Академический Документы

Профессиональный Документы

Культура Документы

Salah Satu Penelitian Mengenai Gaya Hidup

Загружено:

rifqi khairul anamОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Salah Satu Penelitian Mengenai Gaya Hidup

Загружено:

rifqi khairul anamАвторское право:

Доступные форматы

Life Style Patterns and Commercial Bank Credit Card Usage

Author(s): Joseph T. Plummer

Source: Journal of Marketing, Vol. 35, No. 2 (Apr., 1971), pp. 35-41

Published by: American Marketing Association

Stable URL: http://www.jstor.org/stable/1249914

Accessed: 02-10-2015 03:20 UTC

Your use of the JSTOR archive indicates your acceptance of the Terms & Conditions of Use, available at http://www.jstor.org/page/

info/about/policies/terms.jsp

JSTOR is a not-for-profit service that helps scholars, researchers, and students discover, use, and build upon a wide range of content

in a trusted digital archive. We use information technology and tools to increase productivity and facilitate new forms of scholarship.

For more information about JSTOR, please contact support@jstor.org.

American Marketing Association is collaborating with JSTOR to digitize, preserve and extend access to Journal of Marketing.

http://www.jstor.org

This content downloaded from 175.111.89.8 on Fri, 02 Oct 2015 03:20:55 UTC

All use subject to JSTOR Terms and Conditions

Life

and

Patterns

Style

CommercialBank

JOSEPH T. PLUMMER

Are commercial bank card

users more involved in community activities? Are male

and female users interested

in new trends? What role do

charge cards play in the

user's life style? What are

the aspirations of card users?

Life style research is utilized

in this study to provide new

insights into ways of marketing and advertising bank

charge cards.

Credit

Card

Usage

OMMERCIALbank charge cards are being used by more

American consumers in their purchasing behavior than ever

before. The two major bank credit cards-Master Charge and

Bank Americard-are issued by over 6,000 banks, and each claims

slightly more than 20 million holders.1 The number of users of

bank credit cards is steadily on the increase and has become an

area of consumer behavior that has received recent attention in

the marketing literature.

Two studies by Professors Mathews and Slocum found a number of interesting and useful relationships between social class

and income and the usage of bank credit cards.2 For instance,

they found that "members of the lower social classes tend to use

their cards for installment purposes; upper classes for convenience."3 Further, their results indicated that all users had a

favorable general attitude toward credit; however, installment

users tended to use their cards more frequently. Their study also

indicated that "the upper classes are generally favorable toward

using credit to purchase 'luxury' goods, and the lower class users

tended to use their cards for 'durable' and 'necessity' goods."4

To explain these relationships, Mathews and Slocum invoked

many of the life style differences and value orientations between

social classes that have been found in sociological research. For

example, the finding that installment users place a low emphasis

on saving and do not defer gratification was drawn from sociological studies. These concepts were used to explain the differences found between the lower class' tendency toward installment

purchases and the upper class' tendency toward convenience use.

This article provides additional insights into the differences

existing between users and nonusers of commercial bank charge

cards along "life style" dimensions. However, the evidence in this

case is derived from direct study of the life styles of users and

nonusers, rather than from inferences drawn from measurements of

social class and income segments. Many of the findings concur with

and supplement those of Mathews and Slocum, but some provide

evidence contrary to their results. This study also suggests some

new dimensions for future consideration.

1Paul O'Neil, "A Little Gift From Your Friendly Banker," Life

(March 27, 1970), pp. 48-58.

2 H. Lee Mathews and John W. Slocum, Jr., "Social Class and Commercial

Bank Credit Card Usage,"

JOURNAL OF

cators of Consumer

Credit Behavior,"

JOURNAL

34 (April, 1970), pp. 69-74.

Journal

of Marketing,

1971), pp. 35-41.

Vol.

35

(April,

MARKETING,

Vol. 33

(January, 1969), pp. 71-78; and "Social Class and Income as Indi-

3 Same reference as footnote 2, p. 76.

4 Same reference as footnote 2, p. 75.

35

This content downloaded from 175.111.89.8 on Fri, 02 Oct 2015 03:20:55 UTC

All use subject to JSTOR Terms and Conditions

OF MARKETING,Vol.

