Академический Документы

Профессиональный Документы

Культура Документы

ConfigGuide AA

Загружено:

fungayingorimaАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

ConfigGuide AA

Загружено:

fungayingorimaАвторское право:

Доступные форматы

Logo[X]

ASAP Focus Methodology COMPANY [X] SAP ERP AA Configuration Guide

Icons

Icon

Meaning

Caution

Example

Note

Recommendation

Syntax

SAP AG

Page 2 of 46

Logo[X]

ASAP Focus Methodology COMPANY [X] SAP ERP AA Configuration Guide

Contents

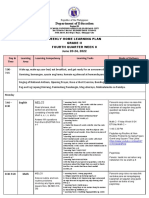

1 Purpose...........................................................................5

2 Configuration...................................................................5

2.1

Organizational Structures..........................................................5

2.1.1 Basic Settings.........................................................................5

2.1.1.1............................................Check Country-Specific Settings

5

2.1.2 Chart of Depreciation..............................................................6

2.1.2.1.......Copy Reference Chart of Depreciation (Define Chart of

Depreciation)..................................................................................6

2.1.2.2.........................Specify Description of Chart of Depreciation

7

2.1.2.3 Copy Reference Chart of Depreciation (Define Depreciation

Area) 7

2.1.2.4....................Assign Chart of Depreciation to Company Code

9

2.1.2.5............Specify Number Assignment across Company Codes

10

2.1.3 Asset Classes........................................................................10

2.1.3.1..............................................Specify Account Determination

10

2.1.3.2...................................................Create Screen Layout Rules

11

2.1.3.3.........................Define Screen Layout for Asset Master Data

12

2.1.3.4...............Define Screen Layout for Asset Depreciation Areas

13

2.1.3.5.....................Define Number Range Interval (Asset Classes)

14

2.1.3.6..............................................................Define Asset Classes

15

Use................................................................................................15

2.1.3.7..........................Specify Tab Layout for Asset Master Record

17

2.1.3.8......................................Assign Tab Layouts to Asset Classes

18

SAP AG

Page 3 of 46

Logo[X]

ASAP Focus Methodology COMPANY [X] SAP ERP AA Configuration Guide

2.1.4 Depreciation Area.................................................................20

2.1.4.1...............................................Configure Asset Value Display

20

2.1.4.2.....................................................Define Depreciation Areas

21

Use................................................................................................21

2.1.4.3..................................................................Specify Area Type

22

2.2

Integration with the General Ledger........................................23

2.2.1 Assign G/L Accounts - Balance Sheet....................................23

2.2.2 Assign G/L Accounts - Depreciation......................................25

2.2.3 Specify Financial Statement Version for Asset Reports.........26

2.2.4 Specify Document Type for Posting of Depreciation.............26

2.2.5 Specify Intervals and Posting Rules......................................28

2.2.6 Specify Account Assignment Types for Account Assignment

Objects............................................................................................28

2.2.7 Specify Document Type for Periodic Processing....................29

2.3

Valuation..................................................................................30

2.3.1 Depreciation Areas................................................................30

2.3.1.1...............................................Specify Transfer of APC Values

30

2.3.1.2..................................Specify Transfer of Depreciation Terms

30

2.3.1.3..................Determine Depreciation Areas in the Asset Class

31

2.3.1.4...............................................Specify Low-Value Asset Class

32

2.3.1.5................Assign Unit of measure to low value asset classes

33

2.3.1.6............................Specify Max. Amount for Low-Value Assets

33

2.3.1.7......Specify Rounding of Net Book Value and/or Depreciation

34

2.3.1.8.................Define Depreciation Areas for Foreign Currencies

35

2.3.1.9....................................Specify the Use of Parallel Currencies

36

2.3.2 Depreciation.........................................................................37

SAP AG

Page 4 of 46

Logo[X]

ASAP Focus Methodology COMPANY [X] SAP ERP AA Configuration Guide

2.3.2.1........Determine Depreciation Areas (Ordinary Depreciation)

37

2.3.2.2.....Determine Depreciation Areas (Unplanned Depreciation)

38

2.3.2.3...................................................Maintain Depreciation Keys

38

2.3.3 Transactions..........................................................................39

2.3.3.1....Allow Down Payment/Transfer Transaction Types in Asset

Classes..........................................................................................39

2.3.3.2.......Determine Cost Element for Settlement to CO Receiver

40

2.3.3.3.....................................................Assign Settlement Profiles

41

2.3.4 Information System...............................................................42

2.3.4.1........................................Define or Assign Forms for History

42

2.3.5 Asset Data Transfer...............................................................42

2.3.5.1.....................................................Set Company Code Status

42

2.3.5.2........................Specify Transfer Date/Last Closed Fiscal Year

43

2.4

Import/Create Master Data......................................................44

2.4.1 Create Fixed Assets Master Data..........................................44

2.4.1.1............................................Create Values for Legacy Assets

44

SAP AG

Page 5 of 46

Logo[X]

ASAP Focus Methodology COMPANY [X] SAP ERP AA Configuration Guide

Asset Accounting: Configuration Guide

1 Purpose

The purpose of this document is to describe the general configuration steps required to

manually set up the configuration within the system landscape that has already been installed

using the corresponding installation or configuration guides for installation.

2 Configuration

2.1 Organizational Structures

2.1.1

Basic Settings

2.1.1.1

Check Country-Specific Settings

Use

The system uses the country-specific data in each company code that agrees with the country

in the definition of the FI company code (FI Customizing).

SAP provides the appropriate default settings for most countries.

The standard defaults have to be checked for the selected country.

Procedure

1. Access the activity using one of the following navigation options:

IMG Menu

Financial Accounting (New) Asset Accounting

Organizational Structures Check Country-Specific

Settings

Transaction Code

OA08

2.

On the Change View: Asset Accounting: Country Information: Overview screen, select

country ZW and choose Details.

3.

On the Change View: Asset Accounting: Country Information: Details screen, check the

following entries for your country (country key ZW in this example).

Field Name

Description

User Action and Values

Country

currency

USD

Max LVA

amount for

posting

1000

Comment

Net book

value for dep.

Change

No entry

Post net book

No selection

SAP AG

Page 6 of

Logo[X]

ASAP Focus Methodology COMPANY [X] SAP ERP AA Configuration Guide

Field Name

Description

User Action and Values

Comment

value

Capitalize

AuC w/o

downpayment

4.

No selection

Choose Save.

Result

The country-specific settings are verified.

2.1.2

Chart of Depreciation

Use

A chart of depreciation is a directory of depreciation areas arranged according to business

requirements. Each chart of depreciation contains the rules for the evaluation of assets that

are valid in a specific country or economic area.

Each company code defined in Asset Accounting must refer to a chart of depreciation.

2.1.2.1

Copy Reference Chart of Depreciation (Define

Chart of Depreciation)

Use

SAP provides country-specific charts of depreciation with predefined depreciation areas (for

example, 0GB for Great Britain). These charts of depreciation are only references for

customer charts of depreciation and therefore cannot be used directly. When you create your

own chart of depreciation, you must copy a reference chart of depreciation.

When you create a chart of depreciation, the system copies all the depreciation areas from

the standard chart of depreciation that you use as a reference. You must delete any

depreciation areas you do not need from your chart of depreciation.

The chart of depreciation 1000 has been created as a copy of the chart of depreciation 0ZA.

Procedure

1. Access the activity using one of the following navigation options:

IMG Menu

Financial Accounting (New) Asset Accounting

Organizational Structures Copy Reference Chart of

Depreciation/Depreciation Areas Copy Reference

Chart of Depreciation

Transaction Code

EC08

2. On the Organizational object Chart of Depreciation screen, select copy org. object (F6).

3. Make the following entries in the Copy dialog box, and choose Enter.

Field Name

From Chart of

SAP AG

Description

User Action and Values

Comment

0ZA

Page 7 of

Logo[X]

ASAP Focus Methodology COMPANY [X] SAP ERP AA Configuration Guide

Field Name

Description

User Action and Values

Comment

dep.

