Академический Документы

Профессиональный Документы

Культура Документы

Patels Airtemp (India) Ltd. - December 2014

Загружено:

PrinceSadhotraАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Patels Airtemp (India) Ltd. - December 2014

Загружено:

PrinceSadhotraАвторское право:

Доступные форматы

PATELS AIRTEMP (INDIA) LTD.

Household Appliances

March 24, 2015

CMP

Rs. 142.2

BSE Code

BSE ID

High/Low 1Y (Rs)

Average Volume (3M)

Market Cap Full/Free

Float (Rs. Cr)

517417

PATELSAI

185.8 / 42.9

12,967

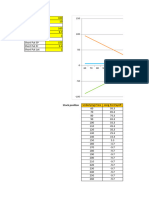

Quarter Review-Dec' FY15

Revenue surged both on Y-o-Y and Q-o-Q basis

Total revenue rose sharply by 139.2% to Rs. 35.8 crore in 3QFY15 against

Rs. 15.0 crore in 3QFY14.On sequential basis the same grew by 58.8%.

Sep-14

46.01

53.99

Stock Chart ( Relative to Sensex)

35.8

22.6

17.3

15.0

3QFY14

350

250

300

200

200

150

100

100

50

Stock Performance (%)

Patels Airtemp

S&P BSE Sensex

Financials

Revenue

EBITDA

Net Profit

EPS (Diluted)

EBITDA Margin

Net Profit Margin

Patels Airtemp

1M

-14.6

-2.9

3QFY15

35.8

4.4

2.0

3.85

12.4%

5.4%

24-Mar-15

6M

19.9

6.4

3QFY14

15.0

2.2

1.0

2.01

14.4%

6.8%

1Yr

218.8

27.7

Y-o-Y

139.2%

105.5%

91.7%

-

58.8%

4.6%

24.2%

2.6%

3QFY14

46.1%

9.7%

29.8%

1.9%

TTM

51.8%

6.6%

28.2%

2.0%

1. Financial Year ends on March 31.

2. Financials are on a Standalone basis.

3. All figures in Rs. crore except for per share data.

4. TR stands for Total Revenue

Initiative of the BSE Investors Protection Fund

4.4

3.1

2.4

2.2

2.4

14%

13%

12.4%

12%

11%

3QFY14

4QFY14

EBITDA

1QFY15 2QFY15 3QFY15

EBITDA Margin (%)

Fall in Net Profit Margin

The fall in EBITDA Margin had a cascading effect on the company's Net

Profit Margin.Net Profit Margin stood at 5.4% in 3QFY15 against 6.8% in

3QFY14.

Rs. in crore

3QFY15

13.6%

2.5

Common size

Analysis

COGS / TR

Emp. Cost / TR

Other Exp. / TR

Interest / TR

13.9%

15%

14.7%

14.4%

S&P BSE Sensex

3QFY15

EBITDA margin fell to 12.4% in 3QFY15 from 14.4% in 3QFY14 due to

significant rise in Cost of Goods Sold.However, fall in employee cost and

other operating expenditure as a percentage of total revenue restricted

the losses.

Rs. in crore

Vol

24-Sep-14

1QFY15

2QFY15

Total Revenue

Decline in EBITDA Margin

24-Mar-14

16.1

4QFY14

300

400

Volume in '000

Price- Rebased

500

40

35

30

25

20

15

10

5

0

EBITDA Margin (%)

Dec-14

46.01

53.99

6.8%

2.0

6.2%

6.4%

5.4%

1.5

1.6

1.0

0.5

1.0

1.1

1.0

3QFY14

4QFY14

1QFY15

8%

6.9%

2.0

6%

4%

2%

0.0

Net Profit Margin (%)

Shareholding %

Promoters

FII

DII

Public & Others

Rs. in crore

41 / 25

0%

Net Profit

2QFY15

3QFY15

Net Profit Margin (%)

-1-

PATELS AIRTEMP (INDIA) LTD.

