Академический Документы

Профессиональный Документы

Культура Документы

197 - Excess Contribution and Deposit Correcti..

Загружено:

tdrkАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

197 - Excess Contribution and Deposit Correcti..

Загружено:

tdrkАвторское право:

Доступные форматы

Excess Contribution and Deposit Correction Request Form

Please consult a tax advisor before making a distribution / withdrawal to determine any possible tax implications. Please contact your Employer for

any questions related to Employer Initiated Contributions via payroll as your Employer must initiate correction requests for these transactions.

PART 1: Optum Bank Contact Information

By Mail:

By Fax:

Questions?

Optum Bank

P.O. Box 271629

Salt Lake City, UT 84127

1-866-314-9795

Please refer to the phone number on the back of your Debit Card.

Customer Service Professionals are available from 8 a.m. to 8 p.m.

Eastern time to assist you.

IMPORTANT NOTE: PLEASE DO NOT PROVIDE ANY CARD INFORMATION ON THIS FORM AS FORMS WITH DEBIT CARD NUMBERS

WILL NOT BE PROCESSED AND WILL BE DESTROYED FOR YOUR PROTECTION.

PART 2: Optum Bank Account Holder Information Please print and complete all fields

Account Holder Name:

Social Security #:

Optum Bank Account #:

Daytime Telephone #:

PART 3: Withdrawal / Distribution Type Required

Please choose one of the following:

Excess contribution refund. (Refund of money that was deposited in excess of my maximum contribution limit.)

Tax Year Excess Contribution Occurred:

Excess Contribution Amount:

Please note, in addition to the excess return amount, a $20.00 Excess Contribution Fee will be deducted from your

account. If the excess occurred for multiple years please list each year and the corresponding amount.

Correction for a previous INDIVIDUAL contribution deposited in error.

Deposit Date:

Deposit Amount:

Please note, in addition to the correction amount, a $10.00 Official Check Fee will be deducted from your account. This

correction cannot be utilized for funds initiated by an Employer or Third Party. If multiple deposits occurred please list

each deposit date and the corresponding amount.

Individual Contribution tax year correction. (Change INDIVIDUAL contribution from one tax reporting year to another.

Deposit Date:

Deposit Amount:

Tax Year Funds WERE Applied to:

Tax Year Funds SHOULD Apply to:

Please note this correction can result in a corrected 5498-SA. This correction cannot be utilized for funds initiated by an

Employer or Third Party. If multiple deposits occurred please list each deposit date and the corresponding amount.

Note: Funds will be returned via check to the address on file for your Health Savings Account.

PART 4: Account Holder Authorization

Due to the important tax consequences when correcting transactions in an HSA, I have been advised to seek the advice of a legal or tax professional. All information

provided by me herein is true and correct and may be relied on by Optum Bank. I assume full responsibility for this transaction and any consequences resulting from

this correction including taxes and penalties owed.

X

Signature of Account Holder

2013 Optum Bank, Member FDIC. All Rights Reserved.

197 01/13

Date

Вам также может понравиться

- Special Instructions:: Check-O-Matic AuthorizationДокумент2 страницыSpecial Instructions:: Check-O-Matic AuthorizationMinh HuynhОценок пока нет

- Notes: Mandatory Electronic Filing and Payment of Income TaxДокумент8 страницNotes: Mandatory Electronic Filing and Payment of Income TaxJose AlexanderОценок пока нет

- QC 16161Документ12 страницQC 16161john englishОценок пока нет

- Ir524 PDFДокумент2 страницыIr524 PDFTiffany Morris0% (1)

- Direct Deposit FormДокумент3 страницыDirect Deposit FormRabindra ShakyaОценок пока нет

- F 9465Документ3 страницыF 9465Pat PlanteОценок пока нет

- Membership Update FormДокумент4 страницыMembership Update FormbmapiraОценок пока нет

- GEK Termination FormДокумент2 страницыGEK Termination Formmobla007Оценок пока нет

- FSA Enrollment Form - English PDFДокумент1 страницаFSA Enrollment Form - English PDFLupita MontalvanОценок пока нет

- Standing Instruction Form Through IndusInd Bank Account-2Документ1 страницаStanding Instruction Form Through IndusInd Bank Account-2SonuОценок пока нет

