Академический Документы

Профессиональный Документы

Культура Документы

Freeborn Brent Fields Letter. Regarding SEC Proposed Rule 147 Changespdf

Загружено:

CrowdfundInsiderАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Freeborn Brent Fields Letter. Regarding SEC Proposed Rule 147 Changespdf

Загружено:

CrowdfundInsiderАвторское право:

Доступные форматы

ANTHONY J.

ZEOLI

Partner

~~

~~~~

f ~,,

Freeborn &Peters LLP

Attorneys at Law

311 South Wacker Drive

Suite 3000

Chicago, IL 60606

(312) 360-6798 direct

(312)360-6520 fax

azeoli@freeborn.com

www.freeborn.com

November 5,2015

Brent J. Fields

Secretary

Securities and Exchange Commission

100 F Street, N.E.

Washington, DC 20549-1090

Re:

File Number 57-22-15 Initial Comments

Dear Mr. Fields,

I would like to preface this letter by saying that, in my opinion, the Securities and

Exchange Commission (SEC) has done an excellent job in drafting rational proposals to help

modernize the outdated Rule 147 and Rule 504 in order to further the use of intrastate and

regional securities offerings. The majority of the SEC's proposals, once finalized, will go a long

way toward easing the regulatory burdens and hoop jumping that has traditionally plagued these

types of offerings. In an effort to help the SEC improve and finalize its proposed amendments I

fully intend to respond to several of the SEC's specific requests for comments, in detail, in the

near future. That being said, there is one matter that I believe warrants immediate attention

which is the reason for my writing to you today. That matter at issue is the SEC's proposal to

make Rule 147 function as a separate exemption from registration under the Securities Act of

1933 (the "Act")rather than as a "safe harbor" under Section 3(a)(11) ofthe Act.

As stated, in one form or another, multiple times through the SEC's proposal, the

"proposed amendments to Rule 147 are intended, in paNt, to facilitate the use of state-based

c~owdfunding statutes."1 However, if the SEC amends Rule 147 such that it will operate as a

separate exemption rather than as a "safe harbor" under Section 3(a)(11), the proposed revisions

will have little to no positive effect on the number of offerings conducted under existing (and

pending) state-based crowdfunding statutes.2 In reality, if Rule 147 and Section 3(a)(11) are

treated separately, Issuers would not be able to avail themselves ofthe more permissive Rule 147

provisions the SEC is proposing and still be in compliance with the state-based crowdfunding

1 File Number 57-22-15; Pg. 14, Footnote 32.

2 In fact, it will most likely serve to decrease the number of offerings conducted under these state-based crowdfunding statutes as

discussed below.

3424064v5/30634-0001

Securities and Exchange Commission

Brent J. Fields, Secretary

November 5, 2p15

Page 2

~ ~

~~

FREEBORN &PETERS LLP

statutes;3 at least not in their current form. As a result, by making Rule 147 a separate exemption

the SEC would effectively make all of the other amendments to Rule 147 moot for Issuers in

almost all of the states that permit state-based crowdfunding.

The problem, as the SEC correctly summarized in its proposal, is that almost all of the

current and proposed state-based crowdfunding statutes specifically require compliance with

Section 3(a)(11) of the Act4 which. is much more restrictive than the proposed amended Rule

147. As you know, Section 3(a)(11) specifically .requires that both the offer and sale of securities

sold in reliance of this section be made only to residents of the same state or territory in which

the issuer is resident and doing business.s The "offer" portion of Section 3(a)(11) is the issue.

