Академический Документы

Профессиональный Документы

Культура Документы

What Is Fiscal Policy

Загружено:

nesjyn0 оценок0% нашли этот документ полезным (0 голосов)

21 просмотров2 страницыBriefly explains what fiscal policy is, its purpose, and its advantages and disadvantages.

Оригинальное название

What is Fiscal Policy

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документBriefly explains what fiscal policy is, its purpose, and its advantages and disadvantages.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

21 просмотров2 страницыWhat Is Fiscal Policy

Загружено:

nesjynBriefly explains what fiscal policy is, its purpose, and its advantages and disadvantages.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 2

ECONOMIC ANALYSIS

MIDTERM EXAM

WHAT IS FISCAL POLICY

1. Fiscal Policy comprises decisions made by the government on revenue

collection and spending in order to influence the economic activity of the

country. Based on the work of John Maynard Keynes, taxes and government

spending are adjusted to improve unemployment rates, control inflation rate,

and increase or decrease income.

a. Actually, there are two forms of Fiscal Policy the Expansionary Fiscal

Policy and the Contractionary Fiscal Policy, which have opposing effects on

the economy. In Expansionary Fiscal Policy, taxes are reduced,

government expenditures are increased, and transfer payments are

augmented. In turn, these measures affect the economy by increasing

aggregate demand, thereby stimulating GDP growth or economic growth.

On the other hand, Contractionary Fiscal Policy has the inverse effect to

the economy. Taxes are increased, government spending is reduced, and

transfer payments are decreased. These measures in turn, dampen

economic activity by decreasing aggregate demand and national income.

b. However, a possible ill side effect in the implementation of fiscal policy

particularly Expansionary Fiscal Policy, is that it could cause crowding

out of the private sector. Crowding out creates at least three problems.

First, an expansionary fiscal policy means that the government is using

financial resources that are now longer available for use by individuals and

businesses. If the spending is financed through raising revenue through

taxation, then that means there will be fewer dollars in the pockets of

individuals and businesses to use for spending and investment.

Additionally, if the government is competing for goods and services along

with individuals and business, it may result in increased prices because of

the increase in demand. The problem may be compounded if the

government finances its spending through borrowing. The sheer size of a

government's borrowing may create upward pressure on interest rates as

the private sector and public sector compete for loans. This will make

financing more expensive, which will have a negative effect on private

economic growth. If it costs too much to obtain financing, individuals will

decide not to purchase and businesses will decide not to invest.

c. The main source of funding of the government in the implementation of

Fiscal Policy is from tax revenue collection. However, when government

incurred budgetary deficits, they would resort into borrowing from both

foreign and local sources.

d. Expectations of the private sector businesses and individual consumers,

may be both a disadvantage and advantage to the implementation of

Fiscal policy. Fiscal policy may undermine the confidence of the private

sector and create expectation of future increase in taxes when taxes are

cut, thereby decreasing consumption and causing no change in national

income.

On the other hand, since consumers are becoming wiser, the government

may opt to implement Expansionary Fiscal Contraction or EFC just like

what happened in Ireland. As a result of contractionary measures such as

increasing taxes and lowering government spending, people are

conserving their resources and being wary about their consumption

decisions. If the government is perceived as serious and committed to

reducing deficit spending, it will create expectations that taxes will be

reduced in the future and risk premium on long-term interest rates will

decline. The expectation of future lower interest rates will boost

investments and the expectation of increase in future wealth or income

can further stimulate consumer spending. In short, due to this positive

outlook, economic activity will be potentiated. Consequently, aggregate

demand, employment, and output will intensify.

Вам также может понравиться

- Euro Disney-Bungling A Successful Format-SWOTДокумент3 страницыEuro Disney-Bungling A Successful Format-SWOTnesjyn100% (1)

- Innovation Case ZARAДокумент4 страницыInnovation Case ZARAnesjynОценок пока нет

- PepsiCo in 2008 - Case-Specific Guide QuestionsДокумент1 страницаPepsiCo in 2008 - Case-Specific Guide QuestionsnesjynОценок пока нет

- Google in 2010 - Case-Specific Guide QuestionsДокумент1 страницаGoogle in 2010 - Case-Specific Guide QuestionsnesjynОценок пока нет

- ZARA CaseAnalysisДокумент17 страницZARA CaseAnalysisnesjynОценок пока нет

- Ab InvestmentsДокумент1 страницаAb InvestmentsnesjynОценок пока нет

- The Worst Data Theft Ever, MIS CaseДокумент3 страницыThe Worst Data Theft Ever, MIS CasenesjynОценок пока нет

- What Is Monetary PolicyДокумент2 страницыWhat Is Monetary PolicynesjynОценок пока нет

- Possessive PronounsДокумент2 страницыPossessive PronounsnesjynОценок пока нет

- FS Analysis of BEL and MEGДокумент15 страницFS Analysis of BEL and MEGnesjynОценок пока нет

- Financial Statement Analysis of Philex Mining Corp. and Abra Mining & Industrial Corp.Документ12 страницFinancial Statement Analysis of Philex Mining Corp. and Abra Mining & Industrial Corp.nesjynОценок пока нет

- ForecastingДокумент16 страницForecastingnesjyn0% (1)

- Normal Lab ValuesДокумент4 страницыNormal Lab ValuesnesjynОценок пока нет

- A Study On Typhoid FeverДокумент4 страницыA Study On Typhoid FevernesjynОценок пока нет

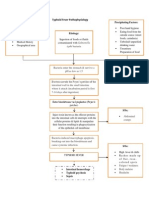

- Typhoid Fever PathophysiologyДокумент1 страницаTyphoid Fever Pathophysiologynesjyn75% (4)

