Академический Документы

Профессиональный Документы

Культура Документы

Clarifies Excise Duty Exemption on Pipes for Water Supply Projects

Загружено:

Chungath LineshОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Clarifies Excise Duty Exemption on Pipes for Water Supply Projects

Загружено:

Chungath LineshАвторское право:

Доступные форматы

3/7/2015

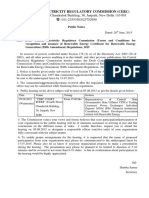

CircularNo.945/6/2011CX,dated16052011

CircularNo.945/6/2011CX

F.No.354/34/2008TRU

GovernmentofIndia

MinistryofFinance

DepartmentofRevenue

TaxResearchUnit

NewDelhi,datedthe16thMay,2011

To

TheDirectorGeneral(All)

TheChiefCommissionersofCentralExcise(All)

TheChiefCommissionersofCentralExciseandCustoms(All)

Sir/Madam,

Subject: Benefit of Central Excise duty exemption on pipes against S. No. 7 in column

(3) of the Notification No. 6/2006 (CE) dated 103/06 as further amended vide No. 6/2007

dated1307&26/2009dated4/12/09.

Kind attention is invited to the Sr. No.7 of the notification No. 6/2006 C.E dated

1.3.2006asamendedtimetotime,providingfullexemptionfromexcisedutywhichiscurrently

availableto

(1)allitemsofmachinery,includinginstruments,apparatusandappliances,auxiliaryequipment

andtheircomponents/partsrequiredforsettingupofwatertreatmentplants

(2)Pipesandpipefittingsneededfordeliveryofwaterfromitssourcetotheplant(includingthe

cleartreatedwaterreservoir,ifany,thereof),andfromtheretothefirststoragepoint

(3)Pipesandpipefittingsofouterdiameterexceeding10cmwhensuchpipesareintegralpart

ofwatersupplyprojects.

2Thescopeofthisexemption,asprovidedintheentries(1)and(2)ofthisnotificationwas

delineated in the CBEC circular 659/50/2002CX dated 06Sep2002. It clearly indicated that

the exemption is limited to pipes needed for delivery of water from its source to the water

treatmentplantandfromtheretothefirststoragepointandthatthedutyconcessionwasnot

available for pipes required to supply the treated water from its storage place to the place of

consumption. This was the correct reflection of the scope as it existed at the relevant time.

However, the scope of this notification was widened by inserting entry (3) to this notification

thereby extending the benefit of excise duty exemption also to the pipes of outer diameter

exceeding 20 cm when such pipes are integral part of water supply projects by amendment

videNotificationNo.6/2007dated1307andsubsequentlyvideNotificationNo.26/2009dated

41209,theouterdiameterexceeding10cmwasprescribedforexemption.

3. Doubts have been raised as to whether the exemption pertaining to pipes of outer

diameter exceeding 10 cm applies only to pipes required for the delivery of water from its

sourcetotheplantandfromtheretothefirststoragepointorwhetheritincludespipesrequired

forthedistributionnetworkalso.

4. The matter has been examined. The amendments made to the notification w. e. f

01.03.2007 were in view of the policy objective of providing potable water for domestic use.

The purpose of the insertion of subentry (3) w. e. f. 1.3.2007 was to obviate disputes about

thescopeofthetermfirststoragepointwhichshiftsdependingonthelayoutandthenature

oftheprojectandtoreplaceitwiththemoreobjectivecriterionofpipediameter.Subsequently

thediameterspecificationwasreducedfrom20cmto10cm.Theonlyqualificationprescribedin

http://www.cbec.gov.in/excise/cxcirculars/cxcirculars11/9452k11cx.htm

1/2

3/7/2015

CircularNo.945/6/2011CX,dated16052011

subentry(3)isthatthepipesshouldformanintegralpartofthewatersupplyproject.Assuch,

post1.3.2007,thebenefitofthisexemptionisavailabletopipesofouterdiameter20cm(10cm

w. e. f 4.12.2009) even if they are used in the distribution network beyond the first storage

point.However,thebenefitisconfinedtothepipesthatformapartoftheproject.Thus,pipes

whichareusedatthelastmiletoprovidetheconsumerconnectionwhosecostiseitherpaid

bytheconsumerorrecoveredfromhimdonotformpartoftheprojectandwillnotbeeligible

fortheexemption.

5.Trade&industryaswellasfieldformationsmaypleasebeinformedsuitably.

6.Receiptofthiscircularmaypleasebeacknowledged.

