Академический Документы

Профессиональный Документы

Культура Документы

Tyco Int Scandal

Загружено:

adam kassamaliИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Tyco Int Scandal

Загружено:

adam kassamaliАвторское право:

Доступные форматы

AUDITING & TAXATION

Course Code: F-209

Submitted To

Mohammad Salahuddin Chowdhury

Lecturer,

Department of Finance,

University of Dhaka

:

Submitted By

Name

Roll

Khaleda Aziz

Akhter-E_Tamanna

16-24

16-102

Md.Rajib Khan

16-134

Sameya Azad

16-152

Mohammad Rasel Mia

16-156

Date of Submission: 17 November 2011

Auditing & Taxation

Tyco international Scandal

November 17, 2011

Mohammad Salahuddin Chowdhury

Lecturer,

Department of Finance,

University of Dhaka.

Subject: Submission of report.

Dear Sir,

We are pleased to submit the report you have assigned to us. The report paper was to

prepare the term paper on the course named Auditing & Taxation course code: F 209,

as a part of our academic activities. This is a report on Tyco International Ltds scandal

for fulfilling course work of BBA program and it is our pleasure to present such before

you.

We have prepared this report based on the data gathered from Internet and newspapers.

For the preparation of the report, we have focused on the information that was found to

be reliable and valid.

We deeply regret for any inconvenience located in this report and we shall always be

available for any clarification required.

Sincerely yours,

Sameya Azad

On behalf of the group 14

Section: B

B.B.A. 16th Batch

Department of Finance

Faculty of Business Studies

University of Dhaka.

2

Auditing & Taxation

Tyco international Scandal

This is high time we conveyed our deepest gratitude and sincere submission to the

Almighty ALLAH for giving us the opportunity to accomplish such an enjoyable task of

preparing this report in time.

We express our thanks to our dear course teacher Mohammad Salahuddin Chowdhury

for assigning us a report dealing with the Tyco International Ltds scandal. In this regard,

we would also like to thank ourselves for our good teamwork and successful team spirit.

Without co-operation and the support from each other, it would not be possible to prepare

a resourceful report.

The presentation of this formal study paper is of a great expectation in our BBA program

and we are quite happy to submit it duly applying that we think should have to be

included. Theoretical knowledge should be valued when it is successfully applied in

practical decision-making scenario. In this respect we found this report a great

opportunity to deal with some progressive methods.

So lastly we would again like to express our heartfelt thanks to our course teacher for

providing the theoretical knowledge and valuable guidelines related to management.

Auditing & Taxation

Tyco international Scandal

Dennis Kozlowski worked all his life to get from the bottom to the top of Tyco

International Ltd. However, he picked up a lavish lifestyle that would soon be his

destruction and bring him behind bars.

After purchasing many art pieces in 2002 the SEC started an investigation and accused

him of failing to pay taxes of about $1 million dollars, but as the investigation proceeded

the case became more complicated as it turned out that CEO Dennis Kozlowski and CFO

Mark Swartz have been looting Tyco International of more than $600 million. Examples

of how this was possible are following:

When Tyco found out about the investigation they fired people involved and also

replaced 10 of the top management positions to regain trust to the stockowner.

Nevertheless the stock price has dropped 86% from $59.31 on 12/28/01 to $8.25 on

7/25/02. Three years later in September 2005 Kozlowski and Schwartz found themselves

in court again after a mistrial in 2004 to face their sentence. They are charged for large

larceny, falsifying business documents and securities fraud. Both are convicted to serve a

minimum of 8 and to 25 years in jail.

