Академический Документы

Профессиональный Документы

Культура Документы

A Review of The Accounting Cycle: Cash Receipts Journal Journal

Загружено:

ariesОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

A Review of The Accounting Cycle: Cash Receipts Journal Journal

Загружено:

ariesАвторское право:

Доступные форматы

A Review of the Accounting Cycle

Use special journals and

subsidiary ledgers to

process accounting information more efficiently

and to provide additional

useful information.

EM

Chapter 2

69

Some examples of special journals are the sales journal, the purchases journal, the

cash receipts journal, the cash disbursements journal, the payroll register, and the

voucher register.

Sales on account are recorded in the sales journal. The subsequent collections on

account, as well as other transactions involving the receipt of cash, are recorded in the

cash receipts journal. Merchandise purchases on account are entered in a purchases

journal or a voucher register. Subsequent payments on account, as well as other transactions involving the payment of cash, are recorded in a cash disbursements journal

or a check register. A payroll register may be employed to accumulate payroll information, including payroll deductions and withholdings for taxes.

Column headings in the various journals specify the accounts to be debited or

credited; account titles and explanations may therefore be omitted in recording routine

transactions. A Sundry column is usually provided for transactions that are relatively

infrequent, and account titles must be entered in recording such transactions.

70

Part 1

EM

Foundations of Financial Accounting

The use of special journals facilitates recording and also simplifies the posting

process, because the totals of many transactions, rather than separate data for each

transaction, can be posted to the ledger accounts. Certain data must be transferred individuallydata affecting individual accounts receivable and accounts payable and data

reported in the Sundry columnsbut the overall volume of posting is substantially

reduced.

The format of a particular journal must satisfy the needs of the individual business

unit. For example, with an automated or computerized system, the general journal, any

specialized journals, and subsidiary ledgers may be modified or eliminated. Recognizing

that modifications are necessary for individual systems, the following sections discuss a

voucher system and illustrate some special journals that are commonly used with manual

accounting systems.

VOUCHER SYSTEM

Relatively large organizations ordinarily provide for the control of purchases and cash disbursements through adoption of some form of a voucher system. With the use of a

voucher system, checks may be drawn only upon a written authorization in the form of

a voucher approved by some responsible official.

A voucher is prepared not only in support of each payment to be made for goods and

services purchased on account but also for all other transactions calling for payment by

check, including cash purchases, retirement of debt, replenishment of petty cash funds,

payrolls, and dividends. The voucher identifies the person authorizing the expenditure,

explains the nature of the transaction, and names the accounts affected by the transaction. For control purposes, vouchers should be prenumbered, checked against purchase

invoices, and compared with receiving reports. Upon verification, the voucher and the

related business documents are submitted to the appropriate official for final approval.

When approved, the prenumbered voucher is recorded in a voucher register. The

voucher register is a book of original entry and takes the place of a purchases journal.

Charges on each voucher are classified and recorded in appropriate Debit columns, and

the amount to be paid is listed in an Accounts Payable or Vouchers Payable column. After

a voucher is entered in the register, it is placed in an unpaid vouchers file together with

its supporting documents.

Checks are written in payment of individual vouchers. The checks are recorded in a

check register, which is used in place of a cash payments journal, as debits to Accounts

Payable or Vouchers Payable and credits to Cash. Since charges to the various asset, liability, or expense accounts were recognized when the payable was recorded in the

voucher register, these accounts need not be listed in the payments record. When a

check is issued, payment of the voucher is reported in the voucher register by entering

the check number and the payment date. Paid vouchers and supporting documents are

removed from the unpaid file, marked paid,and placed in a separate paid vouchers file.

The balance of the payable account, after the credit for total vouchers issued and the

debit for total vouchers paid, should be equal to the sum of the unpaid vouchers file. The

voucher register, while representing a journal, also provides the detail in support of the

accounts payable or vouchers payable total.

ILLUSTRATION OF SPECIAL JOURNALS

AND SUBSIDIARY LEDGERS

Assume that Central Valley, Inc., maintains the following books of original entry: sales

journal, cash receipts journal, voucher register, check register, and general journal. As

noted, the format of a particular journal must satisfy the needs of the individual business

unit. Those presented for Central Valley, Inc., are illustrative only.

A Review of the Accounting Cycle

EM

Chapter 2

71

Sales Journal

The sales journal for the month of July 2002 appears as follows:

SALES JOURNAL

Date

2002

July

2

6

10

12

15

18

20

23

27

29

31

Invoice

No.

