Академический Документы

Профессиональный Документы

Культура Документы

Medical Insurance Scheme For Retired Employees

Загружено:

sunilОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Medical Insurance Scheme For Retired Employees

Загружено:

sunilАвторское право:

Доступные форматы

.i516 (rug F?

*fi

PUNJAB & SIND BANK

(NT{d q{rFr{

ciqEr

II.O. HRD Department,

(tgFr

qftcrATniqrt

ql rigfl

f,

3qiF'T/A GOVERNMDNT OT INDIA UNDERTAKING)

tr, 21 {rda -fg, af friafr-ttooos

5th

Floor, Bank House, 21 Rajendra Place, New Delhi-l10008

Tel No. 011-25716407;

*A

Fax.0tt-25723793;

E-mail: ho.hrd@psb.org.in

':

Circulatory Letter No.

Eaiq'Date:

fi

qa dc+r Code No. of the Department

qn|r|*qRiqrfi q{ dl F TiEqr Number of pages of Circulatory Letter

frsTrtl

f-dT

l+|vTs

09.10.2015

: H9012

:1

TO ALL BRANCHES/CONTROLLING OFFICES

Reg:

for Retired Officers/Emplovees of the Bank

of loth Bipartite Settlement dated 25th May 2015, the reimbursement of hospitalization expenses

to Retired Workmen shall be as per the Medical Insurance Scheme detailed in Schedule lV of the

expenses to

settlement. In terms o.f Joint Note dated 25th May 201.5, the reimbursement of hospitalization

Retired Officers shall be as detailed in Annexure lV of the Joint Note.

to

The scheme covers the existing Retired Officers/Employees of the Bank and their spouse subject

his/her

spouse

payment of stipulated premium by them. In case Retired officer/Employee has expired,

alone is also eligible for insurance under the scheme.

In terms

per annum is

Sum Insured: Hospitalization and Domiciliary Treatment coverage as defined in the scheme

as under:

Cadre

Retired Officer

Retired Clerk

Retired Sub-staff

Sum lnsured

Rs.4.00 Lac

Rs.3.00 Lac

Rs.3.00 Lac

Premium per family (Self & Spouse) Per Annum*

Rs. 6,573/- plus Service Tax

Rs. 4,930/-plus Service Tax

Rs. 4,930/- plus Service Tax

*For employees retiring in mid of the term of policy, premium shall be charged on pro-rata basis.

ln case of spouse of deceased officer/employee, the category for coverage of the scheme will

be

considered on the basis of last designation of deceased officer/employee.

One time option is being given

to

Ex-employees

/ Retirees to ioin the scheme now. Those who do not

opt now, would not be allowed to join later. once they have ioined and subsequently opted out, they

cannot rejoin.

The Bank had in the past provided a Medical lnsurance Scheme from its PSB Employees Welfare Fund

Trust, the Bank has decided to contribute the premium in above categories in the ratio of 50:50. Hence,

the premium (including service tax) will be borne by the ex-officers/employees or their spouse and the

and ExBank equally i.e Rs.3,2g7/- plus Service Tax and Rs.2,4651- plus Service Tax by the Ex-officers

Clerks/Sub-Staff resPectivelY'

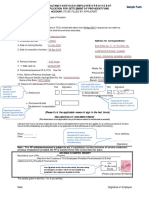

To operationalise the scheme, the information/data and undertaking as per enclosed proforma

(Annexure A) is urgently required in respect of Retired officers & Employees or by their spouse which

shou|dbesubmittedbyposttoH.o.PFDepartment,NewDe|hiorbye-mai|toho.pf@psb.co.in|atestby

40.10.201s.

