Академический Документы

Профессиональный Документы

Культура Документы

M&A Review Newsletter 2014

Загружено:

Michael WangАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

M&A Review Newsletter 2014

Загружено:

Michael WangАвторское право:

Доступные форматы

M&A REVIEW 2014

M&A REVIEW 2014

CONTENTS

Key trends in Irish M&A

Foreword 6

Overview 8

Spotlight: Ireland looks overseas

14

Spotlight: Irelands private equity profile

19

Outlook 24

WILLIAM FRY

2014 heralded a return to volumes

and values not seen since before

the financial crisis.

M&A REVIEW 2014

KEY TRENDS IN IRISH M&A

M&A volume up 37% in 2014 to

115 deals, compared to 84 in 2013

A number of key sectors saw

strong activity by volume, including:

2014

115 DEALS

2013

23

TELECOMS, MEDIA AND

TECHNOLOGY

84 DEALS

PHARMACEUTICALS,

MEDICAL AND BIOTECH

2014s M&A deal value of 42.9bn

is the highest since 2000, up 139%

year-on-year from 2013

14%

FINANCIAL SERVICES

4 2.9 b n

LEISURE

INBOUND M&A

AT THE HIGHEST

ON RECORD

OUTBOUND DEALS

AT THE HIGHEST

ON RECORD

Private equity activity climbed

to its highest point in terms

of both volume and value in

the past seven years

WILLIAM FRY

FOREWORD

Welcome to the fourth edition of the annual

William Fry M&A Review, published in association

with Mergermarket. This report examines the

developments and drivers of Irish M&A throughout

2014 and looks ahead to potential trends in the

marketplace for 2015.

Shane ODonnell

Head of Corporate & M&A

T. +353 1 639 5112

E. shane.odonnell@williamfry.ie

In previous editions of the M&A Review, we have

noted a steady recovery in M&A activity in Ireland

since 2009. Significantly, 2014 was marked by a

return to volumes and values not seen since before

the financial crisis. M&A activity involving Irish

targets rose 37% by volume year-on-year (YoY) to

115 deals. In addition, 2014s deal value of 42.9bn

was the highest on Mergermarket record (beginning

in 2000).1

The significant boost in aggregate deal value was

unquestionably driven by Medtronics 33.9bn

purchase of Covidien in late 2014. However, the

sizeable increase in transaction volume, including

stronger mid-market activity, marks an encouraging

return to pre-crisis levels. This contrasts with our

In this report, Irish M&A figures refer to announced transactions with Irish targets.

findings in previous editions of the M&A Review:

transaction volume struggled to regain ground

but value was sustained by a small number of very

large transactions. In 2014, Irish M&A activity was

strong across all deal size categories and notably

the number of transactions with announced values

under 100m jumped 81% YoY to 58 in 2014.

These positive developments in Ireland mirror

the broader trend of M&A recovery seen across

Europe - with the spectre of the sovereign debt

crisis receding and interest rates at record lows

throughout 2014, many countries in Europe saw

a bounce in M&A figures.

Macroeconomic factors have undoubtedly

contributed to the overall growth in M&A activity:

the European Commission (EC) announced that

Ireland was the fastest-growing economy in the EU

in 2014, at 4.8% YoY GDP growth. This figure can be

compared with a figure of just 1.3% for the EU as a

whole over the same period.

M&A REVIEW 2014

Financing conditions have also showed signs of

moderate improvement during the past 12 months.

While bank lending has largely remained sluggish

since the sovereign debt crisis, other trends in

financing, such as the rise in alternative finance

providers, contributed to the strong M&A activity in

2014. With the European Central Bank (ECB) early

2015 announcement of a programme of quantitative

easing, bond markets and leveraged buyouts will likely

see increased activity in the coming months.

In Ireland, the recovery in M&A demonstrates not

just a return to the pre-crisis status quo, but also

dynamic and indigenous growth. Interestingly,

total European M&A volume grew just 9% in 2014,

compared to Irelands 37% over the same period.

Irelands M&A resurgence was due in part to the

resilience of its sectoral strongholds. The financial

services, telecoms, media and technology (TMT) and

pharma, medical and biotech (PMB) sectors were

consistent performers. Each of these sectors saw

deal volume rise or remain steady in 2014.

In contrast to last years report, when we noted that

overseas acquirers were mainly using Ireland as a

springboard for international expansion, 2014 was

marked by a more encouraging domestic economic

environment which has persuaded more Irish

corporates to embark on cross-border transactions.

There were many small to mid-sized strategic plays,

with Irish companies looking to expand into both

developed and emerging markets.

In 2014, private equity deal value increased tenfold

YoY on the back of several large-cap deals. These

included Charterhouse Capital Partners 1.7bn

buyout of online learning company SkillSoft and BC

Partners 450m purchase of a stake in car rental

service CarTrawler. A number of Irish focused

private equity funds have also been established and

are active in the market, including Carlyle Cardinal

Ireland, MML and AMP.

Increased private equity activity also spurred Irish

M&A. Both buyouts and exits experienced surges

in deal volume in 2014. The revival in buyouts was

especially noticeable in the small to mid-sized deal

category, with the number of buyouts under 100m

increasing from eight in 2013 to 13 in 2014. This

indicates that private equity funds are increasingly

delivering funding for small to medium-sized

enterprises (SMEs) and providing them with a crucial

means of growth.

For all market participants, the Irish M&A landscape

in 2014 was characterised by sustained growth in

what appears to be a healthier marketplace.

Shane ODonnell

Head of Corporate & M&A

WILLIAM FRY

OVERVIEW

M&A QUARTERLY TRENDS

40

40,000

35

35,000

30

30,000

25

25,000

20

20,000

15

15,000

10

10,000

5,000

Number of deals

Value (m)

Although bank lending continued to be somewhat

restricted in 2014, debt markets proved to be

a crucial source of financing for creditworthy

businesses. The bond market is increasingly

robust, with Irelands first bond issue after the

bailout exit achieving record low yields. In Europe

overall, corporate bond issuances increased

throughout 2014. In light of the ECBs January

2015 announcement of quantitative easing, the

current low interest rate environment is set to

continue, reducing financing costs further.

For SMEs who do not consider bond markets

viable financing options, alternative finance

providers, such as Bluebay Asset Management,

have emerged, going some way towards

Volume

Value of deals m

Overall, 2014 was a solid year for Irish

dealmaking. The broader economic climate

improved, helping to encourage businesses at

home and abroad to consider Irish acquisitions.

This has been influenced by a number of factors.

Ireland became the first eurozone country to

exit its bailout programme at the end of 2013.

Also, the EC reported that the countrys GDP

had grown 4.8% YoY, the strongest growth rate

in the EU. These positive developments have

instilled confidence in international investors

regarding the strength and resilience of the

Irish marketplace.

0

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

09 09 09 09 10 10 10 10 11 11 11 11 12 12 12 12 13 13 13 13 14 14 14 14

addressing the funding gap left by more restrictive

lending practices.

A sizeable share of 2014s deal value 33.9bn

was generated by a single deal, medical

technology firm Medtronics announced acquisition

of healthcare products company Covidien.

Although the US Treasury Department and

Internal Revenue Services have taken steps that

will likely impact on the volume of transatlantic

inversion transactions in 2015, Medtronic

elected to continue to pursue Covidien, citing

other strategic and financial rationale. Jos E.

