Академический Документы

Профессиональный Документы

Культура Документы

Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)

Загружено:

Shyam SunderОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)

Загружено:

Shyam SunderАвторское право:

Доступные форматы

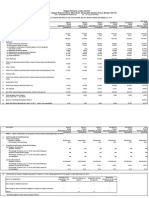

INFOMEDIA PRESS LIMITED

Regd. Office: 503, 504 & 507, 5th Floor, Mercantile House, 15, Kasturba Gandhi Marg, New Delbi-110001,

T +911149812600, F +91114150 6115website: http://www.infomediapress.in CIN no. L22219DL1955PLC211606

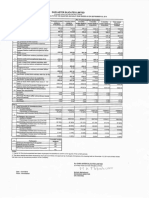

Statement of Unaudited Financial result for quarter and half year ended 30 September 2014

Rs, in Lakhs excent ner share data

PART I

Quarter ended

(Unaudited)

Particulars

30 Sept '14

1. Incorr'n from operations

(a) Net s aes/mcome from operations

(b) Orhes roperating income

Total incieme from operations (net)

2. Expen.ses

a) Empl<yee benefits expense

b) Freight and distribution expenses

c) Depreciation and amortisation expenses

d) Legaf md professional expenses

e) Poweerand fuel expenses

) Secucie charges

g) Rates md taxes

h) Share ,xpenses

j) POSlag< and courier expenses

i) Other <"penses

Total exp<nses

3. Loss fr<m operations before other income, finance costs, prior period

expenses and exceptional item

4. Other income

5. Profit /(1oss) before finance costs, prior period expenses and

exceptional item

6. Finance costs

7. Loss after finance costs but before prior period expenses and

exceptional item

8. Prior period expenses

- Other e<penses

9. Loss after finance costs and prior period expenses but before

exceptional item

10. Exceptional item

11. Loss after exceptional item

12. Paid-up equity share capital, Equity Share of Rs. 10 each

13. Reserves excluding revaluation reserves

30 June '14

30 Sept '13

Half year ended

(Unaudited)

30 Sept '14

I 30 Sept '13

I

I

Year ended

(Audited)

31 Mar '14

1.98

1.98

3.71

3.71

78.62

0.32

12.57

34.51

11.85

13.81

8.43

5.52

0.05

77.77

243.45

81.43

0.32

21.60

76.31

19.97

24.25

23.18

8.05

0.05

87.91

343.07

0.91

0.90

26.65

0.45

6.65

3.34

4.49

1.75

3.13

4.27

5.71

30.70

0.44

4.80

2.91

4.53

2.65

3.06

6.28

9.70

6.50

5.41

0.14

4.39

23.68

14.36

69.04

0.89

11.45

6.25

9.02

4.40

6.19

4.27

10.10

54.38

(30.70)

7.67

(23.68)

41.24

(69.04)

45.65

(54.38)

48.91

(241.47)

48.40

(339.36)

149.66

(23.03)

76.67

17.56

75.67

(23.39)

80.48

(5.47)

152.34

(193.07)

148.19

(189.70)

301.12

(99.70)

(58.11)

(103.87)

(157.81)

(341.26)

(490.82)

11.91

11.91

(99.70)

(58.11)

1.81

11.91

(157.81)

(353.17)

685.48

(1,038.65)

5,019.42

(99.70)

5,019.42

(58.11)

5,019.42

(115.78)

(85.27)

(30.51)

5,019.42

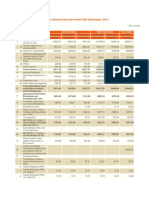

14. Earnings per share EPS (Face Value - Rs. 10)

Basic and diluted (Rs.) (Not annualised)

10.20)

(0.12)

(0.06)

10.31)

12.07)

(1.98\

PART II

A PARTICULARS OF SHAREHOLDING

1. Publie shareholding

- Number of shares

- Percentage of shareholding

2,62,81,111

52.36%

2,62,81,111

52.36%

2,62,81,111

52.36%

2,62,81,111

52.36%

2,62,81,111

52.36%

2,62,81,111

52.36%

2. Promoters and promoter group shareholding

Non-encumbered

- Number of shares

2,39,13,061

2,39,13,061

2,39,13,061

2,39,13,061

2,39,13,061

2,39,13,061

- Percentage of shares (as a % of the total shareholding of promoter and

promoter group)

