Академический Документы

Профессиональный Документы

Культура Документы

China Mediaexpress (Ccme) : Ccme - Sustainable Growth From A Well Defended Niche

Загружено:

noname1234566720Исходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

China Mediaexpress (Ccme) : Ccme - Sustainable Growth From A Well Defended Niche

Загружено:

noname1234566720Авторское право:

Доступные форматы

March 12, 2010

POST SPAC SPECIAL SITUATION

China MediaExpress (CCME)

CCME – Sustainable growth from a well defended niche

Key investment points Key data Current

Price (USD) 11.56

• Intriguing business: Growth driven by network expansion Short term target 20.00

from 20,000+ buses in 2009 to 30,000 buses by the end of 12 month target 28.00

2010. Advertisers are attracted to CCME’s large scale Market cap ($ mn) 457

(100+ million monthly viewers) and low CPM rates. F.d. enterprise value (EV) 336

CCME’s CPM rates should not suffer competitive pricing F.d. shares outstanding (mn) 39.6

pressures due to its well protected niche, leading 32% Public float 10.1

market share and large discount to its peers. Excellent Dec 31 YE 2008 2009 2010 2011

cash generation with low DSO. Growth, profit margins and Revenue 63 95 143 191

cash conversion superior to all China out-of-home EBITDA 38 58 77 95

advertising public peers. Adj net income 27 41 54 66

EPS basic 0.97 1.43 1.64 2.00

• Compelling valuation: Despite these positives, CCME EPS f.d. 0.78 1.16 1.36 1.66

trades at a 69%+ discount to its direct public peers.

F.d. P/E 14.8 10.0 8.5 7.0

• Credibility no longer an issue: The primary issue EV/EBITDA 7.5 4.9 4.4 3.6

holding back a higher multiple has been credibility after a

tough SPAC IPO that raised little cash. The recent Starr EBITDA growth % 201 53 32 23

International preferred investment is validation that EBITDA margin % 60 61 54 50

CCME’s business is sound. Starr spent four months of due Med. Comp. Multiples 2009 2010

diligence before making the decision to invest $30M.

P/E 21.6 37.7

Additional actions to build credibility have been the hiring of

Deloitte and Touche auditors, repurchase of $1M public EV/EBITDA 13.3 11.2

warrants and active communication with public investors. China MediaExpress (CME) Description:

Since its inception in November 2003, CME

Valuation has grown rapidly to become China’s largest

Our short term target is $20.00 which is 14.7x FY10F P/E television advertising operator on inter-city

(12.4x P/E ex-net cash) and 8.7x 2010 EV/EBITDA. Our 12 express buses. The Company generates

month target is $28.00 which is 10.4x 2011 EV/EBITDA which revenue by selling advertisements on its

is in line with typical out-of-home advertiser forward multiples. network of television displays installed on

Our 12 month target is crossed validated with our DCF model over 21,000 express buses originating in

that generates a $28.23 valuation. fourteen of China’s most prosperous

regions, including the five municipalities of

Our forecast is conservative with net income below the Beijing, Shanghai, Guangzhou, Tianjin and

minimum net income targets set by the Starr investment Chongqing and nine economically

th

agreement. For the 4 quarter 2009 we forecast $13.2M net prosperous provinces, namely Guangdong,

income for true fully diluted EPS of $0.38. To meet the Starr Jiangsu, Fujian, Sichuan, Hebei, Anhui,

th

2009 net income target, 4 quarter net income will need to Hubei, Shandong and Shanxi which

be $14.7M which would generate fully diluted EPS of $0.42. generate more than half of China’s GDP.

Bottom line:

CCME’s well defended niche and cash rich balance sheet ($100M net cash) support a sustainable and

th

high growth outlook for its business. We expect the release of strong 4 quarter audited results and

positive guidance for 2010 to be the catalyst to move the shares towards our short term target of $20.00.

Neil Danics (858) 366-4580 MBA, CMA ndanics@spacanalytics.com

SPAC Analytics Special Situation Research

March 12, 2010 China MediaExpress (CCME)

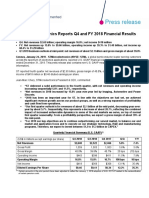

Summary Income Statement (mn USD):

2009 Annual Forecast 2010F Annual Forecast 2011F

2007 2008 Q1 Q2 Q3 Q4F SA Starr CCME Q1 Q2 Q3 Q4 SA Starr CCME SA Starr CCME

Sales, net 25.8 63.0 18.8 19.1 26.1 31.1 95.1 104.2 31.7 33.5 36.3 41.1 142.7 196.6 191.0 305.5

Cost of sales 13.2 25.1 7.1 7.2 8.6 10.3 33.2 10.4 12.1 13.4 15.6 51.6 74.5

Gross profit 12.7 37.9 11.6 11.9 17.5 20.8 61.8 71.5 21.2 21.5 22.9 25.5 91.1 140.9 116.5 219.5

Selling expenses 0.9 1.1 0.3 0.3 1.4 1.9 3.8 2.3 2.9 3.5 5.1 13.9 20.6

G&A 0.7 1.7 0.8 0.5 0.6 1.2 3.2 1.3 1.1 1.2 1.8 5.4 8.2

Total operating exp. 1.7 2.8 1.1 0.8 2.0 3.1 7.0 3.6 4.0 4.7 6.9 19.3 28.8

Operating income 11.0 35.1 10.5 11.1 15.5 17.8 54.9 17.6 17.4 18.2 18.6 71.8 87.7

Interest income 0.0 0.1 0.0 0.0 0.0 0.0 0.1 0.0 0.0 0.0 0.0 0.0 0.0

Income before taxes 11.0 35.2 10.6 11.1 15.5 17.7 54.9 60.2 17.6 17.4 18.2 18.6 71.8 119.4 87.7 186.1