Almeida, Chairman, President and Chief Executive

Officer of Covidien, stated at the time of the deal:

Covidien and Medtronic, when combined, will

provide a compelling portfolio of offerings that

will help improve care and surgical performance.

This transaction provides our shareholders with

immediate value and the opportunity to

participate in the significant upside potential

of the combined organisation.

M&A REVIEW 2014

M&A SPLIT BY DEAL SIZE

in 2014 only Medtronics purchase of Covidien

was greater than 2bn compared with three deals

of this size in 2013.

120

4

7

5

100

Number of deals

5

80

60

40

7

4

5

5

2

1

2

21

20

17

8

10

20

5

5

31

Not disclosed

<15m

15m-100m

101m-250m

251m-500m

19

20

11

12

43

41

41

2012

2013

2014

27

>500m

14

29

32

34

2009

2010

2011

MID-MARKET BOUNCE BACK

The Covidien deal certainly had a distorting

influence on the value figures in 2014: excluding

this transaction, the remaining aggregate deal

value of 9bn would be the lowest since 2009,

with figures in the intervening years ranging

from 9.9bn in 2010 to 25.7bn in 2012 (though

previous years values were also in certain cases

inflated by one or two significant deals).

However, a significant increase in the volume of

deals drove Irish M&A activity in 2014, particularly

in the category of small to mid-sized transactions.

As noted in the third edition of the M&A Annual

Review, 2013 was characterised by a flurry of

megadeals and a high proportion of deals valued

over 500m. In 2014, the deals valued over 500m

remained constant, falling from just five deals to

four. But there were fewer megadeals announced

By contrast, 2014 saw a larger number of small to

mid-cap deals: the number of deals under 100m

increased 81% YoY in 2014 to 58 deals. There

were also 16 deals valued between 100m and

500m, compared to 11 in 2013. This would seem

to indicate that smaller and mid-sized businesses

the overwhelming majority of businesses in

Ireland are embarking on M&A for growth.

Rather than individual deals boosting value

figures, 2014s strong volume figures indicate

that Irish M&A activity is being used in Ireland as

a means of generating growth which points to a

more vibrant and broad-based M&A landscape.

This is a resoundingly positive sign for Irelands

business community and a significant vote of

confidence which bodes well for a strong 2015.

PRIVATE EQUITY LESSONS

Robust private equity activity has also been a

significant component of Irelands M&A resurgence.

In 2014 buyouts numbered 22, compared with 15 in

2013. Meanwhile, buyout value increased sevenfold,

from 401m in 2013 to 2.8bn in 2014. Significantly,

private equity represents a new avenue of funding

WILLIAM FRY

PRIVATE EQUITY DEALS

3000

10

2500

2000

1500

1000

500

Volume

Value (m)

Value of deals m

Number of deals

12

0

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

09 09 09 09 10 10 10 10 11 11 11 11 12 12 12 12 13 13 13 13 14 14 14 14

for businesses, especially mid-market participants.

In an example, Ireland-based Lioncourt Investments

acquired a 30% stake in Beechfield Nursing Homes

in order to help the retirement home operator

expand further in Dublin and the surrounding areas.

Although exits remain a small part of Irelands M&A

narrative, they were at their strongest level in 2014

since 2008. While 2013 saw only four exits valued at

54m, there were 11 exits in 2014 totalling 4.2bn.

In the years immediately following the financial

crisis, exit activity declined markedly throughout

Europe, as private equity firms struggled to find

10

buyers who would pay adequate premiums to repay

investments. Volatility in equity markets also caused

nervousness around initial public offerings as exit

options. With these sentiments receding in 2014,

Ireland experienced an increase in the number of

corporate exits and secondary buyouts.

Several of the years biggest exits involved private

equity firms capitalising on investments made

immediately after the financial crisis, further

demonstrating a market recovery which is

allowing private equity firms to generate solid

returns on investments. For instance, in 2010, the

Jordan Company and Nautic Partners made an

initial investment of 380m in Milestone Aviation,

a helicopter lessor. In October, these two firms

announced plans to sell the company to GE

Capital Partners for 1.4bn. The trends seen

in both exits and buyouts during 2014 should

encourage further private equity investment, with

Irish assets increasingly showing themselves

capable of generating solid returns for investors.

SECTOR APPEAL

A number of Irish sectors experienced growth in

2014. TMT continued to be the biggest Irish M&A

sector by volume in 2014, accounting for 23% of

deals. TMT also increased in real terms, with 25

deals in 2014, compared to 16 in 2013. Computer

software was the busiest sub-sector, with 16 deals

valued at 302m. These transactions involved

private equity and venture capital investors,

along with trade buyers making strategic bolt-on

purchases. In an example of the former trend, after

a number of years of ownership under venture

capital firms including Intel Capital, cloud-based

mobile application developer FeedHenry was sold to

Red Hat, a US-based software developer, for 64m,

a deal underpinned by Red Hats strategy to expand

its mobile product offering.

In the financial services sector, M&A had a robust

year, with volume remaining level at 13 deals,

and value rising 59% YoY to 3bn. The sectors

M&A REVIEW 2014

large-cap deals in 2014 were concentrated in the

insurance, reinsurance and aircraft leasing

sub-sectors.

In terms of sector deal value, Medtronics

purchase of Covidien ensured that the PMB

sector dominated the marketplace, comprising

81% of total deal value in 2014. PMB also

experienced growth in volume, with the number

of deals increasing from five in 2013 to 16 in

2014. Excluding the Covidien deal, all those with

announced values were under 500m, pointing to

vibrant mid-market activity. In a 118m deal, USbased medical technology firm Becton, Dickinson

and Company announced plans in October 2014

to acquire Limericks GenCell Biosystems, which

develops technologies used in biological analysis,

a deal driven by the acquirers desire to grow its

genomics portfolio.

The leisure sector was one of Irelands busiest by

volume in 2014, with the majority of transactions

involving hotel targets. As a pro-cyclical industry,

leisure saw a slump in investments during the

economic downturn, largely due to declines

in consumer spending. But the leisure sector

witnessed a revival in 2014, with a steady stream

of dealmaking. For instance, in the years biggest

leisure deal, Dalata announced in December 2014

its intention to purchase the majority of the Moran

Hotel Group for 455m.

SECTOR SPLIT BY VOLUME

SECTOR SPLITS BY VALUE

1%

2013

4%

3%

2%

6%

5%

3%

2014

23%

2014

7%

6%

6%

11%

19%

2%

7%

2013

11%

1%

1%

1%

13%

13%

7%

10%

6%

17%

12%

77%

16%

11%

81%

14%

Key for above two charts:

TMT

Financial Services

Business Services

Construction

Leisure

Consumer

Industrials & Chemicals

Agriculture

Pharma, Medical & Biotech

Energy, Mining & Utilities

Transportation

EYES ON IRELAND

Inbound M&A remains a critical part of Irelands

M&A narrative, with nine out of the 10 biggest

transactions in 2014 involving foreign bidders.

In comparison with 2013, inbound deal volume

in 2014 increased 23% YoY to 75 deals, while

transaction value more than doubled to 41.7bn

over the same period.

11

WILLIAM FRY

There is also an emerging trend in which buyers

from further afield particularly Asia are

demonstrating an interest in acquiring Irish

assets. After a slight increase in dealmaking in

the mid-2000s, activity involving Asia-Pacific

buyers levelled off following the financial

downturn. In more recent years, Asia-Pacific

buyers have undertaken a handful of acquisitions

annually. There were four such deals in 2014, with

a combined value of 306m, accounting for 5%

of overall inbound activity.