100

100

100

100

100

100

- Percentage of shares (as a % of the total share capital of the Company)

47.64%

47.64%

47.64%

Place: Noida

Date: 11 Octobe~ 2014

(157.81)

5,019.42

47.64%

47.64%

(502.73)

489.41

(992.14)

5,019.42

(7,028.12)

47.64%

Statement of Standalone Assets and Liabilities as at 30 September 2014

Particulars

(Rs, in lakhs)

As at 31 Mar '14

(Audited)

As at 30 Sept '14

(Unaudited)

A EQUITY AND LIABILITIES

Shareholders' funds

Share capital

Reserves and surplus

Non current liabilities

Long-term borrowings

Other long-term liabilities

Long-term provisions

Current liabilities

Trade payables

Other current liabilities

Short-term provisions

TOTAL - EQUITY AND LIABILITIES

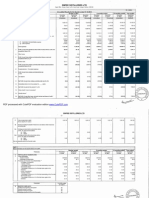

B ASSETS

Non-current assets

Fixed assets

Long-term loans and advances

Trade receivables

Other non current assets

5,019.42

(7,193.42)

5,019.42

(7,028.12)

(2,174.00)

(2,008.70)

2,023.00

412.51

2,023.00

275.58

2,435.51

2,298.58

69.31

590.84

0.26

172.32

593.60

0.24

660.41

766.16

921.92

1,056.04

54.08

775.89

54.97

775.86

829.97

Current assets

Inventories

Trade receivables

Cash and bank balances

Short-term loans and advances

Other current assets

TOTAL - ASSETS

830.83

30.00

138.93

42.22

14.06

91.95

225.21

88.85

3.10

921.'z... r-,

.-1J)5~4

~'

' :

C~8

)~.

(~c

,.

. .:::: i

";<:s/1

. .~/~:.;.,~~

l~

INFOMEDIA PRESS LIMITED

STATEMENT OF FINANCIAL RESULT FOR THE QUARTER AND HALF YEAR ENDED 30 SEPTEMBER 2014

Notes to the Unaudited Financial Results:

I.

The f.tgures for the corresponding previous periods have been restated/regrouped wherever necessary, to make them comparable.

2.

There was no investor complaint pending as on 1 July 2014. During the current quarter, 1 complaint was received which was resolved and as on 30 September 2014, no complaints

remain unresolved.

3.

The Audit Committee has reviewed the above results and the Board of Directors have approved the above results at their respective meetings held on 11 October 2014. The

Statutory Auditors of the Company have carried out a Limited Review of the unaudited financial results of the Company for the quarter and half year ended 30 September 2014.

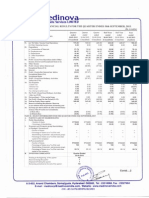

4.

Independent Media Trust (IM1), of which Reliance Industries Limited is the sole beneficiary, has acquired an indirect controlling stake of the promoter group entities namely RB

Mediasoft Private Limited, RRB Mediasoft Private Limited, Adventure Marketing Private Limited, Watermark Infratech Private Limited, Colorful Media Private Limited, RB Media

Holdings Private Limited and RB Holdings Private Limited (collectively referred to as 'Holding Companies') from Raghav Bah! and Ritu Kapur on 7 July 2014. Pursuant to such

acquisition, Raghav Bahl, Ritu Kapur and other existing promoters/promoter group of the Company (other than Network18 Media & Investments Limited) have ceased to be

promoters/promoter group of the Company from 7 July 2014.

5.