Income tax 4.1 8.9 3.1 2.8 3.9 4.4 14.3 4.4 4.4 4.6 4.6 18.0 21.9

Net income 7.0 26.4 7.5 8.3 11.6 13.3 40.6 13.2 13.1 13.7 13.9 53.9 65.8

Foreign cur. Trans. 0.4 1.0 0.1 0.0 0.0 0.0 0.1 0.0 0.0 0.0 0.0 0.0 0.0

Net Income 7.3 27.4 7.4 8.3 11.6 13.2 40.5 42.0 42.1 13.2 13.1 13.7 13.9 53.9 55.0 83.6 65.8 70.0 130.3

Key metrics:

EPS - f.d. 0.21 0.78 0.21 0.24 0.33 0.38 1.16 1.20 1.17 0.33 0.33 0.35 0.35 1.36 1.39 1.76 1.66 1.77 2.39

P/E 55.3 14.8 10.0 8.5 7.0

D&A 1.6 2.9 0.8 0.8 0.8 1.0 3.4 1.0 1.2 1.4 1.6 5.2 6.9

EBITDA 12.6 38.0 11.3 11.9 16.3 18.8 58.2 65.5 18.6 18.6 19.6 20.2 77.0 128.5 94.6 197.8

EV/EBITDA 22.4 7.5 4.9 4.5 4.4 3.3 3.6 2.6

# of buses EOP 10,053 15,260 16,000 16,000 18,000 20,000 20,000 21,000 24,000 26,000 28,000 28,000 30,000 33,000

Quarterly rev. per bus 1,156 1,244 1,201 1,193 1,535 1,637 1,348 1,545 1,491 1,453 1,523 1,486 1,638 1,565

Annual growth 29% 8% 8% 10% 5%

Revenue growth 540% 276% 24% 24% 65% 86% 51% 65% 69% 76% 39% 32% 50% 34%

EBITDA growth 548% 269% 23% 28% 75% 82% 53% 72% 65% 57% 20% 7% 32% 23%

Gross margin 49% 60% 62% 62% 67% 67% 65% 69% 67% 64% 63% 62% 64% 72% 61% 72%

Selling exp % of sales 4% 2% 1% 1% 5% 6% 4% 7% 9% 10% 13% 10% 11%

Opex % of sales 6% 4% 6% 4% 8% 10% 7% 11% 12% 13% 17% 14% 15%

EBITDA margin 49% 60% 60% 62% 63% 60% 61% 63% 59% 56% 54% 49% 54% 65% 50% 65%

Tax rate 37% 25% 29% 25% 25% 25% 26% 25% 25% 25% 25% 25% 25%

Pro forma share count / EV

Basic 32.9 32.9 32.9 32.9 32.9 32.9 32.9 32.9 32.9 32.9 32.9 32.9 32.9 32.9 32.9 32.9 32.9 32.9 32.9

Starr International - pref/common 3.0 3.0 3.0 3.0 3.0 3.0 3.0 3.0 3.0 3.0

Earn out shares 1.0 8.0 15.0

Starr International - warrants 1.5 1.5 1.5 1.5 1.5 1.5 1.5 1.5 1.5 1.5

SPAC mgmt. warrants 2.1 2.1 2.1 2.1 2.1 2.1 2.1 2.1 2.1 2.1 2.1 2.1 2.1 2.1 2.1 2.1 2.1 2.1 2.1

F.d. shares 35.0 35.0 35.0 35.0 35.0 35.0 35.0 35.0 36.0 39.6 39.6 39.6 39.6 39.6 39.6 47.6 39.6 39.6 54.6

Market capitalization 405 405 405 405 405 405 405 405 416 457 457 457 457 457 457 550 457 457 631

Net debt / (cash) -121 -121 -121 -121 -121 -121 -121 -121 -121 -121 -121 -121 -121 -121 -121 -121 -121 -121 -121

Enterprise value (EV) 284 284 284 284 284 284 284 284 295 336 336 336 336 336 336 429 336 336 510

Assumptions / Notes:

Assumes no new acquisitions are made with $77M cash raised in Jan 2010.

Gross margins decline in 2010 and 2011 reflecting higher concession fees to bus operators offset by some degree by a greater % of direct advertising clients.

Selling expense as % of revenues increases by 6% in 2010 reflecting much larger direct sales force in 2010.

No change to RMB exchange rate in 2010 or 2011.

Net debt / (cash) includes cash from warrants redemption, net cash from the Starr Jan 2010 $30M financing, and estimated Dec 31, 2009 company net cash balance.

SA refers to SPAC Analytics forecast.

Starr refers to minimum net income targets per recent $30M Starr International preferred financing.

CCME refers to the share based net income earn out targets per the SPAC merger transaction.

Fully diluted EPS assumes all warrants and convertible preferred securities are converted into common shares.

SPAC Analytics Special Situation Research 2

March 12, 2010 China MediaExpress (CCME)

CCME should avoid pricing & margin pressure due to its dominate share and

unique cooperation agreement with the Chinese government

CCME controls over 32% of the China inter-city express bus television advertising market and by the end

of 2010 CCME should control over 45% of the market. At the end of 2009 CCME had 20,000+ buses on

its network, with 41,000+ television displays and a monthly audience of over 100 million people.

Management expects to grow CCME’s network to over 30,000 buses by the end of this year. The

estimated total market is 65,000+ buses with 27+ passengers.

CCME’s large network is highly attractive to advertisers who want to work with a supplier who has

nd rd

substantial scale to provide access to China’s growing middle class in high growth 2 and 3 tier cities.

A key factor in CCME’s success is a five year cooperation agreement it signed with the Transport

Television and Audio-Video Center, an entity affiliated with the Ministry of Transport of the People’s

Republic of China. The agreement designates CCME as the sole strategic alliance partner in the

establishment of a nationwide in-vehicle television system on buses traveling on highways in China. The

agreement gives CCME preferential status as the only authorized inter-city bus advertising company by

the government and serves as a strong tool to sign new bus operators to CCME’s network and to deter

new competitors from entering the inter-city bus advertising market. The cooperation agreement expires

in October 2012. In the unlikely case the agreement is not renewed it would obviously be a negative

development but not a disaster. The majority of CCME’s 47 bus operators have signed five to eight year

contracts in the past year and several new bus operators are expected to be signed to long term

contracts between now and the end of 2012.

