Академический Документы

Профессиональный Документы

Культура Документы

Understanding NAV: Online Education For The Investment Community

Загружено:

kautiОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Understanding NAV: Online Education For The Investment Community

Загружено:

kautiАвторское право:

Доступные форматы

Online Education for the

Investment Community

Become A REIT University Sponsor

Click For Details

www.reituniversity.com

Monday, May 28, 2003

Home

Register

Forgot Your Password?

Contact Us

REIT Preferreds

Pricing REIT Stocks

Factory Outlet Centers

Create a Portfolio

Edit a Portfolio

Portfolio Tracking

Portfolios at a Glance

Data Downloads

Dates to Remember

Sign up for Realty Stock Review

Sign up for REIT Wrap

Contact Rainmaker

Realty Stock Review

REIT Wrap

Contact Rainmaker

Presented by

Rainmaker Media Group, LLC

Publisher of Realty Stock Review,

REIT Wrap and Property magazine

Understanding NAV

By Barry Vinocur

Net asset value analysis is central to many investors thinking when it comes to investing in REITs and non-REIT

real estate operating companies, or REOCs. However, NAV is but one of a number of valuation metrics. Like any

metric, it has its pluses and minuses. For instance, the calculation of NAV is admittedly more art than science. Its

also important to keep in mind that NAV is a levered number. The more highly levered a company, for instance,

the more pronounced the impact changes in NOI will have on the resulting NAV.

Another issue, highlighted in 2002 by Steve Sakwa and his colleagues on the Merrill Lynch REIT team, is the

drag on NAV arising from unleased space. The Merrill analysts wrote: In calculating our 1Q02 NAV figures,

weve made one major structural change to our previous methodology, which is a positive adjustment in all cases

in which it is applicable. The change involves applying a value to the unleased space within many companies

portfolios, especially those REITs whose occupancy rates are substantially depressed and well below a

normalized occupancy figure. Although coming up with a normalization factor is difficult, we applied

adjustments principally to the apartment and office/industrial REITs as both subsectors are currently experiencing

abnormally high vacancy levels.

No firm is more closely associated with NAV than Newport Beach, California-based Green Street Advisors.

Though Green Street added a discounted cash flow analysis-pricing model to its quiver in 2001, the firm has been

using an NAV-based pricing model as its primary valuation tool for over a decade.

According to Green Streets Mike Kirby, Warner Griswold, and Jon Fosheim: The beauty of an NAV-based

approach is that it compartmentalizes the valuation analysis, and, via the information contained in real estate

prices, specifically addresses the riskiness and long-term growth prospects of a given real estate portfolio. By

first answering the question What is the value of what the REIT now owns? an NAV-based approach allows

investors to address separately the question How much value will be created or destroyed by the REITs growth

strategy? By addressing one question at a time, an NAV-based model does a good job of separating the two

biggest determinants of value for a REIT.

Another plus, cited by the Green Street team, is that an NAV-based model relies on real estate prices in the

private market to provide guidance on appropriate pricing in the public market. For the most part, this is a

positive, as private market prices contain the collective opinions of thousands of buyers and sellers about the

growth prospects and riskiness of a given type of real estate in a given locale. More often than not, these private

markets work efficiently, and public market investors who choose to ignore the information conveyed by

thousands of willing buyers and sellers seem to us to be foolhardy.

A final argument for focusing on NAV, Kirby, Griswold, and Fosheim stress, is that pricing in the REIT sector has

a long-term tendency to revert back to NAV parity. The average discount/premium to NAV for our coverage

universe for more than a decade has been roughly 0%. Their sobering conclusion based on that data: The

historical evidence suggests that investors believe REITs neither create nor destroy value, in aggregate.

As the Green Street team underscored in its 2002 REIT pricing model update, theres no reason to suggest that a

discounted cash flow pricing model, properly constructed and applied, would come up short vs. an NAV-based

pricing model. While the relevant valuation inputs are addressed in a different order and, in some cases, in a

different format, the same parameters serve to determine value no matter which model one uses, Kirby,

Griswold, and Fosheim noted.

