Академический Документы

Профессиональный Документы

Культура Документы

1-6 ComprehIncomeExample AdvFinAcc MI2013

Загружено:

XiaoouАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

1-6 ComprehIncomeExample AdvFinAcc MI2013

Загружено:

XiaoouАвторское право:

Доступные форматы

1.

THE FINANCIAL INFORMATION

SYSTEM AND ITS BASIC PRINCIPLES:

AN APPLIED OVERVIEW

1.6. Comprehensive Income & Equity:

an example

(Ancient Mariner Bank - business case)

Prof. Alberto Marchesi Advanced Financial Accounting

School of Banking, Finance and Insurance

Graduate program in Banking and Finance/Trading and risk management

Universit Cattolica del Sacro Cuore - Milano - Italy - Year 2013-2014

Page 1 of 6

1.6 - Comprehensive Income and Equity: an application - Advanced Financial Accounting

Table 1 - POSITION AT T0

Information:

All values are in Currency Units (CU).

The bank is financed only with Share Capital and retained earnings.

Loans & Receivables assets don't change during time.

No tax nor commission on purchases and sales of securities.

No tax on Net Profit nor on Changes in Fair Value.

All operations are regulated in cash or cash equivalents.

Net Profits are charged to reserve from profits.

The Bank has recently bought nr. 10 Overland Bonds at 100 CU each and has classified them

in the Available For Sale securities.

AFS securities valuation at T0

Overland Bonds nr.

10

Purchase price per unit (CU)

100

AFS Fair Value at T0

1.000

Note: since there are no additonal direct purchase costs, Fair Value at inception equals to purchase cost.

Ancient Mariner Bank - Statement ot Financial Position at T0 (CU)

Loans & Receivables

Available For Sale securities

TOTAL ASSETS

10.000 Share Capital

1.000

11.000 TOTAL LIABILITIES & EQUITY

Page 2 of 6

11.000

11.000

1.6 - Comprehensive Income and Equity: an application - Advanced Financial Accounting

Table 2 - PERIOD T0-T1

Information:

Due to changes in market value, at T1 Fair Value of Overland Bond is 97 CU each.

During the period no sales of bonds occur.

AFS securities valuation at T1

Overland Bonds nr.

10

Fair Value per unit at T1 (CU)

97

AFS Fair Value at T1

970

AFS Fair Value at T0

1.000

Decrease in Fair Value T0-T1

(30)

Note: decrease in Fair Value is due to the decrease in market value of bonds.

Valuation reserve

Valuation reserve at T0

0

Changes in period T0-T1

(30)

Valuation reserve at T1

(30)

Note: valuation reserve originates from negative OCI and is therefore negative.

Ancient Mariner Bank - Statement of Income period T0-T1 (CU)

Interest income & other revenues

Gains (Losses) on disposal of AFS securities

Other operating and financial expenses

NET PROFIT

1.000

0

(990)

10

Ancient Mariner Bank - Statement of Comprehensive Income period T0-T1 (CU)

Net Profit

10

Fair Value changes in AFS securities

(30)

Recycling to profit or loss

0

Other Comprehensive Income

(30)

COMPREHENSIVE INCOME

(20)

Note: while Net Profit is positive, Comprehensive Income is negative (algebraic sum of Net Profit and negative OCI).

Ancient Mariner Bank - Statement ot Financial Position at T1 (CU)

Loans & Receivables

Available For Sale securities

Cash & equivalents

10.000 Share Capital

970 Reserve from profits

10 Valuation reserve

Net Profit

10.980 TOTAL LIABILITIES & EQUITY

TOTAL ASSETS

Notes:

Comprehensive Income is charged: to Valuation reserve as for OCI; to Net Profit as for Net Profit;

Cash & equivalents are produced by Net Income, since in this period there are no non-cash operations

in the Statement of Income.

Page 3 of 6

11.000

0

(30)

10

10.980

1.6 - Comprehensive Income and Equity: an application - Advanced Financial Accounting

Table 3 - PERIOD T1-T2

Information

Due to changes in market value, at T2 Fair Value of Overland Bond is 110 CU each.

During the period no sales of bonds occur.

AFS securities valuation at T2

Overland Bonds nr.

10

Fair Value per unit at T2 (CU)

110

AFS Fair Value at T2

1.100

AFS Fair Value at T1

970

Increase in Fair Value T1-T2

130

Note: increase in Fair Value is due to the increase in market value of bonds.