Household Appliances

Summary Financials*

Particulars (Rs. Crore)

Net Sales

Other Op. Revenue

Total Revenue

Cost of Goods Sold

Gross Profit

Employee Costs

Other Expenditure

EBITDA

Depreciation

EBIT

Finance Cost

Other Income

Exceptional Items

PBT

Income Tax

Profit after Tax

Extra Ordinary Items

Minority Interest

Net Profit

Rep. Basic EPS

Rep. Dilluted EPS

Equity Capital

Face value

3QFY15

33.1

2.8

35.8

(21.1)

14.7

(1.7)

(8.7)

4.4

(0.7)

3.8

(0.9)

0.1

0.0

2.9

(0.9)

2.0

0.0

0.0

2.0

3.85

3.85

5.1

10.0

3QFY14

14.7

0.3

15.0

(6.9)

8.1

(1.5)

(4.5)

2.2

(0.4)

1.7

(0.3)

0.1

0.0

1.5

(0.5)

1.0

(0.0)

0.0

1.0

2.01

2.01

5.1

10.0

2QFY15

21.8

0.7

22.6

(11.1)

11.5

(1.6)

(6.8)

3.1

(0.6)

2.5

(0.3)

0.1

0.0

2.3

(0.7)

1.6

0.0

0.0

1.6

3.07

3.07

5.1

10.0

Y-o-Y %

125.6%

759.0%

139.2%

205.3%

82.7%

14.0%

94.0%

105.5%

61.3%

116.3%

222.2%

-26.8%

89.2%

90.2%

88.8%

91.7%

-

Q-o-Q %

51.4%

279.8%

58.8%

90.1%

28.6%

3.2%

27.5%

44.3%

11.1%

52.5%

236.5%

-48.2%

25.8%

26.7%

25.4%

25.4%

-

TTM

87.6

4.2

91.8

(47.5)

44.3

(6.1)

(25.9)

12.3

(2.4)

9.9

(1.8)

0.5

0.0

8.5

(2.9)

5.6

(0.0)

0.0

5.6

11.05

11.05

5.1

10.0

FY14

68.4

2.4

70.8

(37.6)

33.2

(5.6)

(17.9)

9.7

(1.7)

7.9

(1.2)

0.5

0.0

7.2

(2.6)

4.7

(0.0)

0.0

4.7

9.20

9.20

5.1

10.0

FY13

87.9

2.6

90.6

(54.5)

36.1

(5.1)

(19.6)

11.3

(1.5)

9.8

(2.7)

0.3

0.0

7.4

(2.4)

4.9

0.0

0.0

4.9

9.76

9.76

5.1

10.0

Source: Company Financials, ICRA Online Research TTM-Trailing twelve months * All figures are on Standalone basis

PL: Profit to loss, LP: Loss to profit NA-De-growth due to loss in both the year; $: Percent Change is huge due to base effect.

Contact Details

ICRA ONLINE LIMITED

researchdesk@icraonline.com

Disclaimer

All information contained in this document has been obtained by ICRA Online Limited from sources believed by it to be accurate and reliable. Although reasonable care has been taken to

ensure that the information herein is true, such information is provided as is without any warranty of any kind, and ICRA Online Limited or its affiliates or group companies and its

respective directors, officers, or employees in particular, makes no representation or warranty, express or implied, as to the accuracy, suitability, reliability, timelines or completeness of

any such information. All information contained herein must be construed solely as statements of opinion, and ICRA Online Limited, or its affiliates or group companies and its respective

directors, officers, or employees shall not be liable for any losses or injury, liability or damage of any kind incurred from and arising out of any use of this document or its contents in any

manner, whatsoever. Opinions expressed in this document are not the opinions of our holding company, ICRA Limited (ICRA), and should not be construed as any indication of credit

rating or grading of ICRA for any instruments that have been issued or are to be issued by any entity.

Published on behalf of BSE Investors' Protection Fund

BSE Investors Protection Fund

First Floor, P J Towers, Dalal Street, Mumbai. Tel: 22721233/34 www.bseindia.com

Initiative of the BSE Investors Protection Fund

-2-

Вам также может понравиться

- Midcaps: Value BuysДокумент4 страницыMidcaps: Value Buysapi-234474152Оценок пока нет

- Infosys Ltd-Q2 FY12Документ4 страницыInfosys Ltd-Q2 FY12Seema GusainОценок пока нет

- Yes Bank - EnamДокумент3 страницыYes Bank - Enamdeepak1126Оценок пока нет

- Eq MIRCELECTR Upd1Документ1 страницаEq MIRCELECTR Upd1i2020Оценок пока нет

- Triveni Turbines: Growth On Track Maintain BuyДокумент3 страницыTriveni Turbines: Growth On Track Maintain Buyajd.nanthakumarОценок пока нет

- Market Outlook 7th September 2011Документ3 страницыMarket Outlook 7th September 2011Angel BrokingОценок пока нет