There are nevertheless a number of factors to keep in mind when utilizing NAVs in constructing a valuation

matrix. For instance, because cap rates are central to the calculation of NAV (see sidebar), during periods when

few transactions are taking place, the calculation of NAV can be problematic. At the same time, during periods

when companies are rapidly expanding or contracting their portfolios, getting a fix on NAV is a lot tougher, if not

impossible. That said, we are steadfast in our view that investors ignore NAV at their peril.

1

Back to the top

Next Page

Online Education for the

Investment Community

Become A REIT University Sponsor

Click For Details

www.reituniversity.com

Monday, May 28, 2003

Previous Page

Home

Register

Forgot Your Password?

Contact Us

REIT Preferreds

Pricing REIT Stocks

Factory Outlet Centers

Create a Portfolio

Edit a Portfolio

Portfolio Tracking

Portfolios at a Glance

Data Downloads

Dates to Remember

Sign up for Realty Stock Review

Sign up for REIT Wrap

Contact Rainmaker

Realty Stock Review

REIT Wrap

Contact Rainmaker

Presented by

Rainmaker Media Group, LLC

Publisher of Realty Stock Review,

REIT Wrap and Property magazine

Next Page

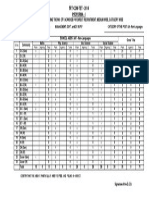

Calculating NAV

NAV Calculation for Summit Properties

The general framework for calculating NAV is

reasonably straightforward. The variance in NAV

estimates, in almost all cases, is the result of differing

inputs, not different methodologies.

Based on 1Q02 Financials

Cap Rate Assumptions

GAAP NOI Cap Rate (1)

Cash NOI Cap Rate (2)

Economic Cap Rate (3)

Steve Sakwa and his colleagues on the Merrill Lynch

REIT team summarized the six-step framework they

utilize in their First Quarter 2002 NAV Handbook.

Start with...

GAAP NOI from owned properties

Straight-line rent adjustment

Cash NOI from owned properties

less: Recurring capital expenditures

Adjusted NOI from apartment properties

Step 1: Determine a companys forward 12-month cash

net operating income (i.e., preleveraged cash flow minus

straightline rents). The reason for choosing this period,

rather than the prior 12 months or the latest quarter

annualized, is that purchasers of real estate generally

focus on the earnings potential of a property, not its past

performance, and cap rates are generally defined as a

consequence of the next-12-months income.

Divide cash NOI by...

Assumed cash NOI cap rate

Produces...

Market value of apartment properties

Step 2: Apply an appropriate cap rate to the companys

cash NOI figure.

8.75%

$1,294,240

$800

20.0%

To derive...

Implied benefit of management income

$4,000

We are left with...

Gross market value of assets

Step 4: Determine the gross market value of assets.

After adding the results from steps 2 & 3, we add cash

and cash equivalents, other assets, land held for

development, value of unleased space, and existing

development projects, which are valued at historical

cost, to derive the gross market value of assets.

$113,246

$0

$113,246

($6,271)

$106,975

Then add benefit of management/third party

income by dividing...

Management/third party income

Economic cap rate applied to management income

Then add...

Cash, Cash Equivalents and Securities

Other Assets

Recent Acquisitions at Cost

Land Held For Future Development

Value of Unleased Space

Benefit of Tax-Exempt Debt (4)

Step 3: Determine the value of third-party income. After

determining the actual cash flow derived from a

companys ancillary businesses, we apply a cap rate to

the income stream. Since management contracts are

typically cancelable on short noticeoften 30 to 60

days noticewe ascribe a substantially lower valuation

to fee income than to rental income. With few

exceptions, we use a 20% cap rateequal to a multiple

of five times cash flowfor fee income vs. propertylevel cap rates that range from 8.0% to 12.5%,

depending on the asset class.