The Company had discontinued its operations during the year ended 31 March 2013 and has incurred net loss of Rs. 99.70 lakhs and Rs. 157.811akhs during the quarter and half year

ended 30 September 2014 respectively, thereby making the Company's accumulated losses to Rs. 7,339.31 lakhs which has resulted in erosion of hundred percent of net worth of the

Company. The management is evaluating various options, including starting a new line of business. There is a material uncertainty related to the aforementioned conditions that may

cast significant doubt on the Company continuing as a going concern and accordingly the Company may be unable to realize its assets and discharge its liabilities in the normal course

of business. Network18 Media & Investments Limited, holding company, has given a support letter to extend, for the foreseeable future (i.e. twelve months from 30 September

2014), any financial and business support which may be required by the Company. Considering these factors, the management has assessed that the Company continues to be a going

concern and hence, these financial results have been prepared on a going concern basis.

6.

All the amounts included in the statement of unaudited results pertain to discontinuing operations except for depreciation of Rs, 0.45 lakhs for quarter ended 30 September 2014 and

Rs 0.89 lakhs for the half year ended 30 September 2014 (Rs. O.44lakhs for the quarter ended 30 June 2014, Rs 3.241akhs for the quarter ended 30 September 2013, Rs, 6.441akhs

for half year ended 30 September 2013 and Rs. 12.85 lakhs for year ended 31 March 2014) and finance costs of Rs, 76.49 lakhs for quarter ended 30 September 2014 and Rs. 152.14

lakhs for the half year ended 30 September 2014 (Rs 75.65 lakhs for the quarter ended 30 June 2014, Rs 76.49 lakhs for the quarter ended 30 September 2013, Rs. 143.88 lakhs for

half year ended 30 September 2013 and Rs. 295.19lakhs for year ended 31 March 2014).

7.

All the amounts included in the statement of assets and liabilities pertain to discontinuing operations except for assets of Rs. 54.08 lakhs as at 30 September 2014 (Rs. 54.971akhs as at

31 March 2014) and liabilities ofRs. 2,435.51lakhs as at 30 September 2014 (Rs. 2,298.581akhs as at 31 March 2014).

>:

Place: Noida

Dated: 11 October 2014

\

Regd. Office: 503,504 & 507, 5th Floor, Mercantile House, 15, Kasturba Gandhi Marg, rve

T +91 11 4981 2600, F +9111 41506115 website: http://ww\\'.infomediaprcss.in CIN No. I22219DL1955PLC211606

'-..,

Walker Chandiok &,Co LLP

WalkerChandiok & Co LLP

(Formerly Walker, Chandiok & Co)

L-41 Connaught Circus

New Delhi 110001

India

T +91 11 4278 7070

F +91 11 42787071

Review Report

To the Board of Directors oflnfomedia Press Limited

1. We have reviewed the accompanying statement of unaudited financial results ("the Statement'')

of Infomedia Press Limited ("the Company") for the quarter ended 30 September 2014 and

the year to date results for the period 1 April 2014 to 30 September 2014, except for the

disclosures regarding 'Public Shareholding' and 'Promoter and Promoter Group Shareholding'

which have been traced from disclosures made by the management and have not been audited by

us. This Statement is the responsibility of the Company's Management and has been approved

by the Board of Directors. Our responsibility is to issue a report on the Statement based on our

review,

2. We conducted our review in accordance with the Standard on Review Engagements (SRE) 2410,

Review of Interim Financial Information Performed by the Independent Auditor of the Entity,

issued by the Institute of Chartered Accountants of India. This standard requires that we plan

and perform the review to obtain moderate assurance as to whether the Statement is free of

material misstatement. A review is limited primarily to inquiries of company personnel and

analytical procedures, applied to financial data and thus provides less assurance than an audit. We

have not performed an audit and accordingly, we do not express an audit opinion.

3. Based on our review conducted as above, nothing has come to our attention that causes us to

believe that the accompanying Statement prepared in accordance with applicable accounting

standards, as notified under the Companies (Accounting Standards) Rules, 2006 read with Rule 7

of the Companies (Accounts) Rules, 2014 in respect of Section 133 of the Companies Act, 2013

and other recognised accounting practices and policies has not disclosed the information

required to be disclosed in terms of Clause 41 of the Listing Agreement, including the manner in

which it is to be disclosed, or that it contains any material misstatement.