YoursFaithfully

(YogendraGarg)

Director

TaxResearchUnit

http://www.cbec.gov.in/excise/cxcirculars/cxcirculars11/9452k11cx.htm

2/2

Вам также может понравиться

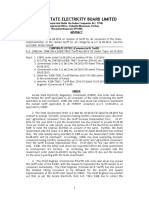

- Design of Electrical Power Supply for Oil and Gas RefineryДокумент70 страницDesign of Electrical Power Supply for Oil and Gas Refinerydaniel_silabanОценок пока нет

- Continuing Disclosure Quarterly Report Providence Q2 2023Документ37 страницContinuing Disclosure Quarterly Report Providence Q2 2023Andrew CassОценок пока нет

- Applied Drilling Circulation Systems: Hydraulics, Calculations and ModelsОт EverandApplied Drilling Circulation Systems: Hydraulics, Calculations and ModelsРейтинг: 5 из 5 звезд5/5 (4)

- Business Intelligence ToolsДокумент7 страницBusiness Intelligence ToolsShiva RokaОценок пока нет

- Infiltration Gallery GuidelinesДокумент34 страницыInfiltration Gallery GuidelinesChungath LineshОценок пока нет

- Damages on Pumps and Systems: The Handbook for the Operation of Centrifugal PumpsОт EverandDamages on Pumps and Systems: The Handbook for the Operation of Centrifugal PumpsРейтинг: 4.5 из 5 звезд4.5/5 (2)

- CPHEEO Manual On Operation and Maintenance of Water Supply Systems - 2005Документ501 страницаCPHEEO Manual On Operation and Maintenance of Water Supply Systems - 2005Tejashri Gyanmotay83% (6)

- Substation Equipment Failure Report October 14 To August 15Документ95 страницSubstation Equipment Failure Report October 14 To August 15Yogendra SwarnkarОценок пока нет

- 1002 R29Документ13 страниц1002 R29LUCASDOURADO18100% (1)

- C-27-2008 Thrust Block DesignДокумент26 страницC-27-2008 Thrust Block Designeagle411Оценок пока нет

- IS2974 Part 1Документ25 страницIS2974 Part 1sttm8Оценок пока нет

- IS 8329 - DI Pipe Specifications For Water, Gas & SewageДокумент27 страницIS 8329 - DI Pipe Specifications For Water, Gas & SewageChungath Linesh50% (2)

- Medico-Legal Protocols: Dead On Arrival (BROUGHT DEAD)Документ3 страницыMedico-Legal Protocols: Dead On Arrival (BROUGHT DEAD)kapindra100% (1)

- Float-In Cofferdams for Large Diameter Bridge PilesДокумент14 страницFloat-In Cofferdams for Large Diameter Bridge PilesChungath LineshОценок пока нет

- Code of Safe Working Practices for Merchant Seafarers Consolidated 2015 edition, including amendments 1-7От EverandCode of Safe Working Practices for Merchant Seafarers Consolidated 2015 edition, including amendments 1-7Оценок пока нет

- Code of Safe Working Practices for Merchant Seafarers: Consolidated edition (incorporating amendments 1-6)От EverandCode of Safe Working Practices for Merchant Seafarers: Consolidated edition (incorporating amendments 1-6)Оценок пока нет

- Sea Water IntakeДокумент9 страницSea Water IntakeChungath LineshОценок пока нет

- Chlorine HandbookДокумент32 страницыChlorine Handbooknimm1962100% (4)

- Consolidation Worksheets: NSS Exploring Economics 3 (3 Edition)Документ17 страницConsolidation Worksheets: NSS Exploring Economics 3 (3 Edition)Rachel LeeОценок пока нет

- SB 1002R29Документ13 страницSB 1002R29LUCASDOURADO180% (2)

- Sea Water IntakeДокумент29 страницSea Water IntakeDanang Rahadian100% (1)

- SB 1003R28Документ14 страницSB 1003R28Alem MartinОценок пока нет

- Case Digest - MMDA Vs Manila BayДокумент4 страницыCase Digest - MMDA Vs Manila BaylengjavierОценок пока нет

- High-Tech 'SMART CITY' Core to Urban LandscapeДокумент12 страницHigh-Tech 'SMART CITY' Core to Urban LandscapeChungath Linesh100% (2)

- IS 12288 - Laying of Ductile Iron PipesДокумент13 страницIS 12288 - Laying of Ductile Iron PipesChungath Linesh100% (1)

- Pipe Network PDFДокумент127 страницPipe Network PDFlaceydawn100% (1)

- MBR Technology Future Water WastewaterДокумент29 страницMBR Technology Future Water WastewaterChungath Linesh100% (1)