8.75%

8.75%

8.27%

$13,709

$9,963

$0

$48,811

$52,237

$4,555

$1,695,241

Then subtract...

Total Liabilities...

Preferred Stock

$809,020

$140,000

Produces...

Net market value of assets

$746,221

Divide by...

Total shares/o.p. units (000)

31,007

Net Asset Value Per Share

$24.07

Notes: (1) GAAP NOI cap rate is defined as rental revenues (including straight-line rents)

minus property level expenditures divided by the market value of owned properties.

(2) Cash NOI cap rate is defined as cash NOI (GAAP NOI minus straight-line rent

adjustment) divided by market value of owned properties.

(3) Economic NOI cap rate is defined as adjusted NOI (Cash NOI minus recurring cap

ex) divided by market value of owned properties.

(4) We multiply the outstanding tax-exempt debt by a 150 basis point subsidy and

capitalize at 8.5%.

Source: Merrill Lynch 1Q02 NAV Handbook

Step 5: Determine the net market value of assets.

Subtract total liabilities from the gross market value of assets to arrive at a net market value of assets.

Step 6: Determine the NAV per share. Divide the net market value of assets by the total number of shares

outstanding to derive the net asset value per share.

Previous Page

Back to the top

Next Page

Online Education for the

Investment Community

Become A REIT University Sponsor

Click For Details

www.reituniversity.com

Monday, May 28, 2003

Previous Page

Home

Register

Forgot Your Password?

Contact Us

REIT Preferreds

Pricing REIT Stocks

Factory Outlet Centers

Create a Portfolio

Edit a Portfolio

Portfolio Tracking

Portfolios at a Glance

Data Downloads

Dates to Remember

Sign up for Realty Stock Review

Sign up for REIT Wrap

Contact Rainmaker

Realty Stock Review

REIT Wrap

Contact Rainmaker

Other Related Metrics

Calculation of Implied Cap Rate and Adjusted

EBITDA Multiple for Summit Properties

In addition to calculating NAV, the Merrill Lynch

analysts stressed the equally important calculation of a

companys implied economic cap rate. They also

addressed computing adjusted EBITDA multiples.

Based on 1Q02 Financials

The calculation of implied economic cap rates, Merrill

Lynchs Steve Sakwa and his colleagues noted, is

essentially the inverse of the net asset value analysis. For

example, for Summit Properties to be worth $22.97 per

share, at what economic cap rate would its properties

have to be valued? [See table at right.] We begin by

multiplying the number of shares outstanding by the

current stock price to find the market value of common

equity. Next, we add total liabilities and subtract other

assets (such as, cash, cash equivalents, development

projects, and land held for future development) to arrive

at our implied market value of properties. Then, we

divide the current adjusted NOI figuredefined as NOI

minus recurring cap ex minus a straightline rent

adjustmentby the implied market value of properties

to arrive at our implied cap rate.

Publisher of Realty Stock Review,

REIT Wrap and Property magazine

Back to the top

$809,020

$140,000

Given...

Net Operating Income - Existing Properties (3)

less: Recurring capital expenditures

Adjusted NOI - Existing Properties

G&A

Adjusted EBITDA

Finally, dividing adjusted NOI by the

implied market value of assets gives us an...

Implied Economic Cap Rate

Take the implied market value of properties

divided by adjusted EBITDA

Adjusted EBITDA Multiple (4)

$4,000

13,709

9,963

0

48,811

52,237

4,555

0

267,725

$1,260,256

$113,246

($6,271)

$106,975

($5,798)

$101,178

8.49%

12.5

Notes: (1) This figure is derived by applying an appropriate cap rate to the projected NOI

derived from mgmt income.

(2) Multiply the outstanding tax-exempt debt by a 150 basis point subsidy and

capitalize at 8.5%.

