Академический Документы

Профессиональный Документы

Культура Документы

Lesson 17 - Service Tax - Tallypdf PDF

Загружено:

Bhanwar Singh RathoreИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Lesson 17 - Service Tax - Tallypdf PDF

Загружено:

Bhanwar Singh RathoreАвторское право:

Доступные форматы

11/29/2015

Lesson17:ServiceTaxtallypdf

Searchthissite

TALLYPDF

TALLYTUTORIALS

Home

Lesson17:ServiceTax

WINDOW7TRICKS,HACKS

ANDTIPS

Calendar

ContactMe

Lesson01:BasicsofAccunting

Lesson02:Fundamentalsof

Tally.ERP9

Lesson02.1Introduction

Lesson02.2GettingFunctional

withTally.ERP9

Lesson02.3Creation/Settingup

ofCompanyinTally.ERP9

Lesson03:CreatingAccounting

MastersinTally.ERP9

Lesson03.1.F11:Features

Lesson03.2.F12:

Configurations

Lesson03.3SettingupAccount

Heads

Lesson04:CreatingInventory

MastersinTally.ERP9

Lesson04.1StockGroups

Lesson04.2StockCategories

Lesson04.3Godowns/Locations

Lesson04.4UnitsofMeasure

Lesson04.5StockItems

Lesson04.6"PracticalExcercise"

ofInventoryMastersforNational

Traders

Lesson05:VoucherEntryin

Tally.ERP9

Lesson:17.ServiceTaxOfTally.ERP9

17.1BasicsofServiceTax

17.2ConfiguringTally.ERP9forServiceTax

17.2.1 SalientFeaturesofServiceTaxcompliantTally.ERP9

17.2.2 CompanySetup

17.2.3EnablingServiceTax

17.2.4 ServiceTaxStatutoryMasters

17.3CreatingMasters

PracticeExercise

17.4EnteringTransactions

17.4.1CreatingPurchaseInvoice

17.4.2CreatingSalesInvoice

17.5AccountingforAdvanceReceipts

17.6AccountingforOpeningServiceTaxCredit

17.7PaymentofServiceTax

17.8ServiceTaxReports

Lesson06:Advanced

AccountinginTally.ERP9

17.8.1ServiceTaxPayables

Lesson07:AdvancedInventory

inTally.ERP9

17.8.2InputCreditForm

Lesson08:ValueAddedTax

(VAT)

17.8.3ST3Report

Lesson09:CentralSalesTax

(CST)

PracticeExercise

LessonObjectives

Lesson10:PointofSale(PoS)

Oncompletionofthislesson,youwillbeableto

EnableServiceTaxinTally.ERP9

CreatethemastersneccesaryforServiceTaxtransactions

RecordServiceTaxtransactions

GenerateServiceTaxreportsandchallansinTally.ERP9

Lesson11:JobCosting

Lesson12:Multilingual

Capabilities

Lesson13:Technological

AdvantagesofTally.ERP9

ServiceTaxisataxonservicesrendered.Theperson,onewhorenderstheservice,isliabletopayservice

1994anditsscopeisincreasingeveryyear.

Lesson14:Tally.NETand

RemoteCapabilities

Lesson15:Application

ManagementandControls

Lesson16:OnlineHelpand

Support

Lesson17:ServiceTax

Lesson18:TaxDeductedat

Source[TDS]

Lesson19:TaxCollectedat

Source[TCS]

LESSON20:ExciseforDealers

TALLYPDF,FormsandDocs

Lesson:17.1.BasicsofServiceTaxOfTally.ERP9

LetusunderstandthefollowingdefinitionsandterminologiesusedinServiceTax:

Featuresofservicetax

Servicetaxis payableongrossamountchargedforserviceprovidedortobeprovided,

payableonreimbursementof expenseswhichformpartofservice.However, payments

agent'ofservicereceiveriskeptoutsidethepurviewofServiceTax.

https://sites.google.com/site/tallyonlinetutor/lesson17servicetax

1/27

11/29/2015

Lesson17:ServiceTaxtallypdf

Incases,wherethevalueofServiceprovidedisnotascertainablethevaluationisdoneo

basisofcost.

tallyshortcutkeys

TALLYTIPS,TRICKSAND

HACKS

Grossamountchargedisconsideredasinclusiveofservicetaxandthentaxisbackcalcu

DOWNLOADTALLYPDF

Servicetax is payable only when bill amount is received from service receiver. Howe

associatedenterprises,servicetaxispayableonbookingsuchentry

HERE

TaxableService

Service tax is payable on 'taxable service'. The definition of taxable service is different fo

caseofadvertisingagency,anyserviceprovidedtoaclient,byanadvertisingagencyinrelatio

willbe'taxableservice'.

ValueofTaxableService

Servicetaxispayableon'valueofservices'.ValueofServiceshallbethegrossamountcharged

servicerenderedbyhim.

ServiceProvider

Asdefinedu/s65(105)aserviceproviderisonewhoprovidestaxableservice.

Personliabletopayservicetax

Everypersonprovidingtaxable servicetoanypersonhastopayservicetaxattheprescribed

servicereceiver,underreversechargemethod.

MoreStuff

TALLYPDF,FormsandDocs

Exemptionfromservicetax

Home

Smallserviceproviderswhosetotalvalueofservicesprovided(includingexemptandnon

10lakhsinpreviousyeararenotrequiredtopayservicetaxincurrentfinancialyeartillthey

Sitemap

TALLYERP9FULL

ServicesprovidedtoSEZunitsordeveloperforconsumptionwithinSEZareexempt.

TUTORIALONLINE

Refundiseligibleforspecifiedservicesutilisedforexport.

ServicesprovidedbyRBIareexemptbutserviceprovidedtoRBIarenotexempt.

RateofServiceTax

AccordingtoSection66ofFinanceAct,1994thereshallbeleviedataxattherateof10%ofva

section65(105)ofFinanceAct,1994.Inaddition, educationcess@2%andSecondaryHigher

Thus,totalservicetaxis10.3%.

LetusconsiderthefollowingexampletounderstandhowServiceTaxiscalculated:

Particulars

Chargeonservice(i.e.Billamount)

ServiceTax@10%

CessonServiceTax@2%

SecCessonServiceTax@1%

Totalinvoiceamount

a.

b.

c.

d.

Rs.

10,000

1,000

20

10

11,030

Assumingthe buyerpays the seller onlyRs.5,000 the ServiceTaxpayableiscalculated

a.

b.

c.

d.

Particulars

Chargepaidonservice(10,000x

5,000)/11,030

ServiceTaxonRs.5000/is(1,000x

5,000)/11,030

CessonServiceTaxis(20x5,000)/11,030

SecCessonServiceTaxis(10x

5,000)/11,030

TotalPayment

Received

Rs.

