Академический Документы

Профессиональный Документы

Культура Документы

Accounting Equations-Practice Material

Загружено:

Tejas Desai0 оценок0% нашли этот документ полезным (0 голосов)

146 просмотров4 страницыAccounting equation

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документAccounting equation

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

146 просмотров4 страницыAccounting Equations-Practice Material

Загружено:

Tejas DesaiAccounting equation

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 4

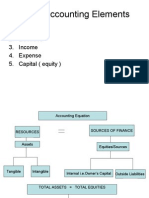

Chapter:-

Introduction:At

Accounting Equation

any point of time, the resources of a business entity must be

equal to the claims of the persons who have financed these resources.

The resources of a business unit,as we all know, is provided by its

owners and outsiders; the claims of the owners/proprietors are known as CAPITAL

while the claims of the outsiders ar called LIABILITIES.

In other words, the total assets of a business entity are equal to its

capital and liabilities.This fact can be expressed in the form of the following

equation:

Assets=Capital + Liabilities

Any business event or transaction taking place in the business affects this

equation in one way or the other ,but ultimate total of Asset side will always be

equal to total of Capital and Liabilities.

Q.No.

Reference

Problem

Q.1

Q2

Show the Accounting Equation on the basis of the following

transactions and prepare a Balance Sheet on the basis of the last

equation.

Transaction 1: Manoj started business with Rs.50,000 as

capital.

Transaction 2: Manoj purchased furniture for cash Rs.5,000.

Transaction 3: He purchased goods for cash Rs.30,000.

Transaction 4: He purchased goods on credit for Rs.20,000.

Transaction 5: Goods costing Rs.25,000 sold on credit for

Rs.35,000.

Transaction 6: Rent paid Rs.3,000.

Show the Accounting Equation on the basis of the following

transactions and prepare a Balance Sheet on the basis of the

last equation.

1. Mahesh commenced business with cash 1,00,000

2. Purchased goods for cash 70,000

3. Purchased goods on credit 80,000

4. Purchased furniture for cash 3,000

5.Paid rent 2,000

6.Sold goods for cash costing Rs.45,000 at 60,000

7. Paid to creditors 20,000

8.Withdrew cash for private use 10,000

9.Paid salaries 5,000

10. Sold goods on credit (cost price Rs.60,000) Rs.80,000

1

Q.3

Q.4

Prepare an Accounting Equation from the following

transactions in the books of Mr. X for January, 2015 :1 Invested Capital in the rm Rs. 20,000

2 Purchased goods on credit from Das & Co. for Rs. 2,000

4 Bought plant for cash Rs. 8,000

8 Purchased goods for cash Rs. 4,000

12 Sold goods for cash (cost Rs. 4,000 + Prot Rs. 2,000)

Rs. 6,000.

18 Paid to Das & Co. in cash Rs. 1,000

22 Received from B. Banerjee Rs. 300

25 Paid salary Rs. 6,000

30 Received interest Rs. 5,000

31 Paid wages Rs. 3,000

Prepare the Accounting Equation on the basis of the

following :

1.Started business with cash Rs.70,000.

2.Credit Purchases of Goods Rs.18,000.

3.Payments made to creditors in full settlement Rs.17,500.

4.Purchase of Machinery for Cash Rs.20,000.

Q.5 Mr.Rakesh started business as on 01.04.2014 with a

capital of Rs.1,50,000.During the year ,the following

transactions took place:---Rs.

1.Furniture purchased for cash

20,000

2.Purchased goods from Mahesh on credit

25,000

Q.6

3.Sold goods(costing Rs.10,000) to Mohan for cash 14,000

4.Additional Capital Introduced

20,000

5.Commission Received in Advance

02,000

6.Paid to creditor [Mahesh] Rs.22,500 in full settlement.

7.Sold goods [costing Rs.15,000] for Rs.18,000 out of which

Rs.5,000 received in cash.

8.Depreciation on Furniture provided @10%.

From the following information ,Calculate the Total Assets of

the business:Capital Rs.4,00,000 ;Creditors Rs.3,00,000;Revenue earned

during the period Rs.7,50,000;Expenses incurred during the

period Rs.2,00,000 and value of unsold stock Rs.2,00,000.

