Академический Документы

Профессиональный Документы

Культура Документы

Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)

Загружено:

Shyam SunderИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)

Загружено:

Shyam SunderАвторское право:

Доступные форматы

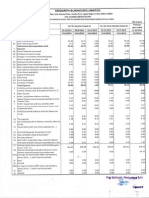

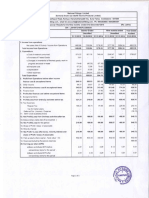

WARNER MULTIMEDIA LIMITED

Regd. Office : Office No. 75C, Park Street, Basement, Kolkata 700016

CIN-L92100WB1983PLC036338, Email: warner.multimedia@gmail.com,website:www.warnermultimedia.in

Statement of Unaudited Results for the Quarter & Nine Months ended 31st December 2014

Rs. in Lacs

Particulars

Sr.

No.

1 Income from Operations

a) Net Sales/Income from Operations

b) Other Operating Income

Total Income from Operations (Net)

2 Expenses

(a) Cost of Material Consumed

(b) Purchases of Stock-in-trade

3 Months

ended

31.12.2014

4

5

6

7

8

9

Corresponding 3

Months ended

31.12.2013

Year to date

figures as on

31.03.2014

Un-Audited

Audited

Un-Audited

3.10

3.10

-

(c) Changes in Inventories of Finished Goods, Work-inProgress and Stock-in-Trade

Preceeding 3

Months ended

30.09.2014

Corresponding

Corresponding 9

9 Months

Months ended

ended

31.12.2014

31.12.2013

2.20

2.20

7.05

7.05

21.66

2.10

23.76

21.67

21.67

19.56

55.31

0.45

1.13

1.58

0.55

1.73

2.28

0.41

0.03

0.44

1.35

4.56

5.91

1.18

0.57

10.25

31.56

(35.74)

1.68

0.57

13.07

34.89

1.52

-

(0.08)

-

(0.44)

-

1.14

-

(7.80)

-

(13.22)

0.70

Profit/(Loss) from ordinary activities before finance costs

and exceptional items (3+4)

Finance Costs

1.52

-

(0.08)

-

(0.44)

-

1.14

-

(7.80)

-

(12.52)

-

Profit/(Loss) from ordinary activities after finance cost but

before exceptional items (3+4)

Exceptional Items

1.52

-

(0.08)

-

(0.44)

-

1.14

-

(7.80)

-

(12.52)

-

1.52

-

(0.08)

-

(0.44)

-

1.14

-

(7.80)

-

(12.52)

-

1.52

1.52

-

(0.08)

(0.08)

-

(0.44)

(0.44)

-

1.14

1.14

-

(7.80)

(7.80)

-

(12.52)

(12.52)

-

1.52

1,855.54

(0.08)

1,855.54

(0.44)

1,855.54

1.14

1,855.54

(7.80)

1,855.54

(12.52)

1,855.54

(d) Employees Benefit Expenses

(e) Depreciation & Amortization Expenses

(f) Other Expenses

Total Expenses

Profit/(Loss) from Operations before other Income, finance

cost and exceptional Expenses (1-2)

Other Income/(Loss)

Profit(+)/Loss(-) from ordinary activites before Tax (7-8)

10 Tax Expense

Net Profit (+)/Loss(-) from ordinary activites after tax (911 10)

Lac)

12 Extra Ordinary Items (Net of Tax Expense of Rs.

13 Net Profit (+)/Loss(-) for the period (11-12)

14 Share of Profit/(Loss) of Associates*

15 Minority Interest*

Net Profit (+)/Loss(-) after tax, minority interest and Share

16 of Profit / (Loss) of Associates (13-14-15)

17 Paid-up Equity Share Capital (Face Value of Rs. 10/- each)

Reserves excluding revaluation Reserves as per last Balance

18 Sheet

0.01

0.01

(0.00)

(0.00)

(0.00)

(0.00)

0.01

0.01

(0.04)

(0.04)

(0.07)

(0.07)

0.01

0.01

(0.00)

(0.00)

(0.00)

(0.00)

0.01

0.01

(0.04)