The biggest crime that happened here was that Kozlowski and Schwartz abused their

power of control to steal from and lie to the stockowners. The journal Business Week

posted Kozlowski as one of their TOP 25 CEOs in 2000. That is how good people

thought he was. The money that was used to buy houses and silly things like $6000

shower curtains should have been used to push the company further or given to the

shareholders. Is that worse than what the executives did in Enron? No, but bottom line is

stealing is stealing. They believed that Kozlowski was sharing the same ideas and goals

that the company represents as he has proven to them many times when he closed up

million dollar deals that made a fortune for them. Instead he used the company funds like

a private bank and spent it like it was his money. The dishonesty of Kozlowski has caused

more distrust to the public, and of course the stock to drop to a price that is worth

virtually nothing compared to what it used to be. Also Tyco as a company had to endure

many million dollar lawsuits and lost a lot of money to that. I think Tyco did the right

thing by replacing top management right away after the issue occurred. They hired

Edward Breen as their new CEO, who invested a lot of time and money to communicate

to the public that Tyco International is operating in many parts of the world and that they

are trustworthy even though their former CEO failed to do so.

It may be very far away from having the trust of investors again, but they took a step in

the right direction.

Auditing & Taxation

C o n t e n t s

Tyco international Scandal

PAGES

Contents

Contents

Introduction...6

o n t e n tLtds

s ................................................................................................................5

TycoCInternational

scandal..........................................................................................9

PAGES.............................................................................................................................5

Overacts in year 2000........................................................................................................11

Tyco International

Ltds scandal..........................................................................................9

Corporate

scandal of 2002.................................................................................................11

Overacts

in

year

2000........................................................................................................11

Tyco International Ltd.......................................................................................................12

Corporate

scandalCondition

of 2002.................................................................................................11

Analysis

of Financial

and Results of operations...............................................12

Tyco International

Ltd.......................................................................................................12

Company

separations................................................................................................16

Analysis of Financial Condition and Results of operations...............................................12

conclusion17

the year ended September 30, 2002 filed on December 30, 2002.12

Bibliography......................................................................................................................19

Bibliography......................................................................................................................19

Auditing & Taxation

Tyco international Scandal

Origin:

This report is written for Course no.F-209(Auditing &Taxation) which is the part of 4 th

semester 2nd year of B.B.A. program of Finance Department. Moreover report writing is

an important lesson of Auditing and Taxation course thus the report will work as a skill

test of us about report writing. This report is based on Tyco International Ltds scandal.

Objective:

The specific objectives aimed for this report are:

Know about one of the biggest scandal of corporate world TYCOs Scandal

How the corporate scandal occurs.

Who are responsible behind the scandals?

How these scandals affected our International market.

Scope of the report:

The proposed report is one of the biggest corporate scandal Tyco International Ltd.

Scandal.

Methodology:

Our report is based on Secondary Data from internet.

Limitations:

There was no authorization letter with us when we went for collecting information to the

companies. At first they were not agreed enough to give information. We had to pursue

them for that time had passed and we could not form our report well. They think some

information is confidential enough to publish in any journal. As a result they did not give

us the information as details as we wanted. So we had to be satisfied by that information.

Those are the limitations we faced during the formation the report.

Auditing & Taxation

Type

Traded as

Industry

Founded

Headquarters

Products

Revenue

Operating

income

Net income

Employees

Website

Tyco international Scandal

Public

NYSE: TYC

Conglomerate

1960, incorporated 1962

Incorporation:

Schaffhausen,

Switzerland

Operational/Corporate: Princeton,

New Jersey

Security Solutions, Fire Protection

and Flow Control

$18.80 billion USD (2007)[1]

$1,715 million USD (2007)[1]

$1,742 million USD (2007)[1]

106,000 (2010)[2]

www.tyco.com

Tyco International Ltd. NYSE: TYC is a highly diversified global manufacturing

company incorporated in Switzerland, with United States operational headquarters in

7

Auditing & Taxation

Tyco international Scandal

Princeton, New Jersey (Tyco International (US) Inc.). Tyco International is composed

of three major business segments: Security Solutions, Fire Protection and Flow Control.

