Академический Документы

Профессиональный Документы

Культура Документы

Finace 7 Months

Загружено:

Saurabh SharmaАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Finace 7 Months

Загружено:

Saurabh SharmaАвторское право:

Доступные форматы

INITIATIVES AND SALIENT ACHIEVEMENTS

IN THE LAST SEVEN MONTHS

28-DECEMBER-2014

MINISTRY OF FINANCE

MAJOR POLICY INITIATIVES, PROGRAMMES/SCHEMES ANNOUNCED AND ACHIEVEMENTS MADE

WITH REGARD TO THE MINISTRY OF FINANCE SINCE THE NEW GOVERNMENT CAME TO POWER

Actions to curb Black Money

on Automatic Exchange of Information

on a fully reciprocal basis, facilitating

present Government after taking

measures, due emphasis on intrusive

exchange of information regarding

over reins of power in May, 2014

enforcement measures in high impact

persons hiding money in offshore cenwas to constitute a Special Investicases with a view to prosecute the

tres.

gating Team (SIT) to implement the

offenders at the earliest possible, for

decision of the Honble Supreme

creating effective deterrence against Legislative measures, wherever reCourt on large amount of money

tax evasion.

quired, including amendment to secstashed abroad by evading taxes or

tion 285BA of the Income-tax Act,

generated through unlawful activi- Joining the global efforts to combat tax

1961 vide Finance (No.2) Act, 2014

evasion,

including

supporting

impleties.

facilitating the Automatic Exchange of

mentation of a uniform global standard

Information.

First major decision taken by the While focusing upon non-intrusive

Pradhan Mantri Jan-Dhan Yojana (PMJDY)

amounting to opening of 7.5 crore ac- RuPay Cards have been issued in

counts by 26th January, 2015. Target

ernment was to launch a major camcase of 7.39 Crore accounts.

has now been revised to opening of 10

paign to open bank accounts. Major

crore accounts by 26th January, 2015 As on 1.12.2014, States of Goa,

achievements have been made with

Kerala, Tripura & Madhya Pradesh,

regard to the implementation of the

A dedicated website for PMJDY

Union Territories of Chandigarh,

Pradhan Mantri Jan-Dhan Yojana

launched

Puducherry and Lakshadweep have

(PMJDY) which was launched by the

achieved 100% Saturation (in terms

Prime Minister on 28th August, As on 23.12.2014, 9.91 Crore acof coverage of all households with at

2014. Target was to open bank accounts have been opened under

least one bank account).

counts of at least one household

PMJDY.

Another major initiative of the Gov-

Varishtha Pension Bima Yojana (VPBY)

The Union Finance Minister Shri The revived scheme will remain open

Arun Jaitley relaunched the Varishtha Pension Bima Yojana (VPBY)

which will benefit the vulnerable section of society with limited resources

and will provide monthly pension

ranging from Rs 500/ to Rs 5,000/

per month to senior citizens of the

country.

during the window stretching from 15th

August, 2014 to 14th August, 2015 for

the benefit of citizens aged 60 years

and above, and will provide financial

security by ensuring regular income

during their advancing years. Like on

the last occasion, the scheme will be

administered by the LIC. The subscrip-

tion to the scheme is likely to create a

corpus of more than Rs. 10,000 crore,

and would thus also be a significant

source of resource mobilization for the

development of the country. About 5

lakh senior citizens are likely to be

covered under this Scheme during the

current year 2014-15.

Direct Benefit Transfer (DBT)

The vision of DBT is to transfer cash

or benefits directly to the beneficiaries accounts, preferably Aadhar

seeded, cutting down several layers

of the intermediaries in order to

achieve timely and more frequent pay- This is also to create transparency

ments, target intended beneficiaries

and accountability in government demore accurately, remove fake, ghost

livery systems and empower beneficibeneficiaries and de duplicate and

aries.

improve efficiency in delivery system.