To Chart of

dep.

1000

Result

The chart of depreciation has been created.

2.1.2.2

Specify Description of Chart of Depreciation

Use

With this activity you specify the description of the chart of depreciation copied in the previous

step.

Procedure

1. Access the activity using the following navigation option:

IMG Menu

Financial Accounting (New) Asset Accounting

Organizational Structures Copy Reference Chart of

Depreciation/Depreciation Areas Specify Description

of Chart of Depreciation

Transaction Code

SPRO

2.

On the Organizational object Chart of Depreciation screen, select copy org. object (F6).

3.

Make the following entries in the Copy dialog box and choose Enter.

Field Name

Description

User Action and Values

ChD

Chart of depreciation

1000

Description

Chart of Depreciation:

Best Practices ZW

Company

Comment

Example

Result

The description of the new chart of depreciation is defined.

2.1.2.3

Copy Reference Chart of Depreciation (Define

Depreciation Area)

Use

You can change the definition of the depreciation areas that were copied from the standard

depreciation plan and add additional depreciation areas if required.

The following depreciation areas have been defined in the chart of depreciation 1000:

Depreciation Area

Description

01

Book depreciation

SAP AG

Page 8 of

Logo[X]

ASAP Focus Methodology COMPANY [X] SAP ERP AA Configuration Guide

The depreciation areas 01 have been copied without any changes from the chart of

depreciation 0ZA

Procedure

1. Access the activity using one of the following navigation options:

IMG Menu

Financial Accounting (New) Asset Accounting

Organizational Structures Copy Reference Chart of

Depreciation/Depreciation Areas Copy Reference Chart of

Depreciation

Transaction Code

OABN

2. Choose Copy/Delete Depreciation Areas.

3. Make the following entries in the Copy/Delete Depreciation Areas dialog box.

Field Name

Chart of

Depreciation

Description

User Action and Values

Comment

1000

4. Copy the depreciation areas as described above.

5. On the Define Depreciation Area screen, enter the depreciation area descriptions listed

above.

6. To delete depreciation areas, select the following depreciation area entries in the Change

View: Define Depreciation Areas: Overview dialog box.

SAP AG

Page 9 of

Logo[X]

ASAP Focus Methodology COMPANY [X] SAP ERP AA Configuration Guide

Ar.

20

30

31

32

41

51

7. Choose the Delete button (Shift + F2).

Result

The depreciation areas 20, 30, 31, 32, 41 and 51 have been deleted.

2.1.2.4

Assign Chart of Depreciation to Company Code

Use

When you assign a chart of depreciation, you define a company code for Asset Accounting.

The chart of depreciation 1000 has been assigned to the company code 1000.

Prerequisites

The company code must be defined in Financial Accounting.

Procedure

1. Access the activity using one of the following navigation options:

IMG Menu

Financial Accounting (New) Asset Accounting

Organizational Structures Assign Chart of Depreciation to

Company Code

Transaction Code

OAOB

2. On the Change View: Maintain company code in Asset Accounting: Overview screen,

make the following entries and save:

Field Name

Description

User Action and Values

Co.

Company Code

1000

Chrt Dep.

Chart of Depreciation

1000

Comment

Result

The chart of depreciation 1000 has been assigned to company code 1000.

SAP AG

Page 10 of

Logo[X]

2.1.2.5

ASAP Focus Methodology COMPANY [X] SAP ERP AA Configuration Guide

Specify Number Assignment across Company

Codes

Use

In the FI-AA application, you can assign the main asset number across company codes.

Therefore, for every company code, you can determine from which (other) company code the

number assignment is to be carried out. In this step, you define a cross-company code

assignment of the main asset number. If you do not want a cross-company code number

assignment, you do not need to define any system settings here.

Procedure

1. Access the activity using one of the following navigation options:

IMG Menu

Financial Accounting (New) Asset Accounting

Organizational Structures Specify Number Assignment

Across Company Codes

Transaction Code

AO11

2. On the Change View FI-AA: Assignmt. to company code providing number range

screen, make the following entries:

Field Name

Description

User Action and Values

CoCd

Company Code

1000

No.Co.Cd.

Company Code for

Number Assignment

1000

Comment

3. Choose Save.

Result

You have determined which company code is to be used for the cross-company code number

assignment for your company codes.

2.1.3

Asset Classes

Use

Asset classes are the most important structuring elements for fixed assets. You can define

any number of asset classes in the system. You can use them to structure your fixed assets

according to different criteria.

2.1.3.1

Specify Account Determination

Use

The most important function of an asset class is to link asset master records to their

respective general ledger accounts in Financial Accounting. This link is created by the

account determination key in each asset class. You can assign several asset classes to the

same account determination key.

SAP AG

Page 11 of

Logo[X]

ASAP Focus Methodology COMPANY [X] SAP ERP AA Configuration Guide

Procedure

1. Access the activity using one of the following navigation options:

IMG Menu

Financial Accounting (New) Asset Accounting

Organizational Structures Asset Classes Specify Account

Determination

Transaction Code

SPRO

2. On the Change View FI-AA: Account Determination: Overview screen, make the

following entries:

Account Determination

Name for Account Determination

10000

11000

20000

30000

31000

32000

40000

50000

60000

80000

3. Choose Save.

Result

The account determination key has been created.

In the system there can be more than these account determination keys. For Best

Practices only the account determinations shown above are used.

2.1.3.2

Create Screen Layout Rules

Use

The asset master record contains a large number of fields because it is used for many

different purposes. To make it easier to maintain master data, you can adapt the asset master

record to suit your own needs.

Procedure

1. Access the activity using one of the following navigation options:

SAP AG

Page 12 of

Logo[X]

ASAP Focus Methodology COMPANY [X] SAP ERP AA Configuration Guide

IMG Menu

Financial Accounting(New) Asset Accounting

Organizational Structures Asset Classes Create Screen

Layout Rules

Transaction Code

SPRO

2. On the Change View Asset Accounting: Screen Layout for Master Record screen, make

the following entries and save:

Screen Layout Rule

Name of Screen Layout Rule

Y100

Y110

Y200

Y300

Y310

Y320

Y400

Y401

Y500

Y600

Result

You have adapted the fields which will show up in the asset master record.

2.1.3.3

Define Screen Layout for Asset Master Data

Use

In order to meet the needs of its many functions, the asset master record contains a large

number of fields. To make master data maintenance nonetheless as simple and efficient as

possible, the system enables you to design the asset master record to best suit your needs.

Screen layout rules, as mentioned in chapter 3.1.3.2 have been created and assigned to the

asset classes.

The screen layouts are copied from the standard layouts provided by SAP.

Procedure

1. Access the activity using one of the following navigation options:

SAP AG

Page 13 of

Logo[X]

ASAP Focus Methodology COMPANY [X] SAP ERP AA Configuration Guide

IMG Menu

Financial Accounting (new) Asset Accounting Master Data

Screen Layout Define Screen Layout for Asset Master Data

Define Screen Layout for Asset Master Data

Transaction Code

SPRO

2. On the Change View Screen Layout: Overview screen, select the layout.

3. Select Logical Field Groups in the dialog structure.

4. On the Display View Logical field groups: Overview screen select the logical field group.

5. Select Field group rules in the Dialog Structure.

6. On the Change View Field group rules: Overview screen make your entries and save.

Lay.

FG

Req.

Y100

01

Y100

02

Y100

Y100

Opt.

No

Class

MnNo.

Sbno.