Valuation reserve

Valuation reserve at T1

(30)

Changes in period T1-T2

130

Valuation reserve at T2

100

Note: positive valuation reserve originates from negative Valuation reserve of former period and from positive

period OCI for the period.

Ancient Mariner Bank - Statement of Income period T1-T2 (CU)

Interest income & other revenues

Gains (Losses) on disposal of AFS securities

Other operating and financial expenses

NET PROFIT

1.001

0

(990)

11

Ancient Mariner Bank - Statement of Comprehensive Income period T1-T2 (CU)

Net Profit

Fair Value changes in AFS securities

Recycling to profit or loss

Other Comprehensive Income

COMPREHENSIVE INCOME

Note: positive Comprehensive Income value is mainly due to positive relevant OCI.

11

130

0

130

141

Ancient Mariner Bank - Statement ot Financial Position at T2 (CU)

Loans & Receivables

Available For Sale securities

Cash & equivalents

10.000 Share Capital

1.100 Reserve from profits

21 Valuation reserve

Net Profit

11.121 TOTAL LIABILITIES & EQUITY

TOTAL ASSETS

Notes:

former period Net Profit has been charged to Reserve from profits;

Cash & equivalents increase because of Net Income, since in this period there are no non-cash operations

in the Statement of Income.

Page 4 of 6

11.000

10

100

11

11.121

1.6 - Comprehensive Income and Equity: an application - Advanced Financial Accounting

Table 4 - PERIOD T2-T3

Information:

Due to changes in market value, at T3 Fair Value of Overland Bond is 111 CU each.

During the period the bank has sold nr. 4 bonds at 115 CU each.

Gains (Losses) on disposal of AFS

Nr. of bonds sold

4

Fair Value at inception per unit (CU)

100

Total original Fair Value

400

Nr. of bonds sold

4

Sale price per unit (CU)

115

Total value of sale

460

Gain on disposal

60

Note: gain is calculated comparing Fair Value at inception and cash generated by sale.

AFS securities valuation at T3

Overland Bonds nr.

6

Fair Value per unit at T3 (CU)

111

AFS Fair Value at T3

666

Overland Bonds nr.

6

Fair Value per unit at T2 (CU)

110

Fair Value at T2 (CU)

660

Increase in Fair Value T2-T3

6

Note: at the end of the period valuation is, of course, only for bonds remaining after the sale.

Valuation reserve

Valuation reserve at T2

Changes in period T2-T3

Valuation reserve at T3

100

(34)

66

Cash & equivalents

Cash & equivalents at T2

21

Cash inflow from sale of bonds

460

Cash inflow from other operations

12

Cash & equivalents at T3

493

Note: Cash & equivalents increase because of cash inflows from: sale of bonds; result from all other

operations in the Statement of Income.

Reclassification adjustements (Recycling) to profit or loss

Valuation reserve at T2 (CU)

100

Nr. of bonds relating to Valuation reserve at T2

10

Valuation reserve per unit at T2 (CU)

10

Nr. of bonds sold during period T2-T3

4

Amount of Valuation reserve to recycle period T2-T3 to profit or loss

40

Notes:

Valuation reserve per unit at T2 = Valuation reserve / Nr. of bonds relating;

Amount of Valuation reserve to recycle during period T2-T3 =

= Valuation reserve per unit at T2 * Nr. of bonds sold during T2-T3

Page 5 of 6

1.6 - Comprehensive Income and Equity: an application - Advanced Financial Accounting

Table 4 - PERIOD T2-T3

(contd.)

Ancient Mariner Bank - Statement of Income period T2-T3 (CU)

Interest income & other revenues

Gains (Losses) on disposal of AFS securities

Other operating and financial expenses

NET PROFIT

Note: Net Profit is increased by negotiated Gain on sale of bonds.

1.002

60

(990)

72

Ancient Mariner Bank - Statement of Comprehensive Income period T2-T3 (CU)

Net Profit

Fair Value changes in AFS securities

6

Recycling to profit or loss

(40)

Other Comprehensive Income

COMPREHENSIVE INCOME

Notes:

Positive Comprehensive Income comes from the sum of positive Net Profit and negative OCI;

Since a part of the bonds have been sold, negative OCI comes from the sum of: increase in Fair Value

of remaining bonds; negative reclassification adjustment related to bonds sold.

72

(34)

38

Ancient Mariner Bank - Statement ot Financial Position at T3 (CU)

Loans & Receivables

Available For Sale securities

Cash & equivalents

10.000 Share Capital

666 Reserve from profits

493 Valuation reserve

Net Profit

TOTAL ASSETS

11.159 TOTAL LIABILITIES & EQUITY

Note: former period Net Profit has been charged to Reserve from profits.