In June 2007, Tyco concluded a corporate separation that split the company into three

publicly independent companies: Covidien Ltd. (formerly Tyco Healthcare), Tyco

Electronics Ltd. (now TE Connectivity Ltd.) and Tyco International Ltd. (formerly Tyco

Fire & Security and Tyco Engineered Products & Services (TFS/TEPS))

Net revenues by year

Year

2007 2006 2005 2004 2003 2002 2001 2000 1999 1998 1997

Revenue (in US$B) $18.8* $41.0 $39.3 $38.0 $36.8 $35.6 $34.0 $28.9 $22.5 $19.1 $6.6

Tyco International Ltds scandal

8

Auditing & Taxation

Tyco international Scandal

Tyco is a global company, employing over 270,000 people, with $36

billion in annual revenues, that manufactures, distributes and services

products and systems for a broad spectrum of markets, with core

business segments in electronics, telecommunications, healthcare and

specialty products, fire and security services, and flow control. Prior to

July 1997, and a merger with a Bermuda company, a current Tyco

subsidiary, now named Tyco International (US) Inc., was Tycos main

operating company under the name Tyco International Ltd. (Mass.)

(Former Tyco). Tyco has approximately 2,342 subsidiaries, including

non-operating holding companies; the corporate headquarters staff of

Tyco, with fewer than 400 people, is paid through a subsidiary named

TME Management Corp. (TME). Tyco itself, other than in its

subsidiaries, has fewer than 20 employees.

During the period from on or about January 1, 1995, through September 9,

2002, in the County of New York and elsewhere, intentionally engaged in a

scheme constituting a systematic on-going course of conduct with intent

to defraud ten and more persons, to wit, shareholders and regulators, and

to obtain property, to wit money and securities, from ten and more

persons, to wit, Tyco International Ltd. (Bermuda) (Tyco), and its

subsidiaries and predecessors, as well as investors in, prospective

purchasers of, and other acquirers of Tycos securities and debt

instruments by false and fraudulent pretenses, representations, and

promises, and so obtained property from one and more of such persons

while engaged in inducing and promoting the issuance, distribution,

exchange, sale, negotiation and purchase of securities issued by Tyco, as

follows:

Tyco is a publicly-owned corporation, the shares of which are traded on the New York Stock

Exchange. Prior to July 1997, and to a merger with a Bermuda corporation, a Tyco

subsidiary, now named Tyco International (US) Inc., was Tycos main operating company,

and was then a corporation named Tyco International Ltd. (Mass.) (Former Tyco), that

traded on the New York Stock Exchange. For purposes of this count, Tyco hereinafter

includes, unless otherwise indicated, Former Tyco. At all times during the scheme Tyco and

its subsidiaries issued stock and debt instruments whose market value depended on the

"market perception" of how valuable Tyco was. Information material to market perception

includes financial statements issued by the corporation, filings by the corporation with the

United States Securities and Exchange Commission (SEC) and other regulatory bodies,

public statements by corporate officers, press reports, releases, and statements issued by the

corporation, and reports disseminated by ostensibly independent analysts and credit rating

agencies, all of which are required to be accurate and truthful.

Among the matters which Tyco, by its officers, reported to the public, and was required by

law to report publicly were

(1) The compensation paid to Tyco's directors and five highest paid executive officers,

Auditing & Taxation

Tyco international Scandal

(2) The existence of loans outstanding to executive officers and directors, if in amounts

greater than $60,000,

(3) The sales of stock by executive officers and directors, and

(4) Certain related party transactions between Tyco and its directors and officers.

Dennis Kozlowski worked all his life to get from the bottom to the top of Tyco

International Ltd. And when he reached the CEO position he was often compared to other

great CEOs in history like Jack Welch. However, he picked up a lavish lifestyle that

would soon be his destruction and bring him behind bars.

After purchasing many art pieces in 2002 the SEC started an investigation and accused

him of failing to pay taxes of about $1 million dollars, but as the investigation proceeded

the case became more complicated as it turned out that CEO Dennis Kozlowski and CFO

Mark Swartz have been looting Tyco International of more than $600 million. Examples

of how this was possible are following:

Over the years they have been giving themselves interest free loans from the

company and then later on forgave themselves for it through Mark Schwartz

falsifying documents.