Rule 147, as proposed to be amended, would allow an Issuer "to engage in general solicitation

and general advertising that could reach out-of-state residents."6 As the SEC correctly noted,

this proposed type of general solicitation "would no longerfall within the statutory parameters of

Section 3(a)(11)."~ As a result, assuming Rule 147 is amended to function as a separate

exemption and not a "safe harbor," Issuers in states with state-based crowdfunding statutes that

specifically require compliance with Section 3(a)(11) would not be able to take advantage of the

more expansive general solicitation provisions the SEC is proposing and still stay in compliance

with state law. Put another way, if an Issuer engages in the types of general solicitation the SEC

is proposing, the Issuer would most likely be in violation of Section 3(a)(11) of the Act, and

hence not be in compliance with the applicable state-based crowdfunding statute.

The SEC adeptly picked up on this issue in its proposal but dismissed it way too quickly

by suggesting that existing state-based crowdfunding statutes would simply need to be amended.

As noted stated:

"We recognize that none of the existing state crowdfunding provisions

contemplate reliance upon the pNOposed amendments to Rule 147 and that states

that have crowdfunding provisions based on compliance with Section 3(a)(I1), or

compliance with both Section 3(a)(I1) and Rule 147, would need to amend these

provisions in orderfor issuers to takefull advantage ofthese amendments."8

~ Other than the state-based crowdfunding statutes of Maine and Mississippi which do not require Compliance with Section

3(a)(11).

4 Other than the state-based crowdfunding statutes of Maine and Mississippi which do not require compliance with Section

3(a)(11).

S Section 3(a)(l 1) of the Act provides an exemption from registration for "Any security which is a part ofan issue offered and

sold only to persons resident within a single State or Territory, where the issuer ofsuch security is a person resident and doing

business within or, ifa corporation, incorporated by and doing business within, such State or Territory."

6 File Number S7-22-15; Pg. 16.

Fi(e Number 57-22-I5; Pg. 13.

$ File Number 57-22-15; Pg. 53.

-2-

Securities and Exchange Commission

Brent J. Fields, Secretary

November 5, 2015

Page 3

FREEBORN &PETERS LLP

Certainly amending each of the twenty-seven (27) currently existing state-based crowdfunding

statutes which specifically require compliance with Section 3(a)(11), 9 as well as each of the

eight (8) currently proposed state-based crowdfunding statutes (each of which specifically

require compliance with Section 3(a)(11)),10 would alleviate the above issue. However, I am

certain that the SEC would agree that such a task would be an extremely time cozlsuming and

arduous process, if it could even be accomplished at all.

As the author and initial proponent of the Illinois state-based crowdfunding statute I can

tell you from personal experience that it has taken almost two (2) years of non-stop effort on the

part of myself and multiple other supporters to het the initial Illinois' crowdfunding statutes

approved and effective.l ~ Further, from my discussions with those in similar positions in other

states, it is my understanding is that process is just as onerous, if not worse, in other states.

Fence any amendment to the existing or proposed state-based crowdfunding statutes will take a

monumental amount of effort and time. Neither of which I believe is warranted or necessary

given the fact that the SEC has the power to alleviate the need for any such amendments simply

by keeping the proposed amended Rule 147 as a "safe harbor" under the Section 3(a)(11) and not

making it a separate exemption.

Not only would keeping the proposed amended Rule 147 as a "safe harbor" under Section

3(a)(11) alleviate the need for state level amendments and be consistent with the stated purpose

of the proposed amendments,12 it would clearly be consistent with the existing opinions and

guidance issued by legislators and the SEC to date. As touched on in the SEC's proposal, while

the language of Section 3(a)(11) specifically limits offers and sales to in-state residents,

legislative history and subsequent guidance has clearly taken a broader view as to permissible

advertising of offerings. In particular, as noted in the SEG's proposal:

"When Congress enacted Section 3(a)(11) in 1934, the legislative history stated,

among other things, that "a person who comes within the purpose of the

exemption, but happens to use a newspaperfog the circulation of his advertising

literature, which newspaper is transmitted in interstate commeNCe, does not

thereby lose the benefits of the exemption." Consistent with this statement, the

Commission in 1.937 released staffguidance on the nature ofthe Section 3(a)(11)

exemption in theform ofa letterfrom the Commission's General Counsel. In this

letter, the General Counsel stated that, "the so-called `intrastate exemption' is

not in any way dependent upon absence of use of the mails or instruments of

transportation or communication in interstate commerce in the distribution."