Page 6 of 6

11.000

21

66

72

11.159

Вам также может понравиться

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideОт EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideОценок пока нет

- Acct Cheat SheetДокумент3 страницыAcct Cheat SheetAllen LiouОценок пока нет

- Quantitative Methods FinanceДокумент2 страницыQuantitative Methods FinanceXiaoouОценок пока нет

- Thesis (Cooperative)Документ10 страницThesis (Cooperative)Ralph Jay Cortez Calunod100% (4)

- Lesson 5-Bollinger MR StrategyДокумент27 страницLesson 5-Bollinger MR StrategyHasan Zaman86% (7)

- Sheba XyzДокумент22 страницыSheba XyzAjnanОценок пока нет

- Questions On International FinanceДокумент31 страницаQuestions On International FinanceSaada100% (1)

- Project On Real Estate InvestmentДокумент61 страницаProject On Real Estate InvestmentAjay79% (29)

- Investments - Risk & ReturnДокумент85 страницInvestments - Risk & ReturnBushra JavedОценок пока нет

- Global Distribution SystemДокумент3 страницыGlobal Distribution SystemAnonymous gUySMcpSqОценок пока нет

- ACI DealingДокумент210 страницACI DealingDarshana Shasthri Nakandala0% (1)

- FINA5520 WK3 IntRatesAndIntRateFuturesДокумент46 страницFINA5520 WK3 IntRatesAndIntRateFuturesthelittlebirdyОценок пока нет

- COST PRICE: The Price That AДокумент47 страницCOST PRICE: The Price That AAlma Agnas100% (3)

- Foreign Currency Transaction Notes (Ias 21) (2021)Документ43 страницыForeign Currency Transaction Notes (Ias 21) (2021)Elago IilongaОценок пока нет

- FOREXДокумент129 страницFOREXVANDANA GOYALОценок пока нет

- Status of Neem in SenegalДокумент10 страницStatus of Neem in SenegalVignesh MurthyОценок пока нет

- Introduction To International Financial ManagementДокумент37 страницIntroduction To International Financial ManagementhappyОценок пока нет

- CH9-Capacity Planning and Location DecisionДокумент35 страницCH9-Capacity Planning and Location DecisionChristian John Linalcoso Arante100% (1)

- P2Документ11 страницP2AbdulHameedAdamОценок пока нет

- Mohammad Ali Jinnah University: AssignmentДокумент10 страницMohammad Ali Jinnah University: AssignmenttuuuhaОценок пока нет

- Introduction To Bank AccountingДокумент22 страницыIntroduction To Bank AccountingHenry So E DiarkoОценок пока нет

- Du Pont Titanium Dioxide - AssumptionsДокумент30 страницDu Pont Titanium Dioxide - Assumptionskaustubh_dec17Оценок пока нет

- Fsa Practical Record ProblemsДокумент12 страницFsa Practical Record ProblemsPriyanka GuptaОценок пока нет

- NewZealand DC 2011 PDFДокумент193 страницыNewZealand DC 2011 PDFdktssaОценок пока нет

- P1 - Financial Accounting April 07Документ23 страницыP1 - Financial Accounting April 07IrfanОценок пока нет

- Chapter 2Документ16 страницChapter 2Eldar AlizadeОценок пока нет

- Corporate Finance AAE 2013Документ22 страницыCorporate Finance AAE 2013Oniga AdrianОценок пока нет

- Paper 11Документ51 страницаPaper 11eshwarsapОценок пока нет

- CA FINAL SFM Solution Nov2011Документ15 страницCA FINAL SFM Solution Nov2011Pravinn_MahajanОценок пока нет

- Fin 621 Final Term Papers 99 25 Sure Solved 2Документ78 страницFin 621 Final Term Papers 99 25 Sure Solved 2Javaid IqbalОценок пока нет

- Financial Accounting 1 Unit 10Документ21 страницаFinancial Accounting 1 Unit 10chuchuОценок пока нет

- Exit Price Accounting & Capital MaintenanceДокумент32 страницыExit Price Accounting & Capital MaintenanceJason InufiОценок пока нет

- p2hkg 2011 Jun AДокумент12 страницp2hkg 2011 Jun AMusaku MukumbwaОценок пока нет

- 1 Lecture Corporation p.2Документ31 страница1 Lecture Corporation p.2by ScribdОценок пока нет