Journal of Marketing, April, 1971

36

Nature of the Study

Data for the present study were derived from

a nationwide survey of activities, interests, and

opinions of female homemakers and male heads

of households---called "life style research."5 The

study was sponsored jointly by the Leo Burnett

Company, Inc., and Market Facts, Inc., and conducted in the fall of 1968. A sample of 1,000

representative female homemakers and a separate

sample of 1,200 male heads of households were

utilized from Market Facts' national mail panels.

The base of usable questionnaires consisted of 858

women and 987 men; the demographic composition

of each sample was very close to U.S. Census figures.

Life style research is designed to indicate the

differences between heavy users and light or nonusers of a product in terms of their life styles or

their activities; i.e., how they spend their time;

their interests; what is of importance in their

immediate surroundings; their opinions; where

they stand on important issues; and their demographics. A wide range of activities, interests, and

opinions is covered in life style research through

300 statements that have been developed from previous research.6 These 300 Activity, Interest and

Opinion statements (AIO's) measure such activities as club membership, community organizations,

hobbies, travel, shopping, work, and entertainment.

The kinds of interests and opinions that are represented in the 300 AIO statements are interest

in their home, their family, and their community,

and opinions on such topics as economics, fashion,

politics, business, and mass media. Each of the 300

AIO statements is rated by a respondent on a sixpoint agreement scale.

Three types of information were collected in

order to determine the differences between product

users and nonusers. First, each respondent indicated his level of agreement along the six-point

scale for each of the 300 AIO statements. Second,

each person specified his "average usage" of over

125 products. In the case of bank charge card

usage, individuals were asked the following question: "Thinking of all members of your family,

how many times in the average month do all members of your family use a bank charge card?"

Finally, the demographics of the respondents were

collected.

From these three sets of data (AIO, demo5 William D. Wells and Douglas J. Tigert, "Activities,

Interests and Opinions," Journal of Advertising Re-

search (in press); and William D. Wells, "It's a

Wyeth, Not a Warhol, World," Harvard Business

Review, Vol. 48 (January-February,1970), pp. 26-30.

6 Wells and Tigert, same reference as footnote 5;

C. C. Wilson, "Homemaker Living Patterns and

Marketplace Behavior-A Psychometric Approach,"

in New Ideas for Successful

Marketing,

J. S. Wright

and J. L. Goldstucker,eds. (Chicago, Illinois: American MarketingAssociation, 1966).

graphics, and product usage), a portrait of the

heavy user of a product was constructed via Pearson Product Moment correlation analysis relating

the level of agreement on each of the 300 AIO

statements and the demographic characteristics

with product usage across the total sample of

respondents. Only those AIO and demographic

characteristics that indicated a significant linear

correlational relationship with product usage were

used to construct the portrait. These significant

correlations indicated the differences, on a probabilistic basis, between heavy users and light or

nonusers of a product. (In the case of bank charge

cards, the light and heavy users were combined

for analysis as each cell alone was quite small for

presentation.) The emphasis in the analysis was

on "clusters" of statements rather than individual

statements, since there was considerable "noise"

in the system, and dependence on a single item

may have been misleading. What constituted a

"cluster" is based partly on judgment of which

similar AIO statements appeared together in the

analysis and on AIO R-factors described in the

analysis by Wells and Tigert.7 In that study a

principal components R-factor analysis was conducted on the 300 AIO items to discover the major

life style dimensions existing in the inventory.

An example of this approach to the analysis

would be to examine the following statements that

differentiated the female user from the female nonuser of bank charge cards:

a. I am an active member of more than one service organization.

b. I would like to be a fashion model.

c. I am a homebody.

d. I do volunteer work for a hospital or service

organization on a fairly regular basis.

On the basis of judgment, statements a and d

seem to be similar in that they appear to be measuring the same phenomenon. Examination of the

R-factor-analysis results by Wells and Tigert supports this judgment since they both load significantly on the factor titled "Community-minded."

This "cluster" of several items provides a more

reliable basis for analysis than do single items.

7Wells and Tigert, same reference as footnote 5.

::~r-:--:;i?:8:~l-:i:

* ABOUT THE AUTHOR. Joseph T.

:-.irZ.