A number of deals involving Asia-Pacific buyers

took place within the aircraft leasing sector. AsiaPacific is experiencing demographic shifts in key

economies, increasing demand for commercial

aircraft, and is seeing regulatory changes which

have opened up airline industries to international

12

INBOUND M&A TRENDS BY QUARTER

30

40,000

Volume

35,000

25

Value (m)

Number of deals

30,000

20

25,000

15

20,000

15,000

10

Value of deals m

The overwhelming majority of buyers in 2014 were

either based in the US (52%) or Western Europe

(35%). These deals were largely aimed at helping

companies expand their geographical reach and

benefit from Irelands position as a launchpad

for international activities. For instance, French

company CNP Assurances announced plans to

purchase a 51% stake in the life and non-life

insurance subsidiaries of Santander Consumer

Finance for 290m. This transaction will provide

CNP with a foothold in new markets, including

Germany and the Nordics.

10,000

5

5,000

0

0

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

09 09 09 09 10 10 10 10 11 11 11 11 12 12 12 12 13 13 13 13 14 14 14 14

carriers. Importantly, Ireland has a dominant

position in the aircraft leasing space, managing

half of the worlds leased aircrafts. There was

strong activity in the sector last year, with

Dublin based Avolon listing on the New York

Stock Exchange, and AWAS, owned by UK-based

private equity firm Terra Firma Capital Partners,

conducting a strategic review of its business.

Consequently, a number of Asia-Pacific buyers

are targeting Ireland-based companies in this

sector. The largest such deal in 2014 was the

announcement by Japans Mitsubishi UFJ Lease

& Finance Company of plans to buy Ireland-

based Engine Lease Finance Corporation and

Beacon Intermodal Leasing for 285m. Engine

Lease Finance Corporation and Mitsubishi UFJ

Lease & Finance Company have launched a joint

venture, Deucalion MC Engine Leasing, targeting

investment in leased aircraft engines. Given the

structural drivers behind the increase in aircraft

leasing activity in Asia-Pacific, the space will likely

see continued activity in 2015.

M&A REVIEW 2014

We expect 2015 activity to be generated

by businesses seeking key strategic

opportunities to support organic growth.

13

WILLIAM FRY

SPOTLIGHT: IRELAND LOOKS OVERSEAS

David Carthy

Partner

T. +353 1 639 5186

E. david.carthy@williamfry.ie

While the attractiveness of Irish companies as

potential targets for M&A has made headlines in

recent years, the gradual increase in outbound

M&A activity since 2009 has largely gone

unreported. However, there was a shift in Irish

M&A dealmaking in 2014, as outbound activity

overtook both inbound and domestic M&A as

a proportion of total Irish M&A activity. In the

past six years, this has only occurred on one

previous occasion (in 2012). In absolute terms,

the number of outbound Irish M&A deals was

the highest on record.

As with other segments of M&A, increased

confidence and a resurgent economy have seen

Irish companies pursue growth overseas, notes

William Fry partner David Carthy.

Outbound value was largely driven by several key

players in the PMB sector. In particular, Irelandbased Actavis spent over 67bn on two deals: the

acquisition of US-based Allergan and US company

Forest Laboratories. These two transactions

made up the vast majority of total Irish outbound

deal value. In terms of volume, PMB outbound

PROPORTION OF DOMESTIC, INBOUND AND OUTBOUND M&A

David Fitzgibbon

Partner

T. +353 1 639 5154

E. david.fitzgibbon@williamfry.ie

100%

Domestic

Percentage

80%

34

Inbound

33

41

42

40

43

60%

37

40%

41

43

37

44

37

16

20

2013

2014

20%

29

26

16

21

0%

2009

14

2010

2011

2012

Outbound

M&A REVIEW 2014

The increase in outbound PMB spending

is partly driven by now-inverted companies

targeting growth. Actavis, for example,

undertook a transatlantic inversion in 2013. In

addition, pharma giant Mallinckrodt, a spin-off

of Covidien (which re-domiciled in Ireland in

2008), acquired US-based Questcor for 3.6bn,

in order to broaden its portfolio of speciality

pharmaceuticals. Given the number of inversions

into Ireland in the PMB sector over the past few

years, we expect that the sector will continue

to drive significant Irish outbound activity in the

short term.

DOMESTIC, INBOUND AND OUTBOUND M&A, NUMBER OF DEALS

250

Inbound

88

150

60

100

58

55

37

75

50

46

62

52

61

26

30

23

29

23

2009

2010

2011

2012

2013

33

40

2014

OUTBOUND M&A TRENDS BY QUARTER

30

70,000

60,000

25

Number of deals

Volume

Value (m)

50,000

20

40,000

15

30,000

10

Value of deals m

Nonetheless, other industries have also been

targeting overseas acquisitions. For instance,

there were 18 deals in the consumer sector in

2014 compared with eight in 2013. Much of this

growth can be attributed to an increase in M&A

activity in the food sub-sector, with 11 of the

Outbound

30

TOP TEN OUTBOUND DEALS

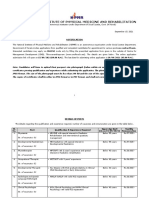

An examination of the top 2014 outbound deals

reveals that PMB had a monopoly in the 1bnplus market. Indeed, the five deals with a value

in excess of 1bn were worth 76.3bn in total,

97% of the entirety of Irish outbound M&A in

2014, and were all in the PMB sector.

Domestic

200

Number of deals

deal numbers also followed an upward trajectory,

with 22 deals in 2014 compared with 10 in 2013.

20,000

5

10,000

0

Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4

09 09 09 09 10 10 10 10 11 11 11 11 12 12 12 12 13 13 13 13 14 14 14 14

15

WILLIAM FRY

TOP 10 OUTBOUND M&A DEALS, 2014

Announced Date

Target Company

Target Sector

Target Country

Bidder Company

17/11/2014

Allergan, Inc

Pharma, Medical & Biotech

USA

Actavis plc

50,539

18/02/2014

Forest Laboratories Inc

Pharma, Medical & Biotech

USA

Actavis plc

16,813

07/04/2014

Questcor Pharmaceuticals, Inc

Pharma, Medical & Biotech

USA

Mallinckrodt Plc

3,603

06/11/2014

Omega Pharma Belgium NV

Pharma, Medical & Biotech

Belgium

Perrigo Company plc

3,600

09/10/2014

Auxilium Pharmaceuticals, Inc

Pharma, Medical & Biotech

USA

Endo International plc

1,768

11/02/2014

Cadence Pharmaceuticals, Inc

Pharma, Medical & Biotech

USA

Mallinckrodt Plc

878

18/08/2014

Cameron International Corporation (Centrifugal Compression Division)

Industrial & Chemicals

USA

Ingersoll-Rand Plc

635

06/10/2014

Durata Therapeutics, Inc

Pharma, Medical & Biotech

USA

Actavis plc

504

10/12/2014

Industrial Safety Technologies LLC

Industrial & Chemicals

USA

Scott Safety

266

11/10/2014

Vicwest Inc

Industrial & Chemicals

Canada

Kingspan Group Plc; Ag Growth International

261

18 consumer deals taking place in this space.

The food industry is evidently strategically

important to the Irish economy, with over 600

food and drink firms in Ireland exporting to 150

countries. Dealmaking in the space was primarily

driven by Irish food businesses striving for scale

and expansion into new markets. According to

the Department of Agriculture, Food and the

Marine, Ireland exports 85% of the agri-food it

produces, with food and drink exports increasing

12% last year.