Dennis Kozlowski gave himself bonuses to repay the debt.They sold stocks at

inflated prices.

When Tyco found out about the investigation they fired people involved and also

replaced 10 of the top management positions to regain trust to the stockowner.

Nevertheless the stock price has dropped 86% from $59.31 on 12/28/01 to $8.25 on

7/25/02. Three years later in September 2005 Kozlowski and Schwartz found themselves

in court again after a mistrial in 2004 to face their sentence. They are charged for large

larceny, falsifying business documents and securities fraud. Both are convicted to serve a

minimum of 8 and to 25 years in jail.

The biggest crime that happened here was that Kozlowski and Schwartz abused their

power of control to steal from and lie to the stockowners. Given that Tyco was not a case

like Enron where the employees lost everything, it is still very serious. The journal

Business Week posted Kozlowski as one of their TOP 25 CEOs in 2000. That is how

good people thought he was. The money that was used to buy houses and silly things like

$6000 shower curtains should have been used to push the company further or given to the

shareholders. Is that worse than what the executives did in Enron? No, but bottom line is

stealing is stealing. I believe Tyco has only did one thing wrong, trusting their CEO too

much. They believed that Kozlowski was sharing the same ideas and goals that the

company represents as he has proven to them many times when he closed up million

dollar deals that made a fortune for them. Instead he used the company funds like a

private bank and spent it like it was his money. The dishonesty of Kozlowski has caused

more distrust to the public, and of course the stock to drop to a price that is worth

virtually nothing compared to what it used to be. Also Tyco as a company had to endure

many million dollar lawsuits and lost a lot of money to that.

10

Auditing & Taxation

Tyco international Scandal

Overacts in year 2000

On or about May 29, 2000, defendant Kozlowski obtained in excess

of $7,000,000 from Tyco for the purchase of property from Tyco

located at 610 Park Avenue in New York County.

In or about September 11, 2000, defendant Kozlowski caused a

memorandum to issue to forgive the relocation loans for a list of

Tyco employees that included himself and defendant Swartz.

In or about September 2000, defendant Kozlowski told Tycos

Director of Human Resources that the Board of Directors of Tyco had

approved the forgiveness of over $56,000,000 in loans to himself

and other Tyco employees, and the "gross-up" of their income by

more than $39,000,000.

In or about September 2000, defendants Kozlowski and Swartz

authorized a Tyco book entry forgiving loans previously booked as

relocation loans to Tyco employees aggregating in excess of

$56,000,000.

In or about November 2000, defendants Kozlowski and Swartz

caused an illegal special bonus in excess of $8,000,000 to be paid

to defendant Swartz.

Corporate scandal of 2002

Former chairman and chief executive Dennis Kozlowski and former chief financial

officer Mark H. Swartz were accused of the theft of more than $150 million from the

company. During their trial in March 2004, they contended the board of directors

authorized it as compensation.

During jury deliberations, juror Ruth Jordan, while passing through the courtroom,

appeared to make an "okay" sign with her fingers to the defense table. She later denied

she had intended that gesture, but the incident received much publicity (including a

caricature in the Wall Street Journal), and the juror received threats after her name

became public. Judge Michael Obus declared a mistrial on April 2, 2004.

11

Auditing & Taxation

Tyco international Scandal

On June 17, 2005, after a retrial, Kozlowski and Swartz were convicted on all but one of

the more than 30 counts against them. The verdicts carry potential jail terms of up to 25

years in state prison. Kozlowski himself was sentenced to no less than eight years and

four months and no more than 25 years in prison. Swartz received the same sentence.