'?:::-'.':B'~::-i--;:l.?jli:jlj~j

:::::::::?::):ii-:(:::i::::i:-::::-`:'i

:.:::::

:::::;:a::::i::

:~':t";r:::::

:I'~'::;~i

Plummer is manager of copy and cre.'."

?

ative research at Leo Burnett Com::::~~:i::i:::

pany, Inc., Chicago. He received his

PhD in communications from The Ohio

:::::::??

::::::

:

I:::::l::::::::::i:lr

?:;:::

::::-:::-:

:::::::--::

State University in 1967. Dr. Plummer

?---;:

.;::

has published articles in the Journal -:::;::

::::::::::::

of Broadcasting and Educational Broad- ::1::::~

cast Review.

Dr. Plummer has been involved in

several national studies on the life

style of consumers and applications of these findings in the

creation of more effective communication.

This content downloaded from 175.111.89.8 on Fri, 02 Oct 2015 03:20:55 UTC

All use subject to JSTOR Terms and Conditions

Life Style Patterns and Commercial Bank Credit Card Usage

37

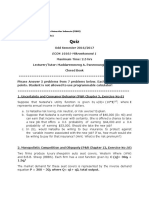

TABLE 1

DEMOGRAPHICCHARACTERISTICS

OF

BANK CHARGE CARD USERS AND NONUSERS

Male Sample

User

Indexa

Users

(183)

Nonusers

(804)

Female Sample

Total

(987)

User

Index

Users

(150)

Nonusers

(708)

Total

(858)

1967

User

Index

Under 25

25-34

35-44

45-54

55+

Less than high school

High school graduate

College

Under $4,999

$5,000-$7,999

$8,000-$9,999

$10,000-$14,999

$15,000 and over

57

124

95

110

87

44

97

147

4%c,4

26

21

22

26

12*

38

50*

8%

20

22

19

31

30

40

30

7%

21

22

20

30

27

39

34

109

121

104

95

63

67

103

118

12%

23

24

19

17*

14*

41

45*

11%7(

19

21

20

29

24

40

36

19

23

20

27

21

40

38

104

140

130

65

70

70

97

127

44

100

94

128

157

11*

19

16

32*

22:

25

22

17

24

12

25

19

17

25

14

67

58

106

157

131

16*

14

17

36*

17*

24

19

15

20

12

24

24

16

23

13

42

79

90

148

130

Craftsman

Clerical and Sales

Managerial

Professional

Other

82

100

104

145

109

32"

16

24

16*

12

41

15

23

10

11

39

16

23

11

11

94

121

86

190

71

29

17

18

19*

17*

32

13

21

9

25

31

14

21

10

24

80

112

90

173

77

11%

NOTE: *Significant at the .05 level, using "t" test for significance of two sample proportions (two-tailed test).

% of segment who are users ). The higher the User Index for a demographicsegment the

(User Index

%0of segment in total sample

more overrepresentedis that demographicamong users than its representationin the total sample which suggests

richness of potential.

a

The Findings

Seventeen percent of the life style sample were

users of bank charge cards. Ten percent used their

charge card less than three times in an average

month, and 7% used their card three or more

times in an average month. This 17% corresponds

with a comparable usage figure of 12% in the

1967 life style study. The percentage of bank

charge card users is quite small, however, when

compared to more established credit cards, such

as gasoline cards, which are carried by 62% of

the sample.

Table 1 sets forth the demographics of male and

female card users and discloses that a surprising

proportion did not go beyond high school and earn

less than $8,000 a year. This point was also expressed in the previous studies by Mathews and

Slocum.8 However, when one examines the card

usage of the demographic segments relative to

their representation in the total sample, it is evident that card usage is considerably greater among

people with higher incomes and better education.

This fact is illustrated by the large proportional

differences between users and nonusers as shown

in the User Index column in Table 1. Thus, in

terms of potential markets, the data suggest the

richness of potential among higher income, better

educated, and more professional demographic segments.

8 Same reference as footnote 2, pp. 73 and 71.

The Male Bank Charge Card Users

These individuals lead an active, urbane, and

upper socioeconomic style of life congruent with

their higher income, position, and education. This

type of person agrees with many statements, more

than the nonuser, which seem to typify the popular stereotypes of the successful man on the rise

as shown in Table 2.