16

In one notable example, an agreement between

Irelands Dawn Meats and French farming cooperative Terrena saw the former acquire 49%

of Terrenas beef processing division Elivia.

Commenting on the deal, Dawn Meats CEO Niall

Browne said: Size is a prerequisite to win in

international markets where quality, efficiency

and traceability of meat are essential attributes.

This agreement will bring our two groups the

scale necessary to promote our steady growth in

exports. Dawn Meats second acquisition of 2014,

Deal Value (m)

purchasing UK-based beef processing company

Jaspers, was also driven in part by increasing

European demand.

The concept of co-opetition (whereby

businesses which compete in some arenas cooperate in others) is also an increasing driving

force in the food space. For instance, an EUfunded programme launched in 2013 is helping

to foster co-operation among 90 food and drink

manufacturers based in Ireland, Northern

M&A REVIEW 2014

One striking aspect of Irish outbound activity in

2014 was the prevalence of 500m-plus deals.

There were eight such deals in 2014, making up

9% of total Irish outbound activity, up from 7% in

2013. Furthermore, the number of deals above

500m in 2014 and 2013 combined equalled the

total number from 2008 through 2012.

According to William Fry partner David

Fitzgibbon: The increase in large-cap activity was

undoubtedly driven by recent PMB transactions,

but also demonstrates that Irish businesses have

100%

3

3

11

3

5

15

30

19

23

80%

Percentage

International expansion was also a catalyst

for Irish outbound deals in the industrial and

chemicals sector. In August, rock-drill producer

Mincon announced that it had purchased

majority stakes in three companies worldwide:

Canadas Rotacan and two Australian companies,

ABC Products and Omina Supplies. The three

acquisitions afford Mincon the opportunity to

increase and diversify its product offering and

extend its distribution network, according to CEO

Kevin Barry.

PROPORTION OF OUTBOUND DEAL SPLITS

30

19

16

40

40

2011

2012

<15m

101m-250m

25

251m-500m

17

17

Not disclosed

15m-100m

18

33

60%

>500m

17

40%

20%

44

35

49

40

0%

2009

2010

2013

2014

OUTBOUND DEAL SPLITS, NUMBER OF DEALS

100

Not disclosed

8

80

Number of deals

Ireland and Scotland, with the aim of increasing

exports, particularly to Europe and the US, by

30m. As these businesses find synergies and

seek to grow, we expect to see further crossborder consolidation in the food space.

60

2

3

2

9

40

2

1

20

9

5

1

1

4

7

14

11

22

19

9

4

4

10

13

2009

2010

<15m

15m-100m

101m-250m

251m-500m

1

15

>500m

11

13

24

23

27

2011

2012

2013

35

2014

17

WILLIAM FRY

the means and the appetite to pursue growth on

a competitive scale globally.

2013

Target Countries

In a comparison between outbound M&A activity

in 2013 and 2014, it is clear that Irish companies

were more actively seeking acquisitions in

Europe, with the number of deals increasing from

26 in 2013 to 45 in 2014. The increase in Irish

outbound activity within Europe is the result of

improving fundamentals and increased confidence

among Irish acquirers in Europes economic

recovery, says William Frys David Carthy.

Nonetheless, as in 2013, Irish outbound activity

was predominantly centred on the US in 2014,

with 32 deals worth 75.9bn, representing 36%

of Irish outbound activity by volume as well as

94% of value. While this focus on the US was

likely due in part to inversions, it also reflects

the continued attractiveness of the US as a target

market more generally for Irish corporates.

Irelands interest in the US also reflects a global

readjustment toward rapid-growth markets, with

many companies looking to refocus on developed

powerhouses, notes David Fitzgibbon. Indeed,

unlike 2013, which saw a handful of deals in

18

2014

Volume

Value (m)

USA

16

4,710

United Kingdom

10

210

Australia

Canada

12

Germany

Italy

Netherlands

Volume

Value (m)

USA

32

75,954

United Kingdom

22

432

Denmark

18

Italy

13

Spain

157

656

Sweden

49

Canada

268

Spain

12

France

138

Ukraine

109

Cyprus

60

Bangladesh

Australia

54

Ukraine and Bangladesh, the top ten Irish outbound

destinations for 2014 were all developed economies.

The combination of recovery in mature

economies, a slowdown in emerging markets and

instability across various regions have directed

Irish companies to safer plays in the M&A space.

Target Countries

In addition, the surge in outbound M&A figures

in 2014 indicates renewed confidence among

Irish businesses, underpinned by a rejuvenated

domestic economy and positive macroeconomic

developments globally.

M&A REVIEW 2014

SPOTLIGHT: IRELANDS PRIVATE EQUITY PROFILE

Eavan Saunders

Partner

T. +353 1 639 5208

E. eavan.saunders@williamfry.ie

Private equity in Ireland experienced a welcome

revival in 2014. There were 30 deals with a

combined value of 4.8bn in 2014, compared with

18 deals worth 455m in 2013. In an interesting

comparison with pre-crisis activity levels in this

sector, there were only 18 private equity deals

valued at 581m in 2008.

Private equity firms received record commitments

from investors in 2014, largely due to the

convincing performance from private equity

funds when compared with other investment

opportunities over the past few years. With

additional cash to deploy, European private equity

firms embarked on an increasing number of

buyouts. Crucially, as businesses emerge from

the recession, private equity investors have some

visibility on future earnings, making it easier to set

valuations and negotiate with vendors.

This European trend was mirrored by the Irish

experience, with increased numbers of transactions

and higher price tags. In particular, there was a

dramatic resurgence in the number of buyouts

in 2014, with 22 buyouts totalling 2.8bn. These

volume and value figures were at the highest levels

since 2006, when there were 22 buyouts valued at

6.8bn. Buoyant debt markets and record-low

interest rates have ensured that there is financing

available for buyouts, according to Eavan Saunders,

partner at William Fry.

In 2014, private equity funds appeared eager

to seize the opportunity to tap into Irelands

continuing growth through acquisitions of

high potential companies. For instance, in

mid-2014, the UKs Carlyle Group and Dublinbased Cardinal Capital raised a 292m fund,

the Carlyle Cardinal Ireland Fund, which is

dedicated to growth capital and private equity

buyouts in Ireland. This fund has received a

125m commitment from the Irish National

Pensions Reserve Fund and support from

Enterprise Ireland. According to Robert Easton,

who heads the Carlyle Cardinal team, this

successful fundraising process reflects the

promise in the Irish economy. Additionally, two

other private equity funds, MML Capital Partners

and Australias AMP Capital, have established

Ireland-focused funds over the past few years,

both with commitments from Irish governmental

organisations. All three funds have already made

strategic plays for Irish targets and are actively

targeting similar transactions in the market.

19

WILLIAM FRY

Another encouraging sign has been the

prevalence of buy-and-build transactions in

2014, demonstrating private equity firms focus

on growth among their portfolio companies. For

instance, Greenstar (owned by Cerberus European

Investments) acquired a number of waste

management businesses last year. Also, Valeo

Foods, which is owned by CapVest and Lioncourt

Investments, announced its acquisition of the

Robert Roberts and Kelkin food businesses from

DCC for 60m. Completion of this transaction will

see Valeo Foods adding to its range of food brands

and cementing its position as Irelands leading

ambient food business.

CONTINUED POST-CRISIS TRENDS

Distressed private equity buys were a notable

fixture of the post-crisis Irish M&A landscape.