2

Q.7

Create an Accounting Equation on the basis of the following

transactions and show the resulting Balance Sheet:-- [Rs.]

1.Manu started business with Cash

5,00,000

2.Purchased a building from Sohan. Paid by

10,00,000

raising a loan from SBI

3.Paid interest on Loan Rs.20,000 and Installment of

Rs.2,00,000.

4.Purchased goods from Sohan on Credit

1,00,000

5.Goods returned to Sohan costing

20,000

6.Sold goods costing Rs.40,000 for Rs.50,000 on credit to

Ram.

7.Took goods of Rs.10,000 from business for personal use.

8.Accrued Interest

5,000

9.Commission Received in Advance

20,000

10.Cash Received From Ram

10,000

Q.8

Mr.X commenced his cloth business on 01.04.2014 with a

capital of Rs.30,000.On 31st March,2015 his assets were

Rs.50,000 and liabilities were Rs.10,000.

Find out his Closing Capital and Profits Earned during the year.

Q.9

X started a business on 1st April,2012 with a capital of

Rs.50,000 and a Loan of Rs.25,000 borrowed from Y.

During 2012-13,he had introduced additional capital of

Rs.25,000 and had withdrawn Rs.15,000 for personal

use.On 31st March,2013 his assets were Rs.1,50,000.

Find out his capital as on 31.03.2013 and profit made or

loss incurred during 2012-13.

Q.10 On 31st March ,2013 ,the total assets and external liabilities

were Rs.1,00,000 and Rs.3,000 respectively.

During the year ,the proprietor had introduced additional

capital of Rs.10,000 and had withdrawn Rs.6,000 for

personal use.He made a profit of Rs.10,000 during the year .

Calculate the Capital as on 01.04.2012.

Вам также может понравиться

- Accounting Equation and General JournalДокумент3 страницыAccounting Equation and General JournalWaqar AhmadОценок пока нет

- Cambridge Made a Cake Walk: IGCSE Accounting theory- exam style questions and answersОт EverandCambridge Made a Cake Walk: IGCSE Accounting theory- exam style questions and answersРейтинг: 2 из 5 звезд2/5 (4)

- Assignment No. 01 FAPДокумент4 страницыAssignment No. 01 FAPUmar FaridОценок пока нет

- Accountancy WorksheetДокумент5 страницAccountancy WorksheetAnimesh RajОценок пока нет

- Accounting Terms and ConceptsДокумент4 страницыAccounting Terms and ConceptsNirajОценок пока нет

- Accounting EquationДокумент31 страницаAccounting EquationKathuria AmanОценок пока нет

- Accounting EquationДокумент31 страницаAccounting EquationgganyanОценок пока нет

- Accountancy XI Question BankДокумент3 страницыAccountancy XI Question BankDeivanai K CSОценок пока нет

- Accounts Worksheet 1.4 Class XIДокумент4 страницыAccounts Worksheet 1.4 Class XIMuskan AgarwalОценок пока нет

- Basics of Accounting Question Bank PDDM Term 1Документ34 страницыBasics of Accounting Question Bank PDDM Term 1sapitfin0% (1)

- Chapter 5 - Accounting EquationДокумент17 страницChapter 5 - Accounting EquationRiya AggarwalОценок пока нет

- Accounting Equation Imp 1Документ5 страницAccounting Equation Imp 1hiritik gupta100% (1)

- Progressive 11th Accounts Chapter 5Документ11 страницProgressive 11th Accounts Chapter 5Aarya khandelwalОценок пока нет

- Tally ExamplesaДокумент7 страницTally ExamplesaDeep Kumar33% (3)

- Tutorial 05Документ3 страницыTutorial 05Janidu KavishkaОценок пока нет

- TS Grewal Accountancy Class 11 Solutions Chapter 2 Accounting EquationДокумент21 страницаTS Grewal Accountancy Class 11 Solutions Chapter 2 Accounting Equationpalak mahobiyaОценок пока нет

- Class 11 Accountancy Worksheet - 2023-24Документ17 страницClass 11 Accountancy Worksheet - 2023-24Yashi BhawsarОценок пока нет

- Fundamentals of Financial Accounting: Question No. 1Документ1 страницаFundamentals of Financial Accounting: Question No. 1Hashim MughalОценок пока нет