(D.D.Sharma)

Вам также может понравиться

- Draft Public Notice CRA 03 2016 PDFДокумент1 страницаDraft Public Notice CRA 03 2016 PDFjasjit singhОценок пока нет

- CircularДокумент2 страницыCircularHemanta SarmaОценок пока нет

- SB Orders 01-01-2007Документ202 страницыSB Orders 01-01-2007Rajesh Mukundanaik KaggaОценок пока нет

- To The Under: DelhilДокумент4 страницыTo The Under: DelhilKabul DasОценок пока нет

- Finance Department: (PGCJ Dated NovemberДокумент13 страницFinance Department: (PGCJ Dated NovemberPrudhvirajОценок пока нет

- Pay Protection of DSC, Appsc Appointed Employees in Govt Service2011fin - ms105Документ2 страницыPay Protection of DSC, Appsc Appointed Employees in Govt Service2011fin - ms105Narasimha Sastry100% (1)

- "Pay Bill Particulars" Mention Below: (Enter Your Details)Документ38 страниц"Pay Bill Particulars" Mention Below: (Enter Your Details)rajbharath300Оценок пока нет

- Aipnbef 20.12.2021Документ3 страницыAipnbef 20.12.2021suman duttaОценок пока нет

- SB OrdersДокумент16 страницSB OrdersyenyesraoОценок пока нет

- JLM 2014 Notification Dt. 28.02 - 2Документ18 страницJLM 2014 Notification Dt. 28.02 - 2PERFECTPARDHUОценок пока нет

- All India Bharat Sanchar Nigam Limited Executives' AssociationДокумент1 страницаAll India Bharat Sanchar Nigam Limited Executives' AssociationAnjali DSuzaОценок пока нет

- Biometri AttendanceДокумент5 страницBiometri AttendanceShanti Bhushan MishraОценок пока нет

- G O RT NoДокумент2 страницыG O RT NoGunda SrikanthОценок пока нет

- 92 Nodal DistДокумент2 страницы92 Nodal DistA2 Section CollectorateОценок пока нет

- Pay and AllowancesДокумент22 страницыPay and AllowancesSharon Elin Sunny0% (1)

- Office of The Principal CDAДокумент3 страницыOffice of The Principal CDADeepak Pandey DeepsОценок пока нет

- Contract Workers Salary G.O. 50%Документ2 страницыContract Workers Salary G.O. 50%aaoОценок пока нет

- Important Notice of Joining For Officer Scale-III, II and IДокумент1 страницаImportant Notice of Joining For Officer Scale-III, II and IShambhu Singh BhatiОценок пока нет

- Postal Mahasangh-April 2013Документ20 страницPostal Mahasangh-April 2013secgenbpefОценок пока нет

- Verification of Qualifying Service After 18 Years Service and 5 Years Before Retirement PDFДокумент2 страницыVerification of Qualifying Service After 18 Years Service and 5 Years Before Retirement PDFRamineedi PrabhakarОценок пока нет

- The South Indian Bank LTD, Personnel Department, Head Office, Mission Quarters, Thrissur, KERALA - 680 001, Phone/Fax: 91-487-2420020 E-MailДокумент3 страницыThe South Indian Bank LTD, Personnel Department, Head Office, Mission Quarters, Thrissur, KERALA - 680 001, Phone/Fax: 91-487-2420020 E-MailDilip RajОценок пока нет

- Nasik Press NotificationДокумент14 страницNasik Press NotificationSANTOSH KUMAR DHULIPALAОценок пока нет

- Swamys Manual On Office Procedure For Central Government Offices PDFДокумент5 страницSwamys Manual On Office Procedure For Central Government Offices PDFKalpana Kushwaha43% (7)

- Swamys Manual On Office Procedure For Central Government Offices PDFДокумент5 страницSwamys Manual On Office Procedure For Central Government Offices PDFSureshJeevan0% (1)

- Swamys Manual On Office Procedure For Central Government Offices PDFДокумент5 страницSwamys Manual On Office Procedure For Central Government Offices PDFनरोत्तमवत्सОценок пока нет

- 17-A (20,02,2008) Amendment in Rule - SOR-III (S&GAD) 2-0-2000Документ2 страницы17-A (20,02,2008) Amendment in Rule - SOR-III (S&GAD) 2-0-2000Sea Shores100% (8)

- Memo On GPF AccountsДокумент1 страницаMemo On GPF AccountsNarasimha SastryОценок пока нет

