Академический Документы

Профессиональный Документы

Культура Документы

Johnson Et Al v. USA Doc 1-1 Filed 19 Oct 15 PDF

Загружено:

scion.scionИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Johnson Et Al v. USA Doc 1-1 Filed 19 Oct 15 PDF

Загружено:

scion.scionАвторское право:

Доступные форматы

Case 2:15-cv-00742-JNP-PMW Document 1-1 Filed 10/19/15 Page 1 of 4

Exhibit A

Case 2:15-cv-00742-JNP-PMW Document 1-1 Filed 10/19/15 Page 2 of 4

Summons

) and Glenda Johnson (TIN#

In the matter of Ncldon .Johnson (TIN#

:

Internal Revenue Service (Division): -=S-"--n-'-'1a"-ll'-B_l:. . :ts'-"it"'-1cc.: s.: .:s/-=S-=-e-'--lf--'--E::. .t-'--np""'lc.::o_,__ye-=--d'---------------------lndustry/Area (name or number): _W_es_te_r_n_A_t_c_a_ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ __

Periods: Calendar year ending December 31, 2012

The Commissioner of Internal Revenue

To: Wells Fargo Bank

At: Subpoena Processing: 2700 S Price Road, 2nd Floor, Chandler, AZ 85286

You are hereby summoned and required to appear before Joel Zielke, Revenue Agent, or Designee

an officer of the Internal Revenue Service, to give testimony and to bring with you and to produce for examination the following books, records, papers,

and other data relating to the tax liability or the collection of the tax liability or for the purpose of inquiring into any offense connected with the

administration or enforcement of the internal revenue laws concerning the person identified above for the periods shown.

In lieu of appearance, you may mail the following documents to the address below before the date of the appearance.

Please produce for examination copies of signature cards, monthly bank statements, bank deposit slips, deposit items, credit

) or Glenda

memos, cancelled checks, and debit memos drawn on accounts which either Neldon Johnson (TIN#

Johnson (TIN #

) either owns or is a signer for the period December 20 II -January 20 I 3.

The term 'credit memos' includes internal and external bank transfers of funds and wires and includes any internal memoranda

evidencing the payor bank name, the payor account name and the payor account number for the accounts paying such transferred

and wired funds. The term 'debit memos' includes internal and external bank transfers of funds and wires and includes any internal

memoranda evidencing the recipient bank name, the recipient account name and the recipient account number for the accounts

receiving such transferred and wired funds. The term 'cancelled checks' includes counter checks, cashier's checks and money

orders. The term 'accounts' includes but is not limited to checking accounts, savings accounts, money market accounts, investment

accounts, merchant accounts, credit card accounts, loan accounts, and the account into which the enclosed cashier's check was

deposited, (Zions Bank, Check Number: 1635357, Amount: $1 ,498, 150.85, Date: 06/27/2012, Payee: Glenda Johnson).

You are authorized to receive reimbursement of up to $500.00 for costs directly related to the search for, reproduction of, and

transport of the records requested in this summons. If the amount of direct costs is expected to exceed this amount please contact

the issuing officer listed below for further authorization.

Do not write in this space

Business address and telephone number of IRS officer before whom you are to appear:

50 South 200 East, MS: 4544JZ, Salt Lake City, UT 84111; Phone 801-799-6685; Fax 801-799-6724

Place and

time for appearance at 50 South 200 East, Salt Lake City, UT 84111

fJIRS

Department of the Treasury

Internal Revenue Service

www.irs.gov

Form 2039 (Rev. 12-2001)

Catalog Number 21405J

on the

----~~~---

day of _ __;0=-c:..:..to=-=b-=-e=-r__

2015

--~~~w~ar~)---

at ---'-'10__ o'clock

e Internal Revenue Code this~ day of ___0"---'--ct"'o_;;_b.;;.;er'----l

. __.1

m.