While there was a decrease in distressed sales

20

TOTAL PRIVATE EQUITY BUYOUTS

25

3000

2500

20

Number of deals

Volume

Value (m)

2000

15

1500

10

1000

5

Value of deals m

Private equity deals of all sizes saw increases

in 2014. There were 13 buyouts under 100m in

2014, compared to eight in the previous year. Also,

while there were no buyouts over 250m in 2013,

there were three such deals in 2014. This scale

of activity demonstrates that private equity firms

were willing to provide growth capital for fastergrowing companies and to pay premiums for more

mature businesses.

500

0

2009

2010

2011

2012

2013

2014

over the second half of 2014, private equity firms

remained keen to acquire distressed assets as they

came to market. The continued trading of nonperforming loans was, in particular, still a distinct

feature in the later part of 2014 and it is clear that

buyers continue to view portfolio loan sales as

representing a good value investment opportunity.

sub-prime mortgage business and focusing on its

core banking and asset management divisions. For

its part, Lonestar focuses on strategic investing

in distressed assets and has already purchased a

number of distressed property loan portfolios in

Ireland, demonstrating its significant commitment

to the Irish market.

In the largest buyout of a formerly trade-owned

company, US-based Lonestar purchased Irelands

Start Mortgages from Investec for 339m. The

deal sees Investec exiting its riskier and struggling

While a number of international private equity

firms made investments in Ireland in 2014,

activity was driven primarily by buyers from two

GEOGRAPHICAL DIMENSIONS

M&A REVIEW 2014

regions: all 15 inbound deals had US or UK-based

acquirers. According to William Fry partner Eavan

Saunders: This is unsurprising, given the high

concentration of global private equity firms in the

US and the UK and the close business and cultural

ties between Ireland and these markets. In one

notable example, US-based KKR Financial Holdings

purchased a minority stake in Irelands Lease

Corporation Internationals (LCI) helicopter unit for

77m. This deal will help the target gain scale and

market share in the helicopter leasing industry.

SECTOR TRENDS

Buyout activity was scattered across a range of

sectors, with the years 22 transactions involving

nine target industries. However, in contrast to

the European experience, where the majority of

private equity deals were seen in industrials and

chemicals, Irelands private equity activity was

concentrated around human capital-intensive

sectors. The computer software space generated

the majority of deals, with four in 2014, and the

deals largely involved smaller target businesses,

with a total deal value of 35m.

Many of these computer software deals were

aimed at helping target companies expand

either their geographical reach or their product

offerings. An example of this was the purchase

of waste technology company AMCS Group by

Highland Capital Partners for 23.5m. After

the announcement, AMCS CEO Jimmy Martin

commented that the deal will enable us to drive

forward our plans to grow our business and expand

our operations in existing and new markets.

The highest value activity was in the business

services sector, with two deals totalling 2.1bn.

The smaller of these deals involves the UKbased BC Partners and Insight Venture Partners

purchasing a stake in CarTrawler for 450m.

There were two deals with an aggregate value

of 351m in the financial services sector, compared

with one deal totalling 102m just a year previously.

Therapeutics, a speciality pharmaceuticals firm,

from DFW Capital and Altiva Capital. Following

completion of the 474m deal, Horizon Pharma

redomiciled in Ireland to take advantage of a more

hospitable business climate and is expected to

become profitable for the first time in 2015.

Buoyant debt markets and record

low-interest rates have ensured

that there is financing available

for buyouts.

BUOYANT EXIT ACTIVITY

In 2014, exit activity had its best performance

since 2008. While there were four exits valued

at 54m in 2013, there were 11 in 2014 which

totalled 4.2bn. All 11 exits saw buyers from

major markets either the US or the UK

buying into Irelands fastest-growing, human

capital-intensive industries: the business

services, computer software and PMB sectors.

In one of the biggest exits of the year, US-based

Horizon Pharma purchased Irelands Vidara

21

WILLIAM FRY

TOTAL EXITS

4,500

12

Volume

4,000

Value (m)

10

3,000

2,500

6

2,000

1,500

Value of deals m

Number of deals

3,500

1,000

2

500

0

0

2009

2010

2011

2012

SECONDARY BUYOUTS

In North America and Europe, secondary buyouts

enjoyed a period of growth post-2009, as private

equity firms struggled to find trade buyers willing

to pay pre-crisis premiums. However, secondary

buyouts remained a small part of Irelands private

equity story and Ireland has only seen a handful

of secondary buyouts over the past 10 years, with

annual combined deal values of less than 400m.

22

2013

For example, in the second-biggest Irish M&A

transaction of the year, Charterhouse Capital

Partners agreed to purchase Skillsoft, an Irelandbased provider of education software, from USbased SSI Investments III for 1.7bn following a

competitive auction process. Educational content

and technology is a space tipped to grow rapidly

over the next few years, with several highprofile private equity transactions taking place

globally in this sector. Since completion of the

transaction, Skillsoft has expanded by acquiring

SumTotal Systems, which specialises in human

capital software.

2014

2014 saw a partial reversal of that trend. While

there were only three secondary buyouts in 2014,

two of these transactions were among the top

ten deals of the year and the combined value

of secondary buyouts totalled 2.2bn. These

secondary buyouts saw private equity firms

challenge for assets which are expected to see

substantial growth.

Based on the strong activity in 2014 and the

diverse drivers underpinning it, we expect the

resurgence in private equity activity to continue

for the coming year. A combination of low

interest rates across Europe and the US and

improved fundamentals in Ireland has provided

private equity firms with the impetus to pursue

opportunities in Ireland. According to the

European Venture Capital Association, 233bn in

investments have been made since 2007, which

suggests that a wave of new deal activity can be

expected in the years ahead.

M&A REVIEW 2014

In addition, global sovereign wealth funds

and public pension funds are also considering

investments which were traditionally the domain

of private equity firms. While this trend is only

beginning to manifest itself in Ireland, we expect

alternative buyers to become more prominent

and to help generate an increase in dealmaking

in 2015.

In terms of exits, 2014s strong showing has

demonstrated that there are buyers, both trade

and institutional, willing to pay premiums for

Irish portfolio companies. We can expect to see

a steady stream of exits and secondary buyouts

in the mid-term. This is likely to provide further

assurance to private equity firms about the longterm health of potential Irish investments, and to

help bolster strong growth in 2015.

A combination of low interest rates across Europe and the US and improved

fundamentals in Ireland has provided private equity firms with the impetus

to pursue opportunities in Ireland.

23

WILLIAM FRY

OUTLOOK

2014s positive momentum is set to continue into

2015, with anticipated M&A activity across a range

of sectors. In contrast to last years edition, when we

reported that a large proportion of activity would be

generated by non-core asset sales, we expect 2015

activity to be generated by businesses seeking key

strategic opportunities to support organic growth.

In our 2013 M&A Review, we also forecasted that

foreign investors would be driving deal flows in

2014. This year, however, we anticipate that M&A

will be driven equally by domestic buyers.

Macroeconomic factors are aligned to support

these predictions. For M&A in Ireland, European

developments such as quantitative easing should

encourage companies to take advantage of

relatively inexpensive finance, with opportunities

for further M&A transactions and leveraged

buyouts. Furthermore, investment in eurozone

countries will likely become more appealing to non

EU-based investors, given the current strength

of other currencies relative to the euro. We are

already seeing proof of this in the level of M&A

activity that has occurred so far in 2015. In the

last months of 2014 and early weeks of 2015, Jazz

Pharmaceuticals has been the subject of takeover

rumours, PMB giant Shire has been targeting

further acquisitions, and CRH agreed to buy assets

of Holcim and Lafarge.