Page 2

INITIATIVES AND SALIENT ACHIEVEMENTS IN THE

LAST SEVEN MONTHS

Goods and Services Tax

Constitutional Amendment Bill was

introduced in Loksabha in the winter

session to facilitate the introduction

of Goods and Services Tax (GST) in

the country.

of GST that would incentivize tax compliance by traders. It is thus, expected

that introduction of GST will foster a

common and seamless Indian market

and contribute significantly to the

growth of the economy.

The proposed amendments in the

by each of the States & UTs with

Legislatures, as members. The Council will make recommendations to the

Union and the States on important

issues like tax rates, exemptions,

threshold limits, dispute resolution

modalities etc.

Constitution will confer powers both Following are the salient features of this

It is proposed to do away with the

to the Parliament and State legisla- Constitution Amendment Bill:

concept of declared goods of special

tures to make laws for levying GST A new Article 246A is proposed which

importance under the Constitution.

on the supply of goods and services

will confer simultaneous power to Unin the same transaction.

ion and State legislatures to legislate Centre will compensate States for

on GST.

loss of revenue arising on account of

GST will simplify and harmonise the

implementation of the GST for a peindirect tax regime in the country. A new Article 279A is proposed for the

riod up to five years. A provision in

GST will broaden the tax base, and

creation of a Goods & Services Tax

this regard has been made in the

result in better tax compliance due

Council which will be a joint forum of

Amendment Bill (The compensation

to a robust IT infrastructure. Due to

the Centre and the States. This Counwill be on a tapering basis, i.e., 100%

the seamless transfer of input tax

cil would function under the Chairmanfor first three years, 75% in the fourth

credit from one state to another in

ship of the Union Finance Minister and

year and 50% in the fifth year).

the chain of value addition, there is

will have Ministers in charge of Fian in-built mechanism in the design

nance/Taxation or Minister nominated

Kisan Vikas Patra (KVP)

while presenting the Union budget

for 2014-15, the Finance Minister

had announced the re-launch of

the Kisan Vikas Patra (KVP).In

order to meet the commitment, the

Finance Minister re-launched the

Kisan Vikas Patra (KVP) on

18.11.2014 to attract investment of

people for small savings scheme

months, the collections under the

designated branches of nationalised

scheme will be available with the Govt.

banks

for a fairly long period to be utilized in

financing developmental plans of the The certificates can be issued in single or joint names and can be transCentre and State Governments and will

ferred from one person to any other

also help in enhancing domestic houseperson / persons, multiple times.

hold financial savings in the country.

The Kisan Vikas Patras (KVP) will be KVP have unique liquidity feature,

where an investor can, if he so deavailable to the investors in the denomisires, encash his certificates after the

nation of Rs. 1000, 5000, 10,000 and

Reintroduction of Kisan Vikas Patra

lock-in period of 2 years and 6

50,000,

with

no

upper

ceiling

on

invest(KVP) is a welcome step not only in

months and thereafter in any block of

ment.

the direction of providing safe and

six months on pre-determined matursecure investment avenues to the

The certificate can also be pledged as

ity value. The investment made in the

small investors but will also help in

security to avail loans from the banks

certificate will double in 100 months.

augmenting the savings rate in the

and

in

other

case

where

security

is

recountry. The scheme will also safequired to be deposited. Initially the cerguard small investors from fraudutificates will be sold through post oflent schemes.

fices, but the same will soon be made

available to the investing public through

With a maturity period of 8 years 4

Committee to examine un-claimed amount

The Union Finance Minister approved

scheme`s (Small Savings and other

Savings Schemes of banks) with

Post Offices/ Public Sector Banks;

the setting-up of a Committee under

the Chairmanship of Deputy Governor,

Reserve Bank of India(RBI) to exam- Procedure for bringing such unine un-claimed amount remained in

claimed deposits to a common pool

PPF, Post Office, Savings Schemes

to be suggested by the Committee.

etc and recommend how this amount

Changes, if any, required to be

can be used to protect and further the

made in the legal framework may be

financial interest of the senior citizens.

suggested. Committee to also suggest if such a pool should be placed

Based on defined scope, by Reserve

within Government account or outBank of India, estimation of amount

side it.

lying unclaimed under various

Committee to recommend how this

unclaimed amount can be used to

protect and further financial interests

of the senior citizens.