- Artifact 5a - Guidelines For Filling PF Withdrawal Form TCSДокумент3 страницыArtifact 5a - Guidelines For Filling PF Withdrawal Form TCSAmy Brady100% (3)

- 1109 - HarmonyДокумент27 страниц1109 - HarmonymbasgroupОценок пока нет

- F G Ryar-: 5rater, RirtdraДокумент4 страницыF G Ryar-: 5rater, RirtdraManash Protim GogoiОценок пока нет

- Contributory PensionДокумент2 страницыContributory PensionvenkatasubramaniyanОценок пока нет

- Cir 72 2018-19 Pension RegulationsДокумент97 страницCir 72 2018-19 Pension Regulationskiran dupatiОценок пока нет

- 12062015fin Ms 68 - Implementation of Automatic Advancement SchemeДокумент6 страниц12062015fin Ms 68 - Implementation of Automatic Advancement Schemeapi-215249734Оценок пока нет

- FINANCE (Allowances) DEPARTMENT Secretariat, Chennai-600 009. Letter No.1074/FS/Fin. (Allowances) /2020, Dated:05-06-2020Документ2 страницыFINANCE (Allowances) DEPARTMENT Secretariat, Chennai-600 009. Letter No.1074/FS/Fin. (Allowances) /2020, Dated:05-06-2020kmtharan.mca@gmail.comОценок пока нет

- Retirement 310813Документ2 страницыRetirement 310813Kabul DasОценок пока нет

- ISO-9001 Iso-14001 Ohsas-18001: No.C1/Rect/CME/2016/1942Документ10 страницISO-9001 Iso-14001 Ohsas-18001: No.C1/Rect/CME/2016/1942nellai kumarОценок пока нет

- Go68 Aas in Rps 2015Документ8 страницGo68 Aas in Rps 2015Ramachandra RaoОценок пока нет

- Clarification CreamyLayerOBC 28072015 NewДокумент9 страницClarification CreamyLayerOBC 28072015 NewSrinivasa SaluruОценок пока нет

- Declaration & SuggestionДокумент4 страницыDeclaration & SuggestionMohd Azam/DPG/DELОценок пока нет

- 8660 Haryana Postal Circle Recruitment 2021Документ18 страниц8660 Haryana Postal Circle Recruitment 2021Maltesh BannihalliОценок пока нет

- Terminal Benefit - Nilam ShahДокумент24 страницыTerminal Benefit - Nilam ShahRaghava NarayanaОценок пока нет

- 1213-23-Si-Og RR GecДокумент8 страниц1213-23-Si-Og RR Gecvkj5824Оценок пока нет

- Transmission Corporation of Andhra Pradesh Limited Vidyut Soudha:: VijayawadaДокумент2 страницыTransmission Corporation of Andhra Pradesh Limited Vidyut Soudha:: Vijayawadaveera chaitanyaОценок пока нет

- Temporary Transfer of Posts of Non-Gazetted StaffДокумент50 страницTemporary Transfer of Posts of Non-Gazetted StaffTvs ReddyОценок пока нет

- TAMIL NADU GOVERNMENT - CONTRIBUTORY PENSION SCHEME - FAQsДокумент4 страницыTAMIL NADU GOVERNMENT - CONTRIBUTORY PENSION SCHEME - FAQsDr.Sagindar100% (1)

- DR VacancyДокумент11 страницDR Vacancysamsingh12345000Оценок пока нет

- Shifting of Pension To Hrms PortalДокумент3 страницыShifting of Pension To Hrms PortalPandurangrao KulkarniОценок пока нет

- GO Ms 102-Endt - Noc-1959-1-2016dt 14-06-2016 - 897.Документ6 страницGO Ms 102-Endt - Noc-1959-1-2016dt 14-06-2016 - 897.mass1984Оценок пока нет

- RCS25 To All ComradesДокумент4 страницыRCS25 To All ComradesinspvizagОценок пока нет

- Fin e 241 2013Документ3 страницыFin e 241 2013raliumОценок пока нет

- HR No. Name S/Sh./Shri/Smt. Design. CircleДокумент2 страницыHR No. Name S/Sh./Shri/Smt. Design. CircleKabul DasОценок пока нет