- Sales Note Sangam India 021215Документ2 страницыSales Note Sangam India 021215Rajasekhar Reddy AnekalluОценок пока нет

- Persistent Company UpdateДокумент4 страницыPersistent Company UpdateAngel BrokingОценок пока нет

- Stock Research Report For AMAT As of 3/26/2012 - Chaikin Power ToolsДокумент4 страницыStock Research Report For AMAT As of 3/26/2012 - Chaikin Power ToolsChaikin Analytics, LLCОценок пока нет

- Market Outlook 19th August 2011Документ3 страницыMarket Outlook 19th August 2011Angel BrokingОценок пока нет

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechДокумент4 страницыJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingОценок пока нет

- Market Watch Daily 25.02.2014Документ1 страницаMarket Watch Daily 25.02.2014Randora LkОценок пока нет

- Market Outlook 23rd August 2011Документ3 страницыMarket Outlook 23rd August 2011angelbrokingОценок пока нет

- Derivatives Report 29th March 2012Документ3 страницыDerivatives Report 29th March 2012Angel BrokingОценок пока нет

- Snapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)Документ2 страницыSnapshot For Straits Times Index STI (FSSTI) Straits Times Index (STI)api-237906069Оценок пока нет

- Investor Update (Company Update)Документ27 страницInvestor Update (Company Update)Shyam SunderОценок пока нет

- MT Educare Ltd Stock Analysis Indicates 39% UpsideДокумент10 страницMT Educare Ltd Stock Analysis Indicates 39% UpsideRajiv BharatiОценок пока нет

- Deleum expands into renewable energyДокумент4 страницыDeleum expands into renewable energyBan-Hong TehОценок пока нет

- Derivative Report: Nifty Vs OIДокумент3 страницыDerivative Report: Nifty Vs OIAngel BrokingОценок пока нет

- Dishman Pharma Q4FY11 Review: Revenues and Margins OutperformДокумент3 страницыDishman Pharma Q4FY11 Review: Revenues and Margins OutperformshahviralbОценок пока нет

- KPIT 2QFY16 Outlook ReviewДокумент5 страницKPIT 2QFY16 Outlook ReviewgirishrajsОценок пока нет

- Piramal Healthcare: Landmark DealДокумент3 страницыPiramal Healthcare: Landmark DealjigarchhatrolaОценок пока нет

- Hexaware CompanyUpdateДокумент3 страницыHexaware CompanyUpdateAngel BrokingОценок пока нет

- Stock Research Report For Cooper Inds PLC CBE As of 9/22/11 - Chaikin Power ToolsДокумент4 страницыStock Research Report For Cooper Inds PLC CBE As of 9/22/11 - Chaikin Power ToolsChaikin Analytics, LLCОценок пока нет

- Daily Technical Report: Sensex (15948) / NIFTY (4836)Документ4 страницыDaily Technical Report: Sensex (15948) / NIFTY (4836)Angel BrokingОценок пока нет

- Dhanuka Agritech - Detailed Report - CRISIL - July 2013Документ27 страницDhanuka Agritech - Detailed Report - CRISIL - July 2013aparmarinОценок пока нет

- HCL Technologies Ltd. - Q4FY11 Result UpdateДокумент3 страницыHCL Technologies Ltd. - Q4FY11 Result UpdateSeema GusainОценок пока нет

- CESC Earnings In LineДокумент3 страницыCESC Earnings In LinesanjeevpandaОценок пока нет

- GDP Growth FY2013 3QДокумент4 страницыGDP Growth FY2013 3QAngel BrokingОценок пока нет

- Kingfisher Airlines LTD.: Result UpdateДокумент4 страницыKingfisher Airlines LTD.: Result UpdateSagar KavdeОценок пока нет

- CRISIL Research Ier Report Sterlite Technologies 2012Документ28 страницCRISIL Research Ier Report Sterlite Technologies 2012J Shyam SwaroopОценок пока нет

- Honda Atlas Cars (Pakistan) Limited: 1QFY15 Result Update - Exceptional Growth To Start The YearДокумент2 страницыHonda Atlas Cars (Pakistan) Limited: 1QFY15 Result Update - Exceptional Growth To Start The YearArslan IshaqОценок пока нет

- Derivative Report: Nifty Vs OIДокумент3 страницыDerivative Report: Nifty Vs OIAngel BrokingОценок пока нет