- Ag 501Документ2 страницыAg 501Cindy FazzinoОценок пока нет

- UntitledДокумент5 страницUntitledsubhajit sahaОценок пока нет

- Account Opening Form and Investment FormДокумент5 страницAccount Opening Form and Investment FormEngr Muhammad Talha IslamОценок пока нет

- How Did The Income Tax Start?: Irs - GovДокумент6 страницHow Did The Income Tax Start?: Irs - GovApurva BhargavaОценок пока нет

- Cigna Claim FormДокумент2 страницыCigna Claim FormLoganBohannonОценок пока нет

- Absa Consultants and Actuaries Afrimat Pension Fund (Withdrawal) - 101456903 PDFДокумент3 страницыAbsa Consultants and Actuaries Afrimat Pension Fund (Withdrawal) - 101456903 PDFAlvin JantjiesОценок пока нет

- New Balance CR$800.00 Minimum Payment Due $0.00 Payment Not RequiredДокумент6 страницNew Balance CR$800.00 Minimum Payment Due $0.00 Payment Not RequiredKevin Diaz100% (1)

- EFT Form - Fillable - LifeДокумент2 страницыEFT Form - Fillable - LifeZachОценок пока нет

- ITR1 - Part 4 (Let Us File The Return)Документ2 страницыITR1 - Part 4 (Let Us File The Return)gaurav gargОценок пока нет

- IRS EFTPS InstructionsДокумент12 страницIRS EFTPS InstructionsLeon Hormel100% (2)

- Care Credit AppДокумент7 страницCare Credit AppwvhvetОценок пока нет

- Waver Application To Recovery OfficerДокумент3 страницыWaver Application To Recovery Officershahsharada11Оценок пока нет

- Occupational Tax and Registration Return For Wagering: Type or PrintДокумент6 страницOccupational Tax and Registration Return For Wagering: Type or Printrobertledoux2Оценок пока нет

- In-Service Withdrawal FormДокумент1 страницаIn-Service Withdrawal FormlanzahouseОценок пока нет

- Meaning of National AnthemДокумент1 страницаMeaning of National Anthemmanishchaudhry73Оценок пока нет

- STMNT 112013 9773Документ3 страницыSTMNT 112013 9773redbird77100% (1)

- Printapplication GE SSДокумент8 страницPrintapplication GE SSmgworkОценок пока нет

- Guideline For GRIPSДокумент5 страницGuideline For GRIPSBishwakarma SahОценок пока нет

- Application and Credit Card Account Agreement: 1. APPLICANT INFORMATION: Please Tell Us About YourselfДокумент8 страницApplication and Credit Card Account Agreement: 1. APPLICANT INFORMATION: Please Tell Us About Yourselfsaxmachine1411Оценок пока нет

- Account Activity: Mar 18-Apr 19, 2011Документ3 страницыAccount Activity: Mar 18-Apr 19, 2011Yusuf OmarОценок пока нет

- Form 5 - Application To Withdraw or Transfer Money From An Ontario Locked-In AccountДокумент6 страницForm 5 - Application To Withdraw or Transfer Money From An Ontario Locked-In AccountDimitrios LatsisОценок пока нет

- University National Bank ("Bank") Refund Transfer Application and AgreementДокумент6 страницUniversity National Bank ("Bank") Refund Transfer Application and AgreementMètrès Rosie-Rose AimableОценок пока нет

- BIR Form 0605 UsesДокумент4 страницыBIR Form 0605 UsesCykee Hanna Quizo LumongsodОценок пока нет

- Direct Deposit FormДокумент3 страницыDirect Deposit FormSreenivas RaoОценок пока нет

- How To Request Direct DepositДокумент1 страницаHow To Request Direct DepositalithebigbossОценок пока нет

- Instructions For Form 941: (Rev. January 2011)Документ9 страницInstructions For Form 941: (Rev. January 2011)Ten TendulkarОценок пока нет

- TRP Change Ownership FormДокумент2 страницыTRP Change Ownership Formambasyapare1100% (1)

- 27four Tax Free Savings New Investment FormДокумент8 страниц27four Tax Free Savings New Investment FormLord OversightОценок пока нет

