Академический Документы

Профессиональный Документы

Культура Документы

3Q-14 VCchart PDF

Загружено:

BayAreaNewsGroupОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

3Q-14 VCchart PDF

Загружено:

BayAreaNewsGroupАвторское право:

Доступные форматы

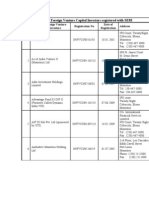

Venture Capital Funding Survey, Third Quarter 2014

VENTURE CAPITAL FUNDING, THIRD QUARTER 2014

This is a listing of many of the Bay Area firms that received venture capital financing between

July 1 and Sept 30, 2014. Most of the data was compiled from a survey conducted by

PricewaterhouseCoopers, Thomson Venture Economics and the National Venture Capital Association

in conjunction with the Mercury News.

In the case of some investments there may have been other participants in the round who are not

credited. Also, the amounts listed may not include all venture funding the company received during

the quarter.

*Indicates this is a seed or first-round infusion of money from venture capitalists. These

companies may have received money previously from other investors and aren't necessarily startups.

BIOTECHNOLOGY / HEALTH

Name

3-V Biosciences

City

Menlo Park

Stage

Early Stage

Afferent Pharmaceuticals San Mateo

Early Stage

$2,700,000 Domain Associates,

undisclosed firm

Clinical-stage

biopharmaceutical

company.

Airxpanders

Palo Alto

Expansion

$5,661,000 GBS Venture Partners,

Prolog Ventures, Vivo

Ventures

Breast cancer

reconstruction.

Aldea Pharmaceuticals

Redwood City

Expansion

$9,263,000 Canaan Partners,

Correlation Ventures,

RusnanoMedInvest,

undisclosed firms

Pharmaceutical company.

Allakos

San Carlos

Early Stage

Armetheon*

Menlo Park

Early Stage

Avinger

Redwood City

Expansion

$34,831,000 Lucas Venture Group

Biomimedica

South San

Francisco

South San

Francisco

Early Stage

$250,000 Emergent Medical

Partners

$16,000,000 Advanced Technology

Ventures, Delphi

Ventures, Morgenthaler

Ventures, T. Rowe Price

Threshold Partnerships,

undisclosed firms,

Wellington Management

Calithera Biosciences

Early Stage

Amount

Investors

Description

$3,499,000 Kleiner Perkins Caufield & Therapeutics that modulate

Byers, New Enterprise

pathways for the treatment

Associates

of oncology.

$15,000,000 Alta Partners, De Novo

Ventures, F Hoffmann La

Roche AG, RiverVest

Venture Partners

Biotechnology company.

$7,000,000 AshHill Pharmaceutical

Drugs for cardiovascular

Investments, undisclosed diseases.

firms

Page 1 of 21

Image-guided therapeutic

devices.

Medical device company.

Therapeutics company.

Venture Capital Funding Survey, Third Quarter 2014

CardioDx

Palo Alto

Later Stage

$20,982,900 Artiman Ventures, Asset Cardiovascular genomic

Management Ventures,

diagnostics company.

Kleiner Perkins Caufield &

Byers, Longitude Capital

Management Co.

Cardiva Medical

Sunnyvale

Later Stage

Claret Medical*

Santa Rosa

Early Stage

$16,822,000 Easton Hunt Capital

Cardiovascular medical

Partners, Lightstone

device company.

Ventures, Sante Ventures

Cleave Biosciences

Burlingame

Early Stage

$27,000,000 5AM Venture

Management, New

Enterprise Associates,

U.S. Venture Partners,

undisclosed firms

Dermira

Redwood City

Early Stage

$51,000,000 Aisling Capital, Bay City

Biopharmaceutical

Capital, Canaan Partners, company.

Epidarex Capital, Fidelity

Investment Funds II, New

Enterprise Associates,

undisclosed firms

Drip Drop

San Francisco

Expansion

Ebr Systems

Sunnyvale

Later Stage

$18,730,000 Delphi Ventures, Split

Rock Partners, St Paul

Venture Capital, SV Life

Sciences Advisers

Medical implant devices

developer.

Eiger BioPharmaceuticals Palo Alto

Early Stage

Emerald Therapeutics*

Menlo Park

Early Stage

$1,100,000 InterWest Partners, Vivo

Ventures

$1,890,000 Founders Fund,

Schooner Capital,

undisclosed firm

Biopharmaceutical

company.

Biotechnology company.

Eureka Therapeutics

Emeryville

Early Stage

$21,000,000 Acorn Campus Ventures,

Harbinger Venture

Management, Majuven,

undisclosed firms

Biotechnology company.

HealthTell*

San Ramon

Early Stage

Life sciences company.

Home Dialysis Plus

Sunnyvale

Early Stage

$3,118,000 Paladin Capital

Management

$12,500,000 Warburg Pincus

Igenica

Burlingame

Early Stage

iHealth*

Mountain View

Expansion

InVitaeoration

San Francisco

Expansion

$9,500,000 Amkey Ventures, PTV

Medical device company.

Healthcare Capital,

Triventures Management,

undisclosed firm

$5,600,000 Undisclosed firms

Biopharmaceutical

company.

Oral rehydration solution.

Hemodialysis solutions.

$7,033,000 5AM Venture

Develops antibodies and

Management, undisclosed ADCs for the treatment of

firm

cancer.

$25,000,000 Xiaomi Ventures

$5,000,000 Thomas Mcnerney and

Partners

Page 2 of 21

Designs mobile personal

healthcare products.

Genetic diagnostics

company.

Venture Capital Funding Survey, Third Quarter 2014

Magforce USA*

San Francisco

Later Stage

$15,000,000 Mithril Capital

Medical device company.

Management, undisclosed

firm

Minerva Surgical

Cupertino

Early Stage

$25,520,000 New Enterprise

Associates, Versant

Ventures, .

Medical device company.

Miramar Labs

Santa Clara

Later Stage

$16,000,000 Aisling Capital, Domain

Associates, Foundry

Group, Morgenthaler

Ventures

Medical device company.

MyoKardia

South San

Francisco

Early Stage

$10,000,000 Third Rock Ventures

Developing a pipeline of

small molecule

therapeutics.

NexSteppe

South San

Francisco

Expansion

$12,342,000 Braemar Energy

Ventures, DuPont

Ventures, Total Energy

Ventures International

SAS, undisclosed firms

Feedstock solutions for the

biofuels and biobased

products industry.

Niveus Medical

Mountain View

Expansion

Oraya Therapeutics

Newark

Expansion

Perceptimed

Mountain View

Early Stage

Powervision

Belmont

Later Stage

$15,000,000 Advanced Technology

Ventures, Aisling Capital,

Correlation Ventures,

undisclosed firm

Medical device company.

Proteus Digital Health

Redwood City

Later Stage

$52,500,000 Undisclosed firm

Digital medicines company.

SFJ Pharmaceuticals

Pleasanton

Expansion

$9,635,000 Undisclosed firm

Siteone Therapeutics*

San Francisco

Early Stage

$1,500,000 Mission Bay Capital,

Novel therapeutics and

Sears Capital

diagnostics.

Management, undisclosed

firms

Twelve

Redwood City

Early Stage

$5,000,000 Domain Associates,

Incubator.

Morgenthaler Ventures,

undisclosed firm, Versant

Ventures, .

Virobay

Menlo Park

Later Stage

VM Discovery

Fremont

Later Stage

$2,000,000 Alta Partners, Sutter Hill

Ventures

$7,870,000 Amkey Ventures

Vytronus

Sunnyvale

Expansion

$7,845,000 New Enterprise

Associates, undisclosed

firm

Whill

San Carlos

Early Stage

$10,999,800 500 Startups, Innovation

Network of Japan, NTT

Docomo Ventures,

undisclosed firms

$1,841,000 Band of Angels,

undisclosed firm

$2,500,000 Domain Associates,

undisclosed firm

$2,393,000 Easton Hunt Capital

Partners LP, Latterell

Venture Partners

Page 3 of 21

Medical device company.

Non-invasive therapy for

wet age-related macular

degeneration.

Medical technology

company.

Specialty drugmaker

Drug discovery and

development company.

New small-molecule biotech

drugs.

Cardiac medical devices.

Devices for people with

difficulty in walking.

Venture Capital Funding Survey, Third Quarter 2014

Zephyrus Biosciences*

Berkeley

Early Stage

$1,500,000 Angels' Forum & the Halo Life science research tools

Fund, Life Science

company.

Angels, Mission Bay

Capital, undisclosed firms

BUSINESS SERVICES

Name

365 Data Centers

City

Emeryville

Stage

Later Stage

Amount

Investors

$16,000,000 Crosslink Capital,

Housatonic Partners

Management Co.

Description

Data centers.

Ace Metrix

Mountain View

Expansion

$4,044,000 Hummer Winblad Venture Television and video

Partner, Palomar

analytics for evaluating

Ventures

video advertising.

Adinch

San Francisco

Early Stage

$3,000,000 TMT Investments,

undisclosed firm

AdStage

San Francisco

Early Stage

$6,250,000 Freestyle Capital,

Tools to help businesses

Newbury Ventures,

advertise online.

undisclosed firms, Verizon

Ventures

Appdynamics

San Francisco

Expansion

$70,000,000 Battery Ventures,

Designs and application

Greylock Partners,

performance management

Institutional Venture

software.