The picture of the suburban businessman arriving home from the office and having a cocktail,

settling down to a nice meal, and then going off

to various activities is reinforced by his agreement

with the following statements:

"I would rather live in or near a big city than

in or near a small town."

"I often have a cocktail before dinner."

"We often serve wine at dinner."

"I do more things socially than most of my

friends."

"I enjoy going to concerts."

"I like ballet."

"I like to think I am a bit of a swinger."

And his disagreement relative to nonusers with

the following statements:

"I stay home most evenings."

"There are day people and there are night people. I am a day person."

"My days seem to follow a definite routine such

as eating meals at a :regular time."

All of these statements were found to significantly

This content downloaded from 175.111.89.8 on Fri, 02 Oct 2015 03:20:55 UTC

All use subject to JSTOR Terms and Conditions

38

Journal of Marketing, April, 1971

TABLE 2

CROSS-TABULATIONRESULTS OF AIO AGREEMENT

WITH MALE BANK CHARGECARD USAGE

Card Users

Definite

and General

Agreement

25%

27

53

36

56

#

8.

10.

17.

18.

23.

24.

Noncard Users

Definite

and General

Agreement

17%

41

21

26

42

Statement

I enjoy going to concerts.

A woman's place is in the home.

In my job I tell people what to do.

I am a good cook.

My greatest achievements are ahead of me.

I buy many things with a charge

or credit card.

39

22

29. We will probably move once in the

next five years.

46

37

39. Five years from now the family income will

71

probably be a lot higher than it is now.

60

42. Good grooming is a sign of self-respect.

52

71

53. There is too much advertising on TV today.

59

70

70. Women wear too much make-up today.

43

51

74. My job requires a lot of selling ability.

51

37

77. I like to pay cash for everything I buy.

26

67

86. Television is a primary source of our

entertainment.

25

40

94. Investing in the stock market is too risky

for most families.

47

56

109. To buy anything other than a house or car

on credit is unwise.

29

47

117. Young people have too many privileges today.

52

64

112. I love the outdoors.

54

76

126. There is too much emphasis on sex today.

52

64

130. There are day people and there are night

58

people; I am a day person.

69

135. I expect to be a top executive in the next

ten years.

44

27

152. I am or have been president of a society

or club.

51

36

174. I would like to have my boss' job.

42

33

175. A party wouldn't be a party without liquor.

29

17

177. I would rather live in or near a big city

than in or near a small town.

46

34

183. I often bet money at the races.

18

8

184. I like to think I'm a bit of a swinger.

38

26

194. I stay home most evenings.

62

71

198. Advertising can't sell me anything

I don't want.

55

68

200. I often have a cocktail before dinner.

36

20

202. I like ballet.

26

16

209. When I must choose between the two,

I usually dress for fashion, not comfort.

19

10

214. Liquor is a curse on American life.

34

49

217. Movies should be censored.

41

57

218. I read one or more business magazines

34

regularly.

18

230. I am active in two or more service

organizations.

28

17

248. I do more things socially than most

of my friends.

19

10

269. We often serve wine with dinner.

30

16

272. I buy at least three suits a year.

25

11

273. Playboy is one of my favorite magazines.

25

16

275. I spend too much time talking on the

telephone.

31

17

282. It is good to have charge accounts.

33

21

283. Hippies should be drafted.

48

61

286. When I think of bad health, I think of

doctor bills.

31

46

290. My days seem to follow a definite routine.

47

58

NOTE: All differences are significant above the .05 level based on Chi-square tests

of significance.

differentiate him from the nonuser at

He is a busy, young businessman

who knows where he is going since he

"I expect to be a top executive within

the .01 level.

