Академический Документы

Профессиональный Документы

Культура Документы

IIFCL Tranche II - Term Sheet1

Загружено:

aajkarenОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

IIFCL Tranche II - Term Sheet1

Загружено:

aajkarenАвторское право:

Доступные форматы

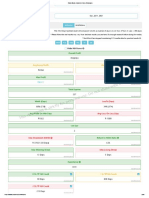

IIFCL Tax Free Secured Redeemable Non Convertible Bonds Tranche II (TERM SHEET)

Issuer

Issue Size

Issue Opening Date

Issue Closing Date

Rating

Minimum Application

Face Value of Bond

Listing

Interest on successful application

Interest on refund

Registrar to the issue

Interest payment

Issuance

INDIA INFRASTRUCTURE FINANCE COMPANY LIMITED

Rs. 1000 cr (Base Issue Size) with option to retain oversubscription upto the shelf

limit (being Rs. 3000 cr)

9th Dec 2013

10th Jan 2014

AAA by CARE, ICRA, IRRPL & BWR

Rs.5000 & in multiples of 1 bond thereafter

Rs.1000

Proposed to be listed in BSE

Respective coupon rates

5% p.a.

M/s Karvy Computershares Pvt. Ltd

Payable Annually Only

Both in dematerialized form as well as in physical form as specified by the Applicant

in the Application Form

Coupon Rates:

Options

Tenure (years)

Interest rate (%) p.a.

Options

Interest rate (%) p.a.

Category wise Allocations

Category I

Upto 15% of Overall Issue

Size*

QIB

Tranche II Series 1B

8.66%

Series of Bonds

For Category I, II & III

Tranche II Series 2A

15

8.48%

For Category IV only

Tranche II Series 2B

8.73%

Category II

Category III

Tranche II Series 1A

10

8.41%

Upto 20% of Overall Issue Upto 25% of Overall Issue

Size*

Size*

Corporate

Individuals & HUF applying

more than Rs. 10 Lakh

Tranche II Series 3A

20

8.66%

Tranche II Series 3B

8.91%

Category IV

Upto 40% of Overall Issue

Size*

Individuals & HUF applying

upto Rs. 10 Lakh

*Allotments of Bonds will be on a first come-first serve basis, on the basis of the date of upload of Applications on the electronic platform of the

Stock Exchange.

HIGHLIGHTS OF TAX BENEFITS

In exercise of the powers conferred by item (h) of sub-clause (iv) of clause (15) of Section 10 of the Income Tax Act, 1961

(43 of 1961) the Central Government authorizes IIFCL to issue during the FY 2013-14, Tax Free, Secured, Redeemable, Nonconvertible Bonds.

The income by way of interest on these Bonds is fully exempt from Income Tax and shall not form part of Total Income as

per provisions under section 10 (15) (iv) (h) of I.T. Act, 1961.

There will be no deduction of tax at source from the interest, which accrues to the bondholders in these bonds irrespective

of the amount of the interest or the status of the investors.

Wealth Tax is not levied on investment in Bond under section 2(ea) of the Wealth-tax Act, 1957

Who Can Apply

Category I

Public financial institution as defined in Section 4A of the Companies Act,

Alternative Investment Fund eligible to invest under the SEBI (Alternative Investment Funds) Regulations,

2012, as amended

Scheduled commercial bank,

Mutual fund, registered with SEBI,

Multilateral and bilateral development financial institutions,

State industrial development corporations,

Insurance companies registered with the Insurance Regulatory and Development Authority,

Provident funds with a minimum corpus of Rs. 2500.00 lakh,

Pension funds with a minimum corpus of Rs. 2500.00 lakh,

The National Investment Fund set up by resolution F. No. 2/3/2005-DD-II dated November 23, 2005 of the

GoI, published in the Gazette of India,

Insurance funds set up and managed by the army, navy, or air force of the Union of India, and

Insurance funds set up and managed by the Department of Posts, India,

Category II Companies within the meaning of section 2(20) of the Companies Act, 2013, Limited Liability Partnerships

registered under the provisions of the LLP Act, statutory corporations, trust, partnership firms in the name

of the firm, cooperative banks, regional rural banks and and legal entities registered under applicable laws

in India and authorised to invest in Bonds

Category III The following investors applying for an amount aggregating to more than Rs. 10.00 lakh across all Series of

Bonds in each Tranche Issue

Resident Individual Investors

Hindu Undivided Families applying through the Karta

Category IV The following investors applying for an amount aggregating up to and including Rs. 10.00 lakh across all

Series of Bonds in each Tranche Issue

Resident Individual Investors

Hindu Undivided Families through the Karta

Вам также может понравиться

- Farid ShahДокумент1 страницаFarid ShahaajkarenОценок пока нет

- Ed Seykota of Technical ToolsДокумент8 страницEd Seykota of Technical ToolsRonitSing89% (9)

- Solutions of Kinematics HC Verma Chapter 3Документ16 страницSolutions of Kinematics HC Verma Chapter 3Wave Education100% (1)

- Ed Seykota of Technical ToolsДокумент8 страницEd Seykota of Technical ToolsRonitSing89% (9)