4,533

453

9

5

5,000.00

Abatements

Abatementreferstothepercentageoftaxexemptionprovidedbythegovernmentonthevalue

ServiceTax.Itiseitherapercentageoftheservicechargesoralumpsumamount.

a.

b.

https://sites.google.com/site/tallyonlinetutor/lesson17servicetax

Particulars

ChargeonService

Anabatementof30%amountsto:

Rs.

10,000

3,000

2/27

11/29/2015

Lesson17:ServiceTaxtallypdf

c.

Here,theassessablevalueis(ab)

Therefore,ServiceTax@10%onRs.7,000,Cess

@

2%andSecCess@1%onServiceTax

7,000

CenvatCredit

ServiceprovidercanavailCenvatcreditofservicetaxpaidoninputservicesandexcisedutypai

credit can be utilised for payment of service tax on output services. However, in cases whe

taxable and exempt services and if input services are common, Cenvat credit can either be ta

'amount'isrequiredtobepaidonexemptedservices.

PaymentofServiceTax

when the assessee is a corporate, service tax is payable on a monthly basis

month. For example, service taxhas to bepaidbyJanuary5,forthemonthofDecember.

Noncorporatebodiessuchasindividuals,proprietaryfirmsandpartnershipfirmspayservicetax

istobemadebythe5thdayofthemonth,followingthequarter.Forexample,servicetaxforth

paidbyJuly5th.ForthemonthofMarchthough,corporateandnoncorporatebodies,havetopa

TheservicetaxassesseemustuseaGAR7Challantopaytaxinthebanknominatedbythecommissioner

tothenearestrupee.ItisadvisabletouseseparateGAR7Challansfordifferentcategoriesofservice.

ServiceTaxOfTally.ERP9

17.2.1SalientFeaturesofServiceTaxcompliantTally.ERP9

17.2.2CompanySetup

17.2.3EnablingServiceTax

17.2.4ServiceTaxStatutoryMasters

ItisaonetimeconfigurationforServiceTaxfeaturestobeenabledinTally.ERP9.

17.2.1 SalientFeaturesofServiceTaxcompliantTally.ERP9

Tally.ERP9tracksthedetailsbillwiseandautomaticallycalculatestheServiceTax

billwhileofferingtheflexibilitytomakeadjustmentslater.

It has a builtinassessable valuefeatureon which ServiceTaxiscalculated. It

forabatementandexpenses.

It maintains information on Service Tax categorywisewhichismandatoryfor filing

ServiceTaxreturns.

Italsomakesaprovisionforexemptionnotificationdetails.

Eliminateserrorproneinformation,incorrectremittances.

Itgeneratesreports inthegovernment suggestedformatslikeGAR7Challans,ST3

Report,ManagementInformationServices(MIS)reportsandServiceTaxPayable

calledFirstCServicestounderstandtheServiceTaxfeatureofTally.ERP9.

17.2.2CompanySetup

Createacompany

GotoGatewayofTally>Alt+F3:CompanyInfo.>CreateCompany

IntheCompanyCreationscreen,

SpecifyFirstCServicesastheCompanyNameandAddressdetails

SelectIndiaintheStatutoryComplianceforfield

SpecifytheState,Pincode&AccountswithInventorydetails

SpecifyFinancialYearFrom&Booksbeginningfromdateas142009

ThecompletedCompanyCreationscreenisdisplayedasshownbelow:

https://sites.google.com/site/tallyonlinetutor/lesson17servicetax

3/27

11/29/2015

Lesson17:ServiceTaxtallypdf

Figure17.1CompanyCreationscreen

17.2.3 EnablingServiceTax

IntheF11:Features(Statutory&TaxationFeatures),

SetEnableServiceTaxtoYes.

EnableSet/AlterServiceTaxDetailstoYes.

TheCompanyOperationsAlterationscreenappearsasshownbelow:

Figure17.2CompanyOperationsAlterations

PressEntertoview theCompanyServiceTaxDetailsscreenandenterthedetailsasshownbelow:

Figure17.3CompanyServiceTaxDetails

ThefieldsthatappearsintheCompanyServiceTaxDetailsscreenarebriefedbelow:

1. ServiceTaxRegistrationNo.:EntertheregistrationnumberallottedtoyoubytheService

https://sites.google.com/site/tallyonlinetutor/lesson17servicetax

4/27

11/29/2015

Lesson17:ServiceTaxtallypdf

2. DateofRegistration:EnterthedateofregistrationofServiceTaxforyourservice.

3.AssesseeCode:EnterthecodegiventoyourcompanybytheServiceTaxDepartment.

4.PremisesCodeNo.EnterthePremisescode/Locationcode.Itistheidentification

taxpayers.

5.TypeofOrganisation:SelectthetypeofyourorganisationfromtheListofOrganisationsmenu

Figure17.4ListofOrganisations

6. IsLargeTaxPayerThisfieldissettoYes/Nobaseontheamountoftaxpaidbytheas

LargeTaxpayersarethoseassesseswhopaylargeamountofTax.Theyaretheeligibletaxpayerforthepurposes

e.g.:Rs.5,00,00,000.

7.LargeTaxpayerUnit:Enterthenameoftheunitwherethelargetaxpayerspaytax.

8.Division:Enterthecodeandnameofthedivisionyourcompanyfallsunder.

9.Range:Enterthecodeandnameoftherangeyourcompanyfallsunder.

10.Commissionerate:EnterthecodeandnameoftheCommissionerateofServiceT

addressofyourCompanysregisteredofficeislocated.

17.2.4 ServiceTaxStatutoryMasters

Beforecreatingmasters,thefollowingStatutoryMasterisloadedintoTally.ERP9.Toviewth

Go to Gateway ofTally>Display >StatutoryInfo. >ServiceCategories>AdvertisingAgency

Figure17.5ServiceCategory

TheServiceCategoryscreenhas a Namefield showingthecategory,followedbythe

CountryCode,AccountingCode,CategoryCodeandSubClauseNo.fields.

TheApplicableFromcolumndisplaysthedatefromwhichtheAbatement(%),Service

TaxRate(%),CessRate(%)andSecondaryCessRate(%)areapplicable.

Eachservicecategory hasapredefined masterinTally.ERP9whichcanalsobeupdatedforstatutorychan

website(www.Tallysolutions.com).YoucanviewthevaluesforeachofthesecategoriesinTally.ERP9.

https://sites.google.com/site/tallyonlinetutor/lesson17servicetax

5/27

11/29/2015

Lesson17:ServiceTaxtallypdf

Tally.ERP9

LetuscreatethefollowingledgermastersrelatedtoServiceTax :

SundryCreditors

SundryDebtors

DutiesandTaxes

SalesAccounts

PurchaseAccounts

i.CreateSundryCreditorLedger

GotoGatewayofTally>AccountsInfo.>Ledgers>Create

1. EntertheNameasKrazyCoolAgencies.

2.SelectSundryCreditorsfromtheListofgroupsintheUnderfield.

3.SetMaintainbalancesbillbybilltoYes.