Page 3

INITIATIVES AND SALIENT ACHIEVEMENTS IN THE

LAST SEVEN MONTHS

Expenditure Reforms

The Union Finance Minister also announced during his Budget Speech in

July 2014 to set-up an Expenditure

Management Commission

to

achieve the objective of Minimum Government, MaximumGovernance. The

Commission will look into various aspects of expenditure reforms to be undertaken by the Government. Keeping

that in view, the Government constituted an Expenditure Management

Commission under the Chairmanship

of Shri Bimal Jalan, former Governor

penditure.

of RBI. The Commission will look into

among others rationalisation of subsi- Utmost economy to be observed

in organizing conferences/

dies given by the Government such as

seminars/workshops.

subsidy for food, kerosene, LPG, and

fertilizers etc and give its interim report

Ban on purchase of vehicles .

within current financial year.

Government announced austerity meas- In all cases of air travel, the lowest air fare tickets available for

ures for fiscal prudence and economy:

entitled class to be purchased/

procured.

Every Ministry/department to effect a

mandatory 10% cut in Non-Plan Ex-

Economy and Growth

largely due to constant monitoring and Capital flows particularly investmeasures taken such

in the last two years has grown at 5.5

ment flows have been buoyant in

per cent in the first half of the current

the first half of 2014-15 and there

as delisting of vegetables and perishyear.

has been significant addition to

ables from APMC Act, release of food

the foreign exchange reserves.

grains stocks, fixing of minimum ex Inflation as measured by Consumer

Total Investment

port prices for key commodities.

Price Index is at its lowest ever level in

November 2014 (4.4 per cent) since the

Flows are placed at USD 43.4

Indias external sector is now far more

introduction of the new series in 2011billion in April-October, 2014 as

resilient and robust than before. Cur12.

against USD 9.4 billion in Aprilrent account deficit was 1.9 per cent

October, 2013. Foreign Exchange

of GDP in the first half of 2014-15 as

Wholesale Price Index inflation is 0.0

Reserves stood at US$ 314.7

against 3.1 percent of GDP in the first

per cent for November, 2014, lowest

billion as on December 5, 2014.

half of 2013-14.

since 2009. This has been achieved

GDP growth which was below 5 percent

Tax Collection and Tax Relief

Investment allowance at the rate

of 15 percent to a manufacturing

also been up to the mark and the Govcompany that invests more than

ernment has made net collections of

Rs. 25 crore in any year in new

Direct taxes to the tune of Rs.

plant and machinery.

2,96,802 crore from 1st April-20th

October, 2014. The target for Current

The benefit to be available for

Financial Year has been fixed at Rs.

three years i.e for investments

7,36,221 crore which the Government

upto 31.03.2017. Investment alis quite optimistic to achieve.

lowance to manufacturing company investing more than Rs.100

The Finance Minister while presenting

crore announced last year to con Measures to boost domestic manufacthe Union Budget 2014-15 in Lok

tinue in parallel till 31.03.2015.

turing sector: A number of changes in

Sabha on 10th July, 2014, announced

the customs and excise duty structure

the raising of the personal income-tax

To promote savings rate in the

including rectification of inverted duty

exemption limit by Rs. 50,000/- that is,

economy investment limit under

structure have been made to promote

from Rs. 2 lakh to Rs. 2.5 lakh in the

Public Provident Fund increased

domestic manufacture, attract new incase of individual taxpayers, below

from Rs 1 lakh to Rs 1.5 lakh;

vestment, increase capacity utilization

the age of 60 years, and from Rs. 2.5

& enable domestic value addition in

lakh to Rs. 3 lakh in the case of senior In furtherance of its objective to

sectors, such as electronics & IT, steel,

citizens. However there is no change

improve the efficiency and equity

chemicals & petrochemicals, and rein the rate of surcharge either for the

of the tax system and to promote

newable energy.