on the rise

agrees with:

the next ten

life style patterns reinforce the idea of the "upper

"I spend too much time on the telephone." These

life style patterns reinforce the idea of the "upper

middle and upper class" conceptualized by Mathews

This content downloaded from 175.111.89.8 on Fri, 02 Oct 2015 03:20:55 UTC

All use subject to JSTOR Terms and Conditions

Life Style Patterns and Commercial Bank Credit Card Usage

and Slocum as being people who "concern themselves with individuality and achievement. Such

people are highly trained and are responsible for

decisions affecting other persons."9

The male charge card holder is aware of appearance and strives to maintain an appearance congruent with his work. He says, "I buy at least

three suits a year"; "When I must choose between

the two, I usually dress for fashion, not for comfort"; and "I would consider using a hair spray

intended for men." This dimension suggests that

appearance is central to the man's life style, and

from within this life style the purchase of a large

amount of clothing such as fashionable suits is not

functioning as a "luxury." It is a part of his life

style and necessary for the role he is playing when

interacting with others, which requires a certain

level of appearance. Within other life styles, this

particular dimension might function as a "luxury"

as discussed in the previous study. Thus, the above

finding suggests that to generally conceptualize

consumer goods as being either "necessity" or

"luxury" without taking into account various styles

of life could sometimes be misleading.

A finding from the previous study that appears

to receive additional support is that users perceive

credit cards as providing a convenience over cash

in every transaction. The user says significantly

more than the nonuser: "I buy many things with

a credit card or a charge card," and tends to disagree with the statement, "I like to pay cash for

everything I buy."

Nothing thus far supports the findings by

Mathews and Slocum that, "the upper classes' quest

for distinction

. . . is a salient

factor

affecting

their credit-buying philosophy."'1 The life style

data suggest that their primary orientation toward

credit cards is as a convenience-a satisfactory

substitute for cash-and not that the cards permit

the purchase of items to aid their quest for distinction which could not be obtained otherwise.

An interesting dimension of the user's life style

emerges that was not brought out by Mathews and

Slocum and that may be a salient factor in his

usage and credit philosophy. Since commercial bank

charge cards are a contemporary form of purchasing goods, persons with very strong traditional

orientations, regardless of their class or financial

status, might reject this contemporary, almost abstract, form of financial transaction. The male user

supports this concept in that he disagrees more

than the nonuser with such traditional, conservative values as: "A woman's place is in the home";

"There is too much emphasis on sex today";

"Young people have too many privileges today";

"Movies should be censored"; and "Hippies should

9 Same reference as footnote 2, p. 72.

10 Same reference as footnote 2, p. 75.

39

be drafted." This individual is also willing to take

certain risks and does not always need ultimate

security. This orientation is indicated in his disagreement with, "Investing in the stock market is

too risky for most families"; "It is important to

shop around a lot before buying a car"; and "To

buy anything other than a house or car on credit

is unwise." Clearly this notion of "traditional, conservative" versus "contemporary, risk-oriented" as

a determinant of charge card usage and philosophy

needs further research.

The final two life style dimensions emerging

from this study are that the male user tends

to belong to several organizations, and he considers reading a source of information and entertainment. He is involved with organizations outside his job, as indicated by his statements, "I am

or have been the president of a society or club,"

and "I am an active member of more than one

service organization." Perhaps indicating where to

reach the male charge card holder in magazines,

he tells us that "Playboy is one of my favorite

magazines," and "I read one or more business

magazines regularly."

The Female Bank Charge Card User

The female user also leads an active, upper

socioeconomic style of life, belongs to social organizations, and is concerned with her appearance. The

picture of the suburban housewife seems to fit her.

However, several differences are worth examining

since they have some bearing on charge card usage.

Two of the most pronounced differences are that

the female charge card user shows a number of

fantasies of potential roles or activities and tends

to be less interested in housework than the nonuser. Table 3 presents the significant AIO statements that differentiate the female card user from

the nonuser. From the 25 statements that related

to the female charge card user in the 1967 life

style study, 19 statements also appeared in the

1968 study and are noted in the table.

The fantasy-orientation of the female user is

indicated in dreams of travel, luxury items, and

self-aspirations. Such fantasies are shown in her

tendency to agree significantly more than the nonuser with the following statements:

"I would like to spend a year in London or

Paris."

"I would like to take a trip around the world."

"I would like to own and fly my own airplane."

"If I had my way, I would own a convertible."

"I would like to be an actress."

"I would like to be a fashion model."

