Академический Документы

Профессиональный Документы

Культура Документы

Financial Statements of Companies Part 1

Загружено:

kautiАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Financial Statements of Companies Part 1

Загружено:

kautiАвторское право:

Доступные форматы

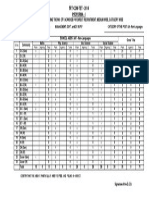

Q 1:

The following is the Profit & Loss a/c of Mudra Ltd for the year ended 31-3-13:

To Administrative, Selling &

By Balance b/d

572350.00

Distribution exp

822542.00 By Balance from Trading

4025365.00

To Donation to Charitable

a/c

232560.00

Funds

25500.00 By Subsidy received Govt

15643.00

To Directors Fee

66750.00 By Interest on investment

722.00

To interest on Debentures

31240.00 By Transfer Fee

25000.00

To Compensation for Breach

By Profit on sale of

of contract

42530.00 Machine

To Managerial Remuneration

285350.00

(WDV Rs 30000)

To Depreciation of Fixed

522543.00

Assets

1242500.00

To Provision for Taxation

400000.00

To General Reserve

To Investment Revaluation

12500.00

Reserve

1420185.00

To Balance C/d

4871640.00

4871640.00

Additional Information:

1- Original Cost of machine sold was Rs 40000.00

2- Depreciaiton on fixed assets as per companies act was Rs 575345.

You are required to comment on the managerial remuneration in the following situations:

a- There is only 1 whole time director

b- There are 2 whole time directors

c- There are two whole time directors, one part time & a manager.

Q 2: Calculate managerial remuneration:

Profit before tax & managerial remuneration but after

870410.00

depreciation

& tax provision for repairs

310000.00

Depreciation (as per books)

25000.00

Provision for Repairs

260000.00

Depreciation (as per companies act)

15000.00

Repair Exp

Case 1: If only 1 whole time director.

Case 2: If 2 whole time directors.

Case 3: 2 whole time directors, 1 part time directors & 1 manager.

Q 3: Following details are extracted from Profit & Loss account:

Remuneration to :

Managing Director

Whole time Director

Provision for Bonus (Including to director Rs 5000)

Provision for Gratuity (Including to director Rs 6000)

Provision for Doubtful Debts

Profit on sale of Building (includes short term capital gain Rs

120000)

Financial Statements of Companies

75000.00

60000.00

550000.00

50000.00

30000.00

150000.00

7000.00

1

Loss on sale of machine (WDV Rs 150000)

Donation to charitable institutions

Contribution to research association approved

Tax Provision

Net Profit as per Profit & Loss Account

Calculate profit available for Managerial Remuneration?

50000.00

400000.00

800000.00

1600000.00

Q 4:

From the following particulars furnished by Pioneer Ltd. Prepare the Balance Sheet as at 31st

March, 2102 and Statement of Profit & Loss for the year ended on that date as required by Parts 1st

& 2nd of New Schedule VI of the Companies Act.

The Details have been properly grouped in the trial Balance itself to avoid further

working.

Particulars

Working Debit

Credit

Equity Capital (Face Value of Rs.100)

4,000

Money received against Share Warrants

1,000

Share Application money pending allotment

500

General Reserve

400

Profit & Loss Account Opening balance 700- Proposed

200

600

Dividend 500

4,500

Land & Building

1,800

Plant and Machinery

6,500

200

Other tangible Fixed asset

500

Intangible Fixed Assets

800

Investment in shares & Debenture- Non Current

700

Investment In shares & debenture- Current

400

Loan from State Financial Corporation for Fixed assets

1,200

800

Long term

1,000

12% Mortgage Debentures

1,600

Borrowing for working capital : Short term

400

Inventory : Finished Goods 900 + WIP 100 + Raw Material 50

600

200

150

Sundry Debtors

150

Cash Balance

300

Cash at Bank

100

Other current assets

200

100

Sundry Creditors

200

Share Application money refundable

700

500

Other current liability

700

Provision for Taxation

400

Proposed Dividend

9,000

Provision for employee retirement benefit

900

Other long term liability (Deferred credit for equipment)

9,300

(-) 600

Purchases of Raw material

1,000

+ Opening Stock of raw material

300

(-)

700

(-) Closing Stock of Raw material

1,000

Closing Stock of WIP & Finished Goods

2,000

(-) Opening Stock Of WIP & Finished Goods

200

Purchase of Finished Goods

100

Salaries and Wages

200

Power and electricity expenses

750

Financial Statements of Companies

Repairs & Maintenance

Commission on sales

Other expenses

Depreciation

250

Interest on Debenture

Interest on Other borrowings

Sakes (net)