24

2015 SECTOR ACTIVITY

Examining the Mergermarket Heat Chart, which

tracks company for sale stories written over the

past six months, we expect robust activity across

a number of sectors. Of these, leisure is predicted

to be the busiest in 2015. This forecast tallies with

M&A undertaken in 2014, as leisure was one of

the most active industries by volume, and saw

20 announced deals (all with hotels as targets).

Given that this sector is being driven by continuing

dynamics, such as an increasingly healthy property

market, we expect to see similar activity into 2015.

PMB is also set to remain one of the busiest

sectors in 2015. In the third edition of the report

published in 2013, we forecasted that PMB would

continue to move from strength to strength, and

this was reflected in 2014s announced figures.

These findings are unsurprising: according

to IDA Ireland, nine of the worlds ten biggest

pharmaceuticals companies are based in

Ireland, and Ireland is home to approximately 120

pharmaceuticals firms. In addition, in recent years

many pharmaceutical companies globally have

sought to develop more specialised portfolios. They

have done so through a series of acquisitions and

divestments in order to fortify themselves against

emptying pipelines and patent expirations.

TOP M&A DEALS HEAT CHART, 2014

Sector

Leisure

10

Pharma/Med/Biotech

TMT

Business Services

Energy/Mining/Utilities

Industrials/Chemicals

Construction

Consumer

Financial Services

Agriculture

Real Estate

Transportation

Grand Total

46

Hot

Cold

Another key facet of the PMB sector is the

healthcare sub-sector, with the healthcare IT space

in particular experiencing a period of growth. This

is largely due to the broad range of new medical

devices coming to market and increasing demand

for automated records and at-home services.

M&A REVIEW 2014

TMT is also tipped for increased activity. Deal

volume in the sector has increased steadily since

2007, and technology continues to be a key industry,

with computer software one of Irelands busiest

segments for M&A. Ireland is one of Europes

primary technology hubs, with a sizeable number

of the worlds largest technology companies based

in the country. This is in part due to Ireland having

a highly skilled workforce, as well as fostering a

business climate which supports research and

development, evidenced by the successful Web

Summit hosted in Ireland in recent years. With

innovation being fundamental to success in the

technology sector, global firms will continue to

target Irish opportunities.

Private equity activity in Europe is also set to

expand more generally this year, as limited

partners have committed record levels of capital

to general partners. While this has already

contributed to a rise in Irish buyouts in 2014, it will

also likely help generate stronger figures in 2015.

The message from 2014 is clear: the international

business community is recognising the strength

of Irish corporates and the countrys position as

a launchpad into Europe. The data shows that

institutional buyers have confidence in Irelands

growth prospects over the mid-term, and that

strategic buyers are willing to pay the premiums

typically sought by private equity firms.

Further, pro-cyclical industries are set to gain

steam on the back of improving economic

fundamentals. In particular, the consumer sector

should see steady gains in the coming months, with

improving employment figures and low inflation,

leading to more positive consumer sentiment.

Retail Ireland predicts that consumer spending will

increase by 2.7% YoY in 2015, compared to 1.3% in

2014, which should also help to pave the way for

further growth in this sector.

25

WILLIAM FRY

ABOUT THE RESEARCH

The underlying data to this report comes from the Mergermarket database.

Historical data contained in this report includes deals announced from

01/01/2009 to 31/12/2014, excluding lapsed or withdrawn bids or deals

valued below 5m.

Remark, the research and publications division of The Mergermarket Group,

publishes over 60 thought leadership reports and holds over 70 events across

the globe each year which allow clients to demonstrate their expertise and

underline their credentials in a given market, sector or product.

For more information please contact

Jeanne Gautron,

Publisher, Remark EMEA,

The Mergermarket Group

Tel: +44 (0)20 7010 6262 Email: Jeanne.Gautron@mergermarket.com

The Mergermarket Group offers a range of services that give clients the opportunity

to enhance their brand profile, and to develop new business opportunities.

To find out more please visit:

www.mergermarketgroup.com/events-publications/

26

M&A REVIEW 2014

ABOUT WILLIAM FRY

As one of Irelands largest law firms, William Fry offers unrivalled legal and tax

expertise across the full breadth of the business sector. We advise a substantial

number of leading Irish and international companies, covering both the public and

private sector.

With a staff of over 400, the firm operates a large international practice with offices

in Dublin, London, New York and Silicon Valley and regularly acts in cases involving

other jurisdictions, including the United Kingdom, the United States, Asia, the

Netherlands, Germany, France, Spain, Italy, Poland and Eastern Europe.

M&A is core to our practice at William Fry. Our team has top tier credentials, a

wealth of experience and an impressive depth of expertise. We are consistently

involved in the most sophisticated and complex corporate transactions in Ireland,

including large cross-border deals. We focus on identifying and delivering on our

clients priorities.

Recent awards include:

Law Firm of the Year (Irish Law Awards 2014)

Equity Capital Markets Deal of the Year Initial Public Offering (Finance Dublin

Magazines Deals of the Year 2014)

Equity Capital Markets Deal of the Year Refinancing / Restructuring

(Finance Dublin Magazines Deals of the Year 2014)

Best in Corporate Disputes Ireland (Acquisition International 2015)

Recent directory commentary includes:

This team brings a wide range of skills to the table and the quality is

consistently high across all the lawyers. One of the most conscientious firms

I have dealt with. Chambers Europe 2014

William Fry consistently delivers in-depth and accurate legal advice with speed

and cost-effectiveness. Legal 500, EMEA 2014

CONTACTS

Shane ODonnell

Head of Corporate and M&A

T. +353 1 639 5112

E. shane.odonnell@williamfry.ie

Eavan Saunders

Partner

T. +353 1 639 5208

E. eavan.saunders@williamfry.ie

Bryan Bourke

Managing Partner

T. +353 1 639 5106

E. bryan.bourke@williamfry.ie

David Carthy

Partner

T. +353 1 639 5186

E. david.carthy@williamfry.ie

Alvin Price

Chairman

T. +353 1 639 5140

E. alvin.price@williamfry.ie

Stephen Keogh

Partner, Head of London office

T. +44 20 7571 0497

E. stephen.keogh@williamfry.com

Brendan Cahill

Partner

T. +353 1 639 5180

E. brendan.cahill@williamfry.ie

David Fitzgibbon

Partner

T. +353 1 639 5154

E. david.fitzgibbon@williamfry.ie

Myra Garrett

Partner

T. +353 1 639 5122

E. myra.garrett@williamfry.ie

Shane Kelleher

Partner

T. +353 1 639 5148

E. shane.kelleher@williamfry.ie

Ken Casey

Partner

T. +353 1 639 5104

E. ken.casey@williamfry.ie

Ivor Banim

Partner

T. +353 1 639 5158

E. ivor.banim@williamfry.ie

David Cullen

Partner

T. +353 1 639 5202

E. david.cullen@williamfry.ie

Andrew McIntyre

Partner

T. +353 1 639 5184

E. andrew.mcintyre@williamfry.ie

Barbara Kenny

Partner

T. +353 1 639 5146

E. barbara.kenny@williamfry.ie

Adam Synnott

Partner

T. +353 1 639 5108

E. adam.synnott@williamfry.ie

Barry Conway

Partner

T. +353 1 639 5284

E. barry.conway@williamfry.ie

Leo Moore

Partner

T. +353 1 639 5152

E. leo.moore@williamfry.ie

Mark Talbot

Partner

T. +353 1 639 5162

E. mark.talbot@williamfry.ie

Mark Quealy

Partner

T. +353 1 639 5130

E. mark.quealy@williamfry.ie

Joanne Conlon

Partner

T. +353 1 639 5118

E. joanne.conlon@williamfry.ie

Owen OConnell

Consultant

T. +353 1 639 5120

E. owen.oconnell@williamfry.ie

27

DUBLIN LONDON NEW YORK SILICON VALLEY

www.williamfry.ie

The material contained in this publication is provided for information purposes only and does not constitute legal or other professional advice.