Rather, the letter explained that, so long as all the statutory requirements of the

~ Being: AL, AZ, CU, DC, FL, GA, ID, IL, IN, IA, KS, KY, MD, MA, MI, MN, MT, NJ, NE, QR, SC, 1'N, TX, VT, VA, WA

and WI; See http//crowdfundin~le~;alhub com/2015/01/16/state-of=the-states-compariative-summaries-ofcurrent-active-andproposed-intr~st~ie-crowdfund ink-exemptions/

10 Being: AK, HI, MO,NV,NH,NM,NC and WV;See httpUcrowdfundin~legalhub.com/2015101/16/state-of-the-statescompariative-summaries-o~fcurrent-active-and-proposed-intrastate-crowdfundin -e~ xemptions/

~~ Illinois' state-based crowdfunding statute will be effective January 1, 2016.

'Z See Note 1 above.

-3-

Securities and Exchange Commission

Brent J. Fields, Secretary

November 5, 2015

Page 4

FREEBORN &PETERS LLP

exemption are satisfied, such securities may be offered and sold through the mails

and may even be delivered in interstate commerce to purchasers, if such

purchasers, though resident, are temporarily out of the state. In this context, the

letter further noted that securities exemptfrom registration pursuant to Section

3(a)(11) "may be made the subject ofgeneral newspaper advertisement.(provided

the advertisement is appropriately limited to indicate that offers to puNChase are

solicited only from, and sales will be made only to, residents of the particular

'

state involved)."13

It is clear from the above that the legislators and the SEC intended to broaden the

interpretation of Section 3(a)(11) to allow for the use of general advertising materials, which

could potentially reach out-of-state residents, so long as the proper restrictive legends were

included in the advertising materials.14 If you replace the use of "general newspaper

ac~vertisement" in the above with the use of social media (or similar outlets) to account for the

realities of today's Internet based society, it sounds an awful lot like what the SEC is currently

proposing with the amended Rule 147.15 This view is further supported by the recent Compliance

and Disclosure Interpretations("C&Dis")released by the SEC which significantly expanded the

permitted use of the Internet to advertise offerings under the existing Rule 147.16 Given the

SEC's increasingly permissive view toward the use of general advertising/solicitation in

promoting offerings under the existing Rule 147, simply expanding- Rule 147 (as proposed) as a

"safe harbor" rather than as a separate exception would be entirely consistent with the SEC's

current treatment of Section 3(a)(11).

At the heart of the SEC's proposed amendments appears to be a desire to significantly

expand the viability and use of intrastate and regional securities offerings. While I fully support

this endeavor, the SEC's proposal to make Rule 147 function as a separate exemption rather than

a "safe harbor" under Section 3(a)(11) of the Act would have the absolute opposite effect.

Creating what, for most state based Issuers, would essentially be an illusory permitted use of

expanded general solicitation methodsl~ would only lead to further confusion regarding the use

13 File Number 57-22-I5; Pg. IS-16.

14 i,e. restrictive legends making providing that the offering is limited only to residents of the relevant state under applicable law.

15 See Note 5 above.

~~ See C&Dts 141.03; 141.04 and 141.05.