Effectively with this cooperation agreement CCME has at minimum a 2.5 year window to further increase

its market share of the inter-city bus market with little competition. This reduces the pressure on CCME to

pay high concession fees to bus operators and/or reduce its CPM rates to keep business. Thus, CCME’s

business has a substantial advantage to several other China out-of-home advertising companies whose

verticals have competition which has led to margin pressures over the past year.

The quality of CCME’s advertising channel is high

CCME’s audience is highly captive since the average passenger typically sits on an express bus for over

two hours. Passengers are able to view the television screens unobstructed unlike crowded intra-city

buses and subways where line of sight can be impeded and the attention span is limited due to short

trips. The programming provided from Fujian SouthEastern Television Channel and Hunan Satellite

Television is considered entertaining and high quality. CCME displays advertisements in ten-minute

blocks after every 30 minutes of entertainment content, so audiences can potentially view the same

advertisement up to three times per average journey. This repeated exposure to the same advertisement

should increase its effectiveness. CTR Market research found that 81% of all passengers said they had

watched the television displays on CCME’s network and almost 80% said they regularly watched the

displays on the network.

CCME’s demographic is attractive despite some competitors criticizing the profile of an inter-city bus

passenger. They believe that passengers on inter-city buses have low income and are under educated.

While inter-city passengers are not as attractive as a pure urban demographic, the express bus market

demographic is still attractive with incomes above the China average. According to surveys conducted by

the CTR Market Research in July 2008, the audience of CCME’s network had the following overall

characteristics:

• the average household income is over RMB 5,800 per month and the average individual income is

over RMB 3,300 per month

• over 50% of the target audiences have received a diploma, college degree or higher education

• over 40% of the target audiences are professionals, managers, executives and business owners

• over 40% of the target audiences are frequent travelers that take inter-city express buses for more

than once a month

SPAC Analytics Special Situation Research 3

March 12, 2010 China MediaExpress (CCME)

CCME’s advertising rates are substantially lower than intra-city buses and local

television

The cost per thousand (CPM) rates that CCME charges is just 13% of equivalent intra-city bus and 2% of

local television rates despite CCME’s large network and positive attributes. CCME’s large discount to

these alternative mediums provides flexibility to raise rates with no decline in demand for its inventory

which is currently experiencing close to 100% utilization.

CCME VISN Local CME CPM % of

Inter-City Bus Intra-City Bus Television Intra-City Bus Local TV

(In RMB for every 15 seconds)

City

Shanghai 4 140 #REF! 2.6%

Guangzhou 3 17 114 #REF! 2.8%

Xiamen 3 255 #REF! 1.2%

Fuzhou 3 268 #REF! 1.0%

Nanjing 3 30 153 #REF! 1.7%

Changzhou 3 317 #REF! 0.8%

Tianjin 3 59 #REF! 4.3%

Beijing 2 26 133 #REF! 1.6%

Average 3 21 180 13% 2%

Source: CCME proxy, VisionChina Median (NASD: VISN) investor presentation (note VISN average composed of

several cities not on this list)

New embedded advertising and other factors should drive strong 2010 growth

In the third quarter of 2009 CCME launched a new embedded advertising initiative that was the driver of a

large portion of the sequential growth in the quarter. Embedded advertising allows advertisers to be the

exclusive sponsor of a specific program in return for paying a higher CPM to CCME. The advertisers gain

additional exposure from announcements that the program is sponsored by that advertiser and a banner

add is placed on the side of the screen displaying the logo of the advertiser during the broadcast of the

programs.

Additional drivers of growth in 2010 are expected to come from:

1. Advertising rate increase of 10%: Raising rates by 10% is reasonable considering CCME’s low

CPM rates and expectations for a strong advertising market as evidenced by:

o The strong November CCTV 2010 advertising auctions

o Reports that VISN and Focus Media (NASD: FMCN) have raised their rates by 10% to

20% in January

o Changes in government regulations that reduce television advertising time which has

caused local television stations to increase their rates by 20% to 30% to make up for their

lost inventory

2. Substantial increase in advertising inventory: Management’s goal is to increase the number of

buses to 30,000 by the end of 2010 for a 50% year over year increase. This appears reasonable

given the rate of new bus growth since June of 2009. For conservatism we assume 28,000 buses by

the end of 2010 in our model.

3. New acquisitions: $77M of capital was raised in the last two weeks of January from the Starr

International preferred investment and the SPAC public warrant redemption. Management expects to

deploy CCME’s excess cash of $100M+ towards acquisitions in the near future. For conservatism we

do not include the contributions from acquisitions in our financial model.

SPAC Analytics Special Situation Research 4

March 12, 2010 China MediaExpress (CCME)

Validation by Starr International and Deloitte and Touche is significant and

should lead to multiple expansion

CCME had a tough SPAC IPO in October 2009 that raised no cash. The difficulties they had coming

public raised questions about the quality of its business. The recently completed $30 million preferred

financing by Starr International reduces these concerns since Starr conducted due diligence that most

investors are not able to do. Before committing to invest $30 million in CCME, Starr conducted a four

month due diligence of CCME that involved several third party cross checks of CCME’s operations

including an independent audit of the financials and verification of CCME’s commercial contracts. Starr

International is a private equity firm that is chaired by Hank Greenburg, the former CEO of AIG. On

average, Starr has invested $100M in three to four companies per year in China.

We expect a further boost to credibility when CCME reports its 2009 results audited by newly hired

Deloitte and Touche.

Financial analysis

Our model is conservative with net income below the minimum targets set by the Starr investment

agreement and the performance share earn outs. Our forecast for 2010 and 2011 assumes 5% to 10%

rate increases and a decrease in CCME’s profit margins as we expect CCME to increase its SG&A

expenses and increase the concession fees it pays to the bus operators on its network.