701

702

703

704

705

706

707

708

709

710

711

Page 6

Post.

Ref.

Account Debited

The Chocolate Factory

Huffman Company

Stocks and Co.

Bennet, Inc.

The Chocolate Factory

Ridnour Corporation

Hillcrest Sales Co.

Kirstein, Inc.

Datamark Systems Inc.

Fuller Distributing Co.

Stocks and Co.

Accts. Rec. Dr.

Sales Cr.

3,450

6,510

1,525

4,860

2,000

5,940

1,910

7,650

1,280

2,925

2,100

40,150

(116) (41)

As illustrated, credit sales are recorded by debits to Accounts Receivable and credits

to Sales. The sales invoice number provides a reference to the original source document

for each transaction. Debits are posted to individual customers accounts in the accounts

receivable subsidiary ledger as indicated by a check () in the Posting Reference column.

The total sales for the month ($40,150) are posted to Accounts Receivable and Sales

(accounts #116 and #41, respectively).

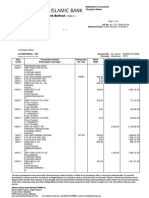

Cash Receipts Journal

The cash receipts journal for Central Valley, Inc., for July 2002 appears as follows:

CASH RECEIPTS JOURNAL

Date

2002

July

3

7

8

10

11

14

16

17

21

22

25

29

31

31

Account Credited

Hamilton Sign Co.

DataMark Systems Inc.

Sales

The Chocolate Factory

Sawyer Co.

Rohas, Inc.

Milo Company

Poynter Corp.

Earnst Co.

Tax Refund Receivable

Sales

Hillcrest Sales Co.

The Chocolate Factory

Notes Receivable

Interest Revenue

Post.

Ref.

41

120

41

113

72

Sundry

Accounts

Cr.

Page 8

Accounts

Receivable

Cr.

Sales

Discounts

Dr.

5,650

1,400

113

28

3,450

2,735

4,875

920

6,100

6,870

69

1,900

2,000

38

365

5,780

440

8,500

65

Cash

Dr.

5,537

1,372

365

3,381

2,735

4,875

920

6,100

6,870

5,780

440

1,862

2,000

8,565

15,150

35,900

248

50,802

()

(116)

(42)

(111)

72

Part 1

EM

Foundations of Financial Accounting

The cash receipts journal records all receipts of cash. Collections of cash from previously recorded credit sales are posted in total as a credit to Accounts Receivable

(account #116) and as debits to Sales Discounts (account #42) and Cash (account #111).

The credits to Accounts Receivable are posted to the individual customer accounts in the

subsidiary ledger as noted by the check () in the Posting Reference column. Cash sales,

for example, as shown for July 8 and July 25, are posted individually as a credit to Sales

(account #41) and as a part of the total debit to Cash. Other transactions involving cash

receipts, for example, the collection of a note receivable on July 31, are posted individually as credits and as a part of the total debit to Cash.

Voucher Register

As noted, the voucher register takes the place of a purchases journal, providing a record

of all authorized payments to be made by check. A partial voucher register is presented

below. For illustrative purposes, separate debit columns are provided for two accounts

Purchases and Payroll. Other items are recorded in the Sundry Dr. column. Additional

separate columns could be added for other items, such as advertising, if desired. The total

amount of each column is posted to the corresponding account, with the exception of

the Sundry Dr. and Cr. columns, which are posted individually.

VOUCHER REGISTER

Date

Vouch.

No.

31

7132

31

31

31

31

7133

7134

7135

7136

Payee

Date

Ck. No.

Accounts

Payable

Cr.

Security National

Bank

Payroll

7/31

7/31

3106

3107

9,120

1,640

Paid

Sundry

Purchases

Dr.

Payroll

Dr.

Account

Notes Payable

Far Fabrications

Midland Inc.

Nyland Supply

Co.

2,130

FICA Taxes

Payable

Income Taxes

Payable

Amount

Post.

Ref.

211

Dr.

Cr.

9,120

215

90

214

400

3,290

1,500

3,290

1,500

5,550

55,375

5,550

24,930

2,130

33,645

(213)

(51)

(620)

()

5,330

()

Check Register

A partial check register is illustrated below. It accounts for all the checks issued during

the period. Checks are issued only in payment of properly approved vouchers. The payee

is designated together with the number of the voucher authorizing the payment.

CHECK REGISTER

Date

Check

No.