(0.04)

(0.07)

(0.07)

12,413,295

12,413,295

12,413,295

12,413,295

12,413,295

12,413,295

66.90

66.90

66.90

66.90

66.90

66.90

Earning Per Share (before extra-ordinary items) of Rs. 10/19 each (not annualized)

(i) a) Basic

b) Diluted

Earning Per Share (after extra-ordinary items) of Rs. 10/19 each (not annualized)

(ii) a) Basic

b) Diluted

A PARTICULARS OF SHAREHOLDING

Public Shareholding

- Number of Shares

- Percentage of Share Holding

18 Promoter and Promoter Group Shareholding

a) Pledged/Encumbered

- Number of Shares

- Percentage of Shares (as a % of the total Shareholding

of Promoter and Promoter Group

- Percentage of Shares (as a % of the total Share Capital

of the Company

b) None-Encumbered

- Number of Shares

- Percentage of Shares (as a % of the total Shareholding

of Promoter and Promoter Group

- Percentage of Shares (as a % of the total Share Capital

of the Company

B INVESTOR COMPLAINTS

Pending at the beginning of the Quarter

Received during the Quarter

Notes :

(1,962.47)

6,142,105

100.00

6,142,105

100.00

6,142,105

100.00

6,142,105

100.00

6,142,105

100.00

6,142,105

100.00

33.10

33.10

33.10

33.10

33.10

33.10

Nil

Nil

Disposed during the Quarter

Remaining Unresolved at the end of Quarter

Nil

Nil

1. Segmental Report for the Quarter as per AS-17 of ICAI is not applicable for the Quarter.

2. Above resultes were reviewed by Audit Committee taken on record in Board Meeting held on 13th February, 2015.

3. The Auditors of the Company have carried out "Limited Review" of the above Financial Results.

Place : Kolkata

Date : 13th February, 2015

For Warner Multimedia Limited

S/dJagdish Prasad Purohit

Managing Director

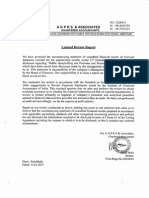

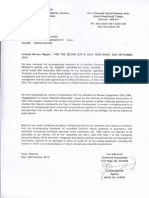

B. S. Kedia & Co.

Chartered Accountants

Bikaner Building, 1St Floor, Room No.8

8/1, Lal Bazar Street, kolkata-zoo 001

Tel: 033-2248 3696, Mobile: 98310 85849

Email: bsk_1@rediffmail.com

Limited Review Report by Auditors

To

The Board of Directors

M/ s, Warner Multimedia

75C, Park Street

Kolkata-700 016

Limited

We have reviewed the accompanying statement of Un-Audited Financial Results of M/s.

Warner Multimedia

Limited for the Quarter ended 31"' December 2014 except for the

disclosures regarding 'Public Shareholding' and 'Promoter and Promoter Group Shareholding'

which have been traced from disclosures made by the management and have not been audited by

us. This statement is the responsibility of the Company's Management and has been approved by

the Board of Directors/ Committee of Board of Directors. Our responsibility is to issue a report

on these financial statements based on our review.

We conducted our review in accordance with the Standard on Review Engagement (SRE) 2400,

engagements to Review Financial Statements issued by the Institute of Chartered Accountants of

India. This standard requires that we plan and perform the review to obtain moderate assurance as

to whether the financial statements are free of material misstatement. A review is limited primarily

to inquiries of company personnel and an analytical procedure applied to financial data and thus

provides less assurance than an audit. We have not performed an audit and accordingly, we do not

express an audit opinion.

Based on our review conducted as above, nothing has come to our attention that causes us to

believe that the accompanying statement of unaudited financial results prepared in accordance

with applicable accounting standards 1 and other recognized accounting practices and policies has

not disclosed the information required to be disclosed in terms of Clause 41 of the Listing

Agreement including the manner in which it is to be disclosed, or that it contains any material

misstatement.

