Академический Документы

Профессиональный Документы

Культура Документы

Anti Dumping Duty (Cust) No.23/2015 Dated 27th May, 2015

Загружено:

stephin k jАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Anti Dumping Duty (Cust) No.23/2015 Dated 27th May, 2015

Загружено:

stephin k jАвторское право:

Доступные форматы

TO BE PUBLISHED IN PART II, SECTION 3, SUB-SECTION (i) OF THE GAZETTE OF

INDIA, EXTRAORDINARY]

GOVERNMENT OF INDIA

MINISTRY OF FINANCE

(DEPARTMENT OF REVENUE)

Notification

No. 23/2015-Customs (ADD)

New Delhi, the 27th May, 2015

G.S.R.

(E). Whereas, in the matter of Purified Terephthalic Acid including its

variants- Medium Quality Terephthalic Acid (MTA) and Quality Terephthalic Acid (QTA)

(hereinafter referred to as the subject goods), falling under tariff item 2917 36 00 of the First

Schedule to the Customs Tariff Act, 1975 (51 of 1975) (hereinafter referred to as the Customs

Tariff Act), originating in, or exported from, the Peoples Republic of China, European Union,

Korea RP and Thailand, and imported into India, the designated authority in its preliminary

findings published in the Gazette of India, Extraordinary, Part I, Section 1 vide notification No.

14/7/2013-DGAD, dated the 19th June, 2014, had recommended imposition of provisional antidumping duty on imports of the subject goods, originating in, or exported from, the Peoples

Republic of China, European Union, Korea RP and Thailand and imported into India;

And whereas, on the basis of the aforesaid preliminary findings of the designated

authority, the Central Government had imposed the provisional anti-dumping duty on the subject

goods, originating in, or exported from, the Peoples Republic of China, European Union, Korea RP

and Thailand vide notification of the Government of India, in the Ministry of Finance (Department

of Revenue), No. 36/2014-Customs (ADD), dated the 25th July, 2014, published in Part II, Section

3, Sub-section (i) of the Gazette of India, Extraordinary vide number G.S.R 541(E), dated the 25th

July, 2014;

And whereas, the designated authority in its final findings published in the Gazette of

India, Extraordinary, Part I, Section 1 vide notification No. 14/7/2013-DGAD, dated the 7th April,

2015, has come to the conclusion that(a)

the volume of imports from the Peoples Republic of China and European Union is

below de minimis level, therefore, imports from the Peoples Republic of China

and European Union have been excluded from the purview of the anti-dumping

investigation;

(b)

the investigation is with respect to import of subject goods, originating in or

exported from Korea RP and Thailand (hereinafter referred as the subject

countries) only;

(c)

the subject goods have been exported to India from the subject countries below its

normal value thus resulting in the dumping;

(d)

the domestic industry has suffered material injury due to dumping of the subject

goods from the subject countries;

(e)

the material injury has been caused by the dumped imports from the subject

countries,

and has recommended imposition of the definitive anti-dumping duty on the subject goods,

originating in, or exported from, the subject countries, in order to remove injury to the domestic

industry.

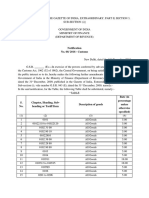

Now, therefore, in exercise of the powers conferred by sub-sections (1) and (5) of

section 9A of the Customs Tariff Act, read with rules 18 and 20 of the Customs Tariff

(Identification, Assessment and Collection of Anti-dumping Duty on Dumped Articles and for

Determination of Injury) Rules, 1995, the Central Government, after considering the aforesaid final

findings of the designated authority, hereby imposes on the subject goods, the description of which

is specified in column (3) of the Table below, falling under tariff item of the First Schedule to the

Customs Tariff Act as specified in the corresponding entry in column (2), originating in the

countries as specified in the corresponding entry in column (4), exported from the countries as

specified in the corresponding entry in column (5), produced by the producers as specified in the

corresponding entry in column (6), exported by the exporters as specified in the corresponding entry

in column (7), and imported into India, an anti-dumping duty at the rate equal to the amount as

specified in the corresponding entry in column (8), in the currency as specified in the corresponding

entry in column (10) and as per unit of measurement as specified in the corresponding entry in

column (9) of the said Table, namely:Table

Sl.