2015

(year)

Revenue Agent

Title

Revenue Agent Group Manager

Title

Part C -

to be given to noticee

Case 2:15-cv-00742-JNP-PMW Document 1-1 Filed 10/19/15 Page 3 of 4

To: Neldon & Glenda Johnson

Date:

October I, 2015

Address: 4035 S 4000 West, Delta, UT 84624

Enclosed is a copy of a summons served by the IRS

to examine records made or kept by, or to request

testimony from, the person summoned. If you object

to the summons, you are permitted to file a lawsuit

in the United States district court in the form of a petition

to quash the summons in order to contest the merits of

the summons.

General Directions

6. Identify and attach a copy of the summons.

7. State in detail every legal argument supporting the

relief requested in your petition. See Federal Rules of

Civil Procedure. Note that in some courts you may be

required to support your request for relief by a sworn

declaration or affidavit supporting any issue you wish

to contest.

8. Your petition must be signed as required by Federal

Rule of Civil Procedure 11.

1. You must file your petition to quash in the United

States district court for the district where the person

summoned resides or is found.

2. You must file your petition within 20 days from the

date of this notice and pay a filing fee as may be

required by the clerk of the court.

3. You must comply with the Federal Rules of Civil

Procedure and local rules of the United States

district court.

Instructions for Preparing Petition to Quash

1. Entitle your petition "Petition to Quash Summons."

2. Name the person or entity to whom this notice is

directed as the petitioner.

3. Name the United States as the respondent.

4. State the basis for the court's jurisdiction, as required

by Federal Rule of Civil Procedure. See Internal

Revenue Code Section 7609(h).

5. State the name and address of the person or entity

to whom this notice is directed and state that the

records or testimony sought by the summons relate

to that person or entity.

9. Your petition must be served upon the appropriate

parties, including the United States, as required by

Federal Rule of Civil Procedure 4.

10. At the same time you file your petition with the court,

you must mail a copy of your petition by certified or

registered mail to the person summoned and to the

IRS. Mail the copy for the IRS to the officer whose

name and address are shown on the face of this

summons. See 7609(b)(2)(B).

The court will decide whether the person summoned

should be required to comply with the summons request.

Your filing of a petition to quash may suspend the running

of the statute of limitations for civil liability or for criminal

prosecution for offenses under the tax laws for the tax

periods to which the summons relates. Such suspension

would be in effect while any proceeding (or appeal) with

respect to the summons is pending.

The relevant provisions of the Internal Revenue Code

are enclosed with this notice. If you have any questions,

please contact the Internal Revenue Service officer

before whom the person summoned is to appear. The

officer's name and telephone number are shown on the

summons.

fJIRS

Department of the Treasury

Internal Revenue Service

www.irs.gov

Form 2039 (Rev. 12-2001)

Catalog Number 21405J

Part D - to be given to noticee

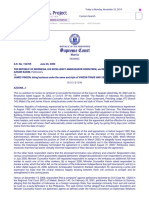

Case 2:15-cv-00742-JNP-PMW Document 1-1 Filed 10/19/15 Page 4 of 4

Page 3 of3

REX Previewer

rr . - . .

""ia<.:..-,. -:.

:~.:::

... .:..... -

, ZIONS

BANK

Salt L..W

UtM 84101

~~~

CASHIER'S CHECK

~~~

1635357

Cu~.

Gl-EIICA JOHN-3JI/

31-511240

Date

June 27 1 2012

Date:07i23/12 Seq #:94126110 Account:2255636 Serial#: 1635357 Amount:$! ,498,150.85 Dcp Seq#:-

https://rex.cs.zionsbank.com/TreXWorkspaceWeb/previewer.jsp

9/23/2015

if.

ll' '

Вам также может понравиться

- Case 18-11291-LSS Doc 17-1 Filed 01 Oct 18Документ18 страницCase 18-11291-LSS Doc 17-1 Filed 01 Oct 18scion.scionОценок пока нет