Whether this is pure fantasy or not, one can only

conjecture. Her life style and socioeconomic status

permit thoughts (or fantasies) about many potential options. A different life style and lower status

would prevent her from ever considering such

This content downloaded from 175.111.89.8 on Fri, 02 Oct 2015 03:20:55 UTC

All use subject to JSTOR Terms and Conditions

40

Journal of Marketing, April, 1971

TABLE3

CROSS-TABULATIONRESULTS OF AIO AGREEMENT

WITH FEMALEBANK CHARGECARDUSAGE

Card Users

Definite

and General

Agreement

Noncard Users

Definite

and General

Agreement

32%

Statement

#

8. I enjoy going to concerts.a

41%

14. The next car our family buys will

32

18

probably be a station wagon.

19. I usually have my dresses altered to

52

the latest hemline levels.a

39

13

27

22. There should be a gun in every home.

24. I buy many things with a credit

64

or charge card.a

28

17

7

41. If I had my way, I would own a convertible."

17

45. I would like to own and fly my own airplane.

10

22

10

55. I would like to be a fashion model.

70

57

62. I would like to take a trip around the world."

51

42

73. I enjoy going through an art gallery.

33

64

77. I like to pay cash for everything I buy."

81. I bowl, play tennis, golf or other active

28

14

sports quite often.,

16

6

84. I would like to be an actress.

47

37

101. I have more than ten pairs of shoes.

109. To buy anything other than a house or car

21

36

on credit is unwise."

44

29

123. Our family travels quite a lot.'

55

41

125. I belong to one or more clubs.

127. I must really admit I don't like

40

32

household chores.

29

16

141. I like to play bridge.

22

33

146. I like to be considered a leader."

28

40

151. I'd like to spend a year in London or Paris."

157. I would rather spend a quiet evening

31

45

at home than go out to a party.

165. I would like to know how to sew like

68

77

an expert.

177. I would rather live in or near a big city

47

28

than in or near a small town.a

5

16

183. I sometimes bet money at the races.

24

11

184. I like to think I am a bit of a swinger."

44

58

188. I am a homebody.a

63

194. I stay home most evenings.

73

21

9

200. I often have a cocktail before dinner.

18

202. I like ballet.

27

213. I like danger.

3

13

223. I do volunteer work for a hospital or

service organization on a fairly regular basis.a

11

27

230. I am an active member of more than

16

one service organization."

26

237. I enjoy most forms of housework.

36

47

248. I do more things socially than most

of my friends.a

23

11

258. Clothes should be dried in the fresh air

and sunshine."

26

37

269. Movies should be censored.

55

65

270. I would like a maid to do the housework.

41

27

282. It is good to have charge accounts."

41

62

"Statements appearing in both the 1967 and 1968 studies.

NOTE: All differences are significant above the .05 level based on Chi-square tests

of significance.

thoughts. Her daily life appears full since she is

involved in many activities outside the home. This

active daily life is reflected in her agreement with

the following statements:

"I bowl, play tennis,

golf or participate in other active sports quite

often"; "I like to play bridge"; "I enjoy going

through an art gallery"; and "I enjoy going to

concerts." This variety of activities indicates a

woman who not only possesses energy but also has

some very specific cultural interests. One other side

of her active life outside her home is her interest

in organizations. She says, "I am an active member of more than one service organization," and

"I do volunteer work for a hospital or service

organization on a fairly regular basis." It also

appears from the agreement levels that these latter

activities are something she has a certain commitment to rather than just "one more activity."

When examining the total profile of the female

charge card holder, one receives the impression of

This content downloaded from 175.111.89.8 on Fri, 02 Oct 2015 03:20:55 UTC

All use subject to JSTOR Terms and Conditions

Life Style Patternsand CommercialBank Credit Card Usage

a woman who views her role of housewife as that

of managing and purchasing as opposed to the

more traditional view of a housewife's duties; i.e.,

cleaning, cooking, and caring for children. This

role seems congruent with the usage of charge

cards because she tends to control many aspects of

purchasing, as contrasted with the concept of an

allowance for only necessities given the housewife by the husband. Adding to this view of her

role, we see that in contrast to the nonuser of

charge cards, she places less value on the more

traditional skills of the housewife. She tends to

disagree with "I would like to know how to sew

like an expert"; "I enjoy most forms of housework"; and "I am a homebody." She tends to

agree more than the nonuser with "I would like

a maid to do the housework" (which reflects a

"managerial" point of view), and "I must admit

I really don't like household chores." It appears,

therefore, that this woman has a more contemporary view of the role of a housewife congruent

with her life style, income, and better education

when compared to the nonuser of charge cards.