- California Excise Taxes Permit Application: Boe 400 Eti Rev. 7 (1 10)Документ8 страницCalifornia Excise Taxes Permit Application: Boe 400 Eti Rev. 7 (1 10)Anonymous UUUcrNОценок пока нет

- IT-AE-36-G01 - Quick Guide On How To Complete The IT12EI Return For Exempt Organisations - External GuideДокумент13 страницIT-AE-36-G01 - Quick Guide On How To Complete The IT12EI Return For Exempt Organisations - External GuideThapeloОценок пока нет

- DR 15 NДокумент8 страницDR 15 Napi-114866560Оценок пока нет

- 2011 Health Saver Form FinalДокумент2 страницы2011 Health Saver Form FinalsaprefОценок пока нет

- Payment Information Summary of Account ActivityДокумент3 страницыPayment Information Summary of Account ActivityTyrone J PalmerОценок пока нет

- Offer in Compromise: Form 656 BookletДокумент28 страницOffer in Compromise: Form 656 BookletAnonymous JRunUFTMbОценок пока нет

- 1040 Exam Prep: Module II - Basic Tax ConceptsОт Everand1040 Exam Prep: Module II - Basic Tax ConceptsРейтинг: 1.5 из 5 звезд1.5/5 (2)

- GFIS-188 - : Pershing Federal Funds Wire RequestДокумент1 страницаGFIS-188 - : Pershing Federal Funds Wire RequestEdwardОценок пока нет

- SIP Registration RenewalForm Dec15Документ2 страницыSIP Registration RenewalForm Dec15singenaadamОценок пока нет

- To Make A Redemption/Switch and Modify Address/Contact DetailsДокумент1 страницаTo Make A Redemption/Switch and Modify Address/Contact DetailsSeetha ChimakurthiОценок пока нет

- 10 Must-Do Things While Filing Your Income Tax Return: Print Email Bookmark/Share Save CommentДокумент3 страницы10 Must-Do Things While Filing Your Income Tax Return: Print Email Bookmark/Share Save CommentShyamala BabuОценок пока нет

- Application For Refund of Educational Contributions: (VEAP, Chapter 32, Title 38, U.S.C.)Документ2 страницыApplication For Refund of Educational Contributions: (VEAP, Chapter 32, Title 38, U.S.C.)Emette E. MasseyОценок пока нет

- Discharge Authority BankWest 5.10.12Документ2 страницыDischarge Authority BankWest 5.10.12ganguly147147Оценок пока нет

- P1 WD Document 6Документ16 страницP1 WD Document 6Magda Cruz BarretoОценок пока нет

- Thrift Savings Plan TSP-1-C: Catch-Up Contribution ElectionДокумент2 страницыThrift Savings Plan TSP-1-C: Catch-Up Contribution ElectionIonut NeacsuОценок пока нет

- Occupational Tax and Registration Return For Wagering: Type or PrintДокумент6 страницOccupational Tax and Registration Return For Wagering: Type or Printdfasdfas1Оценок пока нет

- The Delta Chi Fraternity, IncДокумент4 страницыThe Delta Chi Fraternity, IncKevin CammОценок пока нет

- Liberty Tax HomeworkДокумент9 страницLiberty Tax Homeworkbttvuxilf100% (1)

- Statement Apr 2012Документ14 страницStatement Apr 2012ksj5368100% (2)

- Baroda Pioneer Transaction FormДокумент2 страницыBaroda Pioneer Transaction FormAjith MosesОценок пока нет

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCОт EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCРейтинг: 4 из 5 звезд4/5 (5)

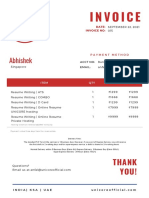

- Unicore InvoiceДокумент1 страницаUnicore InvoiceUNICORE No.1 Resume Writer in IndiaОценок пока нет

- NBP Gomal Uni InternshipДокумент94 страницыNBP Gomal Uni InternshipahmadОценок пока нет

- Universiti Teknologi Mara Final Assessment: Confidential 1 CS/FEB 2022/MAT112Документ6 страницUniversiti Teknologi Mara Final Assessment: Confidential 1 CS/FEB 2022/MAT112MARLINDAH RAHIMОценок пока нет