- Case 18-11291-LSS Doc 17 Filed 01 Oct 18Документ2 страницыCase 18-11291-LSS Doc 17 Filed 01 Oct 18scion.scionОценок пока нет

- Samsung Galaxy Smartphone Marketing and Sales Practices Litigation. - Amended ComplaintДокумент55 страницSamsung Galaxy Smartphone Marketing and Sales Practices Litigation. - Amended Complaintscion.scionОценок пока нет

- USA v. Jaclin Doc 1 - Filed 18 May 17Документ24 страницыUSA v. Jaclin Doc 1 - Filed 18 May 17scion.scion0% (1)

- Internet Research Agency Indictment PDFДокумент37 страницInternet Research Agency Indictment PDFscion.scionОценок пока нет

- Paul Stockinger Et Al v. Toyota Motor Sales, U.S.a - Doc 34 Filed 24 Mar 17Документ84 страницыPaul Stockinger Et Al v. Toyota Motor Sales, U.S.a - Doc 34 Filed 24 Mar 17scion.scionОценок пока нет

- USA v. Cedeno Et Al Doc 3-1Документ24 страницыUSA v. Cedeno Et Al Doc 3-1scion.scionОценок пока нет

- Internet Research Agency Indictment PDFДокумент37 страницInternet Research Agency Indictment PDFscion.scionОценок пока нет

- Internet Research Agency Indictment PDFДокумент37 страницInternet Research Agency Indictment PDFscion.scionОценок пока нет

- USA v. Cedeno Et Al Doc 3Документ1 страницаUSA v. Cedeno Et Al Doc 3scion.scionОценок пока нет

- USA v. Jaclin Doc 4 - Filed 22 May 17Документ1 страницаUSA v. Jaclin Doc 4 - Filed 22 May 17scion.scionОценок пока нет

- USA v. Shkreli Et Al Doc 260Документ1 страницаUSA v. Shkreli Et Al Doc 260scion.scionОценок пока нет

- P10 Industries, Inc. Bankruptcy Petition 17-50635-Cag - Doc 1 Filed 22 Mar 17Документ52 страницыP10 Industries, Inc. Bankruptcy Petition 17-50635-Cag - Doc 1 Filed 22 Mar 17scion.scionОценок пока нет

- SEC v. Imran Husain Et Al Doc 48 Filed 15 Mar 17Документ14 страницSEC v. Imran Husain Et Al Doc 48 Filed 15 Mar 17scion.scionОценок пока нет

- Paul Stockinger Et Al v. Toyota Motor Sales, U.S.A., Inc Doc 32 Filed 13 Mar 17 PDFДокумент4 страницыPaul Stockinger Et Al v. Toyota Motor Sales, U.S.A., Inc Doc 32 Filed 13 Mar 17 PDFscion.scionОценок пока нет

- Cemtrex, Inc. v. Pearson Et Al Doc 1 Filed 06 Mar 17Документ19 страницCemtrex, Inc. v. Pearson Et Al Doc 1 Filed 06 Mar 17scion.scionОценок пока нет

- Paul Stockinger Et Al v. Toyota Motor Sales, U.S.A., Inc Doc 32 Filed 13 Mar 17 PDFДокумент4 страницыPaul Stockinger Et Al v. Toyota Motor Sales, U.S.A., Inc Doc 32 Filed 13 Mar 17 PDFscion.scionОценок пока нет

- SEC v. Miller - Doc 1 Filed 13 Mar 17Документ9 страницSEC v. Miller - Doc 1 Filed 13 Mar 17scion.scionОценок пока нет

- Paul Stockinger Et Al v. Toyota Motor Sales, U.S.A - Doc 1 Filed 03 Jan 17Документ81 страницаPaul Stockinger Et Al v. Toyota Motor Sales, U.S.A - Doc 1 Filed 03 Jan 17scion.scionОценок пока нет