(3) These numbers reflect Merrill Lynchs expectations for income from existing

properties over the next 12 months.

(4) Adjusted EBITDA multiple is equal to implied market value of properties divided

by adjusted EBITDA

Source: Merrill Lynch 1Q02 NAV Handbook

Presented by

Then Add...

Total Liabilities...

Preferred Stock

We are left with...

Implied Market Value of Properties

An adjusted EBITDA multiple, the Merrill analysts

wrote, is defined as the implied market value of

properties divided by adjusted EBITDA. To derive

adjusted EBITDA, they subtract a corporations G&A

expenses from their adjusted NOI figure used in the

NAV calculation. By computing an adjusted EBITDA

multiple, we are able to look through different

accounting policies at the various REITs with respect to

the allocation of overhead expenses.

Previous Page

31,007

$22.97

$712,238

Subtract other Assets...

Implied benefit of management income (1)

Cash, Cash Equivalents and Securities

Other Assets

Recent Acquisitions at Cost

Land Held For Future Development

Value of Unleased Space

Benefit of Tax-Exempt Debt (2)

Equity Investments in Public Companies

Development Projects (at cost)

This analysis shows that SMTs 8.49% implied

economic cap rate is 65 basis points higher than the peer

group average and 22 basis points higher than the

economic cap rate derived in our NAV calculation.

Rainmaker Media Group, LLC

Begin by multiplying...

# of Shares Outstanding

Recent Stock Price

Market Value of Common Equity

Вам также может понравиться

- Robert Kiyosaki The Real Book of Real EstateДокумент256 страницRobert Kiyosaki The Real Book of Real EstateJonnyCane100% (8)

- Real Estate Finance Interview QuestionsДокумент3 страницыReal Estate Finance Interview QuestionsJack Jacinto100% (2)

- Merrill Lynch 2007 Analyst Valuation TrainingДокумент74 страницыMerrill Lynch 2007 Analyst Valuation TrainingJose Garcia100% (21)

- Chapter 1 Answers - OddДокумент2 страницыChapter 1 Answers - OdddaniОценок пока нет

- Practice ProblemsДокумент12 страницPractice ProblemsJonathan BohbotОценок пока нет

- Appraisal Ce Exam 1 Review PDFДокумент30 страницAppraisal Ce Exam 1 Review PDFAmeerОценок пока нет

- Investment Appraisal Report (Individual Report)Документ10 страницInvestment Appraisal Report (Individual Report)Eric AwinoОценок пока нет

- Alex Navab - Overview of Private EquityДокумент21 страницаAlex Navab - Overview of Private EquityAlyson Davis100% (16)

- Mergers & Acquisitions: Crushing It as a Corporate Buyer in the Middle MarketОт EverandMergers & Acquisitions: Crushing It as a Corporate Buyer in the Middle MarketРейтинг: 1 из 5 звезд1/5 (1)

- Borrowing CostДокумент12 страницBorrowing CostKenn Adam Johan Gajudo100% (2)

- 4.1 Set 3 Review Questions) With Answers (Final)Документ20 страниц4.1 Set 3 Review Questions) With Answers (Final)Pol Malonda100% (1)

- Sample Investment ReportДокумент27 страницSample Investment ReportMs.WhatnotОценок пока нет

- Chapter 4 PFS3353Документ6 страницChapter 4 PFS3353dines1495Оценок пока нет

- Cash & Debt FreeДокумент30 страницCash & Debt FreeReza HaryoОценок пока нет

- 6 Essential Data Points For Hotel Investment AnalysisДокумент4 страницы6 Essential Data Points For Hotel Investment AnalysisSharif Fayiz AbushaikhaОценок пока нет

- Capitalization Rate Definition PDFДокумент12 страницCapitalization Rate Definition PDFGerald GallenitoОценок пока нет