- Ed Seykota of Technical ToolsДокумент8 страницEd Seykota of Technical ToolsRonitSing89% (9)

- Reminesces of Stock OpertorДокумент2 страницыReminesces of Stock OpertoraajkarenОценок пока нет

- Reminesces of Stock OpertorДокумент2 страницыReminesces of Stock OpertoraajkarenОценок пока нет

- Ed Seykota of Technical ToolsДокумент8 страницEd Seykota of Technical ToolsRonitSing89% (9)

- Ed Seykota of Technical ToolsДокумент8 страницEd Seykota of Technical ToolsRonitSing89% (9)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Case Name: University of The Philippines College of LawДокумент6 страницCase Name: University of The Philippines College of LawYvette MoralesОценок пока нет

- Prospectus Amazon Store Selling Survival and Sports Gear PDFДокумент11 страницProspectus Amazon Store Selling Survival and Sports Gear PDFAliciaОценок пока нет

- Corporate Reporting Manual Part 2 - Up To 2018Документ774 страницыCorporate Reporting Manual Part 2 - Up To 2018Masum GaziОценок пока нет

- Study of Financial Products Through IFA ChannelДокумент57 страницStudy of Financial Products Through IFA Channelpunit100% (3)

- Head Master: Rupees Fifty Five Thousand Five Hundred and Eighty Three OnlyДокумент10 страницHead Master: Rupees Fifty Five Thousand Five Hundred and Eighty Three Onlyvijay kumarОценок пока нет

- Partnership PRE-MID PersonalДокумент12 страницPartnership PRE-MID PersonalAbigail LicayanОценок пока нет

- Bee Bagley Amended ComplaintДокумент105 страницBee Bagley Amended ComplaintTony OrtegaОценок пока нет

- Trust Deed for Educational CharityДокумент7 страницTrust Deed for Educational CharitySETHUОценок пока нет

- Introduction To Finacial Markets Final With Refence To CDSLДокумент40 страницIntroduction To Finacial Markets Final With Refence To CDSLShoumi Mahapatra100% (1)

- Court upholds definition of "capitalДокумент27 страницCourt upholds definition of "capitalMark Adrian ArellanoОценок пока нет

- ASK Wealth Advisors Corporate PresentationДокумент22 страницыASK Wealth Advisors Corporate PresentationAnonymous bdUhUNm7J100% (1)

- DormantДокумент86 страницDormantReechie TeasoonОценок пока нет

- Banking and InsuranceДокумент24 страницыBanking and InsuranceAbhi ShriОценок пока нет

- Van H Wac CH 09 Amended 2015 v2Документ30 страницVan H Wac CH 09 Amended 2015 v2Mamu FaisalОценок пока нет

- FFC financial analysis 1978-2012Документ22 страницыFFC financial analysis 1978-2012Nabeel KhaliqОценок пока нет

- Electrosteel Castings Limited: Rathod Colony. Rajgangpur. Sundergarh. Odisha 770 017 L273l00Rl955PLC000310Документ48 страницElectrosteel Castings Limited: Rathod Colony. Rajgangpur. Sundergarh. Odisha 770 017 L273l00Rl955PLC000310Contra Value BetsОценок пока нет

- Cfap 1 Aafr PK PDFДокумент312 страницCfap 1 Aafr PK PDFMuhammad ShehzadОценок пока нет

- Sensitivities of Options with DividendsДокумент23 страницыSensitivities of Options with DividendsRaman BabuОценок пока нет

- Branch 1Документ3 страницыBranch 1AMIN BUHARI ABDUL KHADERОценок пока нет

- Foreign Investment 1991 RA 7042Документ44 страницыForeign Investment 1991 RA 7042MikhailFAbzОценок пока нет

- More On Documentary Stamp Tax (DST) On Real Estate TransactionsДокумент7 страницMore On Documentary Stamp Tax (DST) On Real Estate TransactionsChristine DavidОценок пока нет

- Tectonic Setting and Structural Controls of the Vetas Gold SystemДокумент25 страницTectonic Setting and Structural Controls of the Vetas Gold SystemDiego URibeОценок пока нет

- Spec. Pro. ReportДокумент5 страницSpec. Pro. ReportCharshiiОценок пока нет

- Requsition Letter For Due Diligence AssignmentДокумент6 страницRequsition Letter For Due Diligence AssignmentMohammad Monowar Noor ManikОценок пока нет

- Black Scholes ExampleДокумент3 страницыBlack Scholes ExamplechubbyqcayОценок пока нет

- Backtest Index Strategies Performance Over Monthly Periods 2017-2021Документ95 страницBacktest Index Strategies Performance Over Monthly Periods 2017-2021ThE BoNg TeChniCaLОценок пока нет

- Bank Loan DocumentsДокумент10 страницBank Loan DocumentsSatish KanojiyaОценок пока нет

- Understanding Stock OptionsДокумент34 страницыUnderstanding Stock Optionstigertiger70Оценок пока нет

- Lecture 11Документ51 страницаLecture 11Janice JingОценок пока нет

- Certificate of Increase of CsДокумент3 страницыCertificate of Increase of CsAnthonette Beriso JacoboОценок пока нет