- Ship To Ship Operations DynamarineДокумент54 страницыShip To Ship Operations Dynamarineiomerko100% (2)

- A Missoula County Air Quality Permit Will Be Required For Locations Within Missoula County. A List of The Permitted Equipment Is Contained in Section I.A of The PermitДокумент20 страницA Missoula County Air Quality Permit Will Be Required For Locations Within Missoula County. A List of The Permitted Equipment Is Contained in Section I.A of The Permitmacross086Оценок пока нет

- Excus: Notification: 3/2004-C.E. Dated 08-Jan-2004Документ1 страницаExcus: Notification: 3/2004-C.E. Dated 08-Jan-2004nagu221188Оценок пока нет

- Karnataka State Pollution Control Board - 73weez We-, 1: MT) OccДокумент9 страницKarnataka State Pollution Control Board - 73weez We-, 1: MT) OccGiriraj DagaОценок пока нет

- Alkyl Amines KurkumbhДокумент9 страницAlkyl Amines KurkumbhVishvajit PatilОценок пока нет

- 5th Amendment REC Regulation 26 06 2015Документ15 страниц5th Amendment REC Regulation 26 06 2015svvsnrajuОценок пока нет

- Government of Goa: Panaji, 8th January, 2015 (Pausa 18, 1936)Документ42 страницыGovernment of Goa: Panaji, 8th January, 2015 (Pausa 18, 1936)anpuselvi125Оценок пока нет

- KSEB Tariff KeralaДокумент16 страницKSEB Tariff KeralaSangeeth Kavil PОценок пока нет

- Part 1Документ194 страницыPart 1solasmarineОценок пока нет

- Ix. Exemption To Certain Goods and IndustriesДокумент7 страницIx. Exemption To Certain Goods and IndustriesManish GautamОценок пока нет

- A. Central Excise: (Notification No. 02/2013 (CE) NT Dated 01.03.2013)Документ0 страницA. Central Excise: (Notification No. 02/2013 (CE) NT Dated 01.03.2013)kamlesh1714Оценок пока нет

- BHEL Bhandara MPCB FileДокумент9 страницBHEL Bhandara MPCB FileVishvajit PatilОценок пока нет

- Post (Rti Stamp) CompleteДокумент16 страницPost (Rti Stamp) CompleteLive LawОценок пока нет

- New Ex Im Policies 1Документ34 страницыNew Ex Im Policies 1Omar SiddiquiОценок пока нет

- Iteh Standard Preview (Standards - Iteh.ai) : SIST-TP CEN/TR 12566-2:2005 Slovenski StandardДокумент15 страницIteh Standard Preview (Standards - Iteh.ai) : SIST-TP CEN/TR 12566-2:2005 Slovenski StandardRoberto CecchinatoОценок пока нет

- The Goa Water Rules - 11-10-2012Документ117 страницThe Goa Water Rules - 11-10-2012vijayОценок пока нет

- 2 of 2008 8 % To 10 % Duty ChangeДокумент3 страницы2 of 2008 8 % To 10 % Duty Changephani raja kumarОценок пока нет

- Staff Benefit FundДокумент73 страницыStaff Benefit FundAbhey DograОценок пока нет

- 100% Eou PDFДокумент6 страниц100% Eou PDFశ్రీనివాసకిరణ్కుమార్చతుర్వేదులОценок пока нет

- Handbook of Procedures (Vol. I) : 27 August 2009 - 31 March 2014Документ21 страницаHandbook of Procedures (Vol. I) : 27 August 2009 - 31 March 2014connect2rahul4204Оценок пока нет

- Chapter 12Документ32 страницыChapter 12Ram SskОценок пока нет

- OW Separator Inspection and Maintenance Guide 2017Документ2 страницыOW Separator Inspection and Maintenance Guide 2017sterlingОценок пока нет

- Master Circular No. 9 Irregular Retention in Service Beyond The Age of SuperannuationДокумент2 страницыMaster Circular No. 9 Irregular Retention in Service Beyond The Age of SuperannuationharjeetОценок пока нет

- Rules - Entering - Into - Supply - Contracts PDFДокумент855 страницRules - Entering - Into - Supply - Contracts PDFpasamvОценок пока нет

- TNPCB and PublicДокумент187 страницTNPCB and Publicsaravana_ravichandra100% (1)

- Circular 1 2020Документ2 страницыCircular 1 2020inti binduОценок пока нет

- C 10Документ344 страницыC 10Anonymous yxFeWtОценок пока нет

- Orders - Issued.: OfficerДокумент4 страницыOrders - Issued.: Officerraghunath1976Оценок пока нет