Partners, Kleiner Perkins

Caufield & Byers,

Lightspeed Management

Co., Sands Capital

Management, undisclosed

firm

Apropose*

Mountain View

Startup/Seed

ASD Technologies*

San Jose

Expansion

Crowdcurity*

San Francisco

Early Stage

Crowdflower

San Francisco

Expansion

Datanyze*

San Mateo

Early Stage

$2,000,000 Google Ventures, IDG

Ventures, undisclosed

firms

Sales prospecting solution

powered by technology

data.

Delivery Agent

San Francisco

Later Stage

$8,000,000 Cardinal Venture Capital,

Intel Capital

Media company.

Universal self-service

mobile advertising platform.

$1,875,000 Andreessen Horowitz,

New Enterprise

Associates, undisclosed

firms

Furniture, furniture design

and interior design services.

$950,100 BonAngels Venture

Partners Co, Coolidge

Corner Investment,

undisclosed firm

Solutions based on Amazon

web services.

$1,000,000 500 Startups, Kima

Ventures SASU,

undisclosed firm

Crowdsourced IT security

company.

$12,500,100 Bessemer Venture

Crowdsourcing service.

Partners, Morgenthaler

Ventures, Trinity Ventures

Page 4 of 21

Venture Capital Funding Survey, Third Quarter 2014

Docker

San Francisco

Expansion

$40,000,000 Benchmark Capital

Open platform for

Management,

distributed applications.

Gesellschaft MBH,

Greylock Partners, Insight

Venture Partners, Sequoia

Capital, Trinity Ventures,

undisclosed firm

Flint Mobile

Redwood City

Early Stage

$12,000,000 True Ventures, Verizon

Ventures

Geekatoo*

Walnut Creek

Expansion

Glamping Hub*

San Francisco

Early Stage

Glassbeam

Santa Clara

Expansion

Haven*

San Francisco

Early Stage

Health Gorilla*

Sunnyvale

Early Stage

Joyent

San Francisco

Later Stage

Keen Labs

San Francisco

Early Stage

MassDrop.com

San Francisco

Early Stage

$6,500,000 Cowboy Capital, First

Online community for

Round Capital, Kleiner

enthusiasts.

Perkins Caufield & Byers,

Mayfield Fund

Neon Labs

San Francisco

Early Stage

$4,205,000 Mohr Davidow Ventures,

True Ventures,

undisclosed firm

Netbase Solutions

Mountain View

Later Stage

$10,763,200 Altos Ventures, SAIF

Partners, Thomvest

Ventures, WestSummit

Capital Management Ltd

Enterprise social

intelligence company.

PagerDuty

San Francisco

Expansion

$27,199,900 Andreessen Horowitz,

Baseline Ventures,

Bessemer Venture

Partners, Harrison Metal

Capital

Alarm aggregation and

dispatching services.

Plastiq

San Francisco

Early Stage

$9,999,000 Atlas Venture, Flybridge

Capital Partners, Khosla

Ventures

Online payment services.

Powwow*

San Francisco

Early Stage

$2,718,000 Ourcrowd Investment in

Shopial, undisclosed

firms, Vertical Ventures

Application delivery

platform.

Saisei Networks

Sunnyvale

Early Stage

$1,000,000 Undisclosed firm

Control solutions.

$1,700,000 500 Startups, undisclosed

firms

$1,000,000 Axon Partners Group

Investment

$2,000,000 SRI Capital, VKRM

$625,000 OReilly AlphaTech

Ventures

$1,200,000 True Ventures

$210,000 Epic Ventures

$14,533,200 Amplify Partners, Pelion

Venture Partners, Rincon

Venture Partners LP,

Sequoia Capital,

undisclosed firms

Page 5 of 21

iPhone app, which enables

merchants to process credit

card payments.

Nationwide network of local

verified geeks.

Online booking portal.

Machine data analytics

company.

Products and services.

Digital health.

Cloud infrastructure

company.

Analytics products.

Image selection platform for

monetizing digital content.

Venture Capital Funding Survey, Third Quarter 2014

Sellpoints

Emeryville

Later Stage

$5,184,000 Granite Ventures,

Pinetree Capital,

undisclosed firm

Online retail digital video

services.

Sense.ly*

San Francisco

Early Stage

$1,250,000 Launchpad Digital Health Managing patients.

Singular Labs*

Palo Alto

Early Stage

Smaato

San Francisco

Later Stage

SocialChorus

San Francisco

Expansion

SocialWire

San Francisco

Early Stage

Startide*

Menlo Park

Startup/Seed

theBench

Palo Alto

Early Stage

$250,000 5AM Venture

Management

$3,191,000 OReilly AlphaTech

Ventures, undisclosed

firm

Thismoment

San Francisco

Expansion

$4,117,000 Sierra Ventures

ZipZap*

San Francisco

Expansion

$1,100,100 500 Startups, Blumberg

International Partners,

undisclosed firm

$5,000,000 General Catalyst Partners Mobile marketing platform

provider.

$25,000,000 Aeris Capital AG, EDB

Provider mobile real-time

Investments, undisclosed bidding ad exchange

firms

$7,500,000 Kohlberg Ventures

$128,000 Correlation Ventures

Advocate marketing

solution for brands.

Recommendation engine

for advertisements.

Incubator.

Online marketplace for

science experiments.

Social networking and

media sharing services.

Payment network.

CONSUMER GOODS / SERVICES

Anews*

Name

City

Palo Alto

Stage

Early Stage

Amount

Investors

$3,000,000 TMT Investments,

undisclosed firm

$6,000,000 OReilly AlphaTech

Ventures, undisclosed

firm

Betabrand

San Francisco

Later Stage

Bluevine Capital

Palo Alto

Early Stage

B-Stock Solutions

Redwood City

Expansion

Credit Karma

San Francisco

Expansion

Crowdpac

Palo Alto

Early Stage

Dealflicks

San Francisco

Early Stage

$1,699,500 500 Startups, Be Great

Movie ticket and

Partners, Mogility Capital, concession deals.

Rubicon Venture Capital,

Sierra Maya Ventures,

undisclosed firms,

Wavemaker Partners

Dolls Kill*

San Francisco

Early Stage

E-commerce fashion brand.

EagerPanda

Portola Valley

Startup/Seed

$5,000,000 Correlation Ventures,

Maveron

$2,338,000 Undisclosed firm

Eatwith Media*

San Francisco

Early Stage

$8,000,100 Genesis Partners,

Greylock Partners,

undisclosed firm

Online community for dining

experiences.

$1,360,000 Undisclosed firms

$7,000,000 Susquehanna Growth

Equity, True Ventures

$50,000,100 Google Ventures,

Susquehanna Growth

Equity, Tiger Global

Management

$375,000 Undisclosed firm

Page 6 of 21

Description

Technological platform.

Online retail store.

Online invoice financing

service.

Liquidation service

management.

Consumer finance and

technology company.

Political marketplace.

Educators to build their own

custom online courses.

Venture Capital Funding Survey, Third Quarter 2014

Edmodo

San Mateo

Expansion

$30,000,000 Benchmark Capital

K-12 social learning

Management Gesellschaft platform.

MBH In Liqu, Greylock

Partners, Index Ventures,

Learn Capital Venture

Partners, undisclosed

firms, Union Square

Ventures

Elance-oDesk*

Mountain View

Early Stage

$30,000,000 Globespan Capital

Creates online workplaces

Partners, undisclosed firm for the world.

Five Stars Loyalty

San Francisco

Early Stage

$26,000,000 Doll Capital Management, Customer loyalty card and

Lightspeed Management web platform.

Co., Menlo Ventures,

Rogers Communications

Good Egg

San Francisco

Early Stage

$21,000,000 Index Ventures

Grab A Bucket*

San Francisco

Expansion

HandUp PBC*

San Francisco

Early Stage

$849,800 SV Angel II Q,

Direct giving system for

undisclosed firms, Version homeless people and

One Ventures

neighbors in need.

Hipmunk

San Francisco

Early Stage

$9,018,900 Ignition Partners, Nokia

Online travel company.

Growth Partners, Oak

Investment Partners, Tech

Coast Angels

Houzz

Palo Alto

Expansion

$164,999,800 Granite Global Ventures L Online platform for home

P, Kleiner Perkins

remodeling and design.

Caufield & Byers, New

Enterprise Associates,

Sequoia Capital, T. Rowe

Price Threshold

Partnerships, undisclosed

firms

Issuu

Palo Alto

Later Stage

Keas

San Francisco

Expansion

Krave Pure Foods

Sonoma

Expansion

Leeo*

Palo Alto

Startup/Seed

LendingHome*

San Francisco

Early Stage

Online web applications for

farmers and foodmakers.

$6,556,000 Norwest Venture Partners, Allows users to have their

Trinity Ventures,

cars valeted from locations.

undisclosed firm

$10,000,000 Global Brain, Sunstone

Capital A/S

$7,423,000 Atlas Venture, Ignition

Partners, undisclosed

firms

Digital publishing platform.

Employer health and

engagement programs.

$14,000,000 Alliance Consumer

Healthy snack food

Growth

company.

$37,000,000 E.ON SE, Formation 8

Smart home products.

Partners, undisclosed

firm, Visionnaire Ventures

$28,000,000 Foundation Capital,

undisclosed firm

Page 7 of 21

A way to connect borrowers

and lenders.