- Journal Ledger Trial BalanceДокумент8 страницJournal Ledger Trial BalancejessОценок пока нет

- Problem Assignment - 01Документ5 страницProblem Assignment - 01Anand BabarОценок пока нет

- Financial Accounting I Accounting Equation Problem #1Документ2 страницыFinancial Accounting I Accounting Equation Problem #1Muhammad MuneebОценок пока нет

- Accounting Equation Problems and SolutionДокумент7 страницAccounting Equation Problems and SolutionNilrose EscartinОценок пока нет

- 11 Accountancy Notes Ch03 Recording of Transactions 02Документ20 страниц11 Accountancy Notes Ch03 Recording of Transactions 02Subodh Saxena100% (1)

- Problem Set 1 UpdatedДокумент2 страницыProblem Set 1 UpdatedRubab MirzaОценок пока нет

- MAA AssignmentДокумент2 страницыMAA AssignmentVineela PathapatiОценок пока нет

- Assigment BBM Finacial AccountingДокумент6 страницAssigment BBM Finacial Accountingtripathi_indramani5185Оценок пока нет

- Accouting Equation HandoutДокумент5 страницAccouting Equation HandoutALI ZAFAR� LIAQAT UnknownОценок пока нет

- Accounting Equations ProblemsДокумент3 страницыAccounting Equations Problemsmaheshbendigeri5945Оценок пока нет

- Asm 2670Документ3 страницыAsm 2670Pushkar MittalОценок пока нет

- Accounting Equation - EworkbookДокумент20 страницAccounting Equation - EworkbookDENCY THOMASОценок пока нет

- Cash BookДокумент4 страницыCash BookSuneet SaxenaОценок пока нет

- Lecture 4 Accounting EquationДокумент60 страницLecture 4 Accounting EquationDevyansh GuptaОценок пока нет

- Financial Accouting NotesДокумент35 страницFinancial Accouting NotesAditya DalviОценок пока нет

- Chapter 1 - Some Basic QuestionsДокумент6 страницChapter 1 - Some Basic QuestionsBracu 2023Оценок пока нет

- General Journal Practice QuestionsДокумент7 страницGeneral Journal Practice QuestionsTahira Batool100% (1)

- Accounting EquationДокумент2 страницыAccounting EquationVaibhav GuptaОценок пока нет

- June 2017 1 5: Problem 5Документ2 страницыJune 2017 1 5: Problem 5Roqui M. GonzagaОценок пока нет

- Activity ABMДокумент2 страницыActivity ABMRoqui M. GonzagaОценок пока нет

- Accounting Equation ProblemДокумент2 страницыAccounting Equation ProblemSenthil ArasuОценок пока нет

- Question Bank For AccountsДокумент12 страницQuestion Bank For AccountsSwati DubeyОценок пока нет

- Accounting EquationДокумент6 страницAccounting Equationsasmita_giriОценок пока нет

- CBSE Class 11 Accountancy Worksheet - Question BankДокумент17 страницCBSE Class 11 Accountancy Worksheet - Question BankUmesh JaiswalОценок пока нет

- Basic Accounting Complete TheoryДокумент10 страницBasic Accounting Complete TheoryKamlesh KumarОценок пока нет

- AccountancyДокумент2 страницыAccountancy;-}Оценок пока нет

- Debit Credit RulesДокумент9 страницDebit Credit RulesMubeen JavedОценок пока нет

- Transaction & Tabular AnalysisДокумент18 страницTransaction & Tabular AnalysisMahmudul Hassan RohidОценок пока нет

- FA - Excercises & Answers PDFДокумент17 страницFA - Excercises & Answers PDFRasanjaliGunasekeraОценок пока нет

- System of Book-KeepingДокумент19 страницSystem of Book-KeepingSandeep RayОценок пока нет

- Journalizing TransactionsДокумент5 страницJournalizing TransactionsSatvik Bisht100% (1)

- Introduction To Accounting - Assignment 2 - Accounting Equation - Dr. GKДокумент2 страницыIntroduction To Accounting - Assignment 2 - Accounting Equation - Dr. GKshruthinОценок пока нет

- Class Exercise Session 1,2Документ7 страницClass Exercise Session 1,2sheheryar50% (4)

- Accounting Equation Class 11thДокумент7 страницAccounting Equation Class 11thAtul Kumar SamalОценок пока нет