Copy

03

04

Result

In all screen layout rules, the fields Description 1 and Cost Center have been defined as

required entry fields.

2.1.3.4

Define Screen Layout for Asset Depreciation Areas

Use

In this step, you define the screen layout control for the depreciation terms (depreciation key,

useful life, and so on) in the asset master record.

The standard screen layout 2000 has been assigned to asset classes 21000 to 95020. This

screen layout enables depreciation to be calculated at main number and sub-number level.

Procedure

1. Access the activity using one of the following navigation options:

IMG Menu

Financial Accounting Asset Accounting Master Data

Screen Layout Define Screen Layout for Asset Depreciation

Areas

Transaction Code

AO21

2. On the Change View Screen Layout: Overview screen, select the layout.

3. Select Field Group Rules in the dialog structure.

4. On the Change View Screen layout for: Overview screen maintain the following values

and save.

Lay.

FG

Req.

1000

01

SAP AG

Opt.

No

Class

X

MnNo.

X

Sbno.

Copy

X

Page 14 of

Logo[X]

ASAP Focus Methodology COMPANY [X] SAP ERP AA Configuration Guide

Lay.

FG

Req.

Opt.

No

Class

MnNo.

Sbno.

Copy

1000

02

1000

03

1000

04

1000

05

1000

08

1000

09

1000

10

1000

11

1000

12

1000

13

1000

14

1000

15

1000

16

1000

17

1000

18

1000

19

X

X

X

X

Result

The screen layout enables depreciation to be calculated at main number and sub-number

level.

2.1.3.5

Define Number Range Interval (Asset Classes)

Use

An asset number uniquely identifies an asset. It always consists of a main asset number and

an asset sub-number. Numbers can be assigned in the system externally or internally.

With external number assignment, the user is responsible for assigning the numbers. The

system displays only the defined number range interval and issues an error message if a

number has already been assigned. With internal number assignment, the system assigns

numbers sequentially.

Procedure

1. Access the activity using one of the following navigation options:

IMG Menu

Financial Accounting (New) Asset Accounting

Organizational Structures Asset Classes Define Number

Range Interval

Transaction Code

AS08

2. Enter company code 1000.

SAP AG

Page 15 of

Logo[X]

ASAP Focus Methodology COMPANY [X] SAP ERP AA Configuration Guide

3. Choose the Change Intervals button.

4. Make the following entries on the Maintain Number Range Intervals screen:

No

From Number

To Number

Ext.

01

000000010000

000000019999

02

000000020000

000000029999

03

000000030000

000000039999

04

000000040000

000000049999

05

000000100000

000000199999

08

000000080000

000000089999

90

99

000000000001

000000009999

5. Choose Save.

Result

Number ranges have been set up.

2.1.3.6

Define Asset Classes

Use

From an accounting point of view, the asset class is the most important element for

structuring fixed assets. Each asset must be assigned to one asset class only. The asset

class assigns the assets and their business transactions to the appropriate general ledger

accounts. Several asset classes can be assigned to the same account. This makes it possible

for fixed assets to be structured in more detail at asset class level. Such detailed structuring is

not necessary at general ledger account level. It is also possible to define the screen layout,

tab layout, and asset number assignment for each class.

Procedure

1. Access the activity using one of the following navigation options:

IMG Menu

Financial Accounting (New) Asset Accounting

Organizational Structures Asset Classes Define Asset

Classes

Transaction Code

OAOA

2. On the Change View Asset Classes: Overview screen, select New Entries (F5).

3. On the New Entries: Details of Added Entries screen, maintain the following values and

save:

Class

Asset Class Description

Short Text

21000

22000

23000

24000

SAP AG

Page 16 of

Logo[X]

Class

ASAP Focus Methodology COMPANY [X] SAP ERP AA Configuration Guide

Asset Class Description

Short Text

31000

50000

53000

57000

70000

79000

84000

86000

86200

86400

86500

87000

89000

95000

95010

95020

Make sure that the following values are maintained for the asset classes:

Class

Acct.

determ.

Lay.

21000

21000

Y100

22000

22000

23000

Status

of

AuC

Manage

Histor.

Real

Est.

Indicator

08

No AuC

Set

Y100

08

No AuC

Set

23000

Y300

08

No AuC

Set

24000

24000

Y100

08

No AuC

Set

31000

31000

Y100

08

No AuC

Set

50000

50000

Y100

01

No AuC

Set

53000

53000

Y110

01

No AuC

Set

57000

57000

Y300

03

No AuC

Set

70000

70000

Y200

02

Set

No AuC

Set

79000

79000

Y330

02

Set

No AuC

Set

84000

84000

Y310

03

Set

No AuC

Set

86000

86000

Y300

03

Set

No AuC

Set

86200

82000

Y300

03

Set

No AuC

Set

86400

86400

Y300

03

Set

No AcC

Set

86500

86500

Y300

03

Set

No AcC

Set

87000

87000

Y300

03

Set

No AuC

Set

SAP AG

Base

Unit

PC

Nr.

Ra.

Include

Asset

Page 17 of

Logo[X]

ASAP Focus Methodology COMPANY [X] SAP ERP AA Configuration Guide

Class

Acct.

determ.

Lay.

Base

Unit

Nr.

Ra.

Include

Asset

Status

of

AuC

Manage

Histor.

Real

Est.

Indicator

89000

89000

Y330

PC

03

Set

No AuC

Set

95000

95000

Y400

04

No AuC

Set

95010

95000

Y400

04

Line item

settm.

Set

95020

95000

Y401

04

Investment

Measure

Set

Abbreviations:

Class = Asset class

Acct. = Account Determ. (Account Determination)

Lay = Scr.Layout rule (Screen Layout Rule)

Nr.Ra = Number Range

No AuC = No AuC or summary management of AuC (AuC = Asset under Construction)

0 = other asset without real estate management

Since the number of asset classes and the way they are structured varies from

customer to customer, only a small number of asset classes have been created in

the system to serve as examples. Some asset classes refer to the same general

ledger account (for example, 86000 and 86400).

Asset class 95020 is indicated as the asset class for investment measures.

The asset classes must always be revised when the system is set up.

Result

Asset classes have been defined.

2.1.3.7

Specify Tab Layout for Asset Master Record

Use

Because of the large number of fields, the asset master record is divided into several tab

pages. In this step, you define the layout of these tab pages.

You can specify which tab pages are displayed for each asset class (or if needed, by chart of

depreciation within the asset class). For each tab page, you can specify which field groups

appear in which positions on the tab page.

Procedure

1. Access the activity using one of the following navigation options:

IMG Menu

SAP AG

Financial Accounting Asset Accounting Master Data

Screen Layout Specify Tab Layout for Asset Master Record

Page 18 of

Logo[X]

ASAP Focus Methodology COMPANY [X] SAP ERP AA Configuration Guide

Transaction Code

AOLA

2. In the Choose activity dialog box, select Define Tab Layout for Asset Master Data.

3. On the Change View Layout: Overview screen select New Entries.

4. Make the following entries:

Layout

Layout Description

ZBPA

Layout Best Practices

5. Select line ZBPA and Tab page titles in the Dialog Structure.

6. On the Change View Layout Asset Ma screen select the following tab page:

Tab Layout

Tab Page

Title

ZBPA

General

ZBPA

Time-Dependent

ZBPA

Allocations

ZBPA

Origin

ZBPA

Leasing

ZBPA

Deprec. Areas

7. Select Position of groups on the tab pages in the dialog structure.

8. On the Layout Asset Master Data: Position: Overview screen enter the following data

and save:

Tab Layout

Tab Page

Position

Group Box

ZBPA

01

S0001

ZBPA

02

S0011

ZBPA

03

S0002

ZBPA

01

S0003

ZBPA

01

S0004

ZBPA

02

S0012

ZBPA

01

S0009

ZBPA

02

S0010

ZBPA

01

S0100

Result

You have designed the tab page layouts.