Venture Capital Funding Survey, Third Quarter 2014

Liquidspace

Palo Alto

Expansion

$14,016,000 Shasta Ventures

Makerskit*

San Francisco

Early Stage

$1,503,000 Bertelsmann Digital Media Project experience kits.

Investments, Greycroft

Partners, Mesa+, Tribeca

Venture Partners,

undisclosed firm

Navera

San Francisco

Expansion

$8,232,000 Emergence Capital

Partners, undisclosed

firms

Insurance education and

enrollment platform.

OpenDoor Labs

San Francisco

Early Stage

$3,450,000 Khosla Ventures,

undisclosed firms

Focused on streamlining

the selling of homes online.

Product Hunt*

San Francisco

Early Stage

$6,099,800 Andreessen Horowitz,

Cowboy Capital,

CrunchFund, Greylock

Partners, Ludlow

Ventures, SV Angel II Q,

undisclosed firms

Curation of the best new

products.

Remind101

San Francisco

Expansion

$39,999,900 First Round Capital,

A communication solution

Kleiner Perkins Caufield & to help teachers extend

Byers, Social+Capital

their classrooms.

Partnership

Robinhood Financial

Redwood City

Early Stage

$12,999,900 Index Ventures, Ribbit

Capital, undisclosed firm

Secret

San Francisco

Early Stage

$28,000,000 Ceyuan Ventures

Social networking company.

Management, Fuel Capital

Management Co., Index

Ventures, Redpoint

Ventures, SV Angel II Q,

undisclosed firms

Swyft*

San Francisco

Startup/Seed

Thredup

San Francisco

Expansion

Thumbtack

San Francisco

Expansion

Udacity

Mountain View

Early Stage

Upside Financial

San Francisco

Early Stage

$2,100,000 Keiretsu Forum

Online marketplace that

helps to find a space to

work or meet.

Broker-dealer.

Retailer

$23,000,000 Highland Capital Partners, Online children's clothing

Redpoint Ventures, Trinity company.

Ventures, Upfront

Ventures

$100,000,000 Google Ventures, Javelin Online marketplace and

Venture Partners, Sequoia review site for local

Capital, Tiger Global

services.

Management

$35,000,000 Andreessen Horowitz,

Online educational platform

Bertelsmann Digital Media for teachers and students.

Investments, Charles

River Ventures, Drive

Capital, Recruit Holdings

Co, Valor Capital Group

$1,100,100 Cultivation Capital, Six

Thirty, undisclosed firm

Page 8 of 21

Investment advisor.

Venture Capital Funding Survey, Third Quarter 2014

Wedding Spot*

San Francisco

Expansion

$1,222,200 Atlas Venture, Canyon

Online marketplace.

Creek Capital, Great Oaks

Venture Capital, KEC

Holdings, undisclosed

firms

Whale Path*

Sunnyvale

Early Stage

$1,099,700 500 Startups, Altair

Capital Management

GmbH, FundersClub,

Kima Ventures SASU,

TMT Investments,

undisclosed firms

Wikia

San Francisco

Later Stage

$15,000,000 Amazon.com, Bessemer

Venture Partners,

Institutional Venture

Partners, undisclosed

firms

Wizeline*

San Francisco

Early Stage

$500,000 Sierra Ventures

Xambala

Sunnyvale

Later Stage

$4,200,000 Undisclosed firms

Early Stage

$752,000 Undisclosed firm

Sonoma Beverage Works Healdsburg

On-demand business

research.

Network of collaboratively

published content on the

web.

Data service to help

companies in decisionmaking.

Message stream

processing subsytem for

the financial market.

Organic and all-natural hard

ciders.

HARDWARE / INSTRUMENTS

Canara

Name

City

San Rafael

Stage

Later Stage

Amount

Investors

$4,250,000 Columbia Capital Group

Description

Power systems

infrastructure and predictive

services.

E la Carte

Redwood City

Expansion

$35,000,000 Intel Capital, Romulus

Capital, TriplePoint

Capital, undisclosed firm

Tableside tablet for the

restaurants.

FINsix

Menlo Park

Expansion

Kateeva

Menlo Park

Expansion

Navdy

San Francisco

Early Stage

Nebula

Mountain View

Early Stage

OnBeep*

San Francisco

Early Stage

$2,260,000 Undisclosed firm

$38,000,200 DBL Investors, Madrone

Capital Partners, New

Science Ventures,

Samsung Venture

Investment, Sigma

Partners, Spark Capital,

undisclosed firm

$3,230,000 Undisclosed firm, Upfront

Ventures

$2,651,000 Kleiner Perkins Caufield &

Byers, undisclosed firm

Power electronics.

Organic light-emitting diode

(LED) production

technology.

Head-up display (HUD)

systems for cars.

Integrated hardware and

software appliance.

$6,249,000 Fuel Capital Management Wearable gadgets.

Co., undisclosed firms

NETWORKING / TELECOMMUNICATIONS

Name

Electric Imp

City

Los Altos

Stage

Early Stage

Amount

Investors

$15,000,000 PTI Ventures, Redpoint

Ventures, undisclosed

firms

Description

Cloud-based home

automation devices.

IIX*

Palo Alto

Early Stage

$10,418,000 New Enterprise

Associates, undisclosed

firm

Public peering and neutral

Internet exchange services.

Page 9 of 21

Venture Capital Funding Survey, Third Quarter 2014

Reddit*

San Francisco

Later Stage

$50,000,000 Undisclosed firms

Swift Navigation*

San Francisco

Early Stage

$2,599,800 Fall Line Capital GP,

Felicis Ventures, First

Round Capital, Lemnos

Labs, Qualcomm

Ventures, undisclosed

firm, VegasTechFund

VidAngel*

Palo Alto

Early Stage

$600,000 Alta Berkeley Venture

Partners, Kickstart

Ventures, undisclosed

firm

Social sharing and

aggregation website.

Global positioning system

(GPS) technology.

Video site.

ENERGY / INDUSTRIAL

Airware

Name

City

San Francisco

Stage

Expansion

Amount

Investors

Description

$24,999,900 Andreessen Horowitz,

Autopilots for unmanned

First Round Capital,

aircraft systems (UAS).

Kleiner Perkins Caufield &

Byers

Aperia Technologies

Burlingame

Expansion

$6,500,000 Undisclosed firm

Dayone Response*

San Francisco

Expansion

$498,000 Golden Seeds

Ecologic Brands

Oakland

Expansion

Efficient Drivetrains*

San Jose

Later Stage

$3,500,100 Undisclosed firms

Enlighted

Sunnyvale

Expansion

$7,561,000 Draper Fisher Jurvetson, Lighting control systems.

Draper Nexus Ventures

Partners, Intel Capital,

Kleiner Perkins Caufield &

Byers, Rockport Capital

Partners

Glasspoint Solar

Fremont

Expansion

$52,960,000 Chrysalix Energy Venture Manufactures solar steam

Capital, Nth Power,

generators for the oil and

Rockport Capital Partners, gas industry.

Royal Dutch Shell,

undisclosed firms

Knightscope

Mountain View

Early Stage

Mark One Lifestyle

San Francisco

Early Stage

Autonomous technology

platform.

$1,682,000 Felicis Ventures, Horizons Smart cup Vessyl tracks

Ventures Ltd

liquid consumption, nutrient

data.

mOasis

Union City

Expansion

$4,388,000 The Roda Group

Siluria Technologies

San Francisco

Expansion

Inreasing transportation

efficiency through Halo tire

inflator.

Supplies solutions for

disaster relief.

$7,083,000 Catamount Ventures, DBL Designs and manufactures

Investors

packaging solutions.

Commercializing hybrid

electric vehicle (HEV)

technologies.

$1,520,000 Undisclosed firm

$30,396,000 Saudi Aramco Energy

Ventures

Page 10 of 21

Nontoxic, next-generation

soil additive.

Alternatives for fuels and

chemicals.

Venture Capital Funding Survey, Third Quarter 2014

Solexel

Milpitas

Expansion

$55,956,000 Duff Ackerman &

Crystalline silicon solar cells

Goodrich, GSV Capital,

and modules.

Gentry Venture Partners,

Jasper Ridge Partners,

Kleiner Perkins Caufield &

Byers, Northgate Capital,

Technology

Partners,undisclosed firm

Zero Motorcycles

Scotts Valley

Later Stage

Name

6SensorLabs*

City

San Francisco

Stage

Early Stage

Akros Silicon

Sunnyvale

Later Stage

$900,000 Undisclosed firm

Avogy*

San Jose

Expansion

$40,000,000 Intel Capital, Khosla

Ventures

Gainspan

San Jose

Later Stage

$3,000,000 New Venture Partners,

undisclosed firm

GCT Semiconductor

San Jose

Later Stage

Ineda Systems

Santa Clara

Expansion

$23,805,000 Parakletos at Ventures

Millenium Fund

$2,000,000 Undisclosed firm

Designs integrated circuit

solutions.

Chip design company.

Kaiam

Newark

Expansion

$35,000,000 Undisclosed firms

Hybrid photonic integrated

circuit (PIC) technology.

Luxul Technology

Santa Clara

Expansion

Quantenna

Communications

Fremont

Later Stage

Zuli*

San Francisco

Early Stage

Name

Activehours*

City

Palo Alto

Stage

Early Stage

ActivityHero*

San Jose

Early Stage

Acupera*

San Francisco

Early Stage

$5,000,000 The Invus Group

Electric motorcycles.