- Cap RateДокумент5 страницCap Ratearturo7942Оценок пока нет

- Real Estate Cap Rate CalculatorДокумент4 страницыReal Estate Cap Rate CalculatorM ShahidОценок пока нет

- Investors' Behaviour in Real Estate: Realized by Jad EL BOUSTANI (B00153448)Документ7 страницInvestors' Behaviour in Real Estate: Realized by Jad EL BOUSTANI (B00153448)Jad G. BoustaniОценок пока нет

- Investment Analysis Report: 24 Trevor Terrace North Shields Tyne & Wear NE30 2DE 22nd - January, 2007Документ14 страницInvestment Analysis Report: 24 Trevor Terrace North Shields Tyne & Wear NE30 2DE 22nd - January, 2007isaac setabiОценок пока нет

- Thesis ReitsДокумент4 страницыThesis Reitsjennifercampbellerie100% (2)

- Typically Need To Employ Professional ManagementДокумент15 страницTypically Need To Employ Professional Managementd ddОценок пока нет

- Real Estate Research PaperДокумент6 страницReal Estate Research Paperjbuulqvkg100% (1)

- Reit Investment ThesisДокумент4 страницыReit Investment Thesismichellebrownbillings100% (2)

- Real Estate 101Документ15 страницReal Estate 101Avik SarkarОценок пока нет

- Valuation SlidesДокумент26 страницValuation SlidesAiswarya SreekumarОценок пока нет

- Reit ThesisДокумент4 страницыReit Thesisfjgqdmne100% (2)

- Factors That Influence Cap RatesДокумент9 страницFactors That Influence Cap RatesMike AshОценок пока нет

- What Is Real Estate Financial Modeling REFM Acquisition Renovation Development Case StudiesДокумент18 страницWhat Is Real Estate Financial Modeling REFM Acquisition Renovation Development Case StudiesJudy FarhatОценок пока нет

- Accounting and Finance For Decision MakingДокумент10 страницAccounting and Finance For Decision Makingswati raghuvansiОценок пока нет

- Separate Account Client Letter Second Quarter 2017Документ7 страницSeparate Account Client Letter Second Quarter 2017James DeanОценок пока нет

- Investing in A Developing World's InfrastructureДокумент4 страницыInvesting in A Developing World's Infrastructuredominico8333520% (1)

- Cash FlowДокумент31 страницаCash FlowHanumantharao SurampudiОценок пока нет

- Real Estate ThesisДокумент7 страницReal Estate ThesisCustomWritingPapersUK100% (2)

- Real Estate Investment Trusts (Reits) : These Firms Are Sort of Like Private EquityДокумент5 страницReal Estate Investment Trusts (Reits) : These Firms Are Sort of Like Private EquitySteven TangОценок пока нет

- Greenstreet Pricing L ReportДокумент21 страницаGreenstreet Pricing L Reportpalladium83Оценок пока нет

- Chapter 10: Making Capital Investment DecisionДокумент2 страницыChapter 10: Making Capital Investment DecisionFrank WanjalaОценок пока нет

- Chapter 10: Making Capital Investment DecisionДокумент2 страницыChapter 10: Making Capital Investment DecisionFrank WanjalaОценок пока нет

- New Constructs ArticlesДокумент8 страницNew Constructs ArticleskongbengОценок пока нет

- Valuation - DCFДокумент38 страницValuation - DCFKumar Prashant100% (1)

- EBITA VD EBITDA - AD Insights Vernacular of Valuation 1209Документ4 страницыEBITA VD EBITDA - AD Insights Vernacular of Valuation 1209koepzОценок пока нет

- Estimate CostДокумент11 страницEstimate CostdivyasinghbainsОценок пока нет

- ELECTIVE 4 WK 4 5Документ46 страницELECTIVE 4 WK 4 5rubia.jat.bsmtОценок пока нет

- Research Paper On Real EstateДокумент4 страницыResearch Paper On Real Estatefve140vb100% (1)