It does not take account of specific circumstances and cannot be considered a substitute for specific legal or other professional advice.

2009-2015. William Fry. All rights reserved.

Вам также может понравиться

- Current Investment in the United Kingdom: Part One of The Investors' Guide to the United Kingdom 2015/16От EverandCurrent Investment in the United Kingdom: Part One of The Investors' Guide to the United Kingdom 2015/16Оценок пока нет

- Investment Opportunities in the United Kingdom: Parts 4-7 of The Investors' Guide to the United Kingdom 2015/16От EverandInvestment Opportunities in the United Kingdom: Parts 4-7 of The Investors' Guide to the United Kingdom 2015/16Оценок пока нет

- Submission To Joint Oireachtas Committee On Enterprise 2010Документ17 страницSubmission To Joint Oireachtas Committee On Enterprise 2010DonThornhillОценок пока нет

- Stefan Gerlach: Ireland - From Crisis To RecoveryДокумент8 страницStefan Gerlach: Ireland - From Crisis To RecoveryAléxia DinizОценок пока нет

- GR Deloitte Deleveraging Europe en Noexp PDFДокумент60 страницGR Deloitte Deleveraging Europe en Noexp PDFataktosОценок пока нет

- Symbiosis Internantional University: Country: IrelandДокумент6 страницSymbiosis Internantional University: Country: IrelandMainali GautamОценок пока нет

- M Winkworth: Quality Brand Delivering Quality ResultsДокумент12 страницM Winkworth: Quality Brand Delivering Quality ResultsSXC948Оценок пока нет

- 2014 EY European Insurance Outlook: Unlock New Opportunities, Simplify Existing OperationsДокумент12 страниц2014 EY European Insurance Outlook: Unlock New Opportunities, Simplify Existing Operationsapi-247693317Оценок пока нет

- Ireland's Economic GrowthДокумент8 страницIreland's Economic GrowthMarta PacilliОценок пока нет

- External Sector Analysis of Uk: Exports, Imports and Balance of Payments GoodsДокумент8 страницExternal Sector Analysis of Uk: Exports, Imports and Balance of Payments GoodsPriyanjaliDasОценок пока нет

- DHL/BCC Quarterly International Trade OutlookДокумент28 страницDHL/BCC Quarterly International Trade OutlookDHL Express UKОценок пока нет

- Inside Credit: Private-Equity Owners Lead The European IPO Resurgence As Company Valuations ImproveДокумент11 страницInside Credit: Private-Equity Owners Lead The European IPO Resurgence As Company Valuations Improveapi-227433089Оценок пока нет

- Ireland Upgraded To 'A-' On Improved Domestic Prospects Outlook PositiveДокумент9 страницIreland Upgraded To 'A-' On Improved Domestic Prospects Outlook Positiveapi-228714775Оценок пока нет

- Report by The Comptroller and Auditor General Foreign & Commonwealth of Ce, UK Trade & Investment, VisitBritain, British Council and Cabinet of CeДокумент43 страницыReport by The Comptroller and Auditor General Foreign & Commonwealth of Ce, UK Trade & Investment, VisitBritain, British Council and Cabinet of CeTsunTsunОценок пока нет

- Trade Confidence Index Q4 2011 FINALДокумент16 страницTrade Confidence Index Q4 2011 FINALDHL Express UKОценок пока нет

- Invest in The UK Your Springboard For Global GrowthДокумент64 страницыInvest in The UK Your Springboard For Global GrowthnurОценок пока нет

- Vodafone Annual Report 12Документ176 страницVodafone Annual Report 12josé_rodrigues_86Оценок пока нет

- Dow Jones VentureSource EU 4Q 2015Документ18 страницDow Jones VentureSource EU 4Q 2015CrowdfundInsiderОценок пока нет

- The Yorkshire Report 2012 How Did Yorkshire Do?: Aggregated Accounts For The Region's Top 150 CompaniesДокумент44 страницыThe Yorkshire Report 2012 How Did Yorkshire Do?: Aggregated Accounts For The Region's Top 150 CompaniesKaren C. TriunfoОценок пока нет

- Tax GuideДокумент28 страницTax GuidecharmysticОценок пока нет

- SME Trade Finance Research FinalДокумент70 страницSME Trade Finance Research FinalMikeОценок пока нет

- How Do Private Equity Investors Create ValueДокумент16 страницHow Do Private Equity Investors Create ValueManu DhimanОценок пока нет

- Unilever Market HypothesesДокумент14 страницUnilever Market HypothesesrejinОценок пока нет

- EIB Investment Report 2021/2022 - Key findings: Recovery as a springboard for changeОт EverandEIB Investment Report 2021/2022 - Key findings: Recovery as a springboard for changeОценок пока нет

- INM Annual Report 2011Документ124 страницыINM Annual Report 2011Kivanc GocОценок пока нет

- Markets - Factsheet - Annual Overview of 2012Документ1 страницаMarkets - Factsheet - Annual Overview of 2012Jerimiah DickeyОценок пока нет

- Group of 17Документ40 страницGroup of 17boonagОценок пока нет

- AssignmentДокумент5 страницAssignmentRakhaОценок пока нет

- Vodafone Managing Operations and FinanceДокумент17 страницVodafone Managing Operations and FinanceJames OmuseОценок пока нет

- AEGON Annual Report 2011Документ388 страницAEGON Annual Report 2011Marius RusОценок пока нет

- Labour'S Plan For Enterprise, Innovation and GrowthДокумент18 страницLabour'S Plan For Enterprise, Innovation and GrowthInemie-ebi NiweighaОценок пока нет

- Assignment 1Документ7 страницAssignment 1mariyaОценок пока нет

- European Venture Capital Deal Term Review 2021Документ20 страницEuropean Venture Capital Deal Term Review 2021Tobias TemmenОценок пока нет

- Financial Sanctions q3 2012Документ4 страницыFinancial Sanctions q3 2012EstherTanОценок пока нет

- Financial Statement AnalysisДокумент31 страницаFinancial Statement AnalysisAnna MkrtichianОценок пока нет

- Pre-Q1 2022 Sales Communication: Significant Perimeter ImpactДокумент2 страницыPre-Q1 2022 Sales Communication: Significant Perimeter ImpactBilahari PrasadОценок пока нет

- Ireland RT 2017-1Документ11 страницIreland RT 2017-1imabhinav19738Оценок пока нет

- Financial Review: Summary of Financial PerformanceДокумент5 страницFinancial Review: Summary of Financial PerformanceAlicia Razia HussainОценок пока нет

- 2014 Safe Report - en PDFДокумент170 страниц2014 Safe Report - en PDFionutzz_ianisОценок пока нет