4.DefaultCreditPeriod:Leavethefieldblank

5.TheInventoryValuesareaffected?fieldissetbydefaulttoNo

6.SetIsServiceTaxApplicabletoYes.

7.IntheExemptionDetailscreenenterthedetailsasshownbelow:

Figure17.6ServiceTaxExemptionDetailsScreen

8. UnderMailingDetailsentertheAddress,StateandPINCodedetails

9.UnderTaxInformationenterthePAN/ITNo.

10.EnablethefieldSet/AlterServiceTaxDetailstoYes

Figure17.7LedgerCreation

11.InServiceTaxDetailsscreenentertheServiceTaxRegistrationdetails

IntheServiceTaxNo.fieldentertheservicetaxregistrationnumberoftheparty

IntheServiceTaxReg.Datefieldentertheservicetaxregistrationdate

https://sites.google.com/site/tallyonlinetutor/lesson17servicetax

6/27

11/29/2015

Lesson17:ServiceTaxtallypdf

Figure17.8ServiceTaxDetails

12.AccepttheServiceTaxDetailsscreen

ThecompletedLedgerCreationscreenappearsasshownbelow:

Figure17.9LedgerCreationKrazyCoolAgencies

13.PressYorEntertoacceptthescreen.

ii.CreateSundryDebtorLedger

GotoGatewayofTally>AccountsInfo.>Ledgers>Create

1. EntertheNameasComputechSystems.

2.SelectSundryDebtorsfromtheListofgroups.

3.SetMaintainbalancesbillbybilltoYes.

4.TheInventoryValuesareaffectedfieldissetbydefaulttoNo.

5.SetIsServiceTaxApplicabletoYes.

6.IntheExemptionDetailscreen,enterthedetailsasshownbelow:

Figure17.10ServiceTaxExemptionDetailsScreen

7. UnderMailingDetailsentertheAddress,StateandPINCodedetails

8. UnderTaxInformationenterthePAN/ITNo.

9.EnablethefieldSet/AlterServiceTaxDetailstoYes

10.InServiceTaxDetailsscreenentertheServiceTaxRegistrationdetails

https://sites.google.com/site/tallyonlinetutor/lesson17servicetax

7/27

11/29/2015

Lesson17:ServiceTaxtallypdf

Figure17.11ServiceTaxDetails

11.AccepttheServiceTaxDetailsscreen

ThecompletedLedgerCreationscreenappearsasshownbelow:

Figure17.12LedgerCreationComputechSystems

12.PressYorEntertoaccepttheledgercreationscreen.

Similarly,createaledgerforGlobalBusinessHouseundertheSundryDebtorsgroup.

AServiceTaxLedgerisusedtopredefinetherateofServiceTaxandtherateofCessoneachtransaction.

thesevaluesordirectlyselectthemduringvoucherentry.

iii.CreateServiceTaxLedger

GotoGatewayofTally>AccountsInfo.>Ledgers>Create

1. EntertheNameasInputServiceTax.

2.SelectDuties&TaxesfromtheListofgroupsintheUnderfield.

3.IntheTypeofDuty/TaxfieldselectServiceTaxfromtheTypeofDuty/Taxlist

4.IntheCategoryName,selectAdvertisingAgencyfromtheListofServiceTaxCategories

5.SetInventoryvaluesareaffectedtoNo.

ThecompletedLedgerCreationscreenappearsasshownbelow:

https://sites.google.com/site/tallyonlinetutor/lesson17servicetax

8/27

11/29/2015

Lesson17:ServiceTaxtallypdf

Figure17.13LedgerCreationINPUTServiceTax

6. PressYorEntertoacceptthescreen.

PracticeExercise

Createthefollowingledgers.

Ledger

OutputServiceTax

InputSTTELEPHONE

CHRG

HSBC

Under

Typeof

Category

Duty/Tax

Name

Duties&Taxes ServiceTax Advertising

Agency

Duties&Taxes ServiceTax Telephone

Service

BankAccounts

Opening

Balance

Nil

Nil

5,00,000

iv.CreateSalesLedgerforServices

GotoGatewayofTally>AccountsInfo.>Ledgers>Create.

1.EntertheNameasConsultancyServices.

2.SelectSalesAccountsfomtheListofGroupsmenuintheUnderfield.

3. SetInventoryvaluesareaffectedtoNo.

4.SetIsServiceTaxApplicabletoYes.

5.IntheCategoryName,selectAdvertisingAgencyfromthelist.

6.SetIsAbatementApplicabletoNo.

ThecompletedLedgerCreationscreenappearsasshownbelow:

https://sites.google.com/site/tallyonlinetutor/lesson17servicetax

9/27

11/29/2015

Lesson17:ServiceTaxtallypdf

Figure17.14LedgerCreationConsultancyServices

7. PressYorEntertoacceptthescreen.

v.CreatePurchaseLedgerforServices

GotoGatewayofTally>AccountsInfo.>Ledgers>Create

1.EntertheNameasProfessionalServices.

2.SelectPurchasesAccountsfromtheListofGroups.

3.SetInventoryValuesareaffectedtoYesifserviceispurchasedasanitem.

4.SetIsServiceTaxApplicabletoYes.

5.IntheCategoryName,selectAdvertisingAgencyfromthelist.

6.SetIsAbatementApplicabletoNo.

ThecompletedLedgerCreationscreenappearsasshownbelow:

Figure17.15LedgerCreationProfessionalServices

7. PressYorEntertoacceptthescreen.

IfthefieldIsAbatementApplicableissettoYesintheIncome/ExpensesorSales/Purchaseledgermasters,the

whichNotificationNo.andPercentagecanbeentered,whichiscapturedintheinvoiceandcanbealtered.

ServiceTaxOfTally.ERP9

https://sites.google.com/site/tallyonlinetutor/lesson17servicetax

10/27

11/29/2015

Lesson17:ServiceTaxtallypdf

17.4.1CreatingPurchaseInvoice

17.4.2CreatingSalesInvoice

Tally.ERP

9

allows

the

user

to

ServiceTaxtransactionsin AccountingInvoice Mode orVoucherMode.Entertheinvoice

This allows the ServiceTax amount to be displayed automatically in the

ServiceTaxledger.Tally.ERP9alsosupportspurchaseorsaleofaservice,asanitem.

17.4.1 CreatingPurchaseInvoice

On 15409, FirstC Services received Professional Services from KrazyCool Agencies

fortheserviceswasmadeon1642009.

Step1:CreatePurchaseInvoice

GotoGatewayofTally>AccountingVouchers>F9:Purchase

1. PressF2andchangethedateto1542009.

1.EntertheSupplierInvoiceNo.andDateasdesired.

2.IntheParty'sA/cName,selectKrazyCoolAgenciesfromtheListofLedgerAccounts.

3.SelecttheNameofLedgerasProfessionalServicesfromtheListofLedgerAccounts.

4.EntertheamountRs.175000.

5.SelecttheInputServiceTaxledgerfromtheListofLedgerAccounts.