- Gouty Arthritis Health TeachingДокумент14 страницGouty Arthritis Health TeachingnesjynОценок пока нет

- Florence NightingaleДокумент2 страницыFlorence NightingalenesjynОценок пока нет

- Human Anatomy ExamДокумент4 страницыHuman Anatomy ExamnesjynОценок пока нет

- Case Study of Most Common Communicable DiseasesДокумент13 страницCase Study of Most Common Communicable DiseasesnesjynОценок пока нет

- Introduction To AdvertisingДокумент18 страницIntroduction To AdvertisingnesjynОценок пока нет

- Human Ana ReviewerДокумент2 страницыHuman Ana ReviewernesjynОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (120)

- Lecture Notes VII Theories On Government SpendingДокумент6 страницLecture Notes VII Theories On Government SpendingrichelОценок пока нет

- Economics For Decision Making MBA 641Документ25 страницEconomics For Decision Making MBA 641Binyam RegasaОценок пока нет

- Chapter 29 The Monetary System - Some LogicsДокумент3 страницыChapter 29 The Monetary System - Some LogicsMinh Châu Tạ ThịОценок пока нет

- Bbasyllabus 2015-16Документ55 страницBbasyllabus 2015-16Shuvo HasanОценок пока нет

- IMF by RomitДокумент23 страницыIMF by RomitRomit ShahОценок пока нет

- Principles of Macroeconomics by John BoumanДокумент177 страницPrinciples of Macroeconomics by John BoumanUmar Kamal100% (1)

- RBI MoneyKumar ComicДокумент24 страницыRBI MoneyKumar Comicbhoopathy100% (1)

- Applied Economics: Absolute Scarcity Is When A Good Is Scarce Compared To Its Demand. For Example, Coconuts AreДокумент4 страницыApplied Economics: Absolute Scarcity Is When A Good Is Scarce Compared To Its Demand. For Example, Coconuts AreRoma MalasarteОценок пока нет

- Study MaterialsДокумент14 страницStudy MaterialsAnkur DuttaОценок пока нет

- Currency Forecasting A Guide To Fundamental and Technical Models of Exchange Rate Determination PDF DownloadДокумент2 страницыCurrency Forecasting A Guide To Fundamental and Technical Models of Exchange Rate Determination PDF Downloadhidera viops rekona0% (16)

- EEE Final Syllabus 160708Документ78 страницEEE Final Syllabus 160708Siddharth Narayanan ChidambareswaranОценок пока нет

- Chapter 23 Measuring A Nation - S Income (Autosaved)Документ30 страницChapter 23 Measuring A Nation - S Income (Autosaved)Zahra BalqisОценок пока нет

- Exchange Rate Determination in The Short Run: ECON 758 Advanced International EconomicsДокумент12 страницExchange Rate Determination in The Short Run: ECON 758 Advanced International EconomicsdrooldudeabhiОценок пока нет

- Economics Memory MapДокумент37 страницEconomics Memory MapRonit GuravОценок пока нет

- BBA 2nd Sem SyllabusДокумент14 страницBBA 2nd Sem SyllabusPrakash KCОценок пока нет

- Effectiveness of Monetary Policy in KenyaДокумент11 страницEffectiveness of Monetary Policy in KenyaFahmi MuhammadОценок пока нет

- The Big Mac Index For The Year 2000Документ10 страницThe Big Mac Index For The Year 2000Cherylynne EddyОценок пока нет

- GDP and Price Level in The Short RunДокумент37 страницGDP and Price Level in The Short RunAggyapal Singh JimmyОценок пока нет

- Bank Credit Analysis University Study MaterialДокумент116 страницBank Credit Analysis University Study MaterialSekar Murugan100% (2)

- (Econometric Society Monographs) Franklin M. Fisher-Disequilibrium Foundations of Equilibrium Economics-Cambridge University Press (1983)Документ252 страницы(Econometric Society Monographs) Franklin M. Fisher-Disequilibrium Foundations of Equilibrium Economics-Cambridge University Press (1983)Patrick100% (1)

- List of Lending Companies As of 31 MayДокумент81 страницаList of Lending Companies As of 31 MayKim BentirОценок пока нет

- The Nexus Between Foreign Exchange and External Debt in Indonesia Evidence From Linear and Nonlinear ARDL ApproachesДокумент28 страницThe Nexus Between Foreign Exchange and External Debt in Indonesia Evidence From Linear and Nonlinear ARDL ApproachesHospital BasisОценок пока нет

- P Data Extract From World Development IndicatorsДокумент11 страницP Data Extract From World Development IndicatorsMạc Tường VyОценок пока нет

- Monetarism - WikipediaДокумент33 страницыMonetarism - WikipediaEdmund GrahlОценок пока нет

- Guided Notes #2 Great DepressionДокумент1 страницаGuided Notes #2 Great DepressionGiovanni BurkeОценок пока нет

- Azie Eco211 Chap 12007Документ40 страницAzie Eco211 Chap 12007Laila Fajriah0% (1)

- Managerial EconomicsДокумент26 страницManagerial EconomicsMr BhanushaliОценок пока нет

- Introducing Aggregate DemandДокумент1 страницаIntroducing Aggregate DemandMr Aycock100% (1)

- BBA Syllabus PDFДокумент43 страницыBBA Syllabus PDFSuman PandeyОценок пока нет

- Regressive ExpectationsДокумент4 страницыRegressive ExpectationsNavratan ChoudharyОценок пока нет