- Public Services - Revision of Pay and Allowances of Members and Employees ofДокумент2 страницыPublic Services - Revision of Pay and Allowances of Members and Employees ofvanjinathan_aОценок пока нет

- Pay ProtectДокумент2 страницыPay Protectsudhakar_singhОценок пока нет

- 1il !FFTN Ti'I: D.O. No. 33/2019-Eq (MM.!!) Dated: I2December, 2018Документ19 страниц1il !FFTN Ti'I: D.O. No. 33/2019-Eq (MM.!!) Dated: I2December, 2018smОценок пока нет

- Establishment Rules & ProceduresДокумент19 страницEstablishment Rules & ProceduresAmrita Pal100% (1)

- C.H.A.P.P.S.: CLOCKABLE HOURS APPLICATION PROCESS AND PAY SYSTEMОт EverandC.H.A.P.P.S.: CLOCKABLE HOURS APPLICATION PROCESS AND PAY SYSTEMОценок пока нет

- Freedom Unleashed: How to Make Malaysia a Tax Free CountryОт EverandFreedom Unleashed: How to Make Malaysia a Tax Free CountryРейтинг: 5 из 5 звезд5/5 (1)

- Thrift Savings Plan: A Practical Guide to the TSP: Personal Finance, #1От EverandThrift Savings Plan: A Practical Guide to the TSP: Personal Finance, #1Оценок пока нет

- Bo RudrapryagДокумент4 страницыBo RudrapryagsunilОценок пока нет

- Ps Ram SirДокумент2 страницыPs Ram SirsunilОценок пока нет

- Esps DetailsДокумент1 страницаEsps DetailssunilОценок пока нет

- PM Meets Jaitley After He Opts Out of Cabinet: Indigooptsfor Pratt&Whitney Rival, DealsoonДокумент11 страницPM Meets Jaitley After He Opts Out of Cabinet: Indigooptsfor Pratt&Whitney Rival, DealsoonsunilОценок пока нет

- Esps ApplicationДокумент2 страницыEsps ApplicationsunilОценок пока нет

- Target of NULMДокумент5 страницTarget of NULMsunilОценок пока нет

- LC 255Документ1 страницаLC 255sunilОценок пока нет

- Gurjant SinghДокумент3 страницыGurjant SinghsunilОценок пока нет

- 398 Small DairyДокумент4 страницы398 Small DairysunilОценок пока нет

- Balveer Singh PDFДокумент2 страницыBalveer Singh PDFsunilОценок пока нет

- Gursewak Singh So Mohinder SinghДокумент4 страницыGursewak Singh So Mohinder SinghsunilОценок пока нет

- Angrej Singh So Gurbaksh SinghДокумент4 страницыAngrej Singh So Gurbaksh SinghsunilОценок пока нет

- Angrej Singh PDFДокумент4 страницыAngrej Singh PDFsunilОценок пока нет

- Baljinder SinghДокумент4 страницыBaljinder SinghsunilОценок пока нет

- Approved Policy For The Procurement of Health and Medical Equipment and List of ManufacturersДокумент31 страницаApproved Policy For The Procurement of Health and Medical Equipment and List of ManufacturersBALAОценок пока нет

- Insurance Monopoly Made Law - This and 5 Other Complaints About The Health BillДокумент5 страницInsurance Monopoly Made Law - This and 5 Other Complaints About The Health BillWilliam J GreenbergОценок пока нет

- Vwa Traffic MGT ChecklistДокумент1 страницаVwa Traffic MGT ChecklistAnonymous ANmMebffKRОценок пока нет

- Irr of Ra 9262 Anti Violence Against Women and Their Children Act of 2004Документ21 страницаIrr of Ra 9262 Anti Violence Against Women and Their Children Act of 2004Christle PMDОценок пока нет

- Bright HorizonsДокумент3 страницыBright HorizonsJenОценок пока нет

- Lifeline Supreme BrochureДокумент5 страницLifeline Supreme BrochureSumit BhandariОценок пока нет