2007A 2008A 2009F 2010F 2011F

SPAC Analytics Forecast

Revenue (mn USD) 25.8 63.0 95.1 142.7 191.0

EBITDA 12.6 38.0 58.2 77.0 94.6

Net income 7.0 26.4 40.5 53.9 65.8

Fully diluted EPS 0.21 0.78 1.16 1.36 1.66

Gross profit margin 49% 60% 65% 64% 61%

Sales expense % of revenue 4% 2% 4% 10% 11%

EBITDA margin 49% 60% 61% 54% 50%

# of buses 10,053 15,260 20,000 28,000 33,000

Avg. quarterly revenue per bus 1,156 1,244 1,348 1,486 1,565

Annual growth 29% 8% 8% 10% 5%

Capex (mn USD) 6.6 4.2 6.0 28.7 10.0

Starr Minimum Net Income Targets

Net income (mn USD) 42.0 55.0 70.0

Fully diluted EPS 1.20 1.39 1.77

Earn Out Share Guidance

Revenue (mn USD) 104.2 196.6 305.5

EBITDA 65.5 128.5 197.8

Net income 42.1 83.6 130.3

Fully diluted EPS 1.17 1.76 2.39

Earn out shares to be issued (mn) 1.0 7.0 7.0

We assume a large capital outlay in 2010 as management expands the network by 10,000 buses and

retrofits the existing buses and stations network to an automated process from a manual process. We

estimate the cost of this program to be $28.7 million ($1,000 per new bus + $100 retro fit of existing buses

+ $150K per new station) which can be funded from the current estimated net cash balance of $100M as

well as cash flow from operations.

SPAC Analytics Special Situation Research 5

March 12, 2010 China MediaExpress (CCME)

There is upside to our 2010 forecast if accretive acquisitions are made and if operations perform better

than we have conservatively modeled. We believe that $60M+ net income (f.d. EPS of $1.52+) is

probable for 2010 based on current growth rates and margins and the high likelihood of accretive

acquisitions in the next few months. However, for conservatism we maintain our forecast until we gain

better clarity on these events occurring.

CCME has excellent cash conversion

In a country and an industry notorious for long outstanding receivables, CCME is a stand out with very

fast cash conversion. CCME obtains fast 30 day payment terms from its advertising agency clients in

return for providing its inventory at much lower CPMs than equivalent television. CCME has a limited

number of advertising agency clients that make up the majority of its revenue which makes it easier to

manage its receivables. In 2008, its top 20 advertising agencies accounted for 98% of its revenue.

CCME plans to increase the proportion of direct advertising clients to 40% of revenues in 2010 in order to

boost profit margins. By the end of 2010 CCME expects to increase the size of its sales force sales to

300+ from 90 headcount at the end of 2009. We expect CCME’s collection times to decrease as the

percentage of revenue from direct advertising clients increases.

DSO comparison: Out-of-home advertisers

CCME FMCN VISN AMCN LAMR DEC FP CCO

Outdoor advertising channels Buses inter-city Elevators Intra-city buses Airports Billboards Billboards Billboards

LED billboards Subways Gas stations Bus shelters Street Airports

LED displays in store furniture Malls

2009 Days receivables and office Airports Taxis

Period 30-Sep-09 30-Sep-09 31-Dec-09 31-Dec-09 31-Dec-09 31-Dec-09 30-Sep-09

A/R 15 222 37 49 143 601 738

Revenue 95 498 121 149 1056 1919 1935

Days receivables 43 122 112 121 49 114 104

Source: company filings

The only peer that has similar DSO’s is Lamar Advertising (NASD: LAMR).

SPAC Analytics Special Situation Research 6

March 12, 2010 China MediaExpress (CCME)

DCF valuation of $28.23

Our DCF estimate of $28.23 is based on a 2.5% terminal growth rate and a 15.0% WACC which is

derived from a blended peer average beta of 1.30, equity risk premium of 6.0% and a risk free rate of

5.56%.

The $28.23 valuation supports our $28.00 12 month target which is 15.0x FY11F ex-net cash P/E and

10.4x 2011 EV/EBITDA which are in line with the typical one year forward multiples of China and Western

out-of-home advertisers.

Discounted Cash Flow (2010 - 2018)

Dec-08 Dec-09 Dec-10 Dec-11 Dec-12 Dec-13 Dec-14 Dec-15 Dec-16 Dec-17 Dec-18

Revenue 63.0 95.1 142.7 191.0 236.8 281.8 326.9 372.7 417.4 463.3 509.6

Net change 37.2 32.1 47.6 48.3 45.8 45.0 45.1 45.8 44.7 45.9 46.3

Revenue growth 143.8% 50.9% 50.1% 33.9% 24.0% 19.0% 16.0% 14.0% 12.0% 11.0% 10.0%

EBITDA margin 60.3% 61.2% 54.0% 49.5% 48.0% 47.0% 46.0% 45.0% 44.0% 43.0% 42.0%

EBITDA 38.0 58.2 77.0 94.6 113.7 132.5 150.4 167.7 183.7 199.2 214.0

Less: D&A (2.9) (3.4) (5.2) (6.9) (8.9) (10.9) (12.9) (14.9) (16.9) (18.9) (20.9)

EBIT 35.1 54.9 71.8 87.7 104.8 121.6 137.5 152.8 166.8 180.3 193.1

Unlevered Taxes 25.0% (8.9) (14.3) (18.0) (21.9) (26.2) (30.4) (34.4) (38.2) (41.7) (45.1) (48.3)

After Tax Earnings 26.3 40.6 53.9 65.8 78.6 91.2 103.1 114.6 125.1 135.2 144.9

Add back: D&A 2.9 3.4 5.2 6.9 8.9 10.9 12.9 14.9 16.9 18.9 20.9

Less: Capex (4.2) (6.0) (28.7) (10.0) (10.0) (10.0) (10.0) (10.0) (10.0) (10.0) (10.0)

Free cash flow 24.9 38.0 30.3 62.7 77.5 92.1 106.0 119.5 132.0 144.1 155.8

Terminal Growth 2.5%

Discount Rate 13.0% 14.0% 15.0% 16.0% 17.0%

DCF

Sum of PV 411.3 394.4 378.0 363.4 349.2

Terminal Value 805.1 703.4 617.4 549.3 490.0

Enterprise Value 1,216.5 1,097.9 995.5 912.7 839.1

Net Debt / (Cash) (121.0) (121.0) (121.0) (121.0) (121.0)