SEMICONDUCTORS

Amount

Investors

$4,598,200 Lemnos Labs, SK

Ventures, Softtech VC,

undisclosed firm, Upfront

Ventures, Xandex

Investments

Description

Portable gluten sensor.

Energy management

semiconductor devices.

Energy efficiency and

reliability of power

conversion systems.

Semiconductor solutions for

wireless connectivity.

$1,304,000 Translink Capital Partners Lighting products.

$16,163,000 Duff Ackerman &

Developes semiconductor

Goodrich, Rossiyskaya

solutions.

Korporatsiya

Nanotekhnologiy GK,

Sequoia Capital, Sigma

Partners, Southern Cross

Venture Partners

$1,650,000 Menlo Ventures,

undisclosed firms,

Winklevoss Capital

Management, XG

Ventures

Smart plugs and smarthome technology.

SOFTWARE

Amount

Investors

$4,100,000 Felicis Ventures, Ribbit

Capital

Description

Mobile application to give

workers access to their

earned wages.

$2,200,000 Inventus Capital Partners Website for booking camps.

Fund I

$4,000,000 Lightspeed Management Care management platform.

Co., undisclosed firm

Page 11 of 21

Venture Capital Funding Survey, Third Quarter 2014

Adatao*

Sunnyvale

Early Stage

$13,452,000 Andreessen Horowitz,

Bloomberg Beta,

Lightspeed Venture

Partners China Co

Agari Data

San Mateo

Expansion

$15,000,000 Alloy Ventures, Battery

Products and services.

Ventures, First Round

Capital, Scale Venture

Partners, undisclosed firm

Altierre

San Jose

Later Stage

$21,000,000 Ata Ventures, D E Shaw & Provider of ultra low-power

Co, Kinetic Ventures,

wireless technology.

Labrador Ventures,

Stratim Capital,

undisclosed firm

AltspaceVR*

Mountain View

Startup/Seed

$5,200,000 Dolby Family Ventures,

Software company.

Formation 8 Partners,

Foundation Capital,

Google Ventures, Lux

Capital, Promus Ventures,

The Raine Group,

Rothenberg Ventures, SV

Angel II Q, Tencent Collab

Fund, undisclosed firms,

Western Technology

Investment

Amber. Io*

San Francisco

Early Stage

$2,700,000 Khosla

Universal shopping cart.

Ventures,Transmedia

Capital, undisclosed firms

Anki

San Francisco

Expansion

$55,000,100 Andreessen Horowitz,

Index Ventures, Two

Sigma Investments,

undisclosed firm

Appcelerator

Mountain View

Later Stage

$21,821,000 EDB Investments,

Enterprise mobile

Mayfield Fund, Relay

application development

Ventures, Rembrandt

platform.

Venture Partners, Sierra

Ventures, Storm Ventures,

Translink Capital

Partners, Union Grove

Venture Partners 2014

Arena Solutions

Foster City

Later Stage

$8,848,000 Otter Capital, Scale

Venture Partners

Cloud product lifecycle

management (PLM)

solutions.

Authy*

San Francisco

Early Stage

$2,300,000 CrunchFund, Data

Collective, Dgubation,

Salesforce Ventures,

Startcaps Ventures,

undisclosed firms

Authentication platform.

Azumio

Palo Alto

Early Stage

$916,000 The Founders Fund

Biofeedback health

application on mobile

devices.

Bartrendr*

San Francisco

Early Stage

$700,000 Band of Angels,

undisclosed firm

Social application.

Page 12 of 21

Data intelligence solutions.

Robotics and artificial

intelligence company.

Venture Capital Funding Survey, Third Quarter 2014

Bay Dynamics*

San Francisco

Later Stage

$5,025,000 Comcast Ventures

Information risk

intelligence.

$15,500,000 AME Cloud Ventures,

Business platform for

Kleiner Perkins Caufield & employee perks program.

Byers, Pejman Mar

Ventures, undisclosed

firm

Betterworks

Palo Alto

Early Stage

Bitglass

Campbell

Early Stage

BlueStacks Systems

Campbell

Expansion

$3,000,000 Andreessen Horowitz,

Ignition Partners, Intel

Capital, Qualcomm

Ventures, Samsung

Venture Investment

Programs that allow

Android applications to run

on Windows machines.

Boomerang Commerce*

Sunnyvale

Early Stage

$8,500,000 Madrona Venture Group,

Trinity Ventures

Analytics software for

retailers.

Box

Los Altos

Later Stage

Bright Computing

San Jose

Expansion

$158,172,000 Tpg Growth, undisclosed

firm

$14,500,000 Dfj Esprit, Draper Fisher

Jurvetson, ING Belgie NV,

Prime Technology

Ventures NV

Building Robotics

Oakland

Early Stage

Builds*

San Francisco

Early Stage

Captricity

Oakland

Early Stage

Cask Data

Palo Alto

Early Stage

Chobolabs*

Mountain View

Startup/Seed

CipherCloud

San Jose

Expansion

ClassOwl*

Palo Alto

Early Stage

$850,000 First Round Capital,

Follett, undisclosed firms

Cloud Lending*

Santa Clara

Early Stage

$300,000 Epic Ventures

Cloudhelix*

San Francisco

Early Stage

Cloudian

Foster City

Later Stage

Cnex Labs

San Jose

Startup/Seed

Comprehend Systems

Redwood City

Expansion

$25,030,000 New Enterprise

Data protection for

Associates, Norwest

enterprise.

Venture Partners, Singtel

Ventures (Singapore)

$6,707,000 Claremont Creek

Ventures, The Westly

Group

$2,000,000 Goodwater Capital,

undisclosed firm

$11,251,000 Atlas Venture,

Social+Capital

Partnership

$3,550,000 Battery Ventures,

undisclosed firms

$1,300,000 Innovation Endeavors,

undisclosed firms, XG

Ventures

$22,000,000 Undisclosed firm

$3,100,000 First Round Capital

$24,000,000 Fidelity Growth Partners

Asia, Innovation Network

of Japan, Intel Capital

$3,000,000 Sierra Ventures

$20,922,000 Lightspeed Venture

Partners China Co.,

Sequoia Capital

Page 13 of 21

Cloud storage company.

Software for managing

computer servers and

associated equipment.

Software systems for office

buildings.

Application software

developer.

Digitalization of paper

forms.

Big Data application

platform.

Mobile gaming company.

Cloud data protection

solutions.

Time-management

application for schools.

Enterprise cloud-lending

solution provider.

Network and service

operator and developer.

Specializing in cloud

storage software.

Big Data storage solutions.

Clinical data visualization,

analytics and reporting

tools.

Venture Capital Funding Survey, Third Quarter 2014

Content Analytics*

San Francisco

Early Stage

$4,000,000 Almaz Capital Partners,

Dunnhumby

$419,000 Andreessen Horowitz,

New Enterprise

Associates, .

E-commerce analytics

platform.

Support to the open-source

Apache Spark project.

Databricks

Berkeley

Early Stage

DataStax

Santa Clara

Expansion

Delta ID*

Newark

Early Stage

$5,000,000 Intel Capital, undisclosed Brings biometric

firm

authentication to massmarket computing devices.

Digit4me*

Emeryville

Early Stage

$1,100,000 IDG Ventures

Doctor On Demand

San Francisco

Early Stage

DocuSign

San Francisco

Later Stage

$15,369,000 Ignition Partners, Kleiner E-signature transaction

Perkins Caufield & Byers, management solutions.

Scale Venture Partners,

Second Century Ventures,

Sigma Partners, Telstra

Ltd

DoubleDutch

San Francisco

Early Stage

$15,047,000 Bessemer Venture

Data-driven mobile social

Partners, Bullpen Capital, event applications.

Enspire Capital, Index

Ventures, Mithril Capital

Management

DroneDeploy

San Francisco

Early Stage

$2,000,000 Data Collective, Draper

Software that allows users

Fisher Jurvetson,

to fly drones.

Redpoint Ventures,

Softtech VC, undisclosed

firm

Duetto Research

San Francisco

Early Stage

EdCast*

Mountain View

Early Stage

$106,000,400 Comcast Ventures, Cross Products based on the

Creek Capital, Crosslink open-source database

Capital, Draper Fisher

Apache Cassandra.

Jurvetson, Kleiner Perkins

Caufield & Byers,

Lightspeed Management

Co., Scale Venture

Partners, undisclosed

firms

Social networking

application.

$21,000,000 Shasta Ventures,

Video consultation

undisclosed firm, Venrock services.

$16,000,000 Accel Partners, Altimeter

Capital Management,

Battery Ventures,

undisclosed firm

Provides hotel executives

with solutions to optimize

demand

$6,000,000 Aarin Asset Advisors,

Personal learning network

Cervin Ventures, Menlo

and cloud platform.

Ventures, NewSchools

Venture Fund, Novel TMT

Ventures, SoftBank

Capital Partners,

undisclosed firms

Page 14 of 21

Venture Capital Funding Survey, Third Quarter 2014

Entelo

San Francisco

Early Stage

$4,927,000 Battery Ventures,

undisclosed firm

Software solution for

sourcing and recruiting

candidates.