31

31

31

3106

3107

3108

Account Debited

Security National Bank

Payroll

Pat Bunnell

Voucher

No.

7132

7133

7005

Accounts

Payable

Dr.

Purchase

Discounts

Cr.

Cash

Cr.

9,120

1,640

1,500

61,160

30

275

9,120

1,640

1,470

60,885

(213)

(52)

(111)

A Review of the Accounting Cycle

EM

Chapter 2

73

General Journal

Regardless of the number and nature of special journals, certain transactions cannot

appropriately be recorded in the special journals and are recorded in the general journal.

A general journal with an illustrative entry during the month of July is illustrated below.

This general journal is prepared in two-column format. Debit and Credit columns is provided for the entries that are to be made to the general ledger accounts.

GENERAL JOURNAL

Date

Post.

Ref.

Description

2002

July 31

Page 3

Allowance for Doubtful Accounts

Accounts Receivable

To write off uncollectible account.

(The Rit-Z Shop)

117

116

Debit

Credit

1,270

1,270

Subsidiary Ledgers

Subsidiary ledgers provide the detail of individual accounts in support of a control

account in the general ledger. Whenever possible, individual postings to subsidiary

accounts are made directly from the business documents evidencing the transactions.

This practice saves time and avoids errors that might arise in summarizing and transferring this information. If postings to the subsidiary records and to the control accounts are

made accurately, the sum of the detail in a subsidiary record will agree with the balance

in the control account. A reconciliation of each subsidiary ledger with its related control

account should be made periodically, and any discrepancies found should be investigated

and corrected.

As an illustration of the relationship of a general ledger control account to its subsidiary ledger accounts, the accounts receivable control account is shown. Three of the

subsidiary accounts are also shown.

GENERAL LEDGER

Account: ACCOUNTS RECEIVABLE

Date

2002

July

1

31

31

31

Item

Balance

Sales on account

Collections on account

Write - off of uncollectible

account (The Rit - Z Shop)

Account No. 116

Post.

Ref.

S6

CR8

Debit

Credit

Balance

35,900

9,200

49,350

13,450

1,270

12,180

40,150

J3

ACCOUNTS RECEIVABLE SUBSIDIARY LEDGER

Name: Stock and Co.

Address: 546 South Fox Rd., Chicago, IL 60665

Date

2002

July

1

10

31

Item

Balance

Purchase

Purchase

Post.

Ref.

S6

S6

Debit

1,525

2,100

Credit

Balance

1,000

2,525

4,625

74

Part 1

EOC

Foundations of Financial Accounting

Name: The Chocolate Factory

Address: 7890 Redwood Dr., Pittsburgh, PA 15234

Date

2002

July

2

10

15

31

Post.

Ref.

Item

Purchase

Payment

Purchase

Payment

S6

CR8

S6

CR8

Debit

Credit

3,450

3,450

2,000

2,000

Balance

3,450

0

2,000

0

Name: The Rit-Z Shop

Address: 789 Cotton Drive, Phoenix, AZ 85090

Date

2002

July

1

31

Post.

Ref.

Item

Balance

Write - off of uncollectible

account (6 months old)

Debit

Credit

Balance

1,270

J3

1,270

REVIEW OF LEARNING OBJECTIVES

Identify and explain the basic steps in the

accounting process (accounting cycle). The

accounting process, often referred to as the accounting cycle, generally includes the following steps in

well-defined sequence: analyze business documents,

journalize transactions, post to ledger accounts, prepare a trial balance, prepare adjusting entries, prepare

financial statements (using a work sheet or from the

adjusted individual accounts), close the nominal

accounts, and prepare a post-closing trial balance.

This process of recording, classifying, summarizing,

and reporting of accounting data is based on an old

and universally accepted system called double-entry

accounting.

Analyze transactions and make and post

journal entries. Transactions are events that

transfer or exchange goods or services between two or

more entities. Business documents, such as invoices,

provide evidence that transactions have occurred as

well as the data required to record the transaction in the

accounting records. The data are recorded with journal

entries using a system of double-entry accounting.

The journal entries are subsequently posted to ledger

accounts.

Make adjusting entries, produce financial

statements, and close nominal accounts.

Adjusting entries are made at the end of an accounting

period prior to preparing the financial statements for that

period. Adjusting entries are often required to update

accounts so that the data are current and accurate.

Generally, the required adjustments are the result of

analysis rather than based on new transactions. Once

adjusting entries are journalized and posted, the balance

sheet, income statement, and statement of cash flows can

be prepared and reported.