Other income: Interest, Dividend, Profit on sale of

investment

Exception item: Profit on sale of Fixed assets

Deferred tax assets

(-) Deferred tax liability

Income Tax

Deferred tax

Loans and advanced for Fixed Assets

Advances to Customer

96

124

730

220

15,000

250

100

350

(-) 200

150

750

75

300

125

26,250

Financial Statements of Companies

26,250

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Guide To Understanding Financial Statements PDFДокумент96 страницGuide To Understanding Financial Statements PDFyarokОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Bloomberg - Investment Banking CheatsheetДокумент2 страницыBloomberg - Investment Banking CheatsheetjujonetОценок пока нет

- Trading Options Developing A PlanДокумент32 страницыTrading Options Developing A Planjohnsm2010Оценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- When To Sell Inside Justin 1345479Документ2 страницыWhen To Sell Inside Justin 1345479Rajesh Kumar40% (5)

- English IIQE Paper 5 Pass Paper Question Bank (QB)Документ10 страницEnglish IIQE Paper 5 Pass Paper Question Bank (QB)Tsz Ngong KoОценок пока нет

- Clearing and Settlement: Financial DerivativesДокумент24 страницыClearing and Settlement: Financial DerivativesAayush SharmaОценок пока нет

- Basic Earnings Per ShareДокумент20 страницBasic Earnings Per ShareDJ Nicart100% (3)

- Beginners Guide To Short Selling With Toni TurnerДокумент28 страницBeginners Guide To Short Selling With Toni Turnermasktusedo785Оценок пока нет

- Paul Wilmott - Intro To Quanitiative Finance NotesДокумент13 страницPaul Wilmott - Intro To Quanitiative Finance NotesAnonymous 9qJCv5mC0Оценок пока нет

- IFRS 17 Simplified Case Study PDFДокумент18 страницIFRS 17 Simplified Case Study PDFAnonymous H1l0FwNYPS0% (1)

- Selected Thesis Topics 2014-2015Документ5 страницSelected Thesis Topics 2014-2015Miguelo Malpartida BuenoОценок пока нет

- Ca Business Sectors Revision NotesДокумент1 страницаCa Business Sectors Revision NoteskautiОценок пока нет

- How To Obtain A PHD in GermanyДокумент16 страницHow To Obtain A PHD in GermanykautiОценок пока нет

- Sri Venkateswara UniversityДокумент5 страницSri Venkateswara UniversitykautiОценок пока нет

- Reve I W Questions Introduction To Economic UnderstandingДокумент2 страницыReve I W Questions Introduction To Economic UnderstandingkautiОценок пока нет

- University of Hyderabad: General Category Reserved CategoriesДокумент1 страницаUniversity of Hyderabad: General Category Reserved CategorieskautiОценок пока нет

- Concession List NaturalДокумент7 страницConcession List NaturalkautiОценок пока нет

- Hydrogen TwoДокумент6 страницHydrogen TwokautiОценок пока нет

- JFE10 Ugc NetДокумент49 страницJFE10 Ugc NetkautiОценок пока нет

- Glossary MonetraДокумент17 страницGlossary MonetrakautiОценок пока нет

- Accounting ConceptДокумент50 страницAccounting Conceptrsal.284869430Оценок пока нет

- Impact of Inflation IndianДокумент3 страницыImpact of Inflation IndiankautiОценок пока нет

- 01 - Basic UnixДокумент43 страницы01 - Basic UnixkautiОценок пока нет

- General Securities Representative Qualification Examination (Series 7)Документ46 страницGeneral Securities Representative Qualification Examination (Series 7)kautiОценок пока нет

- June 2013 Final GCE Advanced Double Awards Including Applied SubjectsДокумент11 страницJune 2013 Final GCE Advanced Double Awards Including Applied SubjectskautiОценок пока нет

- School Assistant Non LanguagesДокумент1 страницаSchool Assistant Non LanguageskautiОценок пока нет

- Statement Showing The No. of Vacancies For Direct Recruitment, Medium Wise, Category WiseДокумент1 страницаStatement Showing The No. of Vacancies For Direct Recruitment, Medium Wise, Category WisekautiОценок пока нет

- British Council Entry Procedure January 2016Документ2 страницыBritish Council Entry Procedure January 2016kautiОценок пока нет

- S 17 13 III (Management)Документ32 страницыS 17 13 III (Management)kautiОценок пока нет

- SAS Programming II: Manipulating Data With The DATA Step: Course DescriptionДокумент3 страницыSAS Programming II: Manipulating Data With The DATA Step: Course DescriptionkautiОценок пока нет