Place: Kolkata

Date : February 13, 2014

Вам также может понравиться

- Audit Risk Alert: General Accounting and Auditing Developments 2018/19От EverandAudit Risk Alert: General Accounting and Auditing Developments 2018/19Оценок пока нет

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Документ2 страницыFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Документ3 страницыFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Документ4 страницыFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Документ3 страницыFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Документ4 страницыFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Документ2 страницыFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Документ2 страницыFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Документ3 страницыFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Документ3 страницыFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ5 страницStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Документ3 страницыFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Документ3 страницыFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ4 страницыFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Документ2 страницыFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderОценок пока нет

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Документ3 страницыFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results & Auditors Report For March 31, 2015 (Standalone) (Audited) (Result)Документ3 страницыFinancial Results & Auditors Report For March 31, 2015 (Standalone) (Audited) (Result)Shyam SunderОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ5 страницFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Документ3 страницыFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Документ4 страницыFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Документ4 страницыFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review For June 30, 2015 (Standalone) (Company Update)Документ2 страницыFinancial Results & Limited Review For June 30, 2015 (Standalone) (Company Update)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Документ4 страницыFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Документ2 страницыFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Документ2 страницыFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Документ3 страницыFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review For Aug 31, 2014 (Standalone) (Result)Документ3 страницыFinancial Results & Limited Review For Aug 31, 2014 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review For Dec 31, 2012 (Result)Документ3 страницыFinancial Results & Limited Review For Dec 31, 2012 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Документ3 страницыFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Документ3 страницыFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Документ4 страницыFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Документ4 страницыFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review For December 31, 2014 (Standalone) (Result)Документ4 страницыFinancial Results & Limited Review For December 31, 2014 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Документ3 страницыFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ4 страницыFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Документ2 страницыFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Документ3 страницыFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Документ4 страницыFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review For Dec 31, 2012 (Result)Документ3 страницыFinancial Results & Limited Review For Dec 31, 2012 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Документ3 страницыFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results For Dec 31, 2015 (Standalone) (Result)Документ4 страницыFinancial Results For Dec 31, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Документ2 страницыFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Документ4 страницыFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review For Dec 31, 2013 (Result)Документ3 страницыFinancial Results & Limited Review For Dec 31, 2013 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review For June 30, 2015 (Standalone) (Result)Документ4 страницыFinancial Results & Limited Review For June 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Документ6 страницFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Документ3 страницыFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Документ2 страницыFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderОценок пока нет

- Jaihind Synthetics Limited: S BusДокумент4 страницыJaihind Synthetics Limited: S BusShyam SunderОценок пока нет

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Документ3 страницыFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Документ3 страницыFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderОценок пока нет

- Announces Q3 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Документ4 страницыAnnounces Q3 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Документ4 страницыFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Документ4 страницыFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Документ3 страницыFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Документ2 страницыFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderОценок пока нет

- An Iso 9001:2008 and Iso 22000 Accredited Company Registered Office: D-19-20, Panki Industrial Area, Kanpur - 208 022Документ1 страницаAn Iso 9001:2008 and Iso 22000 Accredited Company Registered Office: D-19-20, Panki Industrial Area, Kanpur - 208 022Muralis MuralisОценок пока нет

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Документ4 страницыFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- PDF Processed With Cutepdf Evaluation EditionДокумент3 страницыPDF Processed With Cutepdf Evaluation EditionShyam SunderОценок пока нет

- Standalone Financial Results For September 30, 2016 (Result)Документ3 страницыStandalone Financial Results For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results For March 31, 2016 (Result)Документ11 страницStandalone Financial Results For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ3 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Transcript of The Investors / Analysts Con Call (Company Update)Документ15 страницTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderОценок пока нет

- Investor Presentation For December 31, 2016 (Company Update)Документ27 страницInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderОценок пока нет

- Work in ProgressДокумент7 страницWork in ProgressMehakpreet kaurОценок пока нет

- 14 Financial Statement Analysis: Chapter SummaryДокумент12 страниц14 Financial Statement Analysis: Chapter SummaryGeoffrey Rainier CartagenaОценок пока нет

- Case Study 2 Excel Jackson AutomobileДокумент15 страницCase Study 2 Excel Jackson AutomobileSayantani NandyОценок пока нет