- Market Outlook: India Research Dealer's DiaryДокумент4 страницыMarket Outlook: India Research Dealer's DiaryAngel BrokingОценок пока нет

- Daily Technical Report: Sensex (17885) / NIFTY (5421)Документ4 страницыDaily Technical Report: Sensex (17885) / NIFTY (5421)Angel BrokingОценок пока нет

- Market Outlook 26th September 2011Документ3 страницыMarket Outlook 26th September 2011Angel BrokingОценок пока нет

- KRBL ReportДокумент28 страницKRBL ReportHardeep Singh SohiОценок пока нет

- Market Outlook 18th August 2011Документ3 страницыMarket Outlook 18th August 2011Angel BrokingОценок пока нет

- Technical Format With Stock 14.09Документ4 страницыTechnical Format With Stock 14.09Angel BrokingОценок пока нет

- Technical Format With Stock 25.09Документ4 страницыTechnical Format With Stock 25.09Angel BrokingОценок пока нет

- CRISIL Research Ier Report Apollo Hosp Ent 2014 Q3FY14fcДокумент10 страницCRISIL Research Ier Report Apollo Hosp Ent 2014 Q3FY14fcRakesh SrivastavaОценок пока нет

- MphasisДокумент4 страницыMphasisAngel BrokingОценок пока нет

- Market Outlook 5th August 2011Документ4 страницыMarket Outlook 5th August 2011Angel BrokingОценок пока нет

- RBI Monetary Policy ReviewДокумент4 страницыRBI Monetary Policy ReviewAngel BrokingОценок пока нет

- Daily Technical Report: Sensex (17633) / NIFTY (5348)Документ4 страницыDaily Technical Report: Sensex (17633) / NIFTY (5348)Angel BrokingОценок пока нет

- Derivative Report: Nifty Vs OIДокумент3 страницыDerivative Report: Nifty Vs OIAngel BrokingОценок пока нет

- JET Airways Update Report Dec 31 2010Документ4 страницыJET Airways Update Report Dec 31 2010Vikash KumarОценок пока нет

- Towr 3Q12Документ3 страницыTowr 3Q12dailyinvesting_coОценок пока нет

- Reliance Industries (NSE Cash) : Daily ChartДокумент2 страницыReliance Industries (NSE Cash) : Daily ChartTirthajit SinhaОценок пока нет

- User Guide: Intrinsic Value CalculatorДокумент7 страницUser Guide: Intrinsic Value CalculatorfuzzychanОценок пока нет

- Daily Technical Report: Sensex (17602) / NIFTY (5337)Документ4 страницыDaily Technical Report: Sensex (17602) / NIFTY (5337)Angel BrokingОценок пока нет

- Market Outlook 25th August 2011Документ3 страницыMarket Outlook 25th August 2011Angel BrokingОценок пока нет

- Derivative Report: Nifty Vs OIДокумент3 страницыDerivative Report: Nifty Vs OIAngel BrokingОценок пока нет

- Stock Research Report For Yamana Gold Inc LEG As of 11/17/11 - Chaikin Power ToolsДокумент4 страницыStock Research Report For Yamana Gold Inc LEG As of 11/17/11 - Chaikin Power ToolsChaikin Analytics, LLCОценок пока нет

- Stock Research Report For T As of 9/8/11 - Chaikin Power ToolsДокумент4 страницыStock Research Report For T As of 9/8/11 - Chaikin Power ToolsChaikin Analytics, LLCОценок пока нет

- Daily Technical Report: Sensex (17399) / NIFTY (5279)Документ4 страницыDaily Technical Report: Sensex (17399) / NIFTY (5279)Angel BrokingОценок пока нет

- Technical Format With Stock 25.10Документ4 страницыTechnical Format With Stock 25.10Angel BrokingОценок пока нет

- Technical Format With Stock 13.09Документ4 страницыTechnical Format With Stock 13.09Angel BrokingОценок пока нет

- Market Outlook 07.07Документ3 страницыMarket Outlook 07.07Nikhil SatamОценок пока нет

- Ui sc259 Rev1 pdf2374Документ23 страницыUi sc259 Rev1 pdf2374yugandharОценок пока нет

- Alarm LogДокумент1 страницаAlarm LogPrinceSadhotraОценок пока нет

- Incident Report - Aux BlowerДокумент3 страницыIncident Report - Aux BlowerPrinceSadhotraОценок пока нет