corporates or the individuals, HUFs,

voluntary compliance, the emphafirms etc. The budget proposes to

sis of the government has been

As clean energy initiative, Rate of

continue education cess at 3 percent.

for providing a non adversarial tax

Clean Energy Cess, levied on coal,

regime. Accordingly, the Central

lignite and peat, increased from Rs. 50 Investment limit under section 80C of

Board of Direct Taxes has issued

per tonne to Rs. 100 per tonne so as to

the Income-tax Act has also been

detailed instructions to its field

replenish the National Clean Energy

raised from Rs. 1 lakh to Rs. 1.5 lakh

formations to ensure that the digFund for clean environment and energy

and Deduction limit on account of innity of the taxpayers is respected

purposes. Services provided by comterest on loan in respect of self occuwhile dealing with them, no frivomon bio-medical waste treatment facilpied house property raised from

lous demands are raised and no

ity operators for safe disposal of waste

Rs.1.5 lakh to Rs.2 lakh.

unnecessary litigation is continexempted from service tax.

ued.

To incentivize small entrepreneurs an

Indirect Tax Revenue (Provisional) col- Direct tax collections achievement has

lections have increased from Rs

2,69,909 crore in April-October 2013 to

Rs.2,85,126 crore during April-October

2014. Thus an increase of 5.6 % has

been registered during April-October

2014 over the corresponding period in

the previous year. This is an overall

achievement of 45.7% of the target

fixed at BE 2014-15.

Page 4

INITIATIVES AND SALIENT ACHIEVEMENTS IN THE

LAST SEVEN MONTHS

Fillip to the capital goods and automobile sector

In order to provide a fillip to the capital

goods and automobile sector, the

Government has decided to extend

the duty concessions up-to 31st December, 2014. It was expected that

the benefit of these duty concessions

will be passed on to the consumers

at large. The major items covered

under aforesaid duty concessions

include:

cles from 12% to 8%; Mid-segment

cars from 24% to 20%; Large cars

from 27% to 24%; and SUVs from

30% to 24%.

Small cars, motorcycles, scooters,

three wheelers and commercial vehi-

Scheme for Girl Child and Nirbhaya Fund

A scheme exclusively for the girl child

has been notified. The scheme will

provide funds at the stage of

Education and Marriage of the girl

child.

Nirbhaya Fund has been created to

credited in the Fund. As and when the

try of Road Transport and Highschemes from Ministries/Departments

ways Rs. 50,00 crore;

are approved to be funded from

Nirbhaya Fund suitable allocations are Schemes on Backend Integration

of Distress Signal from Victims

done in their respective demands and

with Mobile Vans and Control

the corpus in DEA is reduced by that

Rooms administered by Ministry

amount. Allocation from Nirbhaya Fund

of Home Affairs Rs. 150.00

has been made for the following

crore.

schemes:

ensure dignity and safety of girl children and women. The Fund has been

created as a corpus in public account

in Department of Economic Affairs Scheme on Women Safety on Public

Road Transport administered by Minis(DEA). Rs. 2000/- crore has been

Disinvestment

countability, participation of the people

at a discount. This is likely to imdisinvestment: Government

and raising resources for priority Govprove public participation in the

has disinvested 5% equity in SAIL

ernment social and economic prodisinvestment program.

and realized Rs.1,720 crore. This

grams.

Offer for Sale (OFS) of Shares

Minimum Public Shareholding

through Stock Exchange Mechanism

Making

the

disinvestment

program

norms: In August 2014, SEBI has

was one of the best ever by the Govmore

inclusive:

Earlier

there

was

no

amended the minimum public

ernment in terms of high percent subreservation for retail investors in OFS.

shareholding norms for every

scription and low discount offered.