- The Search For Persistence: Is Past Performance Related To Future Performance?Документ2 страницыThe Search For Persistence: Is Past Performance Related To Future Performance?kautiОценок пока нет

- Financial Institutions, Markets, and Money, 9 Edition: Power Point Slides ForДокумент23 страницыFinancial Institutions, Markets, and Money, 9 Edition: Power Point Slides ForkautiОценок пока нет

- International Exam FaqДокумент4 страницыInternational Exam FaqckrishnaОценок пока нет

- Grade 7 Solving Percent ProblemsДокумент9 страницGrade 7 Solving Percent ProblemskautiОценок пока нет

- Interview QuestionsДокумент1 страницаInterview QuestionskautiОценок пока нет

- Rates Revision NotesДокумент1 страницаRates Revision NoteskautiОценок пока нет

- Money Market ReformДокумент6 страницMoney Market ReformkautiОценок пока нет

- Biological KnowledgeДокумент1 страницаBiological KnowledgekautiОценок пока нет

- Comparing Investments - An Example: D E A F B CДокумент1 страницаComparing Investments - An Example: D E A F B CkautiОценок пока нет

- Business Valuation: Introduction To Financial MethodsДокумент23 страницыBusiness Valuation: Introduction To Financial MethodsfrancescoabcОценок пока нет

- Assign 1 SolutionДокумент18 страницAssign 1 Solutionnybabo1100% (3)

- Attempt All Questions: Summer Exam-2009 Performance Measurement Duration: 3 Hrs. Marks-100Документ15 страницAttempt All Questions: Summer Exam-2009 Performance Measurement Duration: 3 Hrs. Marks-100GENIUS1507Оценок пока нет

- ACC1002X Tut 3 SolutionsДокумент15 страницACC1002X Tut 3 SolutionssantahahaОценок пока нет

- Sandy Summer Internship Report SBILifeДокумент17 страницSandy Summer Internship Report SBILifeSandeep KumarОценок пока нет

- Satyam Sam 23Документ7 страницSatyam Sam 23Punam GuptaОценок пока нет

- Armenian Banking Sector Overview For Q1 2019 1559853297Документ39 страницArmenian Banking Sector Overview For Q1 2019 1559853297Anush GrigoryanОценок пока нет

- Filed: Class Action ComplaintДокумент39 страницFiled: Class Action ComplaintNat LevyОценок пока нет

- Fin333 Secondmt04w Sample QuestionsДокумент10 страницFin333 Secondmt04w Sample QuestionsSara NasОценок пока нет

- EquityДокумент29 страницEquityThuy Linh DoОценок пока нет

- Emerald Debt Finance Firm PerformanceДокумент19 страницEmerald Debt Finance Firm Performancelina oktavianiОценок пока нет

- Introduction To Indian Financial SystemДокумент31 страницаIntroduction To Indian Financial SystemthensureshОценок пока нет

- PT Delta Djakarta TBK Dan Entitas Anak/: and Its SubsidiaryДокумент77 страницPT Delta Djakarta TBK Dan Entitas Anak/: and Its SubsidiaryAlensyahОценок пока нет

- Mastering Met A Stock ManualДокумент82 страницыMastering Met A Stock ManualTei YggdrasilОценок пока нет

- CIMB Islamic Sukuk Fund MYR FFSДокумент2 страницыCIMB Islamic Sukuk Fund MYR FFSAbdul-Wahab Abdul-HamidОценок пока нет

- Equity Valuation Report - TwitterДокумент3 страницыEquity Valuation Report - TwitterFEPFinanceClubОценок пока нет

- Average Score: Symphony Life (Symlife-Ku)Документ1 страницаAverage Score: Symphony Life (Symlife-Ku)Cf DoyОценок пока нет

- BFC5935 - Tutorial 5 SolutionsДокумент5 страницBFC5935 - Tutorial 5 SolutionsXue XuОценок пока нет

- Investment OpportunityДокумент10 страницInvestment OpportunityJaved100% (1)

- Harry Markowitz's Portfolio Theory Model: Tushar Joshi 14 Pratiksha Pandya 30 Komal Fulekar 09 Mandar Panchal 28Документ15 страницHarry Markowitz's Portfolio Theory Model: Tushar Joshi 14 Pratiksha Pandya 30 Komal Fulekar 09 Mandar Panchal 28tush_joshiОценок пока нет

- 4 5axyzeizffi11gaf.1Документ192 страницы4 5axyzeizffi11gaf.1Rdy SimangunsongОценок пока нет