Equity Value - fully diluted 1,337.5 1,218.9 1,116.5 1,033.7 960.2

Share price target - true fully diluted 33.81 30.82 28.23 26.13 24.27

WACC 15.0% Risk free rate 5.56% 30 year t-bill + 1%

Cost of debt 12.0% Equity risk premium 6.0%

Cost of equity 15.0% Beta 1.30 Average of FMCN, VISN and AMCN

Debt/equity 0.0%

SPAC Analytics Special Situation Research 7

March 12, 2010 China MediaExpress (CCME)

Comparable analysis – CCME is much cheaper than its peers

Adj EBITDA EV/EBITDA EBITDA Margin F.D PE

Price EV* 2009 2010 2009 2010 2009 2010 2009 2010

Chinese Out-of-Home Advertisers

VISN - VisinChina Media 4.77 442 32 16 13.8 28.3 26% 10% 10.9 207.4

AMCN - AirMedia 7.18 373 -21 21 17.8 9% 87.6

IDI - SearchMedia 5.52 114 33 37 3.4 3.0 37% 38% 10.0 7.7

FMCN - Focus Media 16.43 1,741 17 170 101.2 10.3 3% 28% 32.3 20.5

Average 39.5 14.9 22% 21% 17.7 80.8

Median 13.8 14.1 26% 19% 10.9 54.0

Western Out-of-Home Advertisers

LAMR - Lamar 34.32 5,709 443 464 12.9 12.3 42% 42%

CCO - Clear Channel 11.85 6,479 529 618 12.3 10.5 20% 22%

DEC FP - JC Decaux 19.42 4,960 349 445 14.2 11.2 18% 21% 104.4 37.7

Average 13.1 11.3 27% 29%

Median 12.9 11.2 20% 22%

All Out-of-Home Advertisers

Average 26.3 13.3 24% 24% 39.4 72.2

Median 13.3 11.2 23% 22% 21.6 37.7

CCME - C hina MediaExpress 11.56 336 58 77 5.8 4.4 61% 54% 10.0 8.5

% discount to median -69% -84%

* Adj EV includes future estimated cash and stock commitments for acquisitions.

Source: Bloomberg and SA Estimates

CCME trades at a substantial 69%+ discount to its China and Western peers on an EV/EBITDA and PE

basis. FMCN is the best Chinese comparable since its operations are the most stable. VISN and IDI are

currently working through operational issues while AMCN’s high 2010 multiple is in anticipation of a much

stronger 2011. A key point of differentiation is that CCME does not have any acquisition related earnout

payment commitments. This eliminates the risk of a drop in revenues after the earnout period expires as

occurred with VISN and FMCN.

Valuation grid - $20.00 short term target is a discount to peer multiples

Share F.D EV/EBITDA F.D EPS F.D. PE

Price EV 2009 2010 2009 2010 2009 2010 Comments

10.00 275 4.7 3.6 1.16 1.36 8.6 7.3

11.00 314 5.4 4.1 1.16 1.36 9.5 8.1

11.56 336 5.8 4.4 1.16 1.36 10.0 8.5 CCME price Mar 12, 2010

12.00 354 6.1 4.6 1.16 1.36 10.4 8.8

13.00 393 6.8 5.1 1.16 1.36 11.2 9.5

14.00 433 7.4 5.6 1.16 1.36 12.1 10.3

15.00 472 8.1 6.1 1.16 1.36 13.0 11.0

16.00 512 8.8 6.6 1.16 1.36 13.8 11.8

17.00 551 9.5 7.2 1.16 1.36 14.7 12.5

18.00 591 10.1 7.7 1.16 1.36 15.5 13.2

19.00 631 10.8 8.2 1.16 1.36 16.4 14.0

20.00 670 11.5 8.7 1.16 1.36 17.3 14.7 $20.00 short term target

24.90 864 14.8 11.2 1.16 1.36 21.5 18.3 $24.90 in line with peer 2010 EV/EBITDA

28.00 986 16.9 12.8 1.16 1.36 24.2 20.6 $28.00 12 month target

28.23 996 17.1 12.9 1.16 1.36 24.4 20.7 $28.23 DCF valuation

Peer median multiple 13.3 11.2

CCME EBITDA mn USD 58.2 77.0

CCME net income mn USD 40.5 53.9

CCME should trade at $24.90 to be in line with its peer median 2010 EV/EBITDA multiple. Thus our short

term $20.00 target is conservative.

SPAC Analytics Special Situation Research 8

March 12, 2010 China MediaExpress (CCME)

Technical Analysis

Source: Bloomberg

CCME has traded in a band between $10.00 to $14.00 since November. CCME briefly traded above

$14.00 after the announcement of the Starr International $30M investment but subsequently traded lower

with the weaker Chinese markets and additional selling pressure due to the warrant redemptions that

ended at the end of January.

We expect CCME to trade towards $20.00 if CCME closes above $14.00 ideally with positive

fundamental news. A close below $10.00 is a bear signal.

Timeline Catalyst

March 16 Roth Capital annual OC Growth Stock Conference in Laguna Niguel, California

March 23 Q4 audited results and 2010 guidance

Anytime New acquisitions

Anytime New bus operators added to the network

SPAC Analytics Special Situation Research 9

March 12, 2010 China MediaExpress (CCME)

General Disclaimers and Disclosures: This report was originally prepared and issued by SPAC Analytics for distribution to its professional

investor customers. SPAC Analytics is a division of SPAC Investments Ltd. (SIL). The information contained herein is based on sources which

we believe to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. Readers must evaluate, and bear all risks

associated with, the use of any information provided hereunder, including any reliance on the accuracy, completeness, safety or usefulness of

such information. This information is not intended to be used as the primary basis of investment decisions. All information in this report should

be independently verified with the companies mentioned. This report is not to be construed as an offer or the solicitation of an offer to sell or buy

the securities herein mentioned. Neither SIL, nor its officers, directors, partners, contributors or employees/consultants, accept any liability

whatsoever for any direct or consequential loss arising from any use of information from this report. The firm and/or its employees may have

positions in the securities mentioned and, before or after your receipt of this report, may make purchases and/or sales for their own accounts from

time to time in the open market or otherwise. The opinions or information expressed are believed to be accurate as of the date of this report; no

subsequent publication or distribution of this report shall mean or imply that any such opinions or information remains current at any time after

the date of this report. All opinions are subject to change without notice, and we do not undertake to advise you of any such changes.