CharteredAccountants

Walker Chandiok & CoLLPis registered with lim~ed liability

with irl.nlification number Me-2085 and ~ rezistered

iWalker Chandiok &'-Co LLP

4. We draw attention to Note 5 to the Statement which indicates that the Company had

discontinued its operations during the year ended 31 March 2013 and has incurred a net loss of

Rs. 99.70 lakhs and Rs. 157.81lakhs during the quarter and half year ended 30 September 2014

respectively and as of that date the Company's accumulated losses amount to Rs. 7,339.31 lakhs

resulting in erosion of hundred percent of net worth of the Company. The management of the

Company is evaluating various options, including starting a new line of business. These

conditions, along with other matters as set forth in the aforesaid note, indicate the existence of a

material uncertainty that may cast significant doubt about the company's ability to continue as a

going concern. Our report is not qualified in respect of this matter.

L~~~J

For Walker Chandiok & Co LLP

(formerlY Walker, Chandiok & Co)

Chartered Accountants

Firm Registration No: 001076N!N500013

per B.P. Singh

Partner

Membership No. 0116

Place: New Delhi

Date: 11 October 2014

Chartered Accountants

Вам также может понравиться

- INTERIM FINANCIALSДокумент44 страницыINTERIM FINANCIALS2friendОценок пока нет

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Документ4 страницыFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review For Sept 30, 2014 (Result)Документ13 страницFinancial Results & Limited Review For Sept 30, 2014 (Result)Shyam SunderОценок пока нет

- Announces Q2 Results, Limited Review Report & Results Press Release For The Quarter Ended September 30, 2015 (Result)Документ5 страницAnnounces Q2 Results, Limited Review Report & Results Press Release For The Quarter Ended September 30, 2015 (Result)Shyam SunderОценок пока нет

- Colgate-Palmolive (India) Limited Registered Office: Colgate Research Centre, Main Street, Hiranandani Gardens, Powai, Mumbai 400 076Документ4 страницыColgate-Palmolive (India) Limited Registered Office: Colgate Research Centre, Main Street, Hiranandani Gardens, Powai, Mumbai 400 076Aditya MishraОценок пока нет

- Mughal Iron Annual Report 2014Документ38 страницMughal Iron Annual Report 2014sana ahmadОценок пока нет

- Reckitt Benckiser (India) Limited: Standalone Balance Sheet For Period 01/04/2013 To 31/03/2014Документ112 страницReckitt Benckiser (India) Limited: Standalone Balance Sheet For Period 01/04/2013 To 31/03/2014junkyОценок пока нет

- Announces Q3 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Документ4 страницыAnnounces Q3 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Документ3 страницыFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderОценок пока нет

- With You: All The WAYДокумент12 страницWith You: All The WAYmakhalidiОценок пока нет

- Apl 2013Документ45 страницApl 2013Wasif Pervaiz DarОценок пока нет

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Документ9 страницStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Документ4 страницыFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Документ2 страницыFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderОценок пока нет

- 2014-8-25 - Announcement of Interim ResultsДокумент26 страниц2014-8-25 - Announcement of Interim ResultsDan DurayОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ5 страницStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Документ3 страницыFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Документ5 страницFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderОценок пока нет

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Документ2 страницыFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Документ3 страницыFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderОценок пока нет

- Unaudited Financial Results Q2 2014Документ4 страницыUnaudited Financial Results Q2 2014Dhruba DebnathОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Annual Report 2015 PDFДокумент232 страницыAnnual Report 2015 PDFHasnain QaiyumiОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ3 страницыFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Документ4 страницыFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Документ3 страницыFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderОценок пока нет

- Beximco Hy2014Документ2 страницыBeximco Hy2014Md Saiful Islam KhanОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ5 страницStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Документ4 страницыFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ3 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Документ3 страницыFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Quarterly & Nine Months Report Sept 2014Документ22 страницыQuarterly & Nine Months Report Sept 2014Nabeel AftabОценок пока нет

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Документ3 страницыFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Announces Q2 Results & Auditors' Report For The Quarter Ended September 30, 2015 (Result)Документ4 страницыAnnounces Q2 Results & Auditors' Report For The Quarter Ended September 30, 2015 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Документ3 страницыFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderОценок пока нет

