2 страницыBBBB - View ReservationBashir Ahmad BashirОценок пока нет

- Unit 13 Developing, Using, and Organizing Resources in A Specialist AreaДокумент21 страницаUnit 13 Developing, Using, and Organizing Resources in A Specialist AreaKan SonОценок пока нет

- Books Confirmation - Sem VII - 2020-2021 PDFДокумент17 страницBooks Confirmation - Sem VII - 2020-2021 PDFRaj Kothari MОценок пока нет

- Polaris Ranger 500 ManualДокумент105 страницPolaris Ranger 500 ManualDennis aОценок пока нет

- Talent Neuron NewsletterДокумент2 страницыTalent Neuron NewsletterTalent NeuronОценок пока нет

- 1a. Create Your Yosemite Zone USB DriveДокумент9 страниц1a. Create Your Yosemite Zone USB DriveSimon MeierОценок пока нет

- Color Coding - 2018Документ28 страницColor Coding - 2018Aris MunandarОценок пока нет

- Appendix 24 - QUARTERLY REPORT OF REVENUE AND OTHER RECEIPTSДокумент1 страницаAppendix 24 - QUARTERLY REPORT OF REVENUE AND OTHER RECEIPTSPau PerezОценок пока нет

- Reinforcement Project Examples: Monopole - Self Supporter - Guyed TowerДокумент76 страницReinforcement Project Examples: Monopole - Self Supporter - Guyed TowerBoris KovačevićОценок пока нет

- ITEC 11 Lesson 1.1Документ35 страницITEC 11 Lesson 1.1ivyquintelaОценок пока нет

- Numerical Simulation of Turbulent Flow Over Surface Mounted Obstacles With Sharp Edges and CornersДокумент19 страницNumerical Simulation of Turbulent Flow Over Surface Mounted Obstacles With Sharp Edges and CornersHelen ChoiОценок пока нет

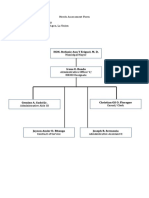

- Needs Assessment Form Company Name: HRMO Address: Sta. Barbara Agoo, La UnionДокумент2 страницыNeeds Assessment Form Company Name: HRMO Address: Sta. Barbara Agoo, La UnionAlvin LaroyaОценок пока нет

- Azhar Marketing Final PPRДокумент9 страницAzhar Marketing Final PPRafnain rafiОценок пока нет

- Q1 LAS 4 FABM2 12 Week 2 3Документ7 страницQ1 LAS 4 FABM2 12 Week 2 3Flare ColterizoОценок пока нет