- Paul Stockinger Et Al v. Toyota Motor Sales, U.S.A - Doc 28-2 Filed 03 Mar 17Документ8 страницPaul Stockinger Et Al v. Toyota Motor Sales, U.S.A - Doc 28-2 Filed 03 Mar 17scion.scionОценок пока нет

- Cor Clearing LLC V Calissio Resources Doc 171 Filed 25 Jan 17Документ2 страницыCor Clearing LLC V Calissio Resources Doc 171 Filed 25 Jan 17scion.scionОценок пока нет

- Paul Stockinger Et Al v. Toyota Motor Sales, U.S.A - Doc 28-1 Filed 03 Mar 17Документ36 страницPaul Stockinger Et Al v. Toyota Motor Sales, U.S.A - Doc 28-1 Filed 03 Mar 17scion.scionОценок пока нет

- USA v. Fernandez Et Al Doc 487 Filed 02 Nov 16Документ16 страницUSA v. Fernandez Et Al Doc 487 Filed 02 Nov 16scion.scionОценок пока нет

- Paul Stockinger Et Al v. Toyota Motor Sales, U.S.A - Doc 28 Filed 03 Mar 17Документ3 страницыPaul Stockinger Et Al v. Toyota Motor Sales, U.S.A - Doc 28 Filed 03 Mar 17scion.scionОценок пока нет

- SEC v. Imran Husain Et Al Doc 33 Filed 22 Nov 16Документ61 страницаSEC v. Imran Husain Et Al Doc 33 Filed 22 Nov 16scion.scionОценок пока нет

- USA v. Affa Et Al Doc 173 Filed 19 Feb 16Документ4 страницыUSA v. Affa Et Al Doc 173 Filed 19 Feb 16scion.scionОценок пока нет

- Cor Clearing LLC V Calissio Resources Doc 171-1 Filed 25 Jan 17Документ21 страницаCor Clearing LLC V Calissio Resources Doc 171-1 Filed 25 Jan 17scion.scionОценок пока нет

- Holtzbrinck JudgmentДокумент6 страницHoltzbrinck Judgmentscion.scionОценок пока нет

- USA v. Fernandez Et Al Doc 484 Filed 03 Oct 16Документ1 страницаUSA v. Fernandez Et Al Doc 484 Filed 03 Oct 16scion.scionОценок пока нет

- USA v. RaPower-3 Et Al Doc 73 Filed 01 Aug 16 PDFДокумент12 страницUSA v. RaPower-3 Et Al Doc 73 Filed 01 Aug 16 PDFscion.scionОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- People v. GumilaoДокумент4 страницыPeople v. GumilaoShimi FortunaОценок пока нет

- G.R. No. 175507 October 8, 2014 Ramon Ching and Powing Properties, Inc., Petitioners, Joseph Cheng, Jaime Cheng, Mercedes Igne AND LUCINA SANTOS, RespondentsДокумент12 страницG.R. No. 175507 October 8, 2014 Ramon Ching and Powing Properties, Inc., Petitioners, Joseph Cheng, Jaime Cheng, Mercedes Igne AND LUCINA SANTOS, RespondentsMV FadsОценок пока нет

- 1 - Misterio v. Cebu State College of Science and Technology (2005) PDFДокумент10 страниц1 - Misterio v. Cebu State College of Science and Technology (2005) PDFGeorgina Mia GatoОценок пока нет

- G.R. No. 154705Документ4 страницыG.R. No. 154705Weddanever CornelОценок пока нет

- Air 1995 SC 1377Документ7 страницAir 1995 SC 1377AmarendraKumarОценок пока нет

- Jurisdiction of Administrative Cases For Our Public School TeachersДокумент4 страницыJurisdiction of Administrative Cases For Our Public School TeachersAiEnmaОценок пока нет

- Statutory Declaration TemplateДокумент2 страницыStatutory Declaration TemplateMark FernandoОценок пока нет

- Indian Contract Act 1872, With Sections & Illustrations: (Section 1) - Title, Commencement & ScopeДокумент32 страницыIndian Contract Act 1872, With Sections & Illustrations: (Section 1) - Title, Commencement & ScopeAshish KumarОценок пока нет