No

Tariff item

Description

of goods

(1)

(2)

(3)

2917 36 00

Country of

origin

Country of

export

(4)

(5)

Purified

Terephthalic

Acid

Korea RP

Korea RP

2917 36 00

Purified

Terephthalic

Acid

Korea RP

Korea RP

2917 36 00

Purified

Terephthalic

Acid

Korea RP

2917 36 00

Purified

Terephthalic

Acid

Korea RP

2917 36 00

Purified

Terephthalic

Acid

Any country

other than

those countries

Producer

Exporter

(6)

Unit Currency

(8)

(9)

(10)

Samsung

C&T

27.32

MT

US

Dollar

Taekwang

Industrial

Co Ltd

23.61

MT

US

Dollar

Korea RP

Any combination other

than Sl.No 1 and 2 above

78.28

MT

Any country

other than

those countries

subject to anti dumping duties

Korea RP

Any

Any

78.28

MT

US

Dollar

Any

Any

78.28

MT

US

Dollar

Samsung

General

Chemical

Co Ltd

Taekwang

Industrial

Co Ltd

(7)

Amount

US

Dollar

subject to anti dumping duties

Thailand

Thailand

Indorama

Petrochem

Ltd

Indorama

Petrochem

Ltd

45.43

MT

US

Dollar

TPT

TPT

Petrochemi Petrochemi

cals Public cals Public

Limited

Limited

Any combination other

than Sl.No 6 and 7 above

45.43

MT

US

Dollar

62.55

MT

US

Dollar

Any

Any

62.55

MT

US

Dollar

Any

Any

62.55

MT

US

Dollar

2917 36 00

Purified

Terephthalic

Acid

2917 36 00

Purified

Terephthalic

Acid

Thailand

Thailand

2917 36 00

Purified

Terephthalic

Acid

Thailand

Thailand

2917 36 00

Purified

Terephthalic

Acid

Thailand

10

2917 36 00

Purified

Terephthalic

Acid

Any country

other than

those countries

subject to anti dumping duties

Any country

other than

those countries

subject to anti dumping duties

Thailand

Note: Purified Terephthalic Acid includes its variants- Medium Quality Terephthalic Acid

(MTA) and Quality Terephthalic Acid (QTA)

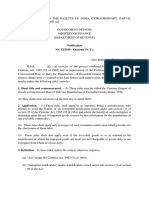

2.

The anti-dumping duty imposed under this notification shall be levied for a period of five

years (unless revoked, amended or superseded earlier) from the date of imposition of the

provisional anti-dumping duty, that is, the 25th July, 2014, and shall be payable in Indian

currency.

Explanation.- For the purposes of this notification, rate of exchange applicable for the purposes

of calculation of such anti-dumping duty shall be the rate which is specified in the notification of

the Government of India, in the Ministry of Finance (Department of Revenue), issued from time to

time, in exercise of the powers conferred by section 14 of the Customs Act, 1962 (52 of 1962), and

the relevant date for the determination of the rate of exchange shall be the date of presentation of

the bill of entry under section 46 of the said Customs Act.

[F.No.354/95/2014-TRU]

(Akshay Joshi)

Under Secretary to the Government of India

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Customs Circular No.04/2015 Dated 9th February, 2016Документ5 страницCustoms Circular No.04/2015 Dated 9th February, 2016stephin k jОценок пока нет

- Customs Circular No.03/2015 Dated 3rd February, 2016Документ4 страницыCustoms Circular No.03/2015 Dated 3rd February, 2016stephin k jОценок пока нет

- Customs Circular No.05/2015 Dated 9th February, 2016Документ21 страницаCustoms Circular No.05/2015 Dated 9th February, 2016stephin k jОценок пока нет

- Customs Circular No. 27/2015 Dated 23rd October, 2015Документ13 страницCustoms Circular No. 27/2015 Dated 23rd October, 2015stephin k jОценок пока нет

- Customs Circular No. 28/2015 Dated 23rd October, 2015Документ3 страницыCustoms Circular No. 28/2015 Dated 23rd October, 2015stephin k jОценок пока нет

- Customs Circular No. 18/2015 Dated 9th Jun, 2015Документ2 страницыCustoms Circular No. 18/2015 Dated 9th Jun, 2015stephin k jОценок пока нет

- Customs Circular No. 25/2015 Dated 15th October, 2015Документ10 страницCustoms Circular No. 25/2015 Dated 15th October, 2015stephin k jОценок пока нет

- Customs Tariff Notifications No.66/2016 Dated 31st December, 2016Документ26 страницCustoms Tariff Notifications No.66/2016 Dated 31st December, 2016stephin k jОценок пока нет

- Customs Tariff Notifications No.67/2016 Dated 31st December, 2016Документ34 страницыCustoms Tariff Notifications No.67/2016 Dated 31st December, 2016stephin k j100% (2)

- Customs Circular No. 20/2015 Dated 31st July 2015Документ15 страницCustoms Circular No. 20/2015 Dated 31st July 2015stephin k jОценок пока нет

- Customs Tariff Notifications No.64/2016 Dated 31st December, 2016Документ22 страницыCustoms Tariff Notifications No.64/2016 Dated 31st December, 2016stephin k jОценок пока нет

- Customs Tariff Notifications No.37/2014 Dated 29th December, 2014Документ60 страницCustoms Tariff Notifications No.37/2014 Dated 29th December, 2014stephin k jОценок пока нет

- DGFT Public Notice No.64/2015-2020 Dated 17th March, 2015Документ3 страницыDGFT Public Notice No.64/2015-2020 Dated 17th March, 2015stephin k jОценок пока нет