- Exam 1: Name Institute AssignmentДокумент12 страницExam 1: Name Institute AssignmentJehan solutionsОценок пока нет

- Fred Shelton, JR., CPA, MBA, CVA - The Valuation of Construction Companies PrimerДокумент7 страницFred Shelton, JR., CPA, MBA, CVA - The Valuation of Construction Companies Primerptd2Оценок пока нет

- Real Estate Investment and Risk Analysis: Lecture MapДокумент27 страницReal Estate Investment and Risk Analysis: Lecture MapTanmoy ChakrabortyОценок пока нет

- Property Derivatives PresentationДокумент30 страницProperty Derivatives Presentationjstamp02100% (1)

- What Is Real Estate Financial ModelingДокумент23 страницыWhat Is Real Estate Financial ModelingTrịnh Minh TâmОценок пока нет

- Entrep-Week06 - Session 2 Financial ViabityДокумент22 страницыEntrep-Week06 - Session 2 Financial ViabityKiara BaldeónОценок пока нет

- Investment Decisions in Hotels: Topic 6Документ20 страницInvestment Decisions in Hotels: Topic 6sv03Оценок пока нет

- ValuationДокумент39 страницValuationIndu ShekharОценок пока нет

- Solution To Questions - Chapter 10 Valuation of Income Properties: Appraisal and The Market For Capital Question 10-1Документ12 страницSolution To Questions - Chapter 10 Valuation of Income Properties: Appraisal and The Market For Capital Question 10-1Rajib Chandra BanikОценок пока нет

- Reits DissertationДокумент5 страницReits DissertationDoMyPaperForMeCanada100% (1)

- Valuation For Investment BankingДокумент27 страницValuation For Investment BankingK RameshОценок пока нет

- How To Analyse REITs (Real Estate Investment Trusts)Документ10 страницHow To Analyse REITs (Real Estate Investment Trusts)paulineОценок пока нет

- Great Investments: How ToДокумент12 страницGreat Investments: How Toweiwei8575Оценок пока нет

- Buy-to-Let Index Q3 2014: The London MarketДокумент4 страницыBuy-to-Let Index Q3 2014: The London MarketTheHallPartnershipОценок пока нет

- Marriott Corporation The Cost of Capital Case Study AnalysisДокумент21 страницаMarriott Corporation The Cost of Capital Case Study AnalysisvasanthaОценок пока нет

- Corporate FinanceДокумент16 страницCorporate FinanceBot RiverОценок пока нет

- Hedge-Funds: How Big Is Big?Документ11 страницHedge-Funds: How Big Is Big?a5600805Оценок пока нет

- Acct6293 Intermediate Accounting Odd 2021/2022Документ4 страницыAcct6293 Intermediate Accounting Odd 2021/2022Ken SyahОценок пока нет

- Investment Appraisal With Solved ExamplesДокумент29 страницInvestment Appraisal With Solved Examplesnot toothlessОценок пока нет

- Great Zimbabwe University: Faculty of Social SciencesДокумент6 страницGreat Zimbabwe University: Faculty of Social SciencesHugo MuchuchuОценок пока нет

- The Real Estate Investor's Pocket Calculator: Simple Ways to Compute Cash Flow, Value, Return, and Other Key Financial MeasurementsОт EverandThe Real Estate Investor's Pocket Calculator: Simple Ways to Compute Cash Flow, Value, Return, and Other Key Financial MeasurementsРейтинг: 1 из 5 звезд1/5 (1)

- Applied Corporate Finance. What is a Company worth?От EverandApplied Corporate Finance. What is a Company worth?Рейтинг: 3 из 5 звезд3/5 (2)

- Sri Venkateswara UniversityДокумент5 страницSri Venkateswara UniversitykautiОценок пока нет

- University of Hyderabad: General Category Reserved CategoriesДокумент1 страницаUniversity of Hyderabad: General Category Reserved CategorieskautiОценок пока нет