Everstring Technology*

San Mateo

Early Stage

Famous Industries

San Francisco

Early Stage

$2,345,100 Insight Venture Partners, Javascript framework

Javelin Venture Partners,

Samsung Venture

Investment

Fixed*

San Francisco

Early Stage

$1,200,000 Merus Capital Investment, Application that helps users

undisclosed firm, Y

fight parking tickets.

Combinator

$12,000,000 IDG Ventures, Lightspeed Predictive analytics

Management Co.,

platform.

Sequoia Capital

Formation Data Systems* Fremont

Early Stage

$24,200,000 Dell Ventures, Mayfield

Fund, Pelion Venture

Partners, Third Point

Ventures, undisclosed

firm

Fuel*

San Francisco

Early Stage

Gametime United*

San Francisco

Early Stage

Gastke*

San Francisco

Early Stage

GoodData

San Francisco

Expansion

Guavus

San Mateo

Later Stage

$20,000,000 Artiman Ventures,

Goldman Sachs Capital

Partners, Intel Capital,

Investor Growth Capital,

QuestMark Partners,

Singtel Ventures

(Singapore), Sofinnova

Ventures, Translink

Capital Partners

Big Data analytics

solutions.

Hashicorp

Palo Alto

Early Stage

$10,175,000 Mayfield Fund, True

Ventures, undisclosed

firm

Tools to manage the

complexities of a virtual

environment.

Hazelcast

Palo Alto

Expansion

$10,962,000 Bain Capital Venture

Partners, Earlybird

Venture Capital GmbH &

Co KG, undisclosed firm

Open source in-memory

data grid software.

Hobo Labs*

Berkeley

Early Stage

$3,500,000 Middle East Venture

Partners, Newbury

Ventures

$3,999,900 Accel Partners,

undisclosed firm

$3,000,000 Rothenberg Ventures,

undisclosed firms

$25,700,000 Andreessen Horowitz,

General Catalyst Partners,

Intel Capital, Next World

Capital, Tenaya Capital,

Totvs Ventures

Participacoes Ltda,

undisclosed firm,

Windcrest Partners

$4,000,000 Shasta Ventures,

undisclosed firm

Page 15 of 21

Data management and

storage platform.

Platform for creating

engaging connected

experiences.

Mobile platform.

Cloud-based software

solution.

SaaS business intelligence

analytics and reporting.

Mobile gaming company.

Venture Capital Funding Survey, Third Quarter 2014

HoneyBook*

San Francisco

Early Stage

$10,000,000 Aleph, undisclosed firms

Hortonworks

Palo Alto

Early Stage

$50,000,000 Undisclosed firms

Software company.

ICIX

South San

Francisco

Later Stage

$25,000,000 Draper Fisher Jurvetson,

Starfish Ventures Pty,

undisclosed firms

Supplier risk and

performance management

in the cloud.

Insightful Labs*

Mountain View

Expansion

$1,100,000 500 Startups, Nexus

Personalization platform for

Venture Partners, SAIF

online businesses.

Partners, undisclosed firm

Jaunt

Palo Alto

Early Stage

$27,838,900 Google Ventures,

Immersive media format for

Highland Capital Partners, virtual reality applications.

Redpoint Ventures,

undisclosed firms

Jfrog

Santa Clara

Expansion

Jiff

Palo Alto

Expansion

$7,000,000 Gemeni Capital Fund

Mgmt, undisclosed firm

$18,000,000 Aberdare Ventures, Aeris

Capital AG, Venrock

Jobr*

San Francisco

Early Stage

$1,999,800 Eniac Ventures, Hive,

Lerer Ventures,

Lowercase Capital,

Redpoint Ventures,

Structure Capital,

undisclosed firms

Job hunting application

solutions.

July Systems

Burlingame

Later Stage

$1,145,000 Updata Partners

Kabam

San Francisco

Later Stage

$120,000,000 Undisclosed firm

Cloud-based mobile

application platform.

Entertainment applications

for social networks.

Kiwi

Palo Alto

Early Stage

Kurbo Health*

Palo Alto

Early Stage

$5,827,000 Bessemer Venture

Data-driven weight-loss

Partners, Data Collective, platform for kids.

Promus Ventures, Signia

Ventures, undisclosed

firm

Landscape Mobile*

San Francisco

Early Stage

$1,850,000 IDG Capital Partners

Lastline

Redwood City

Early Stage

$10,000,000 BV e ventures, Dell

Ventures, Presidio Stx

(Fka Presidio Venture

Partners), Redpoint

Ventures

Lavante

San Jose

Later Stage

$3,500,100 Ata Ventures, Point Guard Profit recovery services

Ventures, SAP Ventures provider.

Leanplum

San Francisco

Early Stage

$4,800,000 Shasta Ventures

Mobile application and

game optimization

company.

LifeNexus*

San Francisco

Later Stage

$12,699,900 Camden Partners,

undisclosed firm

Consumer-based

healthcare technology

company.

$15,000,000 Draper Fisher Jurvetson,

Northgate Capital,

Sequoia Capital

Page 16 of 21

Business software.

Open-source software

solutions.

Social network and digital

health applications platform.

Mobile entertainment

company.

Mobile application

softwares

Active malware defense

solutions for businesses.

Venture Capital Funding Survey, Third Quarter 2014

LiveAction*

Palo Alto

Expansion

$2,850,000 AITV, Cisco Investments, Enterprise software.

Enerdigm Ventures

Lob.com

San Francisco

Early Stage

$9,341,100 First Round Capital,

Integrates print and mail

Floodgate Fund, Polaris solutions into applications.

Partners, undisclosed firm

Lookout

San Francisco

Expansion

Lucidworks

Redwood City

Expansion

$8,000,100 Granite Ventures, Shasta Search development

Ventures, Walden

solutions.

International

Lumiata

San Mateo

Early Stage

$6,000,000 Khosla Ventures,

Sandbox Industries

Predictive analytics around

medical science and patient

data.

Luxe Valet*

San Francisco

Early Stage

$4,000,000 Foundation Capital,

undisclosed firm, Upfront

Ventures

On-demand valet service.

Matchbook Labs*

San Francisco

Expansion

Matterport

Mountain View

Early Stage

Medallia

Palo Alto

Later Stage

$50,000,000 Sequoia Capital

Metanautix*

Palo Alto

Early Stage

MetricStream

Palo Alto

Later Stage

$6,999,900 Sequoia Capital,

undisclosed firms

$60,000,000 Goldman Sachs Capital

Partners, Kaiser

Permanente Ventures,

Sageview Capital

Milyoni

Pleasanton

Expansion

$16,143,900 Ata Ventures, Oak

Investment Partners,

Thomvest Ventures

Social video for

entertainment companies,

brands and artists.

mNectar

San Francisco

Early Stage

Moogsoft (Herd)

San Francisco

Early Stage

$1,000,000 Correlation Ventures,

undisclosed firm

$14,280,000 Redpoint Ventures,

undisclosed firm, Wing

Venture Partners

Mobile application

virtualization software.

Service assurance

software.

Motiondsp

Burlingame

Later Stage

$150,000,000 Accel Partner,

Mobile security company.

Andreessen Horowitz,

Bezos Expeditions,

Goldman Sachs Capital

Partners, Index Ventures,

Khosla Ventures, Mithril

Capital Management, T.

Rowe Price Threshold

Partnerships, undisclosed

firm

$2,314,000 Salesforce Ventures,

Online survey application.

undisclosed firm

$16,000,000 AMD Ventures, AME

Solutions for 3-D scanning

Cloud Ventures, Doll

of spaces and objects.

Capital Management,

Felicis Ventures, Greylock

Partners, Lux Capital,

Navitas Capital,

Qualcomm Ventures,

Rothenberg Ventures,

undisclosed firm

$1,793,000 Undisclosed firm

Page 17 of 21

Customer experience

management software.

Data analytics company.

Quality and compliance

management software.

Video enhancement

software solutions.

Venture Capital Funding Survey, Third Quarter 2014

Moxie Software

Sunnyvale

Later Stage

$5,000,000 Foundation Capital,

undisclosed firm

$18,600,000 August Capital

Management, DFJ

Frontier, DOCOMO

Capital, Javelin Venture

Partners, Nokia Growth

Partners

Netpulse

San Francisco

Later Stage

Nexenta Systems

Santa Clara

Later Stage

Nextumi

Palo Alto

Later Stage

Numerify

Cupertino

Early Stage

Nutanix

San Jose

Expansion

$145,000,000 Fidelity Investment Funds Web-scale converged

II, Wellington

infrastructure company.

Management

Ootu*

San Francisco

Early Stage

$324,900 Undisclosed firms, mc3

Semantic discovery

ventures (FKA: McKenna company.

Venture Accelerator)

Palantir Technologies

Palo Alto

Later Stage

Pawprint Labs*

Menlo Park

Early Stage

$3,000,000 New Enterprise

Associates, Pejman Mar

Ventures, TriplePoint

Capital, undisclosed firm

Software.

Pear Therapeutics*

Redwood City

Early Stage

$1,250,000 5AM Venture

Management

Products for the treatment

of prevalent respiratory

diseases.

Peerspace*

San Francisco

Early Stage

PernixData

San Jose

Early Stage

Pinc Solutions

Alameda

Later Stage

Platform9 Systems*

Sunnyvale

Expansion

PolyRemedy

San Jose

Later Stage

Popout*

San Francisco

Early Stage

$1,999,900 500 Startups,

FundersClub, Softtech

VC, undisclosed firms,

Version One Ventures

Application and application

programming interface.