- DGFT Public Notice No.10/2015-2020 Dated 18th May, 2016Документ1 страницаDGFT Public Notice No.10/2015-2020 Dated 18th May, 2016stephin k jОценок пока нет

- Customs Tariff Notifications No.63/2016 Dated 31st December, 2016Документ38 страницCustoms Tariff Notifications No.63/2016 Dated 31st December, 2016stephin k jОценок пока нет

- Customs Non Tariff Notifications No.32/2016 Dated 1st March, 2016Документ5 страницCustoms Non Tariff Notifications No.32/2016 Dated 1st March, 2016stephin k jОценок пока нет

- Customs Non Tariff Notifications No.11/2016 Dated 12th January, 2016Документ3 страницыCustoms Non Tariff Notifications No.11/2016 Dated 12th January, 2016stephin k jОценок пока нет

- DGFT Public Notice No.08/2015-2020 Dated 6th May, 2016Документ15 страницDGFT Public Notice No.08/2015-2020 Dated 6th May, 2016stephin k jОценок пока нет

- VP Director HR Talent Management in San Francisco Bay CA Resume Shirley BraunДокумент3 страницыVP Director HR Talent Management in San Francisco Bay CA Resume Shirley BraunShirleyBraunОценок пока нет

- ESSA KadunaДокумент178 страницESSA KadunaBaba BanoОценок пока нет

- Introduction To Financial Accounting 1a NotesДокумент52 страницыIntroduction To Financial Accounting 1a NotesNever DoviОценок пока нет

- APY 3202 PrelimAssignment2Документ3 страницыAPY 3202 PrelimAssignment2JOANAFELIZ ROXASОценок пока нет

- Clow Imc8 Inppt 08Документ46 страницClow Imc8 Inppt 08Manar AmrОценок пока нет

- Course Outline - Principles of Marketing BcomДокумент4 страницыCourse Outline - Principles of Marketing Bcomwairimuesther506Оценок пока нет

- Finnish Government and Its Civil ServiceДокумент4 страницыFinnish Government and Its Civil ServiceShurel Marl BuluranОценок пока нет

- Lecture 3 - Introduction To International Business TradeДокумент13 страницLecture 3 - Introduction To International Business TradeCAMELLEОценок пока нет

- A Critic Le Analysis of AppleДокумент14 страницA Critic Le Analysis of Applesabishi2312Оценок пока нет

- Bay' Al-TawarruqДокумент12 страницBay' Al-TawarruqMahyuddin Khalid67% (3)

- 6 CHДокумент27 страниц6 CHjafariОценок пока нет

- ENTREPRENEURSHIP Module IVДокумент9 страницENTREPRENEURSHIP Module IVElaine RiotocОценок пока нет

- Compensation 5Документ10 страницCompensation 5Pillos Jr., ElimarОценок пока нет

- Banking Law Honors PaperДокумент4 страницыBanking Law Honors PaperDudheshwar SinghОценок пока нет

- Philippines National Bank vs. Erlando T. RodriguezДокумент2 страницыPhilippines National Bank vs. Erlando T. RodriguezKen MarcaidaОценок пока нет

- Tourist Attraction and The Uniqueness of Resources On Tourist Destination in West Java, IndonesiaДокумент17 страницTourist Attraction and The Uniqueness of Resources On Tourist Destination in West Java, IndonesiaAina ZainuddinОценок пока нет

- 08641IBM Institute For Business ValueДокумент10 страниц08641IBM Institute For Business ValueanashussainОценок пока нет

- Equity Research AssignmentДокумент3 страницыEquity Research Assignment201812099 imtnagОценок пока нет

- Computer Science AICTEДокумент2 страницыComputer Science AICTEchirag suresh chiruОценок пока нет

- Lecture 6 and 7 Project Finance Model 1Документ61 страницаLecture 6 and 7 Project Finance Model 1w_fibОценок пока нет

- Chapter 5 - Asset ValuationДокумент4 страницыChapter 5 - Asset ValuationSteffany RoqueОценок пока нет

- Kritika AbstractДокумент3 страницыKritika AbstractKritika SinghОценок пока нет

- Finweek English Edition - March 7 2019Документ48 страницFinweek English Edition - March 7 2019fun timeОценок пока нет

- Quiz 7Документ38 страницQuiz 7nikhil gangwarОценок пока нет

- Agnes Hanson's ResumeДокумент1 страницаAgnes Hanson's ResumeAgnes HansonОценок пока нет

- Tck-In Day 9Документ3 страницыTck-In Day 9Julieth RiañoОценок пока нет

- Money & Banking - MGT411 Handouts PDFДокумент149 страницMoney & Banking - MGT411 Handouts PDFnesa100% (1)

- AutogptДокумент3 страницыAutogptKelvin ChenОценок пока нет

- Gilaninia and MousavianДокумент9 страницGilaninia and Mousavianpradeep110Оценок пока нет

- Time Value of Money: Present and Future ValueДокумент29 страницTime Value of Money: Present and Future ValuekateОценок пока нет