- Inv#4 AssignmentДокумент3 страницыInv#4 AssignmentDaniyal AliОценок пока нет

- International Monetary Fund: Quarter Ended July 31, 2011Документ51 страницаInternational Monetary Fund: Quarter Ended July 31, 2011Mark KGОценок пока нет

- Diploma in International Financial Reporting: Thursday 9 December 2010Документ11 страницDiploma in International Financial Reporting: Thursday 9 December 2010Zain Rehman100% (1)

- Deferred TaxesДокумент30 страницDeferred TaxesVikasОценок пока нет

- CH 15 HW SolutionsДокумент5 страницCH 15 HW SolutionsAndi YusufОценок пока нет

- Valuation of SecuritiesДокумент16 страницValuation of SecuritiesPratik KitlekarОценок пока нет

- Nvestments AND Nternational PerationsДокумент34 страницыNvestments AND Nternational PerationsBoo LeОценок пока нет

- Chapter 11 Short Exercise SolutionsДокумент14 страницChapter 11 Short Exercise Solutionsbaseballjunker4Оценок пока нет

- 2023 EBAD401 - Chapter 2 PPT LecturerДокумент38 страниц2023 EBAD401 - Chapter 2 PPT Lecturermaresa bruinersОценок пока нет

- UNSW Business School School of Accounting ACCT1501 Accounting and Financial Management 1A Term 1 2020Документ4 страницыUNSW Business School School of Accounting ACCT1501 Accounting and Financial Management 1A Term 1 2020hvk;h ;Оценок пока нет

- Multicurrency TutorialДокумент29 страницMulticurrency TutorialPacoEscribanoОценок пока нет

- Eitzen Market Report 3q2011Документ32 страницыEitzen Market Report 3q2011Fernandez DelettreОценок пока нет

- SCHOOL YEAR - Semester: ObjectivesДокумент7 страницSCHOOL YEAR - Semester: ObjectivesYnna GesiteОценок пока нет

- Chapter 1 Financial Accounting Key Terms and ConceptsДокумент31 страницаChapter 1 Financial Accounting Key Terms and ConceptsIrfan ShaikhОценок пока нет

- Value + + + FCF FCF FCF (1 + WACC) (1 + WACC) (1 + WACC) ..Документ33 страницыValue + + + FCF FCF FCF (1 + WACC) (1 + WACC) (1 + WACC) ..Manabendra DasОценок пока нет

- Accounting A2 Jan 2005Документ11 страницAccounting A2 Jan 2005Orbind B. ShaikatОценок пока нет

- Acc For Public Sector CH 3Документ36 страницAcc For Public Sector CH 3Tegene TesfayeОценок пока нет

- AfB1 Tutorial Questions For Week 5Документ4 страницыAfB1 Tutorial Questions For Week 5zhaok0610Оценок пока нет

- Extra Questions Solutions JK ShahДокумент16 страницExtra Questions Solutions JK ShahrrkabraОценок пока нет

- 6 Debt FinancingДокумент27 страниц6 Debt Financingfryuo pilanОценок пока нет

- ACI Dealinng Certicate Workshop TreasuryCRR Mentanance SLR Requirement Funds Management Forex Bonds Valuations Finance Elective Banks TreasuryДокумент210 страницACI Dealinng Certicate Workshop TreasuryCRR Mentanance SLR Requirement Funds Management Forex Bonds Valuations Finance Elective Banks TreasuryAjay DaraОценок пока нет

- MGMT 026 Chapter 04 HW Part 2Документ11 страницMGMT 026 Chapter 04 HW Part 2Bánh Bao100% (3)

- Caiib Fmmoda Nov08Документ100 страницCaiib Fmmoda Nov08nellaimathivel4489Оценок пока нет

- FOREXДокумент50 страницFOREXShubham AgarwalОценок пока нет

- Eaton Vance Tax-Mgd Div Eq Inc Fund (ETY)Документ32 страницыEaton Vance Tax-Mgd Div Eq Inc Fund (ETY)ArvinLedesmaChiongОценок пока нет

- Tutorial Computer UnitTrust Exam-EnGLIS 010808Документ132 страницыTutorial Computer UnitTrust Exam-EnGLIS 010808Mohd Hatif KamailОценок пока нет

- FCFF and FcfeДокумент23 страницыFCFF and FcfeSaurav VidyarthiОценок пока нет

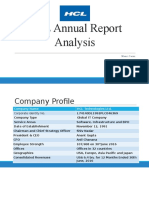

- HCL Annual Report Analysis Final 2015Документ16 страницHCL Annual Report Analysis Final 2015mehakОценок пока нет