- Principles of Leadership HandoutДокумент2 страницыPrinciples of Leadership HandoutPrinceSadhotraОценок пока нет

- Case 1Документ1 страницаCase 1PrinceSadhotraОценок пока нет

- Technical InformationДокумент21 страницаTechnical InformationPrinceSadhotraОценок пока нет

- Measuring The Speed Through Water by Wavex: by Dr. Scient. Rune GangeskarДокумент10 страницMeasuring The Speed Through Water by Wavex: by Dr. Scient. Rune GangeskarPrinceSadhotraОценок пока нет

- KR Webinar For EEXI & CII - 210517Документ112 страницKR Webinar For EEXI & CII - 210517PrinceSadhotraОценок пока нет

- SunRui Enquiry FormДокумент1 страницаSunRui Enquiry FormPrinceSadhotraОценок пока нет

- Service Letter SL2020-705/JAP: Load-Up ProgramДокумент2 страницыService Letter SL2020-705/JAP: Load-Up ProgramPrinceSadhotraОценок пока нет

- Laying Up Vessels: Service Letter SL09-510/SBJДокумент43 страницыLaying Up Vessels: Service Letter SL09-510/SBJPrinceSadhotraОценок пока нет

- MAN Diesel Service Letter on Condition Based OverhaulДокумент6 страницMAN Diesel Service Letter on Condition Based OverhaulDenim102Оценок пока нет

- Shaft EarthingДокумент18 страницShaft Earthingavm4343Оценок пока нет

- Service Letter SL2020-698/KAMO: CPR Piston Ring PackДокумент4 страницыService Letter SL2020-698/KAMO: CPR Piston Ring PackPrinceSadhotraОценок пока нет

- Technical Information L Information: ABB Tekomar XPERTДокумент18 страницTechnical Information L Information: ABB Tekomar XPERTPrinceSadhotraОценок пока нет

- Checking Bolts in Camshaft Coupling MAN SL02-405Документ6 страницChecking Bolts in Camshaft Coupling MAN SL02-405harikrishnanpd3327Оценок пока нет

- MAN Diesel: Service LetterДокумент3 страницыMAN Diesel: Service LetterPrinceSadhotraОценок пока нет

- Bond Marine Consultancy Pte LTDДокумент1 страницаBond Marine Consultancy Pte LTDPrinceSadhotraОценок пока нет

- Summary of MAN Service Letter 16/24: Technical Information L InformationДокумент10 страницSummary of MAN Service Letter 16/24: Technical Information L InformationPrinceSadhotraОценок пока нет

- OFAC - FATF UndertakingДокумент1 страницаOFAC - FATF UndertakingPrinceSadhotraОценок пока нет

- Vessel operation and cargo statusДокумент2 страницыVessel operation and cargo statusPrinceSadhotraОценок пока нет

- Mohan Rao Mylapilli 05th July VTZ COKДокумент2 страницыMohan Rao Mylapilli 05th July VTZ COKPrinceSadhotraОценок пока нет

- AT6000 Alcohol TesterДокумент6 страницAT6000 Alcohol TesterPrinceSadhotraОценок пока нет

- Annexure I MT DECLARATIONДокумент2 страницыAnnexure I MT DECLARATIONPrinceSadhotraОценок пока нет

- Garbage Collection Services For Ships in SingaporeДокумент7 страницGarbage Collection Services For Ships in SingaporePrinceSadhotraОценок пока нет

- Welcome To MEGA PDFДокумент9 страницWelcome To MEGA PDFRüdiger TischbanОценок пока нет

- Introduction of Parts & Service Business DivisionДокумент23 страницыIntroduction of Parts & Service Business DivisionPrinceSadhotraОценок пока нет

- Circular For Stopping Crew ChangeДокумент1 страницаCircular For Stopping Crew ChangePrinceSadhotraОценок пока нет

- Joint Open Letter To UN Agencies From Global Maritime Transport Industry and SeafarersДокумент2 страницыJoint Open Letter To UN Agencies From Global Maritime Transport Industry and SeafarersPrinceSadhotraОценок пока нет

- DGS Order 05of2020 PDFДокумент2 страницыDGS Order 05of2020 PDFPrinceSadhotraОценок пока нет

- IJREAMV05I0452086745Документ4 страницыIJREAMV05I0452086745yash wankhadeОценок пока нет