Reproduction or redistribution of this report without the expressed written consent of SIL is prohibited. Additional information on any securities

mentioned is available on request.

Additional Disclosures: SIL is not an investment advisor registered with the Securities and Exchange Commission or with the securities

regulators of any state, and at the present time is not eligible to file for federal registration. SIL is not acting as a broker dealer under any federal

or state securities laws.

About SPAC Analytics: SPAC Analytics is a private research service that provides analysis of SPAC acquisitions and provides trade

recommendations to portfolio managers. It was found by Neil Danics in March 2007.

Neil Danics is recognized as a leading authority on SPACs and has been invited to present at several conferences and has recently been quoted in

the Wall Street Journal, Washington post, Reuters, Dow Jones and several other businesses publications.

Neil has developed an in-depth expertise analyzing SPACs having been a professional investor in SPACs for over five years and operating a

research service that has analyzed over 100 SPAC acquisitions. The analysis is complemented by utilizing information from his large network of

contacts in the investment community which includes hedge funds, investment banks and sales/trading desks that specialize in SPACs.

For more information please go to www.spacanalytics.com

SPAC Analytics Special Situation Research 10

Вам также может понравиться

- Economic and Business Forecasting: Analyzing and Interpreting Econometric ResultsОт EverandEconomic and Business Forecasting: Analyzing and Interpreting Econometric ResultsОценок пока нет

- Financial Analysis: Nestle India Ltd. ACC LTDДокумент20 страницFinancial Analysis: Nestle India Ltd. ACC LTDrahil0786Оценок пока нет

- Principles of Cash Flow Valuation: An Integrated Market-Based ApproachОт EverandPrinciples of Cash Flow Valuation: An Integrated Market-Based ApproachРейтинг: 3 из 5 звезд3/5 (3)

- Resource Sharing For An Intelligent Future: Interim Report 2021Документ50 страницResource Sharing For An Intelligent Future: Interim Report 2021mailimailiОценок пока нет

- Offices of Bank Holding Company Revenues World Summary: Market Values & Financials by CountryОт EverandOffices of Bank Holding Company Revenues World Summary: Market Values & Financials by CountryОценок пока нет

- East African Breweries Ltd. (EABL) - A Business & Financial AnalysisДокумент16 страницEast African Breweries Ltd. (EABL) - A Business & Financial AnalysisPatrick Kiragu Mwangi BA, BSc., MA, ACSIОценок пока нет

- Dipawali ReportДокумент16 страницDipawali ReportKeval ShahОценок пока нет

- Cocoland 20100727 - CUДокумент2 страницыCocoland 20100727 - CUlimml63Оценок пока нет

- Bhel-3qfy11 Ru-210111Документ12 страницBhel-3qfy11 Ru-210111kshintlОценок пока нет

- Scicom - 4QFY10 Results - FinalДокумент3 страницыScicom - 4QFY10 Results - Finallimml63Оценок пока нет

- BCG InsideSherpa Core Strategy - Telco (Task 2 Additional Data) - UpdateДокумент9 страницBCG InsideSherpa Core Strategy - Telco (Task 2 Additional Data) - UpdateAbinash AgrawalОценок пока нет

- Lbo Case StudyДокумент6 страницLbo Case StudyRishabh MishraОценок пока нет

- CYIENT Kotak 22102018Документ6 страницCYIENT Kotak 22102018ADОценок пока нет

- CECДокумент4 страницыCECJyoti Berwal0% (3)

- Hing Yiap Group Berhad Buy: Results Report SJ Securities Sdn. BHDДокумент4 страницыHing Yiap Group Berhad Buy: Results Report SJ Securities Sdn. BHDlimml63Оценок пока нет

- Stmicro - Q4-Fy2018 PR - FinalДокумент12 страницStmicro - Q4-Fy2018 PR - Finalakshay kumarОценок пока нет

- SECO 03-2022-24 UpdateДокумент13 страницSECO 03-2022-24 UpdateJoachim HagegeОценок пока нет

- Brief Overview of I2Документ7 страницBrief Overview of I2api-3716851Оценок пока нет

- TV3 AnalysisДокумент3 страницыTV3 AnalysishotransangОценок пока нет

- 6 - Zee Entertainment Enterprises 2QF15Документ7 страниц6 - Zee Entertainment Enterprises 2QF15girishrajsОценок пока нет

- Ashok Leyland: Performance HighlightsДокумент9 страницAshok Leyland: Performance HighlightsSandeep ManglikОценок пока нет

- Financial Statements Analysis Case StudyДокумент15 страницFinancial Statements Analysis Case StudyNelly Yulinda50% (2)

- Equity Valuation Report - Corticeira AmorimДокумент3 страницыEquity Valuation Report - Corticeira AmorimFEPFinanceClubОценок пока нет

- Industry Analysis 20074076Документ3 страницыIndustry Analysis 20074076ParkdongwookОценок пока нет

- Bank of Baroda: Q4FY11 - Core Numbers On Track CMPДокумент5 страницBank of Baroda: Q4FY11 - Core Numbers On Track CMPAnkita GaubaОценок пока нет

- Andhra Bank 2009-2010Документ7 страницAndhra Bank 2009-2010Don Iz BackОценок пока нет

- Financial Statements Analysis Case StudyДокумент15 страницFinancial Statements Analysis Case Studyดวงยี่หวา จิระวงศ์สันติสุขОценок пока нет

- Cost of Capital of ITCДокумент24 страницыCost of Capital of ITCMadhusudan PartaniОценок пока нет

- Mind TreeДокумент10 страницMind TreeGaurav JainОценок пока нет

- Wipro: CMP: INR243 TP: INR260 (+7%) Largely in Line Lower ETR Drives A Beat in ProfitabilityДокумент14 страницWipro: CMP: INR243 TP: INR260 (+7%) Largely in Line Lower ETR Drives A Beat in ProfitabilityPramod KulkarniОценок пока нет