2.1.3.8

Assign Tab Layouts to Asset Classes

Use

The master data layout ZBPA has to be assigned to all asset classes.

Procedure

1. Access the activity using one of the following navigation options:

SAP AG

Page 19 of

Logo[X]

ASAP Focus Methodology COMPANY [X] SAP ERP AA Configuration Guide

IMG Menu

Financial Accounting Asset Accounting Master Data

Screen Layout Specify Tab Layout for Asset Master

Record

Transaction Code

AOLK

2. In the Choose activity dialog box, select Assign Tab Layouts to Asset Classes.

3. Select the asset classes for Best Practices (beginning with 1000).

4. Select General Assignment of Layout.

5. On the Change View General Assignment of Layout: Overview screen make the

following entries:

Trans.grp

Name

Tab Layout

Layout

Others

Asset accountant

ZBPA

Layout Best Practices

6. Go back and select the next asset class and begin again with step 3.

7. Save the entries.

Result

The master data layout ZBPA has been created and assigned to the asset classes 21000 to

95020:

Asset Class

Tab Layout

00021000

ZBPA

00022000

ZBPA

00023000

ZBPA

00024000

ZBPA

00031000

ZBPA

00050000

ZBPA

00053000

ZBPA

00057000

ZBPA

00070000

ZBPA

00079000

ZBPA

00084000

ZBPA

00085000

ZBPA

00086000

ZBPA

00086200

ZBPA

00086400

ZBPA

00086500

ZBPA

00087000

ZBPA

00089000

ZBPA

00095000

ZBPA

00095010

ZBPA

SAP AG

Page 20 of

Logo[X]

ASAP Focus Methodology COMPANY [X] SAP ERP AA Configuration Guide

Asset Class

Tab Layout

00095020

ZBPA

2.1.4

Depreciation Area

2.1.4.1

Configure Asset Value Display

Use

In this step you specify the short texts the system displays for the value fields in the asset

value display transaction. You can specify particular value field texts for particular

depreciation areas.

Procedure

1. Access the activity using one of the following navigation options:

IMG Menu

Financial Accounting (New) Asset Accounting

Information System Configure Asset Value Display

Transaction Code

OAWT

1. Choose Change short texts of value fields.

2. On the Display View Depreciation areas: Overview screen you have to select the

depreciation area 01.

3. Choose Value field texts in the dialog structure.

4. Make the following entries on the Change View Value field texts: Overview screen.

No

Short Name

Description

APC

Acquisition value

APC

Acquisition value

Inv.supprt

Investment support

Revaluat.

Revaluation

11

Transf.res

Transfer reserve

12

Ord. dep.

Ordinary deprec.

13

Spec.dep.

Special depreciation

14

Unplnd.dep

Unplanned dep.

20

Revaluat.

Revaluation ord.dep.

21

Write-up

Write-up

30

Interest

Interest

31

Reserves

Trsfr cum.reserves

32

Ord. dep.

Accum. ord. depr.

SAP AG

Page 21 of

Logo[X]

ASAP Focus Methodology COMPANY [X] SAP ERP AA Configuration Guide

33

Spec.dep.

Cum.special dep.

34

Unplnd.dep

Cum.unplanned dep.

90

Net bk.val

Net book value

5. Choose Save (Ctrl +S).

2.1.4.2

Define Depreciation Areas

Use

The depreciation areas in the chart of depreciation 1000 have the following functions:

Book Depreciation (01)

This area is the master area. Transactions for this depreciation area are posted directly to the

general ledger. Depreciation area 01 does not manage any special tax depreciation. Asset

values for cost-accounting depreciation are managed in this area as well.

.

Depreciation areas that are not needed should already have been deleted from the

chart of depreciation and new depreciation areas should have been defined (see

Define Depreciation Areas).

Prerequisites

Set the chart of depreciation 1000 with transaction OAPL.

SAP AG

Page 22 of

Logo[X]

ASAP Focus Methodology COMPANY [X] SAP ERP AA Configuration Guide

Procedure

2. Access the activity using one of the following navigation options:

IMG Menu

Financial Accounting (New) Asset Accounting Valuation

Depreciation Areas Define Depreciation Areas Define

Depreciation Areas

Transaction Code

OADB

3. On the Change View: Define Depreciation Areas: Overview screen, select the

depreciation area and choose Details.

Since the chart of depreciation has been copied from 0GB, the required

depreciation areas already exist. If a depreciation area is missing add the new

depreciation area by copying it from an existing area.

4. On the Change View: Define Depreciation Areas: Details screen, make the following

entries, as shown in the following table:

Depr.

area

Real

Depr.

Area

Post

to

G/L

Target

Ledger

Group

Diff.

depr.

Area

Cross

Syst,

Depr:

Area

Acq.

Value

Net

Book

Value

Inv.

Grant

Reval.

Ord.

Depr.

Set

0L

Depr.

area

Special

Depr.

Unpl.

Depr.

Transf.

Reserv.

Inter.

Reval.

ord.

Deor.

Posting in G/L:

0 = Area does not post

1 = Area posts in real time

2 = Area posts APC and depreciation on periodic basis

3 = Area posts depreciation only

5. Choose Save.

2.1.4.3

Specify Area Type

Use

Depreciation areas are assigned to a type, which describes the primary purpose of the

depreciation area. When you create a chart of depreciation, the system copies this typing

from the reference chart of depreciation. For example, area 01 is assigned to the Book

Depreciation type.

Procedure

SAP AG

Page 23 of

Logo[X]

ASAP Focus Methodology COMPANY [X] SAP ERP AA Configuration Guide

1. Access the activity using one of the following navigation options:

IMG Menu

Financial Accounting Asset Accounting Valuation

Depreciation Areas Define Depreciation Areas Specify

Area Type

Transaction Code

OADC

2. On the chart of depreciation screen, make the following entries:

Field Name

Description

User Action and

Values

Comment

ChDep

chart of

depreciation

1000

Enter the chart of

depreciation you have

defined

3. On the Change View Actual depreciation areas: area type screen, make the following

entries (Table V_T093A_01):

Area

Name of Depreciation Area

Type

Description

01

Book Depreciation

01

Valuation for Trade Balance

Sheet

4. Choose Save

2.2 Integration with the General Ledger

Use

The system settings and entries you make in this section are required for the integration of

Asset Accounting with the General Ledger:

Depreciation areas that post depreciation/APC automatically to the General Ledger

G/L accounts that are relevant for Asset Accounting (reconciliation accounts and

accounts that are posted using batch input)

Screen layout controls for G/L accounts

Default input tax indicator for transactions not subject to tax

Specifications for periodic posting of depreciation to the General Ledger

Prerequisites

The depreciation areas that post their APC transactions and/or depreciation to the general

ledger are specified.

2.2.1

Assign G/L Accounts - Balance Sheet

Use

You need to specify general ledger accounts such as balance sheet accounts and

depreciation accounts to be able to post your asset figures to general ledger accounts.

Prerequisites

SAP AG

Page 24 of

Logo[X]

ASAP Focus Methodology COMPANY [X] SAP ERP AA Configuration Guide

The general ledger accounts must be set up.

Procedure

1. Access the activity using one of the following navigation options:

IMG Menu

Financial Accounting (New) Asset Accounting Integration

with the General Ledger Accounting Assign G/L Accounts

Transaction Code

AO90

2. If the pop-up Chart of Depreciation Selection appears, enter chart of depreciation

1000 in field ChDep. Confirm with Enter.

3. On the Change View Chart of Accounts: Overview screen, select chart of accounts

1000.