- Welcome To HDFC Bank NetBanking 1 PDFДокумент2 страницыWelcome To HDFC Bank NetBanking 1 PDFArup GhoshОценок пока нет

- Indias Leading BFSI Companies 2017Документ244 страницыIndias Leading BFSI Companies 2017rohit sharma100% (1)

- Appendix A: Organizational Chart of DBBL Head Office: Dutch Bangla Bank LTDДокумент2 страницыAppendix A: Organizational Chart of DBBL Head Office: Dutch Bangla Bank LTDMasud Khan ShakilОценок пока нет

- Regulatory Framework For Business Transactions: Atty. Kenneth B. Fabila, CPAДокумент95 страницRegulatory Framework For Business Transactions: Atty. Kenneth B. Fabila, CPAKris Van HalenОценок пока нет

- Credit Risk Management: Prof. Ashok ThampyДокумент55 страницCredit Risk Management: Prof. Ashok ThampyRohan JainОценок пока нет

- 1 4922668794851099327Документ3 страницы1 4922668794851099327Adjei SamuelОценок пока нет

- Bank ReconciliationДокумент6 страницBank ReconciliationnikОценок пока нет

- Your Business Fundamentals Checking: Account SummaryДокумент10 страницYour Business Fundamentals Checking: Account SummaryLando SimmondsОценок пока нет

- KFS - Doc - Mon Sep 05 2022 19 - 03 - 51 GMT+0400 (Gulf Standard Time)Документ3 страницыKFS - Doc - Mon Sep 05 2022 19 - 03 - 51 GMT+0400 (Gulf Standard Time)Abdul QadirОценок пока нет

- Aqeeq-Far East - Special DirectДокумент2 страницыAqeeq-Far East - Special DirectRyan DarmawanОценок пока нет

- Transactions May23Документ1 страницаTransactions May23John FarrellОценок пока нет

- General Banking LawДокумент62 страницыGeneral Banking LawKristine FayeОценок пока нет

- Chapter - 1 Reserve Bank of India Act, 1934Документ13 страницChapter - 1 Reserve Bank of India Act, 1934arushiОценок пока нет

- Bank of BarodaДокумент14 страницBank of BarodaSimran MehrotraОценок пока нет

- Kokila Lavanya (Financial A.Y 22-23)Документ1 страницаKokila Lavanya (Financial A.Y 22-23)mexop31426Оценок пока нет

- Making Suspense Payments: Consider The Following ExampleДокумент2 страницыMaking Suspense Payments: Consider The Following Exampleanoop kumarОценок пока нет

- Time Value of Money Analysis 2Документ26 страницTime Value of Money Analysis 2nabilanabelsОценок пока нет

- Reserve Bank of India (RBI)Документ5 страницReserve Bank of India (RBI)Deepanwita SarОценок пока нет

- Va HomeДокумент17 страницVa Homeapi-235677343Оценок пока нет

- Four Green Houses... One Red HotelДокумент325 страницFour Green Houses... One Red HotelDhruv Thakkar100% (1)

- Market Insight Credit Strategies End CycleДокумент4 страницыMarket Insight Credit Strategies End CycledhyakshaОценок пока нет

- Accounting Treatment of Import PurchaseДокумент3 страницыAccounting Treatment of Import PurchasePallavi ChawlaОценок пока нет

- Deposit Analysis of Nepal SBI Bank LTDДокумент37 страницDeposit Analysis of Nepal SBI Bank LTDParash RanjitОценок пока нет

- Axis BankДокумент123 страницыAxis BankKaranPatilОценок пока нет

- Company Name and Logo: Address 1 Address 2 Address 3 Address 4 Address 5Документ2 страницыCompany Name and Logo: Address 1 Address 2 Address 3 Address 4 Address 5Nadiia AvetisianОценок пока нет

- 7 - Co-Operative AccountingДокумент4 страницы7 - Co-Operative AccountingGaurav Chandrakant100% (1)

- Tax Invoice No. 540: DescriptionДокумент1 страницаTax Invoice No. 540: DescriptionMariam BaldeОценок пока нет