TheServiceTaxDetailssubformappearsasshownbelow:

Figure17.16ServiceTaxDetailsscreen

Tally.ERP9allowsyoutomakethenecessarychangesintheServiceTaxDetailsscreen.

6. InTheBillwiseDetailsscreen,selectNewRefandtypetheNameasKC1.

SelectINPUTServiceTax fromtheListofServiceTaxLedgers

TheCompletedBillwiseDetailsappearsasshownbelow

https://sites.google.com/site/tallyonlinetutor/lesson17servicetax

11/27

11/29/2015

Lesson17:ServiceTaxtallypdf

Figure17.17BillwiseDetailsfor:KrazyCoolAgencies

TheCompletedPurchaseInvoiceappearsasshownbelow:

Figure17.18PurchaseInvoice

7. PressYorEntertoacceptthescreen.

Step2:CreatePaymentVoucher

GotoGatewayofTally>AccountingVouchers>F5:Payment

In theF12:Configuration, set UseSingle Entrymode forPymt/Rcpt/ContratoYes.

1.PressF2andchangethedateto1642009.

2.IntheAccountfield,selectHSBCfromtheListofLedgerAccounts.

3.IntheParticularsfieldselectKrazyCoolAgenciesfromtheListofLedgerAccounts.

4.EnterRs.1,93,025intheAmountfield.

5.IntheBillwiseDetailsscreen,selectAgstRef.

TheBillwisedetailsscreenappearsasshownbelow:

Figure17.19BillwiseDetailsforKrazyCoolAgencies

SelectKC1fromtheListofPendingBillsandaccepttheBillwiseDetailsscreen.

6. EnterNarration,ifany.

ThecompletedPaymentVoucherappearsasshownbelow:

https://sites.google.com/site/tallyonlinetutor/lesson17servicetax

12/27

11/29/2015

Lesson17:ServiceTaxtallypdf

Figure17.20PaymentVoucher

7. PressYorEntertoacceptthePaymentvoucher

17.4.2 CreatingSalesInvoice

On 2042009,ConsultancyServicesworthRs.7,00,000wasprovidedtoComputech

receivedon2542009.

Step1:CreateSalesInvoice

GotoGatewayofTally>AccountingVouchers>F8:Sales

1.PressF2andchangethedateto2042009.

2.IntheParty'sA/cName,selectComputechSystemsfromtheListofLedgerAccounts.

3.PressEntertoviewtheDespatchDetailsandacceptthedefaultdetails.

4.SelectConsultancyServicesfromtheListofLedgerAccounts.

5.EntertheamountasRs.700000.

6.SelectOutputServiceTaxfromtheListofLedgerAccounts.

TheresultantServiceTaxDetailsappearsasshownbelow:

Figure17.21ServiceTaxDetailsscreen

7. TheBillwiseDetailsscreen,selectNewReffromtheMethodofAdj.

https://sites.google.com/site/tallyonlinetutor/lesson17servicetax

13/27

11/29/2015

Lesson17:ServiceTaxtallypdf

Figure17.22BillwiseDetailsforComputechSystems

8.EntertheNameas1andselecttheServiceTaxledgerasOutputServiceTax.

ThecompletedSalesInvoiceappearsasshownbelow:

Figure17.23SalesInvoice

9.PressYorEntertoaccepttheSalesInvoice.

Step2:CreateReceiptVoucher

GotoGatewayofTally>AccountingVouchers>F6:Receipt

In theF12:Configuration, setUse SingleEntry modeforPymt/Rcpt/ContratoNo.

1. PressF2andchangethedateto2542009.

2.SelectComputechSystemsintheCreditfieldandentertheamountasRs.772100.

3.IntheBillwiseDetailsscreen,selectAgstReffromMethodofAdj.

TheBillwiseDetailsscreenappearsasshownbelow:

Figure17.24BillwiseDetailsforComputechSystems

4. SelecttheSalesVoucherfromtheListofPendingBillstodefaultServiceTaxLedger

5.AccepttheBillwiseDetailsscreen.

6.InDebitfieldselectHSBCBankfromtheListofLedgerAccounts,Amountisdefaultedauto

7.InNarrationfieldentertheChequeNumber.

ThecompletedReceiptVoucherisdisplayedasshown:

https://sites.google.com/site/tallyonlinetutor/lesson17servicetax

14/27

11/29/2015

Lesson17:ServiceTaxtallypdf

Figure17.25ReceiptVoucher

8. PressYorEntertoaccepttheReceiptVoucher.

Tally.ERP 9calculates the Service Tax liability basedontheamountreceivedagainstservicedrenderedi.e.,SalesI

Step3:DisplayServiceTaxPayablesReport

GotoGatewayofTally>Display>StatutoryReports>ServiceTaxReports>ServiceTax

TheServiceTax Payablesreportdisplaysthependingservicetaxpayablesforthe selectedperiod.

Figure17.26ServiceTaxPayable

TheServiceTaxpayablereportdisplaysRs.72,100astheServiceTaxdue

Tally.ERP9

As mentioned earlier, Service tax is not applicable on the receipt

theinvoiceisraised.Servicetaxistobepaidontheamountreceivedontheinvoicevalue

On27409,FirstCServicesreceivesanadvanceofRs.70,000foraservicerenderedby

ason2942009.

On

2942009,

FirstC

Services,

completed

the

an invoice on GlobalBusiness House towards Advertising Agency

Service Tax, 2%EducationCessand 1% Secondary Education Cessforatotalamou

70,000 was received as an advance. Service tax, Education Cess and SecondaryC

assessablevalueofRs.1,70,000.

Step1:CreateReceiptVoucher

GotoGatewayofTally>AccountingVouchers>F6:Receipt

1. PressF2andchangethedateto2742009.

2.SelectGlobalBusinessHouseintheCreditfieldandentertheamountasRs.70,000

3.IntheBillwiseDetailsscreen,selectAdvancefromtheMethodofAdj.

TheBillWiseDetailsscreenappearsasshownbelow:

https://sites.google.com/site/tallyonlinetutor/lesson17servicetax

15/27

11/29/2015

Lesson17:ServiceTaxtallypdf

Figure17.27BillwiseDetailsforGlobalBusinessHouse

4. TypetheNameasGBH andselectOutputServiceTaxastheServiceTaxLedger.

5.InDebitfieldselectHSBCBankfromtheListofLedgerAccounts,Amountisdefaultedau

6.InNarrationfieldentertheChequeNumber.

ThecompletedReceiptVoucherappearsasshownbelow:

Figure17.28ReceiptVoucher

7. PressYorEntertoaccepttheReceiptVoucher.

Step2:CreateSalesInvoice

GotoGatewayofTally>AccountingVouchers>F8:Sales

1.PressF2andchangethedateto2942009.

2.IntheParty'sA/CNameselectGlobalBusinessHouse.

3.PressEntertoviewtheDespatchdetailsscreenandacceptthedefaultscreen.