4. Choose Account Determination.

5. Choose the relevant account determination.

6. Choose Balance Sheet Accounts in the dialog structure.

7. The following general ledger accounts (chart of accounts 1000) should be assigned.

Acct.

Determination

table 1

Depr.

Area

21000

22000

23000

Acct.

Determination

table 2

Depr.

Area

21000

22000

23000

Acct. Determination

table 3

Depr.

Area

21000

22000

23000

SAP AG

Acquis.

and

prod.

costs

Acquis.

down

Paymt

Loss asset

retirem.

w/o

revenue

Contra

acct.

acquis.

value

Clear. Acct.

revenue

asset sale

Reval. acquis.

and prod.

Costs

Down

paymt.

Clearing

acct.

Gain

asset

sale

Offsetting

acct. reval.

APC

Acquis.

Affiliated

comp.

Loss

asset

sale

Cost element

settlmt. AuC

to CO obj.

Revenue

post

capitaliz.

Clear. Rev.

sale to

affil.

Comp.

Capital.

difference/

non operat.

exp.

Page 25 of

Logo[X]

ASAP Focus Methodology COMPANY [X] SAP ERP AA Configuration Guide

Acct. Determination

table 4

Depr.

Area

Field Name

21000

22000

2.2.2

Clearing of

Investment

Support

Repaymen

t of

investment

support

Expense:

Repayment of

invest.

Support

KTVIZU

KTRIZU

KTARIZ

Assign G/L Accounts - Depreciation

Use

In this step, you specify the depreciation accounts for Asset Accounting.

Procedure

1. Access the activity using one of the following navigation options:

IMG Menu

Financial Accounting (New) Asset Accounting Integration

with the General Ledger Accounting Assign G/L Accounts

Transaction Code

AO90

2. If the pop-up Chart of Depreciation Selection appears, enter chart of depreciation

1000 in field ChDep. Confirm with Enter.

3. On the Change View Chart of Accounts: Overview screen, select chart of accounts

1000.

4. Choose Account Determination.

5. Choose the relevant account determination.

6. Choose Depreciation in the dialog structure.

7. The following general ledger accounts (chart of accounts 1000) should be assigned.

Acct.

Determination

table 1

Depr.

Area

21000

01

22000

01

23000

01

Acct.

Determination

table 2

Depr.

Area

21000

01

SAP AG

Acc.Dep.

accnt.for

ord. depr.

Exp.

Acc. for

ord.

depr.

Acc.Dep.

accnt.for

unplanned

depr.

Exp.

Acc. for

ord.

depr.

below

zero

Revenue

on WriteUp ord.

depr.

Exp. Acc. Unpl.

depr.

Accum.

Acct.

special

depr.

Exp. Acc.

Unpl. Depr.

below zero

Expense

acct.

special

depr.

Expense

acct.

special

depr.

below

zero

Revenue on

Write-Up ord.

Depr.

Page 26 of

Logo[X]

ASAP Focus Methodology COMPANY [X] SAP ERP AA Configuration Guide

Acct.

Determination

table 2

Depr.

Area

22000

01

23000

01

2.2.3

Acc.Dep.

accnt.for

unplanned

depr.

Exp. Acc. Unpl.

depr.

Exp. Acc.

Unpl. Depr.

below zero

Revenue on

Write-Up ord.

Depr.

Specify Financial Statement Version for Asset Reports

Use

In this step, you determine for each depreciation area which financial statement version the

system is to use as a default. This default applies when the financial statement version is

contained in the sort version used for a given report.

In company code 1000, financial statement version 1000 has been assigned to all

depreciation areas.

Procedure

1. Access the activity using one of the following navigation options:

IMG Menu

Financial Accounting (New) Asset Accounting

Integration with the General Ledger Accounting Specify

Financial Statement Version for Asset Reports

Transaction Code

OAYN

2. On the Change View: Company code selection: Overview screen, select company code

1000 and choose then Assign financial statement version in the dialog structure.

3. On the Change View: Assign financial statement version: Overview screen make the

following entries:

Company Code

Area

Financial Statement Version

1000

01

1000

4. Choose Save.

2.2.4

Specify Document Type for Posting of Depreciation

Use

In order to post the depreciation with the depreciation posting run, you have to specify a

document type and assign it to the company code. This document type must use internal

number assignment and be used exclusively by the depreciation posting run.

Document type AF is assigned to company code 1000.

Procedure

1. Access the activity using one of the following navigation options:

IMG Menu

SAP AG

Financial Accounting (new) Asset Accounting Integration

Page 27 of

Logo[X]

ASAP Focus Methodology COMPANY [X] SAP ERP AA Configuration Guide

with the General Ledger Accounting Post Depreciation to the

General Ledger Specify Document Type for Posting of

Depreciation

Transaction Code

AO71

2. On the Choose Activity dialog box, select Specify Document Type for Posting of

Depreciation.

3. On the Document Type for Posting Depreciation screen, make the following entries:

Field Name

Description

User Actions and Values

CoCode

1000

Doc. Type

AF

Comment

4. Save your entries.

SAP AG

Page 28 of

Logo[X]

ASAP Focus Methodology COMPANY [X] SAP ERP AA Configuration Guide

2.2.5

Specify Intervals and Posting Rules

Use

In Customizing, you specify the depreciation areas for which the depreciation is posted to the

general ledger during the depreciation run. You also specify whether accounts are to be

assigned to a CO object (cost center or internal order) and the period interval in which the

posting takes place.

Procedure

1. Access the activity using one of the following navigation options:

IMG Menu

Financial Accounting (New) Asset Accounting Integration

with the General Ledger Accounting Post Depreciation to the

General Ledger Specify Intervals and Posting Rules

Transaction Code

OAYR

2. On the change view Company code selection: Overview screen, select the company

code 1000. In the dialog structure select Posting rules.

3. On the change view Posting rules: Overview screen, select the depreciation area and

go to Details.

4. On the change view Posting rules: Details screen, make the following entries:

Field Name

Description

User Action and Values

Comment

Depreciation

area

01

Select

monthly

posting

Activate

5. Save your entries.

Result

The following settings have been made for company code 1000:

Deprec.

Area

01

2.2.6

Monthly

Posting

Annual

Posting

Assign

Cost

Centers

Post to

Internal

Order

Period Interval

001 (monthly)

Specify Account Assignment Types for Account

Assignment Objects

Use

In this step, you assign account assignment types to the account assignment objects.

Procedure

1. Access the activity using one of the following navigation options:

SAP AG

Page 29 of

Logo[X]

ASAP Focus Methodology COMPANY [X] SAP ERP AA Configuration Guide

IMG Menu

Financial Accounting (New) Asset Accounting Integration

with the General Ledger Accounting Additional Account

Assignment Objects Specify Account Assignment Types for

Account Assignment Objects

Transaction Code

ACSET

2. On the Company Code: Overview screen, select the company code 1000.

3. Select the Depreciation Area in the dialog structure.

4. On the Depreciation Area Overview screen select the depreciation area listed in the

table below.

5. Select Account Assignment Objects in the dialog structure.

6. On the Account Assignment Objects Overview screen make the following entries for

account assignment type:

Chart of

Depreciation

Depr. Area

Acc.A.

Object

Trans.Type

Acc.A.

Type

Acc.A.

1000

01

CAUFN

APC Values

Posting

1000

01

CAUFN

Depreciation

Run

1000

01

KOSTL

APC Values

Posting

1000

01

KOSTL

Depreciation

Run

Result

Assignments made for Chart of Depreciation 1000.

2.2.7

Specify Document Type for Periodic Processing

Use

In this step, you assign the document type for period processing.