Like her male counterpart, the female charge

card holder also reflects a risk-orientation and a

calculation of the future which might have some

bearing on credit card usage. If a person is concerned with only the present and overextending

himself, and not with the process of active acquisition, then he does not generally own a credit

card. Both life styles appear to be an outcome of a

stage in the life cycle of many affluent families in

today's society, and the use of a credit card appears

to fit into this pursuit of the "good life." This

dimension was not brought out in the previous

studies by Mathews and Slocum. Viewed from within

this life style, the credit card, as a function in their

lives, does not appear to allow individuals to acquire goods and services they might ordinarily

have to do without, but rather allows them to

acquire these items in a more convenient, contemporary manner.

Summary

This study of the male and female user of commercial bank charge cards permits an analysis of

their life styles beyond basic demographic and

purchase data and has reinforced certain findings

41

of the previous studies by Mathews and Slocum.

It has also gone beyond the previous studies to

suggest some additional considerations about this

"product." The basic demographic and usage data

indicate a surprisingly widespread use of commercial bank charge cards across many demographic

segments of the population. From the standpoint of

potential market segments, however, the higher

income, better-educated, middle-aged, and professional segments are more prominent on the user

index scale.

In addition to defining these demographic segments more clearly, this study depicts certain aspects of credit card users' life styles. In particular,

it notes their contemporary thinking, risk-orientation, and service organization affiliations that may

or may not be characteristic of the majority of

these demographic segments. The life style portrait of the users indicates an active, upper socioeconomic, urban-suburban life style with many interests outside the home. Both the male and female

user indicate a convenience-orientation toward credit

cards as a satisfactory cash substitute.

The previous studies' conceptualization of the

upper-middle and upper classes as "achievementoriented" and as "decision makers" appears to be

supported and made more explicit in the present

study of users' life styles.

This study has also revealed a hypothesis that

did not emerge from the previous studies. It indicated that users of commercial bank charge cards,

in contrast to nonusers, exhibit a "contemporary

state of mind" and a rejection of conservative,

traditional concepts. This is possibly a major

detriment to usage beyond specific demographics

or class variables. An adjunct to this hypothesis

is the concept that the definition of a "luxury purchase" must be viewed from within various life

styles and roles rather than broadly categorized for

all groups.

Therefore, traditional concepts of money (i.e.,

financial transactions should be made in cash) and

a conservative orientation toward one's life style

may be major barriers to usage of bank cards

which marketing and communications should seriously consider. These dimensions should be utilized along with social class and income data as a

basis for marketing planning.

This content downloaded from 175.111.89.8 on Fri, 02 Oct 2015 03:20:55 UTC

All use subject to JSTOR Terms and Conditions

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Bank Statement PDFДокумент5 страницBank Statement PDFIrfanLoneОценок пока нет

- Sales Letter Agora FinancialДокумент10 страницSales Letter Agora FinancialJapa Tamashiro JrОценок пока нет

- Flinder Valves and Controls Inc.: Case 50Документ29 страницFlinder Valves and Controls Inc.: Case 50SzilviaОценок пока нет

- Community Driven Development Vs Community Based Development 1 FinalДокумент19 страницCommunity Driven Development Vs Community Based Development 1 FinalDona Ameyria75% (4)

- Concept Paper - Strengthening of Small Coops-1Документ6 страницConcept Paper - Strengthening of Small Coops-1CristyBontuyanОценок пока нет

- 274-B-A-A-C (2683)Документ10 страниц274-B-A-A-C (2683)Ahmed Awais100% (2)

- PentingnyaДокумент10 страницPentingnyarifqi khairul anamОценок пока нет

- Lagi Penelitian Gaya HidupДокумент4 страницыLagi Penelitian Gaya Hiduprifqi khairul anamОценок пока нет

- Gaya Hidup Lagi 2Документ16 страницGaya Hidup Lagi 2rifqi khairul anamОценок пока нет

- Penelitian Gaya HidupДокумент13 страницPenelitian Gaya Hiduprifqi khairul anamОценок пока нет