4.SelectConsultancyServicesfromtheListofLedgersAccountsandentertheamount

5.SelectOutputServiceTaxledgerfromtheListofLedgersAccounts.

6.The Service Tax Details screenappears, theServiceTax andtheCesspercentageandAmounts

https://sites.google.com/site/tallyonlinetutor/lesson17servicetax

16/27

11/29/2015

Lesson17:ServiceTaxtallypdf

Figure17.29ServiceTaxDetails

In Service TaxBill Wise Details forsection,the BillWiseDetailsaredefaulted automatically. The BillW

changed to therequiredreferencenumber.

7. IntheBillwiseDetailsscreen,enterthedetailsasshownbelow:

Figure17.30BillwiseDetailsforGlobalBusinessHouse

TheresultantSalesInvoiceappearsasshownbelow:

Figure17.31SalesInvoice

8. PressYorEntertoaccepttheSalesInvoice.

Step3:DisplayServiceTaxPayableReport

ThiswilldisplaytheServiceTaxPayablescreen.ThisreportcontainsthependingService

period.

GotoGatewayofTally>Display>StatutoryReports>ServiceTaxReports>ServiceTax

TheServiceTaxPayablescreenappearsasshownbelow:

https://sites.google.com/site/tallyonlinetutor/lesson17servicetax

17/27

11/29/2015

Lesson17:ServiceTaxtallypdf

Figure17.32ServiceTaxPayable

ServiceTaxOfTally.ERP9

ThependingServiceTaxpayablesandavailableInput CreditonServiceTaxcanbetransfered

thecurrentfinancialyearinTally.ERP9.

On30409,FirstCServicesdecidedto pay Service Taxtothe government. Information

givenbelow:

InputServiceTaxCreditforRs.1,030 on10,000billvalue

ServiceTaxpayableofRs.2,060on20,000billvalue

Setup:

Createthefollowingledgers:

BSNLunderSundryDebtors.SetIsServiceTaxapplicabletoYes.

ServiceTaxCreditunderDutiesandTaxeswithanopeningbalanceofRs.1030.Select

ServiceTaxPayableunderDuties&TaxeswithanopeningbalanceofRs.2060.

ThecompletedServiceTaxPayableledgercreationscreenappearsasshownbelow:

Figure17.33LedgerCreationServiceTaxPayable

PressYorEntertoaccept

Step1:CreateJournalVoucher

GotoGatewayofTally>AccountingVouchers>F7:Journal.

1. PressF2andchangethedateto142009.

2.SelectInputSTTelephoneChargesintheDebitfieldandentertheamountasRs.1030

TelephoneServices.

3.IntheServiceTaxBillDetailsforInputSTTelephoneCHRG,selectNewRefandtype

https://sites.google.com/site/tallyonlinetutor/lesson17servicetax

18/27

11/29/2015

Lesson17:ServiceTaxtallypdf

NameasJrnl/11.

4.EntertheamountRs.1,030

Figure17.34ServiceTaxBillDetails

5. IntheServiceTaxOpeningBillDetailsscreen,enterthedetailsasshownbelow:

Figure17.35ServiceTaxOpeningBillDetails

6. PressCtrl+Atoacceptthescreen.

EnterthebillreferencenumberassociatedwiththeTaxLedgerintheBillNamefield.SelectNotApplicable

7.SelectServiceTaxCreditintheCreditfield.

ThecompletedJournalVoucherappearsasshownbelow:

Figure17.36JournalVoucher

8. PressYorEntertoaccepttheJournalvoucher

Step2:CreateJournalVoucher

Passa journal voucherfortransferringthepreviousyearsbalanceoftheAdvertisingAgency

ledger

GotoGatewayofTally>AccountingVouchers>F7:Journal.

ThecompletedJournalvoucherappearsasshownbelow:

https://sites.google.com/site/tallyonlinetutor/lesson17servicetax

19/27

11/29/2015

Lesson17:ServiceTaxtallypdf

Figure17.37JournalVoucher

PressYorEntertoaccepttheJournalVoucher.

Lesson:17.7.PaymentofServiceTaxUnderServiceTaxOfTally

On 0552009, FirstC Services, paid Service Tax of Rs. 5506.72 towards Advertising

no.551899 afteradjustingInputServiceTax CreditonTelephoneServices.

PaymentofServiceTaxisdonethroughanormalpaymentvoucher.

Youcanmakeapaymentforasinglecategoryinonepaymentvoucher.

Step1:CreatePaymentVoucher

GotoGatewayofTally>AccountingVouchers>F5:Payment

1.PressF2andchangethedateto0552009.

2.SelecttheOutputServiceTaxLedger,tobedebited,fromtheListofLedgerAccounts.

TheTaxBillDetailsscreenappearsasshownbelow:

Figure17.38ServiceTaxBillDetailsforOutputServiceTax

3. IntheServiceTaxBillDetailsscreen,selectallthebillsintheListofServiceTaxBills.

4.SelecttheINPUTServiceTaxinthecreditfield.

TheServiceTaxBillDetailsforINPUTServiceTaxappearsasshownbelow:

https://sites.google.com/site/tallyonlinetutor/lesson17servicetax

20/27

11/29/2015

Lesson17:ServiceTaxtallypdf

Figure17.39ServiceTaxBillDetailsforInputServiceTax

5. SelectHSBCinthecreditfield.

6.SetthefieldProvideDetailstoYes

Figure17.40PaymentDetails

Theperiodforwhichthepaymentismadeisspecifiedintheabovescreen.

7. Specify theService Tax Periodwith ChallanNo.,Date,Bank Name,Cheque/Draft/Pay

8.Enterthechequeno.inNarrationfield.

ThecompletedPaymentVoucherappearsasshownbelow:

Figure17.41PaymentVoucher

9.PressYorEntertoacceptthePaymentvoucher.

Step2:PrintingGAR7challan

GotoGatewayofTally>Display>DayBook.

PressPgUpfromtheabovevoucherentryscreentogothePaymentVoucher

Use Alt + P key orclickonthePrint optionontheAccountingVoucherAlteration

screen.TheVoucherPrintingscreenisdisplayed.

SetthePrintGAR7ChallanoptiontoYes.

https://sites.google.com/site/tallyonlinetutor/lesson17servicetax

21/27

11/29/2015

Lesson17:ServiceTaxtallypdf

Figure17.42PrintConfigurationScreen

UsethePrintPreviewOption(ALT+I)toviewtheprintpreviewofthechallan.