PunchTab

Palo Alto

Early Stage

$2,189,000 Mohr Davidow Ventures

Engagement and insights

platform.

$667,000 Sierra Ventures

$463,000 Mercury Fund

$15,000,000 Lightspeed Management

Co., Sequoia Capital

$165,119,000 The Founders Fund

Enterprise software and

services provider.

Media and data services

company.

Software-defined storage

solutions.

Online sharing platform.

Cloud analytical solutions

company.

Data analysis software.

$1,500,000 Structure Capital,

Application software.

undisclosed firm

$35,000,000 Kleiner Perkins Caufield & Server-side storage

Byers, Lightspeed

intelligence solutions.

Management Co., Menlo

Ventures, undisclosed

firm

$4,221,000 Sutter Hill Ventures

Real-time asset visibility

solutions.

$4,500,000 Redpoint Ventures

Cloud-based service

company

$35,000 Advanced Technology

Personalized wound

Ventures, Clayton Dubilier management systems.

& Rice, Delphi Ventures,

Flybridge Capital

Partners, Medventure

Associates

Page 18 of 21

Venture Capital Funding Survey, Third Quarter 2014

Quettra*

Mountain View

Startup/Seed

$2,899,800 CrunchFund, Data

Collective, Google

Ventures, Horizons

Ventures, Miramar

Venture Partners, SV

Angel II Q, undisclosed

firms

RackWare

Santa Clara

Expansion

Radius Intelligence

San Francisco

Expansion

RelayRides

San Francisco

Expansion

$6,600,000 Trinity Ventures

Riffyn*

Oakland

Early Stage

$1,159,000 OReilly AlphaTech

Ventures, undisclosed

firm

SchoolMint*

San Francisco

Early Stage

$2,199,600 Crosslink Capital, Imagine Mobile and online

K12, Kapor Capital,

enrollment and school

NewSchools Venture

choice systems for K-12

Fund, Romulus Capital,

Runa Capital, undisclosed

firms

ScriptRock

San Francisco

Early Stage

$8,726,900 Undisclosed firms

Sentient Energy

Burlingame

Later Stage

$7,500,000 Foundation Capital,

undisclosed firm

Sharethrough

San Francisco

Expansion

ShiftPlanning

San Francisco

Expansion

$3,200,100 MHS Capital

Online employee

Management, Point Nine scheduling management

Management GmbH,

software

undisclosed firm

Shyp*

San Francisco

Early Stage

$9,281,000 Homebrew

Sidecar Technologies

San Francisco

Early Stage

$15,872,000 Avalon Ventures,

Correlation Ventures,

undisclosed firm, Union

Square Ventures

Smartzip Analytics

Pleasanton

Expansion

$12,000,000 Claremont Creek

Ventures, Crest Capital

Ventures, Intel Capital

Sololearn*

Pleasanton

Early Stage

$2,300,000 Osage Partners, Signal

Peak Ventures

$54,700,000 Bluerun Ventures L P,

Formation 8 Partners,

Founders Fund, Glynn

Capital Management,

undisclosed firms,

Western Technology

Investment

$10,000,000 Elevation Partners,

Floodgate Fund, North

Bridge Venture Partners,

Silver Creek Ventures,

undisclosed firm

Mobile intelligence

company.

Intelligence and

automation to the cloud.

Integrated, cloud-based

software.

Peer-to-peer carsharing

marketplace.

Software solutions.

Enterprise software

developer.

Electric utilities with

automation monitoring

systems.

Social video advertising

company.

Mobile application for

shipping needs.

Real-time ride-matching

platform.

Investment ratings,

research, and analysis

$100,000 Granatus Ventures CJSC Mobile learning platform.

Page 19 of 21

Venture Capital Funding Survey, Third Quarter 2014

Sonalight*

Mountain View

Early Stage

Stitch Labs

San Francisco

Early Stage

Streetline

Foster City

Later Stage

Swrve New Media

San Francisco

Syapse

$1,975,200 BoxGroup, Data

Voice recognition solutions

Collective, Merus Capital and messaging services.

Investment, Quest

Venture Partners, SV

Angel II Q, Silicon Badia,

Suomen Teollisuussijoitus

Oy, undisclosed firms

$3,550,000 Costanoa Venture Capital,

True Ventures

$10,000,200 Citi Ventures,Fontinalis

Partners, Qualcomm

Ventures, Rockport

Capital Partners, Sutter

Hill Ventures, True

Ventures

Software for designers.

Expansion

$10,000,000 Acero Capital, Atlantic

Bridge, Intel Capital,

undisclosed firm

Mobile application

optimization platform.

Palo Alto

Expansion

$10,000,000 Safeguard Scientifics,

Social+Capital

Partnership

Healthcare software.

Symphony Commerce

San Francisco

Early Stage

$21,500,000 Bain Capital Venture

Partners, Charles River

Ventures, FirstMark

Capital

Commerce as a service

Talkdesk

Mountain View

Early Stage

Tangible Play

Palo Alto

Early Stage

$3,150,000 500 Startups, Storm

Software.

Ventures

$10,000,000 Undisclosed firm, Upfront Artificial intelligence &

Ventures

computer vision-based

gaming startup.

Taulia

San Francisco

Expansion

Teleport*

Palo Alto

Early Stage

$2,500,000 Andreessen Horowitz, SV Software for digital nomads.

Angel II Q, Seedcamp

Investments, undisclosed

firm

TrueAccord*

San Francisco

Early Stage

$5,000,100 Khosla Ventures,

undisclosed firms

Trufa

Palo Alto

Early Stage

Trusper

San Jose

Early Stage

Trustlook*

San Jose

Early Stage

tuul*

Santa Cruz

Startup/Seed

Data and analytics to solve

parking issues for

customers.

$34,475,000 Band of Angels, Duff

Cloud-based invoice and

Ackerman & Goodrich,

dynamic discounting

Lakestar Advisors GmbH, management solutions.

Matrix Partners,

QuestMark Partners,

Trinity Ventures, Valanza

Automated debt recovery

for businesses of all sizes.

$6,400,000 Foundation Capital,

Business software.

undisclosed firm

$16,020,000 Doll Capital Management Mobile app and website

company

$3,000,000 Danhua Capital, Zhen

Next-generation mobile

Fund

security solutions.

$1,700,000 Greycroft Partners, The

Workflow communication

Raine Group,

services.

Streamlined Ventures I,

undisclosed firm

Page 20 of 21

Venture Capital Funding Survey, Third Quarter 2014

vArmour Networks

Mountain View

Early Stage

$21,000,000 Citi Ventures, Columbus Software defined security

Nova Technology Partner, (SDSEC) for virtualized

Highland Capital Partners, data centers.

undisclosed firm

Vectra Networks

San Jose

Early Stage

$25,048,200 AME Cloud Ventures,

Security platform that

Accel Partners, IA

leverages data analytics.

Ventures, Intel Capital,

Juniper Networks, Khosla

Ventures

Verbify*

San Francisco

Early Stage

$12,829,000 Atlas Venture, Redpoint

Ventures, Stanford

University, undisclosed

firm

Vidder

Campbell

Expansion

VisiQuate*

Santa Rosa

Expansion

Wearable Intelligence*

San Francisco

Early Stage

Weaved

Palo Alto

Expansion

wise.io

Berkeley

Early Stage

Workspot

Menlo Park

Early Stage

Xamarin

San Francisco

Early Stage

Zumigo*

San Jose

Expansion

Moov

San Francisco

Later Stage

Splice Machine

San Francisco

Early Stage

Web and mobile contextual

search engine.

$190,000 ONSET Ventures,

Voyager Capital

$6,146,000 First Analysis,

undisclosed firm

$7,874,000 Lightspeed Management

Co., undisclosed firm

Security solutions.

$2,000,000 Double M Partners,

undisclosed firm

$965,000 Voyager Capital

Technology company.

Business analytics

solutions.

Technology company.

Machine learning

applications.

$2,499,900 Helion Venture Partners, Cloud-based, BYOD

Qualcomm Ventures,

solution for the mobile

Translink Capital Partners workplace.

$54,250,000 Charles River Ventures,

Floodgate Fund, Ignition

Partners, Insight Venture

Partners, Lead Edge

Capital

$6,000,000 Aligned Partners, Intel

Capital, Wells Fargo

Startup Accelerator

$500,000 Trinity Ventures

$3,000,000 Correlation Ventures.

undisclosed firm

Page 21 of 21

Enterprise software

solutions that help business

operations

Mobile device location and

identity verification

solutions.

Technology for companies

to build and maintain their

mobile presence

SQL-compliant database.