Then in May 2007, New Hampshire Federal District Court Judge Paul Barbadoro

approved a class action settlement whereby Tyco agreed to pay $2.92 billion to a class of

defrauded shareholders represented by Grant & Eisenhofer P.A., Schiffrin, Barroway,

Topaz & Kessler, and Milberg Weiss & Bershad.

Tyco International Ltd.

Analysis of Financial Condition and Results of

operations

Our results for fiscal 2002 were adversely affected by: decreased

demand, as a result of the overall economic downturn, particularly in

the telecommunications and electronics markets; the termination of

our previously announced plan to separate into four independent

publicly traded companies; rumors and negative publicity; the

resignation of our chief executive officer and chief financial officer; the

replacement of other members of our senior management; the

indictment of former members of our senior management; concern

regarding our ability to maintain compliance with debt covenants and

meet upcoming debt maturities; and the announced investigation

being conducted by the Companys outside counsel. All of these factors

affected employees, customers, vendors and investors. These effects

are continuing. In January 2002, our Board of Directors became aware

of the first of many unauthorized actions that ultimately led to the

resignations of our former chief executive officer and chief financial

officer and the termination of our chief legal officer as well as the

decision not to renominate one of our directors. In September 2002,

our former chief executive officer, chief financial officer and chief legal

officer were each charged with violating New York state criminal law as

a result of their actions. In December 2002, the former director was

charged with, and pleaded guilty to, violating New York state criminal

law as a result of his actions. During the fourth quarter of fiscal 2002,

we announced the hiring of a new chief executive officer, a new chief

financial officer and a new chief legal officer, as well as other key

executives, and also announced the initiation of external and internal

investigations.

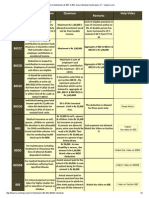

The impact on the Consolidated Statements of Operations,

Consolidated Balance Sheets and Consolidated Statements of Cash

Flow, as a result of the above adjustments, is as follows (in millions,

except per share data).

12

Auditing & Taxation

Tyco international Scandal

The amounts previously reported are derived from the original Form

10-K for the year ended September 30, 2002 filed on December 30,

2002.

13

Auditing & Taxation

Tyco international Scandal

14

Auditing & Taxation

Tyco international Scandal

15

Auditing & Taxation

Tyco international Scandal

16

Auditing & Taxation

Tyco international Scandal

Company separations

An announcement was made publicly on January 13, 2006, that the company would

subdivide into three smaller independent companies.

An official "Separation Management Team" was created to deal with all aspects of the

separation and to make it as smooth as possible for customers, employees, and

shareholders. Bob Scott was announced as its leader.[12] Scott had joined Tyco in 2004.

On June 29, 2007, Tyco completed the share distribution separating the company into

three wholly independent, publicly traded companies, [13][14][15] each with its own board of

directors, CEO, management staff, and financial structure.[16]

The three new companies became:

Covidien Ltd., formerly Tyco Healthcare

Tyco Electronics Ltd., now TE Connectivity

Tyco International Ltd., formerly Tyco Fire & Security and Tyco Engineered

Products & Services (TFS/TEPS)

Edward Breen, CEO of Tyco at the time of the split, announced that he would be staying

on as CEO of the newly structured Tyco International, overseeing TFS/TEPS.

Completing the share distribution, on June 29, shareholders received one common share

each of the two new companies, Covidien and Tyco Electronics, for every four common

shares held of the old Tyco International stock. That July 6, the new Tyco International

issued a one-for-four reverse stock split.

On September 19, 2011, Tyco International Ltd. announced once again that the company

would split into three businesses. ADT North America, to be incorporated in the United

States, would deal with residential security. Other companies incorporated in countries

other than the United States would cover flow control and commercial fire and security.

17

Auditing & Taxation

Tyco international Scandal

Tyco is a global company, employing over 270,000 people, with $36

billion in annual revenues, that manufactures, distributes and services

products and systems for a broad spectrum of markets, with core

business segments in electronics, telecommunications, healthcare and

specialty products, fire and security services, and flow control. Prior to

July 1997, and a merger with a Bermuda company, a current Tyco

subsidiary, now named Tyco International (US) Inc., was Tycos main

operating company under the name Tyco International Ltd. (Mass.)