"The proposed expanded general solicitation provisions of Rule 147 would be illusory for 2 reasons. First, as stated, Issuers

of

Act

acting under most existing and proposed state-based crowdfunding statutes would need to satisfy Section 3(a)(11) the

under

amended

proposed

solicitation

general

which, without further amendment or safe harbor, would not permit the types of

proposal

Rule 147. Hence, Issuers would not be able to avail themselves of the benefits of the amended Rule 147. Second, the

the

specifically (ire pertinent part) "limit(s] the availability of Rule 147, as proposed to be amended, to issuers that ... conduct

sell

issuer

may

an

securities

of

amount

the

limits

state

that

such

in

law

registration

offering pursuant to an exemptionfrom state

an

pursuant to such exerreption to no more than $S million in a twelve-month period and that limits the amount of securities

and

existing

the

are

criteria

forgoing

the

meet

currently

that

investor can purchase in any sz~ch offering." The only provisions

to Issuers

proposed state-based crowdfunding statutes. Accordingly, use of the amended Rule 147 rules would be limited

problem

conducting an offering under astate-based crowdfunding statute. Incorporating this issue with point one and you get a

be

would

rules

147

Rule

amended

of

proposed

the

avail

themselves

to

be

currently

able

loop where the only Issuers who would

1)).

Issuers in Maine and Mississippi (i.e. as the only two(2) states currently not requiring compliance with Section 3(a)(I

~~

Securities and Exchange Commission

Brent J. Fields, Secretary

November 5, 2015

~~

Page 5

FREEBORN &PETERS LLP

of, and the increased reluctance by Issuers to use, state-based crowdfunding statutes; the exact

pppasite result that the SEC's proposed amendments are intending to achieve.

For the above reasons, and on behalf of small and emerging businesses through the

United States as well as all of the people who have worked tirelessly to get the enacted and

proposed state-based crowdfunding statutes to the point where they are today, I implore the SEC

to amend its proposal to specifically expand Rule 147 as a "safe harbor" under Section 3(a)(11)

of the Act and not as a separate exception. The awareness and use of state-based crowdfunding

exemptions has been slow enough to catch on as it is.18 Any required amendment of enacted or

proposed state-based crpwdfunding statutes would only serve to slow, if not completely

eliminate, the progress made to date in the use ofthese statutes. A result the SEC clearly does not

want to see happen. This adverse result can be easily avoided however by not making the

amended Rule 147 as a separate exception so again I strongly urge the SEC to revise its stated

position on this issue.

Should you require additional information or wish to discuss this matter in further detail

please feel-free to contact me at(312) 360-6798.

Very truly yours,

Anthony J. Zeoli

(312)360-6798

azeol i(a),fieeborn.com

AJZ

18 See File Number 57-22-I5; Pg. 152: 106 state crowdfunding offerings to date, with 91 offerings approved or cleared as of June

2015.

-$-

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Cooperation Agreement Asic CSSF 4 OctoberДокумент6 страницCooperation Agreement Asic CSSF 4 OctoberCrowdfundInsiderОценок пока нет

- 2020 Queens Awards Enterprise Press BookДокумент126 страниц2020 Queens Awards Enterprise Press BookCrowdfundInsiderОценок пока нет