Procedure

1. Access the activity using one of the following navigation options:

SAP AG

Page 30 of

Logo[X]

ASAP Focus Methodology COMPANY [X] SAP ERP AA Configuration Guide

IMG Menu

Financial Accounting(New) Asset Accounting Integration

with the General Ledger Accounting Post APC Values

Periodically to the General Ledger Specify Document Type for

Periodic Processing

Transaction Code

SPRO

2. On the Change View Document Types for Periodic Posting of Asset Values: Overview

screen make the following entries.

Company code

Doc Type

Description

1000

AP

Periodic asset post

3. Save the entries.

2.3 Valuation

Use

In this section, you make all configurations that have to do with the valuation of fixed assets.

2.3.1

Depreciation Areas

2.3.1.1

Specify Transfer of APC Values

Use

In this step, you define transfer rules for the acquisition values of depreciation areas. These

transfer rules ensure that certain depreciation areas manage identical acquisition values.

Procedure

1. Access the activity using one of the following navigation options:

IMG Menu

Financial Accounting (new) Asset Accounting Valuation

Depreciation Areas Specify Transfer of APC Values

Transaction Code

OABC

2. On the Depreciation Areas: Rules for value takeover screen, make the following entries:

Chart of Depreciation

Depreciation Area

ValAd

1000

01

00

Ident.

3. Choose Save.

2.3.1.2

Specify Transfer of Depreciation Terms

Use

In this step, you define transfer rules for the depreciation terms. You cannot define any

depreciation terms in the asset master record for the depreciation areas to which the

SAP AG

Page 31 of

Logo[X]

ASAP Focus Methodology COMPANY [X] SAP ERP AA Configuration Guide

depreciation terms are being transferred. This ensures that the value of the depreciation

areas is reduced uniformly.

Procedure

1. Access the activity using one of the following navigation options:

IMG Menu

Financial Accounting (New) Asset Accounting Valuation

Depreciation Areas Specify Transfer of Depreciation Terms

Transaction Code

OABD

2. On the Depreciation areas: Rules for takeover of deprec. term screen, make the following

entries:

Chart of

Depreciation

Depreciation Area

TTr (Terms Transfer)

1000

01

00

Identical

3. Choose Save.

2.3.1.3

Determine Depreciation Areas in the Asset Class

Use

When creating fixed assets, you can assign default values for the depreciation key and useful

life, for example, by means of asset classes.

Since the number and structure of the asset classes is extremely customer-specific, only a

few examples of asset classes have been created in the system.

Note:

The list above only shows the default values for the depreciation key and useful life in

depreciation areas 01.

The asset classes always have to be revised when the system is set up.

Procedure

1. Access the activity using one of the following navigation options:

IMG Menu

Financial Accounting (New) Asset Accounting

Valuation Determine Depreciation Areas in the

Asset Class

Transaction Code

OAYZ

2. On the Change View Asset class: Overview screen, select an asset class. Select

Depreciation Areas in the dialog structure.

3. On the Change View Depreciation Areas: Overview screen, enter the following data for

the asset classes and save your entries.

SAP AG

Page 32 of

Logo[X]

ASAP Focus Methodology COMPANY [X] SAP ERP AA Configuration Guide

Asset

Class

Chart of

Depreciation

Depreciation

Area

Layout

Depreciati

on Key

00021000

1000

01

2000

0000

Planned

Useful

Life in

Years

(Use)

Planned

Useful

Life in

Periods

(Per)

4. Choose Save.

2.3.1.4

Specify Low-Value Asset Class

Use

During every acquisition posting, the system checks the maximum low-value asset (LVA)

amount, providing that the appropriate LVA indicator is set in the asset class concerned.

For chart of depreciation 1000, the LVA indicator has been set in the asset classes 79000 and

89000 for all the depreciation areas. The system checks the maximum amount in conjunction

with the quantity.

Procedure

1. Access the activity using one of the following navigation options:

SAP AG

Page 33 of

Logo[X]

ASAP Focus Methodology COMPANY [X] SAP ERP AA Configuration Guide

IMG Menu

Financial Accounting (New) Asset Accounting Valuation

Amount Specifications (Company Code/Depreciation Area)

Specify Max. Amount for Low-Value Assets + Asset Classes

Specify LVA Asset Classes

Transaction Code

OAY2

2. If the dialog box Chart of depreciation selection appears, enter chart of depreciation YBGB

and choose Enter.

3. On the Change View: Asset Class: Overview screen, select the following asset classes

(one after the other) and select Low-val. asset check in the dialog structure.

4. On the Change View: Low-val. asset check: Overview screen, make the following

entries:

Asset Class

Chart of Depreciation

Depreciation Area

LVA Indicator

5000

1000

01

5. Choose Save.

2.3.1.5

Assign Unit of measure to low value asset classes

Use

For the chart of depreciation 1000, the unit of measure has been set in the asset classes

79000 and 89000.

Procedure

1. Access the activity using one of the following navigation options:

IMG Menu

Financial Accounting (New) Asset Accounting

Organizational Structures Asset Classes Define Asset

Classes

Transaction Code

OAOA

2. On the Asset Class: Overview screen select the following asset classes (one after the

other):

Class

Short Text

Asset Class description

79000

LVA Machinery

Low-Value Assets Machinery

3. On the Change View Asset Classes: Details screen make the following entry:

Base Unit

ea

4. Choose Save.

2.3.1.6

Specify Max. Amount for Low-Value Assets

Use

SAP AG

Page 34 of

Logo[X]

ASAP Focus Methodology COMPANY [X] SAP ERP AA Configuration Guide

In this step, you define the maximum amount for low-value assets (LVAs) for each company

code and depreciation area. The system checks the maximum amount during each

acquisition posting, provided that the corresponding LVA indicator is set in the relevant asset

class.

The following amounts have been defined for low-value assets for the depreciation areas in

company code 1000:

Maximum LVA amount

xxxxUSD

Maximum LVA amount for purchase orders for assets

xxxxUSD

Procedure

1. Access the activity using one of the following navigation options:

IMG Menu

Financial Accounting (New) Asset Accounting Valuation

Amount Specifications (Company Code/Depreciation Area)

Specify Max. Amount for Low-Value Assets + Asset Classes

Transaction Code

OAYK

2. On the Company Code Selection: Overview screen select company code 1000 and

select in amount for low value assets in the dialog structure.

3. On the Amount for low value assets: Overview screen, make the following entries:

Company Code

1000

Area

01

LVA Amount

xxxx.xx

Maximum LVA Amount for

Purchase Order

xxxx.xx

4. Choose Save.

2.3.1.7

Specify Rounding of Net Book Value and/or

Depreciation

Use

You can specify how net book values at year end, depreciation, and replacement values are

to be rounded. You make the specifications for each depreciation area and company code.

No rounding specification has been defined for company code 1000.

Procedure

1. Access the activity using one of the following navigation options:

IMG Menu

SAP AG

Financial Accounting Asset Accounting Valuation

Amount Specifications (Company Code/Depreciation Area)

Specify Rounding of Net Book Value and/or Depreciation

Page 35 of

Logo[X]

ASAP Focus Methodology COMPANY [X] SAP ERP AA Configuration Guide

Transaction Code

OAYO

2. On the Change View Company Code selection: Overview screen select company code

1000 and select Rounding specifications in the dialog structure.

3. On the Change View: Rounding Specifications: Overview screen select the depreciation

area (see table below) and choose Details.

4. On the Change View: Rounding Specifications: Details screen, make the following

entries for each depreciation area:

Area

Net book

value at year

end

01

Autom.

Calcul.

Depr.

x

Replacement

value

Arithm.

Round.

Round

up

Round down

select

5. Save your entries.

2.3.1.8

Define Depreciation Areas for Foreign Currencies

Use

In Asset Accounting, you can manage depreciation areas in any currency. You can use the

values from these areas for consolidation and evaluation purposes.