However, on 8 August, 2014, SEBI has

listed CPSE. After this amendmandated that minimum 10% of the

ment, every listed CPSE has to

Operationalizing the Action Plan on

offer size shall be reserved for retail

increase its public shareholding to

Disinvestment: CCEA approved the

investors in OFS and a discount has

at least 25%, within a period of 3

disinvestment proposals of Coal India

also been made admissible to them.

years. This is likely to give further

Ltd (10% equity), ONGC (5%), NHPC

Subsequent to this amendment in OFS

impetus to disinvestment of

(11.36%), PFC (5%) and REC (5%).

Guidelines, Government has approved

CPSEs with attendant benefits.

Government sees disinvestment of

upto 20% of the offer size being reCPSEs as a tool for realizing their

served for retail investors. Further, reproductive potential, while improving

tail investors may be allocated shares

corporate governance, public ac-

Actual

Swachh Bharat Abhiyan initiatives

Swachh Bharat Kosh (SBK) has been Special provisions made for waste dis-

habitual offenders who indulge in

behaviour not conducive to

cleanliness.

set-up to attract Corporate Social Reposal, especially for e-waste, furniture,

sponsibility (CSR) funds from corpoold news papers, old vehicles etc. A

rate sector and contributions from

quarterly report on waste disposal will

Special drive on awareness creaindividuals and philanthropists in rebe prepared and approved by the Section.

sponse to the call given by Honble

retary.

Prime Minister on 15th August, 2014

to achieve the objective of Clean India Cleanliness committee will be formed to

inspect rooms and to adjudge Cleanest

(Swachh Bharat) by the year 2019,

room of the week/month.

the 150th year of the birth anniversary

of Mahatma Gandhi through Swachh

Separate space on website of departBharat Mission.

ment called Endeavours for Swatchh

Bharat will be kept for hoisting the ac The house keeping activities divided

tivities/events/function there.

into Daily, Weekly and Monthly activities for better implementation and

Action will be taken against offenders/

monitoring.

Вам также может понравиться

- Budget of the U.S. Government: A New Foundation for American Greatness: Fiscal Year 2018От EverandBudget of the U.S. Government: A New Foundation for American Greatness: Fiscal Year 2018Оценок пока нет

- Union BudgetДокумент23 страницыUnion BudgetRamya ChandrasekaranОценок пока нет

- Budget 2019 Notes Made From Budget WebsiteДокумент10 страницBudget 2019 Notes Made From Budget Websitelaxmi bhattОценок пока нет

- Union BudgetДокумент15 страницUnion BudgetagarwaalaaaaОценок пока нет

- Distribution and Expenditures of Philippine National BudgetДокумент92 страницыDistribution and Expenditures of Philippine National Budgetdarlyn avanceОценок пока нет

- Apun Ghar: Home SchemesДокумент6 страницApun Ghar: Home SchemesAnish P DuttaОценок пока нет

- Jagrati Sengar Public Finance CceДокумент25 страницJagrati Sengar Public Finance CceMRS.NAMRATA KISHNANI BSSSОценок пока нет

- Budget Discussion 2011Документ75 страницBudget Discussion 2011arpandalalОценок пока нет

- BudgetДокумент3 страницыBudgetqewqdwfeОценок пока нет

- Feb 2023Документ55 страницFeb 2023TirunamalaPhanimohanОценок пока нет

- 1206purl Weekly-6868Документ17 страниц1206purl Weekly-6868Harish SatyaОценок пока нет

- Key Features of Budget 2014Документ5 страницKey Features of Budget 2014Roxanne AyalaОценок пока нет

- Union Budget 2015-16Документ15 страницUnion Budget 2015-16InvesTrekkОценок пока нет

- Yojana March 2020 FinalДокумент31 страницаYojana March 2020 Finalpaulson arulОценок пока нет

- Macro Business EnvironmentДокумент6 страницMacro Business EnvironmentSBGI MBAОценок пока нет

- Istory of The Company KsfeДокумент16 страницIstory of The Company KsfeAjayanKavilОценок пока нет