At the end of each accounting cycle, the nominal

or temporary accounts must be transferred through

the closing process to real or permanent accounts.

The nominal accounts (all income statement accounts

plus dividends) are left with a zero balance and

are ready to receive transaction data for the new

accounting period. The real (balance sheet) accounts

remain open and carry their balances forward to the

new period.

Distinguish between accrual and cash-basis

accounting. Accrual accounting recognizes

revenues when they are earned, not necessarily when

cash is received. Similarly, expenses are recognized and

recorded under accrual accounting when they are

incurred, not necessarily when cash is paid. Some

organizations (and most individuals) use cash-basis

accounting, which recognizes revenues when cash is

received and expenses when cash is paid. The FASB has

indicated that accrual accounting generally provides a

better basis for financial reports, especially in reporting

Вам также может понравиться

- Accountancy/Books of Prime Entry: Sales Day BookДокумент5 страницAccountancy/Books of Prime Entry: Sales Day BookKhulekani KumaloОценок пока нет

- accou levele iii 4-8Документ31 страницаaccou levele iii 4-8embaendo27uОценок пока нет

- Matter Must Exist. Transactions Must Be Supported by Documents Which Prove That The Transaction Did in Fact OccurДокумент7 страницMatter Must Exist. Transactions Must Be Supported by Documents Which Prove That The Transaction Did in Fact OccurDanica MamontayaoОценок пока нет

- Merchandising Business Pt. 2Документ18 страницMerchandising Business Pt. 2Angelo ReyesОценок пока нет

- Sim For Special Journal Week 15Документ16 страницSim For Special Journal Week 15MAXINE CLAIRE CUTINGОценок пока нет

- Metalanguage: BIG PICTURE IN FOCUS: SLO (7) Record The Transactions Using Special JournalsДокумент13 страницMetalanguage: BIG PICTURE IN FOCUS: SLO (7) Record The Transactions Using Special JournalsAllan LopezОценок пока нет

- Topic 3 Subsidiary LedgersДокумент6 страницTopic 3 Subsidiary LedgersCunanan, Malakhai JeuОценок пока нет

- P2 NOtes Special and Combination JournalsДокумент5 страницP2 NOtes Special and Combination Journalschen.abellar.swuОценок пока нет

- Module 3 CFAS PDFДокумент7 страницModule 3 CFAS PDFErmelyn GayoОценок пока нет

- Special journals optimize recording transactionsДокумент25 страницSpecial journals optimize recording transactionsYuu100% (1)

- CAT1012 Special JournalsДокумент9 страницCAT1012 Special JournalsKean Brean GallosОценок пока нет

- Auditing Report Final ChangedДокумент30 страницAuditing Report Final ChangedA. SheikОценок пока нет

- Auditing Report Final AnishДокумент30 страницAuditing Report Final AnishA. SheikОценок пока нет

- Source: 1. Sales JournalДокумент3 страницыSource: 1. Sales JournalDonita SotolomboОценок пока нет

- Project AДокумент3 страницыProject AANGELA MORATAОценок пока нет

- Powerpoint Journal Ledger and Trial BalanceДокумент40 страницPowerpoint Journal Ledger and Trial BalanceChris Iero-Way100% (1)

- Process financial transactions and extract reportsДокумент21 страницаProcess financial transactions and extract reportsabelu habite neriОценок пока нет

- Accounting SystemДокумент13 страницAccounting SystemChristian Luzon DalisayОценок пока нет

- Assignment2 Giecelle Bsoa2bДокумент7 страницAssignment2 Giecelle Bsoa2bcarlitolopez0122Оценок пока нет

- Business Accounting - BBA-IT 2Документ8 страницBusiness Accounting - BBA-IT 2Ishika SrivastavaОценок пока нет

- Bookkeeping Is The Recording of Financial Transactions. Transactions Include SalesДокумент247 страницBookkeeping Is The Recording of Financial Transactions. Transactions Include SalesSantosh PanigrahiОценок пока нет

- Accounting Books - Journal, Ledger and Trial BalanceДокумент35 страницAccounting Books - Journal, Ledger and Trial BalanceGhie Ragat100% (3)

- Lecture 7 Control AccountsДокумент29 страницLecture 7 Control AccountsLefulesele MasiaОценок пока нет

- Cfas 3Документ10 страницCfas 3Bea charmillecapiliОценок пока нет

- Sap ArДокумент241 страницаSap Arpardham100% (1)