- Updates Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ7 страницUpdates Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Документ3 страницыFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ5 страницStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Документ4 страницыFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Документ4 страницыFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Dec 31, 2015 (Result)Документ6 страницFinancial Results & Limited Review Report For Dec 31, 2015 (Result)Shyam SunderОценок пока нет

- 28 Consolidated Financial Statements 2013Документ47 страниц28 Consolidated Financial Statements 2013Amrit TejaniОценок пока нет

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Документ3 страницыFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderОценок пока нет

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Документ6 страницStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Документ3 страницыFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Документ4 страницыFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Announces Q1 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended June 30, 2016 (Result)Документ4 страницыAnnounces Q1 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended June 30, 2016 (Result)Shyam SunderОценок пока нет

- PVR Annual ReportДокумент147 страницPVR Annual ReportrajofnandaОценок пока нет

- Ar 14Документ71 страницаAr 14Darsh Dilip DoshiОценок пока нет

- 2014 Annual Report FinancialreportsДокумент83 страницы2014 Annual Report FinancialreportsVagish KirubaharanОценок пока нет

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Документ11 страницStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Документ2 страницыFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Ar 11 pt03Документ112 страницAr 11 pt03Muneeb ShahidОценок пока нет

- Finding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesОт EverandFinding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesОценок пока нет

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionОт EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2016 EditionОценок пока нет

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionОт EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionОценок пока нет

- ASEAN Corporate Governance Scorecard: Country Reports and Assessments 2013–2014От EverandASEAN Corporate Governance Scorecard: Country Reports and Assessments 2013–2014Оценок пока нет

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2018 EditionОт EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2018 EditionОценок пока нет

- Mutual Fund Holdings in DHFLДокумент7 страницMutual Fund Holdings in DHFLShyam SunderОценок пока нет

- Order of Hon'ble Supreme Court in The Matter of The SaharasДокумент6 страницOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderОценок пока нет

- JUSTDIAL Mutual Fund HoldingsДокумент2 страницыJUSTDIAL Mutual Fund HoldingsShyam SunderОценок пока нет

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliДокумент5 страницExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderОценок пока нет

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedДокумент2 страницыSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderОценок пока нет

- HINDUNILVR: Hindustan Unilever LimitedДокумент1 страницаHINDUNILVR: Hindustan Unilever LimitedShyam SunderОценок пока нет

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Документ1 страницаPR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderОценок пока нет

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Документ5 страницStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results For September 30, 2013 (Result)Документ2 страницыFinancial Results For September 30, 2013 (Result)Shyam SunderОценок пока нет

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Документ4 страницыFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Settlement Order in Respect of R.R. Corporate Securities LimitedДокумент2 страницыSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderОценок пока нет

- Financial Results For Dec 31, 2013 (Result)Документ4 страницыFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Документ3 страницыFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderОценок пока нет

- Financial Results, Limited Review Report For December 31, 2015 (Result)Документ4 страницыFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderОценок пока нет

- Financial Results For June 30, 2014 (Audited) (Result)Документ3 страницыFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderОценок пока нет

- Standalone Financial Results For March 31, 2016 (Result)Документ11 страницStandalone Financial Results For March 31, 2016 (Result)Shyam SunderОценок пока нет

- Financial Results For Mar 31, 2014 (Result)Документ2 страницыFinancial Results For Mar 31, 2014 (Result)Shyam SunderОценок пока нет

- Financial Results For June 30, 2013 (Audited) (Result)Документ2 страницыFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- PDF Processed With Cutepdf Evaluation EditionДокумент3 страницыPDF Processed With Cutepdf Evaluation EditionShyam SunderОценок пока нет

- Standalone Financial Results For September 30, 2016 (Result)Документ3 страницыStandalone Financial Results For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Transcript of The Investors / Analysts Con Call (Company Update)Документ15 страницTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ3 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results For June 30, 2016 (Result)Документ2 страницыStandalone Financial Results For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Документ5 страницStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Документ3 страницыStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderОценок пока нет

- Investor Presentation For December 31, 2016 (Company Update)Документ27 страницInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderОценок пока нет

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Документ4 страницыStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderОценок пока нет