- Analysis of Bfsi Industry in India: Prepared by Devansh VermaДокумент4 страницыAnalysis of Bfsi Industry in India: Prepared by Devansh VermaDevansh VermaОценок пока нет

- Efficient Capital MarketsДокумент25 страницEfficient Capital MarketsAshik Ahmed NahidОценок пока нет

- Open Interest Is Challenging To Dissect-Scrbd-5Документ1 страницаOpen Interest Is Challenging To Dissect-Scrbd-5Joel FrankОценок пока нет

- AC3202 WK2 Exercises SolutionsДокумент11 страницAC3202 WK2 Exercises SolutionsLong LongОценок пока нет

- MBSA 1323 - Strategic Innovative Marketing Case Study 1Документ3 страницыMBSA 1323 - Strategic Innovative Marketing Case Study 1黄伟伦Оценок пока нет

- Milk Powder ProductionДокумент28 страницMilk Powder Productionabel_kayel100% (2)

- Bear Spread Payoff Strategy CalculationДокумент3 страницыBear Spread Payoff Strategy CalculationMukund KumarОценок пока нет

- The Financial Enviroment Markets, Institutions and Investment BankingДокумент26 страницThe Financial Enviroment Markets, Institutions and Investment BankingFlorence Len CiaОценок пока нет

- Bloomberg Markets Magazine 2014-05.bakДокумент130 страницBloomberg Markets Magazine 2014-05.bakFeynman2014Оценок пока нет

- Post Qualification FormДокумент25 страницPost Qualification FormLalit Trivedi100% (1)

- Illiquidity and Stock Returns - Cross-Section and Time-Series Effects - Yakov AmihudДокумент50 страницIlliquidity and Stock Returns - Cross-Section and Time-Series Effects - Yakov AmihudKim PhượngОценок пока нет

- Nvs Brokerage Pvt. LTD.: 702, Embassy Centre, Nariman Point, Mumbai - 400 021. Tel.: 61539100 Fax: 61539134 E MailДокумент3 страницыNvs Brokerage Pvt. LTD.: 702, Embassy Centre, Nariman Point, Mumbai - 400 021. Tel.: 61539100 Fax: 61539134 E MailMLastTryОценок пока нет

- Tax Reform For Acceleration and Inclusion ActДокумент6 страницTax Reform For Acceleration and Inclusion ActRoiven Dela Rosa TrinidadОценок пока нет

- MS-04 Accounting and Finance for Managers Assignment 1-5Документ3 страницыMS-04 Accounting and Finance for Managers Assignment 1-5Sanjay SanariyaОценок пока нет

- GayanДокумент23 страницыGayanijayathungaОценок пока нет

- Real Feel Test 1Документ50 страницReal Feel Test 1Pragati Yadav100% (2)

- Ioqm DPP-4Документ1 страницаIoqm DPP-4tanishk goyalОценок пока нет

- PrathyushaДокумент17 страницPrathyushaPolamada PrathyushaОценок пока нет

- Mutual Funds: Learning OutcomesДокумент39 страницMutual Funds: Learning OutcomesBAZINGAОценок пока нет

- An Analysis of Demat Account and Online TradingДокумент90 страницAn Analysis of Demat Account and Online TradingNITIKESH GORIWALEОценок пока нет

- 20 Pip Challange - 20pipДокумент6 страниц20 Pip Challange - 20pipBlederson SantosОценок пока нет

- Greeks analysis of options portfolioДокумент11 страницGreeks analysis of options portfolioHarleen KaurОценок пока нет

- Anglo Annual Report 2009Документ180 страницAnglo Annual Report 2009grumpyfeckerОценок пока нет

- Cost of CapitalДокумент8 страницCost of CapitalSiva KotiОценок пока нет

- Wiley CPAexcel - BEC - Assessment Review - 2Документ20 страницWiley CPAexcel - BEC - Assessment Review - 2ABCОценок пока нет

- Betting On The Blind Side - Vanity FairДокумент3 страницыBetting On The Blind Side - Vanity FairSww WisdomОценок пока нет

- Price B1 S2 2024 - DFДокумент30 страницPrice B1 S2 2024 - DFYara AzizОценок пока нет

- 3R Petroleum: Cutting Through The ClutterДокумент6 страниц3R Petroleum: Cutting Through The ClutterDaniel GaravagliaОценок пока нет

- Financial Stability ActivityДокумент3 страницыFinancial Stability Activity[AP-Student] Lhena Jessica GeleraОценок пока нет