- GMC QCR - Sapocom Technologies PVT LTDДокумент1 страницаGMC QCR - Sapocom Technologies PVT LTDShubham GargОценок пока нет

- SIP Annex 2B - Child Protection Policy Implementation ChecklistДокумент2 страницыSIP Annex 2B - Child Protection Policy Implementation ChecklistJohnArgielLaurenteVictor97% (36)

- w2 FINALДокумент10 страницw2 FINALmuhammad mudassarОценок пока нет

- 2011 Behind The Kitchen Door Multi Site StudyДокумент2 страницы2011 Behind The Kitchen Door Multi Site StudyROCUnitedОценок пока нет

- Neccesity AutosavedДокумент8 страницNeccesity AutosavedyouismyfavcolourОценок пока нет

- Title 2 (Animal Welfare) Chapter 1 (General Santos City Animal Shelter) Ord No 11 S of 2013Документ6 страницTitle 2 (Animal Welfare) Chapter 1 (General Santos City Animal Shelter) Ord No 11 S of 2013roy rubaОценок пока нет

- Hse Pja BtsguideДокумент2 страницыHse Pja BtsguideMohamed Ismail ShehabОценок пока нет

- Kode Etik Aacls & CanadaДокумент8 страницKode Etik Aacls & CanadaClarissaОценок пока нет

- Argumentative EssayДокумент4 страницыArgumentative Essaynoreen diorОценок пока нет

- Senate Hearing, 111TH Congress - The Preventable Epidemic: Youth Suicides and The Urgent Need For Mental Health Care Resources in Indian CountryДокумент93 страницыSenate Hearing, 111TH Congress - The Preventable Epidemic: Youth Suicides and The Urgent Need For Mental Health Care Resources in Indian CountryScribd Government DocsОценок пока нет

- TEMPLATE-B-Master-list-of-Learners-for-the-Pilot-Implementation-of-F2F-Classes-for-S.Y.-2021-2022Документ7 страницTEMPLATE-B-Master-list-of-Learners-for-the-Pilot-Implementation-of-F2F-Classes-for-S.Y.-2021-2022Resa Consigna MagusaraОценок пока нет

- PolSci 314 EssayДокумент5 страницPolSci 314 EssayQhamaОценок пока нет

- Constitutional Law - 2 Project: Submitted To: Akhilesh PandeyДокумент15 страницConstitutional Law - 2 Project: Submitted To: Akhilesh PandeypreetОценок пока нет

- Untitled Document - EditedДокумент2 страницыUntitled Document - EditedBenjamin MuriithiОценок пока нет

- Samriddhi MissionДокумент20 страницSamriddhi MissionKumud ShankarОценок пока нет

- Guide To The Workplace Safety and Health (WSHO) Regulations 2007Документ4 страницыGuide To The Workplace Safety and Health (WSHO) Regulations 2007Htin Lin AungОценок пока нет

- S. Walton Letter To FDA FINALДокумент13 страницS. Walton Letter To FDA FINALJoe EskenaziОценок пока нет

- Lions Clubs International Complete InformationДокумент10 страницLions Clubs International Complete InformationJasvinder SinghОценок пока нет

- The Three Dimensions of Universal Medicare in CanadaДокумент9 страницThe Three Dimensions of Universal Medicare in CanadaNavin Gamage100% (2)

- SSS Law OutlineДокумент14 страницSSS Law OutlineJohn Baja GapolОценок пока нет

- The Rape ("Lo Stupro") by Franca Rame Translated by Ed EmeryДокумент6 страницThe Rape ("Lo Stupro") by Franca Rame Translated by Ed EmerypremaseemaОценок пока нет

- Open Letter From The Deputy Director General, Budget, Personnel and Management Systems Department, Asian Development BankДокумент4 страницыOpen Letter From The Deputy Director General, Budget, Personnel and Management Systems Department, Asian Development BankBryan ChingОценок пока нет

- GO Ms 874 PDFДокумент15 страницGO Ms 874 PDFAnupoju Appalaraju0% (1)

- Concept of Deceptive SimilarityДокумент23 страницыConcept of Deceptive SimilarityIshwar0% (1)