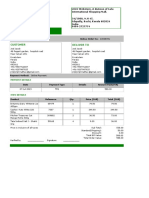

TheprintedGAR7Challanappearsasshownbelow:

Figure17.43GAR7Challan

Lesson:17.8.ServiceTaxReportsUnderServiceTaxOfTally

17.8.1ServiceTaxPayables

17.8.2InputCreditForm

https://sites.google.com/site/tallyonlinetutor/lesson17servicetax

22/27

11/29/2015

Lesson17:ServiceTaxtallypdf

17.8.3ST3Report

ServiceTaxreportsarethereportswhichisusedtoviewalltheServiceTaxrelateddetailsaton

inthemenuare:

ServiceTaxPayables

InputCreditForm

ST3Report

GotoGatewayofTally>Display>StatutoryReports

Figure17.44ServiceTaxReports

17.8.1 ServiceTaxPayables

ServiceTaxPayablereportdisplaystheTotalServiceTaxPayablesasonaspecifieddate.

GotoGatewayofTally>Display>StatutoryReports>ServiceTaxReports>ServiceTa

SelecttheperiodforthereportusingtheF2:Periodoption.

Settheperiodfrom142009to3042009.

TheServiceTaxpayablefortheselectedperioddisplaysvariousdetailsasshownbelow:

Figure17.45ServiceTaxPayable

UsetheAlt+PkeyorclickonPrintoptiontoprintthereport.

The fields which appearsin the ServiceTaxPayablereportarebriefedbelow:

DateThedateofthesalesinvoiceisdisplayed.

Ref.No.:Thereferencenumbergiventothesalesinvoice.

PartysName:Thenameofthecustomertowhomthesaleismade.

CategoryName: Thename of thecategory ofservice selected fromthelistofservicecategories.

BillValue:Thetotalinvoiceamount.

A ssessableValue:Theassessablevaluefortheservice.

ServiceTax:The totalServiceTaxcalculatedontheassessablevalue.

Cess:ThetotalcessontheServiceTax.

RealizedValue:Amountreceivedontheinvoicevalue.

A ssessable Value: Theassessable valuebasedontherealizedvalue.

https://sites.google.com/site/tallyonlinetutor/lesson17servicetax

23/27

11/29/2015

Lesson17:ServiceTaxtallypdf

Service Tax Payable: TheamountofServiceTaxpayable basedontherealizedvalue.

CessPayable:ThecessontheServiceTaxpayablebasedontherealizedvalue.

TotalPayable:TheamountofServiceTaxpayableinclusiveofeducationalcess.

17.8.2 InputCreditForm

GotoGatewayofTally>Display>StatutoryReports>ServiceTaxReports>InputCredi

TheInputCreditFormdisplaysvariousdetailsasshownbelow:

Figure17.46InputCreditForm

TheInputCreditFormcontains:

Dateoftransactions

ReferenceNumberofthetransaction

PartysNamewithServiceTaxNo.andAddress

NameoftheServiceCategorypurchased

Bill Valueofthe input serviceincluding Assessable Value,ServiceTaxandCessamount.

Realised

Valueoftheinputservice including AssessableValue,ServiceTaxandCessamount.

TotalCreditavailableoninputservices.

17.8.3 ST3Report

GotoGatewayofTally>Display>StatutoryReports>ServiceTaxReports>ST3Repor

1. IntheServiceTaxReportsmenu,selectST3Report.

2.InPeriodForfield,selecttheperiodforwhichST3Reporttobeprinted.

3.SpecifythePlaceandDateforPrintingST3Report.

Figure17.47PrintConfigurationScreen

PracticeExercise

1. ProC Advertising Agency,earnsitsmajorincome fromadvertisingservice, which

categoryAdvertisementunderServiceTax.

Createthefollowingledgersinthemastersandselect/enterthefieldsasgiveninthetable.

Nameofthe

Ledger

Group

under

Maintainbalancebill

bybill

IsService

Tax

Applicable

ManojVideos

Sundry

Creditors

Yes

Yes

https://sites.google.com/site/tallyonlinetutor/lesson17servicetax

InventoryValuesare

No

24/27

11/29/2015

Lesson17:ServiceTaxtallypdf

PurVideo&

Graphic

Purchase

A/c

No

Yes

No

Advertise

ment

Contract

Nexus

Solutions

Ltd.

SalesA/c

No

Yes

No

Sundry

Debtors

Yes

Yes

No

CreatethefollowingledgersforServiceTaxandenterthemasgiveninthetablebelow:

NameoftheLedger

Under

Typeof

Duty/Tax

Category

Inventory

valuesare

affected

OutputSTAdvertisement Duties&Taxes ServiceTax

InputSTVideo&Graphic Duties&

Taxes

Advertising No

Agency

ServiceTax Photography No

Givenbelow,aretransactionsfrom30509.CreateProCAdvertisingAgencyand

SNo

Date

1.

3509

2.

7509

3.

12509

4.

15509

5.

19509

6.

20509

7.

21509

8.

25509

9.

28509

10.

30509

11.

31509

Particulars

Sales Bill raised on Nexus Solutions Pvt. Ltd., after completing

theiradvertisementorder no.DL010forRs.30000+ServiceTax

@10%+Cess@2%+SecCess@1%.

PaymentreceivedfromNexusSolutionsPvt.Ltd.,for Rs.

33,090vide

Ch.No.7564121.

ReceivedthebilltowardsphotographychargesfromManojVideo

Ref.No.SV09forRs.15000[ServiceTax@10%+Cess@2%+

SecCess

@1%].

Paymentmadethrough Canara BanktoSoniaVideo for theirbill

no.SVB09forRs.16,545videCh.No.6665261.

SalesbillraisedforOutdoorAdvertisementchargesforRs.6000+

ServiceTax+CesstoNexusSolutionsPvt.Ltd.

Manoj Video sent theirVideorecordingchargesBill[SV012]for

Rs.

8979.20[VideoChargesRs.8000,ServiceTax@10%+Cess@

2%+SecCess@1%].

PaymentmadetoManojVideofortheirbillno.SV012forRs.4000

vide

Ch.No.675510

ReceivedRs. 5000,fromNexus SolutionsPvt.Ltd.,towards

outdooradvertisementbill.

Advance payments of Rs. 10000 received from Nexus Solutions

Pvt.Ltd., vide Ch.No. 7565551 towards their advertisement work

orderno.DL028.DepositthesameintheCanaraBankA/c.

Sales Bill raised on Nexus Solutions Pvt. Ltd., after completing

theiradvertisementworkstowardsorderno.DL028.forRs.40000

+ServiceTax@10%+Cess@2%+SecCess@1%.

MakeapaymenttoCanaraBanktowardsServiceTaxPayablefor

themonthofMay09.

PointstoRemember

ServiceTaxisanindirecttaxleviedoncertaincategoriesofservicesprovidedbyaperson,firm,agencyetc

AvailoftheinputcreditonServiceTaxpaidonpurchasesbydeductingtheServiceTaxpayable.

ServiceTaxiscalculatedontheassessablevaluebutispayableonthevaluerealisedontheinvoice.

Tally.ERP9calculatestheServiceTaxpayableandtheInputCreditoneachbillbytrackingitbillwise.

TheStatutoryMastersinTally.ERP9maintainacategorywiseinformationonServiceTax.