- BBA Semester-I Project on Creating Company and Inventory Masters in Tally PrimeДокумент52 страницыBBA Semester-I Project on Creating Company and Inventory Masters in Tally Primesaniya100% (1)

- Internal Audit Quiz 1Документ2 страницыInternal Audit Quiz 1KathleenОценок пока нет

- Analyzing The Firm's Cash FlowДокумент12 страницAnalyzing The Firm's Cash FlowJohn Joseph CambaОценок пока нет

- Practice Set PSA 200Документ5 страницPractice Set PSA 200Krystalah CañizaresОценок пока нет

- Intermediate Accounting 11Th Edition Nikolai Test Bank Full Chapter PDFДокумент67 страницIntermediate Accounting 11Th Edition Nikolai Test Bank Full Chapter PDFprise.attone.itur100% (3)

- BipinДокумент2 страницыBipinanon-389014Оценок пока нет

- Accelerate Accounting For Power Purchase 2022Документ24 страницыAccelerate Accounting For Power Purchase 2022getquit showОценок пока нет

- FA 2 ModuleДокумент16 страницFA 2 ModuleJohnallenson DacosinОценок пока нет

- Reviewer in AccountingДокумент22 страницыReviewer in AccountingMIKASAОценок пока нет

- 01 Activity 1Документ1 страница01 Activity 1ToastedBaconОценок пока нет

- Inventory Valuation Under And: Ifrs GaapДокумент8 страницInventory Valuation Under And: Ifrs Gaapberhanu adnewОценок пока нет

- Business Com. Prelim ExamДокумент7 страницBusiness Com. Prelim ExamJeane Mae BooОценок пока нет

- ASE20104 - Examiner Report - April 2019Документ14 страницASE20104 - Examiner Report - April 2019Aung Zaw Htwe100% (1)

- Case 1 For PrintДокумент8 страницCase 1 For PrintRichardDinongPascualОценок пока нет

- C12, C13 QuestionsДокумент6 страницC12, C13 QuestionsFery AnnОценок пока нет

- University of Toronto EngДокумент39 страницUniversity of Toronto Engapi-240506461Оценок пока нет

- Capital Markets Research in Accounting: S.P. KothariДокумент1 страницаCapital Markets Research in Accounting: S.P. KothariFebrian FebriОценок пока нет

- Cost Acc Vol. IIДокумент436 страницCost Acc Vol. IISaibhumi100% (3)

- Journal Nov 2010Документ131 страницаJournal Nov 2010a_shish2003Оценок пока нет

- 5 Types of Adjusting Entries ExplainedДокумент10 страниц5 Types of Adjusting Entries ExplainedYaseen GhulamОценок пока нет

- IFRS ConvergenceДокумент39 страницIFRS ConvergencetemedebereОценок пока нет

- Problem 4-2AДокумент6 страницProblem 4-2AAlche MistОценок пока нет

- Back Flush Costing PDFДокумент7 страницBack Flush Costing PDFPankaj GoelОценок пока нет

- Forensic AccountingДокумент28 страницForensic AccountingADITYA MAHAJAN63% (8)

- Active Citizenship and Civic ResponsibilitiesДокумент8 страницActive Citizenship and Civic ResponsibilitiesIrish Mae Plaza QuimpanОценок пока нет

- Mas 1: Short-Term Budgeting, Forecasting and Control Jade D. Solaña, CPA, MBAДокумент7 страницMas 1: Short-Term Budgeting, Forecasting and Control Jade D. Solaña, CPA, MBAABBIE GRACE DELA CRUZОценок пока нет

- Unit 2: Financial Analysis 2.0 Aims and ObjectivesДокумент13 страницUnit 2: Financial Analysis 2.0 Aims and ObjectiveshabtamuОценок пока нет

- MbaДокумент14 страницMbasibin nairОценок пока нет

- Managerial Accouting Final Project - Group 1 - Section B - PELДокумент41 страницаManagerial Accouting Final Project - Group 1 - Section B - PELnomanОценок пока нет

- ACCTG2 - Introduction To Partnership and Corporation AccountingДокумент23 страницыACCTG2 - Introduction To Partnership and Corporation AccountingMaria Camille Sison0% (1)