Вам также может понравиться

- 1Q 14 VCchart PDFДокумент25 страниц1Q 14 VCchart PDFBayAreaNewsGroupОценок пока нет

- 2Q 15 Vcsurvey PDFДокумент11 страниц2Q 15 Vcsurvey PDFBayAreaNewsGroupОценок пока нет

- Empirical Note on Debt Structure and Financial Performance in Ghana: Financial Institutions' PerspectiveОт EverandEmpirical Note on Debt Structure and Financial Performance in Ghana: Financial Institutions' PerspectiveОценок пока нет

- Venture Capital Funding Survey, 1Q 2016Документ10 страницVenture Capital Funding Survey, 1Q 2016BayAreaNewsGroupОценок пока нет

- Q2 Fundraising 2009Документ4 страницыQ2 Fundraising 2009Dan Primack100% (1)

- Stanford Case Study 2014Документ25 страницStanford Case Study 2014Fakhrul IslamОценок пока нет

- CB Insights Global Unicorn Club 2019Документ20 страницCB Insights Global Unicorn Club 2019Yash Joglekar0% (1)

- AIG Private Equity 2007 Annual ReportДокумент70 страницAIG Private Equity 2007 Annual ReportAsiaBuyoutsОценок пока нет

- Presentation File 50f7f380 Ebac 4ef9 A95f 0502ac10168aДокумент5 страницPresentation File 50f7f380 Ebac 4ef9 A95f 0502ac10168aInnoVentureCommunityОценок пока нет

- Private Equity Secondaries China - PEI Magazine WhitepaperДокумент2 страницыPrivate Equity Secondaries China - PEI Magazine WhitepaperpfuhrmanОценок пока нет

- Nubank: Valued at US$25bn in A Series G Raise of US$400mn IPO Ever CloserДокумент5 страницNubank: Valued at US$25bn in A Series G Raise of US$400mn IPO Ever CloserFelipe AreiaОценок пока нет

- 2013 Pan European Private Equity Performance Benchmarks Study Evca Thomson Reuters Final VersionДокумент28 страниц2013 Pan European Private Equity Performance Benchmarks Study Evca Thomson Reuters Final VersionAbdullah HassanОценок пока нет

- An Explorative Event Study of Listed Private Equity VehiclesДокумент105 страницAn Explorative Event Study of Listed Private Equity VehiclesSiddh MehtaОценок пока нет

- Sbic FundsДокумент3 страницыSbic FundsafkdsjfdlsjОценок пока нет

- Quality of EarningsДокумент8 страницQuality of EarningsOlsjon BaxhijaОценок пока нет

- Global Unicorn Company 2019Документ34 страницыGlobal Unicorn Company 2019rickyОценок пока нет

- 2017 TMA ConferenceДокумент16 страниц2017 TMA ConferenceAndrew SeoОценок пока нет

- WSO Resume 24Документ1 страницаWSO Resume 24John MathiasОценок пока нет

- Sterling Bank PLC and Equitorial Trust Bank PLC Sign Transaction Implementation AgreementДокумент2 страницыSterling Bank PLC and Equitorial Trust Bank PLC Sign Transaction Implementation AgreementSterling Bank PLCОценок пока нет

- 2022 Bain Capital Credit (BCC) Application GuidanceДокумент4 страницы2022 Bain Capital Credit (BCC) Application GuidanceLilia Fatma KrichèneОценок пока нет

- A Study On Private Equity in IndiaДокумент21 страницаA Study On Private Equity in IndiaPrabakar NatrajОценок пока нет

- A-List of Foreign Venture Capital Investors Registered With SEBIДокумент24 страницыA-List of Foreign Venture Capital Investors Registered With SEBIVipul ParekhОценок пока нет

- Private Equity Apax Partners 2007 Annual ReportДокумент78 страницPrivate Equity Apax Partners 2007 Annual ReportAsiaBuyouts100% (3)

- Interview Notes For The Tax Review of New Audit Clients (CPTX) 2022.03.17Документ19 страницInterview Notes For The Tax Review of New Audit Clients (CPTX) 2022.03.17AdamОценок пока нет

- Avid Cost of Venture Debt With Warrants and Net Interest TemplateДокумент13 страницAvid Cost of Venture Debt With Warrants and Net Interest TemplateSeemaОценок пока нет

- FILE PlacementAgentsДокумент6 страницFILE PlacementAgentsgsu2playОценок пока нет

- Private Equity Advent International 2007 Annual ReviewДокумент16 страницPrivate Equity Advent International 2007 Annual ReviewAsiaBuyouts100% (2)

- AXA Private Equity 2008 Annual ReportДокумент30 страницAXA Private Equity 2008 Annual ReportAsiaBuyoutsОценок пока нет

- Facebook Initiating ReportДокумент39 страницFacebook Initiating Reportmiyuki urataОценок пока нет

- Underwriting Placements and The Art of Investor Relations Presentation by Sherilyn Foong Alliance Investment Bank Berhad MalaysiaДокумент25 страницUnderwriting Placements and The Art of Investor Relations Presentation by Sherilyn Foong Alliance Investment Bank Berhad MalaysiaPramod GosaviОценок пока нет

- Lender MCC Lender Spanish Smartbuy Phone Gold Level LendersДокумент3 страницыLender MCC Lender Spanish Smartbuy Phone Gold Level LendersRielzaruxo Ka Rioelzarux Ko XОценок пока нет

- Enforcing Private-Equity Thinking in Public-Equity MarketsДокумент49 страницEnforcing Private-Equity Thinking in Public-Equity MarketsaaquibnasirОценок пока нет

- Investment Currency Vintage Year Commitment (USD) : Private Income - June 30, 2020Документ2 страницыInvestment Currency Vintage Year Commitment (USD) : Private Income - June 30, 2020Vishnu MohananОценок пока нет

- Demystifying Venture Capital Economics - Part 1Документ9 страницDemystifying Venture Capital Economics - Part 1KarnYoОценок пока нет

- Capital DirectoryДокумент467 страницCapital DirectoryWorla DewornuОценок пока нет

- Direct Listings - A More Certain Path To NasdaqДокумент16 страницDirect Listings - A More Certain Path To NasdaqkeatingcapitalОценок пока нет

- LABF - Fund of FundsДокумент6 страницLABF - Fund of FundsdavidsirotaОценок пока нет

- VC101: Venture Capital Overview: November 2020Документ35 страницVC101: Venture Capital Overview: November 2020kalinovskayaОценок пока нет

- A Lawsuit Against Private EquityДокумент221 страницаA Lawsuit Against Private Equityoo2011Оценок пока нет

- S P Capital IQ Excel Plug-In Template GuideДокумент35 страницS P Capital IQ Excel Plug-In Template Guiderudy gullitОценок пока нет

- Dokumen - Tips - Middle East Venture Capital Private Equity DirectoryДокумент15 страницDokumen - Tips - Middle East Venture Capital Private Equity DirectorySadeq ObaidОценок пока нет

- First Round Capital Original Pitch DeckДокумент10 страницFirst Round Capital Original Pitch DeckJessi Craige ShikmanОценок пока нет

- Wharton Resume Advice Private Equity Venture CapitalДокумент2 страницыWharton Resume Advice Private Equity Venture CapitalpersianoОценок пока нет

- SV Angel - RC Current Investments As of 11/22/2011Документ24 страницыSV Angel - RC Current Investments As of 11/22/2011FortuneОценок пока нет

- Investment Counsel For Private Clients 1993 PeavyДокумент106 страницInvestment Counsel For Private Clients 1993 Peavywestelm12Оценок пока нет

- SparkLabs Global Technology and Internet Market Bi-Monthly Review 0104 2016Документ11 страницSparkLabs Global Technology and Internet Market Bi-Monthly Review 0104 2016SparkLabs Global VenturesОценок пока нет

- SV Angel - Active PortfolioДокумент20 страницSV Angel - Active PortfolioFortuneОценок пока нет

- Private Debt Presentation - Edl - June 2019Документ23 страницыPrivate Debt Presentation - Edl - June 2019api-276349208Оценок пока нет

- Sample Cap TableДокумент1 страницаSample Cap TablenewyuppieОценок пока нет

- SSP Templates: Business Name: Last Completed Fiscal YearДокумент23 страницыSSP Templates: Business Name: Last Completed Fiscal YearMee TootОценок пока нет

- Topic03 ValuationVCДокумент29 страницTopic03 ValuationVCGaukhar RyskulovaОценок пока нет

- Healthtech Venture CapitalДокумент28 страницHealthtech Venture CapitalFelipe Hernan Herrera SalinasОценок пока нет

- Venture DebtДокумент2 страницыVenture Debtmanoj yadavОценок пока нет

- IAVC - Venture Capital Training PDFДокумент77 страницIAVC - Venture Capital Training PDFvikasОценок пока нет

- HR List PuneДокумент15 страницHR List PuneAnurag SinghОценок пока нет

- Formulate An Offer: Stephen Lawrence and Frank MoyesДокумент13 страницFormulate An Offer: Stephen Lawrence and Frank Moyesvkavtuashvili100% (2)

- WSO ResumeДокумент1 страницаWSO ResumeJohn MathiasОценок пока нет

- Bain IVCA India Venture Capital Report 2022 1648706342Документ42 страницыBain IVCA India Venture Capital Report 2022 1648706342Kiran MaadamshettiОценок пока нет

- What We Watched A Netflix Engagement Report 2023Jan-JunДокумент849 страницWhat We Watched A Netflix Engagement Report 2023Jan-JunBayAreaNewsGroupОценок пока нет

- 4.28.23 Santa Clara County SSA DFCS Response Letter Re Site VisitДокумент21 страница4.28.23 Santa Clara County SSA DFCS Response Letter Re Site VisitBayAreaNewsGroupОценок пока нет

- Follow-Up Letter To SCC Re 16 Uncounted VotesДокумент3 страницыFollow-Up Letter To SCC Re 16 Uncounted VotesBayAreaNewsGroupОценок пока нет