- Just Group Research Report 05.15.21 - v2Документ4 страницыJust Group Research Report 05.15.21 - v2Ralph SuarezОценок пока нет

- Q1FY22 Result Update City Union Bank LTD: Beat On Operational Front Due To Lower Credit CostДокумент12 страницQ1FY22 Result Update City Union Bank LTD: Beat On Operational Front Due To Lower Credit Costforgi mistyОценок пока нет

- IFII Research Report Vincent TjoeДокумент4 страницыIFII Research Report Vincent TjoeVincent TjoeОценок пока нет

- Just Group Research Report 05.15.21Документ4 страницыJust Group Research Report 05.15.21Ralph SuarezОценок пока нет

- Mediaset (MS - MI) : 3Q03 Results On TuesdayДокумент8 страницMediaset (MS - MI) : 3Q03 Results On Tuesdaypoutsos1984Оценок пока нет

- NTC 4Q17 Earnings ReportДокумент4 страницыNTC 4Q17 Earnings ReportJuhie GuptaОценок пока нет

- 2012-08-27 CORD - Si (S&P Capital I) CordlifeFY12ResultsДокумент8 страниц2012-08-27 CORD - Si (S&P Capital I) CordlifeFY12ResultsKelvin FuОценок пока нет

- Tech Mahindra: Performance HighlightsДокумент11 страницTech Mahindra: Performance HighlightsAngel BrokingОценок пока нет

- Finacial Growth - Assignment #1Документ4 страницыFinacial Growth - Assignment #1kattremblay17Оценок пока нет

- 435 FinalДокумент16 страниц435 FinalshakilnaimaОценок пока нет

- BinaPuri 100824 RN2Q10Документ2 страницыBinaPuri 100824 RN2Q10limml63Оценок пока нет

- Bank of AmericaДокумент21 страницаBank of AmericaRavish SrivastavaОценок пока нет

- Microsoft Investment AnalysisДокумент4 страницыMicrosoft Investment AnalysisdkrauzaОценок пока нет

- Delfi DBSДокумент14 страницDelfi DBSquang caoОценок пока нет

- Yes Bank - IDFC SSKI - 22 01 09Документ6 страницYes Bank - IDFC SSKI - 22 01 09api-19728845Оценок пока нет

- Yes Bank: Performance HighlightsДокумент12 страницYes Bank: Performance HighlightsAngel BrokingОценок пока нет

- Assignment 01Документ18 страницAssignment 01Md. Real MiahОценок пока нет

- Infosys Result UpdatedДокумент14 страницInfosys Result UpdatedAngel BrokingОценок пока нет

- Data AnalysisДокумент12 страницData Analysisloic.seguin.proОценок пока нет

- MBA FM - 3102 Security Analysis and Portfolio ManagementДокумент6 страницMBA FM - 3102 Security Analysis and Portfolio ManagementAsh KoulОценок пока нет

- Top Glove 140618Документ5 страницTop Glove 140618Joseph CampbellОценок пока нет

- Voltas Dolat 140519 PDFДокумент7 страницVoltas Dolat 140519 PDFADОценок пока нет

- CompanyfinacialmatrixДокумент3 страницыCompanyfinacialmatrix2009PUEОценок пока нет

- Cipla: Performance HighlightsДокумент8 страницCipla: Performance HighlightsKapil AthwaniОценок пока нет

- HDFC Bank Result UpdatedДокумент13 страницHDFC Bank Result UpdatedAngel BrokingОценок пока нет

- Unaudited Results For The Half Year and Second Quarter Results Ended 31 October 2021Документ36 страницUnaudited Results For The Half Year and Second Quarter Results Ended 31 October 2021imsolovelyОценок пока нет

- GGP Final2010Документ23 страницыGGP Final2010Frank ParkerОценок пока нет

- V-Guard-Industries - Q4 FY21-Results-PresentationДокумент17 страницV-Guard-Industries - Q4 FY21-Results-PresentationanooppattazhyОценок пока нет

- Problem Statement: Sub-Task 1Документ12 страницProblem Statement: Sub-Task 1Preethi Ravi100% (2)

- Feasibility StudyДокумент3 страницыFeasibility StudyShielle Azon100% (1)

- Final Report EntrepreneurshipДокумент23 страницыFinal Report EntrepreneurshiphelperforeuОценок пока нет

- Voss Capital On BlucoraДокумент4 страницыVoss Capital On BlucoraCanadianValueОценок пока нет

- Introduction To Foreign Exchange MarketsДокумент16 страницIntroduction To Foreign Exchange MarketsMalik BilalОценок пока нет

- TheEdge 14.12.2018 PDFДокумент41 страницаTheEdge 14.12.2018 PDFChu Gen LimОценок пока нет

- H63H64Документ1 страницаH63H64MinamPeruОценок пока нет

- RBS Holdings NV Annual ReportДокумент256 страницRBS Holdings NV Annual ReportIskandar IsОценок пока нет

- Black Book (HDFC Bank)Документ54 страницыBlack Book (HDFC Bank)Bhavya chhedaОценок пока нет

- Yue Yuen Industrial (Holdings) Limited 裕元工業(集團)有限公司 Pou Sheng International (Holdings) Limited 寶勝國際(控股)有限公司Документ18 страницYue Yuen Industrial (Holdings) Limited 裕元工業(集團)有限公司 Pou Sheng International (Holdings) Limited 寶勝國際(控股)有限公司Medi AlexanderОценок пока нет

- Form No. SH-4 - Securities Transfer Form: (Share Capital and Debentures) Rules 2014)Документ2 страницыForm No. SH-4 - Securities Transfer Form: (Share Capital and Debentures) Rules 2014)jyottsnaОценок пока нет

- Petty Cash and Bank ReconciliationДокумент34 страницыPetty Cash and Bank ReconciliationLulu LestariОценок пока нет

- Comparison of Asian Development Bank ProcurementДокумент5 страницComparison of Asian Development Bank Procurementfaw030% (1)

- Reviewer Financial ManagementДокумент39 страницReviewer Financial ManagementDerek Dale Vizconde NuñezОценок пока нет