- Gaya Hidup PentingДокумент6 страницGaya Hidup Pentingrifqi khairul anamОценок пока нет

- Tentang Gaya HidupДокумент7 страницTentang Gaya Hiduprifqi khairul anamОценок пока нет

- Penelitian Tentang Gaya HidupДокумент7 страницPenelitian Tentang Gaya Hiduprifqi khairul anamОценок пока нет

- Tentang Gaya HidupДокумент11 страницTentang Gaya Hiduprifqi khairul anamОценок пока нет

- CFAP 1 AAFR Summer 2017Документ10 страницCFAP 1 AAFR Summer 2017Aqib SheikhОценок пока нет

- Explain Multiproduct Breakeven Analysis. What Is The Assumption On..Документ3 страницыExplain Multiproduct Breakeven Analysis. What Is The Assumption On..Anutaj NagpalОценок пока нет

- Insurance and Pension PlansДокумент9 страницInsurance and Pension PlansKazzi ColmenarОценок пока нет

- Quiz Akhir IntermicroДокумент4 страницыQuiz Akhir IntermicroelgaavОценок пока нет

- Understanding The Impact of COVID-19 On The Sports IndustryДокумент3 страницыUnderstanding The Impact of COVID-19 On The Sports IndustrySimona CuciureanuОценок пока нет

- Cost AssignmentДокумент4 страницыCost AssignmentSYED MUHAMMAD MOOSA RAZAОценок пока нет

- C30cy - May - P2021 - 2022-TZ2Документ2 страницыC30cy - May - P2021 - 2022-TZ2MeiliaОценок пока нет

- Bus 5111 Discussion Assignment Unit 7Документ3 страницыBus 5111 Discussion Assignment Unit 7Sheu Abdulkadir BasharuОценок пока нет

- Rancangan MalaysiaДокумент33 страницыRancangan MalaysiacadburyboyОценок пока нет

- Global POVEQ NGAДокумент2 страницыGlobal POVEQ NGABonifaceОценок пока нет

- Regulation and Taxation: Analyzing Policy Interdependence: Walter Hettich and Stanley L. WinerДокумент33 страницыRegulation and Taxation: Analyzing Policy Interdependence: Walter Hettich and Stanley L. WinermarhelunОценок пока нет

- Project Template Comparing Tootsie Roll & HersheyДокумент37 страницProject Template Comparing Tootsie Roll & HersheyMichael WilsonОценок пока нет

- Bill of Exchange 078Документ1 страницаBill of Exchange 078trung2iОценок пока нет

- DepreciationnnДокумент127 страницDepreciationnnHYDER ALIОценок пока нет

- Subsequent SettlementДокумент26 страницSubsequent Settlementapi-3708285Оценок пока нет

- AFM13 Preface Solutions ManualДокумент5 страницAFM13 Preface Solutions ManualArshad33% (3)

- From OEM Supplier To A Global Leading Company: What Does It Take To Build A Cross-Cultural Team?Документ3 страницыFrom OEM Supplier To A Global Leading Company: What Does It Take To Build A Cross-Cultural Team?HugsОценок пока нет

- (International Political Economy Series) Gopinath Pillai (Eds.) - The Political Economy of South Asian Diaspora - Patterns of Socio-Economic Influence-Palgrave Macmillan UK (2013)Документ224 страницы(International Political Economy Series) Gopinath Pillai (Eds.) - The Political Economy of South Asian Diaspora - Patterns of Socio-Economic Influence-Palgrave Macmillan UK (2013)Muhammad Ayyub AlfarazОценок пока нет

- Quiz MG T 503Документ8 страницQuiz MG T 503VirtualianОценок пока нет

- Project AppraisalДокумент18 страницProject Appraisalrajpd28Оценок пока нет

- Financial RatiosДокумент4 страницыFinancial RatiosRajdeep BanerjeeОценок пока нет

- Ba5107 TQMДокумент2 страницыBa5107 TQMRagunath PalanichamyОценок пока нет

- Global Business Strategies EldridgeДокумент22 страницыGlobal Business Strategies EldridgeHassina BegumОценок пока нет

- Econ 281 Chapter07Документ50 страницEcon 281 Chapter07Elon MuskОценок пока нет