- Complaint For Breach of Pac-12 BylawsДокумент16 страницComplaint For Breach of Pac-12 BylawsBayAreaNewsGroup100% (2)

- Darcy Paul Attorney LetterДокумент3 страницыDarcy Paul Attorney LetterBayAreaNewsGroupОценок пока нет

- Pac-12 Settlement AgreementДокумент31 страницаPac-12 Settlement AgreementBayAreaNewsGroupОценок пока нет

- Santa Clara Findings Report FinalДокумент11 страницSanta Clara Findings Report FinalBayAreaNewsGroup100% (3)

- Read Trump Indictment Related To Hush Money PaymentДокумент16 страницRead Trump Indictment Related To Hush Money PaymentBayAreaNewsGroup100% (1)

- Cupertino City Attorney ResponseДокумент3 страницыCupertino City Attorney ResponseBayAreaNewsGroupОценок пока нет

- Read Trump Indictment Statement of Facts Related To Hush Money PaymentДокумент13 страницRead Trump Indictment Statement of Facts Related To Hush Money PaymentBayAreaNewsGroup100% (1)

- Los MeDanos Community Healthcare District ReportДокумент44 страницыLos MeDanos Community Healthcare District ReportBayAreaNewsGroupОценок пока нет

- George Santos IndictmentДокумент20 страницGeorge Santos IndictmentBayAreaNewsGroupОценок пока нет

- Brian Doyle Vs City of Santa ClaraДокумент13 страницBrian Doyle Vs City of Santa ClaraBayAreaNewsGroupОценок пока нет

- Antioch Mayor Calls For Immediate Firing of Officers Involved in Racist Text ScandalДокумент2 страницыAntioch Mayor Calls For Immediate Firing of Officers Involved in Racist Text ScandalBayAreaNewsGroupОценок пока нет

- Sent Via Electronic Mail Only To:: O S S E D Deborah ScrogginДокумент3 страницыSent Via Electronic Mail Only To:: O S S E D Deborah ScrogginBayAreaNewsGroupОценок пока нет

- Memo From Outgoing Interim SJSU President Sue Martin To Incoming President Papazian in 2016Документ5 страницMemo From Outgoing Interim SJSU President Sue Martin To Incoming President Papazian in 2016BayAreaNewsGroupОценок пока нет

- Marie Tuite Response 02.04.22Документ3 страницыMarie Tuite Response 02.04.22BayAreaNewsGroupОценок пока нет

- California Energy Commission Chair David Hochschild's Letter To Major Oil CompaniesДокумент4 страницыCalifornia Energy Commission Chair David Hochschild's Letter To Major Oil CompaniesBayAreaNewsGroupОценок пока нет

- Richmond Police Department: MemorandumДокумент11 страницRichmond Police Department: MemorandumBayAreaNewsGroupОценок пока нет

- Federal Analysis of The BART's San Jose ExtensionДокумент145 страницFederal Analysis of The BART's San Jose ExtensionBayAreaNewsGroupОценок пока нет

- March 9, 2019 - KhalfanДокумент24 страницыMarch 9, 2019 - KhalfanBayAreaNewsGroupОценок пока нет

- San Jose State Investigation of Former Gymnastics CoachДокумент40 страницSan Jose State Investigation of Former Gymnastics CoachBayAreaNewsGroupОценок пока нет

- Mlslistings Inc - Recent Solds Data: Complied For: Bay Area News Group (Bang) For Week ofДокумент14 страницMlslistings Inc - Recent Solds Data: Complied For: Bay Area News Group (Bang) For Week ofBayAreaNewsGroupОценок пока нет

- Richmond PD Use of Force Report: Nathan Tanner MyersДокумент32 страницыRichmond PD Use of Force Report: Nathan Tanner MyersBayAreaNewsGroupОценок пока нет

- Richmondpolicedeptbrandonhodges02132018 - Report RedactedДокумент32 страницыRichmondpolicedeptbrandonhodges02132018 - Report RedactedBayAreaNewsGroupОценок пока нет

- Fly QuarantineДокумент14 страницFly QuarantineBayAreaNewsGroupОценок пока нет

- Personnel Complaint Opa 2018-012 Investigator: Sergeant Josh ClarkДокумент25 страницPersonnel Complaint Opa 2018-012 Investigator: Sergeant Josh ClarkBayAreaNewsGroupОценок пока нет

- Case # 2019-00014491 - Supplement - 2 Report: NarrativeДокумент4 страницыCase # 2019-00014491 - Supplement - 2 Report: NarrativeBayAreaNewsGroupОценок пока нет

- Richmondpolicedeptbrandonhodges12282019 Officer Hodges k9 Supp RedactedДокумент4 страницыRichmondpolicedeptbrandonhodges12282019 Officer Hodges k9 Supp RedactedBayAreaNewsGroupОценок пока нет

- 10.03.21 SJMNДокумент24 страницы10.03.21 SJMNBayAreaNewsGroupОценок пока нет

- II 2022 06 Baena-Rojas CanoДокумент11 страницII 2022 06 Baena-Rojas CanoSebastian GaonaОценок пока нет

- Deal Report Feb 14 - Apr 14Документ26 страницDeal Report Feb 14 - Apr 14BonviОценок пока нет

- The Indonesia National Clean Development Mechanism Strategy StudyДокумент223 страницыThe Indonesia National Clean Development Mechanism Strategy StudyGedeBudiSuprayogaОценок пока нет

- Rule 113 114Документ7 страницRule 113 114Shaila GonzalesОценок пока нет

- Decision Making and The Role of Manageme PDFДокумент20 страницDecision Making and The Role of Manageme PDFRaadmaan RadОценок пока нет

- Floating Oil Skimmer Design Using Rotary Disc MethДокумент9 страницFloating Oil Skimmer Design Using Rotary Disc MethAhmad YaniОценок пока нет

- ReadmeДокумент3 страницыReadmedhgdhdjhsОценок пока нет

- Jesus Prayer-JoinerДокумент13 страницJesus Prayer-Joinersleepknot_maggotОценок пока нет

- Test Your Knowledge - Study Session 1Документ4 страницыTest Your Knowledge - Study Session 1My KhanhОценок пока нет

- Objective & Scope of ProjectДокумент8 страницObjective & Scope of ProjectPraveen SehgalОценок пока нет

- Specificities of The Terminology in AfricaДокумент2 страницыSpecificities of The Terminology in Africapaddy100% (1)

- 5c3f1a8b262ec7a Ek PDFДокумент5 страниц5c3f1a8b262ec7a Ek PDFIsmet HizyoluОценок пока нет

- AntibioticsДокумент36 страницAntibioticsBen Paolo Cecilia RabaraОценок пока нет

- School of Mathematics 2021 Semester 1 MAT1841 Continuous Mathematics For Computer Science Assignment 1Документ2 страницыSchool of Mathematics 2021 Semester 1 MAT1841 Continuous Mathematics For Computer Science Assignment 1STEM Education Vung TauОценок пока нет

- Ron Kangas - IoanДокумент11 страницRon Kangas - IoanBogdan SoptereanОценок пока нет

- IMS Objectives Targets 2Документ2 страницыIMS Objectives Targets 2FaridUddin Ahmed100% (3)

- 11-03 TB Value Chains and BPs - WolfДокумент3 страницы11-03 TB Value Chains and BPs - WolfPrakash PandeyОценок пока нет

- Washing Machine: Service ManualДокумент66 страницWashing Machine: Service ManualFernando AlmeidaОценок пока нет

- Dalasa Jibat MijenaДокумент24 страницыDalasa Jibat MijenaBelex ManОценок пока нет

- 7400 IC SeriesДокумент16 страниц7400 IC SeriesRaj ZalariaОценок пока нет

- From Philo To Plotinus AftermanДокумент21 страницаFrom Philo To Plotinus AftermanRaphael888Оценок пока нет

- Monergism Vs SynsergismДокумент11 страницMonergism Vs SynsergismPam AgtotoОценок пока нет

- Chapter 1 To 5 For Printing.2Документ86 страницChapter 1 To 5 For Printing.2Senku ishigamiОценок пока нет

- B. Geoinformatics PDFДокумент77 страницB. Geoinformatics PDFmchakra720% (1)

- Project Scheduling and TrackingДокумент47 страницProject Scheduling and TrackingArun VinodhОценок пока нет

- DPSD ProjectДокумент30 страницDPSD ProjectSri NidhiОценок пока нет

- Richardson Heidegger PDFДокумент18 страницRichardson Heidegger PDFweltfremdheitОценок пока нет

- The Homework Song FunnyДокумент5 страницThe Homework Song Funnyers57e8s100% (1)

- Agco Serie 800 PDFДокумент24 страницыAgco Serie 800 PDFJohnny VargasОценок пока нет

- Pavement Design1Документ57 страницPavement Design1Mobin AhmadОценок пока нет

- Generative AI: The Insights You Need from Harvard Business ReviewОт EverandGenerative AI: The Insights You Need from Harvard Business ReviewРейтинг: 4.5 из 5 звезд4.5/5 (2)

- Digital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent MoneyОт EverandDigital Gold: Bitcoin and the Inside Story of the Misfits and Millionaires Trying to Reinvent MoneyРейтинг: 4 из 5 звезд4/5 (51)