- Case 5Документ4 страницыCase 5Gaurav GoyalОценок пока нет

- C4 Annual Report 2015 PDFДокумент173 страницыC4 Annual Report 2015 PDFMussadaq RaufОценок пока нет

- Fianna Fáil European Election ManifestoДокумент20 страницFianna Fáil European Election ManifestoFFRenewal100% (1)

- Cushman Wakefield What's in Store - European Retail Report Nov 2011 FINALДокумент20 страницCushman Wakefield What's in Store - European Retail Report Nov 2011 FINALBaby SinghОценок пока нет

- The Work of The Export Credits Guarantee Department: House of Commons Trade and Industry CommitteeДокумент37 страницThe Work of The Export Credits Guarantee Department: House of Commons Trade and Industry CommitteeJefferson KabundaОценок пока нет

- Signs of Recovery (2014 Onwards) : Paul HowardДокумент2 страницыSigns of Recovery (2014 Onwards) : Paul Howardashraf07sОценок пока нет

- Savills Market in Minutes (Dec. 2014)Документ2 страницыSavills Market in Minutes (Dec. 2014)vdmaraОценок пока нет

- RothschildДокумент124 страницыRothschildZerohedgeОценок пока нет

- UK Gross Domestic Expenditure On Research and Development 2015 - ONSДокумент21 страницаUK Gross Domestic Expenditure On Research and Development 2015 - ONSsrowbothamОценок пока нет

- 11 05 11 Wolters Kluwer 2011 Trading Update First QuarterДокумент3 страницы11 05 11 Wolters Kluwer 2011 Trading Update First QuartermarkevansexecutionОценок пока нет

- Macroeconomic Submission 2 (Unemployment and Inflation)Документ5 страницMacroeconomic Submission 2 (Unemployment and Inflation)shazОценок пока нет

- ICCOWR2011 Return Growth FinalДокумент12 страницICCOWR2011 Return Growth FinalAlexey KarlovОценок пока нет

- Financial Reporting of BurberryДокумент16 страницFinancial Reporting of BurberrySalman JindranОценок пока нет

- Global Invacom Group Limited Annual Report 2014Документ130 страницGlobal Invacom Group Limited Annual Report 2014WeR1 Consultants Pte LtdОценок пока нет

- EY Attractiveness Survey 2014Документ52 страницыEY Attractiveness Survey 2014Cátia Martins Dos SantosОценок пока нет

- Distressed DebtДокумент60 страницDistressed Debtpoornip89Оценок пока нет

- Private Equity - Trends Around Europe: 14 March 2007Документ31 страницаPrivate Equity - Trends Around Europe: 14 March 2007reba_sОценок пока нет

- Aviva: Corporate Profile September 2011Документ2 страницыAviva: Corporate Profile September 2011Aviva GroupОценок пока нет

- Corporate Profile Oct 2011Документ2 страницыCorporate Profile Oct 2011Aviva GroupОценок пока нет

- The ScaleUp Index 2022 Beauhurst ReportДокумент53 страницыThe ScaleUp Index 2022 Beauhurst ReportIphone SEОценок пока нет

- EC3073 Research PaperДокумент7 страницEC3073 Research PaperAntonin GonzalezОценок пока нет

- Chemistry Important Questions-2015-2016Документ19 страницChemistry Important Questions-2015-2016janu50% (4)

- Read Online 9789351199311 Big Data Black Book Covers Hadoop 2 Mapreduce Hi PDFДокумент2 страницыRead Online 9789351199311 Big Data Black Book Covers Hadoop 2 Mapreduce Hi PDFSonali Kadam100% (1)

- The Palatability, and Potential Toxicity of Australian Weeds To GoatsДокумент163 страницыThe Palatability, and Potential Toxicity of Australian Weeds To Goatsalshokairsaad513Оценок пока нет

- Occupant Response To Vehicular VibrationДокумент16 страницOccupant Response To Vehicular VibrationAishhwarya Priya100% (1)

- Eapp Module 1Документ6 страницEapp Module 1Benson CornejaОценок пока нет

- Supply Chain Analytics For DummiesДокумент69 страницSupply Chain Analytics For DummiesUday Kiran100% (7)

- Does Moore Succeed in Refuting IdealismДокумент5 страницDoes Moore Succeed in Refuting IdealismharryОценок пока нет

- WatsuДокумент5 страницWatsuTIME-TREVELER100% (1)

- Presentation (AJ)Документ28 страницPresentation (AJ)ronaldОценок пока нет

- NIPMR Notification v3Документ3 страницыNIPMR Notification v3maneeshaОценок пока нет

- Victor Nee (Editor) - Richard Swedberg (Editor) - The Economic Sociology of Capitalism-Princeton University Press (2020)Документ500 страницVictor Nee (Editor) - Richard Swedberg (Editor) - The Economic Sociology of Capitalism-Princeton University Press (2020)Tornike ChivadzeОценок пока нет

- Secant Method - Derivation: A. Bracketing MethodsДокумент5 страницSecant Method - Derivation: A. Bracketing MethodsStephen Dela CruzОценок пока нет

- The Impact of Video Gaming To The Academic Performance of The Psychology Students in San Beda UniversityДокумент5 страницThe Impact of Video Gaming To The Academic Performance of The Psychology Students in San Beda UniversityMarky Laury GameplaysОценок пока нет

- Contract Law: Offer & Acceptance CasesДокумент8 страницContract Law: Offer & Acceptance CasesAudrey JongОценок пока нет

- History of AIДокумент27 страницHistory of AImuzammalОценок пока нет

- Neuromarketing EssayДокумент3 страницыNeuromarketing Essayjorge jmzОценок пока нет

- Rosemarie ManlapazДокумент3 страницыRosemarie ManlapazRonald ManlapazОценок пока нет

- Tutorials in Complex Photonic Media SPIE Press Monograph Vol PM194 PDFДокумент729 страницTutorials in Complex Photonic Media SPIE Press Monograph Vol PM194 PDFBadunoniОценок пока нет

- Histology Solution AvnДокумент11 страницHistology Solution AvnDrdo rawОценок пока нет

- Chargezoom Achieves PCI-DSS ComplianceДокумент2 страницыChargezoom Achieves PCI-DSS CompliancePR.comОценок пока нет

- MInor To ContractsДокумент28 страницMInor To ContractsDakshita DubeyОценок пока нет

- 2016 01 15 12 00 22 PDFДокумент26 страниц2016 01 15 12 00 22 PDFABHIJEET SHARMAОценок пока нет

- Outbreaks Epidemics and Pandemics ReadingДокумент2 страницыOutbreaks Epidemics and Pandemics Readingapi-290100812Оценок пока нет

- National ScientistДокумент2 страницыNational ScientistHu T. BunuanОценок пока нет

- Introductory EconomicsДокумент22 страницыIntroductory Economicswedjefdbenmcve100% (1)

- Development Communication Theories MeansДокумент13 страницDevelopment Communication Theories MeansKendra NodaloОценок пока нет

- A Management and Leadership TheoriesДокумент43 страницыA Management and Leadership TheoriesKrezielDulosEscobarОценок пока нет

- 2018 UPlink NMAT Review Social Science LectureДокумент133 страницы2018 UPlink NMAT Review Social Science LectureFranchesca LugoОценок пока нет

- CardiologyДокумент83 страницыCardiologyAshutosh SinghОценок пока нет

- Singular & Plural Nouns: Regular PluralsДокумент4 страницыSingular & Plural Nouns: Regular PluralsМарина ВетерОценок пока нет