Tally.ERP9givesyoutheoptiontobillforservicesasanitem.

AccountforServiceTaxonthereceiptofadvanceandmakeadjustmentswhenaninvoiceisraised.

TransfertheServiceTaxbalancepayableandinputcreditfrompreviousyeartocurrentyear.TheServiceTax

Taxpayable,afteravailingtheinputcredit.

https://sites.google.com/site/tallyonlinetutor/lesson17servicetax

25/27

11/29/2015

Lesson17:ServiceTaxtallypdf

PrinttheFormGAR7ChallanfromTally.ERP9topayyourServiceTax.

PrintandFileStatutoryReportsfromTally.ERP9,forthehalfyearlyfilingofreturnswithdetailsinFormST3andth

Comments

https://sites.google.com/site/tallyonlinetutor/lesson17servicetax

26/27

11/29/2015

Lesson17:ServiceTaxtallypdf

Signin | RecentSiteActivity | ReportAbuse | PrintPage | PoweredBy GoogleSites

https://sites.google.com/site/tallyonlinetutor/lesson17servicetax

27/27

Вам также может понравиться

- TALLY TIPS, TRICKS AND HACKS - Tallypdf PDFДокумент11 страницTALLY TIPS, TRICKS AND HACKS - Tallypdf PDFBhanwar Singh RathoreОценок пока нет

- Tally Tutorial PDFДокумент3 страницыTally Tutorial PDFAIОценок пока нет

- Tally TutorialДокумент3 страницыTally TutorialAchu BaviОценок пока нет

- Tally Syllabus: 1. Basics of AccountingДокумент4 страницыTally Syllabus: 1. Basics of AccountingijrailОценок пока нет

- Course On Accounting Software - : Tally - ERP9 Course Outline:: Sr. No. Topics Covered Proposed LecturesДокумент2 страницыCourse On Accounting Software - : Tally - ERP9 Course Outline:: Sr. No. Topics Covered Proposed LecturesKulshrestha Shwta SОценок пока нет

- EBA Lab Record Front SheetsДокумент52 страницыEBA Lab Record Front SheetsVarun KumarОценок пока нет

- 46350451066Документ2 страницы46350451066Reetu ChauhanОценок пока нет

- Tally Payroll Tutorial - Tally Payroll Accounting Training TutorialsДокумент3 страницыTally Payroll Tutorial - Tally Payroll Accounting Training TutorialsMarumamula Santosh KumarОценок пока нет

- Liye - Info Tally Erp 9 Tutorial PDF in Tamil Wordpresscom PRДокумент3 страницыLiye - Info Tally Erp 9 Tutorial PDF in Tamil Wordpresscom PRImthiyas Mohamed50% (2)

- Tally Inventory Questions PDFДокумент2 страницыTally Inventory Questions PDFSachin SharmaОценок пока нет

- Tally - Erp 9 - Interest Calculation of Accounting & Inventory Vouchers Creation, Modification, DeletionsДокумент5 страницTally - Erp 9 - Interest Calculation of Accounting & Inventory Vouchers Creation, Modification, DeletionsHeemanshu ShahОценок пока нет

- Tally ERP 9 Professional Self LearningДокумент4 страницыTally ERP 9 Professional Self Learningnavinvijay2100% (2)

- Accounts and Finance Module - Complete - 12 MonthsДокумент5 страницAccounts and Finance Module - Complete - 12 MonthsAshish AgrawalОценок пока нет

- Vs 1037 Certified Tally Erp 9 Professional BrochureДокумент6 страницVs 1037 Certified Tally Erp 9 Professional BrochureManish Mehta (Kapoor)Оценок пока нет

- Learning On Tally - ERP 9Документ7 страницLearning On Tally - ERP 9Swati RasamОценок пока нет

- Payroll ExecutiveДокумент2 страницыPayroll ExecutivePraveen CoolОценок пока нет

- Tally ERP 2017-18 - Basic LevelДокумент44 страницыTally ERP 2017-18 - Basic LevelAnonymous 3yqNzCxtTzОценок пока нет

- Tally Important NotesДокумент34 страницыTally Important NotesPasbanSaibanОценок пока нет

- Introduction of AccountingДокумент13 страницIntroduction of AccountingRafi AhmedОценок пока нет

- Tally ERP9 PDFДокумент8 страницTally ERP9 PDFRizwan AhmedОценок пока нет

- Global Bike Ex 04-01Документ13 страницGlobal Bike Ex 04-01jntoomer100% (1)

- Tally Workshop NotesДокумент13 страницTally Workshop NotesPatel SagarОценок пока нет

- Accounts and Finance Module - Complete - 3 MonthsДокумент2 страницыAccounts and Finance Module - Complete - 3 MonthsAshish AgrawalОценок пока нет

- PDF PDFДокумент14 страницPDF PDFMehmet Mert GündüzОценок пока нет

- Tally ERP9 by Dr.P.rizwan AhmedДокумент8 страницTally ERP9 by Dr.P.rizwan AhmedRizwan Ahmed100% (1)

- Chapter 1 Introduction To TallyДокумент3 страницыChapter 1 Introduction To Tallyddnc gstОценок пока нет

- Self Learning Tutorial Books For Tally - ERP 9: Learn From HomeДокумент16 страницSelf Learning Tutorial Books For Tally - ERP 9: Learn From Homegparya009Оценок пока нет

- New Gagan N 20NCBM1030Документ39 страницNew Gagan N 20NCBM1030Varun KumarОценок пока нет

- AD-ON Course in - Tally ERP 09Документ1 страницаAD-ON Course in - Tally ERP 09nitin jainОценок пока нет

- Project Report Tally Erp 9: Tally - ERP 9 Is A Windows-Based Enterprise Resource PlanningДокумент62 страницыProject Report Tally Erp 9: Tally - ERP 9 Is A Windows-Based Enterprise Resource PlanningnithiyaОценок пока нет

- Sap Fico TrainingДокумент3 страницыSap Fico TrainingSPSINGH RathourОценок пока нет

- It PresentationДокумент23 страницыIt PresentationjyguygОценок пока нет

- TallyДокумент76 страницTallyNishant DaveОценок пока нет

- Tally Solutions - Guides & TutorialsДокумент16 страницTally Solutions - Guides & TutorialsraghavsarikaОценок пока нет

- Lesson 3: Creating Accounting Masters in Tally - ERP 9Документ34 страницыLesson 3: Creating Accounting Masters in Tally - ERP 9suryanarayanaОценок пока нет

- Implementing Basics of Tally - ERP 9Документ4 страницыImplementing Basics of Tally - ERP 9Sohan SinghОценок пока нет

- Learn TallyДокумент73 страницыLearn TallyJayapal VОценок пока нет

- Error AU 133 in RAPERB2000 or RAPOST2000: SymptomДокумент4 страницыError AU 133 in RAPERB2000 or RAPOST2000: Symptomjose.zuluagaОценок пока нет