No foreign currency has been defined for company code 1000. All depreciation areas are

managed in USD.

Procedure

1. Access the activity using one of the following navigation options:

SAP AG

Page 36 of

Logo[X]

ASAP Focus Methodology COMPANY [X] SAP ERP AA Configuration Guide

IMG Menu

Financial Accounting(New) Asset Accounting Valuation

Currencies Define Depreciation Areas for Foreign Currencies

Transaction Code

OAYH

2. On the Change View Company code selection: Overview screen, select following line:

Company Code

Company Name

1000

Company Code 1000

3. On the Change View Depreciation area currency: Overview screen, make the following

entries:

Area

Name of depreciation area

Crcy

01

Book depreciation

USD

4. Save your entries.

2.3.1.9

Specify the Use of Parallel Currencies

Use

In Financial Accounting, you can manage all the values of a company code in up to three

currencies at the same time for the same accounts. If you only need foreign currency

amounts for the group consolidation of your fixed asset, and therefore do not require a

different valuation approach (APC/depreciation terms) to the one you use for local currency,

you can use the function for parallel valuation in Asset Accounting.

To do so, you have to manage a depreciation area for each currency with the following

attributes:

The currency type and currency of the depreciation area are identical with the

corresponding parallel currency in the company code concerned.

In this area, depreciation terms and acquisition values are managed in exactly the

same way as in the book depreciation area.

The system automatically provides the corresponding posting documents with the additional

values from these depreciation areas.

Procedure

1. Access the activity using one of the following navigation options:

IMG Menu

Financial Accounting (New) Asset Accounting Valuation

Currencies Specify the Use of Parallel Currencies

Transaction Code

OABT

2. In the dialog box Determine Work Area: Entry enter chart of depreciation 1000. Choose

Continue.

3. On the Change View: Set up parallel currencies: Overview screen, make the following

entries:

SAP AG

Page 37 of

Logo[X]

ASAP Focus Methodology COMPANY [X] SAP ERP AA Configuration Guide

Ar.

Dep. area

Book deprec.

Crcy type

Val ID

IdAPC

TTr

IdntTrm

4. Choose Save.

2.3.2

Depreciation

Use

In the following section, you make system settings for fixed asset depreciation.

2.3.2.1

Determine Depreciation Areas (Ordinary

Depreciation)

Use

In this step, you determine the depreciation areas in which you want to manage ordinary

depreciation. This setting means that this value type is allowed in the relevant depreciation

area.

In chart of depreciation 1000, ordinary depreciation can be managed in all depreciation areas.

Procedure

1. Access the activity using one of the following navigation options:

IMG Menu

Financial Accounting (New) Asset Accounting Depreciation

Ordinary Depreciation Determine Depreciation Areas

Transaction Code

OABN

2. On the Specify depreciation areas for ordinary depreciation screen, activate for all

depreciation areas.

Field Name

Description

User Action and Values

Depr. Area

Depreciation area

Select all: 01

Ord. Depr.

ordinary

depreciation

Select (all depreciation areas)

Comment

activate

3. Save your entries.

4. Select one depreciation area after the other and go to detail screen.

5. On the Specify depreciation areas for ordinary depreciation screen, make the following

entries:

Field Name

Description

User Action and Values

Depr.Area

Depreciation area

for 01

Only negative

values and zero

allowed

SAP AG

Comment

activate

Page 38 of

Logo[X]

ASAP Focus Methodology COMPANY [X] SAP ERP AA Configuration Guide

6. Save your entries.

2.3.2.2

Determine Depreciation Areas (Unplanned

Depreciation)

Use

In this step, you determine the depreciation areas in which you want to manage unplanned

depreciation. This setting means that this value type is allowed in the relevant depreciation

area.

In chart of depreciation 1000, unplanned depreciation can be managed in all depreciation

areas.

Procedure

1. Access the activity using one of the following navigation options:

IMG Menu

Financial Accounting (New) Asset Accounting Depreciation

Unplanned Depreciation Determine Depreciation Areas

Transaction Code

OABU

2. On the Change View Asset Accounting: Define if unplanned deprec. pos/neg: Overview

screen, activate unplanned depreciation for the following depreciation areas.

Field Name

Description

User Action and Values

Depr. area

depreciation area

Select all: 01

UDep

unplanned

depreciation

Comment

activate

3. Save your entries.

2.3.2.3

Maintain Depreciation Keys

Use

In general only depreciation keys included in the reference chart of depreciation are used.

The copy of the reference chart of depreciation to 1000 also copied all available depreciation

keys.

As only active depreciation keys can be assigned to the fixed assets, you should check that

all the required depreciation keys have been activated.

Procedure

1. Access the activity using one of the following navigation options:

IMG Menu

Financial Accounting (New) Asset Accounting Depreciation

Valuation Methods Depreciation Key Maintain

Depreciation Key

Transaction Code

AFAMA

2. On the Change View Depreciation Key: Overview screen, select New Entries:

SAP AG

Page 39 of

Logo[X]

ASAP Focus Methodology COMPANY [X] SAP ERP AA Configuration Guide

2.3.3

Transactions

Use

In this step, you define the transaction types for asset transactions. You can also specify that

only certain depreciation areas will be proposed for posting for certain transaction types.

The standard transaction types are used, which means that no new transaction types have to

be created

2.3.3.1

Allow Down Payment/Transfer Transaction Types in

Asset Classes

Use

In this step, you determine the asset classes for which postings are to be allowed with the

transaction type groups for down payments and transfers.

Procedure

1. Access the activity using one of the following navigation options:

SAP AG

Page 40 of

Logo[X]

ASAP Focus Methodology COMPANY [X] SAP ERP AA Configuration Guide

IMG Menu

Financial Accounting (New) Asset Accounting Transactions

Acquisitions Allow Down Payment Transaction Types in

Asset Classes

Transaction Code

OAYB

2. On the Display View Transaction type group selection: Overview screen, select

transaction type group 15 (and later 16, 38 and 39). In the dialog structure select

Specification of asset classes.

3. On the Change View Specification of asset classes: Overview screen enter the relevant

asset classes.

4. Save your entries.

Result

The following entries should be made for chart of depreciation YBGB:

TTG

Name for the Transaction Type

Group

Class

Asset Class Description

15

Down Payment

4000

Assets under const.

4001

Investment measure

4000

Assets under const.

4001

Investment measure

16

2.3.3.2

Down Paymt Bal. frm Prev. Years

Determine Cost Element for Settlement to CO

Receiver

Use

When you settle an asset with line item management, debits can be settled to CO receivers

(particularly cost centers). This might be necessary if debits were capitalized to the asset

under construction by mistake. The system requires a cost element in order to make this

settlement to CO receivers.

In chart of accounts BPGB, account 992210 has been defined in AuC account determination

40000 for depreciation area 01 as the cost element for settlement of the asset under

construction to CO objects.

Procedure

1. Access the activity using one of the following navigation options:

IMG Menu

Financial Accounting (New) Asset Accounting Transactions

Capitalization of Assets Under Construction Determine

Cost Element for Settlement to CO Receiver

Transaction Code

AO89

2. If the Chart of Depreciation Selection screen appears, make the following entries:

Field Name

Description

User Action and

Values

ChDep

Chart of

1000

SAP AG

Comment

Page 41 of

Logo[X]

ASAP Focus Methodology COMPANY [X] SAP ERP AA Configuration Guide

Field Name

Description

User Action and

Values

Comment

Depreciation

3. On the Change View Chart of accounts: Overview screen, select Chart of account

BPGB.

4. Select Account Determination.

5. On the Change View Account Determination: Overview screen, select account

determination 40000 and Assign Accounts to Areas.