- CashDisbursementCycle ReДокумент5 страницCashDisbursementCycle ReKenneth Joshua Cinco NaritОценок пока нет

- Acc 101 Financial Accounting and Reporting 1Документ30 страницAcc 101 Financial Accounting and Reporting 1cybell carandangОценок пока нет

- Review of The Accounting ProcessДокумент18 страницReview of The Accounting ProcessRoyceОценок пока нет

- Chapter IVДокумент13 страницChapter IVMariel OroОценок пока нет

- Special journals and voucher system for accounting transactionsДокумент1 страницаSpecial journals and voucher system for accounting transactionsVivienne LayronОценок пока нет

- Debit and Credit PrinciplesДокумент29 страницDebit and Credit PrinciplesHarry100% (1)

- ACCOUNTING CONTROL ACCOUNTSДокумент8 страницACCOUNTING CONTROL ACCOUNTSMehereen AubdoollahОценок пока нет

- Act07 - Lfca133e022 - Lique GinoДокумент4 страницыAct07 - Lfca133e022 - Lique GinoGino LiqueОценок пока нет

- CHAPTER 7 Lecture Notes Accounting Information SystemsДокумент4 страницыCHAPTER 7 Lecture Notes Accounting Information SystemsJaredОценок пока нет

- Special journals streamline accounting transactionsДокумент14 страницSpecial journals streamline accounting transactionsCriziel Ann LealОценок пока нет

- Accounting Cambridge O LevelДокумент6 страницAccounting Cambridge O LevelAgha Saeed AhmedОценок пока нет

- What Is A Packing Slip?Документ4 страницыWhat Is A Packing Slip?KRIS ANNE SAMUDIOОценок пока нет

- Accounts Project 11thДокумент6 страницAccounts Project 11thRishi VithlaniОценок пока нет

- Bookkeeping PDFДокумент4 страницыBookkeeping PDFYo Yo0% (1)

- Accounting Process and Adjusting EntriesДокумент8 страницAccounting Process and Adjusting EntriesFantayОценок пока нет

- Accounting 1st SessionДокумент25 страницAccounting 1st SessionDelfa CastillaОценок пока нет

- Basic AccountsДокумент51 страницаBasic AccountsNilesh Indikar100% (1)

- Books of Accounts: A. JournalДокумент3 страницыBooks of Accounts: A. JournalMylen Noel Elgincolin ManlapazОценок пока нет

- Subsidiary BooksДокумент6 страницSubsidiary BooksBamidele AdegboyeОценок пока нет

- Lesson 16: Accounting Practice SetДокумент47 страницLesson 16: Accounting Practice SetMai Ruiz100% (1)

- StarFarm Finance OfficerДокумент7 страницStarFarm Finance OfficerZany KhanОценок пока нет

- Assignment2 Jenna Bsoa2bДокумент7 страницAssignment2 Jenna Bsoa2bcarlitolopez0122Оценок пока нет

- Special JournalsДокумент15 страницSpecial JournalsJan Allyson BiagОценок пока нет

- Audit of Income and Expenditure Account 1.1Документ27 страницAudit of Income and Expenditure Account 1.1Akshata Masurkar100% (1)

- Bookkeeping Records in OrderДокумент8 страницBookkeeping Records in OrderJenny SaynoОценок пока нет

- SWIFT Payment GuideДокумент7 страницSWIFT Payment GuideZany KhanОценок пока нет

- Mod3 Part 1 Accounting Cyle For Service BusinessДокумент21 страницаMod3 Part 1 Accounting Cyle For Service Businessviaishere4u100% (1)

- General Ledger, Subsidiary LedgerДокумент4 страницыGeneral Ledger, Subsidiary LedgerJohn MedinaОценок пока нет

- Unit-4 ComputerДокумент8 страницUnit-4 Computer29.Kritika SinghОценок пока нет

- NAVTTC SAP Fi Week - 6Документ44 страницыNAVTTC SAP Fi Week - 6Anne RajputОценок пока нет

- What Is A Journal Entry in AccountingДокумент20 страницWhat Is A Journal Entry in AccountingIc Abacan100% (1)

- Special Journals and Internal ControlДокумент16 страницSpecial Journals and Internal ControlFarah PatelОценок пока нет

- Accounting Cycle For ServiceДокумент12 страницAccounting Cycle For ServiceNo MoreОценок пока нет