- Budget 2012-13Документ44 страницыBudget 2012-13Rashi AgrawalОценок пока нет

- Key Features of Budget 2009-2010: ChallengesДокумент15 страницKey Features of Budget 2009-2010: ChallengesmukhunthanОценок пока нет

- PRESS INFORMATION BUREAU PIB IAS UPSC 1st June To 7th June 2020Документ17 страницPRESS INFORMATION BUREAU PIB IAS UPSC 1st June To 7th June 2020Shivangi SahuОценок пока нет

- Functions of Budget:: Economic FunctionДокумент10 страницFunctions of Budget:: Economic FunctionAli BaigОценок пока нет

- Salient Features of On MSMED ActДокумент6 страницSalient Features of On MSMED ActPraneeth Vel Rock100% (1)

- FIN (Budget)Документ19 страницFIN (Budget)SumitChaturvediОценок пока нет

- Atmanirbhar Bharat Abhiyan - COVID-19 Relief PackageДокумент5 страницAtmanirbhar Bharat Abhiyan - COVID-19 Relief PackageAnish AnishОценок пока нет

- Finance Bill 2011Документ12 страницFinance Bill 2011aparajithakОценок пока нет

- YojanaMarch2020summary Part11586344521 PDFДокумент29 страницYojanaMarch2020summary Part11586344521 PDFVikin JainОценок пока нет

- The Financial Kaleidoscope - July 19 PDFДокумент8 страницThe Financial Kaleidoscope - July 19 PDFhemanth1128Оценок пока нет

- Budget23 24Документ9 страницBudget23 24maheshОценок пока нет

- Union Budget 2015-16Документ20 страницUnion Budget 2015-16HarshitaSinghОценок пока нет

- Final Mic EcoДокумент21 страницаFinal Mic EcoPrajna BhatОценок пока нет

- Ey Budget 2023 Financial SectorДокумент8 страницEy Budget 2023 Financial SectorSanjeedeep Mishra , 315Оценок пока нет

- Tax PlanningДокумент7 страницTax PlanningJyoti SinghОценок пока нет

- Budget Sectoral-Impact-FY20-21Документ12 страницBudget Sectoral-Impact-FY20-21tempofaltuОценок пока нет

- Final Budget 2011Документ25 страницFinal Budget 2011Ubaid KhanОценок пока нет

- Union Budget 2023-24 Lyst3527Документ16 страницUnion Budget 2023-24 Lyst3527shivamatblyОценок пока нет

- Strategic Reforms and Growth InitiativesДокумент24 страницыStrategic Reforms and Growth InitiativesDeshGujaratОценок пока нет

- MOd 8 ScriptДокумент6 страницMOd 8 ScriptJennifer GepanayaoОценок пока нет

- Malawi Bots. Sa. Sa Ref. PPPДокумент25 страницMalawi Bots. Sa. Sa Ref. PPPnanayaw asareОценок пока нет

- Financial Services NewsalertДокумент12 страницFinancial Services NewsalertMilind DhandeОценок пока нет

- Economy This Week (7th Sep To 13th Sep 2020) : 1. Draft Electricity Rules Released (BL 11/9/20)Документ3 страницыEconomy This Week (7th Sep To 13th Sep 2020) : 1. Draft Electricity Rules Released (BL 11/9/20)Sai KushalОценок пока нет

- India Budget Highlights - D N Sharma & Associates - FY14-15Документ29 страницIndia Budget Highlights - D N Sharma & Associates - FY14-15Deepak SharmaОценок пока нет

- Finance: Department of Economic AffairsДокумент8 страницFinance: Department of Economic AffairsPawanYadavОценок пока нет

- JurisTax Budget Brief 2023 2024Документ19 страницJurisTax Budget Brief 2023 2024Defimediagroup LdmgОценок пока нет

- Union Budget: Pragmatic Prudent Populist : Banking & FinancialsДокумент6 страницUnion Budget: Pragmatic Prudent Populist : Banking & FinancialsVikrant MalhotraОценок пока нет