(Former Tyco). Tyco has approximately 2,342 subsidiaries, including

non-operating holding companies; the corporate headquarters staff of

Tyco, with fewer than 400 people, is paid through a subsidiary named

TME Management Corp. (TME). Tyco itself, other than in its

subsidiaries, has fewer than 20 employees.

Compensation amounting to millions paid to executive officers, loans extended to

executive officers which were later forgiven, related party transactions, certain executives

utilizing Tycos corporate resources to fund personal ventures and property acquisitions,

to increase their own personal wealth. The first trial of Kozlowski and Swartz, who are

accused of looting the company of $600 million, ended in a mis-trial in April 2004.

Prosecutors retrying the men say they'd like to begin proceedings in September 2004.

18

Auditing & Taxation

Tyco international Scandal

19

Auditing & Taxation

Tyco international Scandal

20

Auditing & Taxation

Tyco international Scandal

Bibliography

http://www.forbes.com

http://news.findlaw.com/hdocs/docs/tyco/nykozlowski91202ind.pdf

http://www.tyco.com

21

Вам также может понравиться

- System Analysis and Design CH 1 Flashcards - Quizlet 2Документ6 страницSystem Analysis and Design CH 1 Flashcards - Quizlet 2adam kassamaliОценок пока нет

- Co So Deep Dive March 6 Training 2014Документ79 страницCo So Deep Dive March 6 Training 2014adam kassamaliОценок пока нет

- COSO 2013 ICFR Executive - SummaryДокумент20 страницCOSO 2013 ICFR Executive - SummaryJuanca QuiñonezОценок пока нет

- Systems Analysis and Design - Chapter 1 Flashcards - QuizletДокумент10 страницSystems Analysis and Design - Chapter 1 Flashcards - Quizletadam kassamaliОценок пока нет

- Search Engine Optimization - Wikipedia, The Free EncyclopediaДокумент11 страницSearch Engine Optimization - Wikipedia, The Free Encyclopediaadam kassamaliОценок пока нет

- COSO in The Cyber Age - FULL - r11Документ28 страницCOSO in The Cyber Age - FULL - r11Alexandru VasileОценок пока нет

- Systems Analysis and Design - Chapter 1 Flashcards - QuizletДокумент10 страницSystems Analysis and Design - Chapter 1 Flashcards - Quizletadam kassamaliОценок пока нет

- PIAC-Due Process and Working ProceduresДокумент13 страницPIAC-Due Process and Working Proceduresadam kassamaliОценок пока нет

- Corruption in Multinational Organizations. The Rise and Fall of Tyco CEO.Документ9 страницCorruption in Multinational Organizations. The Rise and Fall of Tyco CEO.darrenmlindo9888Оценок пока нет

- IAASB FactSheetДокумент2 страницыIAASB FactSheetadam kassamaliОценок пока нет

- IAASB Brief HistoryДокумент4 страницыIAASB Brief Historyadam kassamaliОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- PAS 1 With Notes - Pres of FS PDFДокумент75 страницPAS 1 With Notes - Pres of FS PDFFatima Ann GuevarraОценок пока нет

- Chapter 02, Modern Advanced Accounting-Review Q & ExrДокумент28 страницChapter 02, Modern Advanced Accounting-Review Q & Exrrlg481495% (20)

- Petition For Extrajudicial Foreclosure (Template)Документ6 страницPetition For Extrajudicial Foreclosure (Template)RA MlionОценок пока нет

- Blcok-4 MCO-7 Unit-2 PDFДокумент17 страницBlcok-4 MCO-7 Unit-2 PDFSoitda BcmОценок пока нет

- Magoyag vs. MaruhomДокумент7 страницMagoyag vs. MaruhomcaloytalaveraОценок пока нет