- Tutorial 03 - FinalДокумент4 страницыTutorial 03 - FinalJanidu KavishkaОценок пока нет

- Management Accounting - 3Документ12 страницManagement Accounting - 3Aditya KulkarniОценок пока нет

- Bad Debts Recovered Some TimesДокумент4 страницыBad Debts Recovered Some TimesBRAINSTORM Haroon RasheedОценок пока нет

- Chapter II A For ManagersДокумент46 страницChapter II A For ManagersAsħîŞĥLøÝåОценок пока нет

- Assets Liabilities + Owner's EquityДокумент37 страницAssets Liabilities + Owner's EquityinongeОценок пока нет

- Accounting ProblemsДокумент7 страницAccounting Problemspammy313100% (1)

- Problem 1: Use The Accounting Equation To Show Their Effect On His Assets, Liabilities and CapitalДокумент2 страницыProblem 1: Use The Accounting Equation To Show Their Effect On His Assets, Liabilities and CapitalMadeeha KhanОценок пока нет

- Isometric Output Form Isodraft QueryДокумент1 страницаIsometric Output Form Isodraft QueryTejas DesaiОценок пока нет

- Bulkload 100A1 CatalogДокумент111 страницBulkload 100A1 CatalogTejas DesaiОценок пока нет

- Isometric Output Form Isodraft (Backing Sheet Text Format Is Getting Changed Automatically)Документ1 страницаIsometric Output Form Isodraft (Backing Sheet Text Format Is Getting Changed Automatically)Tejas DesaiОценок пока нет

- Piping ChecklistДокумент43 страницыPiping ChecklistTejas DesaiОценок пока нет

- Piping ChecklistДокумент42 страницыPiping ChecklistTejas Desai100% (2)

- Binder1 PDFДокумент26 страницBinder1 PDFTejas DesaiОценок пока нет

- Ansi, BS, Api, MSS, Din Ansi, BS, Api, Mss DIN: RF To Tongue FE FF NU RTJ VS BLF RS BWD LINДокумент4 страницыAnsi, BS, Api, MSS, Din Ansi, BS, Api, Mss DIN: RF To Tongue FE FF NU RTJ VS BLF RS BWD LINTejas DesaiОценок пока нет

- New Method of Managing Pipe Wall ThicknessДокумент1 страницаNew Method of Managing Pipe Wall ThicknessTejas DesaiОценок пока нет

- E3D-Everything 3DДокумент6 страницE3D-Everything 3DTejas DesaiОценок пока нет

- Piping Assembly ErrorДокумент4 страницыPiping Assembly ErrorTejas DesaiОценок пока нет

- Sale and Agreement To SellДокумент26 страницSale and Agreement To SellTejas DesaiОценок пока нет

- Unpaid SellerДокумент25 страницUnpaid SellerTejas Desai100% (2)

- P IPECATAДокумент83 страницыP IPECATATejas DesaiОценок пока нет

- Coco Description1Документ3 страницыCoco Description1Tejas Desai0% (1)

- 3-1 Reference Manual 3 Symbol Keys PDFДокумент62 страницы3-1 Reference Manual 3 Symbol Keys PDFTejas DesaiОценок пока нет

- PdmsДокумент1 страницаPdmsTejas DesaiОценок пока нет

- Branch Connection TableДокумент3 страницыBranch Connection TableTejas DesaiОценок пока нет

- EN 12953-8-2001 - enДокумент10 страницEN 12953-8-2001 - enעקיבא אסОценок пока нет

- WOREL Q2 Week 2Документ8 страницWOREL Q2 Week 2Pearl CuarteroОценок пока нет

- First Summative Test in TLE 6Документ1 страницаFirst Summative Test in TLE 6Georgina IntiaОценок пока нет

- Gothic Voodoo in Africa and HaitiДокумент19 страницGothic Voodoo in Africa and HaitiJames BayhylleОценок пока нет

- Mormond History StudyДокумент16 страницMormond History StudyAndy SturdyОценок пока нет

- Determination Letter (June 15 2023) FOIA Request For Review - 2022 PAC 71791 71791 F 95c Improper 71b Improper 71c Improper 75r Improper Sd-1Документ4 страницыDetermination Letter (June 15 2023) FOIA Request For Review - 2022 PAC 71791 71791 F 95c Improper 71b Improper 71c Improper 75r Improper Sd-1John KuglerОценок пока нет