- Bold Step Towards 5 Trillion Economy: CMA Bhogavalli Mallikarjuna GuptaДокумент3 страницыBold Step Towards 5 Trillion Economy: CMA Bhogavalli Mallikarjuna GuptavenkannaОценок пока нет

- Embargoed Until Speech DeliveryДокумент7 страницEmbargoed Until Speech DeliveryEnvironmental CapitalОценок пока нет

- FRBM ActДокумент12 страницFRBM ActjashuramuОценок пока нет

- Key Features of Budget 2011-2012: OpportunitiesДокумент84 страницыKey Features of Budget 2011-2012: OpportunitiesvishwanathОценок пока нет

- Only Rs. 100 Per Month Till The Age of 60 Years. A Worker Joining The Pension Yojana at 18 Years, WillДокумент15 страницOnly Rs. 100 Per Month Till The Age of 60 Years. A Worker Joining The Pension Yojana at 18 Years, WillRAJARAJESHWARI M GОценок пока нет

- 11 - Rao Approaches To Maximize Accountability and MinimizingRisksДокумент15 страниц11 - Rao Approaches To Maximize Accountability and MinimizingRisksJeffrey BrooksОценок пока нет

- Budget PresentatinДокумент29 страницBudget PresentatinhardikgosaiОценок пока нет

- Union Budget 2019: Journal of The Institute of Chartered Accountants of IndiaДокумент3 страницыUnion Budget 2019: Journal of The Institute of Chartered Accountants of IndiaChaitanya KumarОценок пока нет

- Contestación de Rosselló A Carta de La Junta de Control FiscalДокумент8 страницContestación de Rosselló A Carta de La Junta de Control FiscalDiálogoОценок пока нет

- BUDGETДокумент17 страницBUDGETAyushi GuptaОценок пока нет

- 1 Doc 202421304501Документ5 страниц1 Doc 202421304501Brian DixieОценок пока нет

- Scheme GovtДокумент64 страницыScheme GovtharshitaОценок пока нет

- USAID Fiscal Decentralisation Paper16 10 2017Документ32 страницыUSAID Fiscal Decentralisation Paper16 10 2017Tomas KvedarasОценок пока нет

- Aatma Nirbhar Bharat Lyst5425Документ34 страницыAatma Nirbhar Bharat Lyst5425amritОценок пока нет

- Thousands Small Steps 3rd Edition - FinalДокумент44 страницыThousands Small Steps 3rd Edition - FinaljayeshbhandariОценок пока нет

- Strategic Action Plan 2009-2012Документ36 страницStrategic Action Plan 2009-2012LaMine N'tambi-SanogoОценок пока нет

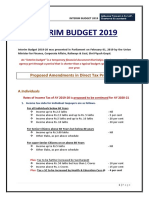

- Interim Budget 2019: Proposed Amendments in Direct Tax ProvisionsДокумент4 страницыInterim Budget 2019: Proposed Amendments in Direct Tax ProvisionsaaОценок пока нет

- Japanese Erotic Fantasies: Sexual Imagery of The Edo PeriodДокумент12 страницJapanese Erotic Fantasies: Sexual Imagery of The Edo Periodcobeboss100% (4)

- Louis I Kahn Trophy 2021-22 BriefДокумент7 страницLouis I Kahn Trophy 2021-22 BriefMadhav D NairОценок пока нет

- B. Contract of Sale: D. Fraud in FactumДокумент5 страницB. Contract of Sale: D. Fraud in Factumnavie VОценок пока нет

- Hudson Legal CV Interview GuideДокумент16 страницHudson Legal CV Interview GuideDanielMead100% (1)

- Slavfile: in This IssueДокумент34 страницыSlavfile: in This IssueNora FavorovОценок пока нет

- Specific Relief Act, 1963Документ23 страницыSpecific Relief Act, 1963Saahiel Sharrma0% (1)