- Easy Chart of Deductions U - S 80C To 80U Every Individual Should Aware of ! - TaxworryДокумент2 страницыEasy Chart of Deductions U - S 80C To 80U Every Individual Should Aware of ! - Taxworrytiata777Оценок пока нет

- ACC 102 Chapter 14 Review QuestionsДокумент2 страницыACC 102 Chapter 14 Review QuestionsKaitlyn MakiОценок пока нет

- Pablo P. Garcia V. Yolanda Valdez Villar G.R. No. 158891, June 27, 2012, J. Leonardo-DecastroДокумент2 страницыPablo P. Garcia V. Yolanda Valdez Villar G.R. No. 158891, June 27, 2012, J. Leonardo-DecastroBianca Nerizza A. Infantado IIОценок пока нет

- SMCH 16Документ20 страницSMCH 16FratFoolОценок пока нет

- Advocates For Truth in Lending, Inc. & Olaguer v. Banko Sentral Monetary BoardДокумент6 страницAdvocates For Truth in Lending, Inc. & Olaguer v. Banko Sentral Monetary BoardNoemi MejiaОценок пока нет

- Application Form For Vehicle Car LoanДокумент9 страницApplication Form For Vehicle Car LoanAbhishekGautamОценок пока нет

- CH 07Документ8 страницCH 07Saleh RaoufОценок пока нет

- Importance of Time Value of Money in Financial ManagementДокумент16 страницImportance of Time Value of Money in Financial Managementtanmayjoshi969315Оценок пока нет

- Financial Statements AnalysisДокумент97 страницFinancial Statements AnalysisAshutosh Kumar Dubey0% (1)

- Suggested Quey4uujjrstions For Advance Assignment To StudentsДокумент3 страницыSuggested Quey4uujjrstions For Advance Assignment To StudentsDendy FebrianОценок пока нет

- Session 8 and 9 Money, Money Supply, and Money DemandДокумент86 страницSession 8 and 9 Money, Money Supply, and Money DemandhmsbegaleОценок пока нет

- ExpertsAcademy 2 BlueprintДокумент45 страницExpertsAcademy 2 Blueprintmibaruka4546100% (3)

- Project Report Format For LoanДокумент7 страницProject Report Format For LoanSunil Aherkar67% (3)

- Marshall PlanДокумент22 страницыMarshall Planapi-26307249Оценок пока нет

- Certificate in Advanced Business Calculations: ASE3003 Level 3 Thursday 8 November 2012 Time Allowed: 3 HoursДокумент5 страницCertificate in Advanced Business Calculations: ASE3003 Level 3 Thursday 8 November 2012 Time Allowed: 3 HoursGloria WanОценок пока нет

- Novogratz Berhad 2014 Financials and Tax CalculationДокумент3 страницыNovogratz Berhad 2014 Financials and Tax CalculationMohd NuuranОценок пока нет

- Colt Request FormДокумент1 страницаColt Request FormAmmoLand Shooting Sports NewsОценок пока нет

- Chapter-5 - Financial Aspect RevisedДокумент17 страницChapter-5 - Financial Aspect RevisedCM Lance75% (4)

- JKMS Business Loan ApplicationДокумент3 страницыJKMS Business Loan Applicationgerhard greylingОценок пока нет

- Research Project On SHG 5Документ15 страницResearch Project On SHG 5ashan.sharmaОценок пока нет

- Name: Le Duy Khang Sid: s3881714Документ3 страницыName: Le Duy Khang Sid: s3881714Lê Duy KhangОценок пока нет

- Cfsa2 PDFДокумент706 страницCfsa2 PDFravikumarОценок пока нет

- Rec Center News Sun City West Feb 09Документ24 страницыRec Center News Sun City West Feb 09Del Webb Sun Cities MuseumОценок пока нет

- JjyvДокумент2 страницыJjyvTk KimОценок пока нет