- AC12 ch12Документ17 страницAC12 ch12Danny GoldstoneОценок пока нет

- Final Exam f02Документ13 страницFinal Exam f02Omar Ahmed ElkhalilОценок пока нет

- Retained EarningsДокумент76 страницRetained EarningsKristine DoydoraОценок пока нет

- Lecture Notes - : Company Financial Statements Under IFRS (-The Specific Presentation Skills)Документ20 страницLecture Notes - : Company Financial Statements Under IFRS (-The Specific Presentation Skills)Thương ĐỗОценок пока нет

- Chapter 18 SolutionДокумент5 страницChapter 18 SolutionSilver BulletОценок пока нет

- Trading Economics: A Guide to Economic Statistics for Practitioners and StudentsОт EverandTrading Economics: A Guide to Economic Statistics for Practitioners and StudentsОценок пока нет

- QMF Lectures 2013-14Документ196 страницQMF Lectures 2013-14XiaoouОценок пока нет

- Exam 3Документ11 страницExam 3XiaoouОценок пока нет

- 1-b IFRS-FoundДокумент3 страницы1-b IFRS-FoundXiaoouОценок пока нет

- Cost Quizlet 2Документ7 страницCost Quizlet 2agm25Оценок пока нет

- Group ProjectДокумент5 страницGroup ProjectMelisa May Ocampo AmpiloquioОценок пока нет

- Porter's Fiver Forces ModelДокумент3 страницыPorter's Fiver Forces ModelMRUDULA HANNA REJIОценок пока нет

- Lecture 5: Monopoly and Price DiscriminationДокумент72 страницыLecture 5: Monopoly and Price DiscriminationStefan SiridzanskiОценок пока нет

- DERIVATIVEДокумент7 страницDERIVATIVEKiên Phạm CôngОценок пока нет

- Assignment 01-Fin421Документ11 страницAssignment 01-Fin421i CrYОценок пока нет

- ECE333 Renewable Energy Systems 2015 Lect7Документ43 страницыECE333 Renewable Energy Systems 2015 Lect7rdelgranadoОценок пока нет

- 10 - Financing of Railway Projects - IRAДокумент34 страницы10 - Financing of Railway Projects - IRAsakethmekalaОценок пока нет

- MAZEN ABU-HUDEIB Task2-Draft-Business Report On Case Study 1302567 710994038-2Документ15 страницMAZEN ABU-HUDEIB Task2-Draft-Business Report On Case Study 1302567 710994038-2Isaac MwangiОценок пока нет

- Industrial Control Transformers (Machine Tool) - 9070T500D1Документ4 страницыIndustrial Control Transformers (Machine Tool) - 9070T500D1Luis Eduardo Vargas NeriОценок пока нет

- Precedent Transaction Anaysis RevisedДокумент28 страницPrecedent Transaction Anaysis RevisedParvesh AghiОценок пока нет

- Business Model LadaДокумент24 страницыBusiness Model LadaAbah IcanОценок пока нет

- Pioneers and FollowersДокумент36 страницPioneers and FollowersMarc HoogendoornОценок пока нет

- CIVL4230 Lecture FourДокумент10 страницCIVL4230 Lecture FourDennisОценок пока нет

- English in Maritime Business and Law - Vidishcheva T.V. - 2008 PDFДокумент200 страницEnglish in Maritime Business and Law - Vidishcheva T.V. - 2008 PDFkiransharma0124Оценок пока нет

- Uniform System of AccountingДокумент1 страницаUniform System of Accountinganon_368154272Оценок пока нет

- Final Exam QANT630 Fall 2019 (Part-2)Документ14 страницFinal Exam QANT630 Fall 2019 (Part-2)Simran SachdevaОценок пока нет

- Developing Innovation Capability in Organisations: A Dynamic Capabilities ApproachДокумент25 страницDeveloping Innovation Capability in Organisations: A Dynamic Capabilities ApproachkishoreОценок пока нет

- 2010-2011 Q2. Compute The Following Financial Ratios For Merck's and Company Inc (December 2008)Документ5 страниц2010-2011 Q2. Compute The Following Financial Ratios For Merck's and Company Inc (December 2008)royaviОценок пока нет

- What Is Economic DepressionДокумент4 страницыWhat Is Economic DepressionFarhana RahmanОценок пока нет

- Kantar Worldpanel FMCG Monitor Dec 2018 enДокумент9 страницKantar Worldpanel FMCG Monitor Dec 2018 enAnh Nguyen TranОценок пока нет