- Tally NotesДокумент76 страницTally NotesManikandan Manohar100% (2)

- INTRODUCTION - To Accounting Voucher in Tally - ERP 9: Android Developer Full Stack DeveloperДокумент7 страницINTRODUCTION - To Accounting Voucher in Tally - ERP 9: Android Developer Full Stack DeveloperAakash JainОценок пока нет

- AC010 4.6 AC010-Financial Accounting and ReportingДокумент79 страницAC010 4.6 AC010-Financial Accounting and ReportingklonovoskyОценок пока нет

- SAP FICO Tutorial Summary: SAP FI Is An Important Module of SAP ERP. It Is Mainly Used To Store FinancialДокумент8 страницSAP FICO Tutorial Summary: SAP FI Is An Important Module of SAP ERP. It Is Mainly Used To Store FinancialNaveen Kumar RudrangiОценок пока нет

- Tally ManualДокумент80 страницTally ManualVishnu VardhanОценок пока нет

- Fab Report Iniya 2Документ29 страницFab Report Iniya 2Iniya AnandОценок пока нет

- Shoper 9 Tally ERP 9 InterfaceДокумент25 страницShoper 9 Tally ERP 9 Interfaceamits_66Оценок пока нет

- New Certificate Course in TallyДокумент2 страницыNew Certificate Course in TallyRonny HedaooОценок пока нет

- Questions Certif TFIN50Документ25 страницQuestions Certif TFIN50Hakim HbiОценок пока нет

- CH 17Документ7 страницCH 17Rishu shakyaОценок пока нет

- Tally 9 Erp Full GuideДокумент6 страницTally 9 Erp Full Guideابو جعفرОценок пока нет

- TallyERP 9 SyllabusДокумент5 страницTallyERP 9 SyllabusAbdur RakibОценок пока нет

- TallyДокумент1 199 страницTallyVikram Ullal100% (3)

- NM NSE Academy Final Assessment Reference Question Bank - Advanced Tally With GSTДокумент24 страницыNM NSE Academy Final Assessment Reference Question Bank - Advanced Tally With GSTMR. GOKULОценок пока нет

- Student Hand Book: On Tally - ERPДокумент33 страницыStudent Hand Book: On Tally - ERPRia MakkarОценок пока нет

- Official Guide to Financial Accounting using TallyPrime: Managing your Business Just Got SimplerОт EverandOfficial Guide to Financial Accounting using TallyPrime: Managing your Business Just Got SimplerОценок пока нет

- TallyДокумент8 страницTallysprasad durgaОценок пока нет

- How To Create Ledgers in Tally (Multiple Ledgers)Документ8 страницHow To Create Ledgers in Tally (Multiple Ledgers)harshita kaushik100% (1)

- Accounting Policies and Procedures Manual: A Blueprint for Running an Effective and Efficient DepartmentОт EverandAccounting Policies and Procedures Manual: A Blueprint for Running an Effective and Efficient DepartmentОценок пока нет

- Documents at Bureau of TreasuryДокумент7 страницDocuments at Bureau of Treasuryimelda khairunnisaОценок пока нет

- Tax Invoice: Invoice Address Invoice Details Delivery AddressДокумент2 страницыTax Invoice: Invoice Address Invoice Details Delivery Addresskgalalelo seaneОценок пока нет

- Adjusting Project InvoicesДокумент7 страницAdjusting Project InvoicesRaman RajputОценок пока нет

- Nit Boq Merged3Документ13 страницNit Boq Merged3SOUMYA BHATTОценок пока нет

- Bne S4hana2022 Master Data en XXДокумент24 страницыBne S4hana2022 Master Data en XXEduardo PadillaОценок пока нет

- Postpaid Bill 9940673307 FM2006I000859510Документ3 страницыPostpaid Bill 9940673307 FM2006I000859510ArunTomarОценок пока нет

- FETERSV62 NewДокумент9 страницFETERSV62 NewsapanОценок пока нет

- Exposing CorruptionДокумент128 страницExposing CorruptionRita CahillОценок пока нет

- All The BAPI ListДокумент189 страницAll The BAPI Listchandrashekhar khasnisОценок пока нет

- Solution To The Exercise On Printing InvoicesДокумент24 страницыSolution To The Exercise On Printing InvoicesRaj Rajesh100% (1)

- Detailed MRC Check ListДокумент4 страницыDetailed MRC Check ListdrsaritakambleОценок пока нет

- Oracle R12 SCM Oracle Order Management and Advance Pricing Consultant Training V1.1Документ50 страницOracle R12 SCM Oracle Order Management and Advance Pricing Consultant Training V1.1kumar appsОценок пока нет

- 1905 January 2018 ENCS FinalДокумент3 страницы1905 January 2018 ENCS FinalSunmi GashinaОценок пока нет

- 1Документ32 страницы1Adaikalam Alexander RayappaОценок пока нет

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Документ1 страницаTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Kamal MeshramОценок пока нет

- TameДокумент24 страницыTameAbdi fatah BashirОценок пока нет

- Motor Claim FormДокумент4 страницыMotor Claim FormAnsh SharmaОценок пока нет

- Fob Contract Henshang VersionДокумент10 страницFob Contract Henshang Versionrudiawan100% (1)

- Subcontract Agreement For Concrete Supply - For JayamixДокумент6 страницSubcontract Agreement For Concrete Supply - For JayamixAde ChavezОценок пока нет

- Service Industries Limited Internship ReportДокумент49 страницService Industries Limited Internship Reportbbaahmad8967% (9)

- Intern Report Apex ShoesДокумент36 страницIntern Report Apex ShoesAlex MoonОценок пока нет

- 01 339 PDFДокумент2 страницы01 339 PDFvanderbrley100% (1)

- InvoiceReports PDFДокумент1 страницаInvoiceReports PDFJoel Mathew JacobОценок пока нет

- Proforma Invoice and Purchase Agreement No.2828272Документ3 страницыProforma Invoice and Purchase Agreement No.2828272maryamqasimprosourceОценок пока нет

- SD - FI IntegrationДокумент21 страницаSD - FI IntegrationSivaОценок пока нет

- 4500232702Документ2 страницы4500232702Jamal Al-deenОценок пока нет

- Eng Iveco PDFДокумент36 страницEng Iveco PDFdobasОценок пока нет

- Compliance Requirements SEC. 113. Invoicing and Accounting Requirements For VAT-Registered Persons.Документ4 страницыCompliance Requirements SEC. 113. Invoicing and Accounting Requirements For VAT-Registered Persons.shakiraОценок пока нет

- Kenimalava Dominiko - 26.07.2001Документ3 страницыKenimalava Dominiko - 26.07.2001KenОценок пока нет

- Guided By: Submitted By: Dr. Gazala Yasmin Ashraf Kanishka ChhabriaДокумент8 страницGuided By: Submitted By: Dr. Gazala Yasmin Ashraf Kanishka ChhabriaKanishka ChhabriaОценок пока нет