- UK Cryptoassets Taskforce Final Report Final WebДокумент58 страницUK Cryptoassets Taskforce Final Report Final WebCrowdfundInsiderОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Monzo Annual Report 2019Документ92 страницыMonzo Annual Report 2019CrowdfundInsider100% (2)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- House of Commons Treasury Committee Crypto AssetsДокумент53 страницыHouse of Commons Treasury Committee Crypto AssetsCrowdfundInsider100% (1)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- 2020 Queens Awards Enterprise Press BookДокумент126 страниц2020 Queens Awards Enterprise Press BookCrowdfundInsiderОценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Bank of Canada Staff Working Paper :document de Travail Du Personnel 2018 - 34 Incentive Compatibility On The Blockchainswp2018-34Документ19 страницBank of Canada Staff Working Paper :document de Travail Du Personnel 2018 - 34 Incentive Compatibility On The Blockchainswp2018-34CrowdfundInsiderОценок пока нет

- OCC Fintech Charter Manual: Considering-charter-Applications-fintechДокумент20 страницOCC Fintech Charter Manual: Considering-charter-Applications-fintechCrowdfundInsiderОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Annual Report and Consolidated Financial Statements For The Year Ended 31 March 2018Документ47 страницAnnual Report and Consolidated Financial Statements For The Year Ended 31 March 2018CrowdfundInsiderОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Token Alliance Whitepaper WEB FINALДокумент108 страницToken Alliance Whitepaper WEB FINALCrowdfundInsiderОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- A Financial System That Creates Economic Opportunities Nonbank Financi...Документ222 страницыA Financial System That Creates Economic Opportunities Nonbank Financi...CrowdfundInsiderОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Cryptocurrencies and The Economics of Money - Speech by Hyun Song Shin Economic Adviser and Head of Research BISДокумент5 страницCryptocurrencies and The Economics of Money - Speech by Hyun Song Shin Economic Adviser and Head of Research BISCrowdfundInsiderОценок пока нет

- Annual Report and Consolidated Financial Statements For The Year Ended 31 March 2018Документ47 страницAnnual Report and Consolidated Financial Statements For The Year Ended 31 March 2018CrowdfundInsiderОценок пока нет

- Crowdcube 2018 Q2 Shareholder Update 2Документ11 страницCrowdcube 2018 Q2 Shareholder Update 2CrowdfundInsiderОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- EBA Report On Prudential Risks and Opportunities Arising For Institutions From FintechДокумент56 страницEBA Report On Prudential Risks and Opportunities Arising For Institutions From FintechCrowdfundInsiderОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Bitcoin Foundation Letter To Congressman Cleaver 5.1.18Документ7 страницBitcoin Foundation Letter To Congressman Cleaver 5.1.18CrowdfundInsiderОценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Speech by Dr. Veerathai Santiprabhob Governor of The Bank of Thailand July 2018Документ6 страницSpeech by Dr. Veerathai Santiprabhob Governor of The Bank of Thailand July 2018CrowdfundInsiderОценок пока нет

- AlliedCrowds Cryptocurrency in Emerging Markets DirectoryДокумент20 страницAlliedCrowds Cryptocurrency in Emerging Markets DirectoryCrowdfundInsiderОценок пока нет

- HR 5877 The Main Street Growth ActДокумент10 страницHR 5877 The Main Street Growth ActCrowdfundInsiderОценок пока нет

- Mueller Indictment of 12 Russian HackersДокумент29 страницMueller Indictment of 12 Russian HackersShane Vander HartОценок пока нет

- Virtual Currencies and Central Bans Monetary Policy - Challenges Ahead - European Parliament July 2018Документ33 страницыVirtual Currencies and Central Bans Monetary Policy - Challenges Ahead - European Parliament July 2018CrowdfundInsiderОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Ontario Securities Commissionn Inv Research 20180628 Taking-Caution-ReportДокумент28 страницOntario Securities Commissionn Inv Research 20180628 Taking-Caution-ReportCrowdfundInsiderОценок пока нет