- Prakas On Accreditation of Professional Accounting Firm Providing... EnglishДокумент12 страницPrakas On Accreditation of Professional Accounting Firm Providing... EnglishChou ChantraОценок пока нет

- Market Pulse May 2023 0Документ149 страницMarket Pulse May 2023 0devilОценок пока нет

- BFC5935 - Tutorial 10 SolutionsДокумент8 страницBFC5935 - Tutorial 10 SolutionsAlex YisnОценок пока нет

- CDO Powerpoint SubPrime PrimerДокумент45 страницCDO Powerpoint SubPrime PrimerFred Fry100% (39)

- Presentation of Dabur and Fem CareДокумент19 страницPresentation of Dabur and Fem Caresarikagr8Оценок пока нет

- List of All CompaniesДокумент86 страницList of All CompaniesRaj Sa100% (2)

- Naseer SwiftДокумент67 страницNaseer SwiftNaseeruddin MohdОценок пока нет

- Google Advanced Search Preference S: Search: The Web Pages From IndiaДокумент4 страницыGoogle Advanced Search Preference S: Search: The Web Pages From IndiaamitrathiОценок пока нет

- II Regulations in India:: Foreign Institutional Investors (FII's) SebiДокумент17 страницII Regulations in India:: Foreign Institutional Investors (FII's) SebiKumar DayanidhiОценок пока нет

- 1st Answer Keys PPT - Ia 2Документ44 страницы1st Answer Keys PPT - Ia 2mia uyОценок пока нет

- 30th AGM Annual Report 2017 18Документ204 страницы30th AGM Annual Report 2017 18MohankumarОценок пока нет

- A2Z Annual Report 2018Документ216 страницA2Z Annual Report 2018Siddharth ShekharОценок пока нет

- Ethics in Banking PDFДокумент2 страницыEthics in Banking PDFSarah0% (1)

- Advanced Bond ConceptsДокумент32 страницыAdvanced Bond ConceptsJohn SmithОценок пока нет

- Parte 2 Segundo ParcialДокумент23 страницыParte 2 Segundo ParcialJose Luis Rasilla GonzalezОценок пока нет

- CHAPTER 15 - TranspoДокумент6 страницCHAPTER 15 - TranspoRenz AmonОценок пока нет

- Questionnaire Regarding Awareness and Perception of Equity MarketДокумент2 страницыQuestionnaire Regarding Awareness and Perception of Equity MarketAwadhoot Prakash Singh100% (6)

- Facebook IPOДокумент4 страницыFacebook IPOvaibhavОценок пока нет

- BV DDRДокумент276 страницBV DDRManish RawatОценок пока нет

- Pengukuran Kinerja Keuangan Berdasarkan Roi (Return On Investment) Dengan Pendekatan Sistem Dupont Pada Pt. Tropica Cocoprima PDFДокумент10 страницPengukuran Kinerja Keuangan Berdasarkan Roi (Return On Investment) Dengan Pendekatan Sistem Dupont Pada Pt. Tropica Cocoprima PDFAgung SetiawanОценок пока нет

- Chapter 11Документ48 страницChapter 11Rasel SarkerОценок пока нет

- Investments Analysis and Management 12th Edition Jones Test BankДокумент18 страницInvestments Analysis and Management 12th Edition Jones Test Bankchowterleten2409100% (23)

- Regulatory Framework of Mutual Funds in IndiaДокумент14 страницRegulatory Framework of Mutual Funds in Indiaayushi guptaОценок пока нет

- "Nishat Chunian LTD.": Final Assignment On Financial Analysis ofДокумент21 страница"Nishat Chunian LTD.": Final Assignment On Financial Analysis ofAsad MuhammadОценок пока нет

- Mandatory IFRS Adoption and The Effects On SMES in Nigeria: A Study of Selected SMEsДокумент5 страницMandatory IFRS Adoption and The Effects On SMES in Nigeria: A Study of Selected SMEsInternational Journal of Business Marketing and ManagementОценок пока нет

- TDTLДокумент4 страницыTDTLGeorgeОценок пока нет