- AcknowledgementДокумент80 страницAcknowledgementsantasforuОценок пока нет

- SyllabusДокумент101 страницаSyllabusnghianguyen50% (2)

- Working Capital Management of RINLДокумент3 страницыWorking Capital Management of RINLSneha GuptaОценок пока нет

- Transnational Corporations (Grazia Ietto-Gillies)Документ266 страницTransnational Corporations (Grazia Ietto-Gillies)Nicholas Pardesi100% (6)

- PoaДокумент75 страницPoaNISHANTH100% (1)

- CORPO 1st Wave of Cases For FinalsДокумент35 страницCORPO 1st Wave of Cases For FinalsHijabwear BizОценок пока нет

- Time Interest Earned RatioДокумент40 страницTime Interest Earned RatioFarihaFardeenОценок пока нет

- Buckley 2009Документ12 страницBuckley 2009AnnОценок пока нет

- Motives ofДокумент9 страницMotives ofYogesh BatraОценок пока нет

- Inflation PresentationДокумент12 страницInflation PresentationVivek SinghОценок пока нет

- Credit Analysis RatiosДокумент24 страницыCredit Analysis RatiosParul Jain100% (1)

- FinQuiz Level1Mock2018Version2JuneAMSolutionsДокумент79 страницFinQuiz Level1Mock2018Version2JuneAMSolutionsYash Joglekar100% (2)

- Advantages and Disadvantages of TaxationДокумент20 страницAdvantages and Disadvantages of TaxationNimraa NoorОценок пока нет

- CASE STUDY-Financial Statement AnalysisДокумент10 страницCASE STUDY-Financial Statement Analysisssimi137Оценок пока нет

- Users of Accounting Information For Automobile Sector PFAДокумент14 страницUsers of Accounting Information For Automobile Sector PFASaloni SurekaОценок пока нет

- 7 4 - Federal Reserve SystemДокумент26 страниц7 4 - Federal Reserve Systemapi-235395204Оценок пока нет

- L&T Final ReportДокумент37 страницL&T Final ReportSorav SharmaОценок пока нет

- John D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthОт EverandJohn D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthРейтинг: 4 из 5 звезд4/5 (20)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaОт EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaРейтинг: 4.5 из 5 звезд4.5/5 (14)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaОт EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaРейтинг: 3.5 из 5 звезд3.5/5 (8)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNОт Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNРейтинг: 4.5 из 5 звезд4.5/5 (3)

- Mind over Money: The Psychology of Money and How to Use It BetterОт EverandMind over Money: The Psychology of Money and How to Use It BetterРейтинг: 4 из 5 звезд4/5 (24)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialОт EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialОценок пока нет

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisОт EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisРейтинг: 5 из 5 звезд5/5 (6)

- Creating Shareholder Value: A Guide For Managers And InvestorsОт EverandCreating Shareholder Value: A Guide For Managers And InvestorsРейтинг: 4.5 из 5 звезд4.5/5 (8)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingОт EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingРейтинг: 4.5 из 5 звезд4.5/5 (17)

- The 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamОт EverandThe 17 Indisputable Laws of Teamwork Workbook: Embrace Them and Empower Your TeamОценок пока нет

- Ready, Set, Growth hack:: A beginners guide to growth hacking successОт EverandReady, Set, Growth hack:: A beginners guide to growth hacking successРейтинг: 4.5 из 5 звезд4.5/5 (93)

- An easy approach to trading with bollinger bands: How to learn how to use Bollinger bands to trade online successfullyОт EverandAn easy approach to trading with bollinger bands: How to learn how to use Bollinger bands to trade online successfullyРейтинг: 3 из 5 звезд3/5 (1)

- Mastering the VC Game: A Venture Capital Insider Reveals How to Get from Start-up to IPO on Your TermsОт EverandMastering the VC Game: A Venture Capital Insider Reveals How to Get from Start-up to IPO on Your TermsРейтинг: 4.5 из 5 звезд4.5/5 (21)

- Product-Led Growth: How to Build a Product That Sells ItselfОт EverandProduct-Led Growth: How to Build a Product That Sells ItselfРейтинг: 5 из 5 звезд5/5 (1)

- Applied Corporate Finance. What is a Company worth?От EverandApplied Corporate Finance. What is a Company worth?Рейтинг: 3 из 5 звезд3/5 (2)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialОт EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialРейтинг: 4.5 из 5 звезд4.5/5 (32)

- Warren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorОт EverandWarren Buffett Book of Investing Wisdom: 350 Quotes from the World's Most Successful InvestorОценок пока нет

- Buffett's 2-Step Stock Market Strategy: Know When To Buy A Stock, Become A Millionaire, Get The Highest ReturnsОт EverandBuffett's 2-Step Stock Market Strategy: Know When To Buy A Stock, Become A Millionaire, Get The Highest ReturnsРейтинг: 5 из 5 звезд5/5 (1)

- Venture Deals: Be Smarter Than Your Lawyer and Venture CapitalistОт EverandVenture Deals: Be Smarter Than Your Lawyer and Venture CapitalistРейтинг: 4 из 5 звезд4/5 (32)

- Finance Secrets of Billion-Dollar Entrepreneurs: Venture Finance Without Venture Capital (Capital Productivity, Business Start Up, Entrepreneurship, Financial Accounting)От EverandFinance Secrets of Billion-Dollar Entrepreneurs: Venture Finance Without Venture Capital (Capital Productivity, Business Start Up, Entrepreneurship, Financial Accounting)Рейтинг: 4 из 5 звезд4/5 (5)

- The Wall Street MBA, Third Edition: Your Personal Crash Course in Corporate FinanceОт EverandThe Wall Street MBA, Third Edition: Your Personal Crash Course in Corporate FinanceРейтинг: 4 из 5 звезд4/5 (1)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistОт EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistРейтинг: 4.5 из 5 звезд4.5/5 (73)

- The Value of a Whale: On the Illusions of Green CapitalismОт EverandThe Value of a Whale: On the Illusions of Green CapitalismРейтинг: 5 из 5 звезд5/5 (2)