- Initial Coin Offerings Report PWC Crypto Valley June 2018Документ11 страницInitial Coin Offerings Report PWC Crypto Valley June 2018CrowdfundInsiderОценок пока нет

- Let Entrepreneurs Raise Capital Using Finders and Private Placement Brokers by David R. BurtonДокумент6 страницLet Entrepreneurs Raise Capital Using Finders and Private Placement Brokers by David R. BurtonCrowdfundInsiderОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- FINRA Regulatory-Notice-18-20 Regarding Digital AssetsДокумент4 страницыFINRA Regulatory-Notice-18-20 Regarding Digital AssetsCrowdfundInsiderОценок пока нет

- Funding Circle Oxford Economics Jobs Impact Report 2018Документ68 страницFunding Circle Oxford Economics Jobs Impact Report 2018CrowdfundInsiderОценок пока нет

- Robert Novy Deputy Assistant Director Office of Investigations United States Secret Service Prepared Testimony Before the United States House of Representatives Committee on Financial Services Subcommittee on Terrorism and Illicit FinanceДокумент7 страницRobert Novy Deputy Assistant Director Office of Investigations United States Secret Service Prepared Testimony Before the United States House of Representatives Committee on Financial Services Subcommittee on Terrorism and Illicit FinanceCrowdfundInsiderОценок пока нет

- Bill - 115 S 2756Документ7 страницBill - 115 S 2756CrowdfundInsiderОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (120)

- Testimony On "Oversight of The U.S. Securities and Exchange Commission" by Jay Clayton Chairman, U.S. Securities and Exchange Commission Before The Committee On Financial Services June 21 2018Документ25 страницTestimony On "Oversight of The U.S. Securities and Exchange Commission" by Jay Clayton Chairman, U.S. Securities and Exchange Commission Before The Committee On Financial Services June 21 2018CrowdfundInsiderОценок пока нет

- The OTCQX Advantage - Benefits For International CompaniesДокумент20 страницThe OTCQX Advantage - Benefits For International CompaniesCrowdfundInsiderОценок пока нет

- Role of Defense Counsel Under CRPCДокумент15 страницRole of Defense Counsel Under CRPCarmaan100% (2)

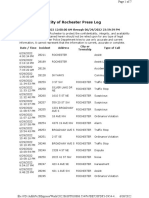

- RPD Daily Incident Report 6/29/22Документ7 страницRPD Daily Incident Report 6/29/22inforumdocsОценок пока нет

- Handbook On International Law and TerrorismДокумент17 страницHandbook On International Law and Terrorismjaseme7579Оценок пока нет

- Digital Banking FraudДокумент23 страницыDigital Banking FraudRavindra Vemuri100% (1)

- Special Penal Laws, An OverviewДокумент49 страницSpecial Penal Laws, An OverviewangelikaromanОценок пока нет

- Maruna and Mann 2006Документ23 страницыMaruna and Mann 2006stephanieОценок пока нет

- Nightbane - Survival GuideДокумент162 страницыNightbane - Survival GuideFaz Maldov100% (3)

- Schindlers ReadingsДокумент21 страницаSchindlers Readingsapi-256056875Оценок пока нет

- Wray Complaint Against HeimsnessДокумент60 страницWray Complaint Against HeimsnessGreg GelembiukОценок пока нет

- Santos V PNOCДокумент2 страницыSantos V PNOCManila LoststudentОценок пока нет

- Bba1597057103 1 PDFДокумент89 страницBba1597057103 1 PDFNANDINI RAJ N RОценок пока нет

- R V Wilson (Alan Thomas)Документ4 страницыR V Wilson (Alan Thomas)Alicia Tan0% (1)

- ESTATE of Ong V Minor DiazДокумент4 страницыESTATE of Ong V Minor DiazElah ViktoriaОценок пока нет

- Beverly BrabhamДокумент24 страницыBeverly BrabhamLee GaylordОценок пока нет

- Dishonour of Cheque - Complaint by Power of Attorney HolderДокумент2 страницыDishonour of Cheque - Complaint by Power of Attorney HolderPrasadОценок пока нет