- DESIGNATIONДокумент16 страницDESIGNATIONSan Roque ES (R IV-A - Quezon)Оценок пока нет

- Cases in Political Law Review (2nd Batch)Документ1 страницаCases in Political Law Review (2nd Batch)Michael Angelo LabradorОценок пока нет

- Selection Letter Abhishek TodkarДокумент1 страницаSelection Letter Abhishek TodkarDipak GiteОценок пока нет

- Descartes and The JesuitsДокумент5 страницDescartes and The JesuitsJuan Pablo Roldán0% (3)

- Organizational Behavior: L. Jeff Seaton, Phd. Murray State UniversityДокумент15 страницOrganizational Behavior: L. Jeff Seaton, Phd. Murray State UniversitySatish ChandraОценок пока нет

- HRM in NestleДокумент21 страницаHRM in NestleKrishna Jakhetiya100% (1)

- Assignment MS-28 Course Code: MS - 28 Course Title: Labour Laws Assignment Code: MS-28/TMA/SEM - II /2012 Coverage: All BlocksДокумент27 страницAssignment MS-28 Course Code: MS - 28 Course Title: Labour Laws Assignment Code: MS-28/TMA/SEM - II /2012 Coverage: All BlocksAnjnaKandariОценок пока нет

- 1 Rodney Britton v. Apple Inc. Job Descrimination, Sexual HarrassmentДокумент8 страниц1 Rodney Britton v. Apple Inc. Job Descrimination, Sexual HarrassmentJack PurcherОценок пока нет

- Hudson Legal CV Interview GuideДокумент16 страницHudson Legal CV Interview GuideDanielMead100% (1)

- ReadmeДокумент2 страницыReadmeParthipan JayaramОценок пока нет

- Public Provident Fund Card Ijariie17073Документ5 страницPublic Provident Fund Card Ijariie17073JISHAN ALAMОценок пока нет

- Facilitators of Globalization PresentationДокумент3 страницыFacilitators of Globalization PresentationCleon Roxann WebbeОценок пока нет

- Prof. Sujata Patel Department of Sociology, University of Hyderabad Anurekha Chari Wagh Department of Sociology, Savitribaiphule Pune UniversityДокумент19 страницProf. Sujata Patel Department of Sociology, University of Hyderabad Anurekha Chari Wagh Department of Sociology, Savitribaiphule Pune UniversityHarish KumarОценок пока нет

- Future Trends in Mechanical Engineering-ArticleДокумент2 страницыFuture Trends in Mechanical Engineering-ArticleanmollovelyОценок пока нет

- Hatch Waxman Act OverviewДокумент7 страницHatch Waxman Act OverviewPallavi PriyadarsiniОценок пока нет

- General Nursing Council of Zambia: Summary of Results For Each School December 2019 Qualifying Examinations SessionДокумент15 страницGeneral Nursing Council of Zambia: Summary of Results For Each School December 2019 Qualifying Examinations SessionAndrew LukupwaОценок пока нет

- Pierre Bonnard: La Revue BlancheДокумент2 страницыPierre Bonnard: La Revue BlancheHdjsОценок пока нет

- BPV Installation Inspection Request Form With Payment AuthorizationДокумент2 страницыBPV Installation Inspection Request Form With Payment AuthorizationBoriche DivitisОценок пока нет

- Travel Services AgreementДокумент36 страницTravel Services AgreementEllijala VarunОценок пока нет

- Mock 10 Econ PPR 2Документ4 страницыMock 10 Econ PPR 2binoОценок пока нет

- Online MDP Program VIIIДокумент6 страницOnline MDP Program VIIIAmiya KumarОценок пока нет

- 10 Grammar, Vocabulary, and Pronunciation AДокумент7 страниц10 Grammar, Vocabulary, and Pronunciation ANico FalzoneОценок пока нет

- Dessert Banana Cream Pie RecipeДокумент2 страницыDessert Banana Cream Pie RecipeimbuziliroОценок пока нет

- Mentor-Mentee 2020-2021Документ17 страницMentor-Mentee 2020-2021sivakulanthayОценок пока нет