- EEOC Administrative Judge Awards $250,000 To Disabled USPS EmployeeДокумент2 страницыEEOC Administrative Judge Awards $250,000 To Disabled USPS EmployeePR.comОценок пока нет

- Interpretation 1Документ17 страницInterpretation 1ysunnyОценок пока нет

- Marasigan Vs FuentesДокумент8 страницMarasigan Vs Fuentesdoora keysОценок пока нет

- People v. Rubio PDFДокумент24 страницыPeople v. Rubio PDFAsh MangueraОценок пока нет

- Peczenick, The Binding Force of Precedent, La Fuerza Vinculante Del PrecedenteДокумент10 страницPeczenick, The Binding Force of Precedent, La Fuerza Vinculante Del PrecedenteEdgar Carpio MarcosОценок пока нет

- Bankruptcy Code Section 365 ChartДокумент4 страницыBankruptcy Code Section 365 Chartchristensen_a_gОценок пока нет

- TRUSTДокумент19 страницTRUSTOffshore Company FormationОценок пока нет

- Principle of Delay - Case DigestsДокумент3 страницыPrinciple of Delay - Case DigestsAngel DeiparineОценок пока нет

- Republic of The Philippines Court of Appeals Manila: PetitionersДокумент12 страницRepublic of The Philippines Court of Appeals Manila: PetitionersNetweightОценок пока нет

- Supreme Court Dismisses Estafa Case Due to Lack of EvidenceДокумент4 страницыSupreme Court Dismisses Estafa Case Due to Lack of EvidenceJoovs JoovhoОценок пока нет

- Divorce Form XMLДокумент11 страницDivorce Form XMLHarish ChauhanОценок пока нет

- JOSEPH EJERCITO ESTRADA, Petitioner, Sandiganbayan (Third Division) and People of The PhilippinesДокумент2 страницыJOSEPH EJERCITO ESTRADA, Petitioner, Sandiganbayan (Third Division) and People of The PhilippinesRoyce Ann PedemonteОценок пока нет

- Paranaque Kings v. CAДокумент2 страницыParanaque Kings v. CAAlfonso Miguel Dimla100% (1)

- Intellectual Property Laws (Copyright)Документ3 страницыIntellectual Property Laws (Copyright)PaulineОценок пока нет

- Republic of The Philippines Quezon City: Court of Tax AppealsДокумент7 страницRepublic of The Philippines Quezon City: Court of Tax AppealsfrsfwtetОценок пока нет

- Software Requirements Specification OLX: Prepared For Sudhanshu Kumar Tiwari by K. Sai Kumar 1140 K1405 A-17Документ6 страницSoftware Requirements Specification OLX: Prepared For Sudhanshu Kumar Tiwari by K. Sai Kumar 1140 K1405 A-17Devraj Singh ShekhawatОценок пока нет

- COA Authority Over NEA Salary IncreasesДокумент2 страницыCOA Authority Over NEA Salary IncreasescarmelafojasОценок пока нет

- UCPB General Insurance v. HensonДокумент5 страницUCPB General Insurance v. HensonJan Carlo SanchezОценок пока нет

- Right To Form Association Samahan NG Manggagagawa Sa Hanjin Shipyard Vs Bureau of Labor Relations GR No G.R. No. 211145 FactsДокумент1 страницаRight To Form Association Samahan NG Manggagagawa Sa Hanjin Shipyard Vs Bureau of Labor Relations GR No G.R. No. 211145 FactsChristopher AdvinculaОценок пока нет

- People Vs KalaloДокумент1 страницаPeople Vs KalaloShiela PilarОценок пока нет

- Amla To Ra 10586Документ34 страницыAmla To Ra 10586Parubrub-Yere TinaОценок пока нет

- 04 Harv JLTech 193Документ44 страницы04 Harv JLTech 193Ram GoruОценок пока нет