- Selected Thesis Topics 2014-2015Документ5 страницSelected Thesis Topics 2014-2015Miguelo Malpartida BuenoОценок пока нет

- Reve I W Questions Introduction To Economic UnderstandingДокумент2 страницыReve I W Questions Introduction To Economic UnderstandingkautiОценок пока нет

- How To Obtain A PHD in GermanyДокумент16 страницHow To Obtain A PHD in GermanykautiОценок пока нет

- Clearing and Settlement: Financial DerivativesДокумент24 страницыClearing and Settlement: Financial DerivativesAayush SharmaОценок пока нет

- JFE10 Ugc NetДокумент49 страницJFE10 Ugc NetkautiОценок пока нет

- Glossary MonetraДокумент17 страницGlossary MonetrakautiОценок пока нет

- Ca Business Sectors Revision NotesДокумент1 страницаCa Business Sectors Revision NoteskautiОценок пока нет

- Hydrogen TwoДокумент6 страницHydrogen TwokautiОценок пока нет

- Impact of Inflation IndianДокумент3 страницыImpact of Inflation IndiankautiОценок пока нет

- Money Market ReformДокумент6 страницMoney Market ReformkautiОценок пока нет

- Concession List NaturalДокумент7 страницConcession List NaturalkautiОценок пока нет

- Accounting ConceptДокумент50 страницAccounting Conceptrsal.284869430Оценок пока нет

- General Securities Representative Qualification Examination (Series 7)Документ46 страницGeneral Securities Representative Qualification Examination (Series 7)kautiОценок пока нет

- 01 - Basic UnixДокумент43 страницы01 - Basic UnixkautiОценок пока нет

- June 2013 Final GCE Advanced Double Awards Including Applied SubjectsДокумент11 страницJune 2013 Final GCE Advanced Double Awards Including Applied SubjectskautiОценок пока нет

- SAS Programming II: Manipulating Data With The DATA Step: Course DescriptionДокумент3 страницыSAS Programming II: Manipulating Data With The DATA Step: Course DescriptionkautiОценок пока нет

- Statement Showing The No. of Vacancies For Direct Recruitment, Medium Wise, Category WiseДокумент1 страницаStatement Showing The No. of Vacancies For Direct Recruitment, Medium Wise, Category WisekautiОценок пока нет

- School Assistant Non LanguagesДокумент1 страницаSchool Assistant Non LanguageskautiОценок пока нет

- The Search For Persistence: Is Past Performance Related To Future Performance?Документ2 страницыThe Search For Persistence: Is Past Performance Related To Future Performance?kautiОценок пока нет

- International Exam FaqДокумент4 страницыInternational Exam FaqckrishnaОценок пока нет

- British Council Entry Procedure January 2016Документ2 страницыBritish Council Entry Procedure January 2016kautiОценок пока нет

- S 17 13 III (Management)Документ32 страницыS 17 13 III (Management)kautiОценок пока нет

- Financial Institutions, Markets, and Money, 9 Edition: Power Point Slides ForДокумент23 страницыFinancial Institutions, Markets, and Money, 9 Edition: Power Point Slides ForkautiОценок пока нет

- Grade 7 Solving Percent ProblemsДокумент9 страницGrade 7 Solving Percent ProblemskautiОценок пока нет

- Rates Revision NotesДокумент1 страницаRates Revision NoteskautiОценок пока нет

- Comparing Investments - An Example: D E A F B CДокумент1 страницаComparing Investments - An Example: D E A F B CkautiОценок пока нет

- Biological KnowledgeДокумент1 страницаBiological KnowledgekautiОценок пока нет

- Interview QuestionsДокумент1 страницаInterview QuestionskautiОценок пока нет

- Borrowing Costs Lkas 23: ACC 3112 Financial ReportingДокумент17 страницBorrowing Costs Lkas 23: ACC 3112 Financial ReportingDhanushika SamarawickramaОценок пока нет