6. On the screen Change View Assign Accounts to Areas: Details screen, make the

following entries:

Field Name

Description

User Actions and Values

Cost Elem. for

Settlmt AuC to CO

Objects

Comment

992210

7. Save your entries.

2.3.3.3

Assign Settlement Profiles

Use

In order to settle assets under construction, you have to assign a settlement profile at

company code level. The settlement profile includes settings on the allowed receivers of the

settlement.

The standard SAP system contains settlement profile AI for settling assets under construction.

The standard settlement profile AI has been assigned to company code 1000.

Procedure

1. Access the activity using one of the following navigation options:

IMG Menu

Financial Accounting (New) Asset Accounting Transactions

Capitalization of Assets Under Construction Define/Assign

Settlement Profiles Assign Settlement Profile to Company

Code

Transaction Code

OAAZ

2. On the screen Change View FI-AA: Settlement Profile, make the following entries:

Field Name

Description

User Actions and Values

CoCd

Company Code

1000

SProf.

Settlement Profile

AI

Comment

3. Save your entries.

SAP AG

Page 42 of

Logo[X]

2.3.4

ASAP Focus Methodology COMPANY [X] SAP ERP AA Configuration Guide

Information System

2.3.4.1

Define or Assign Forms for History

Use

When the historical management function is active (Manage Historically indicator), you can

print an asset chart. The Manage Historically indicator has been set for all asset classes.

For each asset class, you can define a separate form for the asset history. The standard SAP

form FIAA_F001 had been copied to YB_FIAA_F001 and is now assigned to the Best

Practice example asset classes.

Procedure

1. Access the activity using one of the following navigation options:

IMG Menu

Financial Accounting (new) Asset Accounting Information

System Define or Assign Forms Assign Asset

Class/History Sheet

Transaction Code

OAAY

2. `Make the following entries on the Assignment of Form for History screen:

No.

Class

Layout Set Name

00021000

YB_FIAA_F001

00022000

YB_FIAA_F001

00023000

YB_FIAA_F001

3. Save your entries.

Result

The Asset History report uses the form YB_FIAA_F001 for all assets created within the Best

Practice asset classes and generates an asset chart. The form YB_FIAA_F001 is a copy of

the standard form in client 000 and can therefore be adjusted for individual requirements.

2.3.5

Asset Data Transfer

2.3.5.1

Set Company Code Status

Use

Status 2 (Test company code with data transfer always allowed) has been assigned to

company code 1000. After the go live, status 0 (Asset Data Transfer Completed) should be

set. The productive indicator prevents data in this company code being deleted by programs

for deleting test data.

Procedure

1. Access the activity using one of the following navigation options:

IMG Menu

SAP AG

Financial Accounting (New) Asset Accounting Asset Data

Transfer Set Company Code Status

Page 43 of

Logo[X]

ASAP Focus Methodology COMPANY [X] SAP ERP AA Configuration Guide

Transaction Code

SPRO

2. On the FI-AA: Set Status of the Company Code screen, make the following entries:

Field Name

Description

User Actions and

Values

CoCd

Company code

1000

Status

Comment

3. Save your entries.

Result

The test status is set for asset accounting. You can still delete your test data.

2.3.5.2

Specify Transfer Date/Last Closed Fiscal Year

Use

In this step, you determine the transfer date for the legacy data transfer. This date determines

the posting status to be used for the transfer (posting up to this date will be included in the

transfer), not the actual date the data transfer is carried out. This setting also determines

whether you want to perform the transfer during the fiscal year (with transfer of posted

transactions/depreciation in the current fiscal year) or at the end of the fiscal year (without

transactions).

The system automatically derives the last closed fiscal year from the transfer date.

The transfer date 12/31/<previous year> is proposed for company code 1000, in other words,

the values are transferred for fiscal year <current year>.

If no data transfer is carried out during the fiscal year, the current fiscal year first has

to be opened using the Carry Out Fiscal Year Change function before the data

transfer is carried out.

If no fiscal year change is carried out, the system outputs the error message AY 252

Current fiscal year xxxx has to be after transfer date xx/xx/xxxx when the legacy

data is created.

Procedure

1. Access the activity using one of the following navigation options:

IMG Menu

Financial Accounting (New) Asset Accounting Asset Data

Transfer Parameters for Data Transfer Date Specifications

Specify Transfer Date/Last Closed Fiscal Year

Transaction Code

SPRO

2. On the Change View FI-AA: Date of Legacy Data Transfer screen, make the following

entries:

Field Name

Company Code

SAP AG

Description

User Actions and Values

Comment

1000

Page 44 of

Logo[X]

ASAP Focus Methodology COMPANY [X] SAP ERP AA Configuration Guide

Field Name

Description

Take-Over Date

User Actions and Values

Comment

31.12./<previous year>

Select current

year 1

3. Save your entries.

2.4 Import/Create Master Data

2.4.1

Create Fixed Assets Master Data

In the following subchapters you can create the asset master data.

2.4.1.1

Create Values for Legacy Assets

Use

Legacy data transfer is the transfer of existing data from a previous system or from a

manually maintained fixed asset card file. The transfer of legacy data is generally the first

action after you configure the Asset Accounting (FI-AA) component and classify your assets.

This task involves transferring asset master records and transactions from the start of the

fiscal year up until you go live.

The asset data part of this transaction is the same as in the Create asset function (AS01).

The data transfer transaction, however, also includes functions for entering cumulative asset

values and the transactions in the current fiscal year.

Procedure

1. Access the activity using one of the following navigation options:

IMG Menu

Financial Accounting (New) Asset Accounting Asset Data

Transfer Manual Online Transfer Create/Change/Display

Legacy Asset

Transaction Code

AS91

2. On the Choose Activity screen choose Create Legacy Asset.

3. On the Create Legacy Data: Initial screen, provide the necessary data and select Master

Data:

Field Name

Description

Asset class

Name of the

asset class

Company Code

User Action and

Values

Comment

1000

4. On the Create Asset: Master Data screen, make the following sets of entries on tab pages

General, Time-Dependent and Deprec. Areas:

5. On the Create Legacy Data: Master Data screen, choose Takeover values ((Shift + F8)

and make the following sets of entries and save:

SAP AG

Page 45 of

Logo[X]

ASAP Focus Methodology COMPANY [X] SAP ERP AA Configuration Guide

Temp

num

Asset value fields

01 Book deprec. USD

Accm.ord.deprec

38710,68

Cum.acquis.val.

51608,68

Accm.ord.deprec

173.893,08

Cum.acquis.val.

231826,08

6. Save your entries.

SAP AG

Page 46 of

Вам также может понравиться

- Sap Fi Asset Accounting Aa User GuideДокумент29 страницSap Fi Asset Accounting Aa User GuideHarsha B Narayanappa100% (1)

- Sap Internal OrderДокумент37 страницSap Internal OrderVaidyanathanОценок пока нет

- PARALLEL LEDGERS IN ASSET ACCOUNTINGДокумент35 страницPARALLEL LEDGERS IN ASSET ACCOUNTINGSharad TiwariОценок пока нет

- F-05 - Foreign Currency ValuationДокумент14 страницF-05 - Foreign Currency ValuationDipak kumar PradhanОценок пока нет

- Capital Investment OrdersДокумент7 страницCapital Investment OrdersSujith Kumar33% (3)

- Difference Between Leading Ledger and Non Leading LedgerДокумент1 страницаDifference Between Leading Ledger and Non Leading LedgeromiconОценок пока нет

- Scenarios For SAP FCVДокумент21 страницаScenarios For SAP FCVmanishpawar11Оценок пока нет

- Automatic Payment Program Run F110 - SAP TutorialДокумент20 страницAutomatic Payment Program Run F110 - SAP TutorialVenkateswarlu vОценок пока нет

- Parallel LedgerДокумент35 страницParallel LedgerhshasapОценок пока нет