- The Overseas Chinese of South East Asia: Ian Rae and Morgen WitzelДокумент178 страницThe Overseas Chinese of South East Asia: Ian Rae and Morgen WitzelShukwai ChristineОценок пока нет

- Nestle Corporate Social Responsibility in Latin AmericaДокумент68 страницNestle Corporate Social Responsibility in Latin AmericaLilly SivapirakhasamОценок пока нет

- Full Download Fundamentals of Thermodynamics 6th Edition Sonntag Solutions ManualДокумент20 страницFull Download Fundamentals of Thermodynamics 6th Edition Sonntag Solutions Manualadenose.helveo0mvl100% (39)

- Urban Transportation System Design and Feasibility Analysis A Case Study of Lagos Mega-CityДокумент8 страницUrban Transportation System Design and Feasibility Analysis A Case Study of Lagos Mega-CityKaren EstradaОценок пока нет

- Computer Engineering Project TopicsДокумент5 страницComputer Engineering Project Topicskelvin carterОценок пока нет

- Top Notch 1 Unit 9 AssessmentДокумент6 страницTop Notch 1 Unit 9 AssessmentMa Camila Ramírez50% (6)

- Action Plan Templete - Goal 6-2Документ2 страницыAction Plan Templete - Goal 6-2api-254968708Оценок пока нет

- Aradau Security Materiality SDДокумент22 страницыAradau Security Materiality SDTalleres NómadaОценок пока нет

- SaveHinduTemples PDFДокумент7 страницSaveHinduTemples PDFRavi RathoreОценок пока нет

- Posh TTTДокумент17 страницPosh TTTKannanОценок пока нет

- Farhat Ziadeh - Winds Blow Where Ships Do Not Wish To GoДокумент32 страницыFarhat Ziadeh - Winds Blow Where Ships Do Not Wish To GoabshlimonОценок пока нет

- Journey Toward OnenessДокумент2 страницыJourney Toward Onenesswiziqsairam100% (2)

- Compsis at A CrossroadsДокумент4 страницыCompsis at A CrossroadsAbhi HarpalОценок пока нет

- Assignment MS-28 Course Code: MS - 28 Course Title: Labour Laws Assignment Code: MS-28/TMA/SEM - II /2012 Coverage: All BlocksДокумент27 страницAssignment MS-28 Course Code: MS - 28 Course Title: Labour Laws Assignment Code: MS-28/TMA/SEM - II /2012 Coverage: All BlocksAnjnaKandariОценок пока нет

- Admin Law ReviewerДокумент5 страницAdmin Law ReviewerNirvana Time Sulivan Estiva100% (1)

- Military Laws in India - A Critical Analysis of The Enforcement Mechanism - IPleadersДокумент13 страницMilitary Laws in India - A Critical Analysis of The Enforcement Mechanism - IPleadersEswar StarkОценок пока нет

- Allama Iqbal Open University, Islamabad: WarningДокумент3 страницыAllama Iqbal Open University, Islamabad: Warningمحمد کاشفОценок пока нет

- Baggage Handling Solutions LQ (Mm07854)Документ4 страницыBaggage Handling Solutions LQ (Mm07854)Sanjeev SiwachОценок пока нет

- Sally Tour: TOUR ITINRARY With QuoteДокумент2 страницыSally Tour: TOUR ITINRARY With QuoteGuillermo Gundayao Jr.Оценок пока нет

- Final Advert For The Blue Economy PostsДокумент5 страницFinal Advert For The Blue Economy PostsKhan SefОценок пока нет

- 1 s2.0 S0141391023000721 MainДокумент28 страниц1 s2.0 S0141391023000721 MainYemey Quispe ParedesОценок пока нет

- Wine Express Motion To DismissДокумент19 страницWine Express Motion To DismissRuss LatinoОценок пока нет

- Assignment 1Документ3 страницыAssignment 1Bahle DlaminiОценок пока нет

- Ocampo - v. - Arcaya-ChuaДокумент42 страницыOcampo - v. - Arcaya-ChuaChristie Joy BuctonОценок пока нет