- RPV 3Документ158 страницRPV 3Melkamu AmusheОценок пока нет

- Gov Acc Chapt 10 12Документ9 страницGov Acc Chapt 10 12Yami HeatherОценок пока нет

- Numericals On Capital Structure Theories - KДокумент12 страницNumericals On Capital Structure Theories - KnidhiОценок пока нет

- Faculty of Management Studies: Take-Home Assignment in Lieu of Ii Periodical Test 2020 AND Ii Continuous Assignment 2020Документ7 страницFaculty of Management Studies: Take-Home Assignment in Lieu of Ii Periodical Test 2020 AND Ii Continuous Assignment 2020Atulit AgarwalОценок пока нет

- Borrowing Cost 0Документ22 страницыBorrowing Cost 0pam pamОценок пока нет

- CH 3 Capital StructureДокумент28 страницCH 3 Capital StructureSayeed AhmadОценок пока нет

- Test Bank For Global Investments 6th 0321527704 DownloadДокумент15 страницTest Bank For Global Investments 6th 0321527704 Downloadrebeccafloydaetozmjrsb100% (25)

- Activity Chapter 3: (A) Average Annual Earnings 2,600,000Документ2 страницыActivity Chapter 3: (A) Average Annual Earnings 2,600,000Randelle James FiestaОценок пока нет

- MGT602 Technical Article Theme 2Документ7 страницMGT602 Technical Article Theme 2Asif AltafОценок пока нет

- To Lease or Not To Lease?: Hotel ContractsДокумент10 страницTo Lease or Not To Lease?: Hotel ContractsDaryl ChengОценок пока нет

- Chatham Lodging TrustДокумент5 страницChatham Lodging Trustpresentation111Оценок пока нет

- Capital Structure - 1Документ25 страницCapital Structure - 1bakhtiar2014Оценок пока нет

- Real Estrate Valuation Theory PDFДокумент440 страницReal Estrate Valuation Theory PDFavisitoronscribd100% (2)

- Commando Test On FM (COC, CSP, DP) : Ranker's ClassesДокумент3 страницыCommando Test On FM (COC, CSP, DP) : Ranker's ClassesmuskanОценок пока нет

- University of Perpetual Help System Dalta: I. PAS 20: Government Grant A. DefinitionДокумент3 страницыUniversity of Perpetual Help System Dalta: I. PAS 20: Government Grant A. DefinitionJeanette LampitocОценок пока нет

- Unit 4: Indian Accounting Standard 23: Borrowing Costs: After Studying This Unit, You Will Be Able ToДокумент31 страницаUnit 4: Indian Accounting Standard 23: Borrowing Costs: After Studying This Unit, You Will Be Able ToSri KanthОценок пока нет

- Fundamentals of Project Financial and Investment AnalysisДокумент70 страницFundamentals of Project Financial and Investment AnalysisAmol BagulОценок пока нет

- Method 1: Multiples of Average Excess EarningsДокумент8 страницMethod 1: Multiples of Average Excess EarningsDanielle JuntillaОценок пока нет

- Capitalization of Borrowing CostДокумент3 страницыCapitalization of Borrowing Costvb_krishnaОценок пока нет

- Borrowing Cost (PAS 23)Документ6 страницBorrowing Cost (PAS 23)CharléОценок пока нет

- FRS 123 Borrowing CostsДокумент4 страницыFRS 123 Borrowing CostsRoslan Mohamad NorОценок пока нет

- B. Preliminary Limited Offering Memorandum-Retail Appraisal Report Posted 09-26-2016 PDFДокумент290 страницB. Preliminary Limited Offering Memorandum-Retail Appraisal Report Posted 09-26-2016 PDFNAVEENAОценок пока нет

- Golf Course Valuation TrendsДокумент3 страницыGolf Course Valuation TrendsSarahОценок пока нет