- Carl Odell Echard v. Jerry C. Hedrick Charles Brown, Attorney General For The State of West Virginia, 902 F.2d 28, 4th Cir. (1990)Документ8 страницCarl Odell Echard v. Jerry C. Hedrick Charles Brown, Attorney General For The State of West Virginia, 902 F.2d 28, 4th Cir. (1990)Scribd Government DocsОценок пока нет

- Am 1994Документ353 страницыAm 1994Bogdan MarcuОценок пока нет

- Defences in International Criminal LawДокумент44 страницыDefences in International Criminal Lawnailawe0% (1)

- Aismun 2020 - Un Women Committee GuideДокумент29 страницAismun 2020 - Un Women Committee GuideLauraОценок пока нет

- The Rise of The Dark Knight Workplace VigilanteДокумент4 страницыThe Rise of The Dark Knight Workplace Vigilantesantosrodriguez1971Оценок пока нет

- On DepositsДокумент48 страницOn DepositsSusan Sabilala MangallenoОценок пока нет

- MurderДокумент2 страницыMurderAngelica FielОценок пока нет

- Douglas M. Ostling Act: Financial RealitiesДокумент6 страницDouglas M. Ostling Act: Financial Realitiesxeileen08Оценок пока нет

- English Editorials 15-12-2023Документ34 страницыEnglish Editorials 15-12-2023seyed18400Оценок пока нет

- Jurisprudence (Murder)Документ15 страницJurisprudence (Murder)Mary Lorie BereberОценок пока нет

- Judicial Complaint Judge J Anthony Miller Statement of FactsДокумент23 страницыJudicial Complaint Judge J Anthony Miller Statement of Factsmikekvolpe100% (1)

- Criminal Justie System in TanzaniaДокумент6 страницCriminal Justie System in TanzaniaKessyEmmanuelОценок пока нет

- Countries With Legal IncestДокумент12 страницCountries With Legal IncestMichelle Marie Tablizo100% (1)

- PEOPLE OF THE PHILIPPINES vs. Hon. Judge Nitafan G.R. Nos. 81559-60, 1992 Ponente: Gutierrez, JR., J FactsДокумент1 страницаPEOPLE OF THE PHILIPPINES vs. Hon. Judge Nitafan G.R. Nos. 81559-60, 1992 Ponente: Gutierrez, JR., J Factsthirdy demaisipОценок пока нет

- Police DevianceДокумент17 страницPolice DevianceDurgesh 136Оценок пока нет

- Scalping is Fun! 3: Part 3: How Do I Rate my Trading Results?От EverandScalping is Fun! 3: Part 3: How Do I Rate my Trading Results?Рейтинг: 3.5 из 5 звезд3.5/5 (18)

- Systematic Trading: A unique new method for designing trading and investing systemsОт EverandSystematic Trading: A unique new method for designing trading and investing systemsРейтинг: 3.5 из 5 звезд3.5/5 (12)

- How to Trade a Range: Trade the Most Interesting Market in the WorldОт EverandHow to Trade a Range: Trade the Most Interesting Market in the WorldРейтинг: 4 из 5 звезд4/5 (5)

- Stock Market 101: From Bull and Bear Markets to Dividends, Shares, and Margins—Your Essential Guide to the Stock MarketОт EverandStock Market 101: From Bull and Bear Markets to Dividends, Shares, and Margins—Your Essential Guide to the Stock MarketРейтинг: 4 из 5 звезд4/5 (26)

- Trade Like a Stock Market Wizard: How to Achieve Super Performance in Stocks in Any MarketОт EverandTrade Like a Stock Market Wizard: How to Achieve Super Performance in Stocks in Any MarketРейтинг: 5 из 5 звезд5/5 (52)

- Investing 101: From Stocks and Bonds to ETFs and IPOs, an Essential Primer on Building a Profitable PortfolioОт EverandInvesting 101: From Stocks and Bonds to ETFs and IPOs, an Essential Primer on Building a Profitable PortfolioРейтинг: 4.5 из 5 звезд4.5/5 (38)

- A Beginner's Guide To Day Trading Online 2nd EditionОт EverandA Beginner's Guide To Day Trading Online 2nd EditionРейтинг: 3.5 из 5 звезд3.5/5 (12)

- Laughing at Wall Street: How I Beat the Pros at Investing (by Reading Tabloids, Shopping at the Mall, and Connecting on Facebook) and How You Can, TooОт EverandLaughing at Wall Street: How I Beat the Pros at Investing (by Reading Tabloids, Shopping at the Mall, and Connecting on Facebook) and How You Can, TooРейтинг: 4 из 5 звезд4/5 (14)