- 6 - Importance of Knowing The Right Tariff Code of Your ProductДокумент19 страниц6 - Importance of Knowing The Right Tariff Code of Your ProductRyanna Ang-angcoОценок пока нет

- Abandonment/Relinquish Regulations: Ministry of Energy and Mineral Resources Regulation No. 03, 2008Документ3 страницыAbandonment/Relinquish Regulations: Ministry of Energy and Mineral Resources Regulation No. 03, 2008ediabcОценок пока нет

- MODU Part 4 eДокумент168 страницMODU Part 4 efrmarzoОценок пока нет

- DJBBillДокумент2 страницыDJBBillAshish KhantwalОценок пока нет

- Amadeus Automated Refund StepsДокумент3 страницыAmadeus Automated Refund StepsAmesh AlexОценок пока нет

- Trnaspo Cases 2Документ47 страницTrnaspo Cases 2Raul AspeОценок пока нет

- Auto Refund MethodsДокумент3 страницыAuto Refund MethodsameshalexОценок пока нет

- Office of Chief Engineer Panki Thermal Power Station Panki-KanpurДокумент39 страницOffice of Chief Engineer Panki Thermal Power Station Panki-Kanpuraharish_iitkОценок пока нет

- So 07 09Документ6 страницSo 07 09Rajula Gurva ReddyОценок пока нет

- Rules Entering Into Supply ContractsДокумент855 страницRules Entering Into Supply ContractsSanjay Dasgupta50% (4)

- Report on Proposed Reforms to the System of Way Bills in Andhra PradeshДокумент22 страницыReport on Proposed Reforms to the System of Way Bills in Andhra PradeshNitin K. ParekhОценок пока нет

- TNPCB 2013Документ190 страницTNPCB 2013Rajeshkumar ElangoОценок пока нет

- WBPДокумент174 страницыWBPJeshiОценок пока нет

- Effecting of New LT Industrial Service Connections Up To A Demand of 1l2 KW Within 15 Days Instruction IssuedДокумент4 страницыEffecting of New LT Industrial Service Connections Up To A Demand of 1l2 KW Within 15 Days Instruction IssuedibookmarkxОценок пока нет

- Fifth Schedule PDFДокумент56 страницFifth Schedule PDFAkber LakhaniОценок пока нет

- Cir40 17.09.2005Документ4 страницыCir40 17.09.2005suganthaОценок пока нет

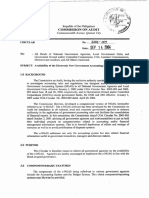

- 2010 Mvuc Response To ArrДокумент7 страниц2010 Mvuc Response To ArrIan Mizzel A. DulfinaОценок пока нет

- Mepc.1 Circ.834 Rev.1Документ22 страницыMepc.1 Circ.834 Rev.1Onur ÜnlüОценок пока нет

- Commission On Audit: Commonwealth Avenue, Quezon CityДокумент2 страницыCommission On Audit: Commonwealth Avenue, Quezon CityWilmar TagleОценок пока нет

- Coast Guard guidance for enforcing oily waste reception facilitiesДокумент56 страницCoast Guard guidance for enforcing oily waste reception facilitiesedtatel73Оценок пока нет

- Ricms PaДокумент1 088 страницRicms PaClaudivanОценок пока нет

- How to Make Effective Legislative Proposals: Trinidad and Tobago Legislative ProcessОт EverandHow to Make Effective Legislative Proposals: Trinidad and Tobago Legislative ProcessОценок пока нет

- Cad DrawingДокумент53 страницыCad DrawingAvish Gunnuck100% (3)

- Overhead TankДокумент4 страницыOverhead TankChungath LineshОценок пока нет

- GammonBulletinJan Mar2014Документ20 страницGammonBulletinJan Mar2014Chungath LineshОценок пока нет

- CRZ Notification 2011 AmendmentДокумент4 страницыCRZ Notification 2011 AmendmentChungath LineshОценок пока нет

- Economic Design of Water Tank of Different Shapes With Reference To IS: 3370 2009Документ9 страницEconomic Design of Water Tank of Different Shapes With Reference To IS: 3370 2009IJMERОценок пока нет

- The Most Talked About Buildings in 2014 - 146Документ6 страницThe Most Talked About Buildings in 2014 - 146Chungath LineshОценок пока нет

- Fire HydrantДокумент3 страницыFire HydrantChungath LineshОценок пока нет

- Friction LossДокумент22 страницыFriction LossChungath LineshОценок пока нет

- MSE3 CorrosionДокумент9 страницMSE3 CorrosionMirko KerОценок пока нет

- Chlorination and Use of ChlorinatorsДокумент60 страницChlorination and Use of ChlorinatorsChungath LineshОценок пока нет