- VouchersДокумент9 страницVouchersRaviSankar100% (2)

- Bookkeeping And Accountancy Made Simple: For Owner Managed Businesses, Students And Young EntrepreneursОт EverandBookkeeping And Accountancy Made Simple: For Owner Managed Businesses, Students And Young EntrepreneursОценок пока нет

- SAP Reports For All ModulesДокумент52 страницыSAP Reports For All ModulesrajeswariОценок пока нет

- SLM Lean Strategies.Документ9 страницSLM Lean Strategies.Raja Atiq Qadir SattiОценок пока нет

- 8 VatДокумент11 страниц8 VatRiyo Mae MagnoОценок пока нет

- General JournalДокумент5 страницGeneral Journalmonicaaa melianaaaОценок пока нет

- Rules of Debits and CreditsДокумент2 страницыRules of Debits and CreditsRadhika PatkeОценок пока нет

- SWOT分析模板 34个Документ34 страницыSWOT分析模板 34个e3883513Оценок пока нет

- Implementasi Akad Ijarah Muntahiya Bittamlik di Perbankan SyariahДокумент8 страницImplementasi Akad Ijarah Muntahiya Bittamlik di Perbankan SyariahDINDA NUR HALIZAОценок пока нет

- Accounting EquationДокумент12 страницAccounting EquationriaОценок пока нет

- ERPДокумент55 страницERPSachin MethreeОценок пока нет

- College Accounting Chapters 1-24-11th Edition Nobles Test BankДокумент28 страницCollege Accounting Chapters 1-24-11th Edition Nobles Test Bankthomasgillespiesbenrgxcow100% (19)

- Statement of Accounts: Today's StatementsДокумент1 страницаStatement of Accounts: Today's Statementsхуивпи дрилоОценок пока нет

- ACCY 111 Quiz 2 Practice QuizДокумент3 страницыACCY 111 Quiz 2 Practice Quizchi_nguyen_100Оценок пока нет

- Procuretopay 130705141434 Phpapp01 PDFДокумент18 страницProcuretopay 130705141434 Phpapp01 PDFMuhammad JunaidОценок пока нет

- Sn53sup 20170331 001 2200147134Документ4 страницыSn53sup 20170331 001 2200147134Henry LowОценок пока нет

- Needs Are State of Felt Deprivation - DoneДокумент7 страницNeeds Are State of Felt Deprivation - Doneyousef olabiОценок пока нет

- Term VIДокумент3 страницыTerm VIsheph_157Оценок пока нет

- Date (Value Date) Narration Ref/Cheque No. Debit Credit BalanceДокумент5 страницDate (Value Date) Narration Ref/Cheque No. Debit Credit BalanceanubhaОценок пока нет

- Basic and Expanded Accounting EquationДокумент2 страницыBasic and Expanded Accounting EquationnelieОценок пока нет

- Sales Midterms ReviewerДокумент115 страницSales Midterms ReviewerAnonymous fnlSh4KHIgОценок пока нет

- Mater Dei College Bank ReconciliationДокумент8 страницMater Dei College Bank ReconciliationYamit, Angel Marie A.Оценок пока нет

- Audit of Cash Bank ReconДокумент8 страницAudit of Cash Bank ReconPaul Mc AryОценок пока нет

- SAP - SD TutorialДокумент23 страницыSAP - SD TutorialVaibhav NaiduОценок пока нет

- Technical Part 1Документ52 страницыTechnical Part 1BizuayehuОценок пока нет

- General Accounting Cheat SheetДокумент35 страницGeneral Accounting Cheat SheetZee Drake100% (5)

- Website Privacy Policy on Cookies and Data CollectionДокумент72 страницыWebsite Privacy Policy on Cookies and Data Collectionpalma sinagaОценок пока нет

- Doubtful AccountsДокумент3 страницыDoubtful AccountsMikhaela TorresОценок пока нет

- Adjusting Entries and Adjusted Trial BalanceДокумент8 страницAdjusting Entries and Adjusted Trial Balancetgibson621Оценок пока нет

- Investing and Financing Decisions and The Balance Sheet: Answers To QuestionsДокумент47 страницInvesting and Financing Decisions and The Balance Sheet: Answers To QuestionsabraamОценок пока нет

- Material Management Study Material - MCQ For SailДокумент16 страницMaterial Management Study Material - MCQ For SailJason SОценок пока нет

- DownloadДокумент11 страницDownloadClayton StreeterОценок пока нет