- IS 12709 GRP Pipes & Fittings For Potable Water Supply - SpecificationsДокумент30 страницIS 12709 GRP Pipes & Fittings For Potable Water Supply - SpecificationsChungath Linesh0% (1)

- List of Is Codes II - Sewerage and Sewage TreatmentДокумент4 страницыList of Is Codes II - Sewerage and Sewage TreatmentChungath LineshОценок пока нет

- Volunteer Training White PaperДокумент7 страницVolunteer Training White PaperArun HarpalaniОценок пока нет

- Caregiving: A Common or Uncommon ExperienceДокумент13 страницCaregiving: A Common or Uncommon ExperienceANGELОценок пока нет

- Self-Employment On Road-Side PavementsДокумент17 страницSelf-Employment On Road-Side PavementsRaj KrishnaОценок пока нет

- Input Data Sheet For E-Class Record: Region Division School Name School Id School YearДокумент20 страницInput Data Sheet For E-Class Record: Region Division School Name School Id School YearJeffrey SalinasОценок пока нет

- CREA Stay of Implementation Letter FINAL 12.5.17Документ3 страницыCREA Stay of Implementation Letter FINAL 12.5.17Michael_Lee_RobertsОценок пока нет

- Electric Vehicles and Charging Stations Act summaryДокумент18 страницElectric Vehicles and Charging Stations Act summaryLouie SantosОценок пока нет

- Notice: Environmental Statements Availability, Etc.: Energy Department, Three Mile Island, IDДокумент2 страницыNotice: Environmental Statements Availability, Etc.: Energy Department, Three Mile Island, IDJustia.comОценок пока нет

- SAQ123 NursesUserGuide V6Документ30 страницSAQ123 NursesUserGuide V6LisaBrook100% (1)

- Riverside County FY 2020-21 First Quarter Budget ReportДокумент50 страницRiverside County FY 2020-21 First Quarter Budget ReportThe Press-Enterprise / pressenterprise.comОценок пока нет

- 2016 Apple - Good Business, Poor CitizenДокумент11 страниц2016 Apple - Good Business, Poor CitizenNA NA100% (1)

- Summary Report On The Cooperation Fund For Fighting HIV/AIDS in Asia and The Pacific Regional Conference, 24 Oct 2014, BangkokДокумент4 страницыSummary Report On The Cooperation Fund For Fighting HIV/AIDS in Asia and The Pacific Regional Conference, 24 Oct 2014, BangkokADB Health Sector GroupОценок пока нет

- Sharing of Housework and Childcare in Contemporary JapanДокумент10 страницSharing of Housework and Childcare in Contemporary JapanViorel UrsacheОценок пока нет

- Bloomfield Township Council - Agenda Packet For 11/17/2023Документ111 страницBloomfield Township Council - Agenda Packet For 11/17/2023erickieferОценок пока нет

- NLUD AILET Admit CardДокумент3 страницыNLUD AILET Admit CardAmit SinghОценок пока нет

- $101 Million Award For Child With MMR Vaccine InjuryДокумент1 страница$101 Million Award For Child With MMR Vaccine InjuryFrank ReitemeyerОценок пока нет

- PIC/S Assessment & Joint Reassessment ProgrammeДокумент15 страницPIC/S Assessment & Joint Reassessment ProgrammesppОценок пока нет

- Child Rights & Juvenile JusticeДокумент27 страницChild Rights & Juvenile Justicepriyadarshi matrisharan100% (3)

- Philippine Water Supply Sector Roadmap 2nd EditionДокумент91 страницаPhilippine Water Supply Sector Roadmap 2nd EditionjohnllenalcantaraОценок пока нет

- FOMB - Letter - OMB - Christmas Bonus FY22Документ7 страницFOMB - Letter - OMB - Christmas Bonus FY22Erick A. Velázquez SosaОценок пока нет

- DHS MarchДокумент2 страницыDHS MarchCommunities in Schools of DelawareОценок пока нет

- The Passing of The Public Utility ConceptДокумент14 страницThe Passing of The Public Utility Conceptcagrns100% (2)

- J&K Services Selection Board exam noticeДокумент3 страницыJ&K Services Selection Board exam noticeAddullah ArifОценок пока нет

- Social Policy Social Welfare and The Welfare StateДокумент21 страницаSocial Policy Social Welfare and The Welfare StateCanice BlakeОценок пока нет

- Surgery List April 22Документ85 страницSurgery List April 22fercito1Оценок пока нет